- The investment objective of the Hang Seng China A Industry Top Index Fund (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Hang Seng China A Industry Top Index (the “Index”). The Fund is a feeder fund and an index fund that seeks to achieve its investment objective by investing solely in the Hang Seng China A Industry Top Index ETF (the “Underlying Fund”).

- The Underlying Fund is listed and traded on The Stock Exchange of Hong Kong Limited. Investors should note the differences between the Fund and the Underlying Fund, including the differences in respect of fees and charges, trading channel, dealing frequency and dealing price determination and decide whether they wish to invest in the Fund or invest in the Underlying Fund directly.

- Risks relating to the Fund Structure/Underlying Fund: As the Fund invests solely in the Underlying Fund, the Fund is exposed to such risks to which the Underlying Fund is subject.

- The Fund is subject to concentration risk as the Underlying Fund tracks the performance of a single geographical region (the PRC). By having exposure in the PRC, an emerging market, it may involve increased risks and special considerations not typically associated with investment in more developed markets. A-share market is considered volatile and unstable (with the risk of suspension of a particular stock or government intervention).

- RMB is currently not freely convertible and is subject to exchange controls and restrictions. Non RMB-based investors are exposed to foreign exchange risks.

- In respect of hedged classes of Units, there can be no assurance that any currency hedging strategy employed by the Manager will fully and effectively eliminate the currency exposure of the relevant class. Hedging strategies may preclude investors from benefiting from an increase in the value of the Fund’s base currency. Any expenses arising from such hedging transactions, which may be significant depending on prevailing market conditions, will be borne by the relevant currency hedged class.

- The Fund is subject to passive investment risk and tracking error risk. There can be no assurance of exact or identical replication at any time of the performance of the Index.

- There may be additional fees involved when investing into the Underlying Fund, such as fees and expenses charged by the service providers of the Underlying Fund.

- The Underlying Fund is subject to the RQFII Regime related risks and Stock Connect risks. The laws, rules and regulations applicable to them are subject to change and such change may have potential retrospective effect.

- Although all transactions will be at arm’s length, conflicts of interest in respect of the Fund may arise from time to time amongst the Trustee (also acting as the trustee of the Underlying Fund), the Manager (also acting as the manager of the Underlying Fund) and the Index Provider which are all members of the same financial group. The Manager will vigorously manage any such conflicts in the best interest of investors.

- Investments involve risks and investors may lose a substantial part of their investment in the Fund.

Why invest in Hang Seng China A Industry Top Index Fund?

If you:

- are interested to invest in the mainland China A-share market via a fund

- wish to capture the growth potential of leaders in 11 industries(1) in mainland China

- would like to make investments in RMB, HKD or USD

(1) The 11 industries are energy, materials, industrial, consumer goods, consumer services, telecommunications, utilities, financials, properties & construction, information technology and conglomerates.

“Hang Seng China A Industry Top Index Fund” could be an investment choice!

The investment objective of the Hang Seng China A Industry Top Index Fund (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Hang Seng China A Industry Top Index (the “Index”). The Fund is a feeder fund and an index fund that seeks to achieve its investment objective by investing solely in the Hang Seng China A Industry Top Index ETF(2) (the “Underlying Fund”).

(2) Hang Seng China A Industry Top Index ETF is another index-tracking fund authorised by the Securities and Futures Commission in Hong Kong (“SFC”) with a substantially similar investment objective as that of the Fund and managed by Hang Seng Investment Management Limited. SFC authorisation is not a recommendation or endorsement of that fund nor does it guarantee the commercial merits of that fund or its performance. It does not mean that fund is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors.

(3) The market related information provided in this section is for general reference only. The investments mentioned in this section may not be suitable for all investors. No consideration has been given to the investment objectives, investment experience, financial situation, risk tolerance abilities or particular needs etc of any individual investors. Hang Seng Investment Management Limited hereby discloses that the funds under its management include funds investing in the market mentioned in this section. Investments involve risks. Investors should read the relevant investment product’s offering documents (including the risk factors stated therein) in detail before making any investment decisions.

Inclusion of China A-Shares in the MSCI Indexes Marks a Key Milestone in the Internationalisation Roadmap

Morgan Stanley Capital International (“MSCI”) has started to gradually include China A-Shares in its MSCI Emerging Markets Index and MSCI All Country World Index from June 2018. In the initial stage, China A-Shares have a weighting of around 0.8%*, in terms of market capitalisation, of the MSCI Emerging Markets Index. As of 31 December 2017, the MSCI All Country World Index and the MSCI Emerging Markets Index were tracked by more than USD3,700 billion and USD1,900 billion in assets under management around the world^.

Chinese Government’s Economic Reforms Improve Operating Efficiencies

As a result of various economic reforms initiated by the Chinese government to encourage industry transformation and improve operating efficiencies, state-owned Chinese enterprises saw a 23.5% and 13.6% annual increase in their earnings and revenues respectively in 2017. This meant that the growth of their earnings outpaced that of revenues by 9.9%#.

*Source: Morgan Stanley Capital International, 20 June 2018

^Source: Morgan Stanley Capital International, 20 June 2018

#Source: The Ministry of Finance of the People’s Republic of China, 23 January 2018

Hang Seng China A Industry Top Index

- With coverage across 11 industries in mainland China, it provides risk diversification, while allowing investors to capture the potential growth of various mainland industries and investment opportunities in different economic cycles.

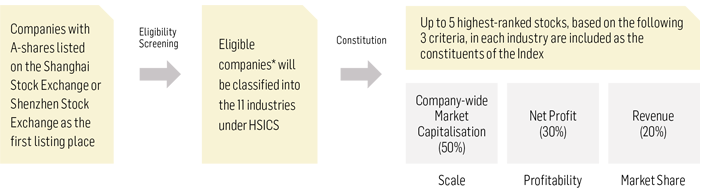

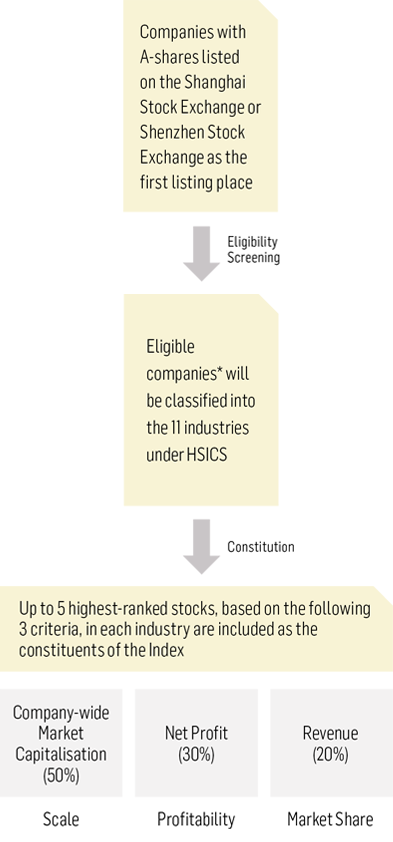

- Multi-perspective criteria in selection of constituent stocks, stocks in each industry are ranked by company-wide market capitalisation, net profit and revenue, the 5 highest-ranked stocks in each industry are included in the Index.

Compared with the median management fee of China A-share funds offered in

Hong Kong, the management fee of the Fund is lower*.

*Source: Morningstar. As of 19 June 2018, the median of the fund management fee for SFC-authorised China A-share funds offered in Hong Kong was 1.75% per annum. The aggregate management fee of the Hang Seng China A Industry Top Index Fund is currently 0.55% per annum (the maximum being 1.0% per annum). For details, please refer to the Term Sheet of the Fund.

RMB, HKD hedged and USD hedged classes of units are available, for investors with different currency exposure to choose from to capture the investment opportunities of the China A-share market.

About the Hang Seng China A Industry Top Index

The Hang Seng China A Industry Top Index reflects the performance of the leaders of each of the 11 industries(4) under the Hang Seng Industry Classification System (“HSICS”), aiming to provide exposure to a diversified portfolio of top industry players on the Mainland.

(4) The 11 industries are energy, materials, industrial, consumer goods, consumer services, telecommunications, utilities, financials, properties & construction, information technology and conglomerates.

*Companies which are among the top 300 in terms of their average A-Share market capitalisation in the preceding 12 months and which fulfill the specific criteria will form the eligibility list. For details, please refer to the website of Hang Seng Indexes Company Limited (http://www.hsi.com.hk)(The contents of this website have not been reviewed by the SFC).

Know More:

The Fund’s Marketing BrochureFund Brochure |

The Fund’s Offering DocumentsProduct Key Facts Statement Explanatory Memorandum |

The Fund’s Marketing BrochureFund Brochure |

The Fund’s Offering DocumentsProduct Key Facts Statement Explanatory Memorandum |