Let's switch to Hang Seng PayDay+ for reward earning and easy banking

Want a pay raise and have a wonderful time during your vacation? Simply switch to Hang Seng PayDay+ for payroll services to enjoy HKD Savings rate up to 6% p.a., to manually raise your income! Moreover, you can exchange JPY or EUR at Bank's Cost Price1, making your travels even more delightful! Hang Seng customers remember to use our upgraded one-stop security settings in Hang Seng Mobile App to ensure your financial security, whether locally or overseas, so you can travel at ease!

New customers who open Preferred Banking now can enjoy a total reward of value over $5,000! Switch to Hang Seng Bank to experience more comprehensive daily banking services!

Hang Seng can now help wage earners like you to satisfy your 3 major wishes — Income+, Travel+, Security+! Hurry up and read on!

Hoping to top-up your income? From now till 30 June 2024, register and switch to Hang Seng PayDay+ to enjoy up to 6% p.a. HKD Savings rate! Whether you want to travel, buy insurance, or invest after receiving your paycheck, Hang Seng helps you save the most and earn the most with a series of following rewards!

Enjoy up to 6% p.a. HKD Savings rate

Registering PayDay+ via Hang Seng Mobile App and successfully switching to Hang Seng as your payroll account can enjoy up to 6% p.a. HKD Savings rate

HKD1 for Travelsure Protection Plan 8-days Single Trip Cover

Travelsure Protection Plan Single Trip covers medical expenses up to HKD1,000,000, as well as various protections for personal belongings, travel delays, etc., to fully meet your various needs!

- Hang Seng Credit Card customers exclusive offer: Apply for Travelsure Protection Plan Single Trip Cover for just HKD12 and stay protected for up to 8 days of your Asia# trip!

#Asia refers to destinations including mainland China, Bangladesh, Brunei, Cambodia, Guam, India, Indonesia, Japan, Korea, Laos, Macau SAR, Malaysia, Mongolia, Myanmar, Nepal, Pakistan, Philippines, Saipan, Singapore, Taiwan, Thailand, Tinian and Vietnam. Please refer to the Terms and Conditions for the promotion offer.

Enjoy 5X +FUN Dollars upon subscribing QDAP

eIncomePro Deferred Annuity Plan (100% guaranteed) provides you with, aside from life protection, an annuity income with a guaranteed internal rate of return of 3.02% to 3.30%^ and application of tax deduction!

- Pay the premium using Hang Seng credit card can enjoy 5X +FUN Dollars or yuu Points

- Use Hang Seng accounts to subscribe to eIncomePro successfully and pay premiums can enjoy a free health check with a value of up to HKD1,300!

^Monthly Guaranteed Annuity Income is payable on each monthiversary starting from the commencement date of the Annuity Period. The Monthly Guaranteed Annuity Income will be directly deposited into the designated Hang Seng Bank saving account. Annuity Period refers to the period during which Monthly Guaranteed Annuity Income is payable. The Annuity Period of "eIncomePro" is 10 years. Eligible customers must provide the designated promo code when applying for insurance online to enjoy this offer. Terms and conditions apply, for details please click here.

First-year 11-month premium waiver for eCancerPro Insurance Plan

eCancerPro Insurance Plan helps you meet unexpected expenses with ease. Upon successful application of eCancerPro Insurance Plan, you can enjoy a first-year 11-month premium waiver (a total quota of 100)

Eligible customers must provide the designated promo code when applying for insurance online to enjoy this offer. Terms and conditions apply, for details please click here.

Apply for Personal Accident Insurance Plan to enjoy accidental medical benefits and up to 15% off

Personal Accident Insurance Plan aims to provide you with appropriate protection with multiple personal accident insurance coverage, including accidental medical and bonesetter benefits, also includes up to 15 visits to post-hospitalization outpatient services, which allows you to focus on recovery with ease and enjoy every day to the fullest

- Eligible customers must provide the designated promo code and successfully apply for Personal Accident Insurance Plan online to enjoy up to 15% off for the first-year premium and earn HKD150 e-voucher

Terms and conditions apply, for details please click here.

Designated credit card extra +FUN Dollars reward

Apply for Hang Seng Prestige World Mastercard or Hang Seng MMPOWER World Mastercard successfully to enjoy extra $100 +FUN Dollars

Cash reward offer for stock buying

Open new securities accounts3 and conduct one buy trade of HK stocks/A-shares/US stocks via online trading channels during a designated period, can enjoy HKD100 cash reward!

SimplyFund Account $0 monthly fee offer

Can enjoy a SimplyFund Account $0 monthly fee offer4

Extra cash rebate for personal instalment loan

Enjoy an extra HKD800 cash rebate by applying for and drawing down the loan with a minimum drawdown amount of HKD100,000 and a minimum tenor of 36 months

Hazel turns herself into TamJai SamGor's waitress to teach you how to top up your earnings

Switch it the sooner the better!

Switch it the sooner the better!

Switch it the sooner the better!

Switch it the sooner the better!

Download and log on to Hang Seng Mobile App > Click "Offers" in Main Menu > Click "Latest Offers" > Click "Banking" > Click PayDay+ Promotion > Click "Register PayDay+ now" in PayDay+ website

Wishing to enjoy your vacation to the fullest? Hang Seng customers can exchange JPY or EUR at Bank's Cost Price, then withdraw currency notes at FX ATMs throughout Hong Kong, to set off breezily! Also, now you can use FPS via Hang Seng Mobile App in Thailand to enjoy cashless transactions!

Bank's Cost Price for exchanging JPY or EUR

From now till 31 May 2024, you can enjoy Bank's Cost Price upon completing JPY or EUR exchange with at least HKD10,000 or its equivalent via Hang Seng Mobile App or Hang Seng Personal e-Banking

Logon to Hang Seng Personal e-Banking > Please click "Foreign Exchange" > "Foreign Exchange Service"

Enjoy seamless cross-border spending on your Thailand trip with FPS

Hong Kong FPS has already connected with Thailand's PromptPay! Now, with only your mobile phone, you can scan the PromptPay merchant QR code in Thailand and pay directly with your Hang Seng HKD Savings Account via Hang Seng Mobile App, making cross-border payments smooth and easy!

- Faster Payment System (FPS) is a real-time payment platform operated by Hong Kong Interbank Clearing Limited. Terms and conditions related to the Faster Payment System (FPS) apply.

- When customers pay merchants in Thailand via FPS, the relevant spending amount will be converted into Hong Kong Dollars automatically based on the exchange rate on the relevant transaction day and deducted from HKD Savings Account with Hang Seng Bank.

Diversified foreign exchange services

- Hang Seng FX ATMs5 located throughout Hong Kong

- Hang Seng now provides the most FX ATM service points in Hong Kong, with 49 in total, among them, up to 19 service points provide 24-hour service

- Up to 12 foreign currency banknotes for your selection

- Hong Kong's first artificial intelligence Chatbot in retail bank (H A R O)

- Instant rate quotes and execution of FX orders

- Provide personalized FX news and customer offers to help you seize good foreign exchange opportunities

- FX Order Watch

- Simply pre-set the desired exchange rate and we'll notify you and automatically make the exchange when your target rate is reached

- Covers up to 10 currencies6

Money Master helps you achieve your travel savings goal

Money Master will automatically track your expenses from your Hang Seng HKD accounts and credit cards, and reflect the remaining spending budget in real time. And H A R O WhatsApp will send over personalized tips and progress updates to assist you in setting savings goals based on your travel needs!

Hazel turns herself into Hong Kong Airlines' flight attendant to teach you how to travel smoothly

Hang Seng has always been committed to providing you with safe and reliable banking services, helping you manage your finances at ease. Hang Seng Mobile App is equipped with various security options, like setting transfer limits and managing credit card-related settings instantly for security support of your account.

AutoSweeping service to avoid unsuccessful cheque payment

AutoSweeping service to the current account to ensure the successful processing of account transfer instructions and issued cheques and avoid the risk of overdraft. Our services provide you with enhanced convenience and flexibility in managing your finances, while also helping you save on unnecessary interest expenses and service charges. The upper limit of AutoSweeping Service will be uplifted to HKD100,000, providing greater ease and peace of mind!

AutoSweeping Service is applicable to the situation that your Hong Kong Dollar Current Account under the Integrated Account is overdrawn/ the line of credit is exceeded. It is limited to a daily total overdraft /excess amount of HKD20,000 or below.

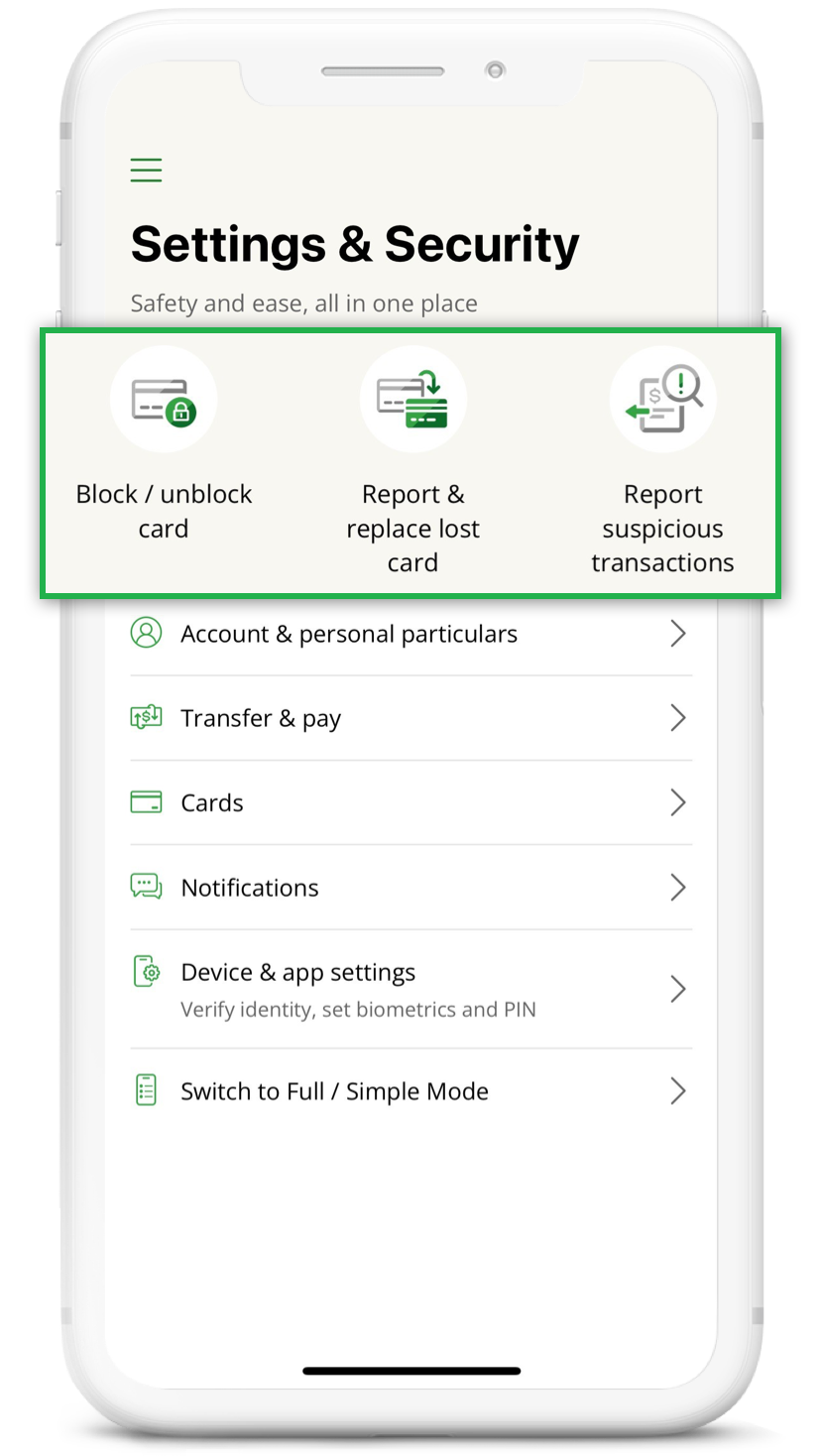

New "Settings & Security" interface provides you with security support

Features of "Settings & Security":

- Access the new interface "Settings & Security" easily for all security options at a glance

- Block or report lost cards instantly

- Adjust credit card limits and set "card-not-present" transaction limits

- Enable push notifications to keep an eye on account status. Once suspicious transactions are spotted, report them immediately in just a few steps

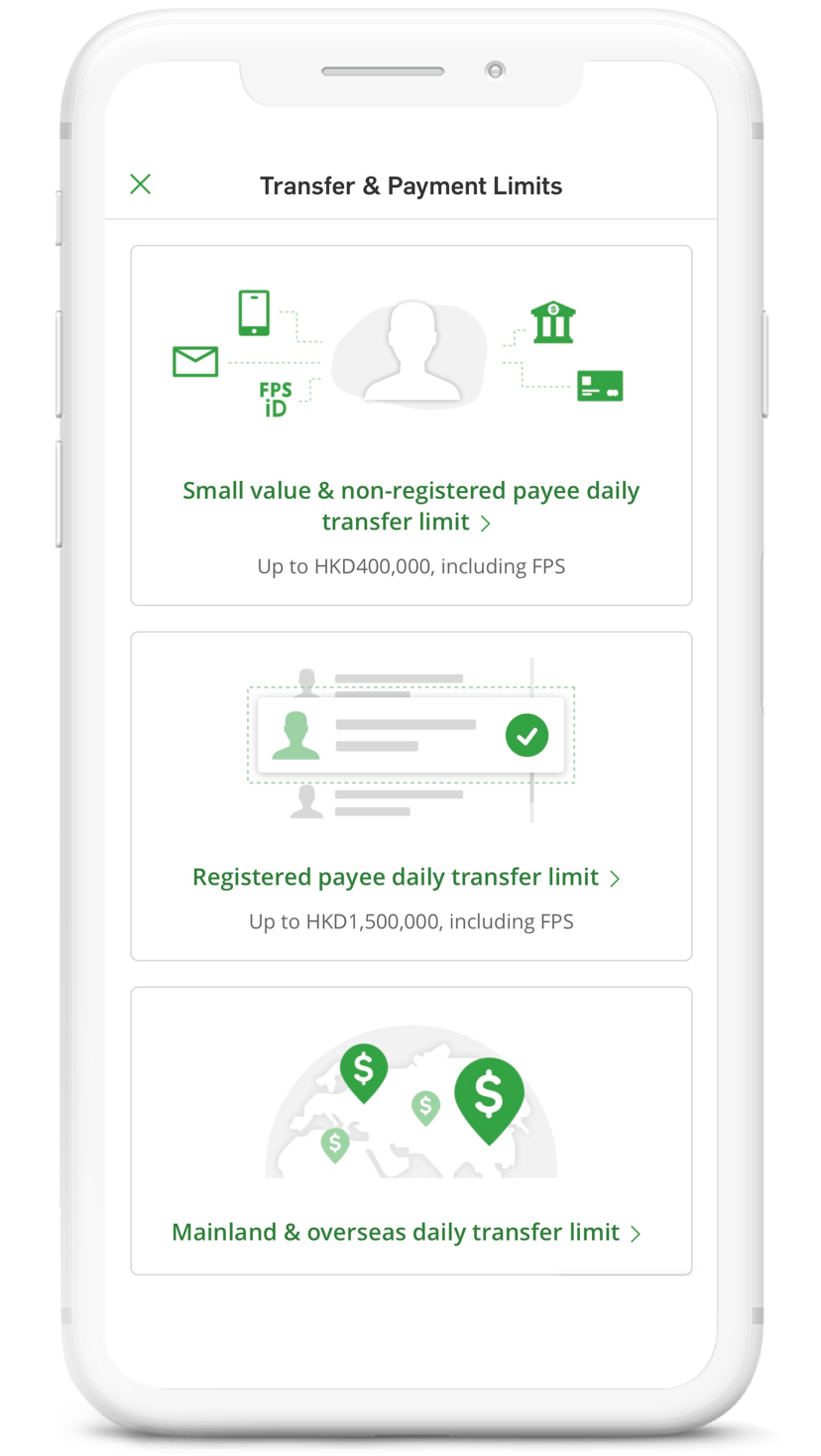

Adjust various transfer limits anytime

Let you easily and quickly choose the settings needed in different scenarios or examples, including setting daily transfer limits for local, cross-border and overseas transactions

Manage various credit card security options easily

- Block or unblock credit cards temporarily, and report unauthorized transactions anytime

- One click to transfer or change credit limit, and set "card-not-present" transaction limit

- Pending transactions will also be displayed on "My Credit Card" page to identify suspicious transactions earlier

- Authenticate "card-not-present" transactions through Hang Seng Mobile App to ensure the security for online transactions

- You can add your credit cards to Apple Wallet securely right after card activation via Hang Seng Mobile App to start using mobile payment service immediately (Not applicable to Hang Seng USD Visa Gold Card, e-shopping MasterCard, CUP Credit Card, Private Label Card and Spending Card)

Enhanced mobile app security measures to safeguard your account

For Android users

- Disabled the screen sharing, recording and capturing functions on Hang Seng Mobile App

- Enabled Hang Seng Custom Keyboard. When you enter sensitive information, such as password and security code, you will no longer be able to use your device's default keyboard or third-party keyboards

- Your Hang Seng Mobile App may be temporarily suspended upon detection of suspicious apps*

For iOS users

- Disabled screen sharing and recording functions on Hang Seng Mobile App

If you need to access your records, please use the "Save Image" button in Transfer, Pay Bills and Time Deposit.

*To reduce the risk of scammers infiltrating your mobile phone through malicious apps, if our system detects any apps on your mobile phone downloaded from unofficial sources with excessive permission settings, a reminder may be displayed, advising you to disable the accessibility features or uninstall these apps before using Hang Seng Mobile App. Otherwise, you may no longer be able to use Hang Seng Mobile App.

Hazel turns herself into a nurse to teach you how to manage your money safely

As a new customer, do you want to enjoy the same rewards and services?

Open / Upgrade to Preferred Banking now to enjoy the welcome offer at a total reward of value over $5,0001)

Complete below missions to power up your financial management skills from Saving, Protection, and Investment! The promotion period is from 15 April to 30 June 2024:

Complete below missions to power up your financial management skills from Saving, Protection, and Investment! The promotion period is from 15 April to 30 June 2024:

Successfully open / upgrade to Preferred Banking account via Hang Seng Mobile App and update marketing preference to enjoy HKD100 HKTVmall e-Gift voucher2)

New Preferred Banking customer3) who have successfully made 2 online bill payment transactions via Hang Seng Personal e-Banking during the first 2 consecutive months from the month of account opening can enjoy HKD100 HKTVmall e-Gift voucher4)

New Preferred Banking customer3) who successfully apply for Hang Seng MMPOWER World Mastercard or University / College Affinity Credit Card or Travel+ Visa Signature Card can enjoy $100 +FUN Dollars5)

Complete "Hang Seng PayDay+" online registration and designated missions can earn reward of value up to $3,1006)

Olive members enjoy rewards of value up to $2,100 upon successful application for designated insurance plan7),8),9)

Open Preferred Banking now

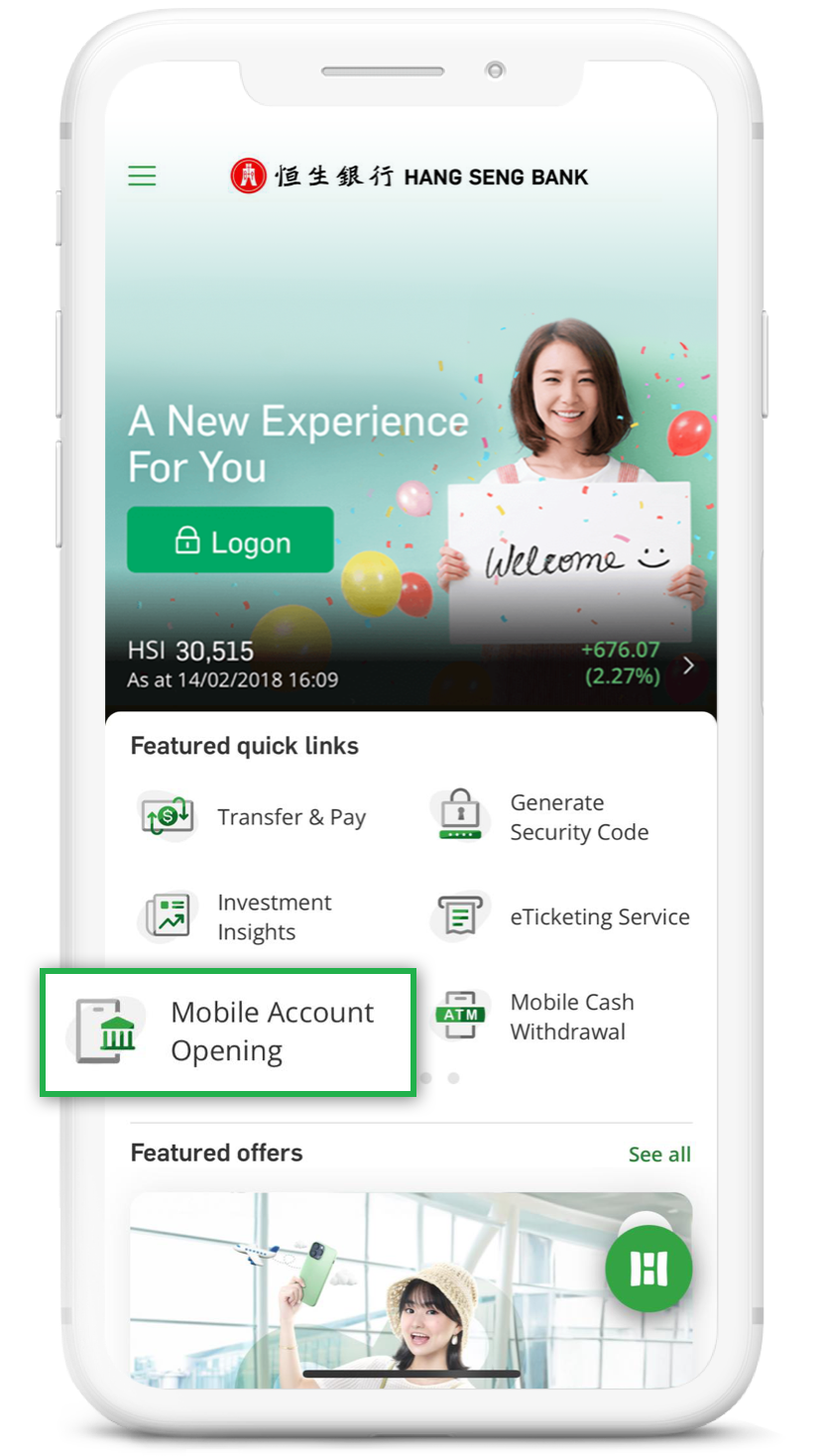

Download and open Hang Seng Mobile App, select "Mobile Account Opening" under "Quick links" on the home page. Verify your identity and fill in the personal details needed for mobile account opening to open an account. Click to download

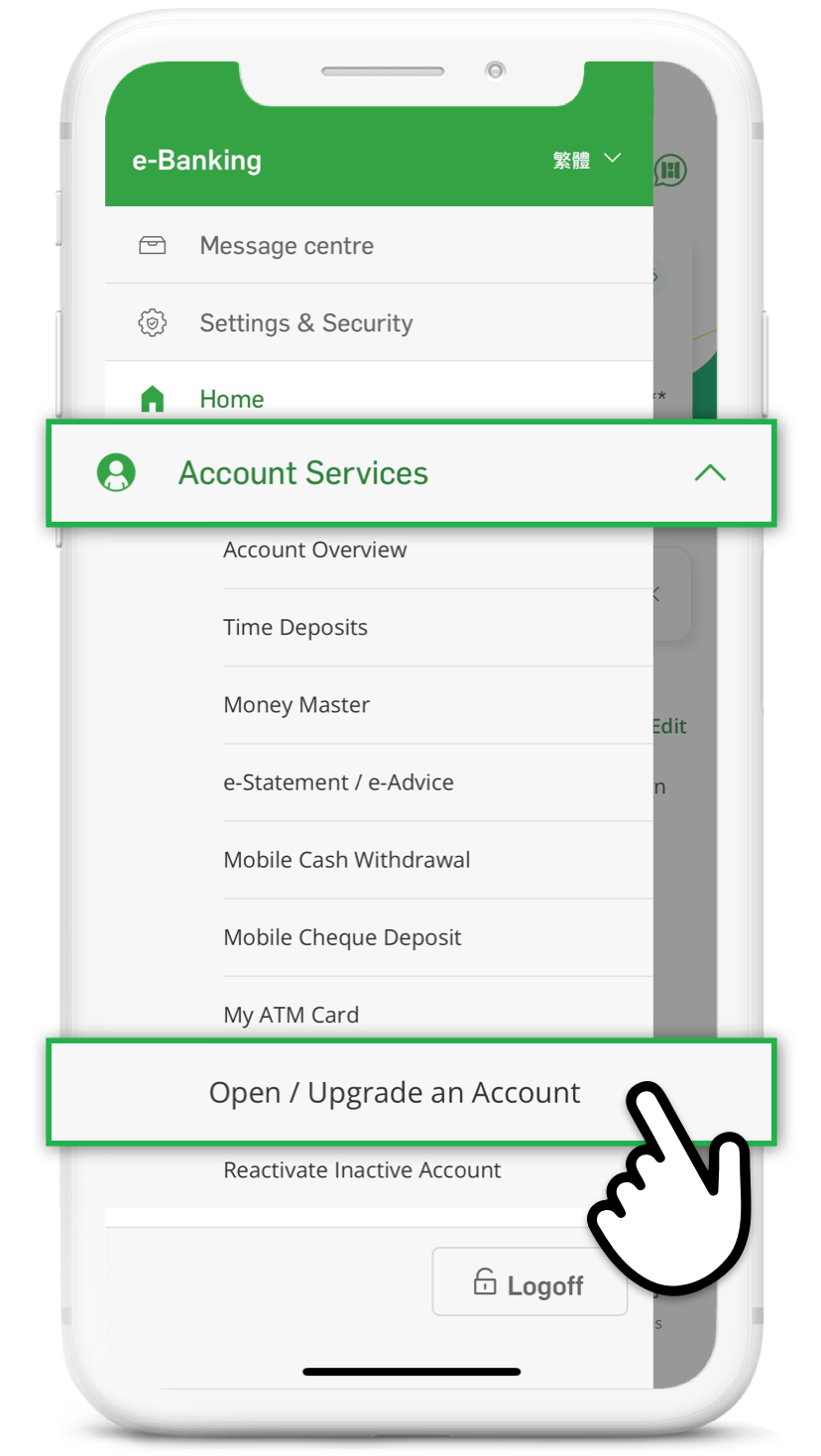

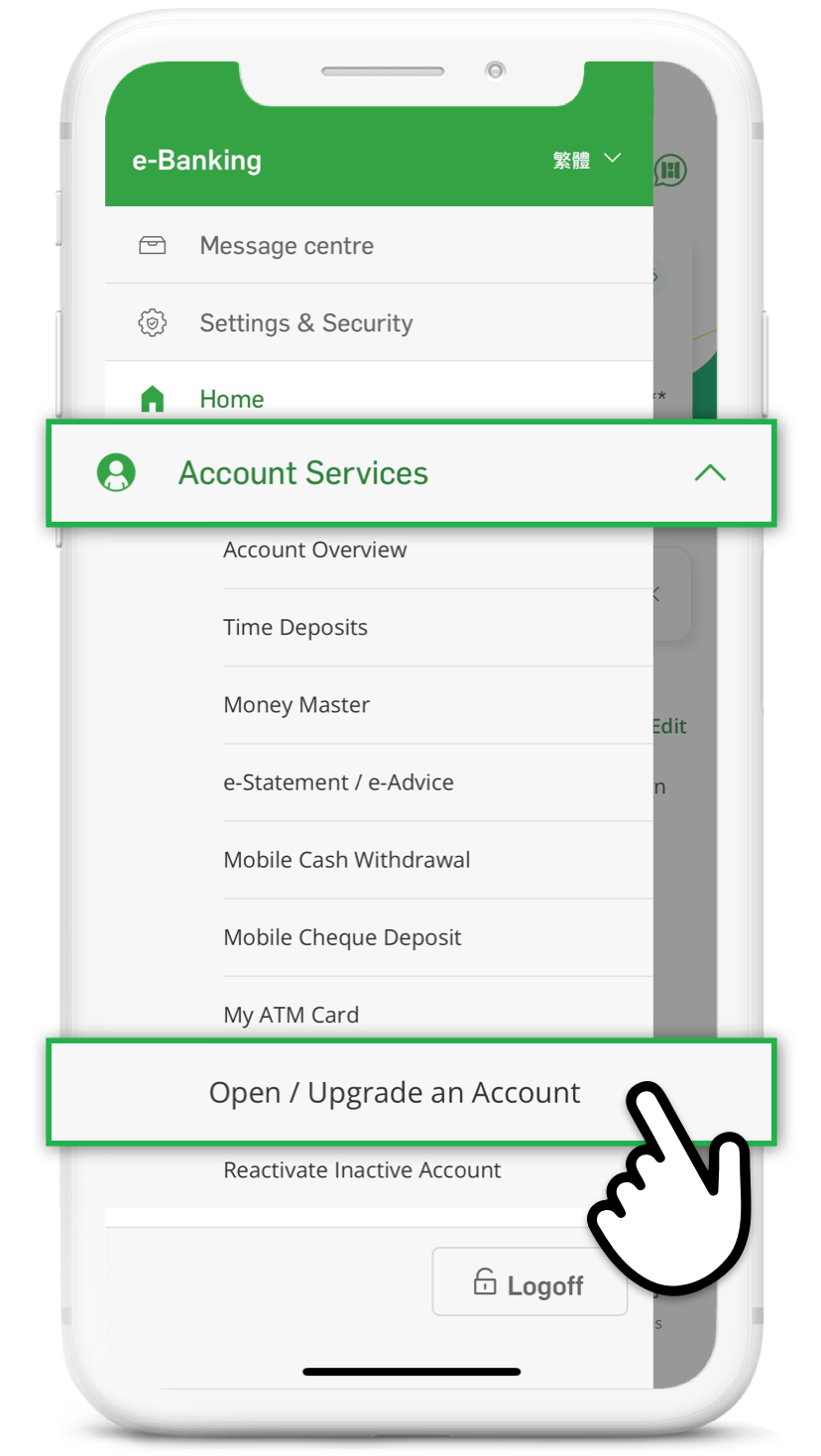

Upgrade to Preferred Banking now

Open Hang Seng Mobile App, select "Account Services" from the main menu, and click "Open / Upgrade an Account". Verify your identity and fill in the personal details needed for mobile account opening to open an account.

Remarks: If you are upgrading your existing Integrated Account to Preferred Banking, your application will be processed within 2 to 3 working days.

Upgrade to Preferred Banking now

Open Hang Seng Mobile App, select "Account Services" from the main menu, and click "Open / Upgrade an Account". Verify your identity and fill in the personal details needed for mobile account opening to open an account.

Remarks: If you are upgrading your existing Integrated Account to Preferred Banking, your application will be processed within 2 to 3 working days.

Not yet registered e-Banking? Remember to register to earn a dining e-voucher too!

Want to manage your account easily? Use Hang Seng Personal e-Banking to keep track of your account status, check your account balance and download e-Statement anytime and anywhere. You may also register for FPS and set Hang Seng as the FPS default receiving bank, to manage your daily finances smoothly!

From 1 April to 30 June 2024, existing customers7 who register Personal e-Banking and e-Statement successfully can enjoy a guaranteed HKD50 Dining e-Voucher8!

Remark: A redemption notification would be sent to eligible customers via Push Notification. Customers must enable Marketing Push Notification to receive the e-Voucher. Terms and conditions apply.

Watch this video now for more tips from Hazel!

Remarks

- "Bank's Cost Price" refers to the exchange rate for foreign exchange without any sales margin normally charged by the Bank. Other mark-up applied to the exchange rate for operational reasons however will not be waived. Terms and Conditions apply. Visit

for more details.

for more details. - The offer is only applicable for Travelsure Protection Plan Single Trip Cover with Destinations of Asia. For eligible customers who successfully applied for Travelsure Protection Plan Single Trip Cover and settled the premiums with Hang Seng Credit Card, Hang Seng Bank will deposit +FUN Dollars or yuu Points with amount equivalent to premium amount minus $1 to eligible customers' Hang Seng Credit Card account.

- All the account holders of the new securities account must not hold any securities account (personal/ joint) with the Bank within a period of 6 months preceding the account opening date.

- SimplyFund Account $0 Monthly Account Fee Offer is applicable to eligible customers with Monthly Average Portfolio Value of a SimplyFund Account of HKD100,000 or below (or its equivalent).

- Visit Hang Seng Bank Website (Banking > Branch, Self-service, Phone & Social Caring Banking > Self-service Banking > Foreign Currency ATMs) for more FX ATM service, service sites and service time details.

- 10 currencies include AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, RMB and USD.

- Existing customer refers to personal customers who have successfully opened and are holding Prestige Private, Prestige Banking, Preferred Banking, Integrated Account, Family+ Account, Savings / Current Account or Hang Seng Credit Card with Hang Seng before 31 March 2024.

- Eligible Customers will get HKD50 dining e-Voucher if they successfully register Personal e-Banking and e-Statement service for at least one of the Eligible Accounts within 7 calendar days of the e-Banking registration via Hang Seng Mobile App or Hang Seng Personal e-Banking (i.e. if you register personal e-Banking on 1 April, the last day of e-Statement registration is 7 April). Please click here for detailed Terms and Conditions of Welcome Reward for Personal e-Banking Customers Promotion.

If you are in doubt of our marketing and promotional activities and materials, please call customer service enquiry hotline for verification.

Enquiry and Trading Hotlines - Hang Seng Bank

If you are in doubt of our marketing and promotional activities and materials, please call customer service enquiry hotline for verification. Hang Seng Bank Website > About Us > Contact Us > Enquiry and Trading Hotlines

Click here for the relevant Terms and Conditions of PayDay+ Promotion.

Terms and Conditions apply to all the products/services and offers above. Please click here for detailed Terms and Conditions of Preferred Banking Welcome Offers Promotion.

- Open / Upgrade to Preferred Banking account could enjoy rewards of value over HKD5,000 (including e-Gift vouchers, +FUN Dollars and cash rewards), please refer to the Terms and Conditions of Preferred Banking Welcome Rewards at this website.

- The promotion period is from 15 April 2024 to 30 June 2024. New customers who successfully open or upgrade to Preferred Banking account via Hang Seng Mobile App and update marketing preference to"Opt-in for all marketing channels" (channels include Email, SMS, Post, Telephone call or Marketing push notification) are entitled to receive HKD100 HKTVmall e-Gift Voucher. Terms and Conditions apply, for details, please refer to the Terms and Conditions of Preferred Banking Welcome Rewards at this website.

- "New Customer(s)" mentioned herein refers to personal customers who have opened a new Preferred Banking of the Bank during 15 April 2024 to 30 June 2024, but excluding: existing customers who are holding any Hong Kong Dollars/Foreign Currency savings, current, time deposit accounts or any Integrated Accounts at Hang Seng Bank Limited ("the Bank") (including Prestige Banking, Preferred Banking and any other Integrated Account) (the "Existing Customer(s)"), or customers who have closed any of the above accounts with the Bank in the previous 12 months prior to the account opening month, or customers whose accounts mentioned above have been terminated in any period.

- The promotion period is from 15 April 2024 to 30 June 2024. New Preferred Banking customers who successfully make 1 online bill payment transaction each month via Hang Seng Personal e-Banking during the first 2 consecutive months (as specified in Terms and Conditions for Designated Month) from the month of account opening are entitled to receive HKD100 HKTVmall e-Gift Voucher. Terms and Conditions apply, for details, please refer to the Terms and Conditions of Preferred Banking Welcome Rewards at this website.

- The promotion period is from 15 April 2024 to 30 June 2024. Customers who have successfully applied for Hang Seng MMPOWER World Mastercard or University / College Affinity Credit Card or Travel+ Visa Signature Card within promotion period are entitled to receive $100 +FUN Dollars. For details, please refer to the Terms and Conditions of Preferred Banking Welcome Rewards at this website.

- The promotion period is from 15 April 2024 to 30 June 2024. The promotion only applicable to customer who successfully complete the"Hang Seng PayDay+" online registration ("Registration date") via Hang Seng Personal Mobile App and designated missions. For details, please refer to the Terms and Conditions of PayDay+ Customers Welcome Rewards at this website. The Bank will determine the eligibility of the eligible Customer based on the record of their registration date record held by the Bank. The Bank's records shall be final and conclusive. Terms and Conditions apply. For details, please refer to the Terms and Conditions of"Hang Seng PayDay+ promotion" at this website.

- The promotion period is from 1 April 2024 to 30 June 2024. Customer can enjoy up to HKD50 Maxim's e-Gift Voucher upon successful upgrading to Olive VIP Gold member. Customers who have already downloaded the Hang Seng Olive Wellness App are required to get the updated version to enjoy the e-Gift Voucher. Please visit https://cms.hangseng.com/cms/emkt/pmo/grp02/p54/eng/tnc_gift_voucher_new.html for the Terms and Conditions of the Hang Seng Olive Member Upgrading Maxim's e-Gift Voucher Rewards.

- The promotion period is from 1 April 2024 to 30 June 2024. Enjoy a HKD50 HKTVmall e-Gift voucher upon successful application for QuickReward Endowment Life Insurance Plan (1-Year) or The Choice 5-Year Life Insurance Plan (HKD)/(USD) or Imperial Dragon (RMB) Life Insurance Plan. Please visit https://cms.hangseng.com/cms/emkt/pmo/grp02/p54/eng/tnc_quickreward.html for the Terms and Conditions for the Reward of an e-Gift Voucher for Hang Seng Olive Members upon successful application for QuickReward Endowment Life Insurance Plan (1-Year) or The Choice 5-Year Life Insurance Plan (HKD)/(USD) or Imperial Dragon (RMB) Life Insurance Plan. This offer is only available to customers who complete a successful application via the Hang Seng Bank website and have already downloaded the Hang Seng Olive Wellness App (the most updated version is required for customers to enjoy the e-Gift Voucher). Please note the relevant product risks and credit risks. The above life insurance plan is underwritten by Hang Seng Insurance Company Limited.

- The promotion period is from 1 April 2024 to 30 June 2024. Upon successful application with an Eligible Hang Seng Credit Card for Any designated life insurance plans, first HKD50,000 of the initial premium paid enjoy up to $2,000 +FUN Dollars Rebate or 500,000 yuu Points. Please visit https://cms.hangseng.com/cms/emkt/pmo/grp02/p54/eng/tnc_olivecash.html for the Terms and Conditions for the Offer of an up to Extra 10X +FUN Dollars Rebate / yuu Points. Terms and Conditions apply. Please note the relevant product risks. The relevant life insurance plans are underwritten by Hang Seng Insurance Company Limited.

Notes:

- The document by itself is not and should not be considered as an offer, recommendation or solicitation to deal in any of the investment and insurance products or services mentioned herein.

- Hang Seng Bank Limited (the"Bank") reserves the right to suspend, vary or terminate this promotion and the related offers and to amend their terms and conditions at any time without prior notice. In case of disputes, the decision of the Bank shall be final.

- The contents of this document have not been reviewed by any regulatory authority in Hong Kong.

- This material is not intended to provide or regard as legal or taxation advice, or investment recommendations.

- The promotion is intended for persons in Hong Kong.

RMB Currency Risk

Renminbi ("RMB") is subject to exchange rate risk. Fluctuation in the exchange rate of RMB may result in losses in the event that the customer subsequently converts RMB into another currency (including Hong Kong Dollars). Exchange controls imposed by the relevant authorities may also adversely affect the applicable exchange rate. RMB is currently not freely convertible and conversion of RMB may be subject to certain policy, regulatory requirements and/or restrictions (which are subject to changes from time to time without notice). The actual conversion arrangement will depend on the policy, regulatory requirements and/or restrictions prevailing at the relevant time.

Foreign Currency Risk

Foreign Exchange involves Exchange Rate Risk. Fluctuations in the exchange rate of a foreign currency may result in gains or losses in the event that the customer converts HKD to foreign currency or vice versa.

Important Risk Warnings for Securities

Investors should note that investment involves risks. The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling securities.

Investors should note that investing in different Renminbi-denominated securities and products involves different risks (including but are not limited to currency risk, exchange rate risk, credit risk of issuer / counterparty, interest rate risk, liquidity risk (where appropriate)). The key risks of investing in securities via the Stock Connect Northbound Trading include:

- Once the respective quota is used up, trading will be affected or will be suspended.

- Stock Connect Northbound Trading will only operate on days when both markets are open for trading. Investors should take note of the days the Stock Connect Northbound Trading is open for business and decide according to their own risk tolerance whether or not to take on the risk of price fluctuations in securities during the time when Stock Connect Northbound Trading is not trading.

- When a security is recalled from the scope of eligible securities for trading via Stock Connect Northbound Trading, that security can only be sold but NOT bought.

- Investors will be exposed to currency risk if conversion of the local currency into RMB is required.

Foreign securities carry additional risks not generally associated with securities in the domestic market. The value or income (if any) of foreign securities may be more volatile and could be adversely affected by changes in many factors. Client assets received or held by the licensed or registered person outside Hong Kong are subject to the applicable laws and regulations of the relevant overseas jurisdiction which may be different from the Securities and Futures Ordinance (Cap.571) and the rules made thereunder. Consequently, such client assets may not enjoy the same protection as that conferred on client assets received or held in Hong Kong.

Investors should not only base on this material alone to make any investment decision, but should read in detail in the relevant risk disclosure statements.

Investment involves risk (including the possibility of loss of the capital invested). Prices of investment products may go up as well as down and may even become valueless. Past performance information presented is not indicative of future performance. Investors should not only base on this marketing material alone to make any investment decision, but should read in detail the offering documents and the Risk Disclosure Statement of the relevant investment products.

Risk Disclosure of SimplyFund Account

- Investors should note that all investments involve risks (including the possibility of loss of the capital invested), prices or value of investment fund units may go up as well as down and past performance information presented is not indicative of future performance. Investors should read carefully and understand the relevant offering documents of the investment funds (including the fund details and full text of the risk factors stated therein) and the Notice to Customers for Fund Investing before making any investment decision. Investment funds are investment products and some may involve derivatives. Investors should carefully consider their own circumstances whether an investment is suitable for them in view of their own investment objectives, investment experience, preferred investment tenor, financial situation, risk tolerance abilities, tax implications and other needs, etc., and should understand the nature, terms and risks of the investment products. Investors should obtain independent professional advice if they have concerns about their investment.

- Not all of the investment funds that are distributed by Hang Seng Bank Limited (the"Bank") are available here. Only specific funds are available for subscription with this account. If you are looking for other investment funds or investment products, please visit our branches or our websites for more information.

- In respect of the investment funds available for subscription with this account at the moment, they are provided either by the Bank's wholly owned subsidiary, Hang Seng Investment Management Limited, or by the Bank's affiliates HSBC Global Asset Management (Hong Kong) Limited.

The above general insurance plan ("this Plan") is underwritten by Chubb Insurance Hong Kong Limited ("Chubb") which is authorised and regulated in Hong Kong SAR by the Insurance Authority. Chubb reserves the right of final approval of the policy issuance. Hang Seng Bank Limited ("Hang Seng Bank") is registered as an insurance agency by the Insurance Authority (License No.: FA3168) and authorised by Chubb for distribution of this Plan. This Plan is a product of Chubb and not Hang Seng Bank. Upon application to this Plan, insurance premium will be payable to Chubb, and Chubb will provide Hang Seng Bank with commission and performance bonus as remuneration for distribution of this Plan. The existing staff remuneration policy on sales offered by Hang Seng Bank takes into account various aspects of the staff performance instead of focusing solely on the sales amount.

In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between Hang Seng Bank and the customer out of the selling process or processing of the related transaction, Hang Seng Bank is required to enter into a Financial Dispute Resolution Scheme process with the customer; however, any dispute over the contractual terms of the insurance product, underwriting, claims and policy service should be resolved directly between Chubb and the customer.

The above information is intended to be a general summary for reference only. Please refer to the policy wording for product features, exact terms, conditions, details of the exclusions and product risk.

Terms and Conditions apply to the promotion offer and the above insurance plans.

The above Life Insurance Plan is underwritten by Hang Seng Insurance Company Limited. IRR depends on your chosen accumulation period and payment mode. Terms and conditions apply. Please note the relevant product and credit risks. Please note the early surrender loss. The QDAP status of the Plan does not necessarily mean you are eligible for tax deduction available for QDAP premiums paid. The product's QDAP status is based on the features of the product as well as certification by the IA and not the facts of your own situation. You must also meet all the eligibility requirements set out under the Inland Revenue Ordinance and any guidance issued by the Inland Revenue Department of HKSAR before you can claim these tax deductions. Any general tax information provided is for your reference only, and you should not make any tax-related decisions based on such information alone. Please note that only the premium paid net of any marketing offers (e.g. discount, premium waiver, etc.) might be eligible for tax concession and the actual tax benefits of this Policy would depends on personal tax position (e.g. salaries income and assessable profits) and you should always consult with a professional tax advisor if you have any doubts.

To borrow or not to borrow? Borrow only if you can repay!