Open an account and apply for insurance now to enjoy the fabulous rewards

To smoothen your insurance application, we sincerely invite you to open a Hang Seng Preferred Banking Account via Hang Seng Mobile App in just a few steps, new customers are entitled for designated welcome rewards1!

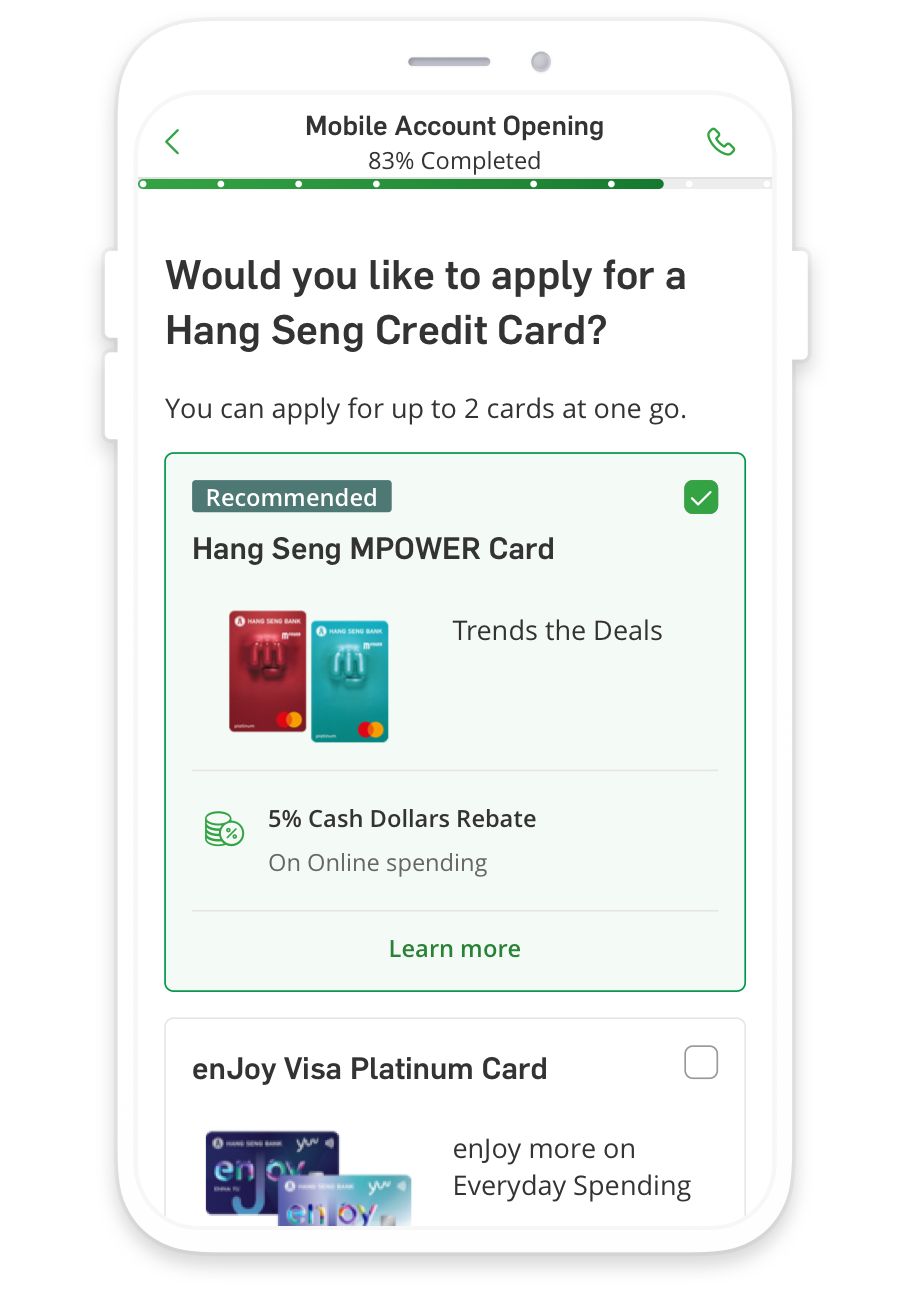

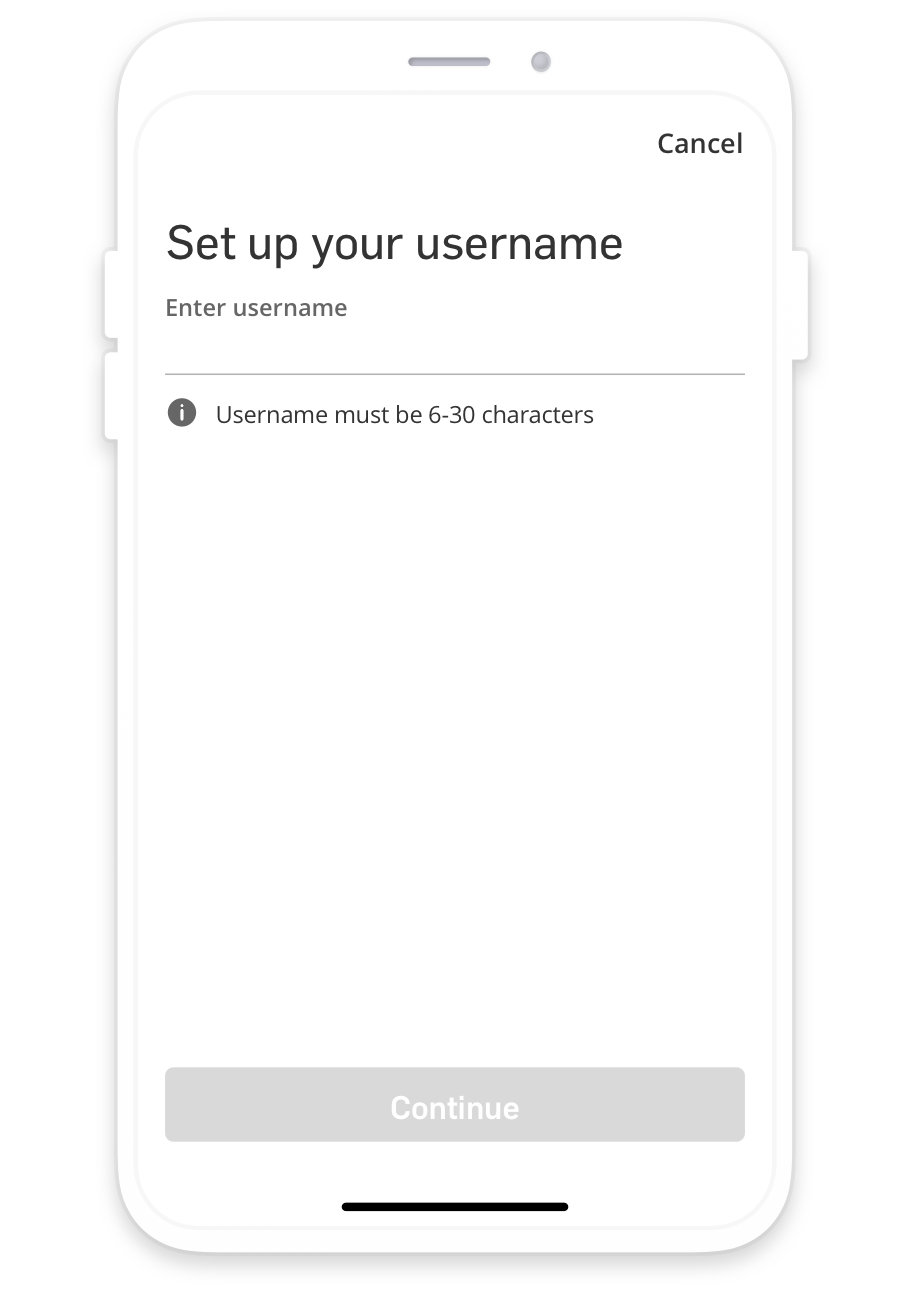

Step-by-step guide to opening an account and applying for insurance

Mobile Account Opening

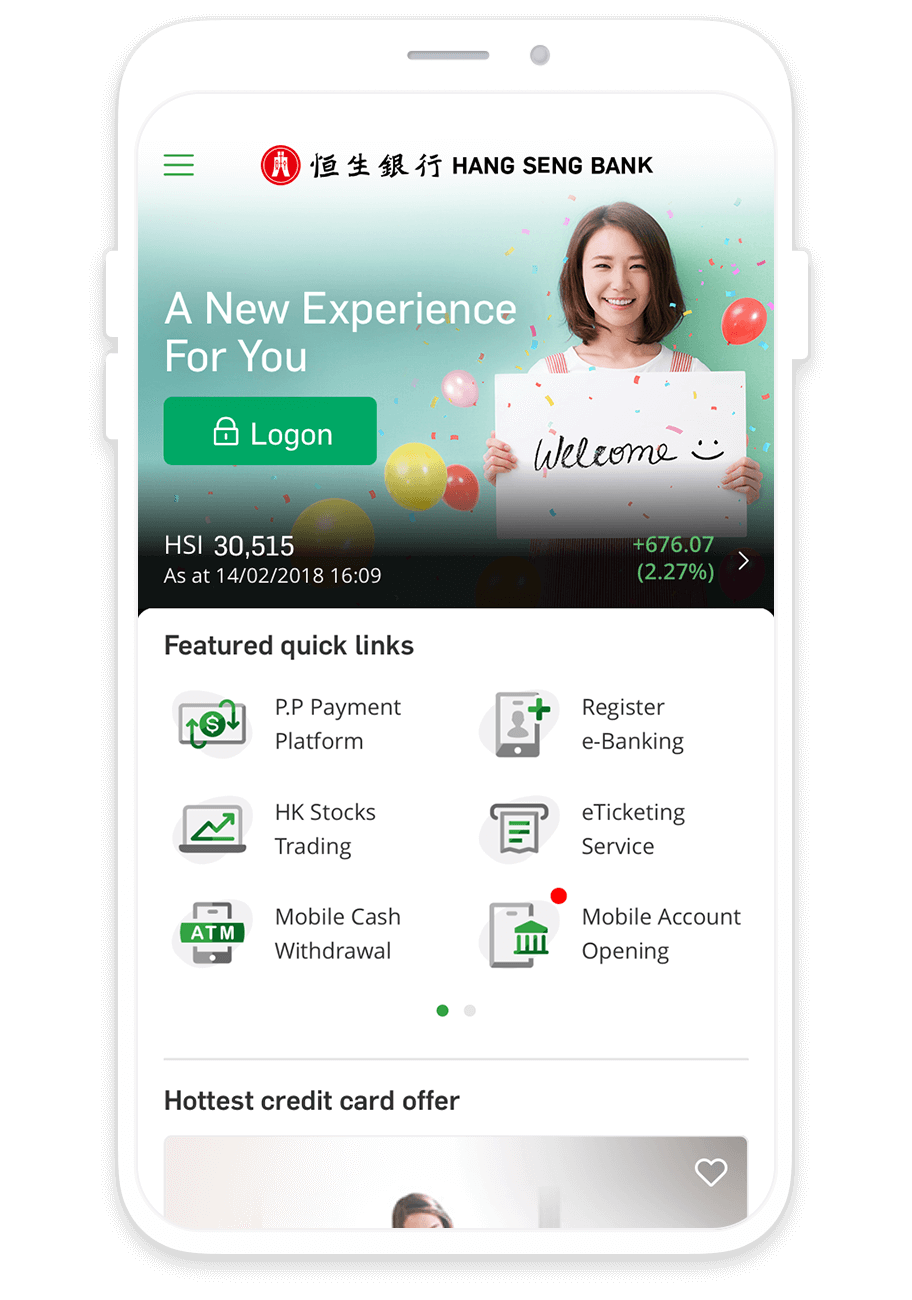

Download and open Hang Seng Mobile App, select “Mobile Account Opening”2 under Featured quick links at the Home page

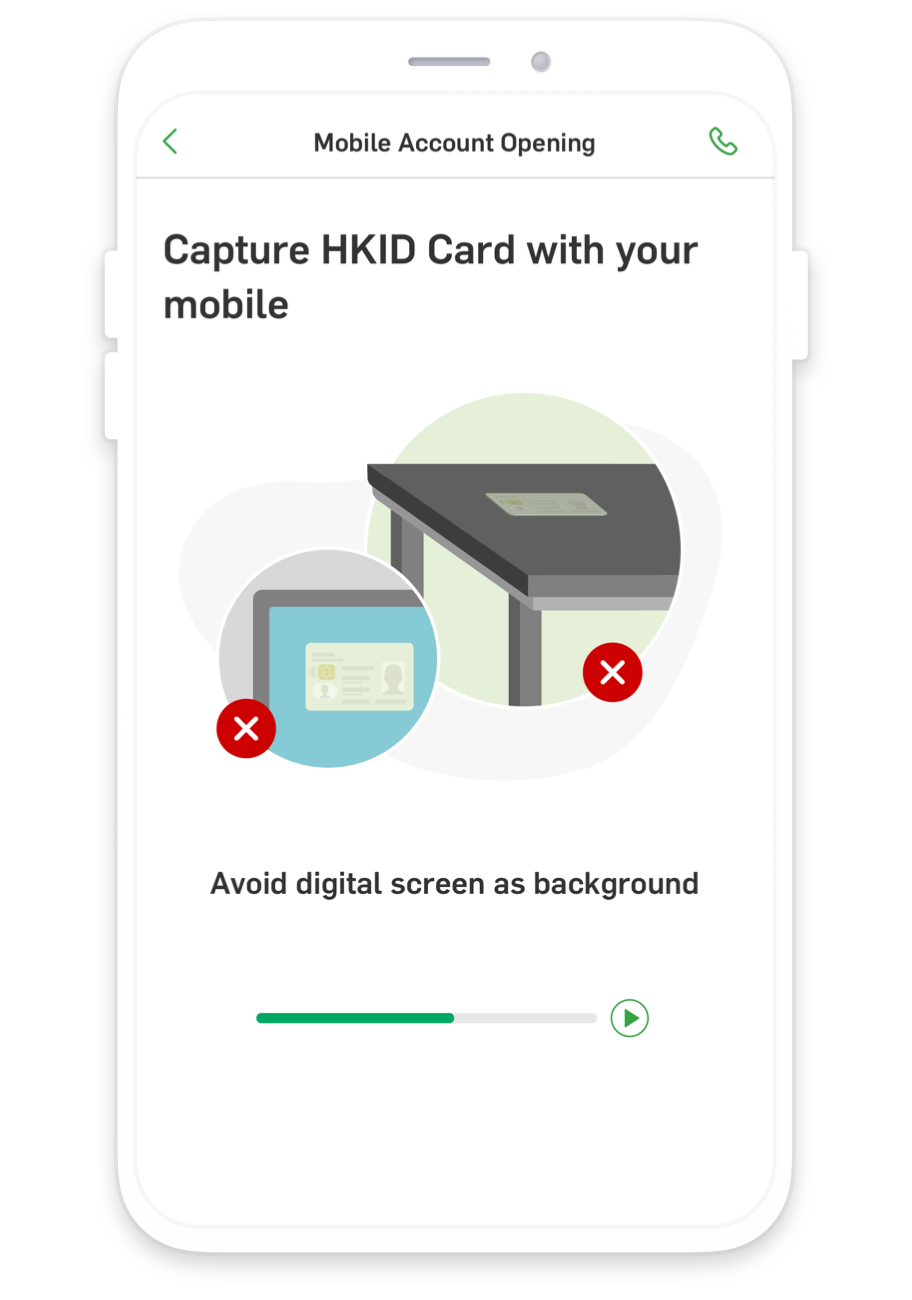

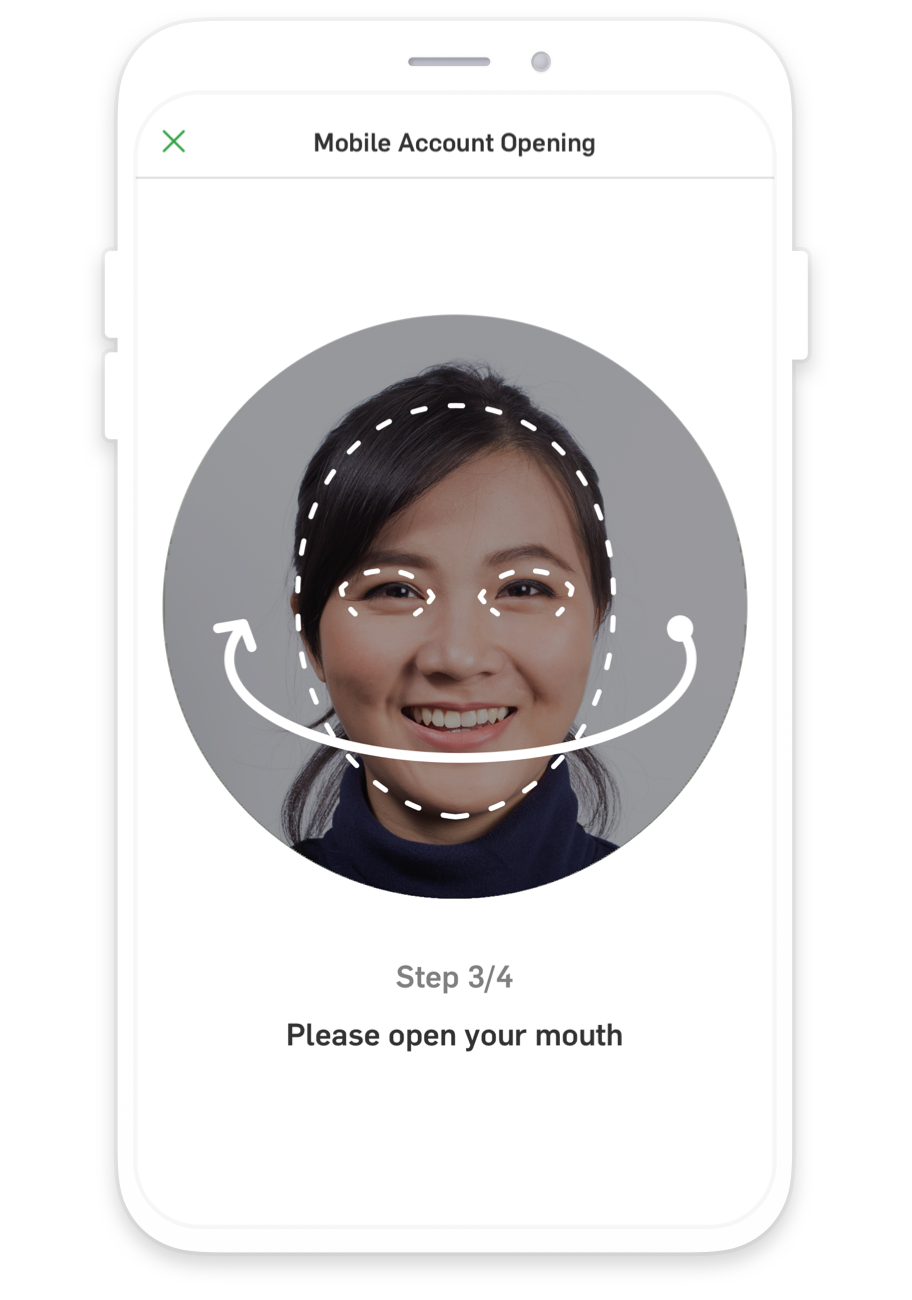

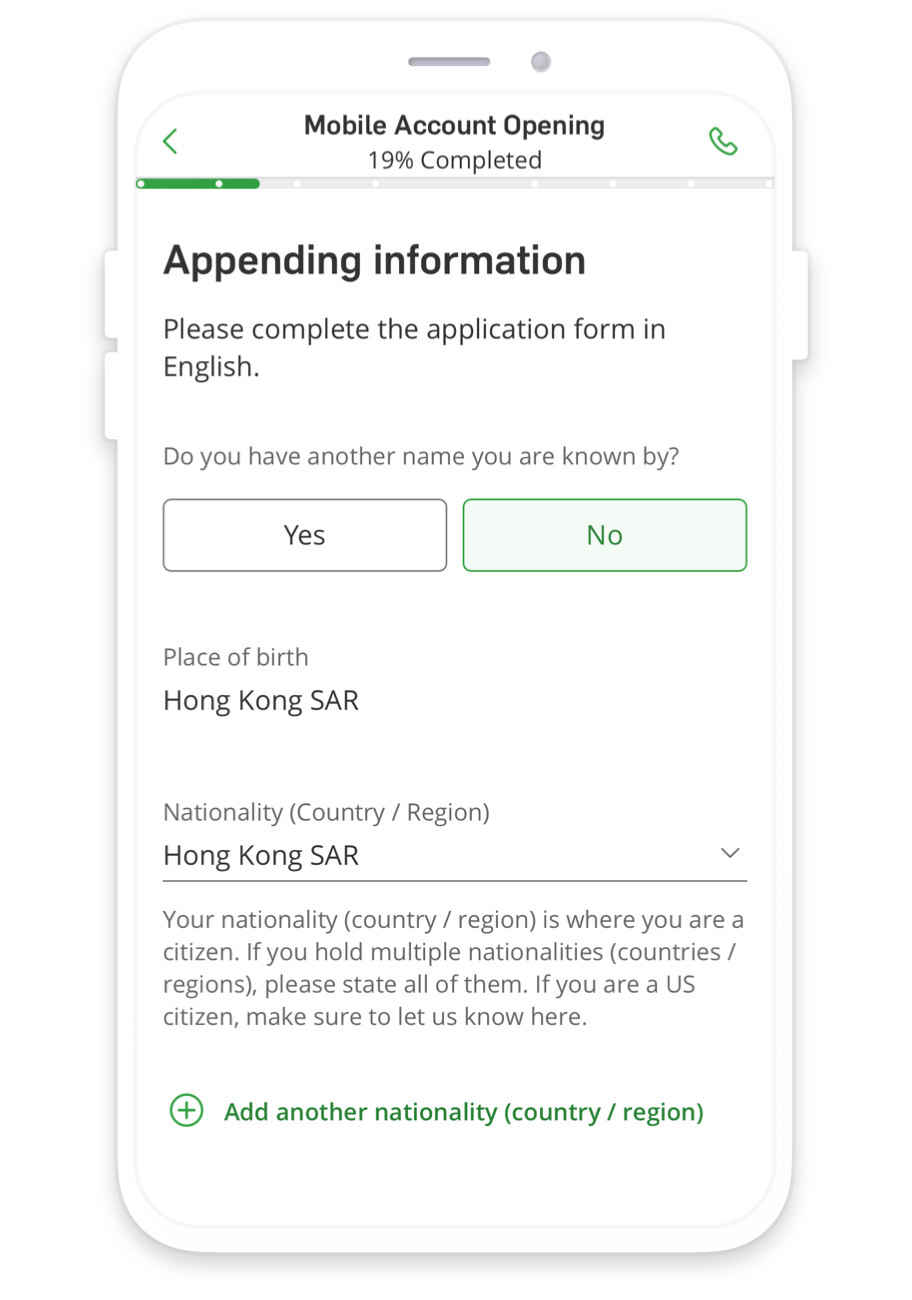

To verify your identity, capture your HKID and take a selfie by following the instructions provided. Fill in your personal details needed for Mobile Account Opening.

Activate your Personal e-Banking right after your account is opened

Transfer funds to the newly opened Hang Seng account (Tips: you can use FPS3 for an instant transfer)

Insurance Application

After your account is activated (full banking service will be available in 3 working days from application submission) , logon to yuu app and select yuu Insure

Choose Hang Seng Online Life Insurance Plan “Quote and Apply Now” to fill in information for application, and make payment with your new account number

Account Opening and

Insurance Application Offers

Starting from 1 April 2024 to 30 June 2024, you may enjoy an array of exclusive benefits by successfully opening a Preferred Banking Account and applying for an insurance plan:

Key features and exclusive privileges of Preferred Banking1

No below balance fee requirement

Offer a range of exclusive benefits such as Wealth Management products and other banking services

Discount offers at an array of merchants and welcome rewards

Hang Seng Online Life Insurance Plan Offer

Offer 1: 5-month premium waiver for the first year (Applicable to eFamilyPro Life Insurance Plan and eCancerPro Insurance Plan)

Offer 2: Earn 1 yuu Reward Point for every HKD1 first year premium paid

Offer 3: Earn extra 1 yuu Reward Point4 for every HKD1 spent at any designated yuu partner shop within designated period (Only Applicable to eFamilyPro Life Insurance Plan)

Download Hang Seng Personal Mobile App Now

Enjoy Account Opening and

Insurance Application Offer!

New to Hang Seng?

Step 1 / 6

Download and open Hang Seng Personal Banking mobile app, then select "Mobile Account Opening" under Featured quick links at the homepage

If you are in doubt of our marketing and promotional activities and materials, please call customer service enquiry hotline for authentication.

Enquiry and Trading Hotlines:

Terms and Conditions apply to all products/services, the above screen is for reference only.

Please click here for the Terms and Conditions for the “5-month Premium Waiver for the First Year Offer” and the “yuu Reward Point Offer”.

The above information is a product summary of information for reference only. Please

refer to the promotion leaflets, flyers, contracts and product brochures for the

important information such as detailed coverage, exact Terms and Conditions and

exclusions of the relevant Selected Life Insurance Plans. Please refer to the product

brochures for the relevant product risks.

The above Life Insurance Plan is underwritten by Hang Seng Insurance. Hang Seng

Insurance is authorised and regulated by the Insurance Authority of the HKSAR.

Remarks:

-

Terms and conditions apply. Please refer to

for details.

for details.

-

You can select "Mobile Account Opening" on Hang Seng Personal Banking mobile app by one of the following methods. (Note: If you are our existing Personal e-Banking customers and have activated the Mobile Security Key on your mobile, you will only find "Mobile Account Opening" under Main menu > Banking > "Prestige Banking" / "Preferred Banking" / "Payroll Services" until you re-install the app.)

- Homepage > Featured quick links > "Mobile Account Opening"

- Main menu > "Mobile Account Opening"

- Main menu > Banking > "Prestige Banking" / "Preferred Banking" / "Payroll Services" > "Mobile Account Opening"

- Log on > "Open account now"

-

Faster Payment System (FPS) is a real-time payment platform operated by Hong Kong

Interbank Clearing Limited. For terms and conditions related to Faster Payment

System, please visit

for details.

for details.

- Eligible policyholders can earn extra yuu Reward Points for shopping in designated merchants. For offer details, please visit the yuu App.

Other point(s) to note

- The mobile app is free of charge, but normal banking and transaction charges may apply when you conduct transactions via the app. Please refer to the Bank's service charges for details. In addition, customers are responsible for any fees and charges which may be levied by relevant telecommunication service provider from time to time. For any queries on charges for internet access, please contact your mobile network service provider.

- The mobile app can be accessed via the network of any local or overseas telecommunications service provider. You can use a 2G, 3G, HSDPA, 4G or Wi-Fi service. However, you must have a mobile internet service plan and handset that can support Internet access. Access to the Internet may also involve set-up procedures on your handset for some fixed IP SIM cards. Please check with your telecommunication service provider for details and up-to-date instructions. The connection speed may vary for different telecommunication service providers, different data usage plans, and different geographical locations. If you experience a slow response when mobile web browsing or during data transmission, please check with your telecommunication service provider. Customers are responsible for any fees and charges which may be levied by relevant telecommunication service provider from time to time. For any queries on charges for internet access, please contact your telecommunication service provider.

- Android, Google Play and the Google Play logo are trademarks of Google LLC.

- Apple, the Apple logo, and iPhone are trademarks of Apple Inc., registered in the US and other countries. App Store is a service mark of Apple Inc.

To borrow or not to borrow? Borrow only if you can repay!