Easily enjoy great interest

with the flexible Hang Seng Deposit Services

From now until 31 July 2023, as a Selected Customer1, you

can enjoy a preferential savings rate of up to

7.5% p.a. by

depositing new funds into your HKD and/or USD Savings/Current

Account (“Eligible Deposit Account(s)”)2 maintained with us

by completing 3 simple steps!

3 simple steps for an up to

7.5%

p.a. Preferential Savings Rate

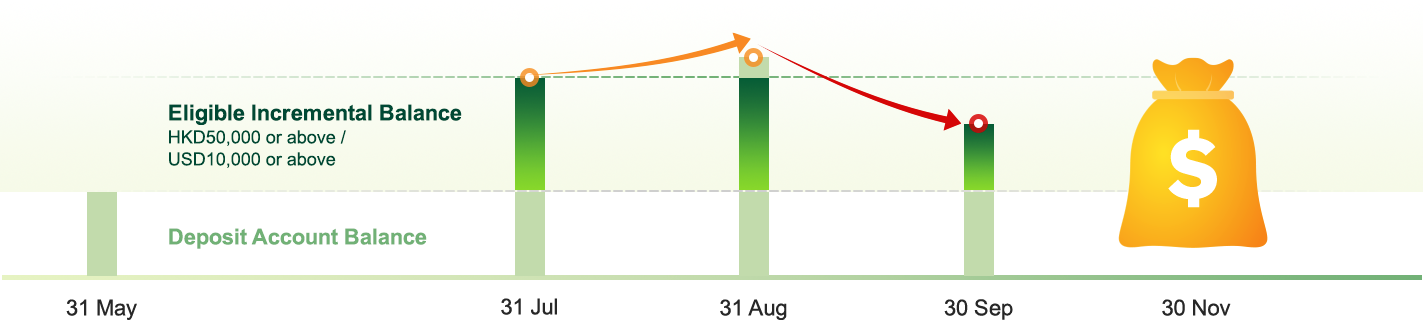

Deposit new funds to reach the Eligible Incremental Balance3 of HKD50,000 or above / USD10,000 or above by 31 July 2023

For each calendar day throughout the Bonus Interest Period, maintain the total balance of the Eligible Deposit Account at not lower than that on 31 July 2023

-

If you fulfill the Requirements in Phase I

You will enjoy the respective Bonus Savings

Rate4 in Phase I only

You will enjoy the respective Bonus Savings

Rate4 in Phase I only

-

If you fulfill the Requirements in both Phases I and II

you can enjoy the respective Bonus Savings

Rate4 in both Phases I and II

you can enjoy the respective Bonus Savings

Rate4 in both Phases I and II

-

If you do not fulfill the requirement in Phase I

you

cannot enjoy any bonus rate for Phase I and Phase II.

you

cannot enjoy any bonus rate for Phase I and Phase II.

1-31 August 2023

(both dates inclusive)

1-30 September 2023

(both dates inclusive)

Example Demonstration

(Bonus Interest Period

Phase I )

(Bonus Interest Period

Phase II)

Account Balance(A)

Account Balance(B)

Account Balance

Account Balance

(C) + (D)

Fulfill the Requirements

Fulfill the Requirements

Fulfill the Requirements

Fulfill the Requirements

Can enjoy the respective Bonus Savings Rate in both

Phases I and II

Can enjoy the respective Bonus Savings Rate in both

Phases I and II

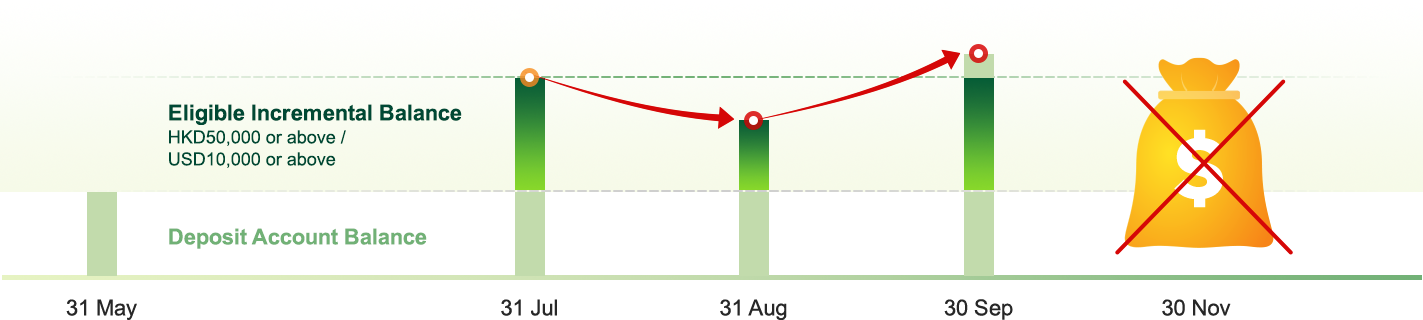

(Bonus Interest Period

Phase I )

(Bonus Interest Period

Phase II)

Account Balance(A)

Account Balance(B)

Account Balance

Account Balance

(C) + (D)

(Cannot fulfill the Requirements in Phase II)

(Cannot fulfill the Requirements in Phase II)

Fulfill the Requirements

Fulfill the Requirements

Fulfill the Requirements

Fulfill the Requirements

Cannot fulfill the Requirements

Cannot fulfill the Requirements

Can only enjoy the Bonus Savings Rate in Phase I

Can only enjoy the Bonus Savings Rate in Phase I

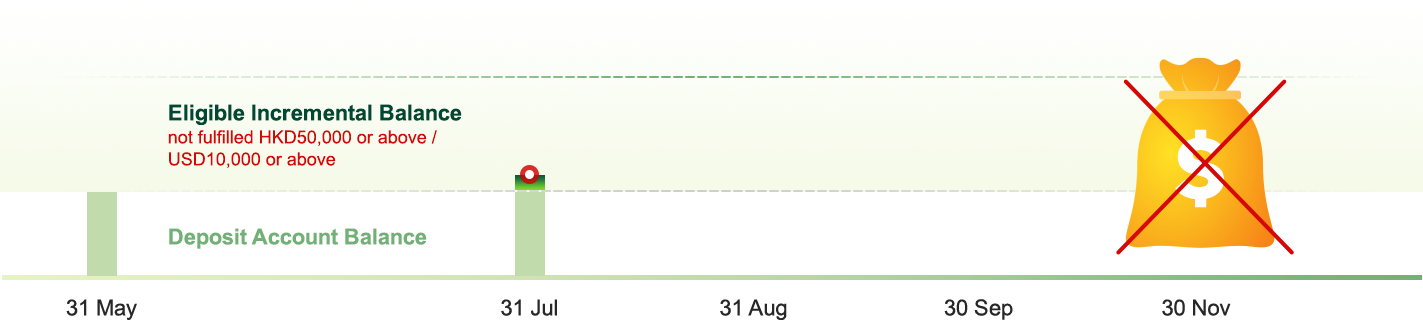

(Bonus Interest Period

Phase I )

(Bonus Interest Period

Phase II)

Account Balance(A)

Account Balance(B)

Account Balance

Account Balance

Fulfill the Requirements

Fulfill the Requirements

Cannot fulfill the Requirements in Phase I

Cannot fulfill the Requirements in Phase I

Cannot enjoy the Bonus Savings Rate

Cannot enjoy the Bonus Savings Rate

(Bonus Interest Period

Phase I )

(Bonus Interest Period

Phase II)

Account Balance(A)

Account Balance(B)

Account Balance

Account Balance

Not Eligible

Not Eligible

Not Applicable

Not Applicable

Cannot enjoy the Bonus Savings Rate

Cannot enjoy the Bonus Savings Rate

Want to effortlessly deposit new funds and enjoy the above benefits? Try the Pull Money and Mobile Cheque Deposit service!

As your daily banking partner, we are committed to taking care of your everyday financial needs on all fronts. Be it savings, bill payment or merchant payment, you can get it done hassle-free with one click via the Hang Seng Personal e-Banking or Mobile App.

From 1 July to 30 September 2023, simply complete designated transactions for a chance to share a prize of HKD 1 million#!

- "Selected Customer(s)" refers to the personal customer(s) who has/ have received the relevant promotion materials from Hang Seng Bank Limited (“the Bank"). This offer is not applicable to the employees of the Bank.

- “Eligible Deposit Account(s)” includes the Savings/ Current Account(s) of a Selected Customer in Hong Kong Dollars (HKD) and/or US Dollars (USD) maintained with the Bank in his/ her sole name or in the capacity as the primary account holder in the case of a joint account. For the avoidance of doubt, Time Deposit accounts are excluded from the Eligible Deposit Accounts.

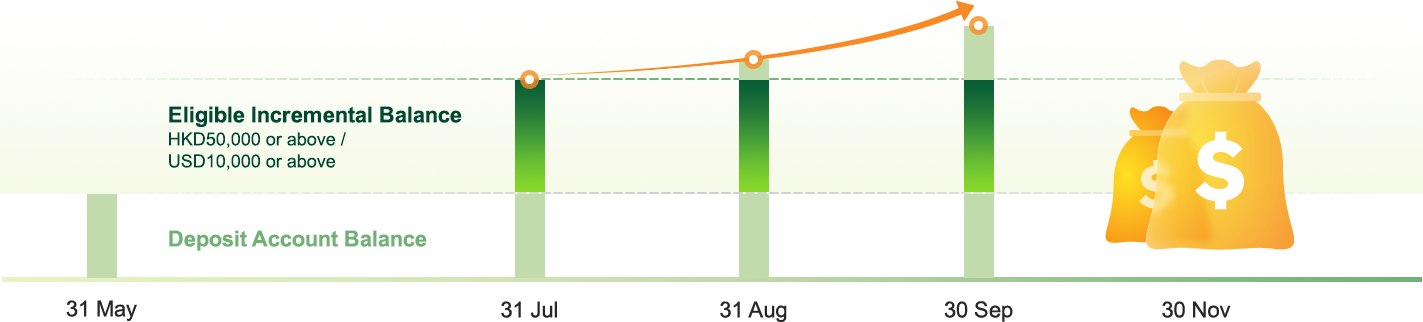

- Eligible Incremental Balance means the incremental total balance, per currency, of the relevant Eligible Deposit Account on 31 July 2023 as compared with that on 31 May 2023. In the case of any funds transfer made after 9pm on Mondays to Fridays or 6pm on Saturdays, and cheques deposited after the cut-off time of the Bank, the deposit balance will be updated and reflected in the calculation of the Eligible Incremental Balance on the next working day. All the related account deposit balances shall be based on the records of the Bank.

- The Bonus Savings Rate is applicable to the Eligible Incremental Balance up to the cap of HKD8,000,000 or USD1,000,000 only. The prevailing Savings Rate will apply to any deposits in excess of the cap (Prevailing Savings Rate is only applicable to HKD/USD savings accounts) . The Bonus interest part is calculated as simple interest for HKD on a 365-day or 366-day basis (for a leap year), as simple interest for USD on a 360-day basis.

- The Mobile Cheque Deposit service is applicable to the Hong Kong Dollar cheques, cashier orders, customized cheque and dividend cheques. The deposit limit of each cheque is HKD100,000 and the maximum daily deposit amount is HKD100,000. A maximum of 20 cheques can be deposited. For cheques deposit before 5:30pm on the settlement day, the funds will be credited as soon as on the next settlement day. Terms & Conditions apply.

Foreign Currency Risk

Foreign Exchange involves Exchange Rate Risk. Fluctuations in the

exchange rate of a foreign currency may result in gains or losses

in the event that the customer converts the HKD to a foreign

currency or vice versa.