Hang Seng Preferred Banking Welcome Offers Promotion (April - May 2022) – Terms and Conditions

General Terms and Conditions

- Unless otherwise specified, the promotion period of Hang Seng Preferred Banking Welcome Offers Promotion is from 1 April 2022 to 9 May 2022, both dates inclusive (“Promotion Period”).

- Each Eligible Customer can only enjoy the offers once unless otherwise specified. The offers cannot be used in conjunction with other promotional offers of the same product offered by Hang Seng Bank Limited (the “Bank”).

- The Bank reserves the right to suspend, vary or terminate this promotion and the related offers and to amend these terms and conditions at any time without prior notice. The decision of the Bank on all matters relating to this promotion and the related offers shall be final and binding on all the parties concerned. The relevant offers are subject to the terms and conditions of the relevant products/services. If there is any inconsistency between the terms and conditions of the relevant products/services and these terms and conditions, these terms and conditions shall prevail. In case of any discrepancy between the English and the Chinese versions of these terms and conditions, the English version shall prevail.

- No person other than the Customer and the Bank (which includes its successors and assigns) will have any right under the Contracts (Rights of Third Parties) Ordinance to enforce or enjoy the benefit of any of the provision of these terms and conditions.

- These terms and conditions are governed by and will be construed in accordance with the laws of the Hong Kong Special Administrative Region.

- These terms and conditions are subject to prevailing regulatory requirements.

Preferred Banking Welcome Rewards

-

Unless otherwise specified, this offer is only applicable to personal customers who meet the account opening requirements and have newly opened/ upgraded to Integrated Account of Preferred Banking (“Preferred Banking”) at the Bank branches or through digital channels (including Hang Seng Personal Banking mobile app and Hang Seng Personal e-Banking) or phone banking hotline during the Promotion Period (the “Eligible Customers”). The Eligible Customers exclude:

- existing customers who are holding sole-named or joint-named Preferred Banking; or

- customers who have closed any sole-named or joint-named Preferred Banking with the Bank in the previous 12 months prior to the account opening month; or

- customers whose accounts have been terminated in any period

- “New Customer(s)” mentioned herein refers to the Eligible Customers, who are not:

- existing customers who are holding any Hong Kong Dollars/Foreign Currency savings, current, time deposit accounts or any Integrated Accounts at the Bank (including Prestige Banking, Preferred Banking, Green Banking and any other Integrated Account) (the “Existing Customer(s)”), or

- customers who have closed any of the above accounts with the Bank in the previous 12 months prior to the account opening month, or

- customers whose accounts mentioned above have been terminated in any period.

- In case the relevant Preferred Banking is a joint-named account, only the primary account holder can enjoy the offers.

- The offers are not applicable to commercial customers.

- In case of any disputes, the Bank’s records shall be final and conclusive.

Preferred Banking Account Opening Reward

- New Customers who open a new Preferred Banking at branches or through Hang Seng Personal Banking mobile app and also open / use the designated banking/ investment services during the Promotion Period can earn up to USD100 reward.

- New Customers who fund in and achieve deposit balance growth of HKD5,000 (“Eligible Incremental Amount”) are entitled to USD20 cash rewards. Eligible Incremental Amount refers to the positive net growth amount of the customer’s combined total deposit balance (HKD equivalent) of all sole-named deposit accounts of the Bank (“Total Deposit Balance”) from the Baseline date to the Comparison Date, as mentioned in the below table. For customers who did not hold any account with the Bank at the Baseline, his/her “Total Deposit Balance” on the Baseline date will be treated as Zero. All the related account deposit balances shall be based on the records of the Bank which shall prevail. The relevant cash rewards will be credited in US dollars into the relevant Preferred Banking Account of the New Customers on or before the date specified in the below table.

-

The Hang Seng Payroll Service Promotion is only applicable to New Customers / Eligible Customers who have no payroll record under any account of the Bank during the period from 1 October 2021 to 31 March 2022 (“Eligible Payroll Customer”). Eligible Payroll Customer who successfully set up Payroll service via their Preferred Banking account (“Payroll Account”) within the Designated Period as below, and fulfil the following requirements:

- with incremental deposit balance growth of HKD20,000 by depositing new fund (“Payroll Promotion Eligible Incremental Amount”) and with at least one payroll record of HKD10,000 or above (“Payroll Amount”) are entitled to USD30 Cash Reward, Eligible Payroll Customer is entitled to the cash reward once.

- Payroll Promotion Eligible Incremental Amount refers to the positive net growth amount of the Eligible Payroll Customer’s combined total deposit balance (HKD equivalent) of all sole-named deposit accounts of the Bank (“Total Deposit Balance”) from the Baseline date to the Comparison Date as mentioned in the below table. For Eligible Payroll Customers who did not hold any account with the Bank at the Baseline, his/her “Total Deposit Balance” on the Baseline date will be treated as Zero. All the related account deposit balances shall be based on the records of the Bank which shall prevail. The Hang Seng Payroll Service Promotion is not applicable to Private Banking customers and the Bank’s staff.

- The payroll amount must be directly credited to customer’s Payroll Account from the employer's company account via Autopay. Any payroll amount not credited from the employer’s company account is not considered as eligible payroll record. The payroll amount and the number of payroll transactions are subject to the Bank's records. In case of any dispute, the decision of the Bank shall be final. The relevant cash rewards will be credited in US dollars into the relevant Preferred Banking Account of the New Customers/ Eligible Customers on or before the date specified in the below table. The Payroll Account must be valid at the time the corresponding cash reward is credited, otherwise he/she will forfeit his/her right to receive the cash reward. The Hang Seng Payroll Service Promotion is applicable to Eligible Payroll Customer who has payroll transactions in Hong Kong Dollars only.

- For Rewards 3, 4 and 5, New Customers are required to fulfill the requirements of designated banking/ investment services within the Designated Period in order to enjoy the relevant cash rewards. The relevant cash rewards will be credited in US dollars into the relevant Preferred Banking Account of the New Customers on or before the date specified in the below table.

- New Customers who open new SimplyFund Account through Hang Seng Personal Banking mobile app within the Designated Period are entitled to USD20 cash rewards.

- New Customers who open Securities Account and complete one successful HK stocks/ Stock Connect Securities or US stocks buy or sell transaction via the Bank’s digital trading channels (including Invest Express mobile app, Hang Seng Personal e-Banking or Hang Seng Personal Banking mobile app) within the Designated Period are entitled to USD20 cash rewards. “HK stocks” refer to Hong Kong dollar-denominated stocks listed on The Stock Exchange of Hong Kong Limited. “Stock Connect Securities” refer to eligible stocks for Shanghai-Hong Kong Stock Connect Northbound Trading/ Shenzhen-Hong Kong Stock Connect Northbound Trading. “US stocks” refer to Common Stocks (excluding warrants), Exchange Traded Funds (ETFs) and American Depository Receipts (ADRs) traded on New York Stock Exchange (NYSE), Nasdaq Global Market (NASDAQ), NYSE Amex Equities Market (AMEX) and NYSE ARCA.

- New Customers who set up a savings plan with duration of at least 3 months by using Savings Planner via Hang Seng Personal Banking mobile app within the Designated Period are entitled to USD10 cash rewards.

- Customers must maintain a valid Preferred Banking account at the time the relevant cash rewards are being awarded. If customers have terminated the relevant Preferred Banking or changed such account to a non-Preferred Banking at the time when rewards are being awarded, the Bank reserves the right to deduct from any accounts of the customers maintained with the Bank an amount equivalent to the value of the reward without prior notice.

- The Bank reserves the right to credit the relevant cash rewards in HKD equivalent without prior notice.

| Reward | Designated Banking/ Investment Services | Cash Reward |

|---|---|---|

| Reward 1 | Fund in HKD5,000 | USD20 |

| Reward 2 | Switch to Hang Seng Payroll Service and fund in HKD20,000 or above (“Hang Seng Payroll Service Promotion”) | USD30 |

| Reward 3 | Open a new SimplyFund account | USD20 |

| Reward 4 | Open a new Securities account and complete a trade | USD20 |

| Reward 5 | Set up a savings plan on Savings Planner | USD10 |

| Preferred Banking Account Opening Date | Baseline for Eligible Incremental Amount | Comparison Date for Eligible Incremental Amount | Cash Reward Credit Date |

|---|---|---|---|

| 1 April to 9 May 2022 | 31 March 2022 | 30 June 2022 | On or before 31 August 2022 |

| Preferred Banking Account Opening Date | Designated period to set up Payroll Services and with payroll record | Baseline for Payroll Promotion Eligible Incremental Amount | Comparison Date for Payroll Promotion Eligible Incremental Amount | Cash Reward Credit Date |

|---|---|---|---|---|

| 1 April to 9 May 2022 | 1 April to 30 June 2022 | 31 March 2022 | 30 June 2022 | On or before 31 August 2022 |

| Preferred Banking Account Opening Date | Designated Period to fulfill the requirements of designated banking/ investment services (“Designated Period”) | Cash Reward Credit Date |

|---|---|---|

| 1 April to 9 May 2022 | On or before 30 June 2022 | On or before 31 August 2022 |

- The promotion period of the Deposit Offer is from 1 April 2022 to 30 June 2022, both dates inclusive (“Promotion Period of the Deposit Offer”).

- This offer is only applicable to New Customer(s) and their Hong Kong Dollar (HKD) Savings/ Current Accounts maintained with the Bank in their sole name or in the capacity as the primary account holder in the case of a joint account (“Eligible Deposit Accounts”). This offer is not applicable to the employees of the Bank.

-

From the account opening date to 30 June 2022 (“Bonus Interest Period”), New Customers can enjoy the 2% p.a. HKD Savings Deposit Bonus Interest Rate for the first HKD200,000 Eligible Deposits (“Eligible Customers of the Deposit Offer”). All related account deposit balance shall be based on the record of the Bank.

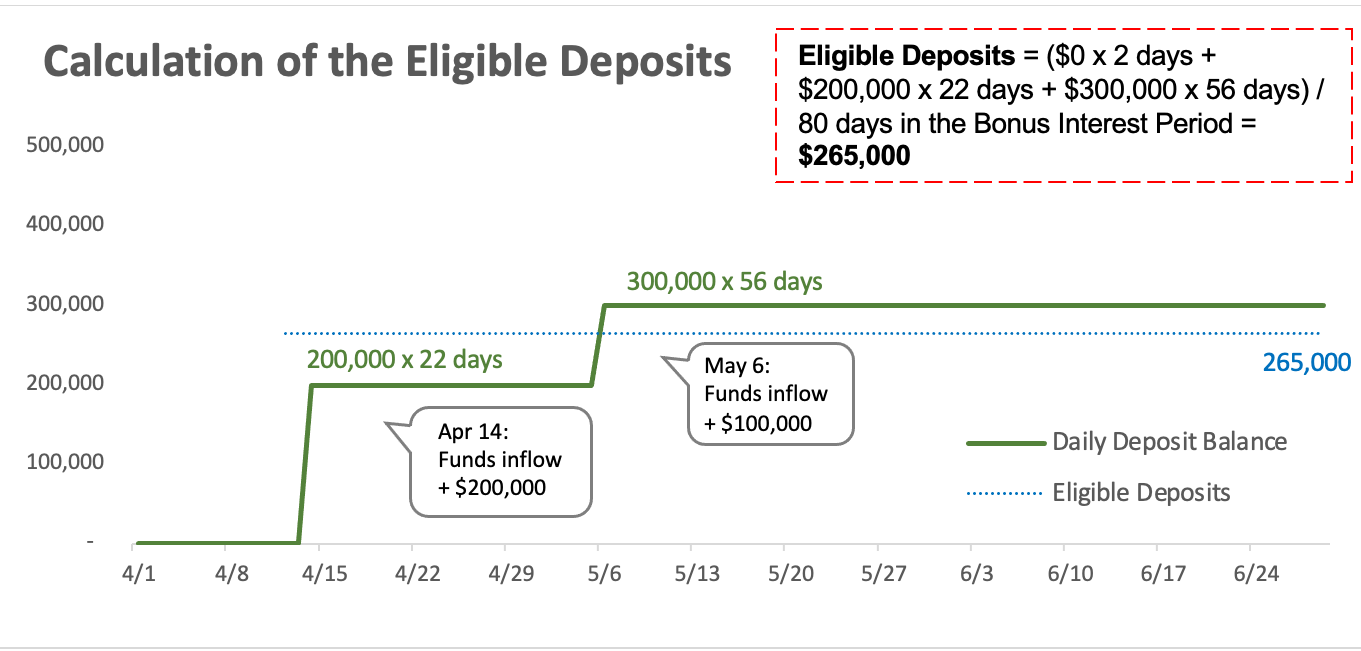

About the definition of the Eligible Deposits

Eligible Deposit is the average daily deposit balance of the Eligible Deposit Accounts during the Bonus Interest Period.

Example:

Assuming that the customer has opened the new Preferred Banking on 12 Apr 2022, and with the following deposit balance and transactions during the Bonus Interest Period:

HKD deposit balance from 12 – 13 Apr: $0 2 days Funds in on 14 Apr: +$200,000 HKD deposit balance from 14 Apr – 5 May: $200,000 22 days Funds in on 6 May: +$100,000 HKD deposit balance from 6 May – 30 Jun: $300,000 56 days Eligible Deposits: $265,000

-

Eligible Deposits entitled to the Deposit Offer= $200,000

(The Deposit Offer is only applicable to the first HKD200,000 Eligible Deposits)

-

Bonus interest entitlement= $876.7

($200,000 * Bonus Interest Rate 2% p.a. * 80 days in the Bonus Interest Period / 365 days in 2022)

-

- The bonus interest will be credited into the Eligible Deposit Account of each Eligible Customer of the Deposit Offer on or before 31 Aug 2022. Each Eligible Customer of the Deposit Offer must continue to maintain a valid Preferred Banking at the time the bonus interest is credited, or he/ she will be deemed to have forfeited the right to receive the relevant bonus interest.

- There are limited quotas for this Offer and it is rewarded on a first-come-first-served basis.

- Each Eligible Customer of the Deposit Offer can enjoy this offer only once during the Promotion Period of the Deposit Offer. This offer cannot be used in conjunction with other savings deposit offers for the same currency (including but not limited to the deposits under Mortgage-link Loan Scheme).

- The prevailing HKD Savings Board Rate remains in force. Deposit interest rates of the Bank are subject to review according to changes in market conditions from time to time. Please check with our branch staff for details.

2% p.a. HKD Savings Deposit Bonus Interest Rate Offer (“Deposit Offer”)

- The promotion period of Extra Offer for Full-time University/ Tertiary Students is from 1 April 2022 to 30 June 2022, both dates inclusive ("Students Extra Offer Promotion Period").

- Eligible Customers who are full-time university/ tertiary Students open a new Preferred Banking account and also successfully apply for a University/ College Affinity Credit Card during the Students Extra Offer Promotion Period can earn up to $500 extra reward.

- The offer is only applicable to Eligible Customers who are full-time university / tertiary students, aged 18 or above and attending certificate level or above course offered by following accredited education institutions and their subsidiaries, including: accredited universities in Hong Kong, Chu Hai College of Higher Education, Vocational Training Council, Hong Kong Institute of Vocational Education, The Hong Kong Academic of Performing Arts, Caritas Institute of Higher Education, Caritas Bianchi College of Careers, Hong Kong Institute of Technology, Hong Kong College of Technology/HKCT Institute of Higher Education, Centennial College, Tung Wah College, UOW College Hong Kong, Hong Kong Nang Yan College of Higher Education, Caritas Institute of Community Education, Hong Kong Art School, Gratia Christian College and Yew Chung College of Early Childhood Education (“Eligible University/ Tertiary Students”). Eligible University/ Tertiary Students are required to present HKID identity copy, valid Student ID Cards or related supporting document (applicable to open a new Preferred Banking, examples of valid address proof: formal document issued by any local university / tertiary institution, mobile phone bill or statement / advice issued by any local licensed bank, etc.) upon application of Preferred Banking and designated Hang Seng Credit Card at branch. Eligible University/ Tertiary Students must maintain their occupation status as “Students” in the Bank’s record to enjoy the above rewards.

- For Eligible University/ Tertiary Students who have successfully applied for University/ College Affinity Credit Card principal card during 1 April 2022 to 30 June 2022, and whose applications are successfully approved and have fulfilled the designated spending requirements of welcome offer of University / College Affinity Credit Card on or before 30 September 2022, are entitled to $300 Cash Dollars. Eligible University/ Tertiary Students who have also successfully opened/ upgraded to new Preferred Banking during the Promotion Period, are entitled to an extra $200 Cash Dollars reward. The Bank will credit the relevant Cash Dollars to the relevant principal card account of the Eligible University/ Tertiary Students customers on or before 31 October 2022. The Preferred Banking of Eligible University/ Tertiary Students must remain valid, and the relevant credit card account must be still valid and in good standing when the Cash Dollars are granted.

- For the details, spending requirement and the terms and conditions for University/ College Affinity Credit Card Welcome Offer, please contact our branch staff or visit

.

.

Extra Offer for Full-time University/ Tertiary Students

| Full-time University / Tertiary Students Extra Offer | Reward |

|---|---|

| Successfully apply for University/ College Affinity Credit Card and fulfill designated spending requirements | $300 Cash Dollars |

| Open / upgrade to a new Preferred Banking and successfully apply for University/ College Affinity Credit Card and fulfill designated spending requirements | $200 Cash Dollars |

-

Hang Seng MPOWER Card Welcome Offer

The promotion period is from 1 April 2022 to 30 June 2022. For Eligible Customers who have successfully applied for Hang Seng MPOWER Card principal card during the Promotion Period, and whose applications are successfully approved and have fulfilled the designated spending requirements of welcome offer on or before 30 September 2022, are entitled to up to $700 Cash Dollars. Terms and Conditions apply. For details, please contact our branch staff or visit hangseng.com/mpower. Customers who have fulfilled the welcome offer’s requirement of Hang Seng MPOWER Card and successfully opened a new / upgraded to Preferred Banking account during the Promotion Period, are entitled to an extra $200 Cash Dollars. The Bank will credit the relevant Cash Dollars to the relevant principal card account of the Eligible Customers on or before 31 October 2022. The Preferred Banking of Eligible Customers must remain valid, and the relevant credit card account must be still valid and in good standing when the Cash Dollars are granted.

-

0% Fund Subscription Fee Offer

The promotion period is from 1 April to 31 December 2022. Investment involves risk, Terms and Conditions apply. For details, please contact our branch staff or visit

.

. -

SimplyFund Reward

The promotion period is from 1 April 2022 to 30 June 2022. Investment involves risk, Terms and Conditions apply. For details, please contact our branch staff or visit

.

. -

Foreign Currency Time Deposit Interest Rate of up to 13% p.a.

The promotion period is from 1 April 2022 to 30 June 2022. The above interest rate offers are quoted with reference to the interest rates offered by the Bank on 31 March 2022 and are for reference only. The relevant interest rates will be subject to revision based on the prevailing market conditions. Terms and Conditions apply. For details, please contact our branch staff or visit

.

. -

Securities Services Offer

The promotion period is from 1 April 2022 to 30 June 2022. New Securities Customers (including all the account holders of the New Securities Account) means customers must not hold any securities account (personal/ joint) with the Bank within a period of 6 months preceding the account opening date. Investment involves risk, Terms and Conditions apply. For details, please contact our branch staff or visit .

.

Terms and Conditions of other Rewards and Privileges

Risk Disclosure of Investment Fund

Investors should note that investments involve risks (including the possibility of loss of the capital invested), prices of fund units may go up as well as down and past performance information presented is not indicative of future performance. Investors should read the relevant fund's offering documents (including the full text of the risk factors stated therein (in particular those associated with investments in emerging markets for funds investing in emerging markets) in detail before making any investment decision.

Risk Disclosure of SimplyFund Account

- Investors should note that all investments involve risks (including the possibility of loss of the capital invested), prices or value of investment fund units may go up as well as down and past performance information presented is not indicative of future performance. Investors should read carefully and understand the relevant offering documents of the investment funds (including the fund details and full text of the risk factors stated therein) and risk disclosure statements of the relevant investment funds before making any investment decision. Investors should carefully consider whether an investment is suitable for them in view of their own investment objectives, investment experience, preferred investment tenor, financial situation, risk tolerance abilities, tax implications and other needs, etc., and should understand the nature, terms and risks of the investment products. Investors should obtain independent professional advice if they have concerns about their investment.

- Not all of the investment funds that are distributed by Hang Seng Bank Limited (the “Bank”) are available in SimplyFund Account. Only specific funds are available for subscription with the SimplyFund Account. If you are looking for other investment funds or investment products, please visit our branches or our websites for more information.

- In respect of the investment funds available for subscription with the SimplyFund Account, they are provided either by the Bank’s wholly owned subsidiary, Hang Seng Investment Management Limited, or by the Bank’s affiliate HSBC Global Asset Management (Hong Kong) Limited.

RMB Currency risk

Renminbi ("RMB") is subject to exchange rate risk. Fluctuation in the exchange rate of RMB may result in losses in the event that the customer subsequently converts RMB into another currency (including Hong Kong Dollars). Exchange controls imposed by the relevant authorities may also adversely affect the applicable exchange rate. RMB is currently not freely convertible and conversion of RMB may be subject to certain policy, regulatory requirements and/or restrictions (which are subject to changes from time to time without notice). The actual conversion arrangement will depend on the policy, regulatory requirements and/or restrictions prevailing at the relevant time.

Currency Risk

Foreign Exchange involves Exchange Rate Risk. Fluctuations in the exchange rate of a foreign currency may result in gains or losses in the event that the customer converts HKD to foreign currency or vice versa.

Important Risk Warnings in relation to Securities Investment

Investors should note that investment involves risks. The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling securities.

Investors should note that investing in different Renminbi-denominated securities and products involves different risks (including but are not limited to currency risk, exchange rate risk, credit risk of issuer / counterparty, interest rate risk, liquidity risk (where appropriate)). The key risks of investing in A-shares of Stock Connect Northbound Trading include:

- Transactions under the Northbound or Southbound Trading of Shanghai-Hong Kong Stock Connect / Shenzhen-Hong Kong Stock Connect will not be covered by the Investor Compensation Fund in Hong Kong.

- Once the respective quota is used up, trading will be affected or will be suspended.

- Stock Connect Northbound Trading will only operate on days when both markets are open for trading and when banks in both markets are open on the corresponding settlement days. Investors should take note of the days the Stock Connect Northbound Trading is open for business and decide according to their own risk tolerance whether or not to take on the risk of price fluctuations in securities during the time when Stock Connect Northbound Trading is not trading.

- When some stocks are recalled from the scope of eligible stocks for trading via Stock Connect Northbound Trading, the stocks can only be sold but NOT bought.

- Investors will be exposed to currency risk if conversion of the local currency into RMB is required.

Foreign securities carry additional risks not generally associated with securities in the domestic market. The value or income (if any) of foreign securities may be more volatile and could be adversely affected by changes in many factors. Client assets received or held by the licensed or registered person outside Hong Kong are subject to the applicable laws and regulations of the relevant overseas jurisdiction which may be different from the Securities and Futures Ordinance (Cap.571) and the rules made thereunder. Consequently, such client assets may not enjoy the same protection as that conferred on client assets received or held in Hong Kong.

Investors should not only base on this material alone to make any investment decision, but should read in detail in the relevant risk disclosure statements.