Investment involves risk (including the possibility of loss of the capital invested). Prices of investment products may go up as well as down and may even become valueless. Past performance information presented is not indicative of future performance. Investors should not only base on this marketing material alone to make any investment decision, but should read in detail the offering documents and the Risk Disclosure Statement of the relevant investment products.

Potential returns and risk levels vary for different types of investment products. How to choose the investment products that best suit you? “Risk Profiling Questionnaire” and “Investor Protection Assessment” are tools that can help you get a good grasp of your risk tolerance level and investment attributes. Make sure they are updated regularly to help better understand your current profile and needs. Valid “Risk Profiling Questionnaire” and/or “Investor Protection Assessment” records are required before subscribing for investment products.

“Risk Profiling Questionnaire”

gives you a full picture of your risk tolerance level and investment needs,

and also serves as a reference for you when making trading decisions for various investment products1.

“Risk Profiling Questionnaire”

gives you a full picture of your risk tolerance level and investment needs,

and also serves as a reference for you when making trading decisions for various investment products1.

“Investor Protection Assessment”

allows you to evaluate if any additional protection2 is required based on your personal circumstances (including trading experience).

Latest Offers for first-time complete/ update the expired “Risk Profiling Questionnaire”

From now till 31 December 2024 (“Promotion Period”), by successfully first-time complete / update your expired “Risk Profiling Questionnaire“ via Hang Seng Personal e-Banking or Hang Seng Personal Mobile App, you can enjoy the following reward:

Olive Reward Get!

First-time complete/ update the expired “Risk Profiling Questionnaire” via digital channel to earn 1,000 Olive Points3

Steps for redemption

Steps for redemption

1

Eligible customers4 complete/ update the “Risk Profiling Questionnaire“

2

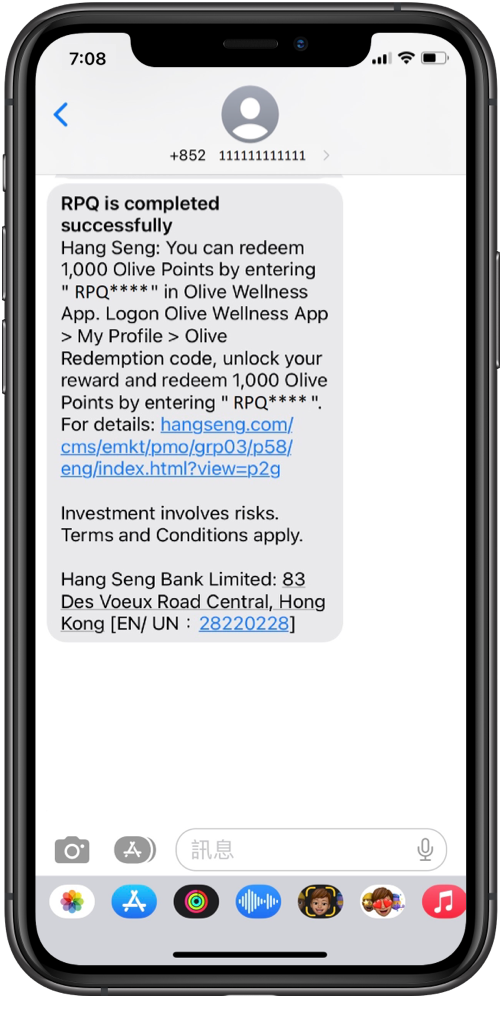

You will receive Olive redemption code via an SMS within 7 days

3

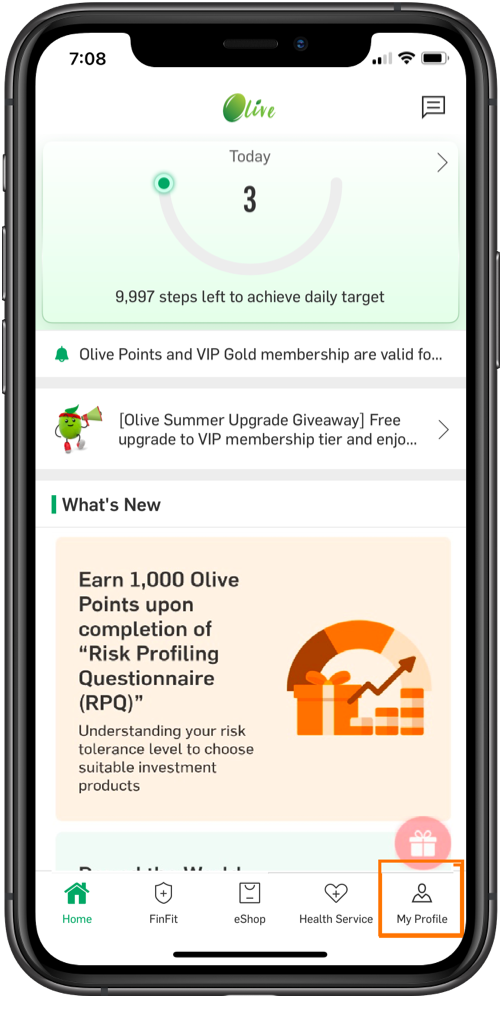

Logon to the Hang Seng Olive Wellness App

4

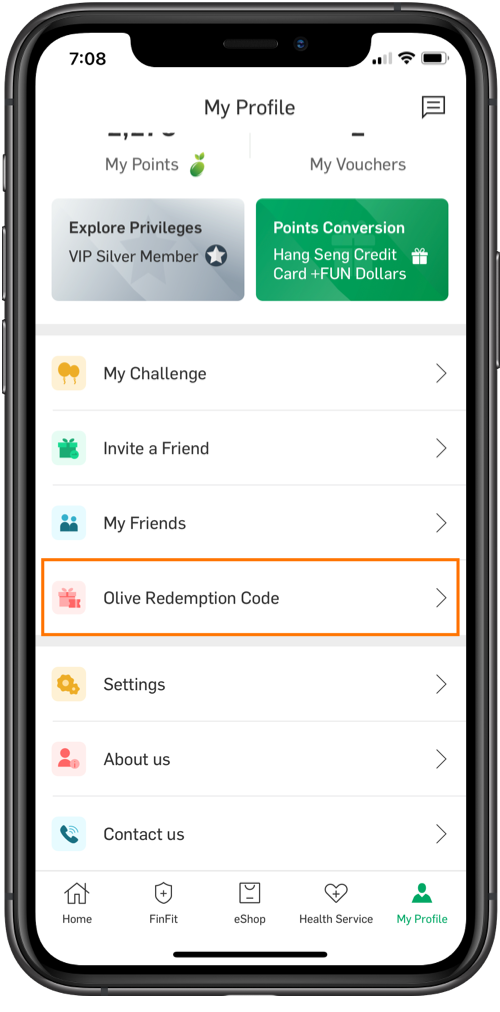

Click the "Olive Redemption Code" at the bottom right corner of “My Profile” page

5

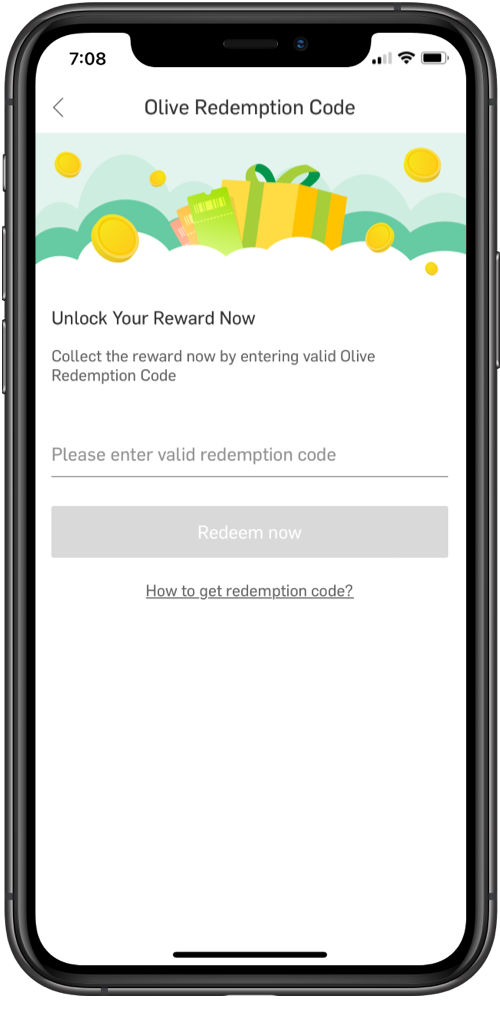

Enter your redemption code to instantly redeem 1,000 Olive points

Terms and ConditionsTerms and ConditionsTerms and Conditions apply to Risk Profiling Questionnaire x Olive Points

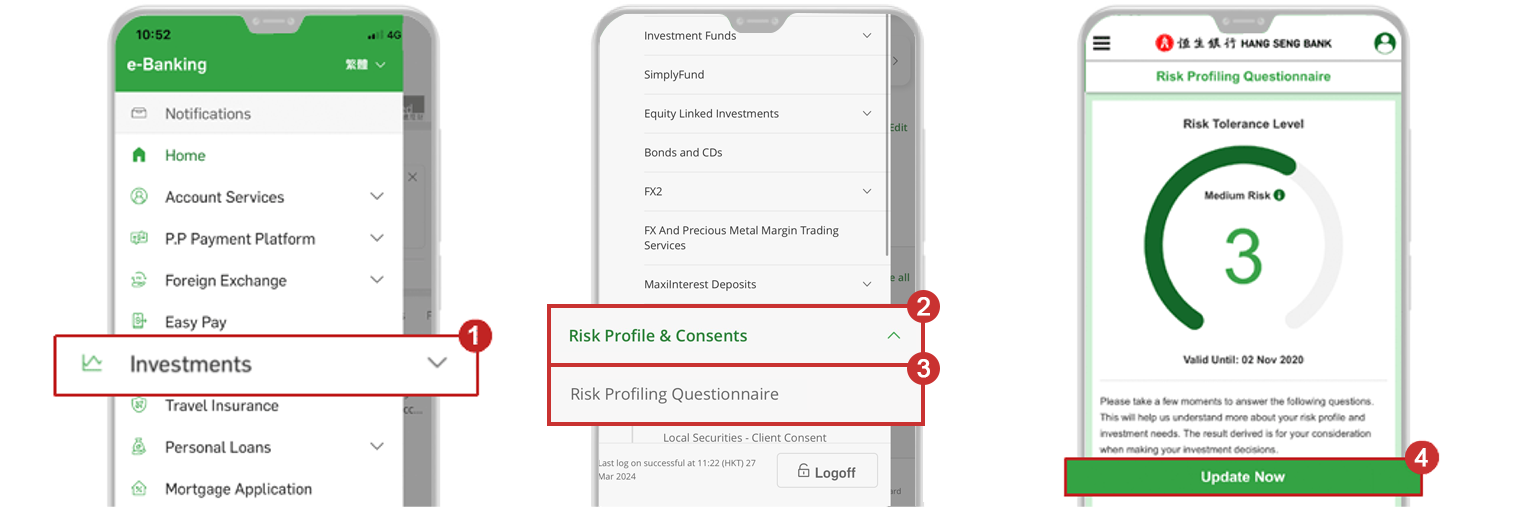

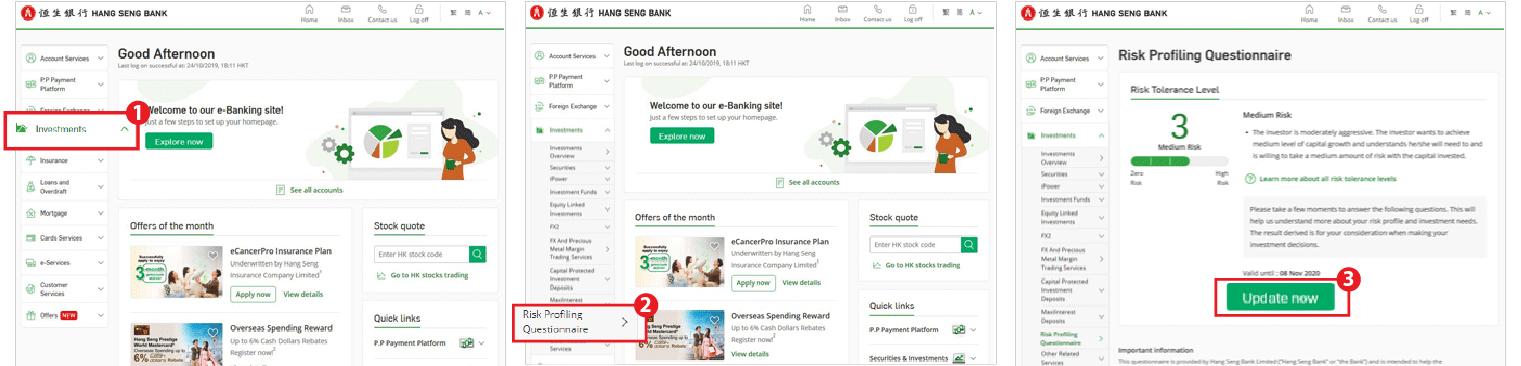

How to complete / update “Risk Profiling Questionnaire” via online

Hang Seng Personal Mobile App

Logon to the Hang Seng Personal Mobile App>Tap “Investments”>“Risk Profile & Consents”>“Risk Profiling Questionnaire”>“Update Now”

Hang Seng Personal e-Banking

Logon to Hang Seng Personal e-Banking>Click “Investments”>“Risk Profiling Questionnaire”>“Update Now”

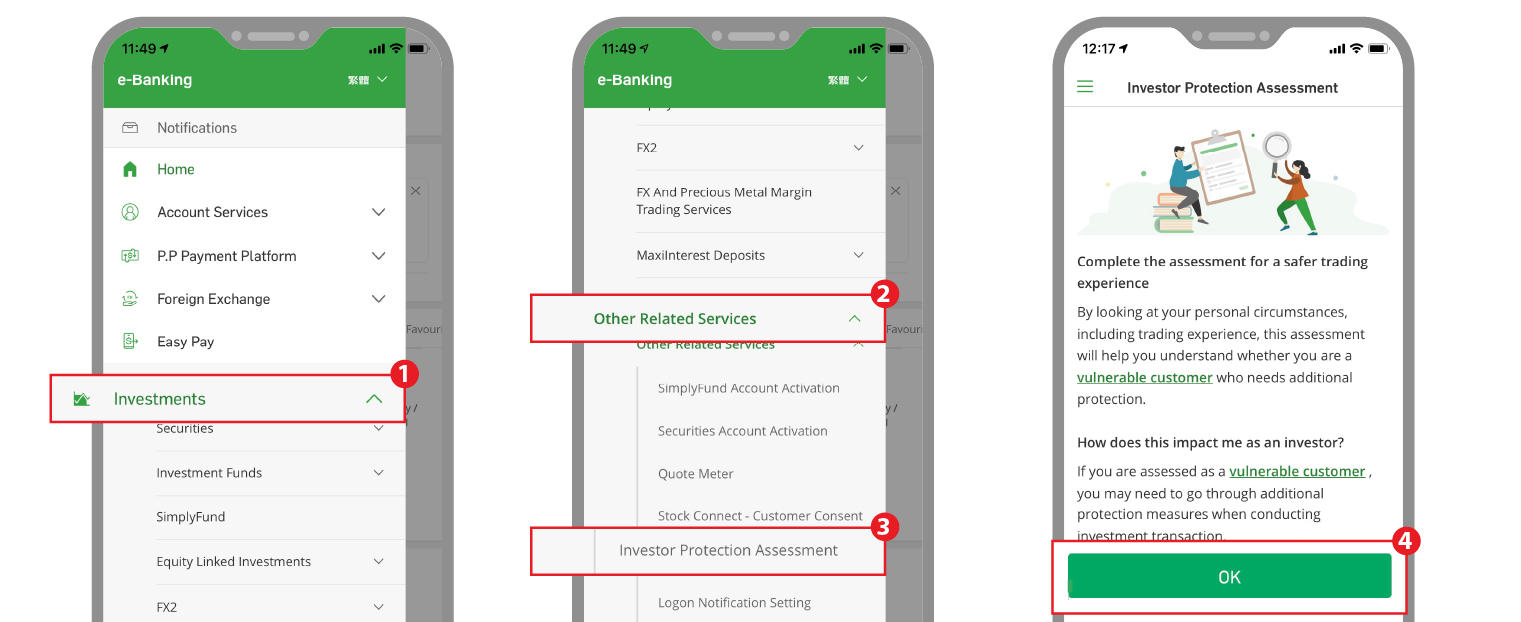

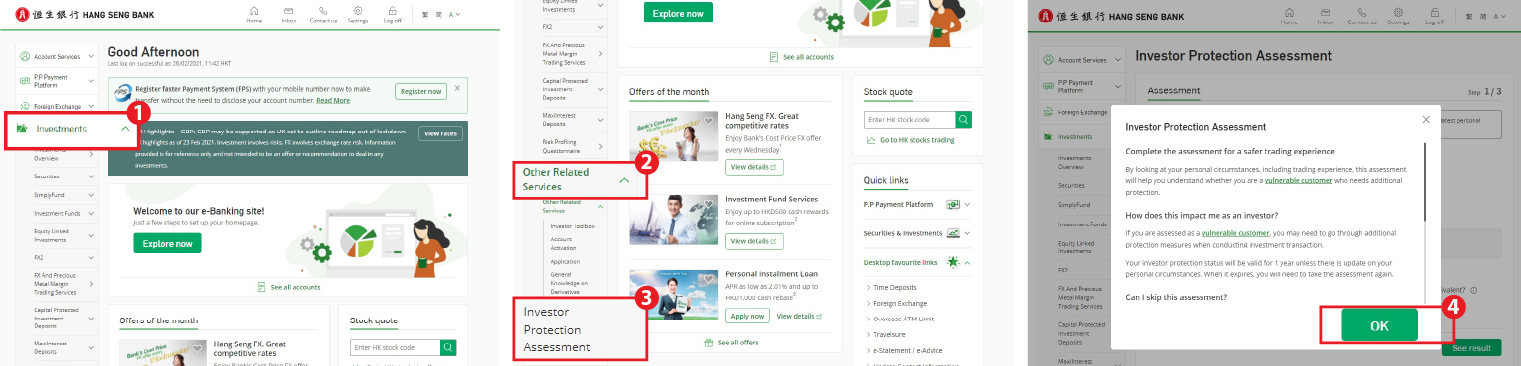

How to complete / update “Investor Protection Assessment” via online

Hang Seng Personal Mobile App

Logon to the Hang Seng Personal Mobile App>Tap “Investments”>“Other Related Services”>“Investor Protection Assessment”>“OK”

Hang Seng Personal e-Banking

Logon to the Hang Seng Personal e-Banking>Click “Investments”>“Other Related Services”>“Investor Protection Assessment”>“OK”

Learn more

Prestige Private & Prestige customers can contact our 24-hour Wealth Service Team via "Click-to-call" or "Live Chat" on Hang Seng Personal Mobile App, or call hotline for enquires.

Remarks:

-

Various types of investment (general stock trading is not included):

- Investment Funds Distributed by the Bank

- Monthly Investment Plan for Funds

- Capital Protected Investment Deposit

- Structured Products

- MaxiInterest Investment Deposit

- FX2 - FX and Precious Metal Trading Services or FX and Precious Metal Margin Trading Services

- Secondary Market Bonds

- Certificates of Deposit

- SimplyFund

-

“Investment Protection Assessment” evaluates whether you are a vulnerable customer. Examples of vulnerable customers include customers with disabilities affecting investment decisions (e.g. visually impaired).

Other examples include:- The elderly (aged 65 or above);

- Illiterate or those with low education level (secondary or below);

- Those who have limited financial means, who at the same time lack investment experience.

- You are not allowed to trade specific investment products that are assessed as being not suitable for vulnerable customers.

- You may choose to go through the investment sales process with sales staff executing your transaction through branch or over the phone under the witness of a companion of yours and/or another sales staff.

- Your investment sales process for investment transactions executed by sales staff through branch or over the phone will be audio recorded.

- Terms and Conditions apply. Please refer to the Terms and ConditionsTerms and ConditionsTerms and Conditions for Risk Profiling Questionnaire x Olive Points.

-

The Offer is applicable to Prestige Private, Prestige Banking, Preferred Banking and Integrated Account personal customers of Hang Seng Bank Limited (the "Bank") who fulfill both criteria below (“Eligible Customers”) :

- Whose Risk Profiling Questionnaire record is expired before or during the Promotion Period or who have never completed the Risk Profiling Questionnaire; and

- Who have provided “Opt-in for all marketing channels” or “Opt-in for partial marketing channels” for MMS from Marketing Preferences

The above information is not and should not be considered as an offer or solicitation to deal on any of the investment products and services mentioned herein.

Important information

For "Risk Profiling Questionnaire":

- The Risk Profiling Questionnaire is provided by Hang Seng Bank Limited (the "Bank") and is intended to help the customer understand his/her risk profile and investment needs. The Bank makes no guarantee, representation or warranty and accepts no responsibility or liability as to the accuracy or completeness of the information or recommendation given. The suggestions are derived from information that the customer has provided to the Bank. The suggestions are designed to meet the needs discussed in this test and are in line with the customer’s attitude towards risk. The suggestions are for the customer’s consideration when making his/her own investment decisions. The suggestions are not an offer to sell or a solicitation to buy any financial products and the suggestions should not be considered as investment advice.

For “Investor Protection Assessment”:

- Hang Seng Bank Limited (“Hang Seng Bank” or “the Bank”) is committed to exercising care and providing additional protection to vulnerable customers in the sale of investment products. This assessment is provided by the Bank and is intended to help customer understand whether he/ she is a Vulnerable Customer based on his/ her personal circumstances, including his/ her investment trading experience.

- The investor protection status derived from this Investor Protection Assessment will be valid for 1 year from the last updated date unless there is any update on the customer’s circumstances in the Bank’s record in which case the assessment result would become invalid automatically. Customer should complete a new assessment if there are any changes to the customer’s circumstances that may impact his/her investor protection status.

- Any assessment on the customer’s investor protection status will be based on the information in the Bank’s record (such as age, education level, net liquid asset and investment experience in past 5 years), the information customer provides to the Bank and the observation from the sales staff when contacting with customer. If a customer fails to provide complete, accurate, and up-to-date information, it will affect the Bank’s assessment of the customer’s investor protection status and any services that may be provided.

- For joint account, each account holder must complete an investor protection assessment separately.

- For authorized person, he/she must complete an Investor Protection Assessment before conducting any investment transactions.

Risk Disclosure of Investment Funds:

- Investors should note that all investments involve risks (including the possibility of loss of the capital invested), prices or value of investment fund units may go up as well as down and past performance information presented is not indicative of future performance. Investors should read carefully and understand the relevant offering documents of the investment funds (including the fund details and full text of the risk factors stated therein) and the Notice to Customers for Fund Investing before making any investment decision. Investment funds are investment products and some may involve derivatives. Investors should carefully consider their own circumstances whether an investment is suitable for them in view of their own investment objectives, investment experience, preferred investment tenor, financial situation, risk tolerance abilities, tax implications and other needs, etc., and should understand the nature, terms and risks of the investment products. Investors should obtain independent professional advice if they have concerns about their investment.

Important Risk Warnings for Securities:

- Investors should note that investment involves risks. The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling securities.

-

Investors should note that investing in different Renminbi-denominated securities and products involves different risks (including but are not limited to currency risk, exchange rate risk, credit risk of issuer / counterparty, interest rate risk, liquidity risk (where appropriate)). The key risks of investing in securities via the Stock Connect Northbound Trading include:

- Once the respective quota is used up, trading will be affected or will be suspended.

- Stock Connect Northbound Trading will only operate on days when both markets are open for trading and when banks in both markets are open on the corresponding settlement days. Investors should take note of the days the Stock Connect Northbound Trading is open for business and decide according to their own risk tolerance whether or not to take on the risk of price fluctuations in securities during the time when Stock Connect Northbound Trading is not trading.

- When a security is recalled from the scope of eligible securities for trading via Stock Connect Northbound Trading, that security can only be sold but NOT bought.

- Investors will be exposed to currency risk if conversion of the local currency into RMB is required.

- Foreign securities carry additional risks not generally associated with securities in the domestic market. The value or income (if any) of foreign securities may be more volatile and could be adversely affected by changes in many factors. Client assets received or held by the licensed or registered person outside Hong Kong are subject to the applicable laws and regulations of the relevant overseas jurisdiction which may be different from the Securities and Futures Ordinance (Cap.571) and the rules made thereunder. Consequently, such client assets may not enjoy the same protection as that conferred on client assets received or held in Hong Kong.

- Investors should note that ETF is different from a typical unit trust and many factors will affect its performance. In general, the market price per ETF unit may be significantly higher or lower than its net asset value per unit due to market demand and supply, liquidity, and scale of trading spread in the secondary market and will fluctuate during the trading day. ETF is different from stocks, investors should read the offering documents of the relevant ETF and understand the features and risks of ETF etc. Investors should not only base on this material alone to make any investment decision, but should read in detail the relevant risk disclosure statements.

Investors should not only base on this material alone to make any investment decision, but should read in detail the relevant risk disclosure statements.

Risk Disclosure of SimplyFund Account:

- Investors should note that all investments involve risks (including the possibility of loss of the capital invested), prices or value of investment fund units may go up as well as down and past performance information presented is not indicative of future performance. Investors should read carefully and understand the relevant offering documents of the investment funds (including the fund details and full text of the risk factors stated therein) and the Notice to Customers for Fund Investing before making any investment decision. Investment funds are investment products and some may involve derivatives. Investors should carefully consider their own circumstances whether an investment is suitable for them in view of their own investment objectives, investment experience, preferred investment tenor, financial situation, risk tolerance abilities, tax implications and other needs, etc., and should understand the nature, terms and risks of the investment products. Investors should obtain independent professional advice if they have concerns about their investment

- Not all of the investment funds that are distributed by Hang Seng Bank Limited (the “Bank”) are available here. Only specific funds are available for subscription with this account. If you are looking for other investment funds or investment products, please visit our branches or our websites for more information.

- In respect of the investment funds available for subscription with this account at the moment, they are provided either by the Bank’s wholly owned subsidiary, Hang Seng Investment Management Limited, or by the Bank’s affiliates HSBC Global Asset Management (Hong Kong) Limited.

Risk Disclosure of Capital Protected Investment Deposit:

- This is a structured product involving derivatives. The investment decision is yours but you should not invest in the Capital Protected Investment Deposit unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. Investor should read the Important Facts Statement of the relevant investment type, the relevant term sheet, Terms and Conditions and risk disclosure statement before making any investment decision.

- Investor should note that this product is not normal time deposit and thus should not be considered as normal time deposit or its alternative.

- This product is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

- Investment in this product is subject to the credit risk of the Bank.

- Renminbi (RMB) is subject to foreign exchange control by the PRC government and thus investors investing in the Currency-Linked Capital Protected Investment Deposit involving RMB are subject to the currency risk of RMB.

Risk Disclosure of Structured Products:

- Structured Products involve derivatives. The investment decision is yours but you should not invest in a Structured Product unless the intermediary who sells it to you has explained to you that the Structured Product is suitable for you having regard to your financial situation, investment experience and investment objectives. Structured Product is a complex product and you should exercise caution in relation to Structured Products. The market value of the Structured Products may fluctuate and investors may sustain a total loss of their investment. Prospective investors should therefore ensure that they understand the nature of the Structured Products and carefully study the risk factors set out in the offering documents for the Structured Products and, where necessary, seek independent professional advice, before they decide whether to invest in any Structured Products. If you purchase the Structured Products, you are relying upon the creditworthiness of the Issuer of the Structured Products.

- Liquidity risk - Structured Products are designed to be held to its maturity. You may not be able to sell your investment in the Structured Products before maturity. If you try to sell the Structured Products before maturity, the amount you receive may be substantially less than the investment amount you paid for the Structured Products.

- Credit risk of the Structured Products issuer - Structured Products constitute general unsecured and unsubordinated contractual obligations of the issuer. When you buy Structured Products, you will be relying on the creditworthiness of the Structured Products issuer and of no other person. You have no rights under the terms and conditions of the Structured Products against any issuer of any linked underlying(s). If the relevant Structured Products issuer becomes insolvent or default on its obligations under the Structured Products, in the worst case scenario, you could lose all of your investment.

- Not the same as investing in linked underlying(s) - Investing in Structured Products is not the same as investing in the linked underlying(s). Changes in the market price or level of any linked underlying(s) may not lead to a corresponding change in the market value of, or your potential gain or loss under, the Structured Products.

- Before making any investment, investors should i) read and fully understand all the offering documents relating to Structured Products and all the risk disclosure statements and risk warnings therein; and ii) make investment decisions in light of your own investment objectives, financial position and particular needs and where necessary consult your own professional advisers before investing.

Risk Disclosure of MaxiInterest Investment Deposit:

- This is a structured product involving derivatives. The investment decision is yours but you should not invest in the MaxiInterest Investment Deposit unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. Investors should read the relevant Important Facts Statement, Terms and Conditions and risk disclosure statement before making any investment decision.

- Investors should note that this product is not capital protected and is not a normal time deposit, and thus should not be considered as normal time deposit or its alternative.

- Earnings on this product are limited to the nominal interest payable. As the principal and the earning will be paid in the Deposit Currency or the Linked Currency, whichever has depreciated against the other, investors will have to bear the potential losses due to currency depreciation, which may be substantial. If the product is withdrawn before maturity, investors will also have to bear the costs involved. Such losses and costs may reduce the earnings and the principal amount of this product. Investors should seek professional advice where necessary. The relevant Terms and Conditions of this product are available upon request to the staff of the Bank.

- This product is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

- Investment in this product is subject to the credit risk of the Bank.

- Renminbi (RMB) is subject to foreign exchange control by the PRC government and thus investors investing in the MaxiInterest Investment Deposit involving RMB are subject to the currency risk of RMB.

Risk Disclosure for FX2 - FX and Precious Metal Trading Services:

- Foreign exchange and precious metal trading involves a high degree of risk. You may sustain a substantial or even total loss of your initial collateral. Under certain market conditions, you may find it difficult or impossible to liquidate a position of outstanding FX2 Trading Contracts. Placing contingent orders, such as "stop-loss" or "stop-limit" orders, will not necessarily limit your loss at the designated price. In extreme circumstances whereby the market moves significantly against your positions, you may be required to make additional deposits or interest payments within a short period of time to maintain your positions. If you fail to provide the required deposits or interest payments immediately, your positions under all outstanding FX2 Trading Contracts may be closed out without prior notice. You should therefore carefully consider if foreign exchange and precious metal trading is suitable for you in light of your own financial position and investment objectives.

- Renminbi ("RMB") is subject to foreign exchange control by the PRC government. If your FX2 Trading Contract involves offshore RMB, you will be subject to foreign control and currency risks of RMB.

- Trading on an electronic trading system may differ from trading on other trading systems or platforms. You will be exposed to risks associated with the system including the failure of hardware and software, which could result in your order not being executed according to your instructions or at all.

- Investment involves risks. The above risk disclosure cannot disclose all the risks involved. You should read and understand all the relevant documents and risk disclosure (in particular, the Risk Disclosure Statement contained in the relevant application form) before making any investment decision.

- The contents of this webpage have not been reviewed by any regulatory authority in Hong Kong. If you are uncertain of or do not understand the nature of and the risks involved in foreign exchange and precious metal trading, you should seek independent professional advice.

Risk Disclosure for FX and Precious Metal Margin Trading Services:

- The risk of loss in leveraged foreign exchange and precious metal trading can be substantial. You may sustain losses in excess of your initial margin funds. Placing contingent orders, such as "stop-loss" or "stop-limit" orders, will not necessarily limit losses to the intended amounts. Market conditions may make it impossible to execute such orders. You may be called upon at short notice to deposit additional margin funds. If the required funds are not provided within the prescribed time, your position may be liquidated. You will remain liable for any resulting deficit in your Account. You should therefore carefully consider whether FX and precious metal margin trading is suitable for you in light of your own financial position and investment objectives.

- Renminbi (RMB) is subject to foreign exchange control by the PRC government. If your Margin Trading Contract involves Offshore Renminbi, you will be subject to foreign control and currency risk of RMB.

- Trading on an electronic trading system may differ from trading on other trading systems or platforms. You will be exposed to risks associated with the system including the failure of hardware and software, which could result in your order not being executed according to your instructions or at all.

- Investment involves risks. The above risk disclosure cannot disclose all the risks involved. You should read and understand all the relevant documents and risk disclosure (in particular, the Risk Disclosure Statement contained in the relevant application form) before making any investment decision.

- The contents of this webpage have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to this webpage. If you are uncertain of or do not understand the nature of and the risks involved in leveraged foreign exchange and precious metal trading, you should seek independent professional advice.

Important Risk Warning of Bond and Certificate of Deposit Product:

- Bonds and Certificates of Deposit (CDs) are investment products. The investment decision is yours but you should not invest in a bond/CD unless the intermediary who sells it to you has explained to you that the bond/CD is suitable to you having regard to your financial situation, investment experience and investment objectives. Your intermediary is under a duty to assure that you understand the nature and risks of this product, and that you have sufficient net worth to be able to assume the risks and bear the potential losses of trading in this product.

- Bonds are not deposits and should not be treated as substitute for conventional time deposits.

- Certificate of Deposit is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

- Investors who purchase bonds/CDs are exposed to the credit risk of the issuer and guarantor (if any) of the bonds/CDs. There is no assurance of protection against a default by the issuer/guarantor in respect of the repayment obligations. In the worst case scenario, any failure by the issuer and the guarantor (if any) to perform their respective obligations under the bonds/CDs when due may result in a total loss of all of your investment.

- Renminbi (RMB) is not a freely convertible currency. As such, investors trading bonds and/or CDs denominated in RMB are subject to additional risks (such as currency risk).

- The above is not an exhaustive list of risk factors. Please refer to the section on “Risk Factors” in the relevant “Bond / Certificate of Deposit Trading Services” Factsheet to understand other risk factors applicable to bonds and CDs.

- The information displayed does not constitute nor is it intended to be construed as any professional advice, offer, solicitation or recommendation to deal in Bonds / CDs. Investors should be aware that all investments involve risks (including the possibility of loss of the capital invested). The prices of Bonds and CDs may go up as well as down and past performance is not indicative of future performance. Investors should not only base on this information alone to make investment decisions, and should carefully consider whether an investment is suitable for them in view of their own investment objectives, investment experience, investment tenor, financial situation, risk tolerance abilities, tax implications and other needs, etc., and should read the relevant product offering documents and terms and conditions (including the full text of the risk factors therein) in detail before making any investment decisions. Investors should obtain independent professional advice if they have concerns about their investment.

- No guarantee, representation, warranty or undertaking, express or implied, is made as to the fairness, accuracy, timeliness, completeness or correctness of any general financial and market information, news services and market analysis, projections and/or opinions (“Market Information”) provided above and the basis upon which any such Market Information have been made, and no liability or responsibility is accepted by the Bank in relation to the use of or reliance on any such Market Information whatsoever provided in the webinar.

- Investors must make their own assessment of the relevance, accuracy and adequacy of the information provided and make such independent research/investigations as they may consider necessary or appropriate for the purpose of such assessment. The Bank does not make any representation or recommendation or assessment as to whether or not any of the investment(s) mentioned are suitable or applicable to any persons and thus shall not be held responsible in this regard.