Tips for Online Tax Payment

Steps for paying tax with the Online Bill Payment Service for Hang Seng Personal e-Banking customers:

Visit hangseng.com/e-banking and logon to Hang Seng Personal e-Banking

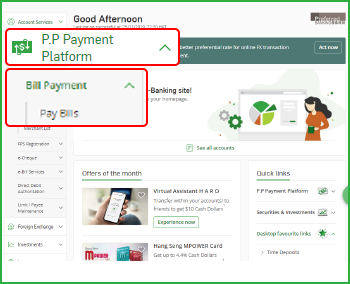

Select "P.P Payment Platform" > "Bill Payment" > "Pay Bills"

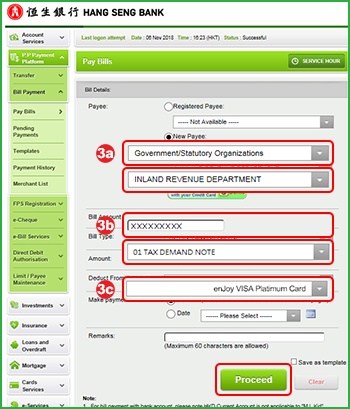

For "Payee", select "Government/Statutory Organizations" and "INLAND REVENUE DEPARTMENT"

Enter the "Bill Account No." (i.e. the Shroff No. on the upper right corner of the tax bill) > Select "01 TAX DEMAND NOTE" for the "Bill Type"

For "Deduct From Account", select a credit card account > Click "Proceed" to check the bill payment details and then complete the payment

If you have any queries relating to the services of Hang Seng Personal e-Banking, please call the Hang Seng Personal e-Banking Hotline at 2822 0228

Steps for applying "Spending Instalment – One-off Handling Fee Plan for Online Tax Payment" ("Online Tax Payment Instalment")

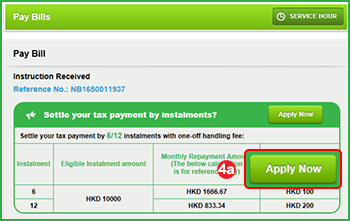

Upon completion of the tax payment transaction, you can access Online Tax Payment Instalment application form by clicking "Apply Now" in this handling fee table.

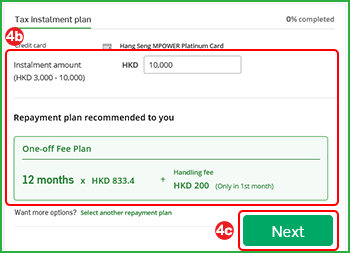

Please input the required information

Click "Next" to proceed

If you do not apply Tax Instalment Plan instantly right after the online tax payment, please call 2998 6868 after the tax payment transaction is posted and at least 9 working days prior to credit card statement due date.