Hang Seng Commercial Banking x YOOV Online Remittance Credit to the account within 5 minutes Keep track of real-time progress of payments Diverse Digital Solutions to Help Your Business Level Up!

Timely incoming and outgoing payments are essential for business success. Committed to making business easy for you, Hang Seng allows you to make remittance and easily keep track of the real-time progress of your inward and outward payments via our digital platforms. By enhancing communications with your business partners and speeding up the cash flow cycle, you can gain a head-start in every business move!

Your remittance applications via Hang Seng Business e-Banking or Hang Seng HSBCnet will be processed in minutes, speedy and reliable.

Inward and outward remittance to Hang Seng Bank (China) will be credited to the beneficiary account within 3 hours1,2,3Footnote remark[1,2,3].

Newly launched solution of Mainland – Hong Kong Express Payment is available to support USD payment from Hang Seng Bank (China) to Hang Seng Bank (Hong Kong) within 5 minutes4,5Footnote remark[4,5]。

From 1 January to 31 March 20246Footnote remark[6], inward remittances from Hang Seng Bank (China) to Hang Seng Bank (Hong Kong) are entitled to handling fee waivers.

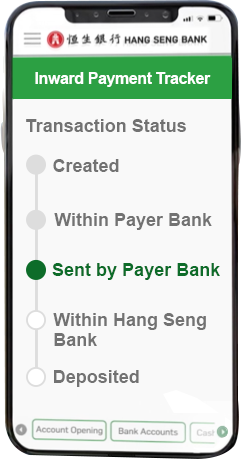

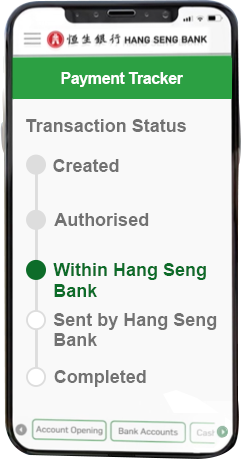

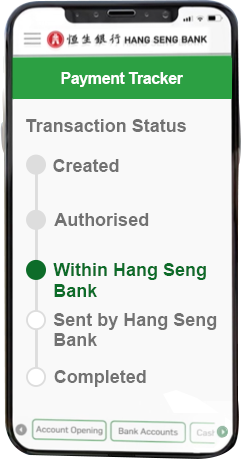

You can easily keep track of the real-time progress of your inward and outward payments via “Inward Payment Tracker” or “Payment Tracker” of Hang Seng Business e-Banking or Hang Seng Business Mobile App for free. No need to bother calling our Customer Relationship Manager or enquiry hotline to enhance communications with your business partners.

The Primary User of Hang Seng Business e-Banking can create and authorize employee as the Secondary User, using “Inward Payment Tracker” and “Payment Tracker” to keep track of the remittance progress to increase operation efficiency.

You can customize employee’s access right to Business e-Banking selected banking services to avoid disclosing unnecessary financial information to employee.

Details Once my overseas buyers have set up the

Once my overseas buyers have set up the

With the first-in-town Inward Payment Tracker introduced by Hang Seng, you can look up via Business e-Banking the real-time progress7Footnote remark[7] of your buyers’ payments to you once initiated. So you will know for sure when the remittances will hit your account.

User GuideOnce enabled, you can receive instant Inward Payment Notifications with your mobile phone, even when you are staying overseas or have replaced your SIM card. Not enabled yet? Visit here for the easy steps to get it done.

To check up on my payments to sellers,

To check up on my payments to sellers,

You can also stay on top of the real-time progress7Footnote remark[7] of your outgoing payments with the Payment Tracker. Log onto Hang Seng Business Mobile App or Business e-Banking to use the function to trace the precise timeline of your payments to sellers.

User Guide

Key Advantages of Inward Payment Tracker and Payment Tracker

Protect your online transactions with strict security measures. Enhance your banking experience with smart and user-friendly interface.

A clear view of the latest status and transaction details of all incoming and outgoing payments within the past 60 days.

Search your target transactions speedily by entering the pre-set criteria, such as the credit/debit account, type of transfer or transfer date.

Transaction files (in CSV format*) can be downloaded anytime for future reference, enhancing your operating efficiency by saving the time and hassles of creating your own records.

*Only available at Hang Seng Business e-Banking

24-hour Business Partner Direct