|

|

|

|---|

Our Values

|

|

|---|

|

|

|

Our overarching objective is to achieve the sustainable long-term growth of our business and the communities in which we operate by striving for service excellence in everything we do. Our values are the foundation of our efforts to meet this objective. They guide our approach to doing business and provide a common set of operating standards for Hang Seng employees.

Our business takes place in one of the most dynamic and fast-evolving regions in the world. Changing economic, environmental and social trends have implications for Hang Seng and for our key stakeholders. We work to ensure we are well positioned to respond swiftly and effectively to capitalise on new opportunities and manage new risks. Our reputation as a sustainability leader that makes a positive contribution to society will distinguish us from our peers, inspire our people and enhance our stakeholder value.

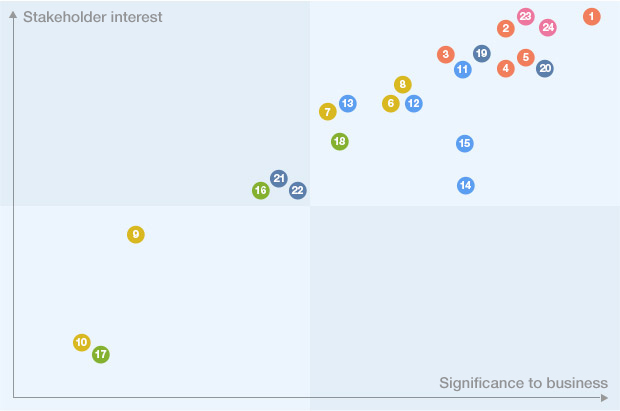

Materiality Assessment

For the purposes of sustainability, our standard of materiality is defined as follows: Issues that could have a significant impact on the reputation or viability of our business and/or an impact on a stakeholder's decision as to whether or not to do business with Hang Seng.

Identifying our material aspects

To identify our reportable material aspects, we aligned our stakeholder engagement process with the structure provided in the GRI sustainability reporting guidelines. We asked internal and external stakeholders to rank sustainability issues based on importance. This included asking managers from across different business functions and operations to rank the issues according to their significance to our business. We also considered qualitative feedback gathered through formal and informal meetings. This data was then used by our CSR Sustainers to plot and validate a materiality matrix.

Hang Seng's Material Aspects

-

Economic

| 1. |

Economic performance |

| 2. |

Market presence |

| 3. |

Procurement practices |

| 4. |

Compliance |

| 5. |

Regulatory |

-

Environment

| 6. |

Energy and GHG emissions |

| 7. |

Waste |

| 8. |

Materials |

| 9. |

Water |

| 10. |

Biodiversity |

-

Workplace Practices

| 11. |

Employment practices |

| 12. |

Employee engagement |

| 13. |

Occupational health and safety |

| 14. |

Employee development |

| 15. |

Diversity and equal opportunities |

-

Human Rights

| 16. |

Human rights and non-discrimination |

| 17. |

Child labour and forced labour |

| 18. |

Security practices |

-

Society

| 19. |

Community investment |

| 20. |

Anti-corruption |

| 21. |

Public policy and advocacy |

| 22. |

Anti-competitive behaviour |

-

Product Responsibility

| 23. |

Customer satisfaction and responsibility / Customer experience |

| 24. |

Customer privacy |

Our Principles In Practice

Our mission is to be a profitable, growing business by exceeding the expectations of our stakeholders through service excellence based on core values that include integrity, innovation and financial strength.

Our objective is best achieved by maintaining a central emphasis on responsible corporate practices throughout our operations and finding new and more effective ways to engage our customers, colleagues and local communities. How we do business is as important as what we do in continuing to refine our strategy for long-term growth.

This holistic approach supports good risk management, helps us pinpoint areas in which we can enhance efficiency and generates new business opportunities. It also offers us a competitive advantage as stakeholders increasingly focus on the social and environmental - as well as economic - performance of companies in the financial services industry.

Stakeholder Engagement

We use a variety of top-down and bottom-up approaches to openly, actively and effectively engage our stakeholders, which include customers, staff, shareholders, suppliers and business partners, regulators and the broader community (see table below).

Our efforts to maintain an open dialogue with our stakeholders not only focus on current issues, but also aim to assess the potential impact of emerging and/or longer-term trends. This allows us to be proactive rather than reactive in adapting our operational practices and sustainability activities to maintain our market leadership and strike an effective balance in addressing a diverse range of expectations, views and objectives, with the primary goal of optimising long-term outcomes for our business and our stakeholders.

| Key Stakeholders |

Primary Methods of Engagement |

|

| 1. Customers |

• customer satisfaction surveys

• customer loyalty events

• relationship manager visits

• daily operations/ interactions

|

|

| 2. Shareholders |

• financial reports

• shareholders' notices

• Annual General Meeting

|

|

| 3. Employees |

• staff opinion surveys

• focus groups

• face-to-face interviews

• performance assessments

• business briefings

• volunteer activities

|

|

| 4. Analysts |

• Annual General Meeting

• results announcements

• senior management meetings

• interviews with CFO, economists and analysts

|

| 5. Business partners |

• reports

• meetings

• visits

• gatherings

• relationship-building events

|

|

| 6. Regulators |

• meetings

• compliance reporting

|

|

| 7. Media |

• media briefings

• press materials

• senior management interviews

• results announcements

• social gatherings

|

|

| 8. Non-governmental organisations |

• volunteer activities

• community investments and donations

• meetings

• CSR forums

|

|

| 9. Financial sector peers |

• strategic collaborations

• Group circulars

• Group 'town hall' meetings

|

|

| 10. Professional bodies |

• meetings

• regular visits

• memberships

• working groups

|

|

| 11. Suppliers |

• vendor management processes

• meetings

• site visits

|

|

Continual Improvement

Good corporate citizenship is not a static goal, but an ongoing process that requires monitoring, maintenance and a willingness to strive for continual improvement. We have worked hard to bring our sustainability reporting in line with the internationally recognised GRI guidelines - enabling us to evaluate our progress in a standardised manner and benchmark our performance against large listed corporations in Hong Kong and leading financial institutions around the world.

In addition to GRI requirements, the content and structure of our 2013 Report reflects a number of other factors, including:

- Issues identified through the CSR Sustainers workshop (see below)

- Issues arising from stakeholder engagement initiatives

- Issues commonly identified in the banking and finance industry, including benchmarking against other financial institutions

- Use of the materiality assessment and Hang Seng Sustainability Matrix

- Reference to ISO 14001 environmental standards

- Reference to the Environmental, Social and Governance (ESG) Reporting Guide issued by the Stock Exchange of Hong Kong

We continue to promote a business culture that encourages all our employees to keep corporate sustainability at the centre of our operations. Our team of CSR Sustainers play a crucial role in motivating and mentoring their colleagues and ensuring we uphold our principles and enhance our sustainability performance (see box: CSR Best Practice: Building Responsibility From Within).

| CSR Best Practice: Building Responsibility From Within |

|

| To further enhance employee support for our approach to corporate sustainability, we organised our first inter-departmental CSR Sustainers workshop in 2011. These annual workshops help us identify our material corporate sustainability issues and ways in which to further enhance engagement with internal and external stakeholders. |

Key responsibilities of our CSR Sustainers include:

- Ensuring that our day-to-day business operates in line with our sustainability beliefs

- Collecting and recording data to facilitate sustainability reporting

- Taking the lead in developing and promoting new sustainability initiatives

|

| Other steps taken to strengthen internal buy-in during 2013 include holding two CSR forums for staff - one with 2012 Olympic bronze medal winner Lee Wai-sze and another with Dr Rosanna Wong, Executive Director of the Hong Kong Federation of Youth Groups. The forums promoted positive messages about the importance of dedication, drive and engaging with young people to over 500 Bank colleagues. |

|

| Sustainable Business Success: Keystone Principle and Core Values |

|

| How we do business reflects our core values, which underlie our decision making, policies and actions. They also provide the foundation that supports our keystone principle - an unwavering commitment to service excellence. |

| Keystone Principle |

| Service Excellence: Achieving service excellence in all our stakeholder relationships is the keystone of our strategy for long-term business success. |

| Core Values |

| Courageous Integrity: We act with courageous integrity in all we do, standing firm for what is right, regardless of any pressure to act differently. We make decisions without fear but without ever compromising the high ethical standards and integrity on which our business is built. Our people are dependable, open to different ideas and cultures, and connected to our customers, communities and each other. |

| Financial Strength: Maintaining strong financial fundamentals gives us the ability to create long-term value for shareholders and make the best possible contribution to community betterment through economic growth and support of social and environmental development. |

| Leadership and Innovation: We are the leading domestic bank in Hong Kong, with a strong brand, extensive branch network and large base of customers. We work hard to maintain our reputation as a local pioneer in business best practice and as an innovator in product and service development. We lead by example in considering sustainability and corporate responsibility issues. |

| Transparency and Clear Communication: Our credibility is closely tied to quality of the information we provide to stakeholders. We continue to develop new and effective ways to engage stakeholders to better understand their priorities and concerns and to communicate clearly about all aspects of our business. We establish long-term partnerships with customers, business associates and community groups based on the loyalty and trust we build through championing open dialogue. |

|

Hang Seng Sustainability Matrix

|

|

|