Investment involves risk (including the possibility of loss of the capital invested). Prices of investment products may go up as well as down and may even become valueless. Past performance information presented is not indicative of future performance. Investors should not only base on this marketing material alone to make any investment decision, but should read in detail the offering documents and the Risk Disclosure Statement of the relevant investment products.

Risk Disclosure of Investment Funds:- Investors should note that all investments involve risks (including the possibility of loss of the capital invested), prices or value of investment fund units may go up as well as down and past performance information presented is not indicative of future performance. Investors should read carefully and understand the relevant offering documents of the investment funds (including the fund details and full text of the risk factors stated therein) and the Notice to Customers for Fund Investing before making any investment decision. Investment funds are investment products and some may involve derivatives. Investors should carefully consider their own circumstances whether an investment is suitable for them in view of their own investment objectives, investment experience, preferred investment tenor, financial situation, risk tolerance abilities, tax implications and other needs, etc., and should understand the nature, terms and risks of the investment products. Investors should obtain independent professional advice if they have concerns about their investment.

Professional fund management

Diversification

Fund type

Regular rebalancing is important to

New Hang Seng Bank

Wealth Master

How Wealth Master can help you:

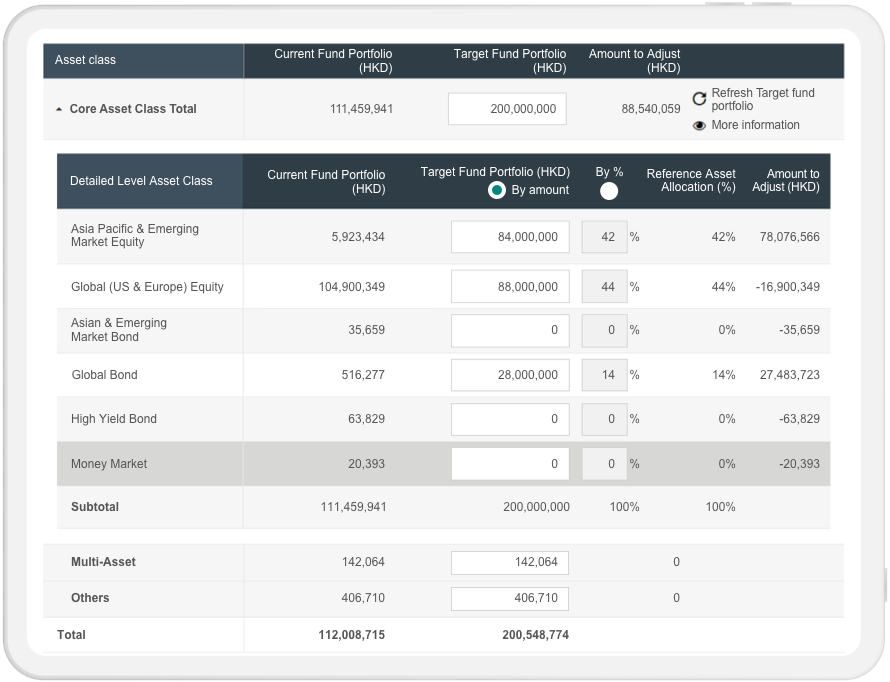

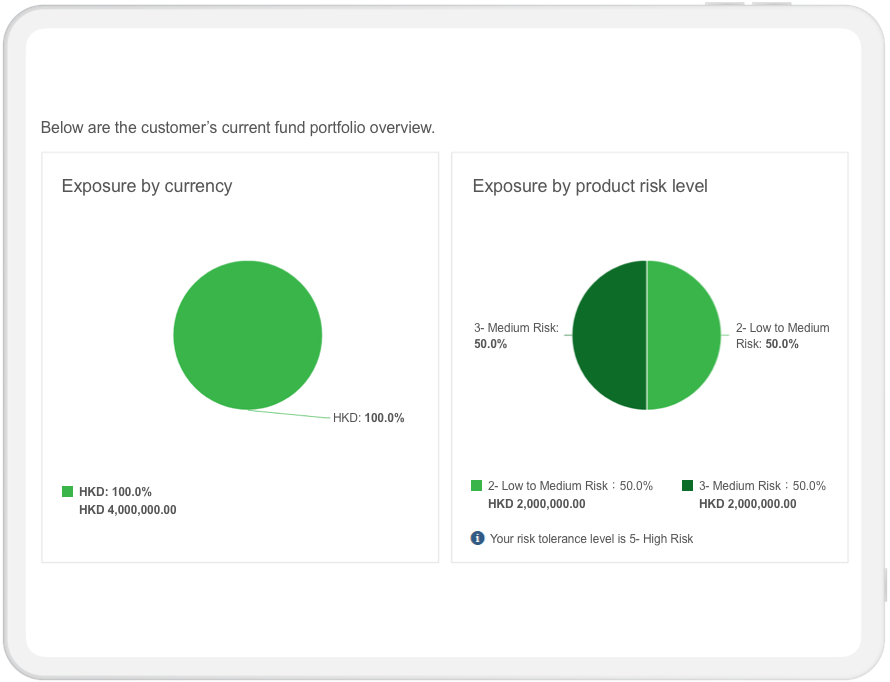

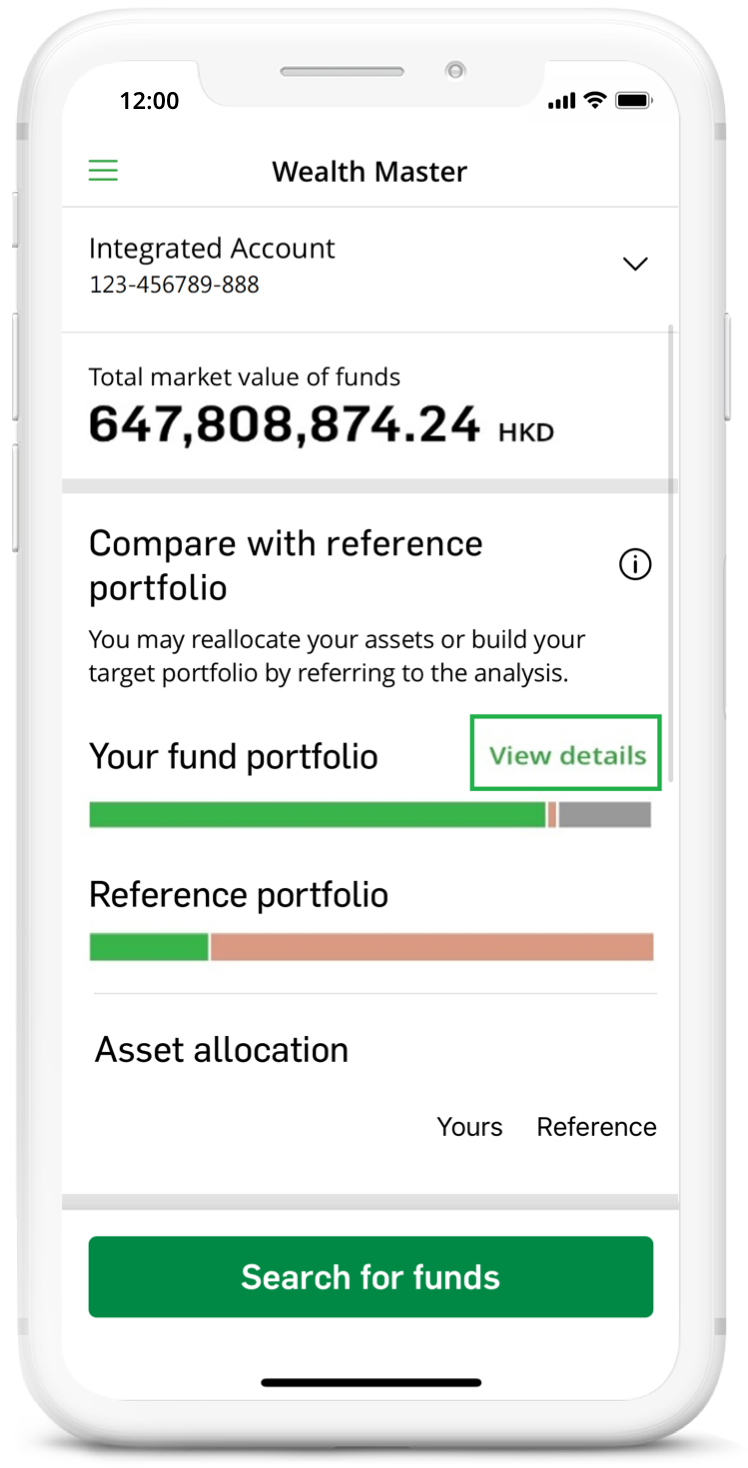

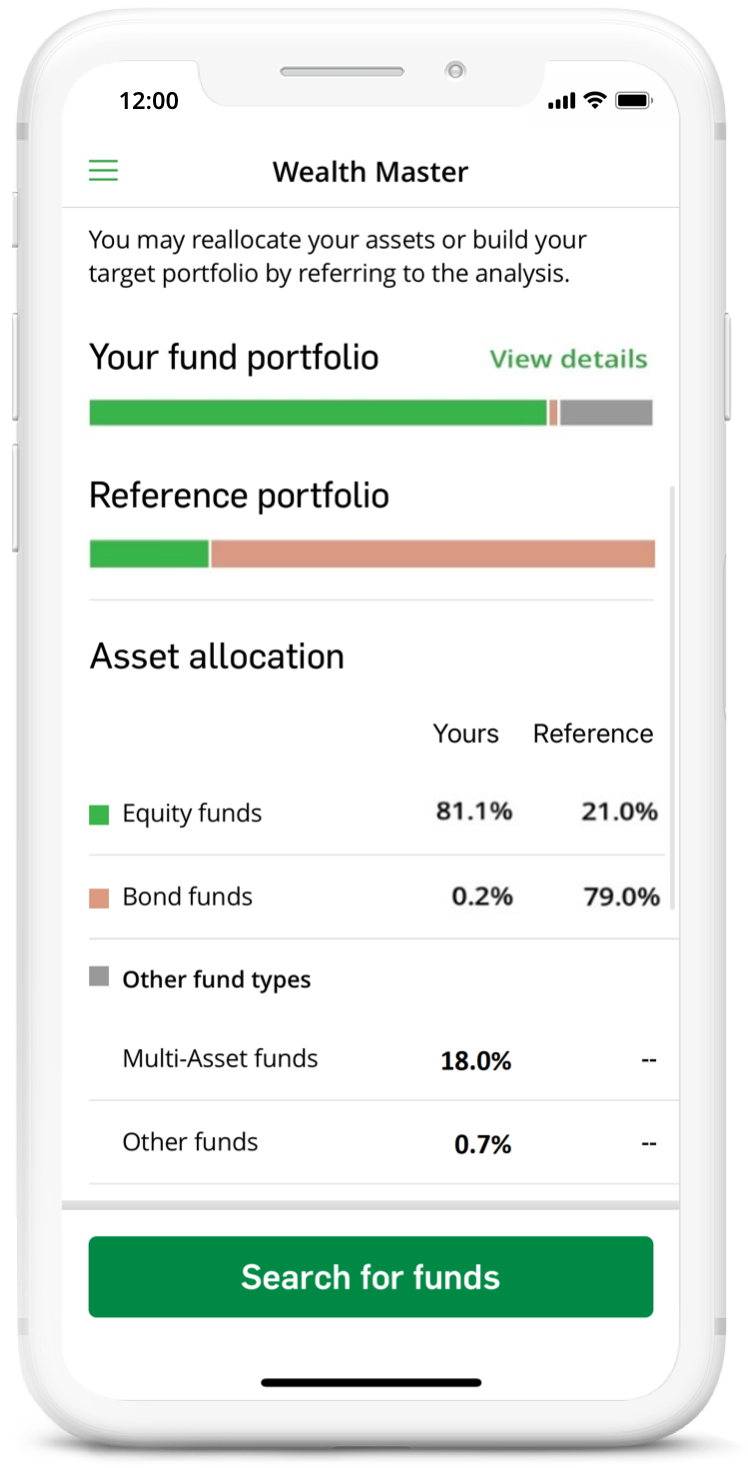

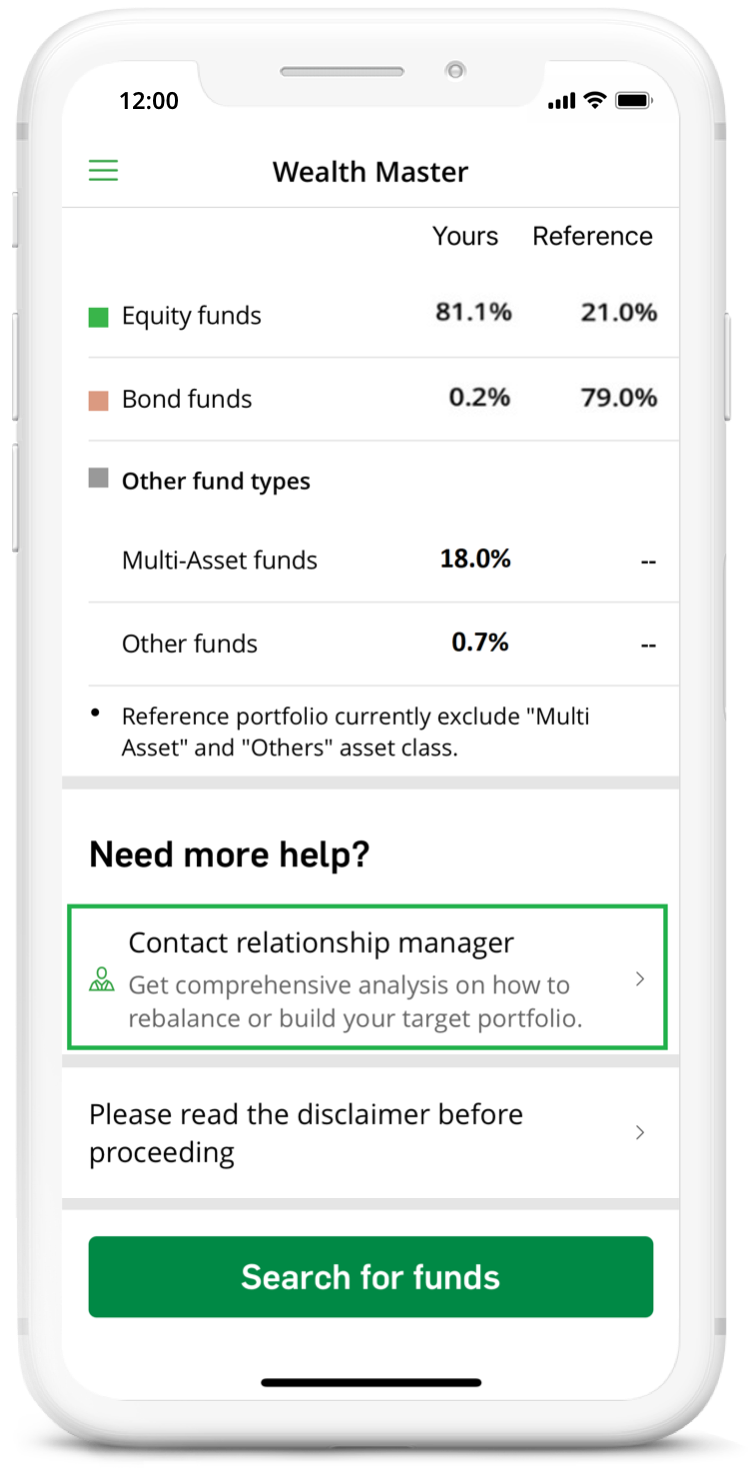

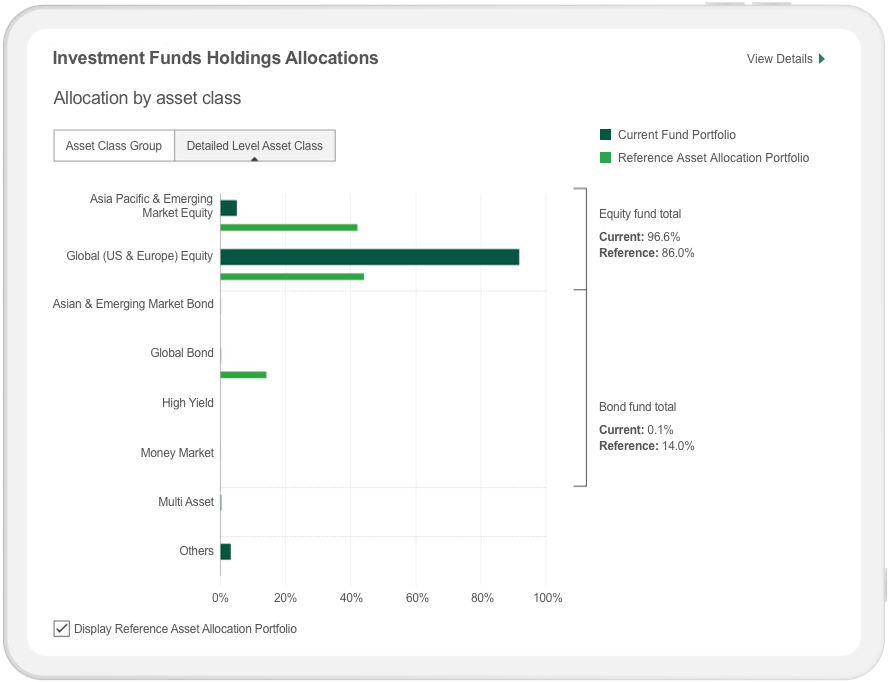

Wealth Master will provide an overview of your portfolio to let you understand the asset concentration, analyze past performance, and help to rebalance your desired portfolio.

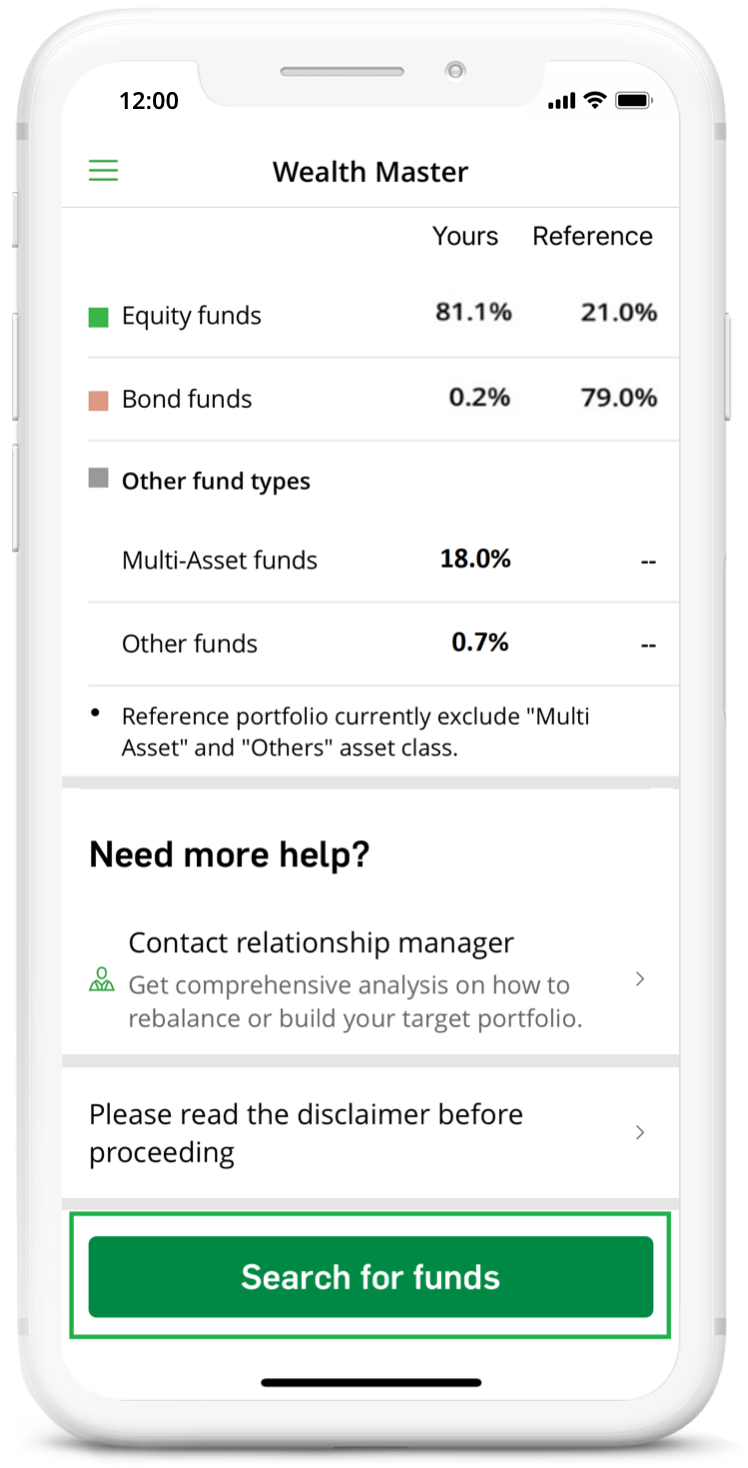

The screen displays are for reference and illustration purposes only.

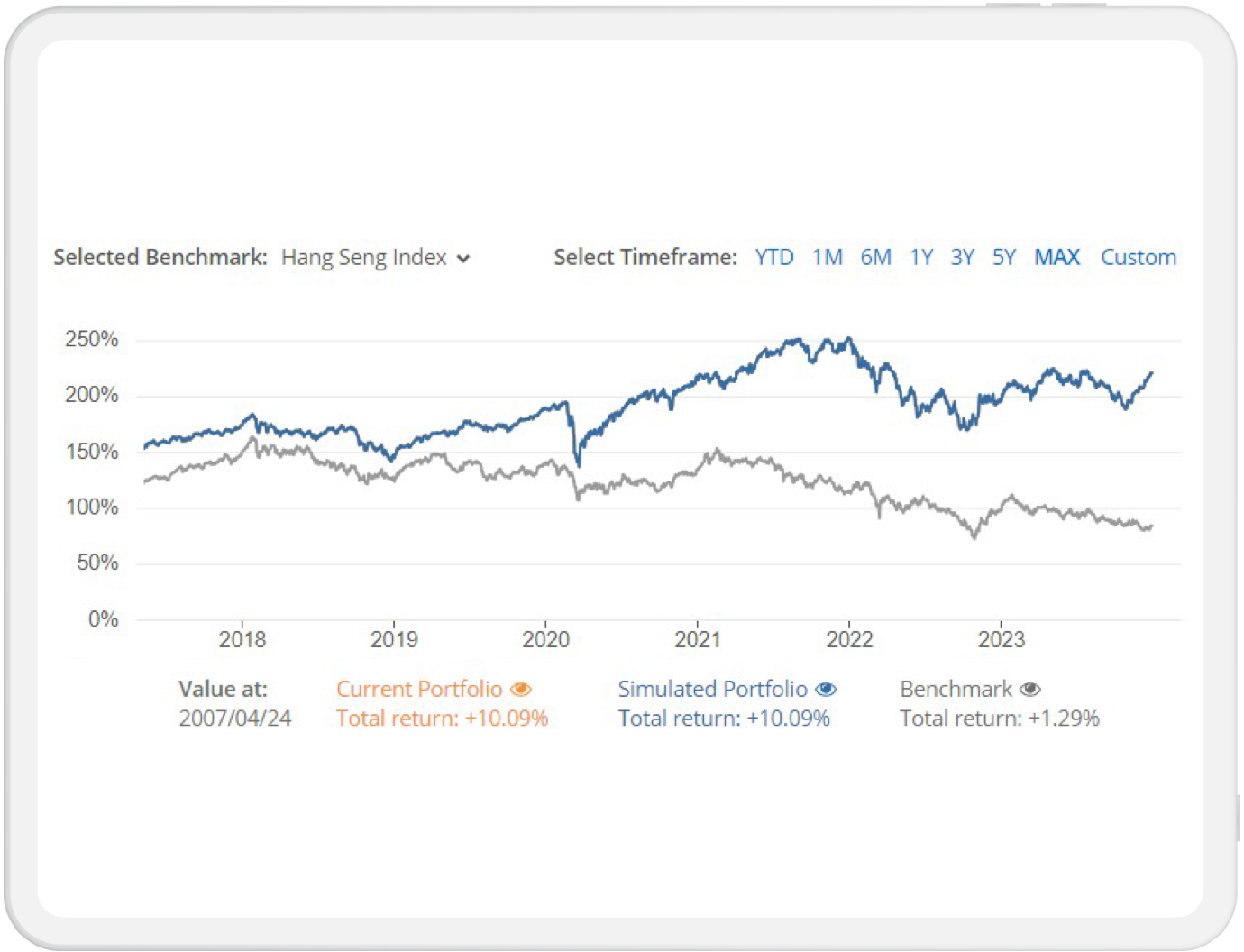

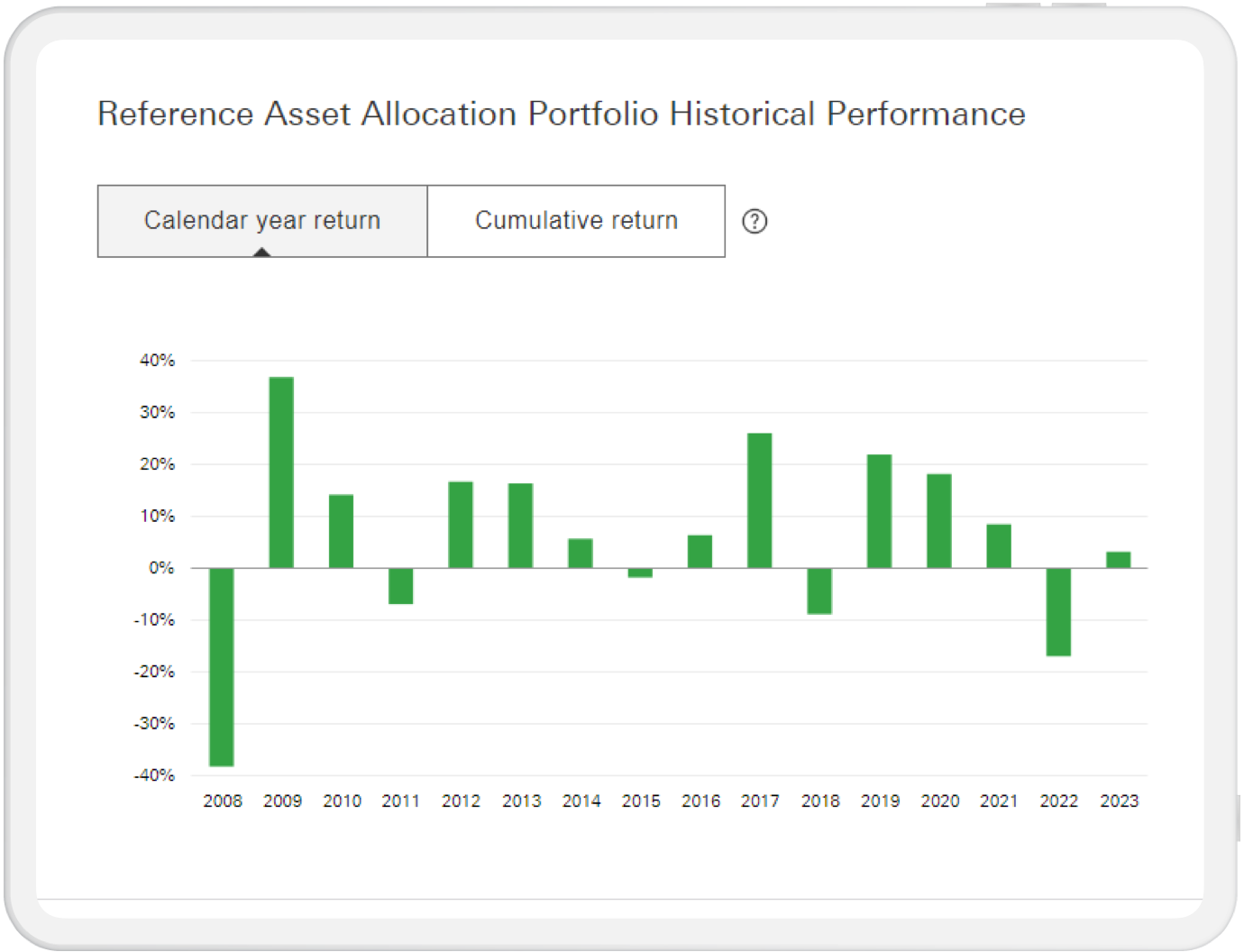

The analysis offers you a comprehensive performance review and back testing, such as simulated historic portfolio returns, historical scenario analysis and benchmark comparison.

The screen displays are for reference and illustration purposes only.

A reference portfolio is generated by our bank’s specialist team in order to give reference to you for diversification.

The screen displays are for reference and illustration purposes only.

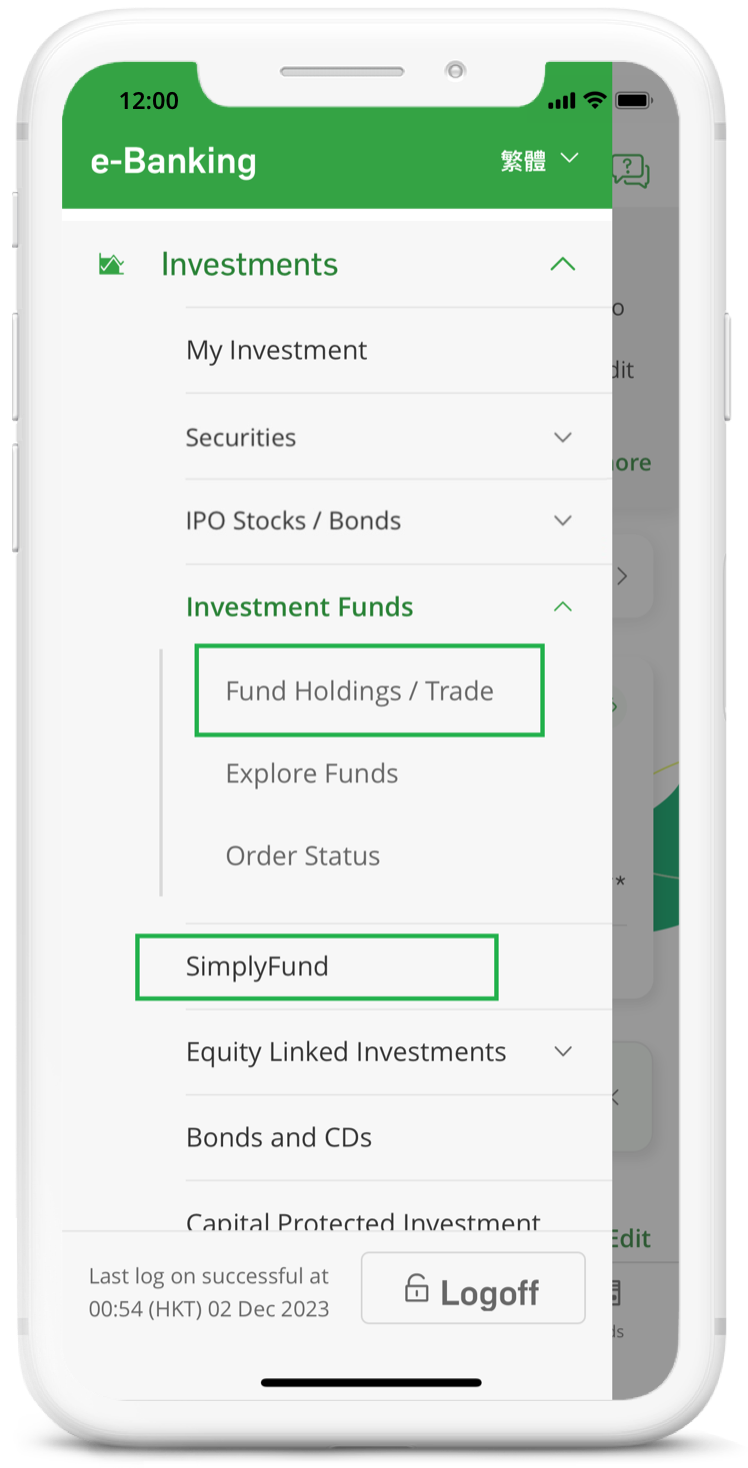

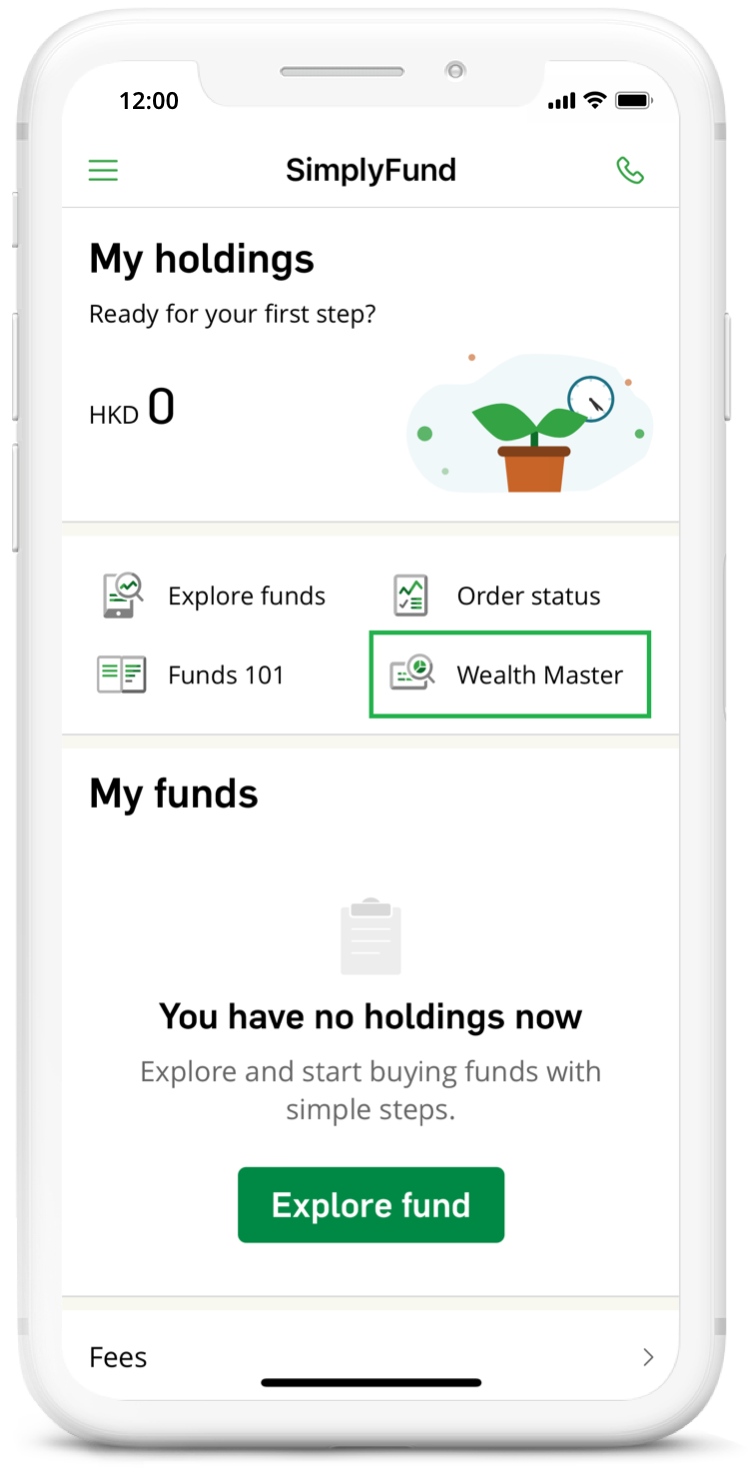

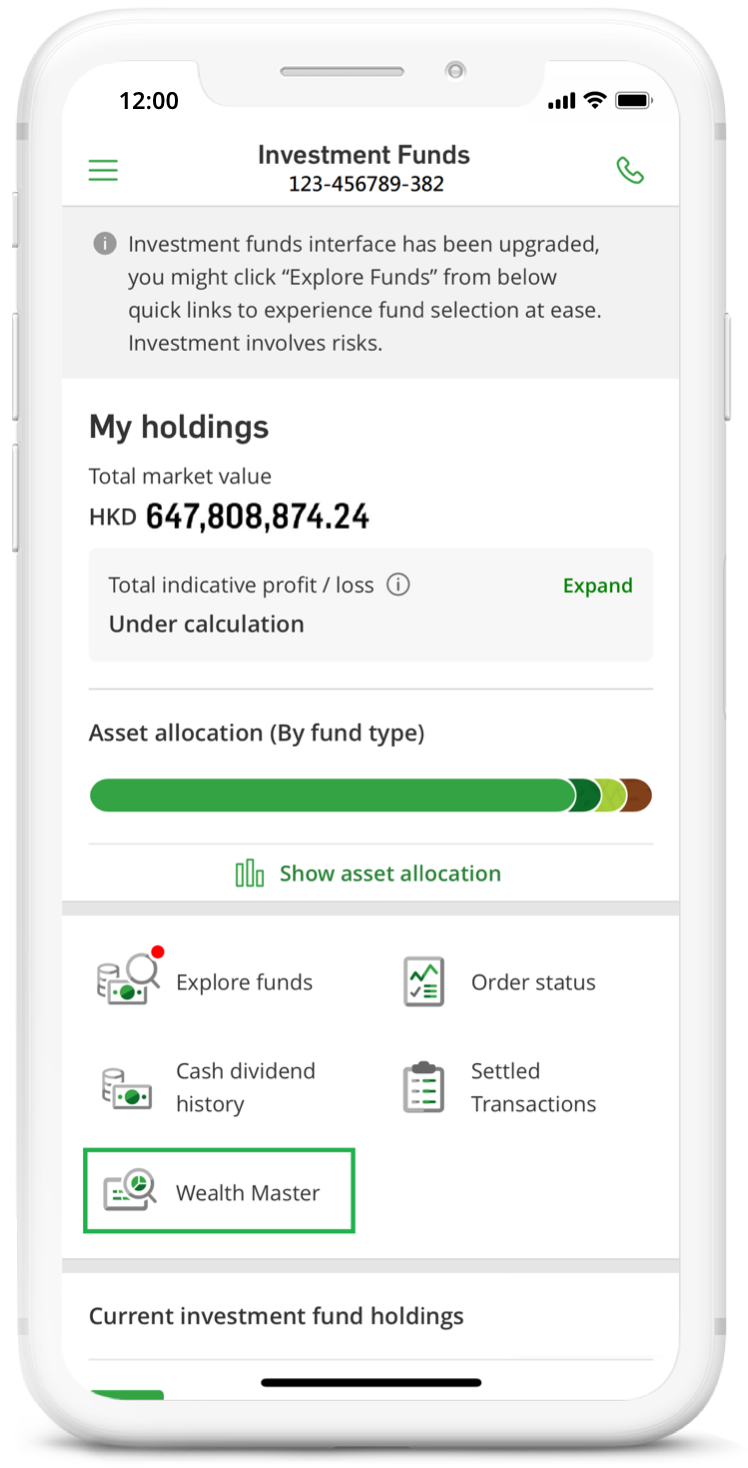

Step by step flow on Mobile App

Click "SimplyFund" or "Investment Funds" >

"Fund Holdings / Trade"

a. Click "Wealth Master" at "SimplyFund" page

b. Click "Wealth Master" at "Investment Funds" page

View your current fund portfolio, and you can click “View details” for more information

View the result after comparison with reference portfolio

If you want to have a more comprehensive analysis, click “Contact relationship manager” or if you want to explore funds online after the comparison, click "Search for funds"

Prestige Private Banking Customer

Explore the universe of funds that are available for subscription via Hang Seng Personal e-Banking/ Hang Seng Mobile App:

Join Prestige Banking / Prestige Private to enjoy the privileged services of “Wealth Master” available via Hang Seng Mobile App

Wealth Master at your fingertips

A preliminary analysis of your fund portfolio is ready for you via Hang Seng Mobile App’s newly enhanced function - Wealth Master, with the below features:

View detailed breakdown of your fund portfolio

Compare your portfolio with a reference portfolio that matches your risk tolerance level

Gain insights on how to allocate your assets

For a comprehensive analysis of your portfolio, visit any of our branches or contact your Relationship Manager.

Click here to find the branch nearest to youRemark:

- Bond Funds may invest in a variety of debt securities, including but not limited to, bonds, loans, fixed-rate or floating-rate debt securities.

Remarks

- Wealth Master aims to help customers understand their asset allocation and facilitate their investment planning to achieve their own financial goals. No asset allocation and/or product recommendation will be made by Hang Seng Bank Limited (the “Bank”). No representation is made to the appropriateness of any of the securities and/or investment products referred to herein for any particular person’s circumstances.

- The information of Wealth Master is for general reference only and information presented is not indicative of future performance of any assets. There is no guarantee that target portfolio can achieve any results or can be used as reference under any market conditions. Wealth Master does not and is not intended to provide any professional financial, investment or other opinion or advice, nor should it be considered as a recommendation to deal in any investment products, investment portfolio management service or ongoing portfolio monitoring services. No financial or investment decision should be made solely based on Wealth Master (including the results).

- The performance of the customer’s individual investment portfolio depends on the performance of the actual investment products chosen by themselves, the actual market situation and other factors. There is no guarantee that it can be close / similar to the performance of the target portfolio designed by the customer. The relative risk level of particular investment products chosen by the customer to build their investment portfolio may be lower or higher than the Risk Tolerance Level deduced from their Risk Profiling Questionnaire. Product Suitability and its risk should be carefully evaluated by the customer before making any investment decision.

- No consideration has been given to any particular investment objectives or experience, financial situation or other needs of any customers. Customers must make their own assessment of the relevance and adequacy of investments in the target portfolio. They should not only base on Wealth Master to make investment decisions. Customers should carefully consider whether the relevant investments are suitable for them in view of their own investment objectives, investment experience, financial situation, risk tolerance abilities and other needs etc., and consult independent professional advisers where necessary.

- The information provided in Wealth Master shall not be construed as a recommendation on the portfolio reallocation. More generally, making available to you any advertisements, marketing or promotional materials, market information or other information relating to a product or service shall not, by itself, constitute solicitation of the sale or recommendation of any product or service. It is your sole discretion to decide on any rebalancing target asset allocation.

- All investments involve risks (including the possibility of loss of the capital invested). Prices of investment products may go up as well as down and may even become valueless. Past performance information presented is not indicative of future performance. The risk disclosure statements and the offering documents of the relevant investment products should be read in detail before making any investment decision.

- Transactions which are pending settlement have not been taken into account in the holding position of current holdings. Holding position of current holdings (including but not limited to the number and nominal value of various investment products/assets held) and market price data may not be based on real-time data, but may be based on the latest information available in the bank system.