We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Join Preferred Banking via Hang Seng Mobile App and switch your payroll to PayDay+ to enjoy up to $2,700 in rewards and up to 4.3% p.a. savings rate on HKD and designated foreign currencies! Maximise Earning, Maximise Saving, and Maximise Fun!

Scan QR code to open or upgrade an account via mobile now

Opening or upgrading a bank account online is that easy.

If you are aged 18 or above and residing in Hong Kong, you can open or upgrade an account now with Hang Seng Personal Banking mobile app[1].

For the complete list of Mobile Account Opening / Upgrade eligibility requirements, please refer to the FAQs tab below.

You can also activate your investment accounts via Hang Seng Personal Banking mobile app.

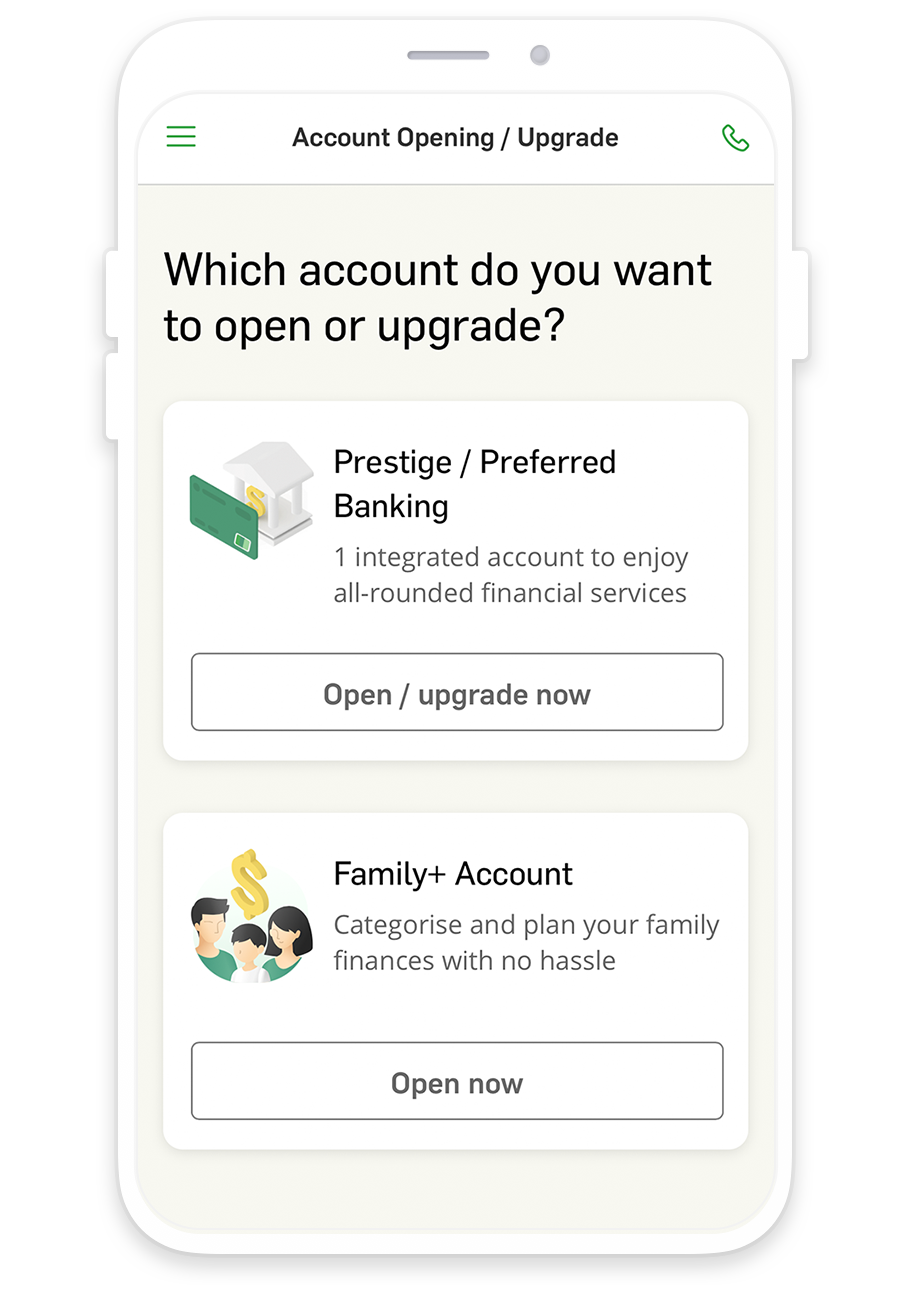

Prestige Banking takes care of your needs. Our team of experts is always here to help you formulate comprehensive investment and protection solutions. You can also enjoy an array of fabulous rewards and benefits especially selected for you.

Preferred Banking helps you kick start your wealth management journey effortlessly in one hub, without balance fee. Start saving and investing, and enjoy many exclusive offers. Simple and easy. That’s Preferred Banking.

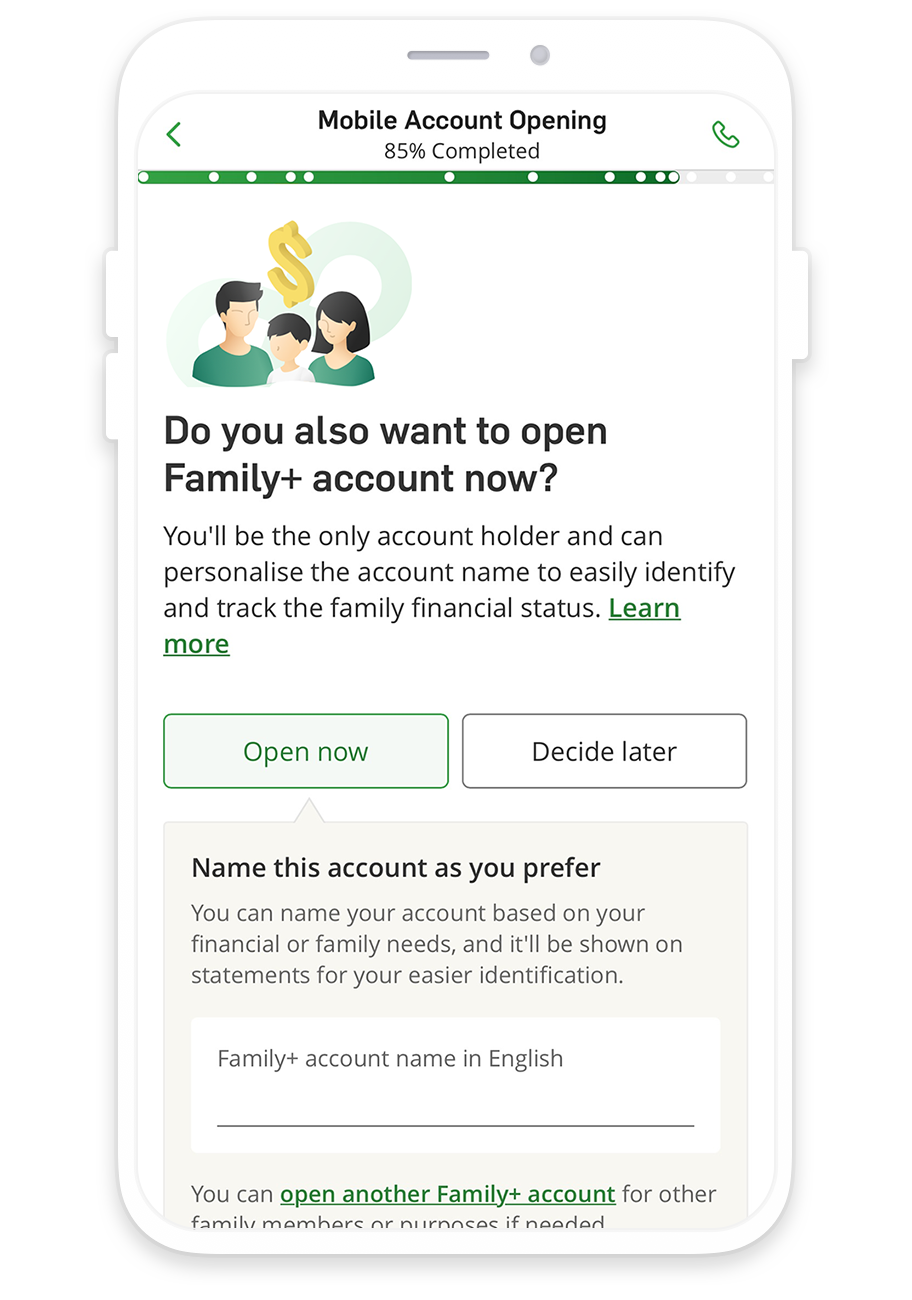

With Family+ account, you can effectively organise your family finances, making it easier for you to manage your household budget. You have the flexibility to open up to 4 Family+ accounts to set aside money for different family members or financial goals. Being the account holder, you can easily manage all accounts directly at our bank. To qualify for opening a Family+ account, you must already hold a Preferred or Prestige Banking account.

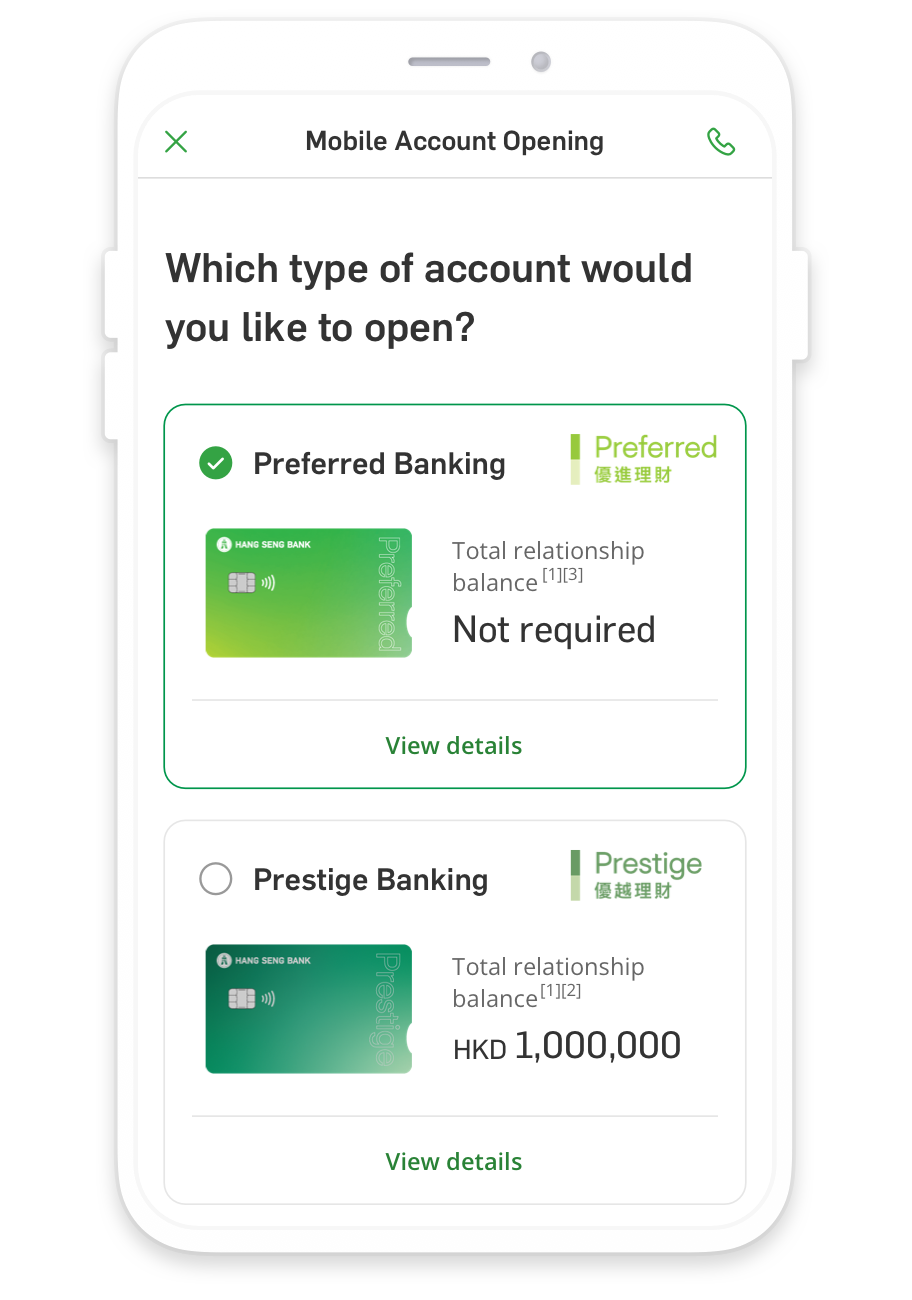

Prestige Banking

Preferred Banking

Total relationship balance[2]

HKD1,000,000

Not required

Below balance fee

HKD40 per month[3]

Waived

You are eligible for Mobile Account Opening / Upgrade if you are aged 18 or above and residing in Hong Kong.

Both new and existing customers can open or upgrade an account via mobile. Please note this service is not available to customers who:

Such customers can make an appointment online to open or upgrade account in any of our branches.

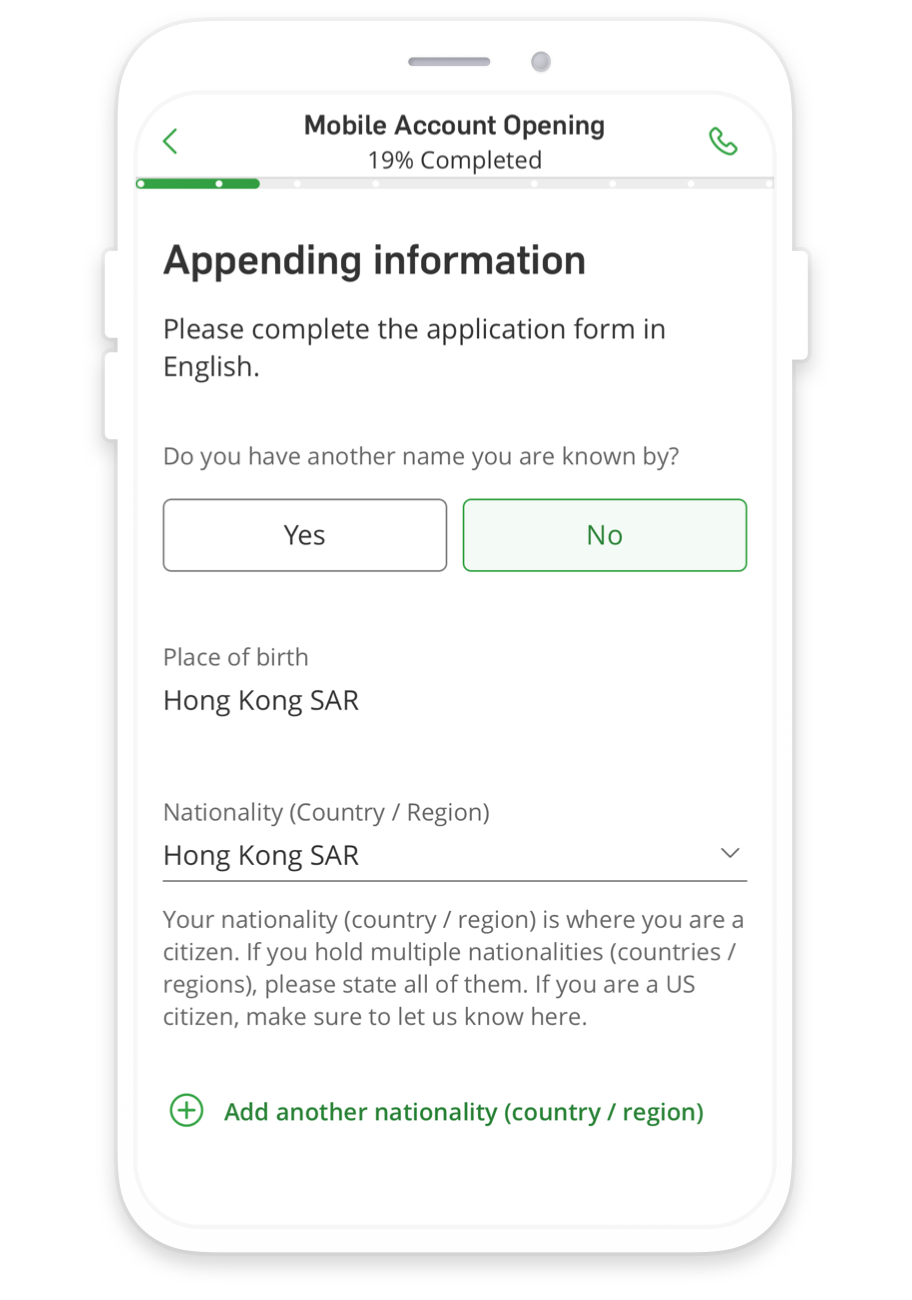

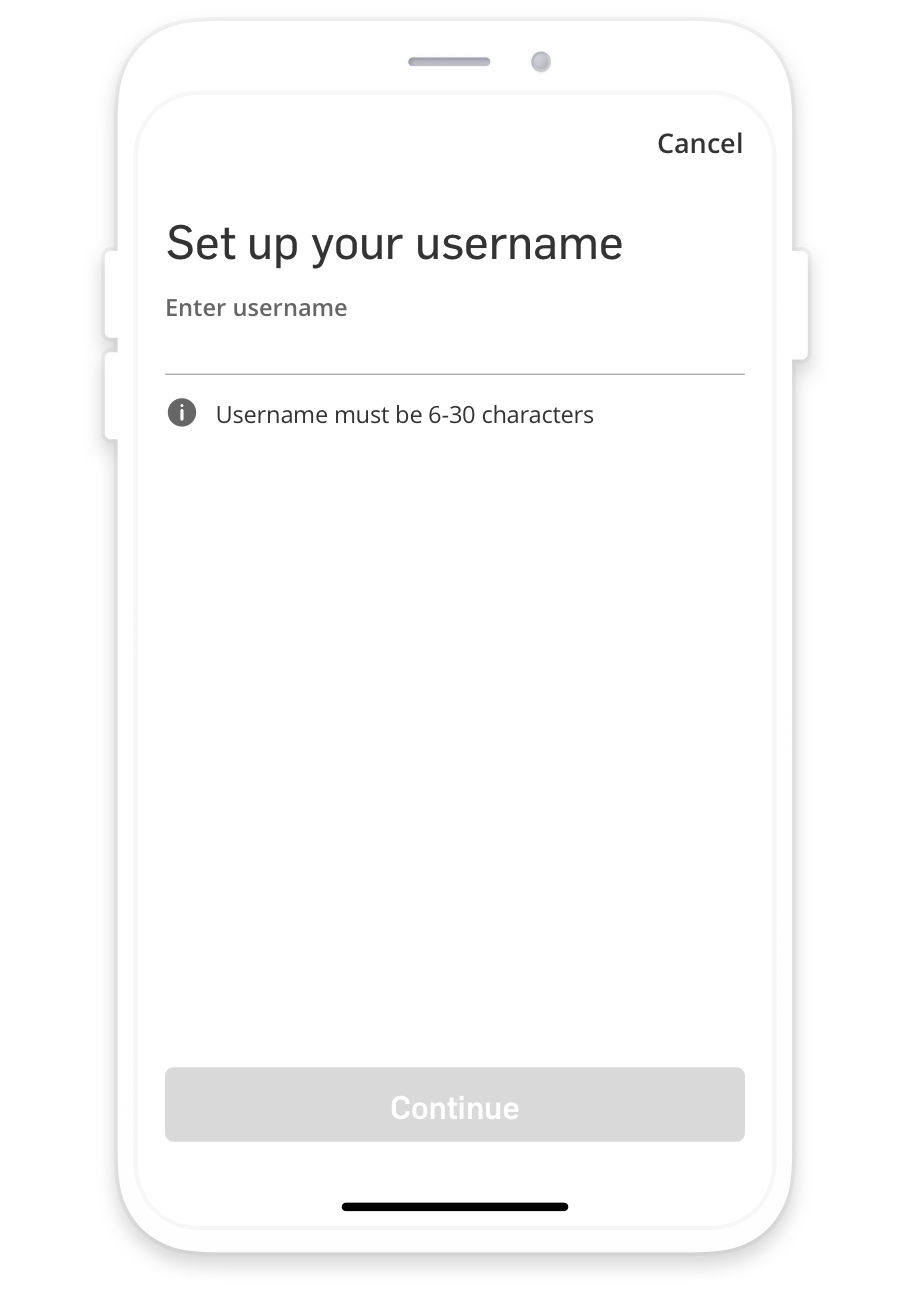

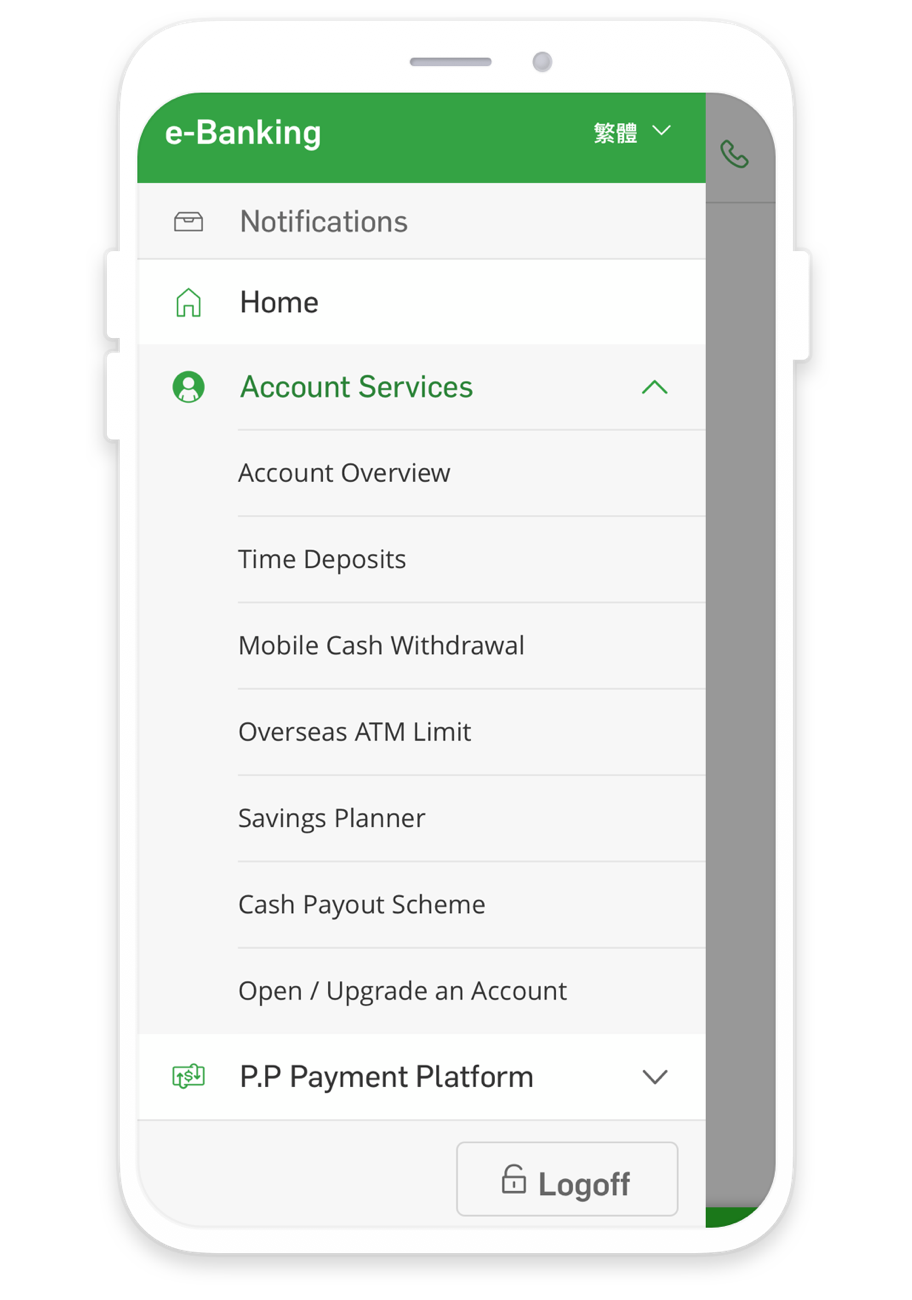

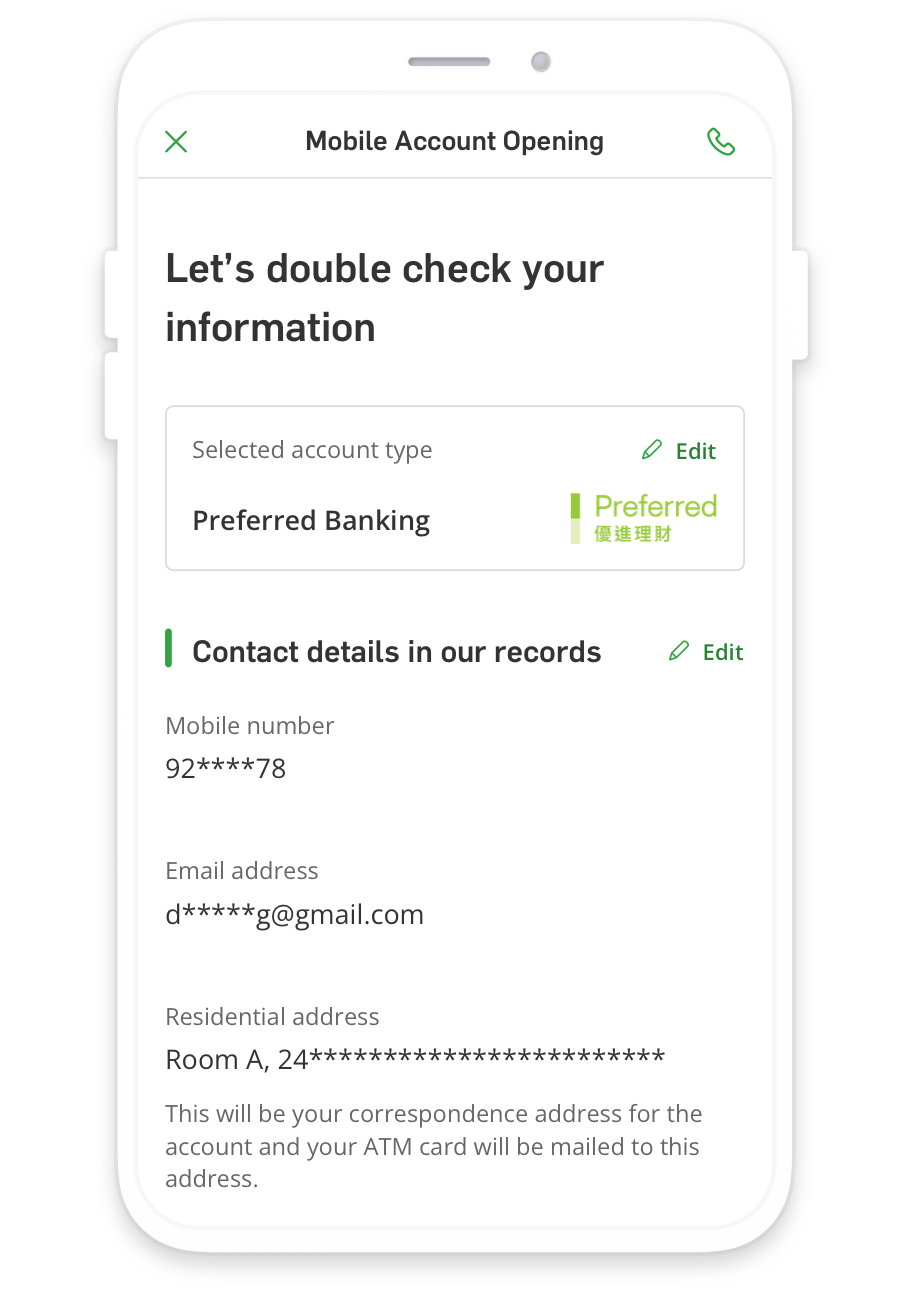

You can follow these steps to complete Mobile Account Opening / Upgrade process.

If you are new to Hang Seng or only holding Hang Seng credit cards:

If you are already holding a Hang Seng bank account (Not applicable if you only hold credit card accounts):

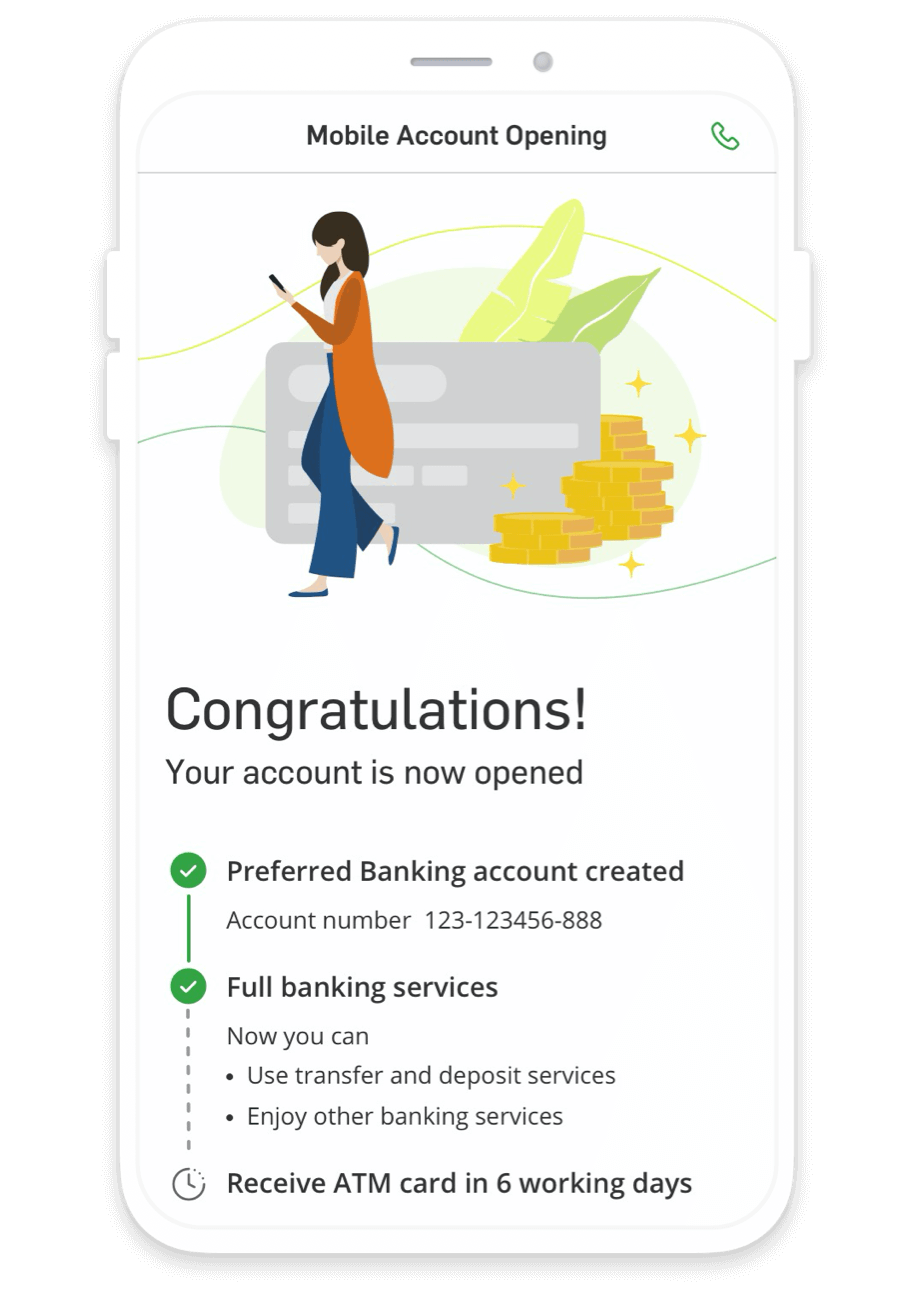

You have successfully opened a new account and can enjoy full banking services right away.

If you are upgrading your existing Integrated Account or Preferred Banking account to Preferred or Prestige Banking, the application will be processed within 2 to 3 working days.

Preferred Banking account and Family+ account don't have any Total Relationship Balance[2] requirement, so the account holders won't be charged for below balance fee. If you open a Prestige Banking account, you'll need to make sure your Total Relationship Balance for the previous month is at HKD1,000,000 or above[3]. Otherwise, you'll be charged for below balance fee.

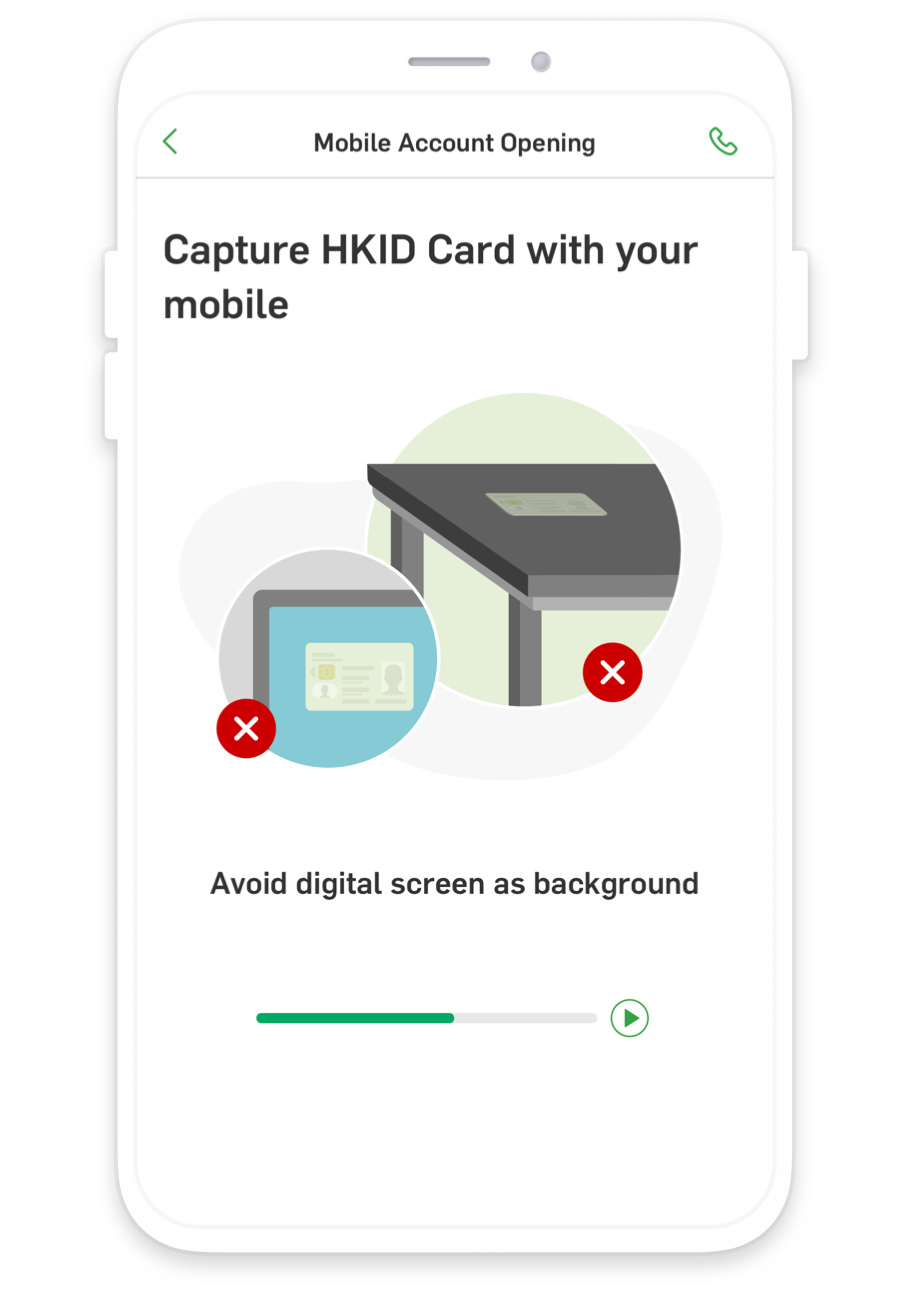

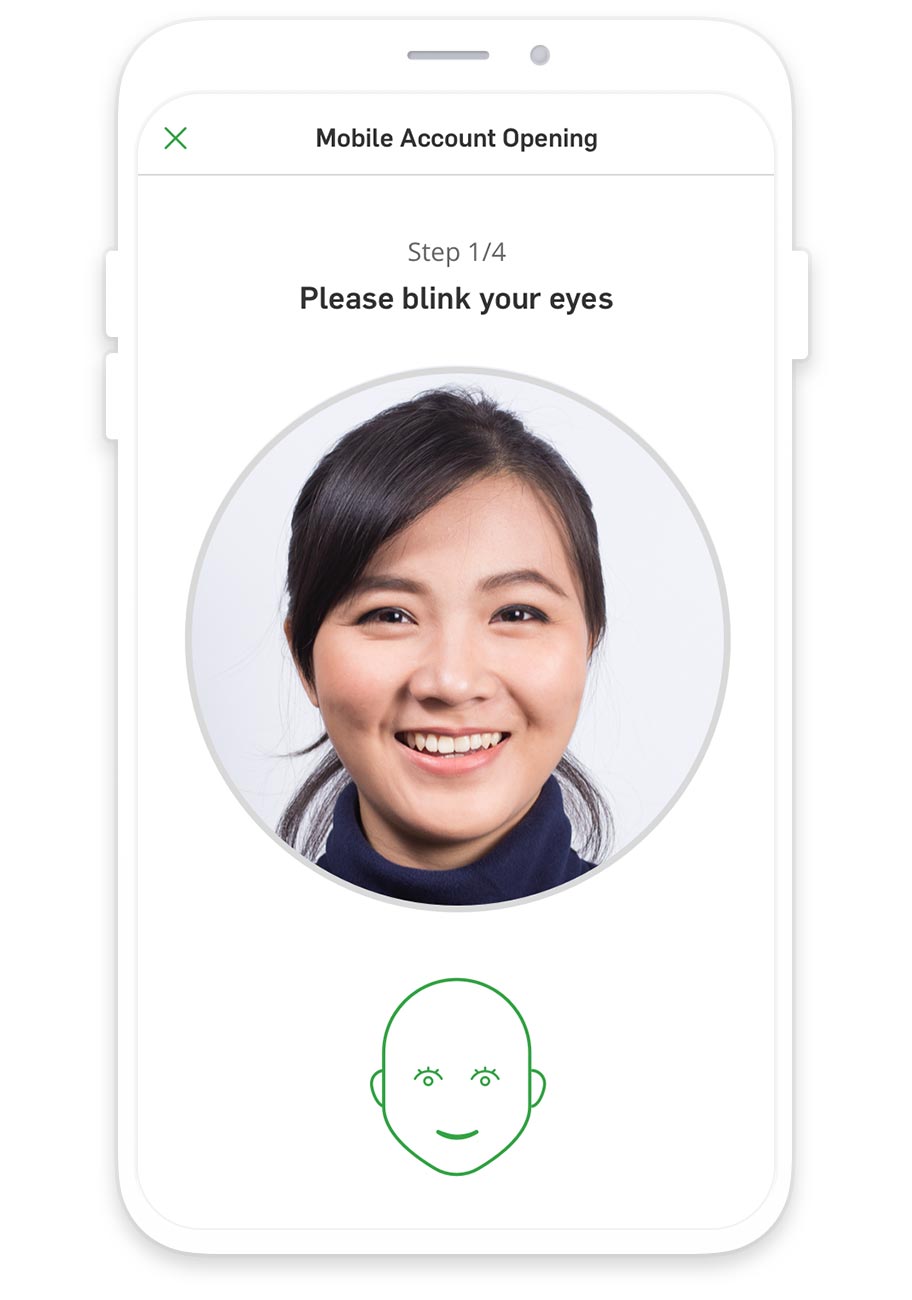

If you are new to us or only holding Hang Seng credit cards, you simply need to prepare to capture your HKID and take a selfie.

If you are already holding a Hang Seng bank account (Not applicable if you only hold credit card accounts), you can log on to Personal e-Banking or mobile app to make sure your personal information in our record is correct and updated.

If you are eligible to open or upgrade a bank account via mobile, you can now open or upgrade to Prestige Banking account or Preferred Banking account (for savings and current accounts only) through Hang Seng Personal Banking mobile app. To open or upgrade joint account, please visit one of our branches.

If you close the application during the Mobile Account Opening / Upgrade process, any information you've entered will not be saved and you will need to start over.

You will see an acknowledgement page after completing the Mobile Account Opening / Upgrade application, we will also notify you with SMS via mobile if the account is successfully opened or upgraded. You can make deposits right away. If you are new to Hang Seng, full banking services (e.g. cash withdrawal from the account) will only be available after 3 working days.

If you are upgrading your existing Integrated Account or Preferred Banking account to Preferred or Prestige Banking, the application will be processed within 2 to 3 working days.

You are just one step away. You will need to provide your specimen signature for record at one of our branches to complete your cheque book request. We will send you the cheque book by ordinary mail in 7 working days after you've complete this last step.

Your new account opened or upgraded via mobile will adopt the signature of your existing account, and you should use this existing signature for issuing a cheque as well. You can visit our branches anytime to check your existing signature or provide a new one.

We'll send out the ATM card by mail within 5 working days from the date of your successful account opening or upgrade. (Not applicable to Family+ account)

After receiving the ATM card, if you have a Personal e-Banking account, you can log on to Hang Seng Mobile App, choose "Settings & Security" > "Card" > "Reset Card PIN" to activate and confirm receipt of your ATM card, and set up your ATM card PIN, ATM card PIN will be effective immediately.

Alternatively, you can call our 24-hour hotline to activate your ATM card and apply for an ATM card PIN, we'll send you the ATM card PIN by mail after you made the request.

Prestige Banking customer hotline: (852) 2998 9188

Preferred Banking customer hotline: (852) 2822 8228

If you're upgrading your existing Integrated Account or Preferred Banking account to Preferred or Prestige Banking, you can insert new ATM card to ATM machine and input your existing ATM card PIN to activate the new ATM card. The existing ATM card will be obsoleted once the new ATM card is activated.

You can activate Personal e-Banking right after successful online account opening via mobile. If you have exited the activation page, you can visit Personal e-Banking log on page of Hang Seng Bank website or Hang Seng Personal Banking mobile app after receiving your ATM card and ATM card PIN to activate your Personal e-Banking.

Your Hong Kong Identity Card photo and video, the information on your Hong Kong Identity Card, as well as your photo will be provided to our third-party service providers for the purpose of verifying your identity and personal information (which may include checking against our third-party service providers’ own data), and will be used, processed and kept by us and our third-party service providers according to the Personal Data (Privacy) Ordinance (CAP. 486) and the Notice to Customers and other Individuals relating to the Personal Data (Privacy) Ordinance (the “Notice”).

Your Hong Kong Identity Card photo and video, the information on your Hong Kong Identity Card, as well as your photo will be kept in the database of our third-party service providers for 2 days.