Preferred Banking has been powering up your financial management skills in savings, insurance and investment. In 2024, it is time for us to power up your year-round bonus, so you can earn offers to the fullest, achieve more goals with ease! From today to 14 April 2024, new Preferred Banking customers1 who open a Preferred Banking account can enjoy reward of value up to HKD1,7002, and customers who insure QuickReward Endowment Life Insurance Plan (1-Year) can enjoy guaranteed annual return of up to 5% p.a.3. There are even more rewards when you travel and exchange foreign currency! Open account now to power up your bonus!

Offers for new customers1 / existing customers

In App Account Opening Rewards

HKD100 HKTVmall e-Gift Voucher

1

New Preferred Banking customers who successfully open Preferred Banking account via Hang Seng Mobile App and successfully make 2 online bill payment transactions via Hang Seng Personal e-Banking at the 4th month after account opening

HKD100

HKTVmall e-Gift Voucher4

HKTVmall e-Gift Voucher4

Wealth Planning Rewards

Up to 5% guaranteed annual rate of return

& rewards of value up to HKD800

& rewards of value up to HKD800

Currency Exchange Reward

30% FX Spread Discount

+ 1-week time deposit rate up to 13% p.a.

New Card Rewards

Up to $800 +FUN Dollars

Just a few minutes – Open Preferred Banking Account*

New customer

Existing customer

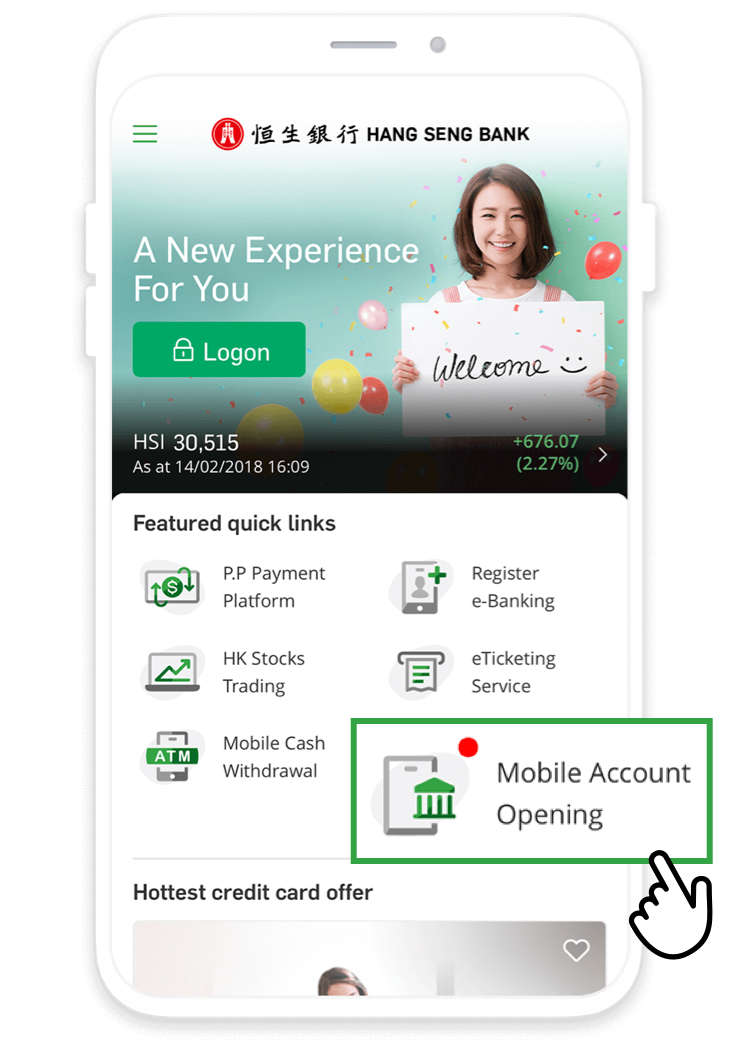

Download Hang Seng Mobile App to open account now

Download and open Hang Seng Mobile App, select “Mobile Account Opening” under “Featured quick links” at the Home page. Verify your identity by capturing your HKID and taking a selfie as instructed, then fill in your personal details needed.

*Mobile Account Opening / Upgrade is not available to customers who only hold Hang Seng credit cards or joint-named Integrated Accounts or already hold a sole-named Prestige Banking account. Customers who are new to Hang Seng can make deposits right away after successful Mobile Account Opening, full banking services (e.g. cash withdrawal from account) will be available after 2 working days and ATM card will be dispatched by mail within 5 working days. If you are existing Hang Seng customers, you can enjoy full banking services right away after successful Mobile Account Opening. If you are upgrading your existing Integrated Account or Preferred Banking account to Preferred or Prestige Banking, your application will be processed within 2 to 3 working days.

Power up year-round bonus

Want extra for your annual bonus? Complete the 3 smashing reward combos to actualize more wishes at ease!

Switch to Hang Seng's payroll service during the annual bonus season to earn up to HKD800 rewards6

Exchange foreign currency with your bonus and set up a 1-week foreign currency time deposit to enjoy a Time Deposit Offer, in which exchanging USD can enjoy an interest rate of up to 8% p.a.9

Learn more

Learn more

Exchange foreign currency with your bonus and set up a 1-week foreign currency time deposit to enjoy a Time Deposit Offer, in which exchanging USD can enjoy an interest rate of up to 10% p.a.9

Learn more

Learn more

Exchange foreign currency with your bonus and set up a 1-week foreign currency time deposit to enjoy a Time Deposit Offer, in which exchanging USD can enjoy an interest rate of up to 10% p.a.9

Learn more

Learn more

Enter promo code “INCOME” when you insure Hang Seng QuickReward Endowment Life Insurance Plan (1-Year) and choose USD plan to enjoy guaranteed return up to 5% upon maturity3

Learn more

Enter promo code “INCOME” when you insure Hang Seng QuickReward Endowment Life Insurance Plan (1-Year) and choose USD plan to enjoy guaranteed return up to 5% upon maturity3

Learn more

Enter promo code “INCOME” when you insure Hang Seng QuickReward Endowment Life Insurance Plan (1-Year) and choose USD plan to enjoy guaranteed return up to 5% upon maturity3

Learn more

Power up travel budget

Want to keep earning even on travelling? Open Preferred Banking account and MMPOWER World Mastercard, along with foreign currency time deposit.

Complete these 2 travel essential combos so you can journey on and power up the travel budget at the same time!

Complete these 2 travel essential combos so you can journey on and power up the travel budget at the same time!

Combo 1

Combo 2

New customers who successfully apply for MMPOWER World Mastercard can enjoy welcome offer up to

$800 +FUN Dollars10,11,12

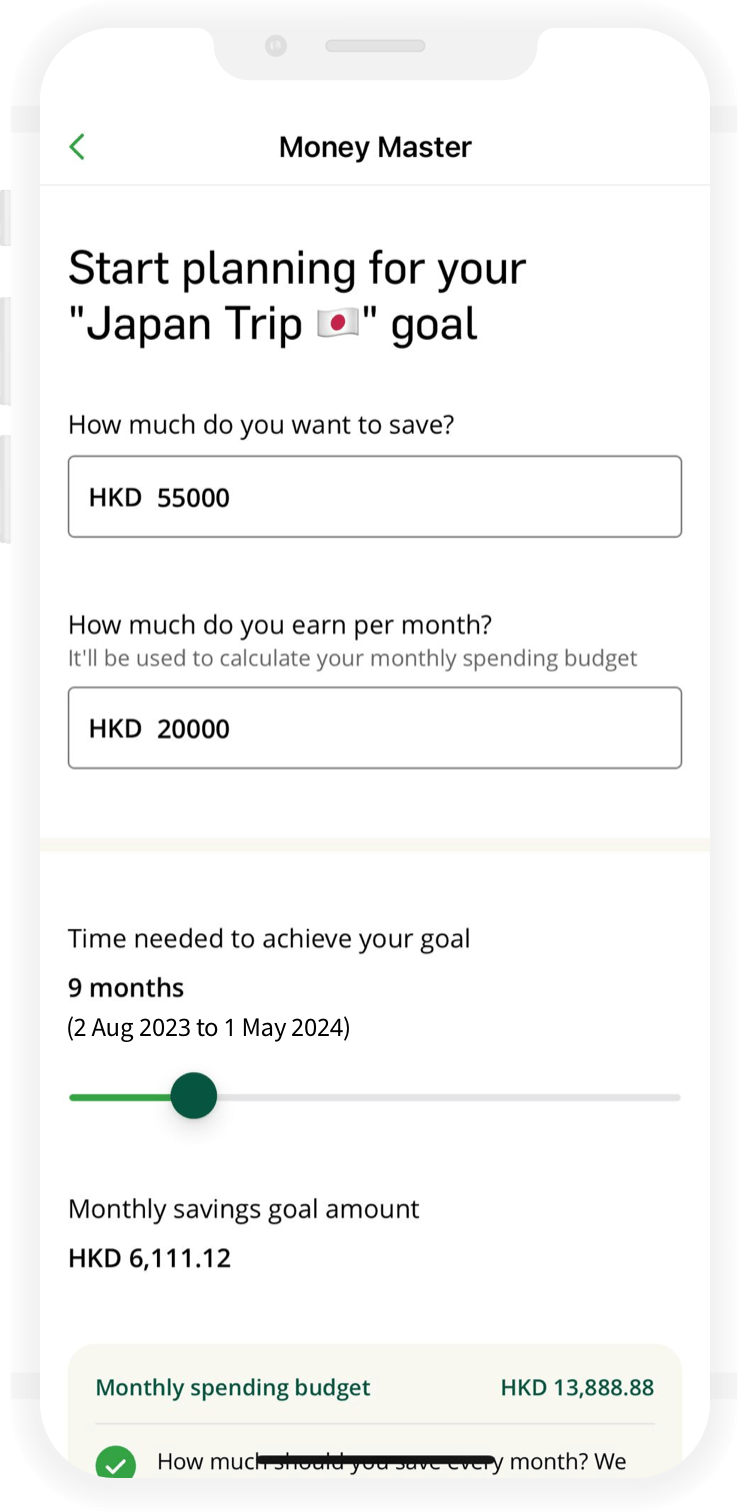

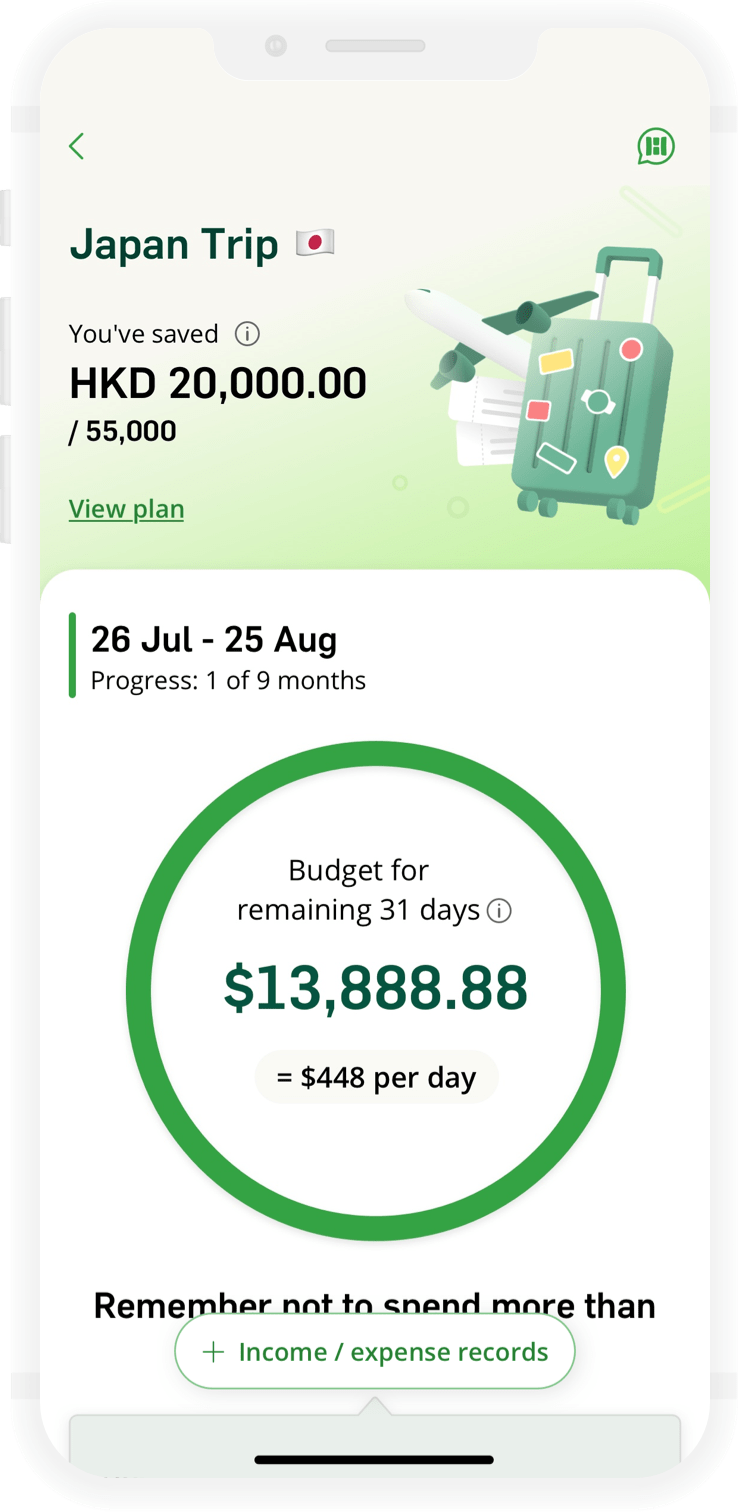

Save money with Money Master

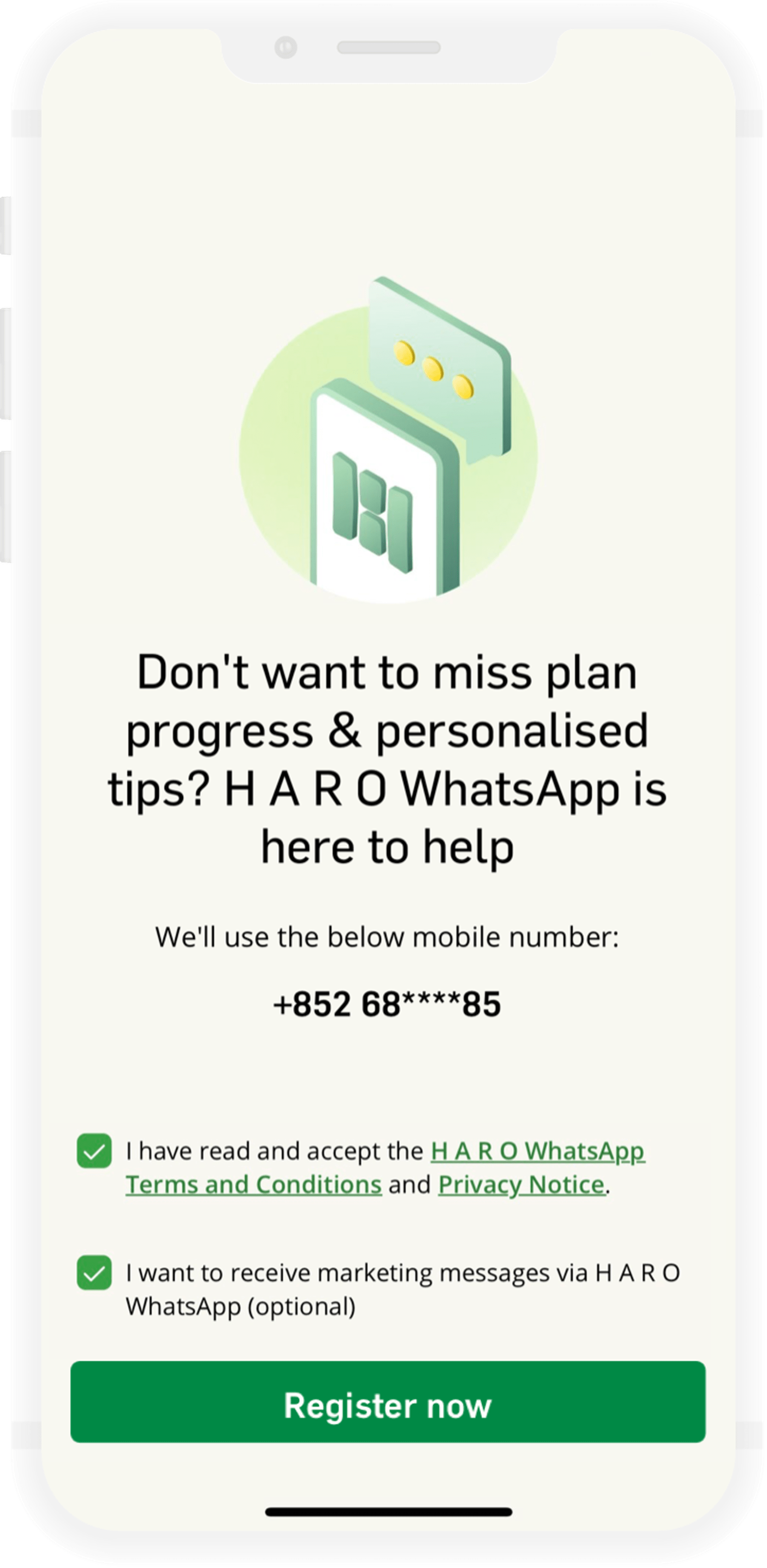

Got some big plans to achieve in 2024? Money Master will automatically track your expenses from your Hang Seng Hong Kong Dollar accounts and credit cards, and reflect remaining spending budget in real time. You can also register for H A R O WhatsApp to receive personalised tips and progress updates so that you can achieve your goal with ease!

Set up your bespoke saving plan

1

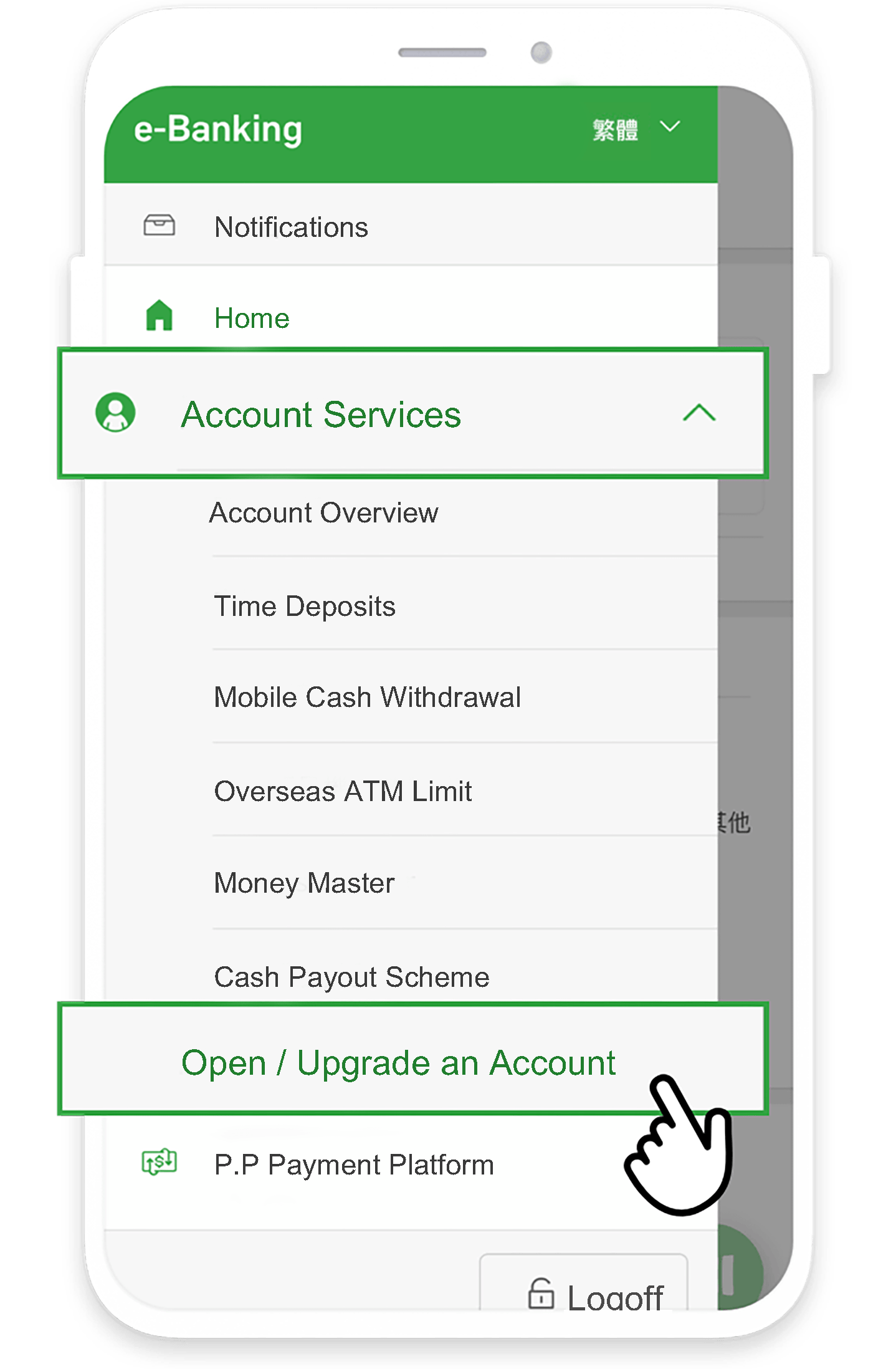

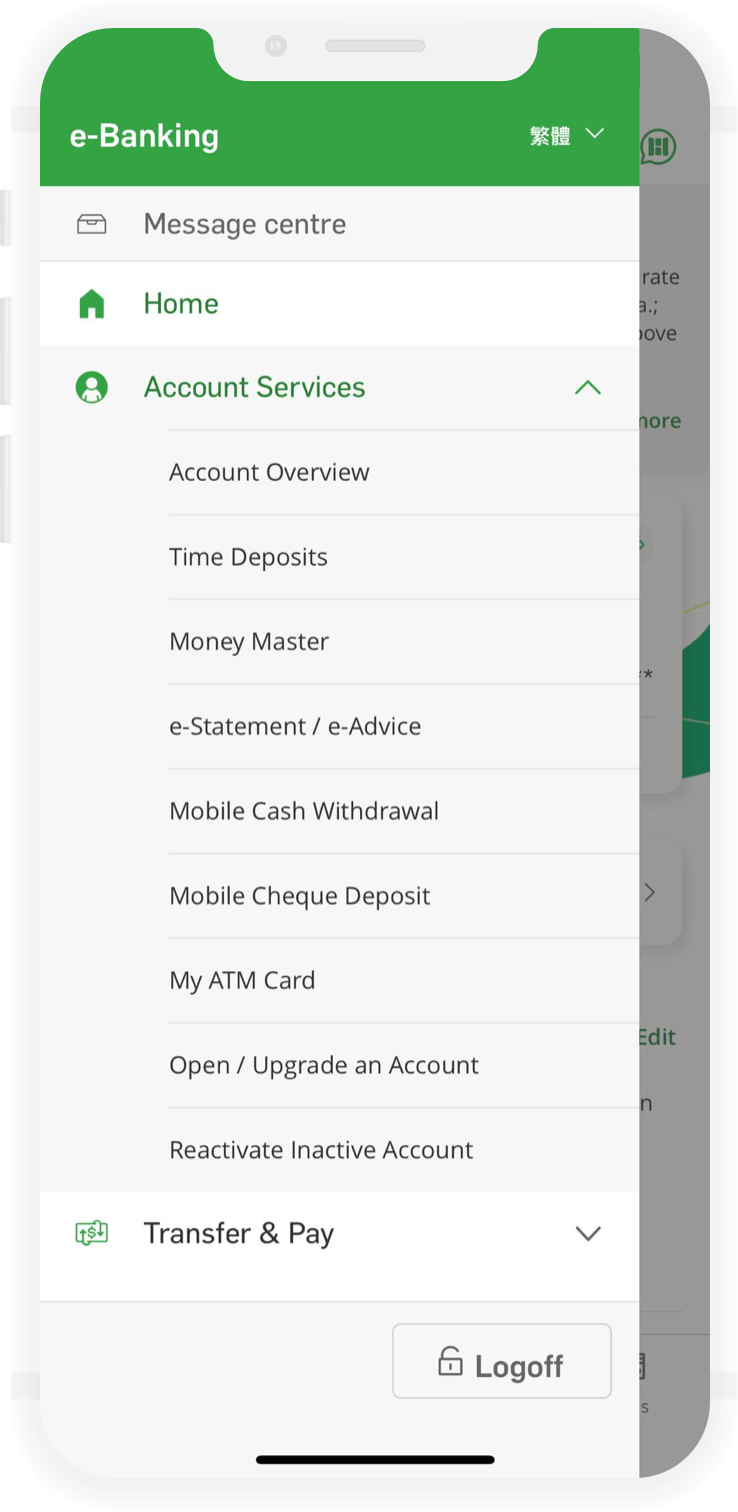

Log on to Hang Seng Mobile App and tap "Account Services" > "Money Master" from the left menu.

2

Select a savings goal you want to achieve and enter plan details, Money Master will automatically track the expense records of your Hang Seng HKD accounts and credit card and reflect monthly remaining spending budget.

3

Register for H A R O WhatsApp to receive personalised tips and progress updates.

4

Your saving plan is all set!

To borrow or not to borrow? Borrow only if you can repay!

If you are in doubt of our marketing and promotional activities and materials, please call customer service enquiry hotline for verification.

Terms and Conditions apply to all the products/services and offers above. Please click here for detailed Terms and Conditions of Preferred Banking Welcome Offers Promotion.

If you are in doubt of our marketing and promotional activities and materials, please call customer service enquiry hotline for verification.

Hang Seng Bank Website > About Us > Contact Us > Enquiry and Trading Hotlines

Terms and Conditions apply to all the products/services and offers above. Please click here for detailed Terms and Conditions of Preferred Banking Welcome Offers Promotion.

Remarks

- "New Customer(s)" mentioned herein refers to personal customers who have opened a new Preferred Banking of the Bank during 1 January 2024 to 14 April 2024, but excluding: existing customers who are holding any Hong Kong Dollars/Foreign Currency savings, current, time deposit accounts or any Integrated Accounts at Hang Seng Bank Limited ("the Bank") (including Prestige Banking, Preferred Banking and any other Integrated Account) (the "Existing Customer(s)"), or customers who have closed any of the above accounts with the Bank in the previous 12 months prior to the account opening month, or customers whose accounts mentioned above have been terminated in any period.

- New Customers could enjoy rewards of value up to HKD1,700 (including e-Gift vouchers, +FUN Dollars and cash rewards), please refer to the Terms and Conditions of Preferred Banking Welcome Rewards at this website.

- This is the return rate of USD plan with premium discount included. Terms and Conditions apply. This offer is applicable to all customers who enter the promo code "INCOME" for application to enjoy up to 5% guaranteed annual rate of return.

- The promotion period is from 1 January 2024 to 14 April 2024. New customers open Preferred Banking account via Hang Seng Mobile App and successfully make 2 online bill payment transactions via Hang Seng Personal e-Banking at the 4th month after account opening are entitled HKD100 HKTVmall e-Gift Voucher. Terms and Conditions apply, for details, please refer to the Terms and Conditions of Preferred Banking Welcome Rewards at this website.

- QuickReward Endowment Life Insurance Plan (1-Year) is underwritten by Hang Seng Insurance Company Limited. Hang Seng Insurance Company Limited is authorised and regulated by the Insurance Authority of the HKSAR. Hang Seng Bank is an insurance agent authorised by Hang Seng Insurance Company Limited and the insurance products are products of Hang Seng Insurance Company Limited but not Hang Seng Bank. In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between Hang Seng Bank and you out of the selling process or processing of the related insurance product transaction, Hang Seng Bank will enter into a Financial Dispute Resolution Scheme process with you; however any dispute over the contractual terms of the insurance products should be resolved between Hang Seng Insurance Company Limited and you directly. Terms and Conditions apply. Please note the relevant product risks, credit risks and early surrender loss.

-

The Promotion is only applicable to Eligible Customers who successfully set up payroll service via the sole-named or joint-named newly opened/upgraded Preferred Banking account (“Payroll Account”) within the Promotion Period, and fulfil the following requirements (“Eligible Payroll Customers”). Each Eligible Payroll Customer is entitled to the cash reward once:

-

Applicable to customers who newly opened/upgraded to Preferred Banking account of the Bank during 1 January 2024 to 14 April 2024

- Have no payroll record under any account of the Bank during the period from 1 October 2023 to 31 December 2023; and

- Have at least one-month of payroll record of HKD10,000 or above in Eligible Customer’s Payroll Account during the period from 1 January 2024 to 31 May 2024 (“Designated Payroll Period”); and the salary must be directly credited to Eligible Customer’s Payroll Account from the employer’s company account via Autopay (“Eligible Payroll Record”). Any salary not credited from the employer’s company account is not considered an Eligible Payroll Record.

-

Applicable to customers who newly opened/upgraded to Preferred Banking account of the Bank during 1 January 2024 to 14 April 2024

- During the Promotion Period, Eligible Customers can enjoy preferential interest rate by placing a time deposit with Eligible New Fund Balance via online banking (including Hang Seng Personal e-Banking and Hang Seng Mobile App). Terms and Conditions apply. For details, please visit

.

. - The promotion period is from 1 January 2024 to 14 April 2024. New customer can enjoy a “30% FX Spread Discount” by conducting real-time currency exchange successfully under his/ her Preferred banking Account via Hang Seng Personal e-Banking or Hang Seng Mobile App during the designated FX transaction period. “30% FX Spread Discount” refers to reduction of 30% on sales margin normally charged for FX transaction by the Bank. Other mark-up applied to the exchange rate for operational reasons however will not be waived. For details, please refer to the Terms and Conditions of Preferred Banking Welcome Rewards at this website.

- The promotion period is from 2 April 2024 to 29 June 2024. For exchange of designated currencies and set up of 1-week/1-month time deposit at the same time with designated transaction amount. The above interest rate offers are quoted with reference to the interest rates offered by the Bank on 2 April 2024 and are for reference only. The relevant interest rates will be subject to revision based on the prevailing market conditions. Terms and conditions apply. Please visit

for more details.

for more details. - The promotion period is from 1 January 2024 to 14 April 2024. Customers who have successfully applied for Hang Seng MMPOWER World Mastercard or University / College Affinity Credit Card within promotion period are entitled $100 +FUN Dollars. For details, please refer to the Terms and Conditions of Preferred Banking Welcome Rewards at this website.

- The promotion period is from now to 30 June 2024. Customers who have successfully applied for MMPOWER World Mastercard during the Promotion Period and fulfilled the designated spending requirements of welcome offer are entitled to up to $700 +FUN Dollars. For details, please visit

.

. - The promotion period is from now to 30 June 2024. Customers who have successfully applied for University/College Affinity Credit Card during the Promotion Period and fulfilled the designated spending requirements of welcome offer are entitled to up to $600 +FUN Dollars. For details, please visit

.

. - The promotion period is from now to 30 June 2024, you can get up to 6% +FUN Dollars rebates in Eligible Overseas Foreign Currencies Transactions by successfully registering for “2024 MMPOWER World Mastercard +FUN Dollars Reward Program" and accumulative monthly Eligible Retail Spending meets HKD5,000. Monthly Reward Cap up to $500 +FUN Dollars. Terms and conditions apply, please visit

.

. - Existing customers who upgrade to Preferred Banking during the Promotion Period could enjoy rewards of value up to HKD1,500 (including +FUN Dollars and cash rewards), please refer to the Terms and Conditions of Preferred Banking Welcome Rewards at this website.

- Visit Hang Seng Bank Website (Banking > Branch, Self-service, Phone & Social Caring Banking > Self-service Banking > Foreign Currency ATMs) for more FX ATM service, service sites and service time details.

Other Important Risk Warnings

RMB Currency risk

Renminbi ("RMB") is subject to exchange rate risk. Fluctuation in the exchange rate of RMB may result in losses in the event that the customer subsequently converts RMB into another currency (including Hong Kong Dollars). Exchange controls imposed by the relevant authorities may also adversely affect the applicable exchange rate. RMB is currently not freely convertible and conversion of RMB may be subject to certain policy, regulatory requirements and/or restrictions (which are subject to changes from time to time without notice). The actual conversion arrangement will depend on the policy, regulatory requirements and/or restrictions prevailing at the relevant time.

Foreign Currency Risk

Foreign Exchange involves Exchange Rate Risk. Fluctuations in the exchange rate of a foreign currency may result in gains or losses in the event that the customer converts HKD to foreign currency or vice versa.

Important notes and disclaimer

Investors should not only base on this material alone to make any investment decision, but should read in detail in the relevant risk disclosure statements. The information contained herein is for general information and reference purposes only and is not intended to provide professional investment or other advice. It is not intended to form the basis of any investment decision. You should not make any investment decision based solely on the information and services provided herein. Before making any investment decision, you should take into account your own circumstances including but not limited to your financial situation, investment experience and investment objectives, and should understand the nature, terms and risks of the relevant investment product. You should obtain appropriate professional advice where necessary.

Investors should not only base on this material alone to make any investment decision, but should read in detail in the relevant risk disclosure statements. The information contained herein is for general information and reference purposes only and is not intended to provide professional investment or other advice. It is not intended to form the basis of any investment decision. You should not make any investment decision based solely on the information and services provided herein. Before making any investment decision, you should take into account your own circumstances including but not limited to your financial situation, investment experience and investment objectives, and should understand the nature, terms and risks of the relevant investment product. You should obtain appropriate professional advice where necessary.

Information Disclosure

The above information is intended as a general summary of information and is for reference only. Please refer to the relevant leaflet or factsheet for exact contents, product risk, credit risk, terms, conditions and exclusions of the relevant Life Insurance Plan, and the policy of the relevant Life Insurance Plan shall be considered as final.

The above information is intended as a general summary of information and is for reference only. Please refer to the relevant leaflet or factsheet for exact contents, product risk, credit risk, terms, conditions and exclusions of the relevant Life Insurance Plan, and the policy of the relevant Life Insurance Plan shall be considered as final.

The above Life Insurance Plan is underwritten by Hang Seng Insurance Company Limited. Hang Seng Insurance Company Limited is authorized and regulated by the Insurance Authority of the HKSAR. Hang Seng Bank is an insurance agent authorised by Hang Seng Insurance Company Limited and the insurance products are products of Hang Seng Insurance Company Limited but not Hang Seng Bank. In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between Hang Seng Bank and you out of the selling process or processing of the related insurance product transaction, Hang Seng Bank will enter into a Financial Dispute Resolution Scheme process with you; however any dispute over the contractual terms of the insurance products should be resolved between Hang Seng Insurance Company Limited and you directly.

If you surrender the Policy after the expiry of the cooling-off period, the surrender proceeds to be received may be significantly less than the Total Premiums Paid. Please refer to the illustration summary of this Plan for the projected surrender values. All details regarding policy surrender should be referred to the relevant policy provisions.