Existing customers can enjoy a guaranteed HKD50 Dining e-Voucher upon completion of designated missions!

Remark: A redemption notification would be sent to eligible customers via Push Notification. Customers must enable Marketing Push Notification to receive the e-Voucher. Terms and conditions apply.

Step 1: Register Personal e-Banking

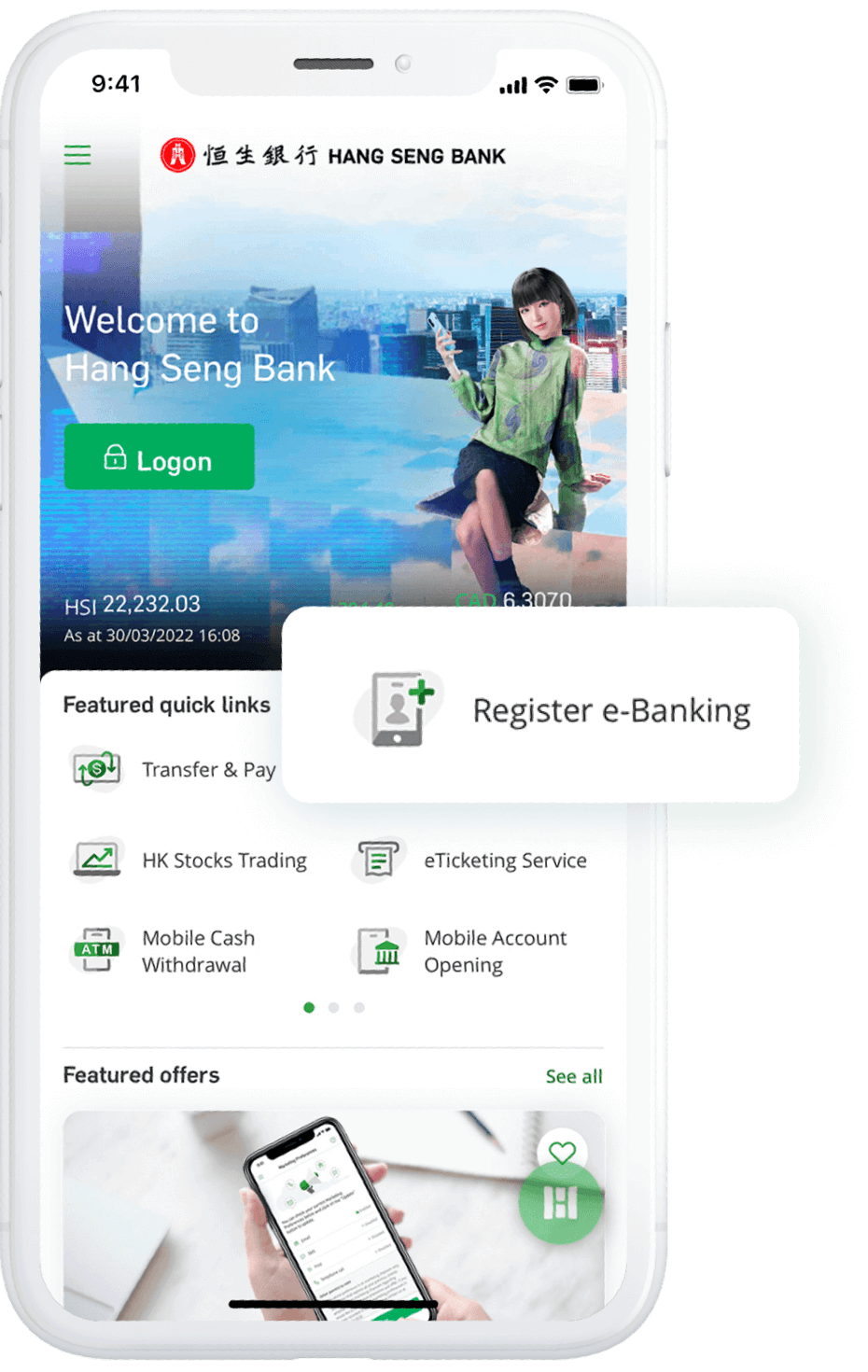

Download and open Hang Seng Mobile App > tap "Register e-Banking"

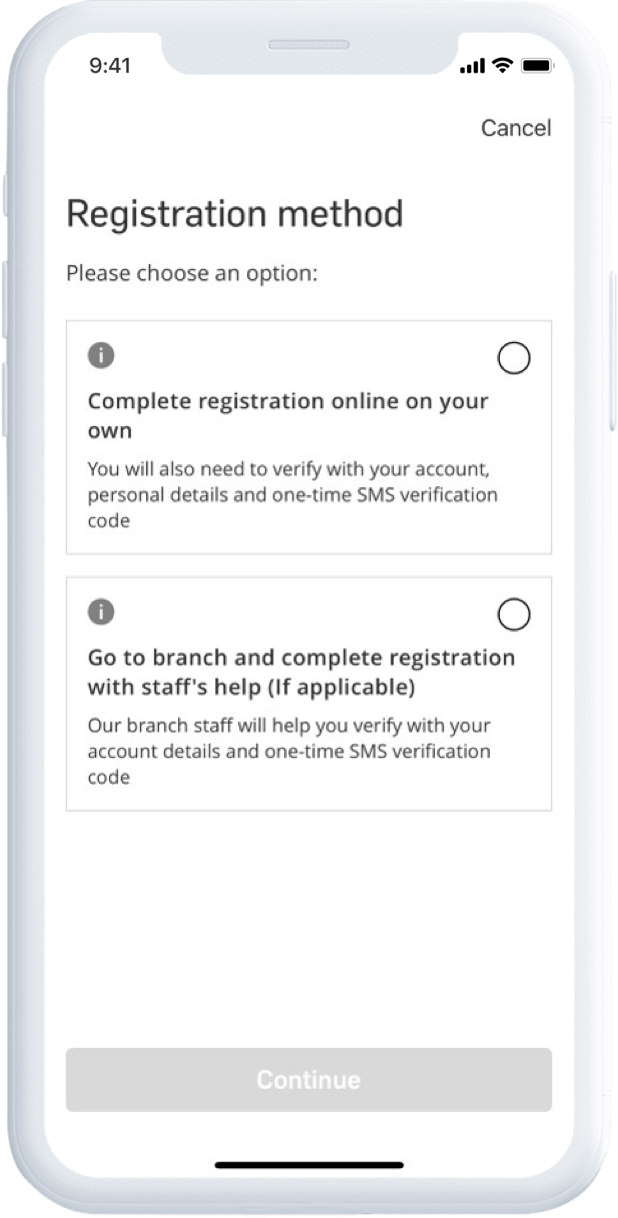

Choose your registration and verification method. Read and accept Terms and Conditions

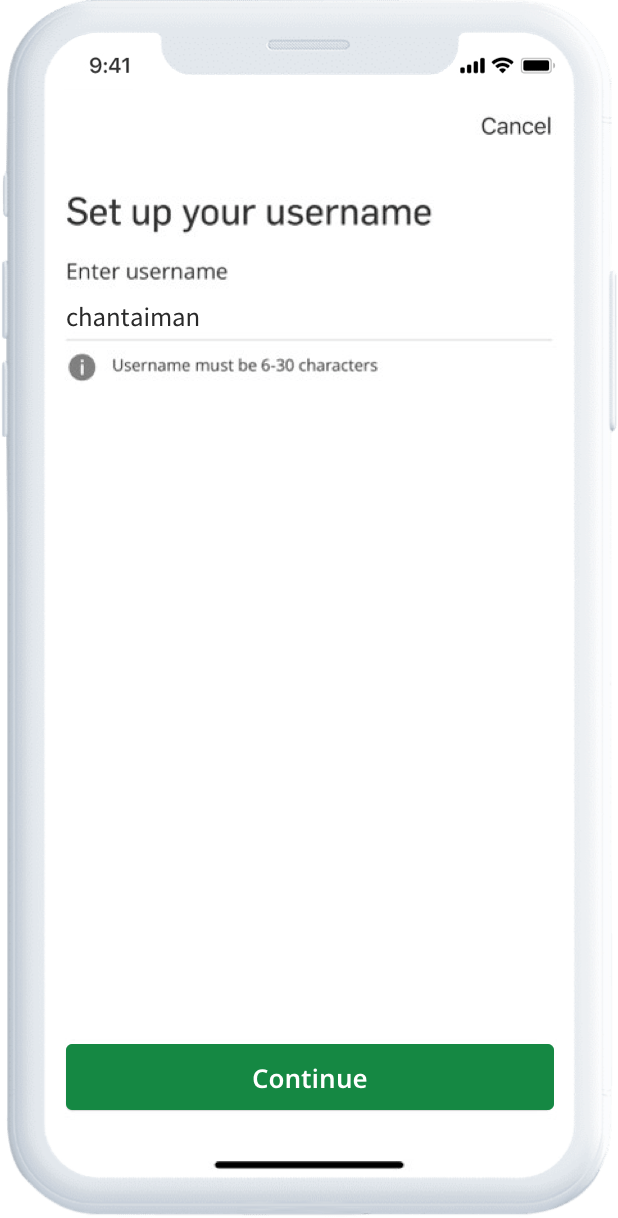

Fill in your personal details, set up username, password and security question

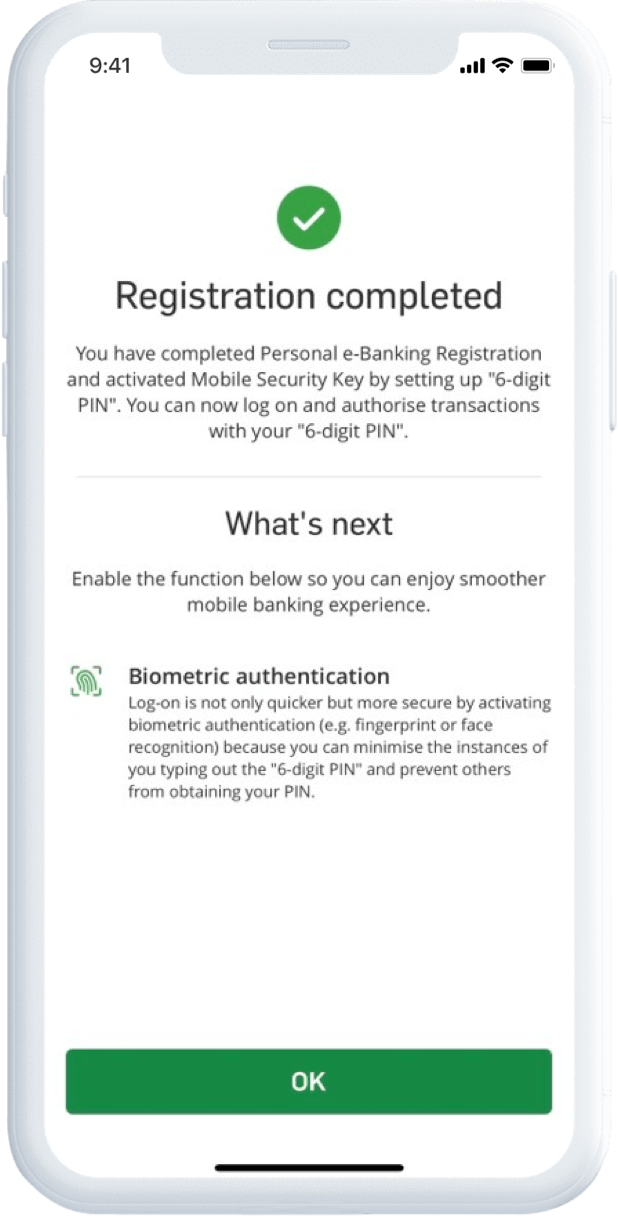

Create and re-confirm the "6-digit PIN". Complete the registration and press "OK" to get started

Please note that if we don't have your mobile number and email address in our record, you can't continue the service registration. Please also keep your mobile number and email address in our bank record accurate and up-to-date so you can log on smoothly in the future.

Please note that if we don't have your mobile number and email address in our record, you can't continue the service registration. Please also keep your mobile number and email address in our bank record accurate and up-to-date so you can log on smoothly in the future. For details, please visit Hang Seng Bank Website > Banking > Manage your banking profile.

Step2: Register e-Statement

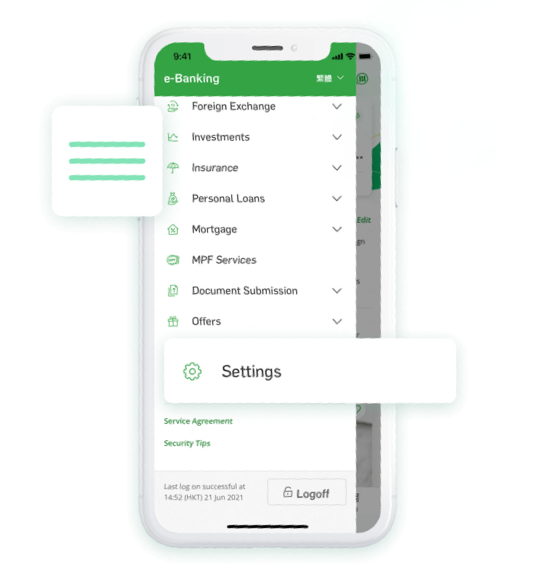

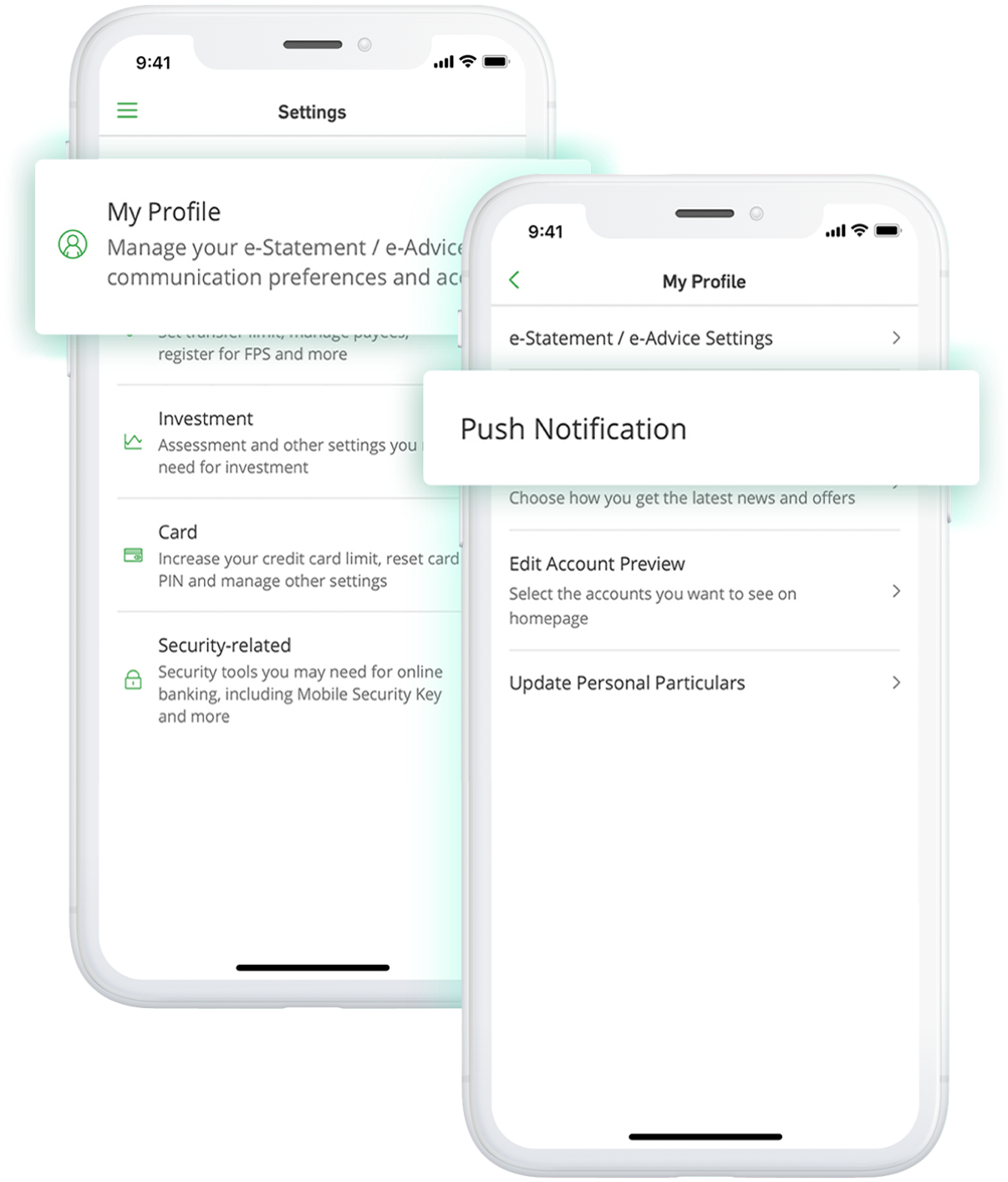

Log on and Hang Seng Mobile App, tap on "Setting"

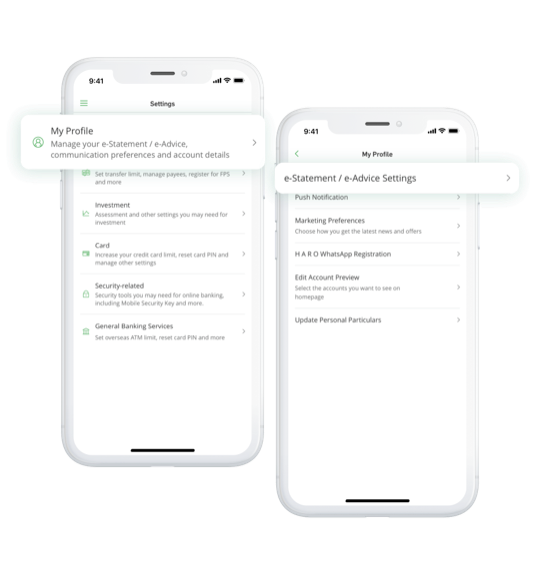

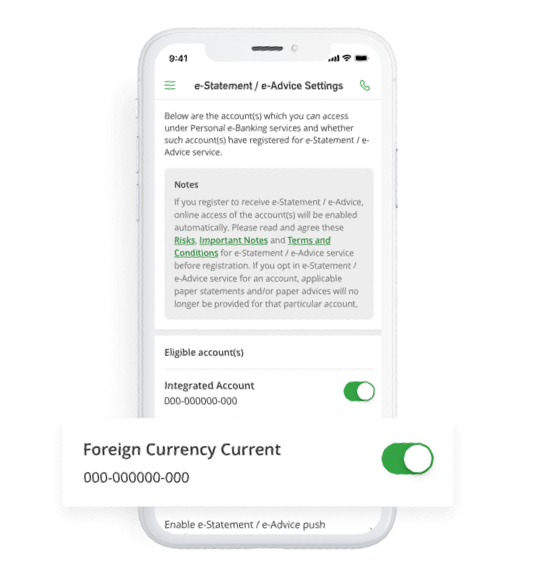

Tap on "My Profile" > "e-Statement / e-Advice Settings"

Select the account(s) you wish to receive e-Statements / e-Advice

You will now start receiving e-Statements/ e-Advice from the selected account(s)

Step3: Enable Marketing Push Notification to receive the reward

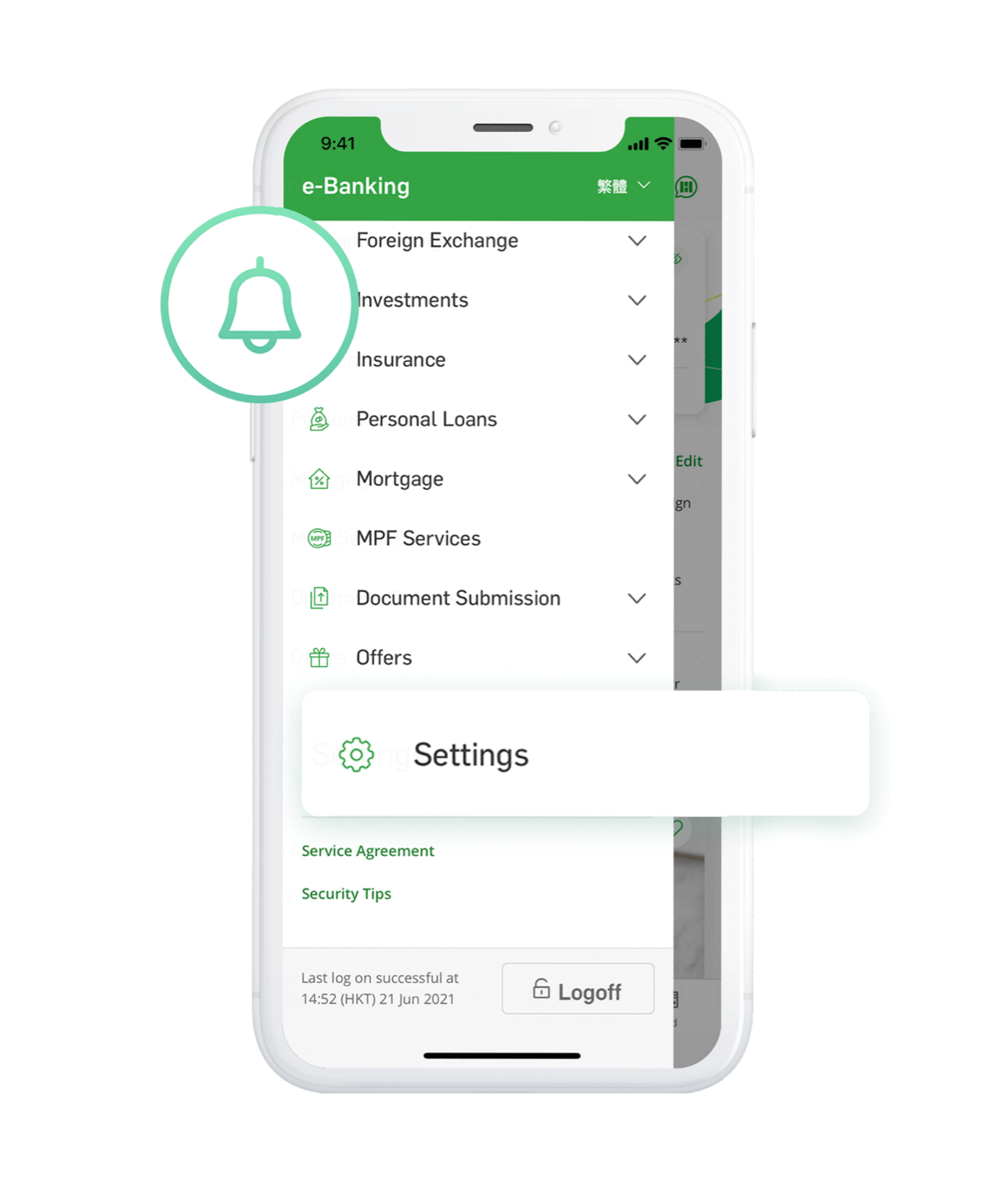

Log on to Hang Seng Mobile App, tap on "Settings"

Tap on "My Profile" and "Push Notification"

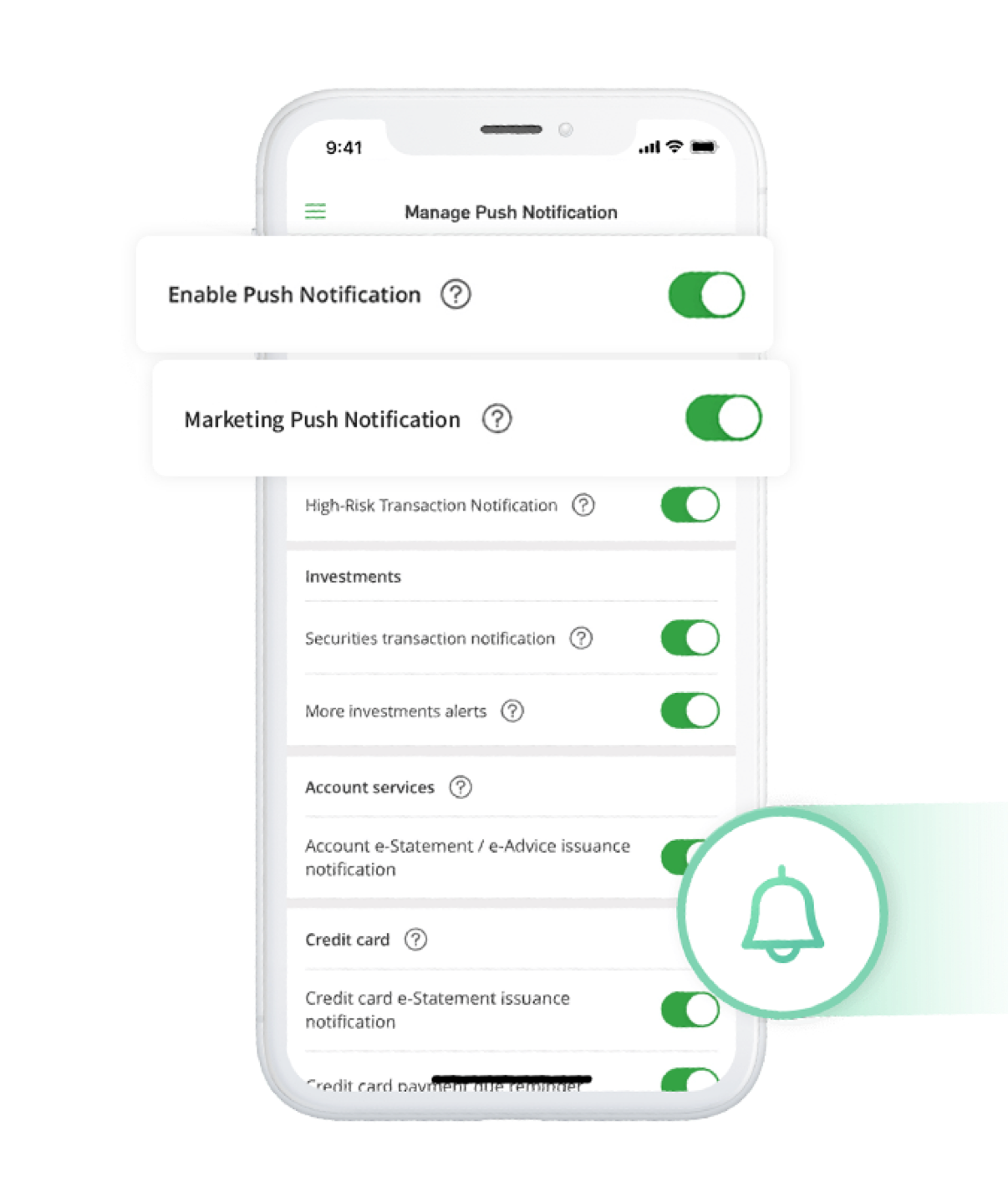

Enable Push Notification, then enable Marketing Push Notification. Read and agree to the Terms and Conditions, and tap on "OK" to complete your update

Enable push notifications to track transaction statuses

Enable push notifications to get notified of your account activities, like payments, e-Statement issuance, credit card payment due reminder, credit card limit utilization and "card-not-present" transactions etc., so you may get notified of the latest news related to your account anytime anywhere.

Minimize security risks with card-free Mobile Cash Withdrawal

Withdraw cash swiftly at any Hang Seng's or HSBC's ATMs by just scanning the QR code on the machine with your mobile phone, which minimizes the risk of losing your ATM card or leaking your password.

New "Settings & Security" interface provides you with security support

The brand new one-stop security settings makes it easier to manage your security options and access emergency support for account and card services, including:

Block or report lost cards instantly

Transfer credit limit between cards and set "card-not-present" transaction limits

Enable push notifications to keep an eye on account status. Once suspicious transactions are spotted, report them immediately in just a few steps

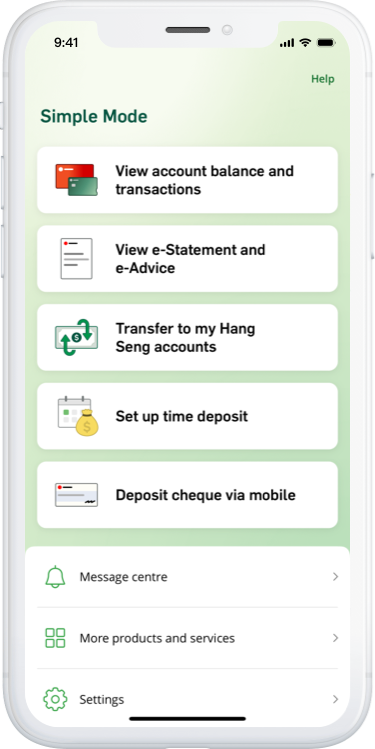

Enjoy easier and intuitive mobile banking with Simple Mode

Users of Simple Mode can only transfer money to their own Hang Seng accounts under the same name, to prevent users from transferring money to others mistakenly. Simple Mode also offers attentive online support for you to directly contact us for enquiry or reporting suspicious transactions.

Additional measures that strengthen account protection

To enhance the security of your account, below security measures have been implemented:

For Android users: Disabled the screen sharing, recording and capture functions on Hang Seng Mobile App. Also, Hang Seng Custom Keyboard has been enabled. When customers enter sensitive information (like password and security code), customers will not be able to use their device default keyboard or third-party keyboards. This measure helps reduce the risk of scammers from stealing information.

For iOS users: Disabled screen sharing and recording functions on Hang Seng Mobile App

If you need to access your records, please use the "Save Image" button in Transfer, Pay Bills and Time Deposit.

Fulfil numerous banking needs in one App

Manage your bank account flexibly and conveniently with Hang Seng Digital Banking, including updating your personal information, managing Direct Debit Authorisation (DDA), viewing e-Statements of the past 7 years2 , and requesting for ATM card replacement.

24-hours instant transfer with "FPS"3

Set Hang Seng as the FPS default receiving bank to make free instant transfers to other banks with your mobile number. Pay via Hang Seng Mobile App anytime you need, and collect money from others in seconds. Enjoy a flexible and speedy transferring experience.

Pull money straight to your Hang Seng account in one App

Transfer money from your other banks' account to Hang Seng with Pull Money. After linking with other accounts, only Hang Seng Mobile App is needed to allocate funds between different banks. Skip the trouble of logging out and switching between different banks' apps to manage your cross-bank assets smoothly!

Exchange foreign currency all-day 24/7

Exchange up to 11 currencies4 online 24/75 at any moment, and set up FX Order Watch and Rate Alert to grasp the chances of exchanging at your ideal rate.

Money Master savings plan

After setting up your savings plan with Money Master, we will automatically track and categorize your expenses via Hang Seng HKD accounts and credit cards. You may also closely monitor your progress through H A R O WhatsApp to help you achieve your goal.

One-stop credit card management

Manage your credit card whenever you need, including settling your credit card balance and checking the latest offers. You may also discover various missions in +FUN Centre to earn more rewards.

SimplyFund

Start investing in funds with HKD 1 only, with subscriptions to funds covering tech, ESG, global, mainland China, and Hong Kong markets.

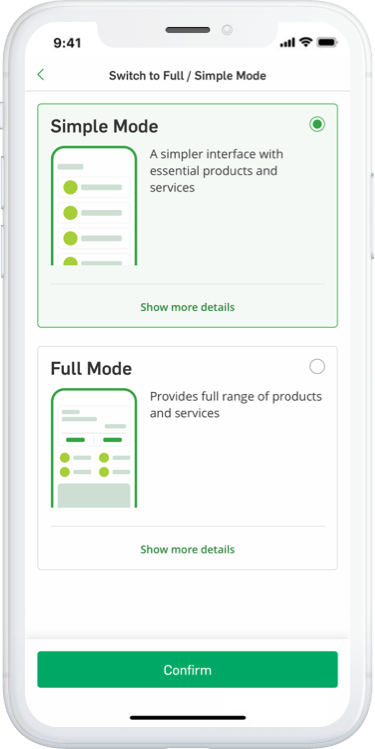

Log on Hang Seng Mobile App, select "Settings" from the left menu, tap "Switch to Full / Simple Mode", select "Simple Mode" and tap "Confirm"

Successfully switched to Simple Mode

to experience Hang Seng Mobile App!

Visit Smart@Digital Banking | Digital AcademySmart@Digital Banking | Digital AcademySmart@Digital Banking | Digital Academy!

Enquiry and Trading Hotlines – Hang Seng Bank (hangseng.com)

To borrow or not to borrow? Borrow only if you can repay!

Remarks:

- "Existing Customer(s)" mentioned herein refers to personal customers who, on or before 31 March 2024, successfully opened and are still holding a valid Prestige Private, Prestige Banking, Preferred Banking, Integrated Account, Family+ Account, Savings / Current Account or Hang Seng Credit Card with Hang Seng.

- 7 years e-Statement records are applicable to a Prestige Private, Prestige Banking, Preferred Banking, Integrated Account, Family+ Account, HKD Statement Savings/Current Account and foreign currency Saving/Current Account. Personal Credit Card customers can view up to 7 years e-Statements starting from 22 Mar 2020 and issued between 23 Mar 2017 to 22 Mar 2020 while investment e-statement can be viewed for up to 3 years.

- FPS (Faster Payment System) is a real-time payment platform provided by Hong Kong Interbank Clearing Limited. The service limits to receiving banks that support instant transfer functionality and is subject to the General Terms & Conditions.

- 24/7 online foreign currency exchange service is available via Hang Seng Mobile App and Hang Seng Personal e-Banking (except for Foreign Currency Passbook Savings Account and during system maintenance hours and special circumstances).

- 11 foreign currencies include AUD, CAD, CHF, EUR, GBP, JPY, NZD, RMB, THB, USD and ZAR. SGD exchange service is only provided via branches and FX ATMs and applicable to Foreign Currency Statement Savings Account and Foreign Currency Passbook Savings Account.

- Android, Google Play and the Google Play logo are trademarks of Google LLC.

- Apple, the Apple logo, and iPhone are trademarks of Apple Inc, registered in the US and other countries. App Store is a service mark of Apple Inc.

- Investments involve risks. The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling securities.

- Foreign securities carry additional risks not generally associated with securities in the domestic market. The value or income (if any) of foreign securities may be more volatile and could be adversely affected by changes in many factors. Client assets received or held by the licensed or registered person outside Hong Kong are subject to the applicable laws and regulations of the relevant overseas jurisdiction which may be different from the Securities and Futures Ordinance (Cap.571) and the rules made thereunder. Consequently, such client assets may not enjoy the same protection as that conferred on client assets received or held in Hong Kong. The key risks of investing in RMB-denominated securities include market risk, company risk, liquidity risk, currency risk, exchange rate risk and default risk.

- Investors should not only base on this webpage alone to make any investment decision, but should read in detail the relevant Risk Disclosure Statements before making any investment decision.

Risk Disclosure of Foreign Exchange

RMB Currency Risk

Renminbi ("RMB") is subject to exchange rate risk. Fluctuation in the exchange rate of RMB may result in losses in the event that the customer subsequently converts RMB into another currency (including Hong Kong Dollars). Exchange controls imposed by the relevant authorities may also adversely affect the applicable exchange rate. RMB is currently not freely convertible and conversion of RMB may be subject to certain policy, regulatory requirements and/or restrictions (which are subject to changes from time to time without notice). The actual conversion arrangement will depend on the policy, regulatory requirements and/or restrictions prevailing at the relevant time.

Foreign Exchange Risk

Foreign Exchange involves Exchange Rate Risk. Fluctuations in the exchange rate of a foreign currency may result in gains or losses in the event that the customer converts HKD to foreign currency or vice versa, and/or in the event that the customer converts a foreign currency time deposit to HKD upon maturity.

Risk Disclosure of SimplyFund Account

- Investors should note that all investments involve risks (including the possibility of loss of the capital invested), prices or value of investment fund units may go up as well as down and past performance information presented is not indicative of future performance. Investors should read carefully and understand the relevant offering documents of the investment funds (including the fund details and full text of the risk factors stated therein) and the Notice to Customers for Fund Investing before making any investment decision. Investment funds are investment products and some may involve derivatives. Investors should carefully consider their own circumstances whether an investment is suitable for them in view of their own investment objectives, investment experience, preferred investment tenor, financial situation, risk tolerance abilities, tax implications and other needs, etc., and should understand the nature, terms and risks of the investment products. Investors should obtain independent professional advice if they have concerns about their investment.

- Not all of the investment funds that are distributed by Hang Seng Bank Limited (the "Bank") are available here. Only specific funds are available for subscription with this account. If you are looking for other investment funds or investment products, please visit our branches or our websites for more information.

- In respect of the investment funds available for subscription with this account at the moment, they are provided either by the Bank's wholly owned subsidiary, Hang Seng Investment Management Limited, or by the Bank's affiliates HSBC Global Asset Management (Hong Kong) Limited.

Terms and Conditions