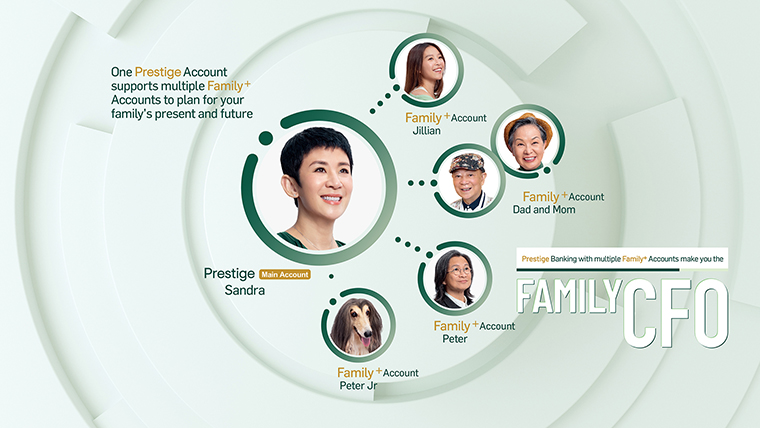

Hang Seng Prestige Main Account and multiple Family+ accounts

We are here to help you plan for your family’s present and future. As the Family CFO, apart from growing your own wealth, you also have to take care of your family’s different financial needs. Hang Seng has launched the first-in-market Prestige "Family+ account”, for you to add multiple Family+ accounts to your Prestige Main Account, making it easy to allocate deposits, foreign currencies and investment products, to match the different objectives of each account. So you can stay on top of everything to build a comprehensive financial roadmap for yourself and your family. No matter how your family’s life goals change, you can see them come true effortlessly.

Unless otherwise specified, the promotion period is 1 April 2024 till 30 June 2024, join Prestige via mobile with HK$1,000,000 new funds to enjoy up to HK$6,300 cash rewards2. Open a Family+ account and fulfill designated requirements to earn an extra HK$200 cash reward. In addition, deposit new funds to enjoy 1-month foreign currency Time Deposit rate up to 5% p.a.1

See Terms and Conditionsyour family financial planning and cross border needs

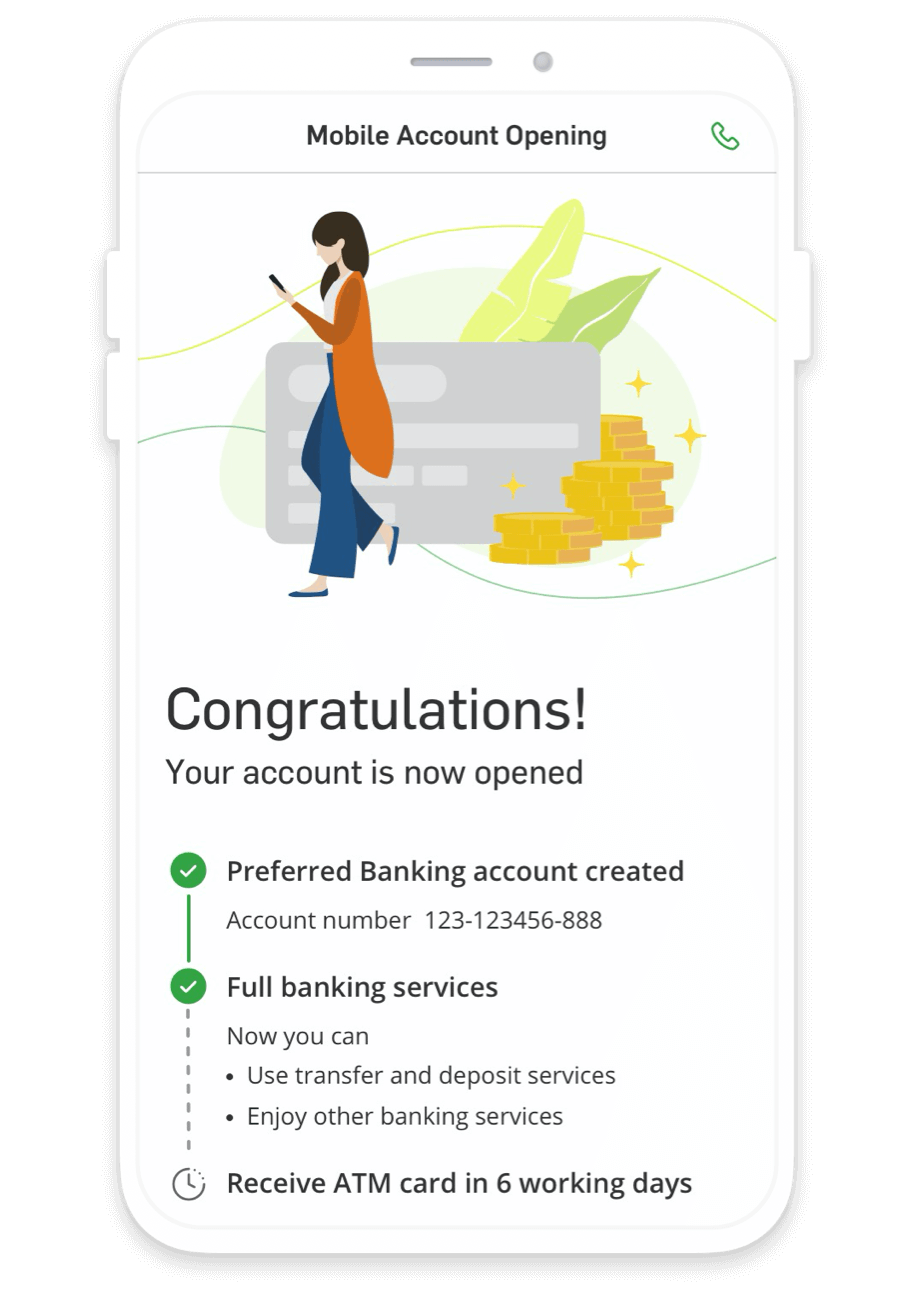

If you are upgrading your existing Integrated Account or Preferred Banking account to Preferred or Prestige Banking, the application will be processed within 2 to 3 working days.

^ To borrow or not to borrow? Borrow only if you can repay!

Notes

- The above interest rates are for reference only and subject to revision based on the prevailing market conditions.The above interest rates are indicative as of 7 March 2024, for reference only and subject to revision based on the prevailing market conditions. Terms and Conditions apply. For details, please visit

- The offer includes fulfilling the first HKD1,000,000 "Total Relationship Balance" growth and the designated requirement with Investment Account successfully opened by 31 July 2024 to enjoy up to HKD6,000 and mobile account opening reward of HKD300.

- The promotion period of "Total Relationship Balance" reward is from 1 April 2024 to 30 June 2024. The offers are only applicable to customers who meet the account opening requirements and have newly opened/upgraded to Integrated Account of Prestige Banking ("Prestige Banking") at the Bank branches or through digital channels or phone banking hotline during the Promotion Period (the "Eligible Customers"). Eligible Customers must have register for Hang Seng Personal e-Banking within one-month after the Promotion Period (i.e. on or before 31 July 2024) and maintain valid e-Banking account before receiving cash rebate, and complete "Risk Profile Questionnaire" or whose "Risk Profile Questionnaire" record is valid as of 31 July 2024. Terms and Conditions apply. Please refer to the enclosed Terms and Conditions for details.

- The promotion period is from 15 April 2024 to 30 June 2024. Terms and conditions apply. Please visit hangseng.com/payrolloffer8 for the eligibility of PayDay+ customers and detailed Terms and Conditions of PayDay+ offers.

- The offer is only applicable for Travelsure Protection Plan Single Trip Cover with Destinations of Asia and total trip duration within 8 days. For eligible customers who successfully applied for Travelsure Protection Plan Single Trip Cover and settled the premiums with Hang Seng Credit Card, Hang Seng Bank will deposit +Fun Dollars or yuu Points with amount equivalent to premium amount minus $1 to eligible customers' Hang Seng Credit Card account.

- Asia refers to destinations including mainland China, Bangladesh, Brunei, Cambodia, Guam, India, Indonesia, Japan, Korea, Laos, Macau SAR, Malaysia, Mongolia, Myanmar, Nepal, Pakistan, Philippines, Saipan, Singapore, Taiwan, Thailand, Tinian and Vietnam. Please refer to the Terms and Conditions for the promotion offer.

- Eligible Customers who newly open/upgrade to Prestige Banking can enjoy first 6-month grace period for fund-in without below balance monthly fee. After the first 6- month grace period, the standard monthly fee for Prestige Banking will be applied if the Total Relationship Balance of the previous month is below HKD1,000,000. If the Total Relationship Balance of previous month is below HKD1,000,000 or HKD500,000, monthly fee for Prestige Banking of HKD40 or HKD340 will be applied respectively. For details of the monthly fee, please check with the Bank’s staff.

-

Terms and Conditions apply. For details of Family support

and Family+ privileges, please visit

.

.

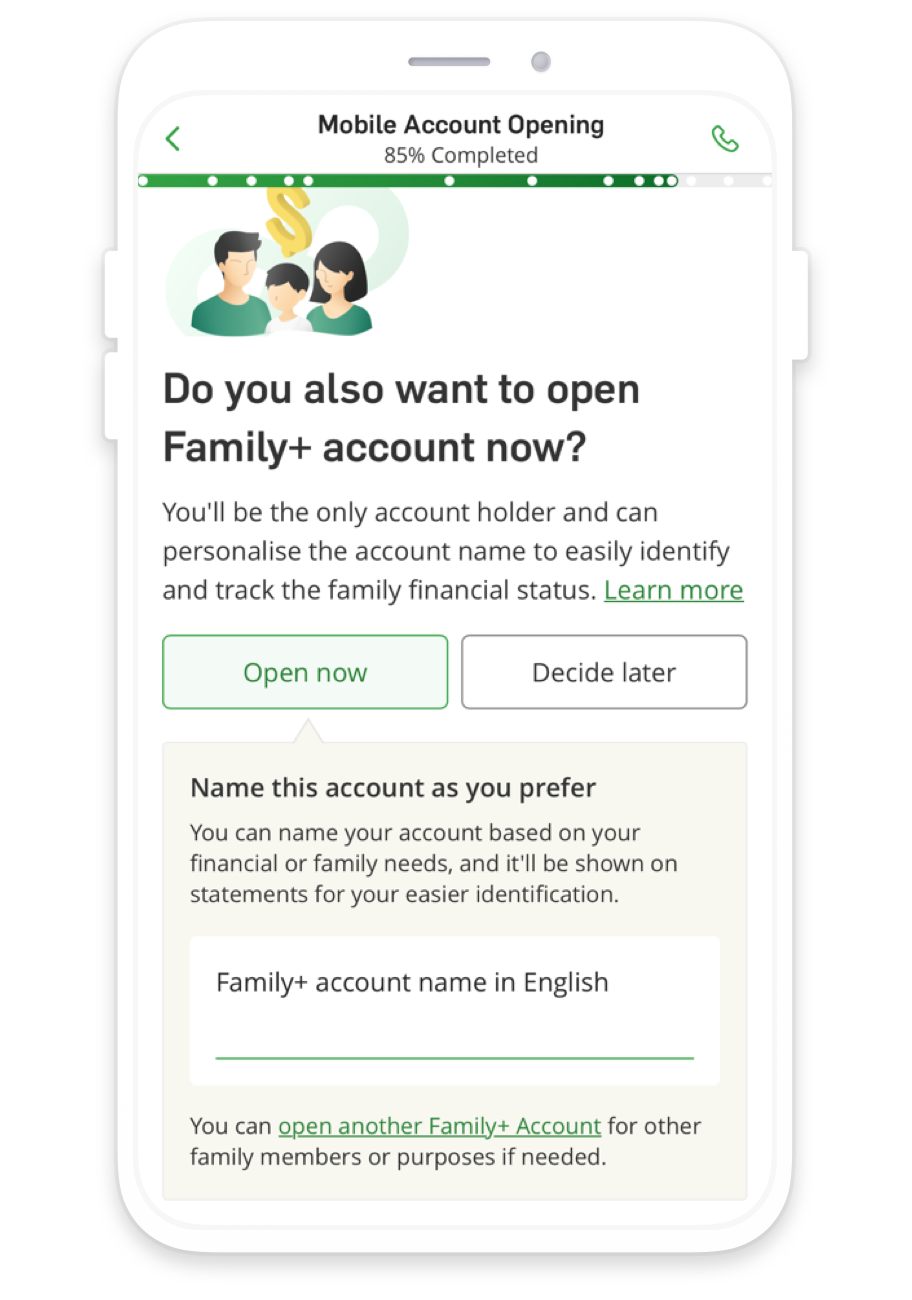

- Each customer is allowed to open up to 4 Family+ Accounts.

-

Terms and Conditions apply to the lifestyle privileges. For

details, please visit

.

.

-

The promotion period of the offer is from 1 April 2024 to 29 June 2024. The offer is only applicable to customers who newly opened Prestige Private or Prestige Banking and is applicable to Relevant Investment Products subscribed through his/ her Family+ account. Terms and conditions apply to the offer. Investment involves risks, please visit

for details.

for details.

-

The promotion period is from 2 April 2024 to 28 June 2024. Terms and Conditions apply, investment involves risk, please contact our branch staff or visit

for details.

for details.

-

The promotion period is from 1 January 2024 to 31 December 2024. Terms and conditions apply, investment involves risk, please contact our branch staff or visit

for details.

for details.

-

The promotion period is from 2 January 2024 to 31 December 2024. Terms and Conditions apply, investment involves risk,

please contact our branch staff or visit

for details.

for details.

-

The promotion period is from 2 April 2024 to 28 June 2024. Terms and conditions apply, investment involves risk, please contact our branch staff or visit

for details.

for details.

- The promotion period is from 1 April 2024 to 30 June 2024. For details, please visit

. “New Securities Customers” (including all the account holders of the New Securities Account) means customers who must not hold any securities account (personal/ joint) with the Bank within a period of 6 months preceding the account opening date. Investment involves risks. Terms and Conditions apply.

. “New Securities Customers” (including all the account holders of the New Securities Account) means customers who must not hold any securities account (personal/ joint) with the Bank within a period of 6 months preceding the account opening date. Investment involves risks. Terms and Conditions apply. - The promotion period is from 1 December 2023 to 30 June 2024. For details, please visit

. Investment involves risks. Terms and Conditions apply.

. Investment involves risks. Terms and Conditions apply. - The promotion period is from 1 March 2024 to 31 December 2024. For details, please visit

. Investment involves risks. Terms and Conditions apply. This offer is only applicable to ETFs managed by Hang Seng Investment Management Limited and listed on the Stock Exchange of Hong Kong Limited. To learn more about the eligible ETFs, please visit website of Hang Seng Investment Management Limited > Our Products > Exchange Traded Funds (ETF). This offer is provided by Hang Seng Bank Limited. However, please note that the eligible ETFs are managed by Hang Seng Investment Management Limited (a wholly-owned subsidiary of Hang Seng Bank Limited) and the relevant eligible ETFs’ trustee, index provider, the participating dealers, market makers and any other service providers (as applicable) may include members of the HSBC Group. Please refer to the Hong Kong offering document of the eligible ETFs for details including any potential conflicts of interest in respect of those ETFs that may arise.

. Investment involves risks. Terms and Conditions apply. This offer is only applicable to ETFs managed by Hang Seng Investment Management Limited and listed on the Stock Exchange of Hong Kong Limited. To learn more about the eligible ETFs, please visit website of Hang Seng Investment Management Limited > Our Products > Exchange Traded Funds (ETF). This offer is provided by Hang Seng Bank Limited. However, please note that the eligible ETFs are managed by Hang Seng Investment Management Limited (a wholly-owned subsidiary of Hang Seng Bank Limited) and the relevant eligible ETFs’ trustee, index provider, the participating dealers, market makers and any other service providers (as applicable) may include members of the HSBC Group. Please refer to the Hong Kong offering document of the eligible ETFs for details including any potential conflicts of interest in respect of those ETFs that may arise. -

The promotion period is from 1 April 2024 to 30 June 2024. Terms and conditions apply. Please note the relevant

product risks. For details, please contact our branch staff

or visit

for details.

for details.

-

eCancerPro Insurance Plan or eFamilyPro Life Insurance Plan:

The promotion period is from 1 April 2024 to 30 June 2024. Terms and Conditions apply. Please note the relevant

product and credit risks. For details, please contact us at 2998 8038 or please

visit

. This plan is underwritten by Hang Seng Insurance Company

Limited.

. This plan is underwritten by Hang Seng Insurance Company

Limited.

-

The promotion period is from 1 January 2024 to 30 June 2024.. Terms and conditions apply to promotion offer and insurance plan. Please note the relevant product risks. The above general insurance plan is underwritten by Chubb Insurance Hong Kong Limited. Please call our hotline at (852) 2998 9888 for the details and obtaining dedicated promotion code. For the Terms and Conditions of the promotion offer , please visit

.

.

- The promotion period is from 15 April 2024 to 31 May 2024. “Bank’s Cost Price” refers to the exchange rate for foreign exchange without any sales margin normally charged by the Bank. Other mark-up applied to the exchange rate for operational reasons however will not be waived. Terms and Conditions apply. Visit

for more details.

for more details. - The promotion period is from 2 April 2024 to 29 June 2024. For exchange of designated currencies and set up of 1-week/1-month time deposit at the same time with designated transaction amount. The above interest rate offers are quoted with reference to the interest rates offered by the Bank on 2 April 2024 and are for reference only. The relevant interest rates will be subject to revision based on the prevailing market conditions. Terms and conditions apply. Visit

for more details.

for more details. -

Terms and conditions apply. Please refer to

.

.

- The promotion period is until 30 June 2024. Terms and conditions apply. For details, please visit to Hang Seng Bank Website: Cards > Credit Card Products > Prestige World Mastercard.

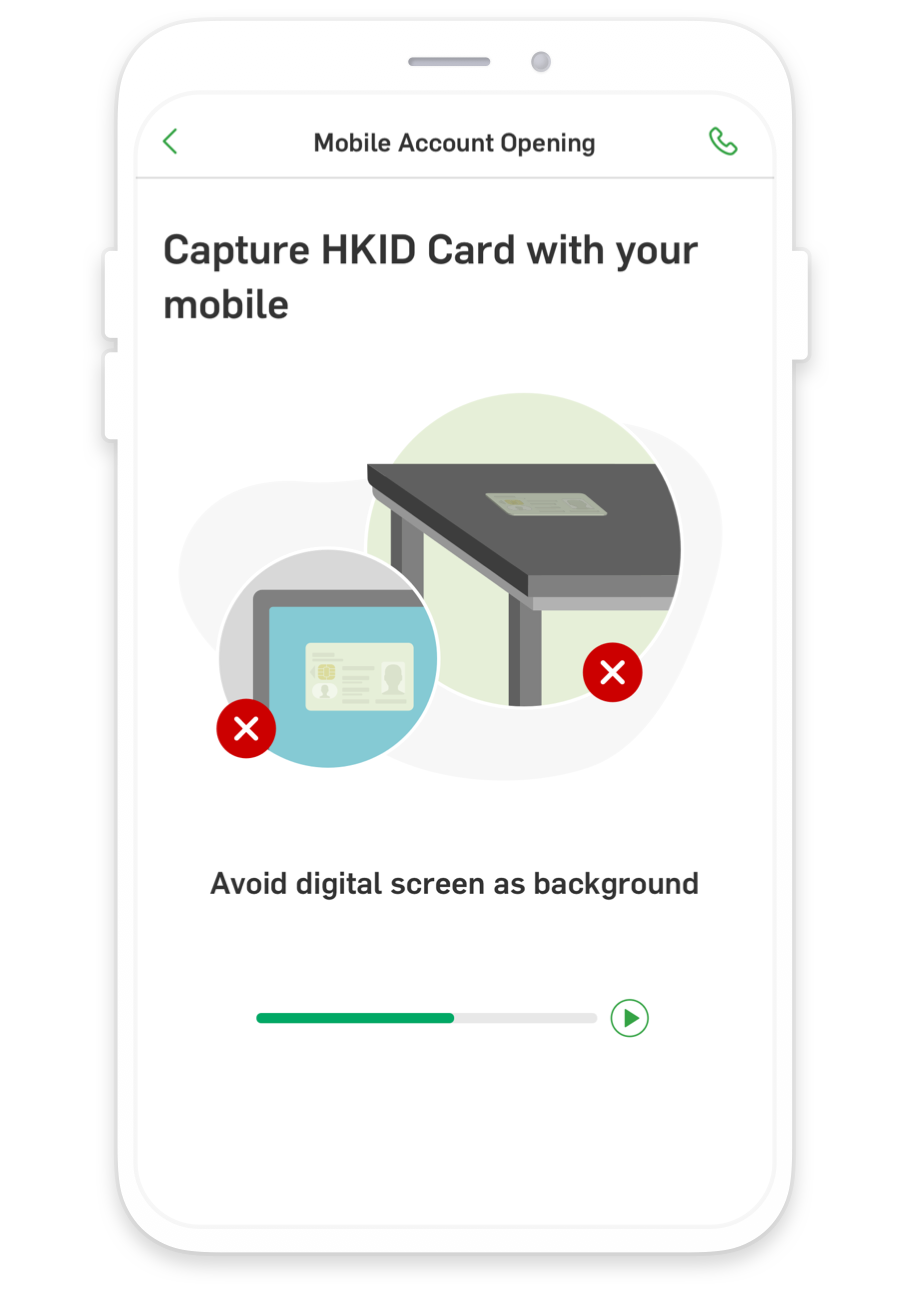

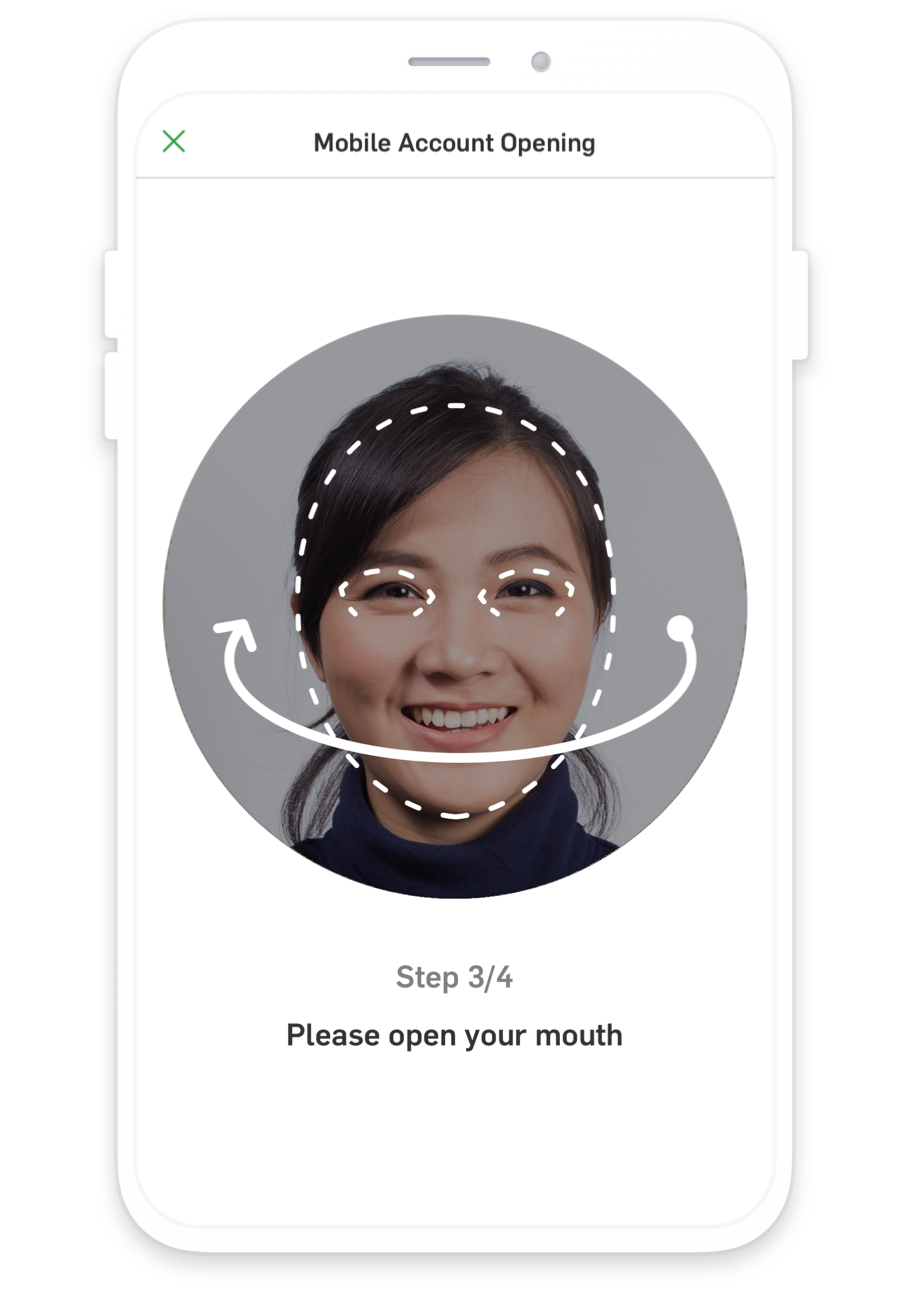

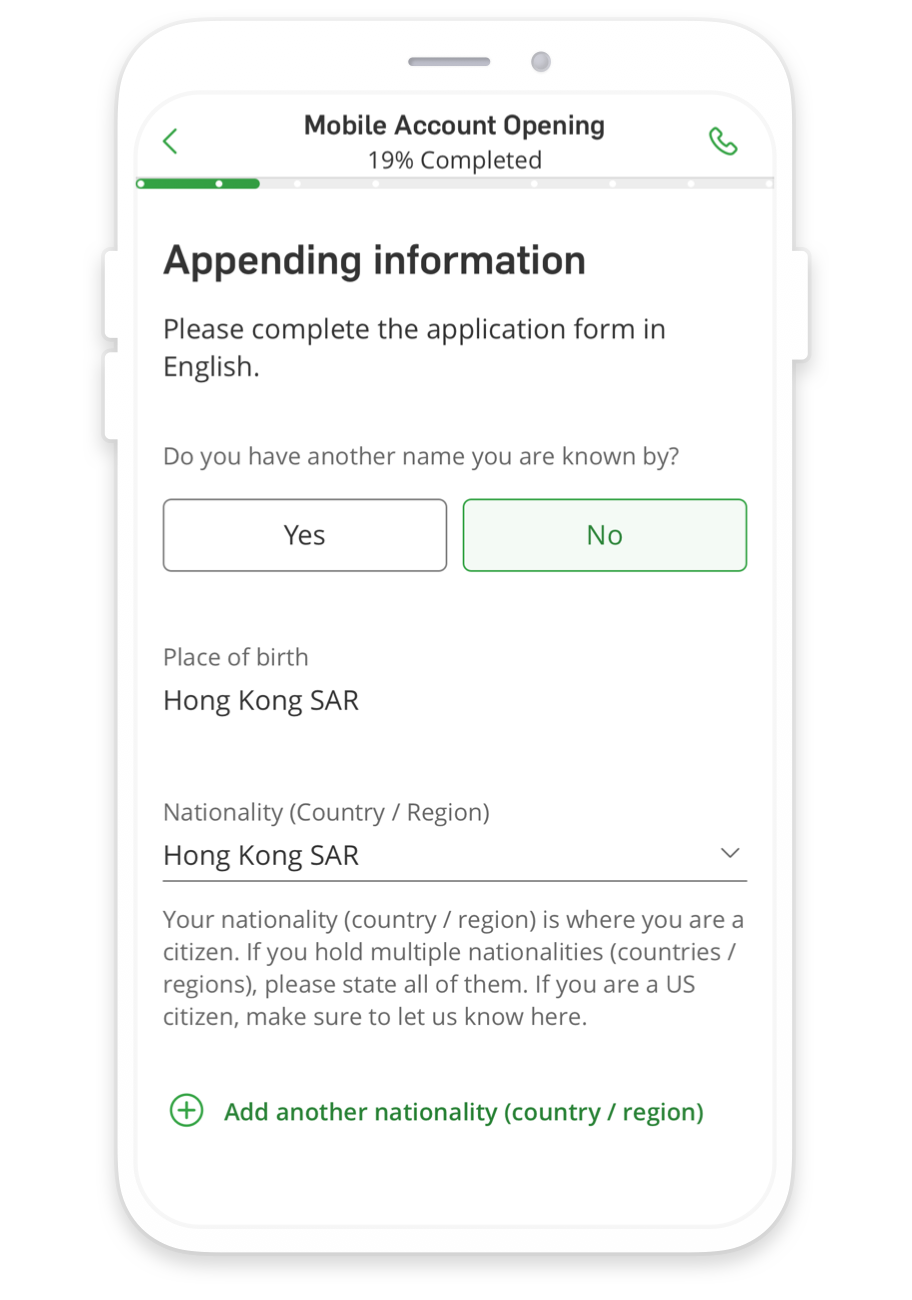

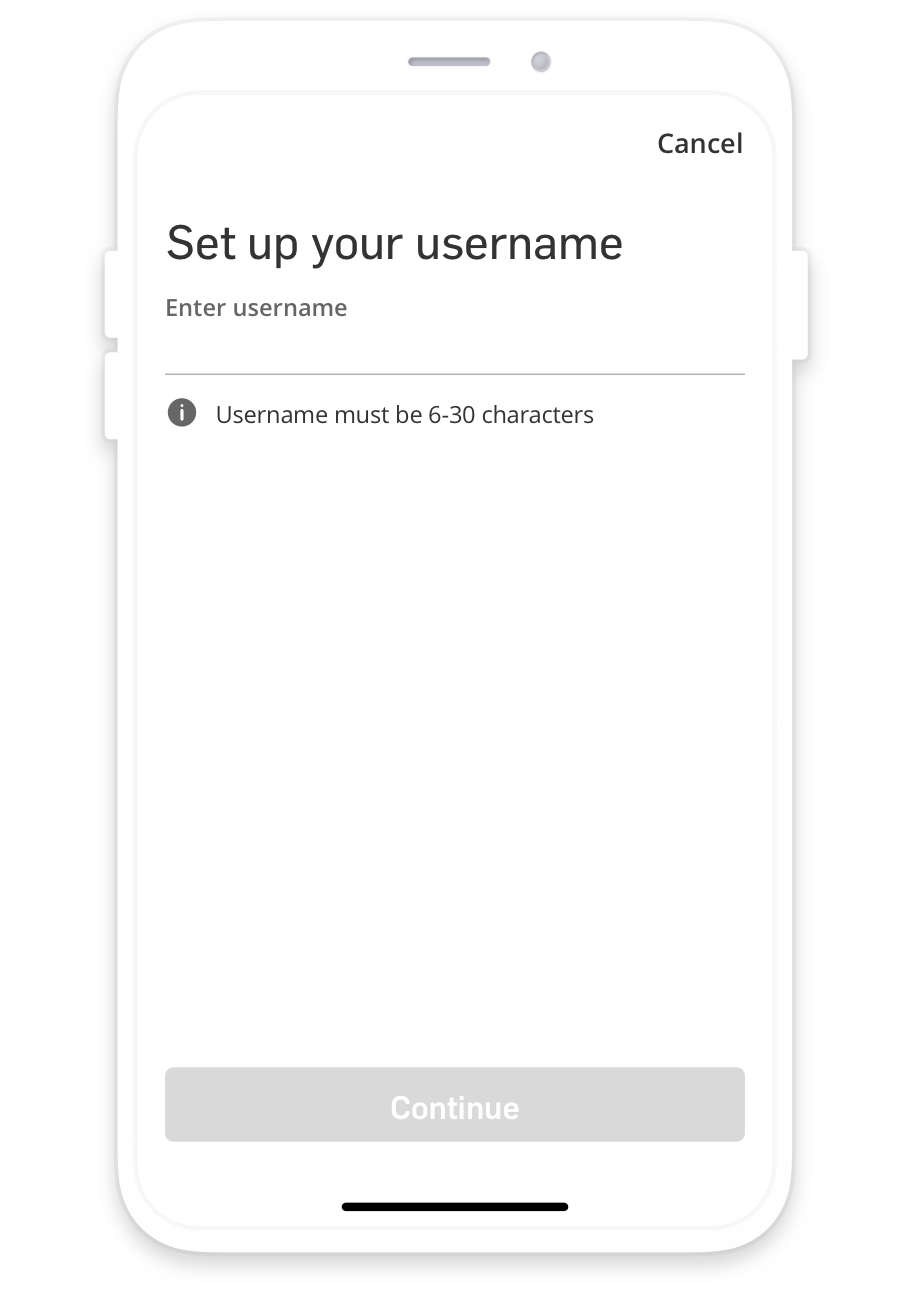

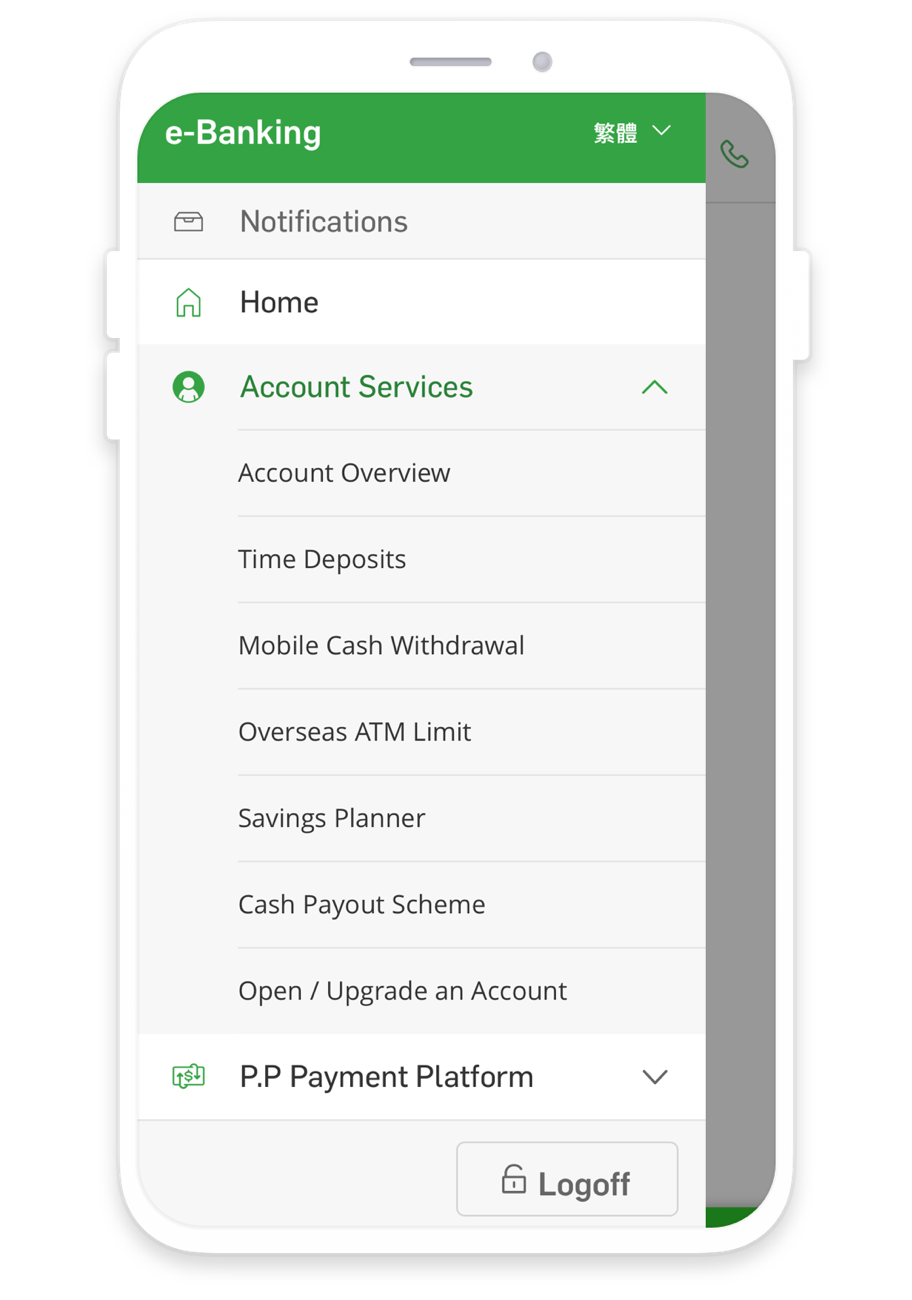

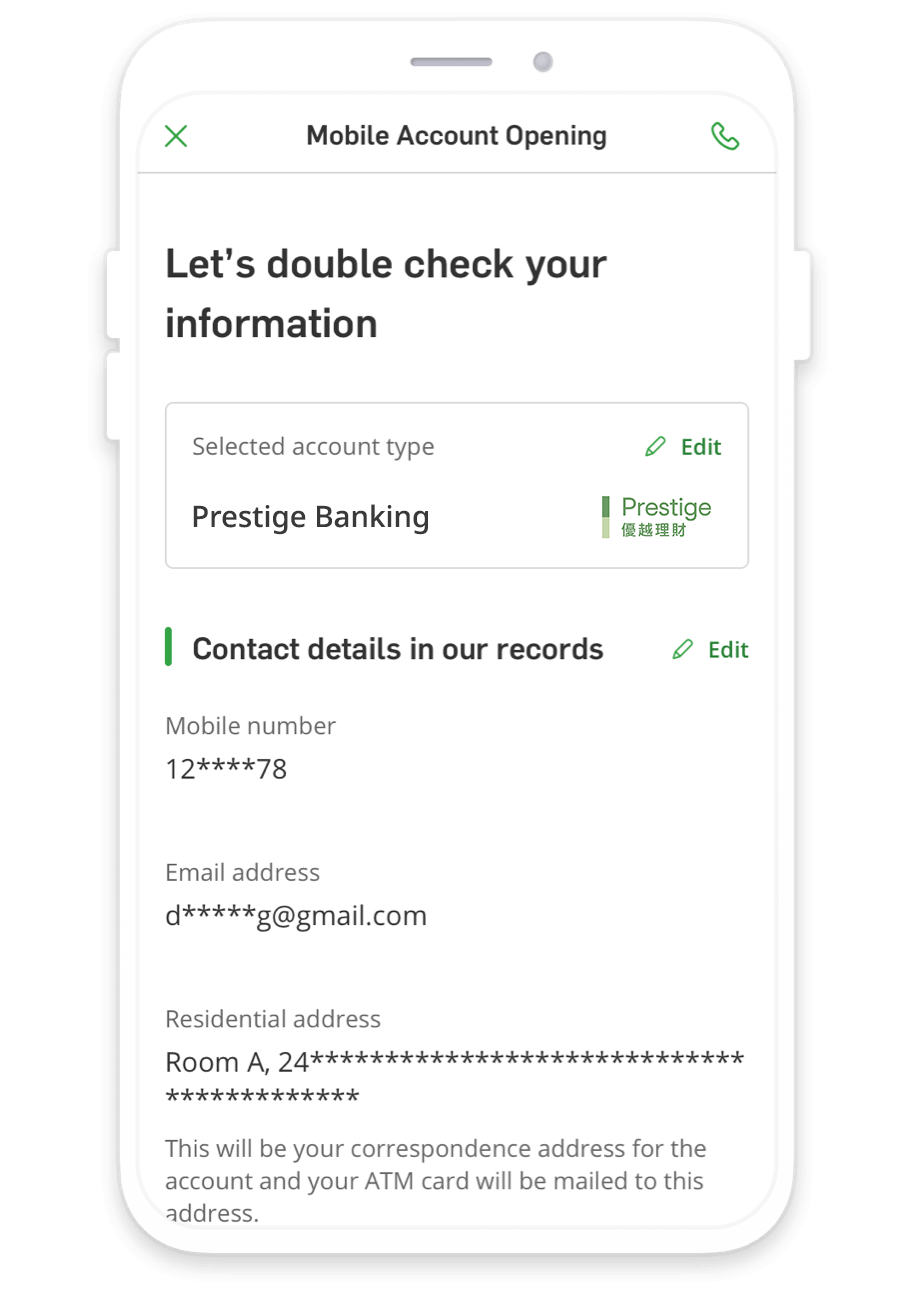

- For a full list of Mobile Account Opening eligibility requirements, please visit Hang Seng Bank Website > Banking > Account Opening > Mobile Account Opening > FAQs.

Terms and Conditions and Remarks

- Terms and conditions apply to all products / services and offers mentioned in this document. Please visit here.

- The document by itself is not and should not be considered as an offer, recommendation or solicitation to deal in any of the investment products or services mentioned herein.

- Terms and conditions apply. Please approach our branch staff for enquiries.

- Hang Seng Bank Limited (the "Bank") reserves the right to suspend, vary or terminate this promotion and the related offers and to amend their terms and conditions at any time without prior notice. In case of disputes, the decision of the Bank shall be final.

- The contents of this document have not been reviewed by any regulatory authority in Hong Kong.

- This material is not intended to provide or regard as legal or taxation advice, or investment recommendations.

- The promotion is intended for persons in Hong Kong.

Open account via mobile

Open account via mobile