Whether you are exchanging currencies for traveling, preparing

your family and yourself to study, staying or visiting your

relatives overseas, or leveraging FX as an investment tool for

steady interest earnings , Hang Seng Foreign Exchange Service can

cater to your different FX needs along with the following fabulous

offers:

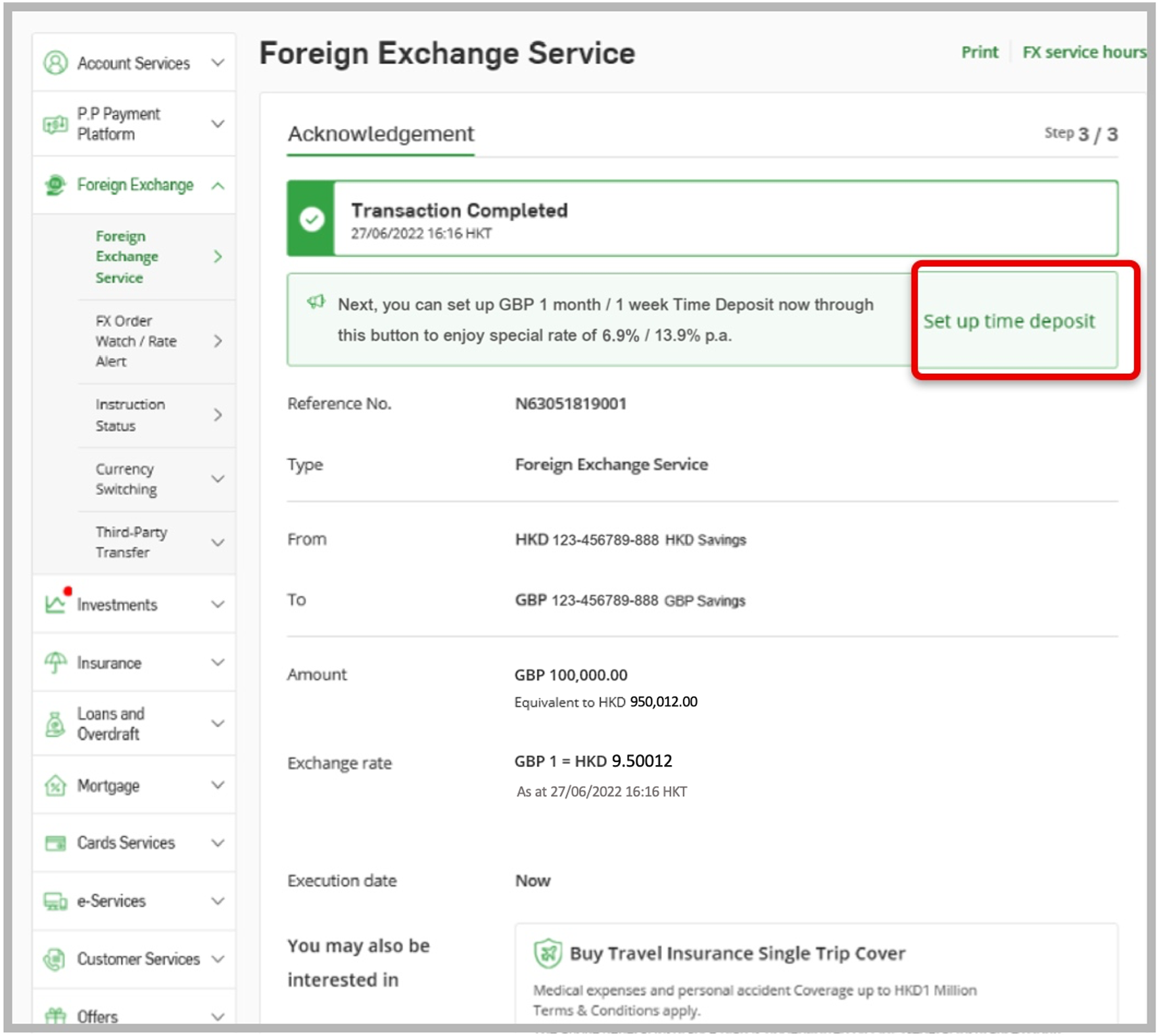

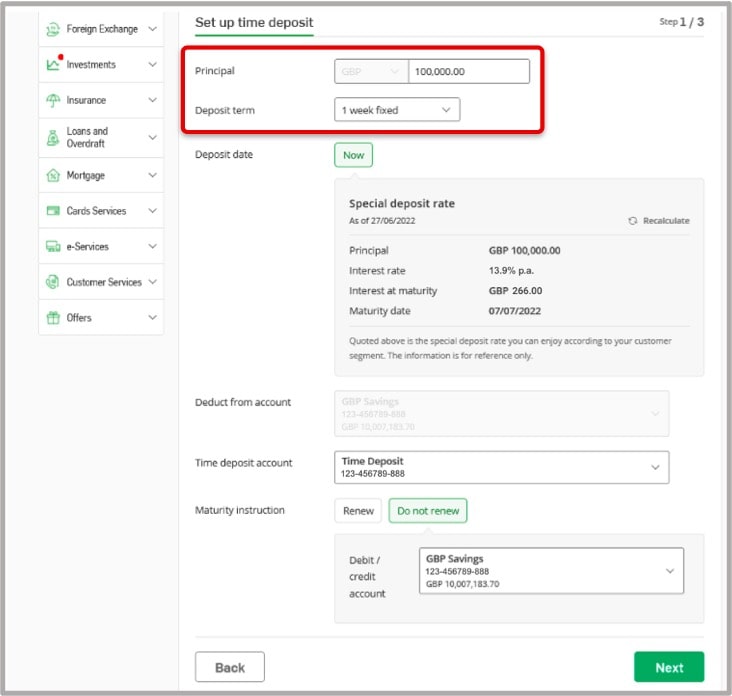

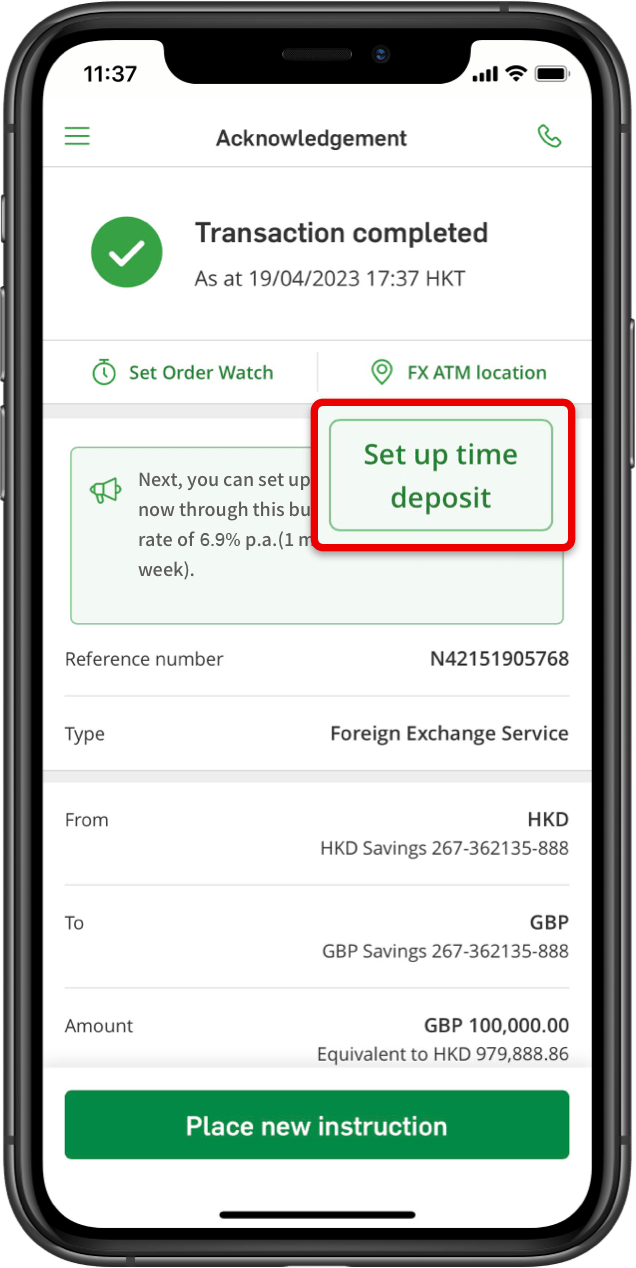

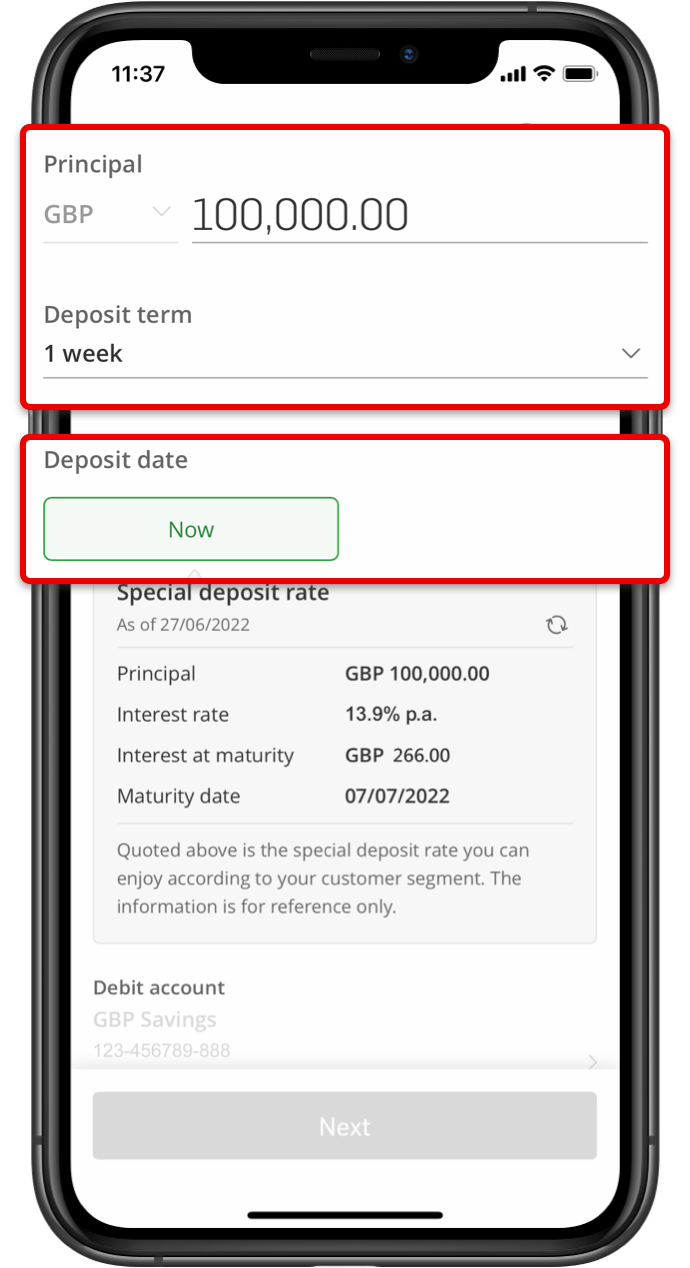

You can enjoy 1-week / 1-month foreign currency time deposit interest rate of up to 13.9% p.a. / 6.9% p.a.1 respectively by conducting FX transaction(s) now!

Limited Time Offer

Planning a shopping tour in Japan or Europe? You can enjoy Bank's Cost Price3 upon completing JPY or EUR exchange with at least HKD10,000 or its equivalent2 via Hang Seng Mobile App or Hang Seng Personal e-Banking from now until 31 May 2024, making your travel even more delightful.

Click here for the Terms and Conditions of Bank's Cost Price for exchanging JPY or EUR

Want to exchange currencies swiftly and effortlessly when you are already busy planning your trip? Hang Seng offers 24/7 online foreign exchange service@, which saves you from the hassle of scouring exchange stores! And we are now promoting a 1-week foreign currency time deposit offer, allowing you to earn more from FX to support your trip!

1-week / 1-month time deposit interest rate of up to 13.9% p.a. / 6.9% p.a1 respectively, which helps you to earn extra interest to fund your travel spending

Covers up to 12 foreign currencies in popular travel regions# to match your destination

Schedule FX Order Watch^ flexibly to convert funds automatically once your target rate is reached, so you can secure your desired rate at ease

Hang Seng FX ATM service sites are available throughout Hong Kong, you can reach out to a nearby FX ATMFX ATMFX ATM at any time to exchange or withdraw foreign currency&. Get your travel expenses ready with our seamless online-to-offline experience

@ 24/7 online foreign currency exchange service is available via Hang Seng Mobile App and Hang Seng Personal e-Banking (except for Foreign Currency Passbook Savings Account and during system maintenance hours and special circumstances).The foreign currency time deposit offer stated in this page is only applicable to designated transaction time4. # FX trading service covers 12 foreign currencies, including AUD, CAD, CHF, EUR, GBP, JPY, NZD, RMB, SGD, THB, USD and ZAR. And SGD service is available in branch and FX ATM only. ^ Supports any pairs among 10 currencies, including AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, RMB and USD. FX Order Watch Service is not applicable to the foreign currency time deposit offer stated in this page. & Up to 12 currencies applicable, including AUD, CAD, CHF, EUR, GBP, JPY, NZD, THB, USD, SGD, KRW and TWD.

Preparing to send your children to study abroad or planning to settle down oversea? Hang Seng foreign currency service can fulfil your needs on overseas transfers. We are now having a foreign currency time deposit offer, which can help you to plan ahead for living abroad!

1-month time deposit offer with an interest rate of up to 6.9% p.a.1, which helps you to earn interest to fund the overseas study and investment costs

Covers up to 12 foreign currencies# to meet your various needs

Pre-set target exchange rate through FX Order Watch^ to convert funds automatically once your intended rate is reached, so you can grow your FX savings at a desired rate

Our reliable remittance services are supported with "Track My Remittance"+ function to help you closely monitor the progress of your outward remittances

# FX trading service covers 12 foreign currencies, including AUD, CAD, CHF, EUR, GBP, JPY, NZD, RMB, SGD, THB, USD and ZAR. And SGD service is available in branch and FX ATM only. ^ Supports any pairs among 10 currencies, including AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, RMB and USD. FX Order Watch Service is not applicable to the foreign currency time deposit offer stated in this page. + Track My Remittance can trace the progress of outward remittances to overseas (except for 1. remittance to Hang Seng China; and 2. remittance to Mainland China in RMB) which are pending to be effected / already affected by intermediary banks and payee banks. Please refer to Terms and ConditionsTerms and ConditionsTerms and Conditions for Notes for Use of Track My Remittance Service.

Want to have a relatively stable interest return without limiting yourself to HKD time deposit? Invest and earn interest with Hang Seng foreign currency time deposit! Hang Seng offers 24/7 online foreign exchange service@, which allows you to keep track of the latest currency movements and seize FX opportunities.

To capture market potential, just specify the exchange rate you aim for by FX Order Watch^, you will receive alerts and convert funds automatically once your target rate is reached

Provide real-time market news and commentary to help you closely monitor market insights

1-month time deposit offer with an interest rate of up to 6.9% p.a.1, which helps you to earn stable interest return

Rate charts of major currencies are available for you to observe FX trends thoroughly

Virtual Assistant H A R O% can answer your rate enquiries and execute FX orders instantly to avoid missing out the valuable chances

@ 24/7 online foreign currency exchange service is available via Hang Seng Mobile App and Hang Seng Personal e-Banking (except for Foreign Currency Passbook Savings Account and during system maintenance hours and special circumstances).The foreign currency time deposit offer stated in this page is only applicable to designated transaction time4. ^ Supports any pairs among 10 currencies, including AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, RMB and USD. FX Order Watch Service is not applicable to the foreign currency time deposit offer stated in this page. % Terms and conditions apply.

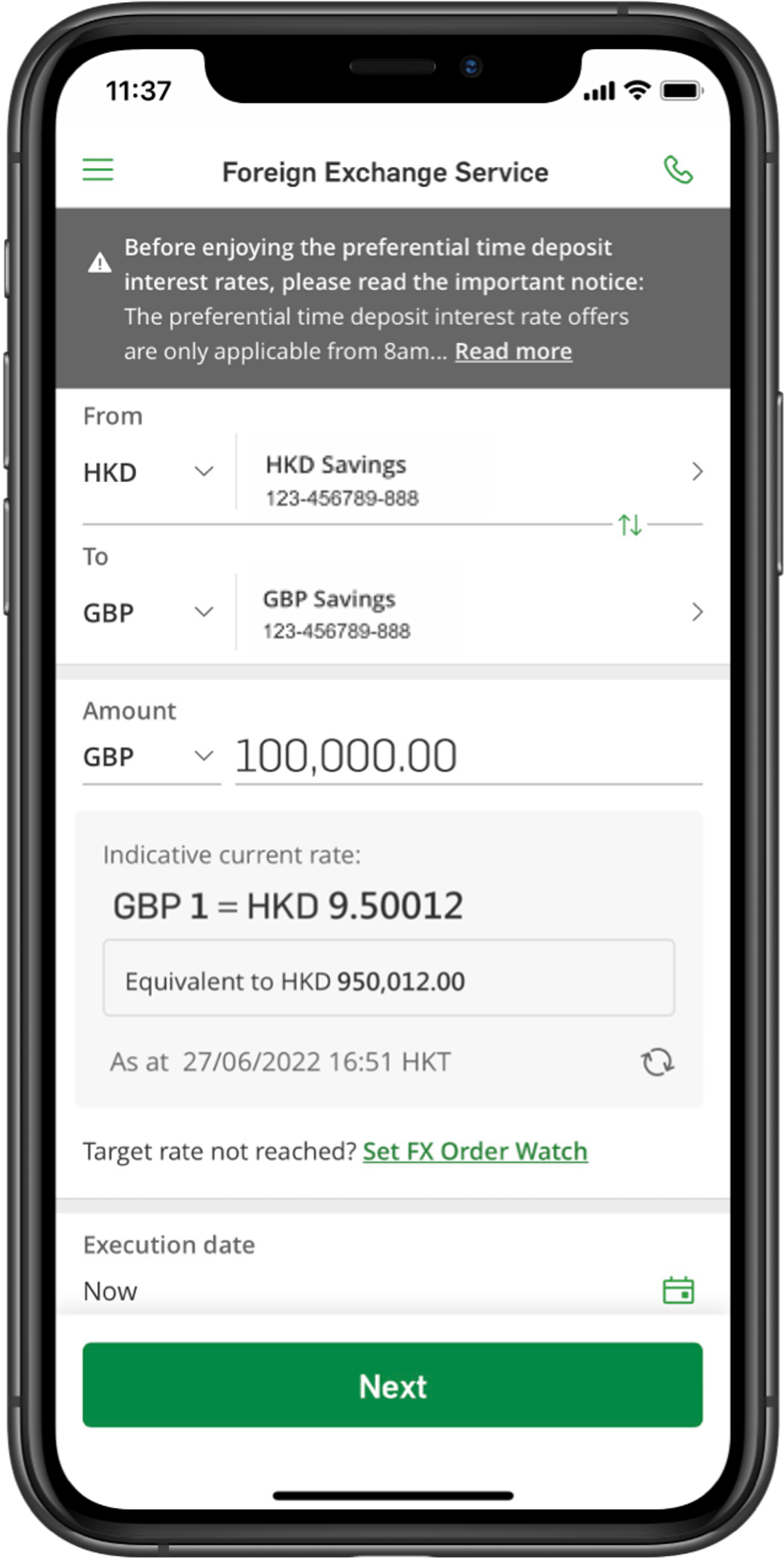

Want to exchange currencies swiftly and effortlessly when you are already busy planning your trip? Hang Seng offers 24/7 online foreign exchange service@, which saves you from the hassle of scouring exchange stores! And we are now promoting a 1-week foreign currency time deposit offer, allowing you to earn more from FX to support your trip!

1-week / 1-month time deposit interest rate of up to 13.9% p.a. / 6.9% p.a1 respectively, which helps you to earn extra interest to fund your travel spending

Covers up to 12 foreign currencies in popular travel regions# to match your destination

Schedule FX Order Watch^ flexibly to convert funds automatically once your target rate is reached, so you can secure your desired rate at ease

Hang Seng FX ATM service sites are available throughout Hong Kong, you can reach out to a nearby FX ATMFX ATMFX ATM at any time to exchange or withdraw foreign currency&. Get your travel expenses ready with our seamless online-to-offline experience

@ 24/7 online foreign currency exchange service is available via Hang Seng Mobile App and Hang Seng Personal e-Banking (except for Foreign Currency Passbook Savings Account and during system maintenance hours and special circumstances).The foreign currency time deposit offer stated in this page is only applicable to designated transaction time4. # FX trading service covers 12 foreign currencies, including AUD, CAD, CHF, EUR, GBP, JPY, NZD, RMB, SGD, THB, USD and ZAR. And SGD service is available in branch and FX ATM only. ^ Supports any pairs among 10 currencies, including AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, RMB and USD. FX Order Watch Service is not applicable to the foreign currency time deposit offer stated in this page. & Up to 12 currencies applicable, including AUD, CAD, CHF, EUR, GBP, JPY, NZD, THB, USD, SGD, KRW and TWD.

Preparing to send your children to study abroad or planning to settle down oversea? Hang Seng foreign currency service can fulfil your needs on overseas transfers. We are now having a foreign currency time deposit offer, which can help you to plan ahead for living abroad!

1-month time deposit offer with an interest rate of up to 6.9% p.a.1, which helps you to earn interest to fund the overseas study and investment costs

Covers up to 12 foreign currencies# to meet your various needs

Pre-set target exchange rate through FX Order Watch^ to convert funds automatically once your intended rate is reached, so you can grow your FX savings at a desired rate

Our reliable remittance services are supported with "Track My Remittance"+ function to help you closely monitor the progress of your outward remittances

# FX trading service covers 12 foreign currencies, including AUD, CAD, CHF, EUR, GBP, JPY, NZD, RMB, SGD, THB, USD and ZAR. And SGD service is available in branch and FX ATM only. ^ Supports any pairs among 10 currencies, including AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, RMB and USD. FX Order Watch Service is not applicable to the foreign currency time deposit offer stated in this page. + Track My Remittance can trace the progress of outward remittances to overseas (except for 1. remittance to Hang Seng China; and 2. remittance to Mainland China in RMB) which are pending to be effected / already affected by intermediary banks and payee banks. Please refer to Terms and ConditionsTerms and ConditionsTerms and Conditions for Notes for Use of Track My Remittance Service.

Want to have a relatively stable interest return without limiting yourself to HKD time deposit? Invest and earn interest with Hang Seng foreign currency time deposit! Hang Seng offers 24/7 online foreign exchange service@, which allows you to keep track of the latest currency movements and seize FX opportunities.

To capture market potential, just specify the exchange rate you aim for by FX Order Watch^, you will receive alerts and convert funds automatically once your target rate is reached

Provide real-time market news and commentary to help you closely monitor market insights

1-month time deposit offer with an interest rate of up to 6.9% p.a.1, which helps you to earn stable interest return

Rate charts of major currencies are available for you to observe FX trends thoroughly

Virtual Assistant H A R O% can answer your rate enquiries and execute FX orders instantly to avoid missing out the valuable chances

@ 24/7 online foreign currency exchange service is available via Hang Seng Mobile App and Hang Seng Personal e-Banking (except for Foreign Currency Passbook Savings Account and during system maintenance hours and special circumstances).The foreign currency time deposit offer stated in this page is only applicable to designated transaction time4. ^ Supports any pairs among 10 currencies, including AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, RMB and USD. FX Order Watch Service is not applicable to the foreign currency time deposit offer stated in this page. % Terms and conditions apply.

From now to 29 June 2024, customer can enjoy the

following interest rate offer1 upon completing a single

FX transaction5 to exchange for any designated currency

with at least HKD10,000 or its equivalent6,7 and

setting up a 1-week or 1-month time deposit in the same currency

at the same time via

Hang Seng Mobile App, Hang Seng Personal e-Banking,

phone banking hotline or branch

within the designated transaction time4.

| Time Deposit Interest Rate (p.a.) | |||

|---|---|---|---|

| Tenor | 1-week | 1-month | |

| GBP | 13.90% | 6.90% | |

| NZD | 13.90% | 6.90% | |

| CAD | 12.90% | 6.90% | |

| AUD | 12.90% | 5.90% | |

| CNY | 12.90% | 4.30% | |

| USD | 8.90% | 5.90% | |

| HKD | 8.90% | - | |

| Time Deposit Interest Rate (p.a.) | |||

|---|---|---|---|

| Tenor | 1-week | 1-month | |

| GBP | 13.00% | 6.50% | |

| NZD | 13.00% | 6.50% | |

| CAD | 12.00% | 6.50% | |

| AUD | 12.00% | 5.50% | |

| CNY | 12.00% | 3.90% | |

| USD | 8.00% | 5.50% | |

| HKD | 8.00% | - | |

Deposit new funds in foreign currency for the online exclusive time deposit offer!

^Terms and Conditions apply. For details, please visit hangseng.com/depositspromo5.

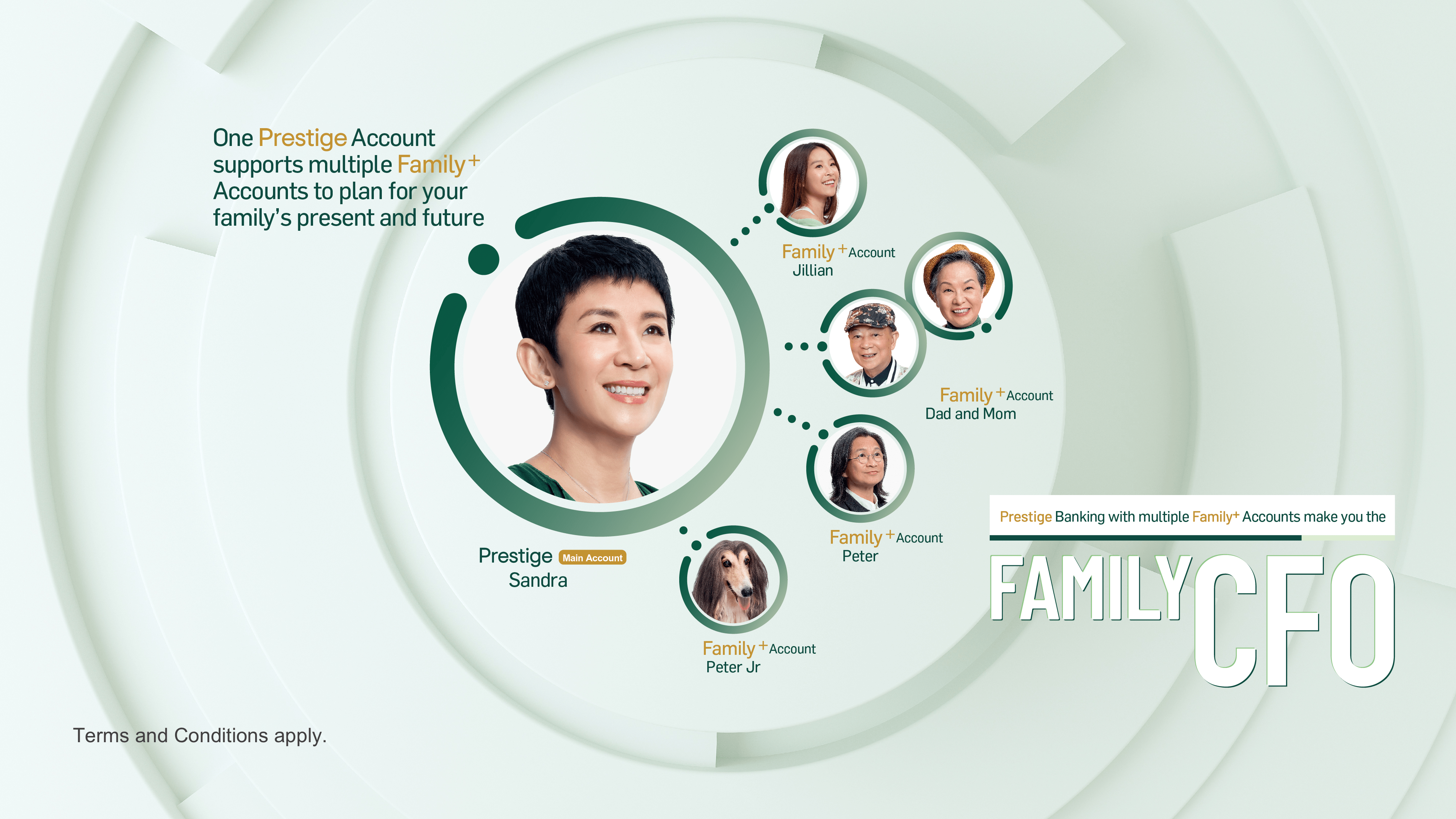

A Prestige main account can come with multiple Family+ Accounts8 for better organisation of your family finances. Your family wealth management is made easy as you can name different accounts to, say, meet the need for saving foreign currency funds ahead of an overseas travel or study plan.

Notes:

- For exchange of designated currencies and set up of either a 1-week or 1-month time deposit at the same time. The above interest rate offers are quoted with reference to the interest rates offered by the Bank on 2 April 2024 and are for reference only. The relevant interest rates will be subject to revision based on the prevailing market conditions.

- The exchange amount cap of a single FX transaction is USD2,000,000 or its equivalent. For any cross currency exchange, the relevant amount will be converted into the Hong Kong Dollar equivalent with the exchange rate solely determined by the Bank on the transaction day, so as to calculate the relevant transaction amount in the Hong Kong Dollar equivalent.

- "Bank's Cost Price" refers to the exchange rate for foreign exchange without any sales margin normally charged by the Bank. Other mark-up applied to the exchange rate for operational reasons however will not be waived. Applicable to real-time FX transaction performed by customer with integrated account(s) (including Prestige Private, Prestige Banking, Preferred Banking and Integrated Account). This offer is not applicable to foreign exchange transaction(s) involving notes exchange, cash deposit, notes withdrawal, inward/outward remittance, Overseas Transfer Service, FX Order Watch Service, foreign exchange transaction(s) via Passbook Savings Account and foreign exchange transaction(s) made on pre-defined dates by way of forward dated instruction(s).

-

Designated transaction time:

Transaction Channel Transaction Time - Hang Seng Personal e-Banking

- Hang Seng Mobile App

- Mondays to Fridays: 8:00am to 7:55pm

Phone banking hotlines -

Prestige Private

(852)29988022 -

Prestige Banking

(852)29989188 -

Preferred Banking

(852)28228228 -

Integrated Accounts

(852) 28228233

- Mondays to Fridays: 9:00am to 7:00pm

- Saturdays: 9:00am to 12:55pm

Branches Please refer to Hang Seng Bank Branch Service Arrangements. - Not applicable to the pending and the renewal of time deposit and is not applicable to transaction(s) via FX Order Watch Service, Virtual Assistant HARO services, notes exchange and Passbook Savings Account.

- For any cross currency exchange, the relevant amount will be converted into the Hong Kong Dollar equivalent with the exchange rate solely determined by the Bank on the transaction day, so as to calculate the relevant transaction amount in the Hong Kong Dollar equivalent.

- The exchange amount cap of a single FX transaction is USD2,000,000 or its equivalent. If the actual transaction amount exceeds the exchange amount cap, the time deposit board rate of corresponding tenor will be offered to the actual transaction amount.

- Each customer is allowed to open up to 8 Family+ Accounts.

| Prestige Private | Prestige Banking | Preferred Banking | Integrated Account |

|---|---|---|---|

| 29988022 | 29989188 | 28228228 | 28228233 |

|

Prestige Private 29988022 |

Prestige Banking 29989188 |

|---|---|

|

Preferred Banking 28228228 |

Integrated Account 28228233 |

- In case of discrepancies between the English and Chinese versions, the English version shall apply and prevail.

- If you are in doubt of the marketing and promotional activities and materials of the Bank, please call customer service enquiry hotline for authentication.

- Hong Kong Dollar - 365 days (ordinary year) or 366 days (leap year),

- Pound Sterling, Thailand Baht and South Africa Rand - 365 days,

- Other currencies - 360 days.

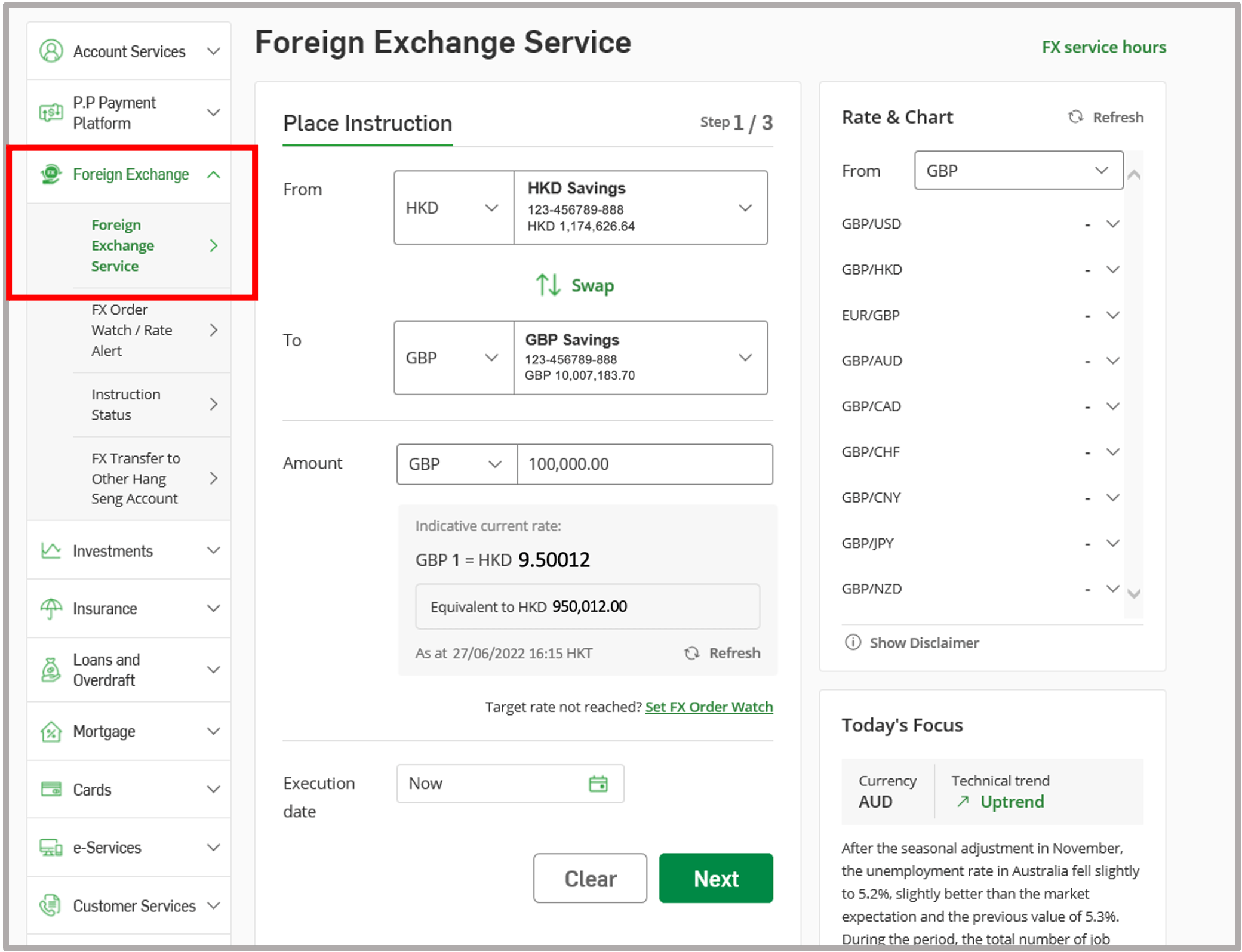

Logon to Hang Seng Personal

e-Banking

Logon to Hang Seng Personal

e-Banking Please click "Foreign Exchange"

> "Foreign Exchange Service"

Please click "Foreign Exchange"

> "Foreign Exchange Service"