We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Keep your money extra secure with the Money Safe Account!

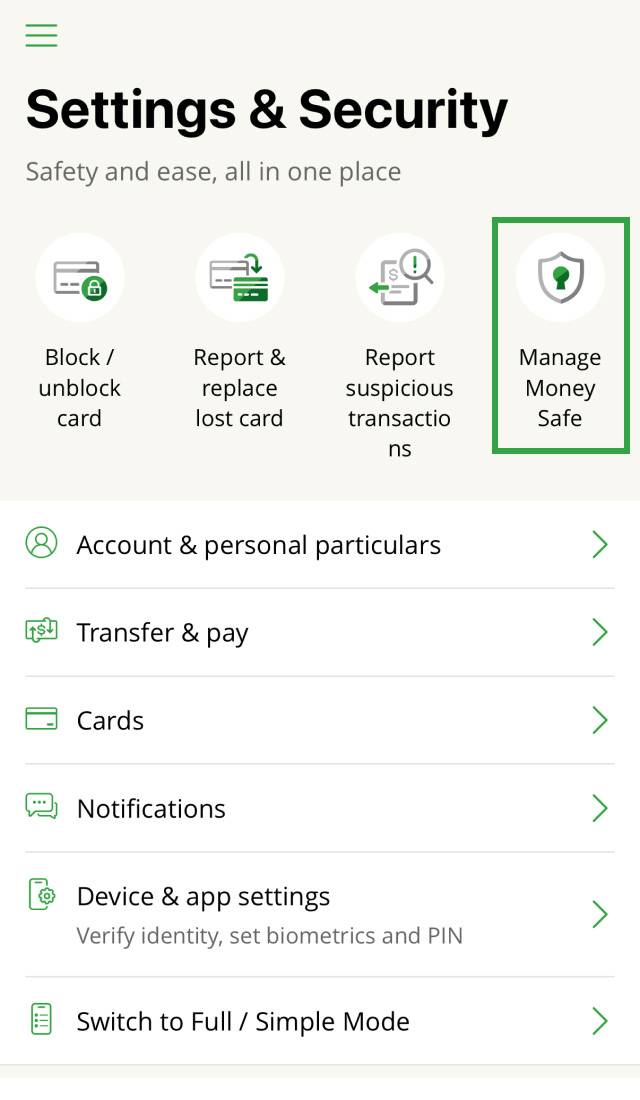

Apply online using Hang Seng Mobile App for faster processing, or opt for branch application with an e-Appointment.

Open a Money Safe Account for extra protection of your funds and a chance to win a "Golden Fortune" God of Wealth Ornament!

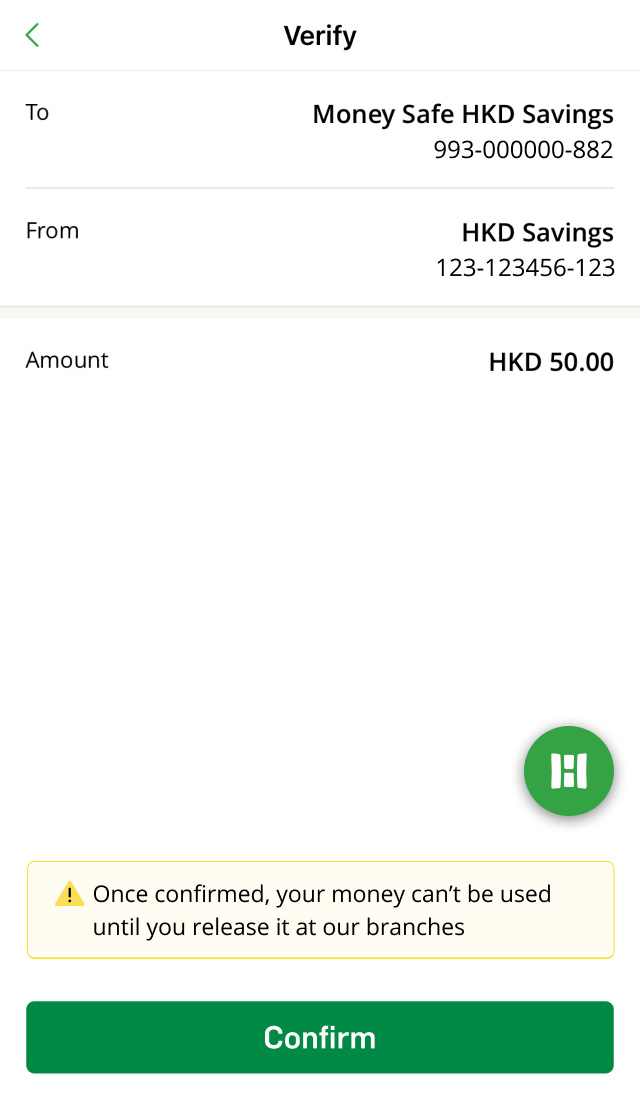

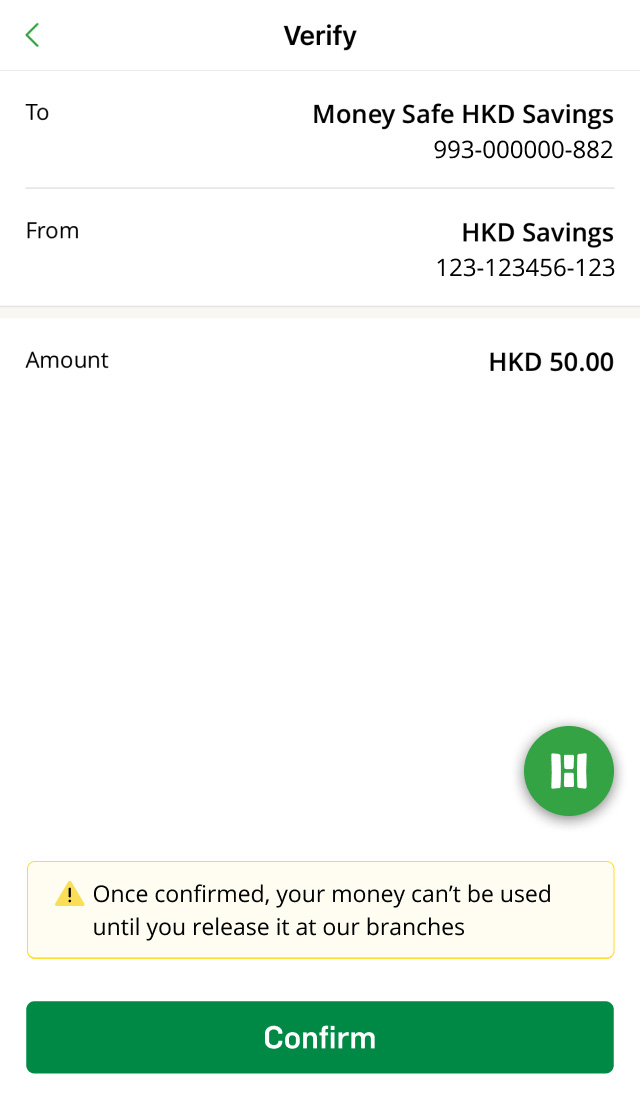

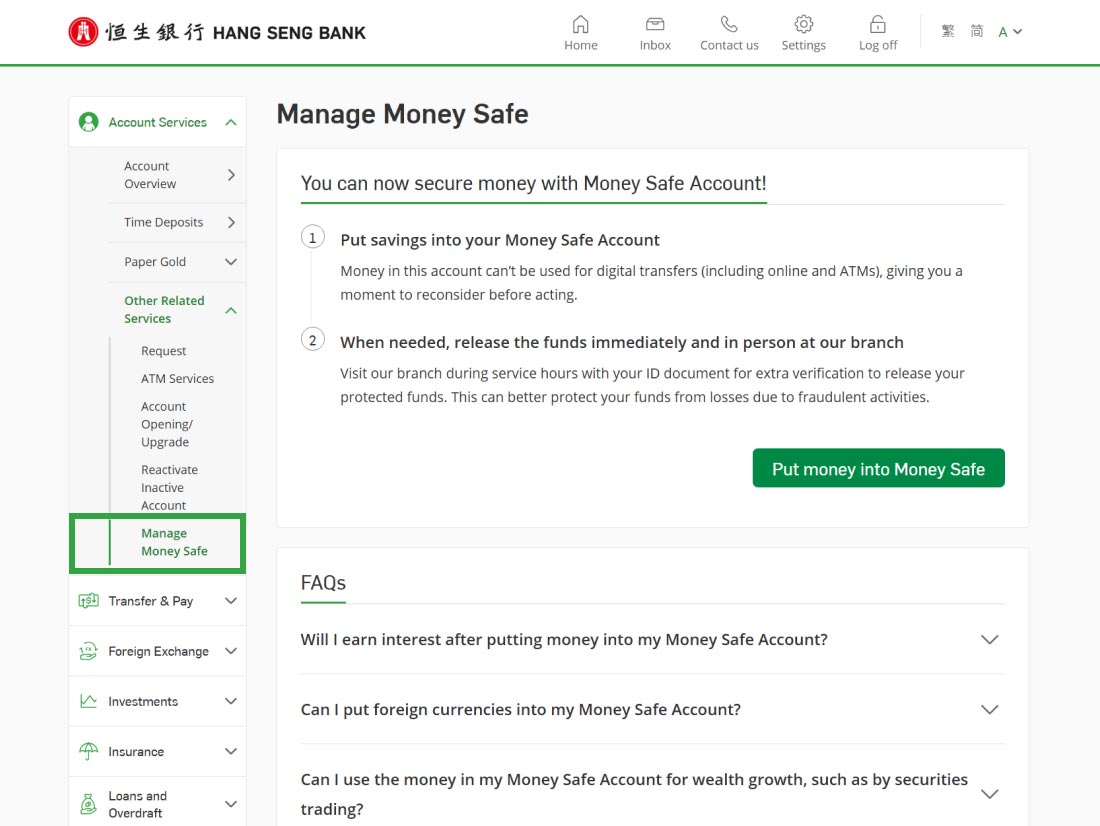

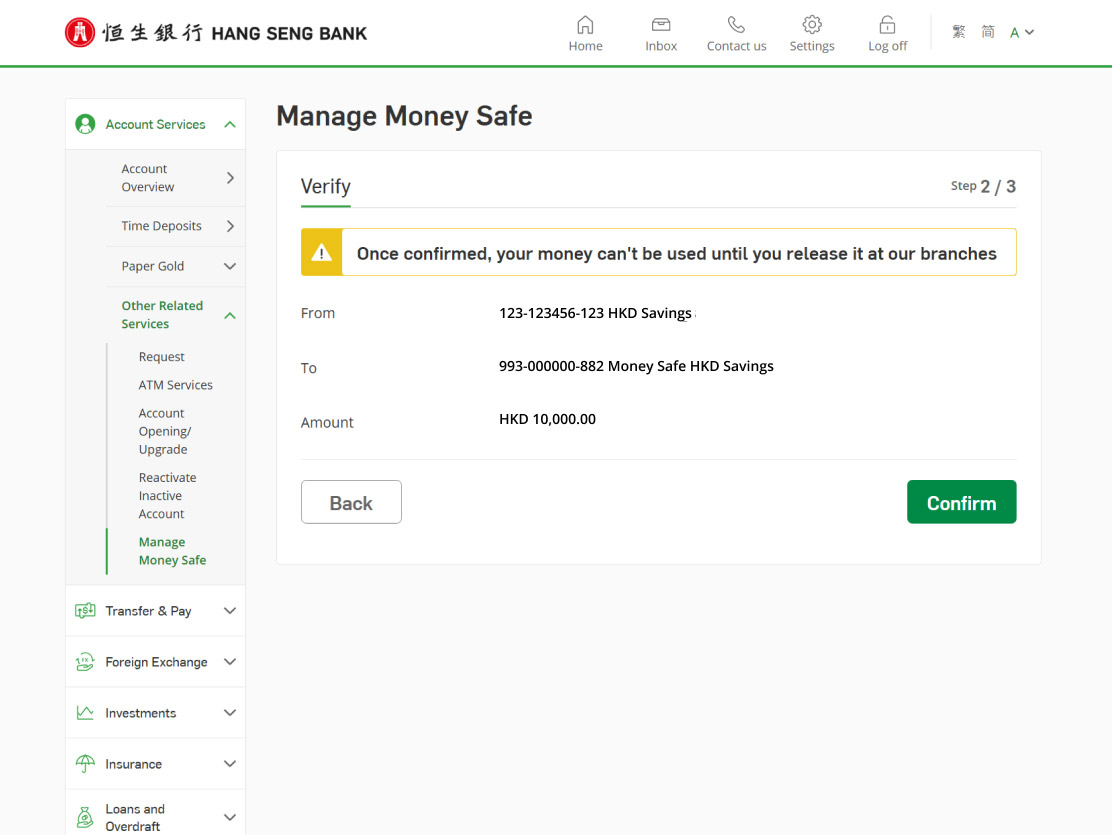

Once you put your funds into a Money Safe Account, they're as secure as being locked in a safe. The funds can't be withdrawn or transferred digitally (including online, Phone Banking and ATMs).

To release your locked funds, you'll need to visit our branch with your ID document for extra verification by our staff.

Funds in the Money Safe Account can earn interest at the prevailing deposit interest rate. You can also set up a time deposit to enjoy a higher interest rate.

Clearly records every fund you put into and release from your Money Safe account, making it easy for you to check and manage.

Dos |

Don'ts |

|---|---|

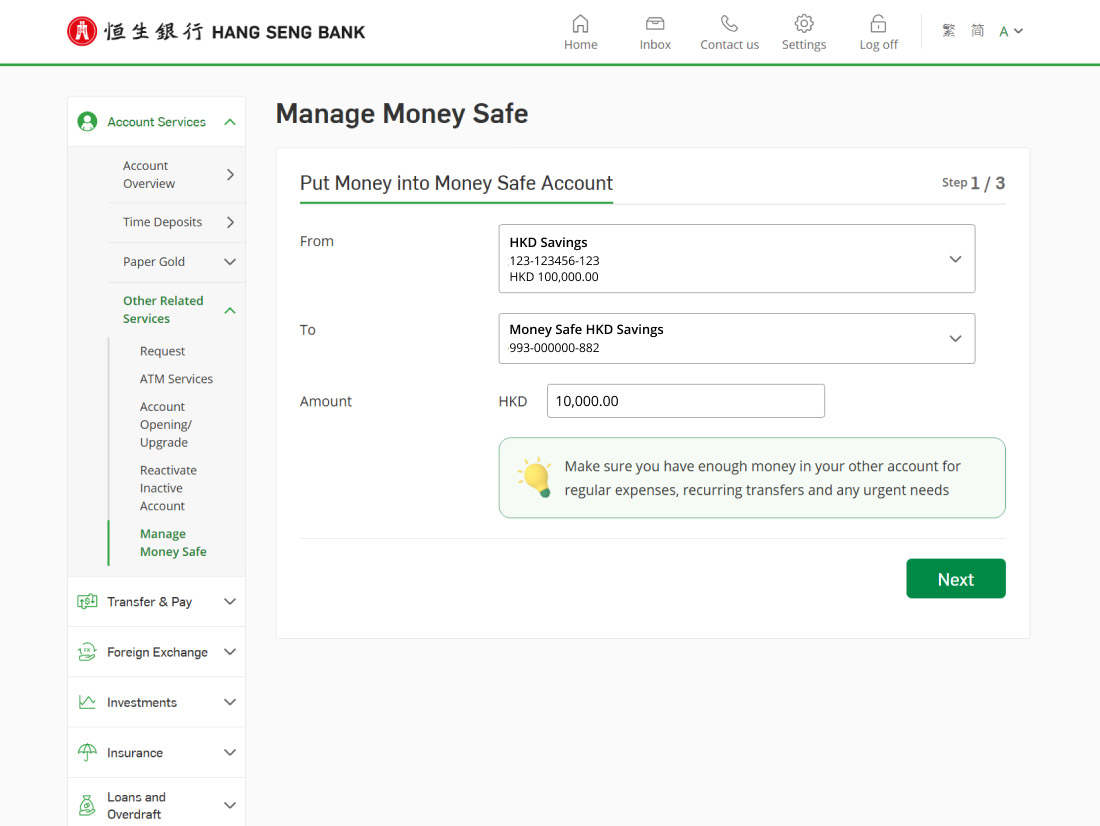

Make sure you have enough money in your other accounts for regular expenses (e.g. water and electricity bills), recurring transfers and any urgent needs. Also, only put the funds you wish to protect into the account. |

Put all or too much of your money into the Money Safe Account, as you won’t be able to withdraw or transfer funds digitally right away for daily or other needs. |

Yes, funds in the Money Safe Account can earn interest at the prevailing deposit interest rate. You can also set up a time deposit to enjoy a higher interest rate.

Yes, you can use your Money Safe Account for foreign exchange transactions. Just make sure the debit and credit accounts are currency accounts under the Money Safe Account.

The funds can be used for time deposits and foreign exchange transactions within your Money Safe Account, but not for investments or securities trading.

Yes, you can use your Money Safe Account to set up time deposit. Just make sure your debit account and principal and interest credit account are all under Money Safe Account.

The below account services are disabled for the Money Safe Account:

Please note, we may change the services or restrictions of Money Safe account from time to time.

You'll receive a separate account statement for your Money Safe Account.

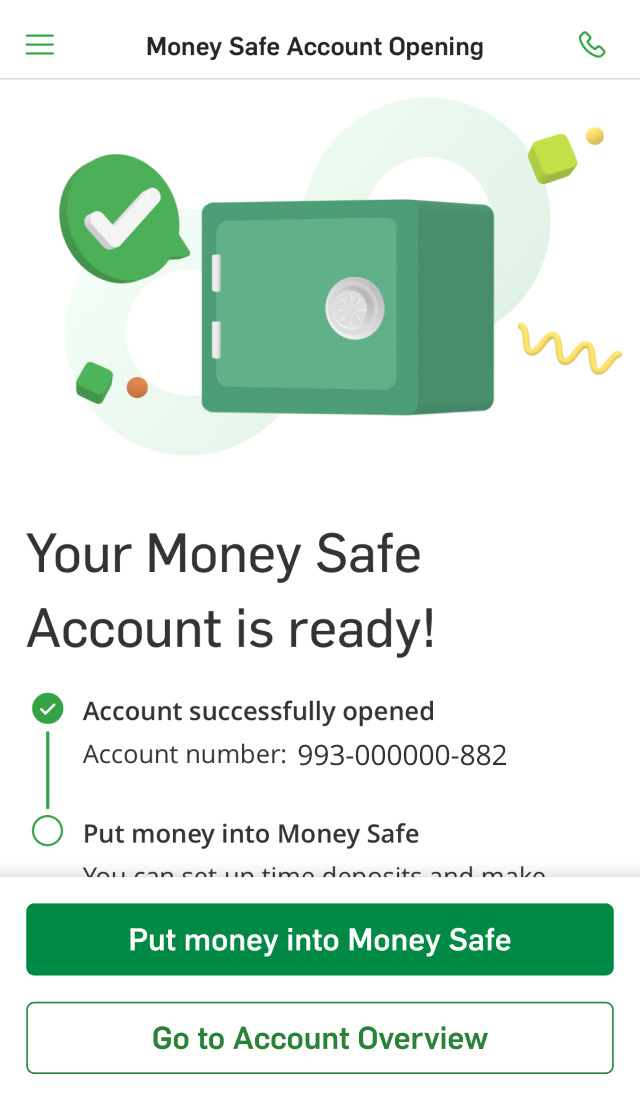

You can open a Money Safe Account as long as you hold a Hang Seng deposit account, including a HKD Passbook Savings Account, HKD Statement Savings Account, ATM Statement Savings Account, HKD Standalone Current Account Standalone Foreign Currency Account and an Integrated Account (i.e. Integrated Account, Preferred Banking account and Prestige Banking account).

There's no minimum balance or service charges for the Money Safe Account.

Yes, if you have a sole-named deposit account with us, you can still open a sole-named Money Safe Account using Hang Seng Mobile App.

Yes, you can open an account at our branch with your guardian. However, foreign exchange transactions and time deposits aren't available for your account.

If you'd like to close your Money Safe account, please visit any of our branches. You can easily find your nearest branch and check the service hours on our website.

You can put money into your Money Safe Account easily using these methods:

You need to open a Money Safe Account with us first. Once opened, you can put the funds you want to protect into it.

Yes, you can put foreign currencies directly into Money Safe Account by transferring them from your other accounts. Alternatively, you can put HKD into your Money Safe Account and exchange it for other supported currencies using Hang Seng Mobile App or Personal e-Banking.

You can put HKD, USD, GBP, AUD, CAD, CHF, CNY, JPY, NZD, THB, ZAR and EUR into your Money Safe Account using Hang Seng Mobile App or Personal e-Banking.

To release your locked funds, please visit our branch during service hours with your ID document.

No, ATM services and cheque books aren't available for this account.

You can release all or part of your funds in Money Safe Account at our branch during our service hours, with no limits on frequency.

Only one of the joint-named Money Safe Account holders is required to release funds at our branch. The funds can only be transferred to the deposit account you jointly own with the same account holder(s). You can easily find your nearest branch and check the service hours on our website.

To keep your funds safe from potential fraud, the locked funds in your account can't be withdrawn or transferred digitally, you'll need to visit our branch for extra verification.

Get 24/7 support from our Virtual Assistant.

24-hour Banking Manned hotline

(852) 2822 0228

Want to know more about Money Safe?

Want to know more about Money Safe?

Chat with H A R O now