We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

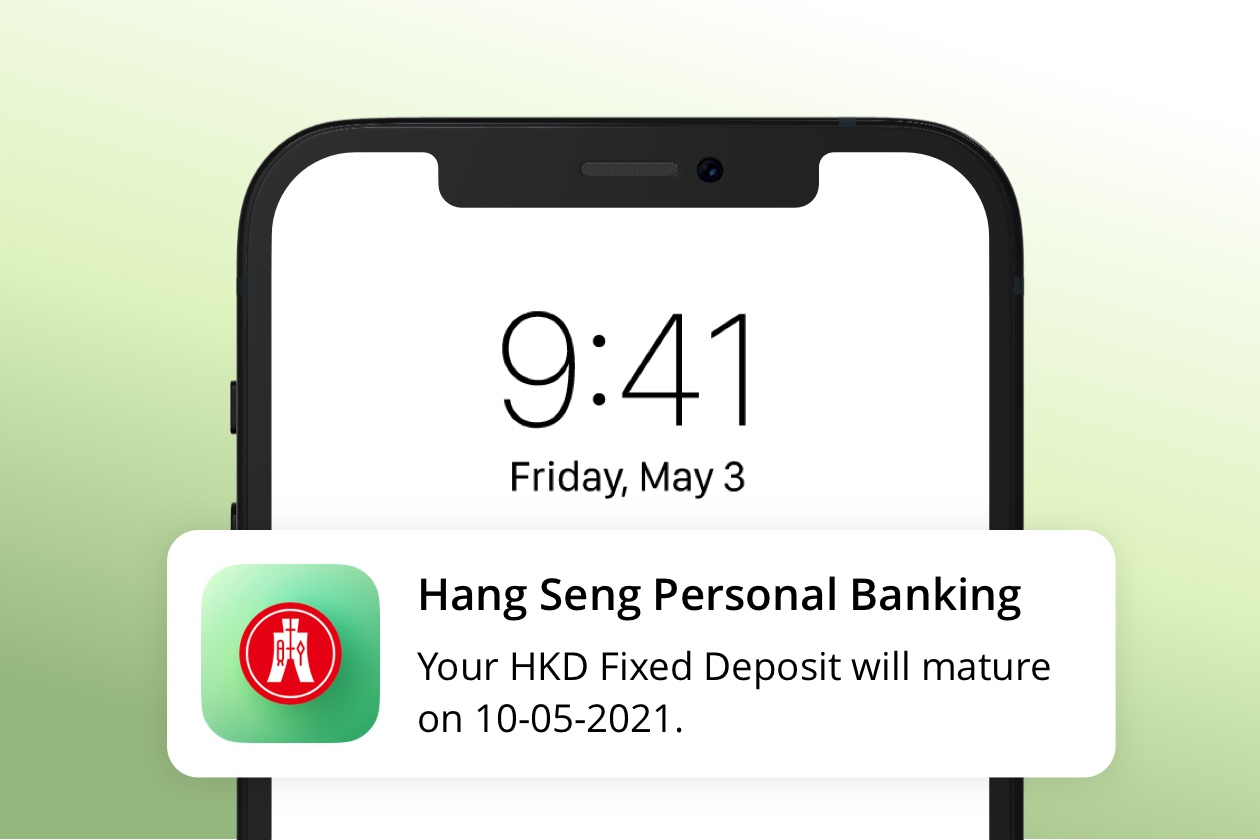

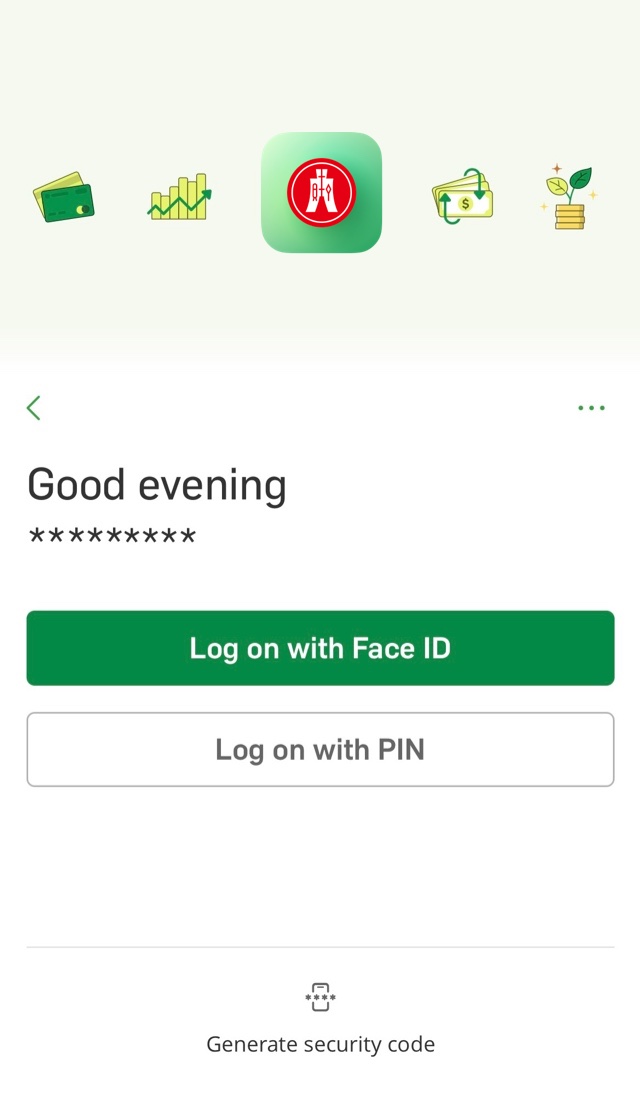

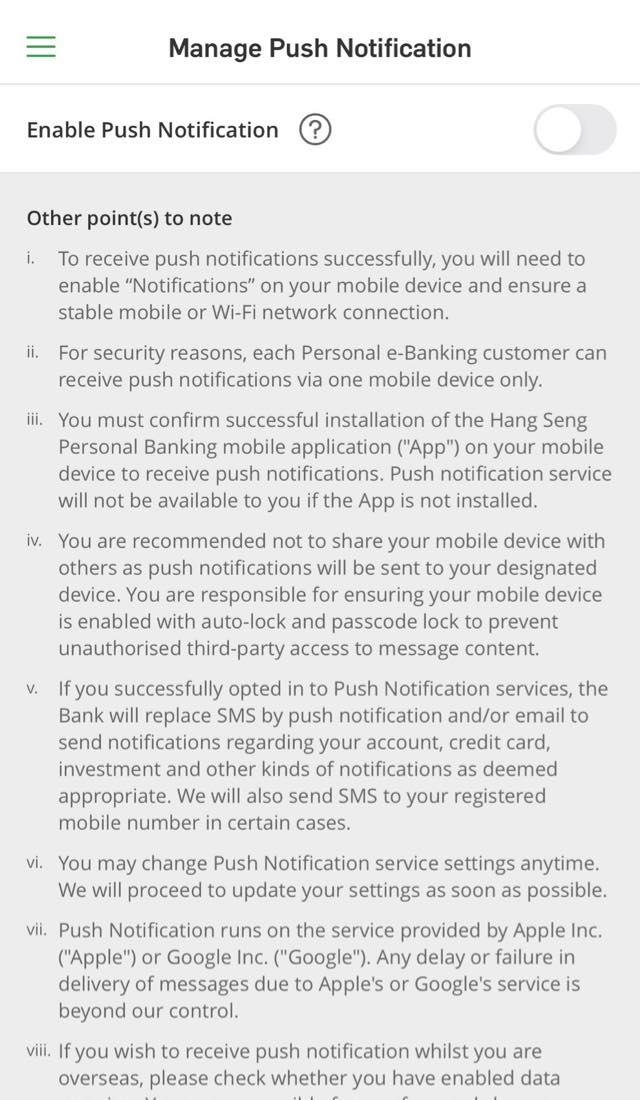

An easy way to receive important account updates on your device, Push Notification is here to help you better manage your account. Simply enable Push Notification via Hang Seng Personal Banking mobile app ("Hang Seng Mobile App").

You'll receive push notifications from us when:

More push notifications will be coming soon, stay tuned.

Get notified of your banking, investment, credit card account activities and more whenever you’re connected to the internet, for free[1].

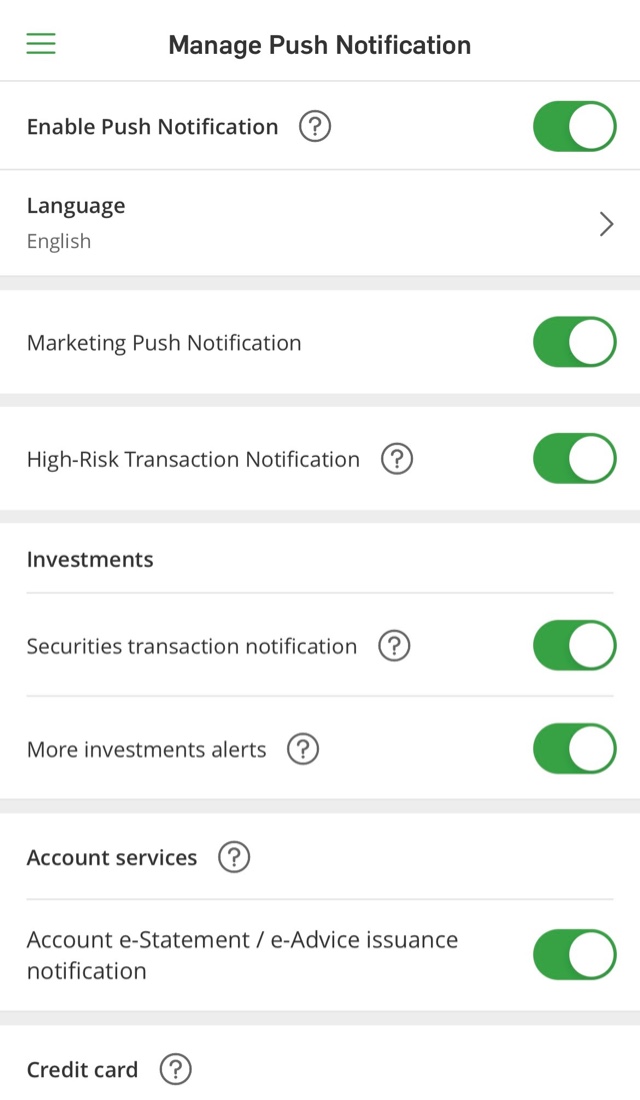

Simply turn on the service on Hang Seng Mobile App and personalise your push notification preferences.

All banking messages will be stored in the mobile app for 180 days. You can view the messages in “Message centre” via Hang Seng Mobile App.

Push Notification is an optional service offered for free. However, data charges (including roaming charges) imposed by your mobile service provider may apply, please consult your mobile service provider for details.

For security reasons, you can enable Push Notification on one designated device only.

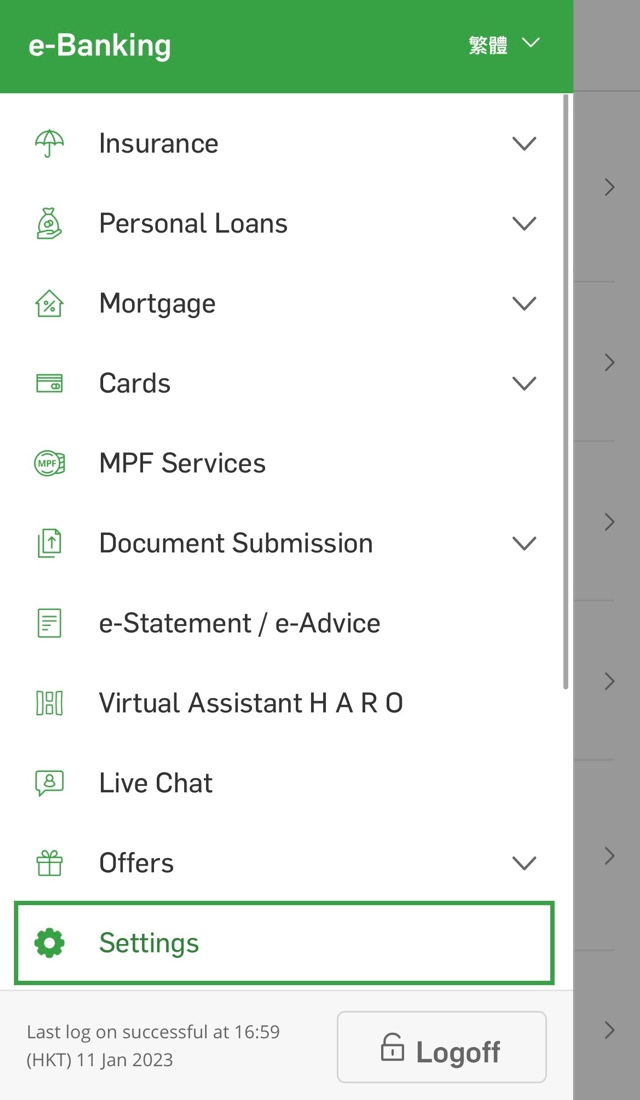

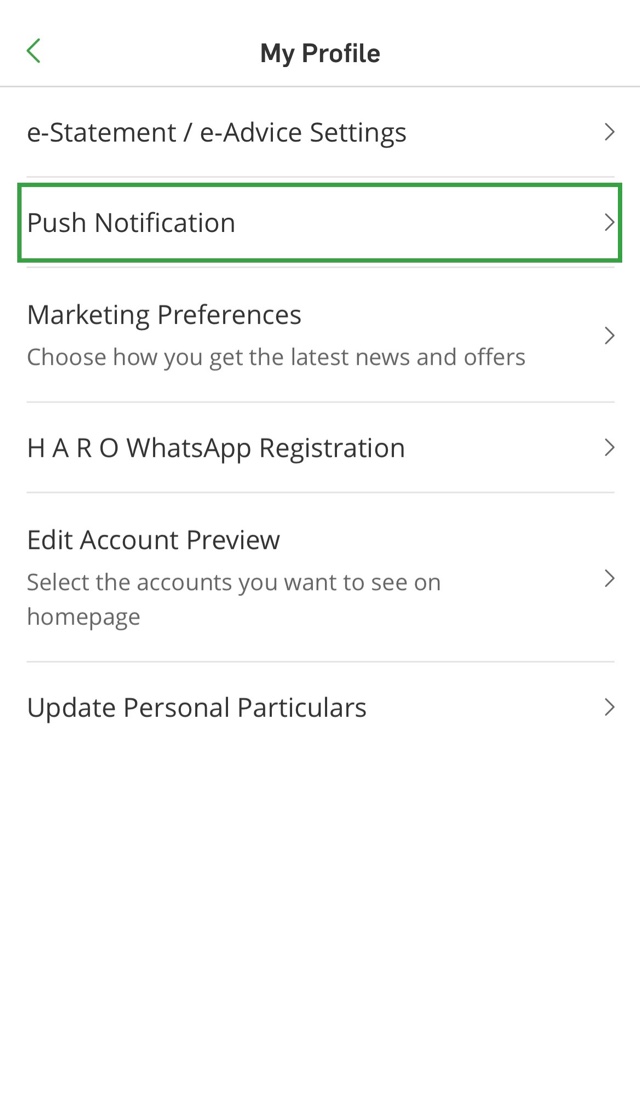

Yes, you can select your language preference in “Push Notification” under “Settings” in the menu. 3 languages are available: English, Traditional Chinese and Simplified Chinese.

Received banking messages are retained for 180 days, while messages on promotions and latest news are retained for 30 days only.

Simply install Hang Seng Mobile App and log on to Personal e-Banking using your new mobile device. Follow the steps on screen and proceed to switching the service to your new device. Then you’re all set and you can receive push notifications again.

Alternatively, you can visit “Settings” > “Push Notification” to do the same.

Don’t worry, you can view your messages in "Message centre" as long as you’ve logged on to Personal e-Banking via Hang Seng Mobile App.

Yes. You can log on to Personal e-Banking via Hang Seng Mobile App and press “Settings” > “Push Notification” to disable the service.

You may not be able to receive push notifications due to network problems or inadequate device settings.

You are recommended to check the following: