We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Savings Planner will be renamed to Money Master and the new Terms and Conditions (which includes updates on data collection, new features of Money Master, etc.) will take effect on 26 Aug 2023. Learn more

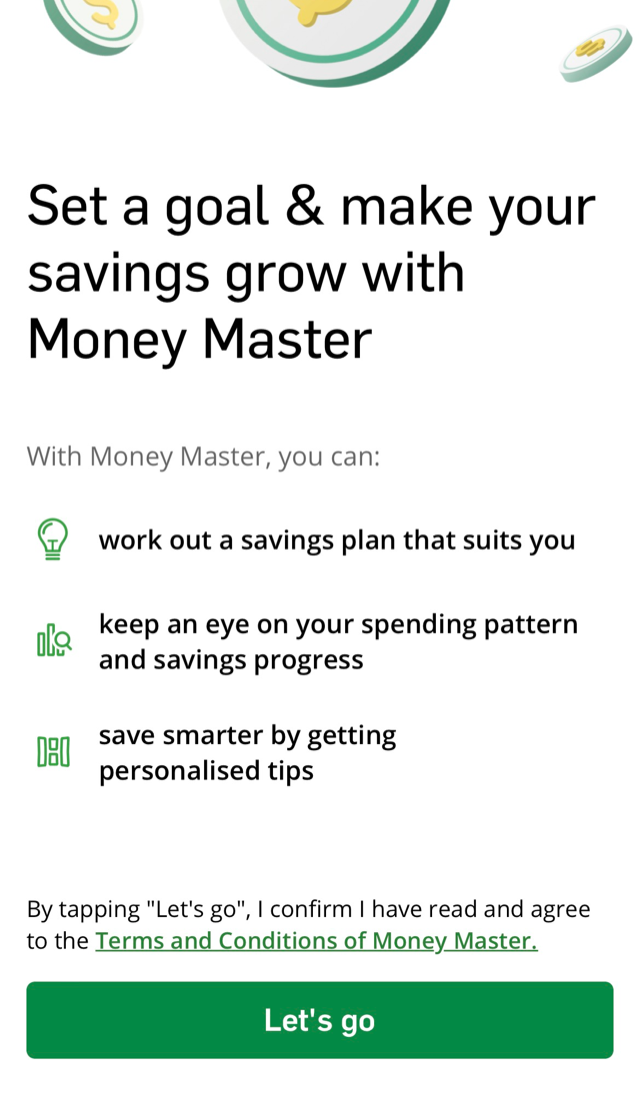

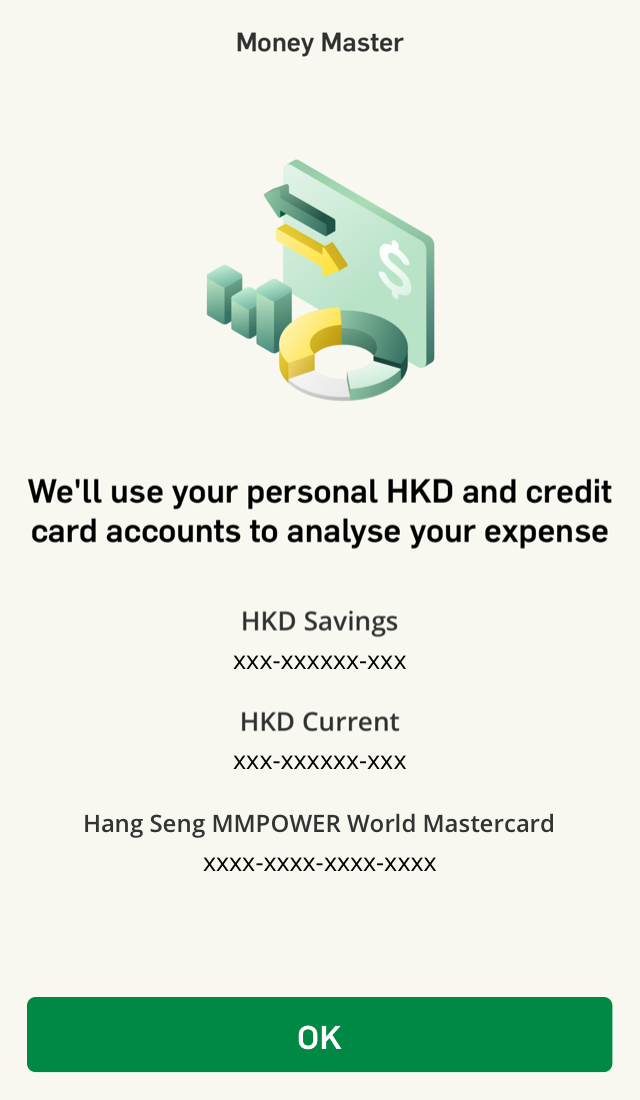

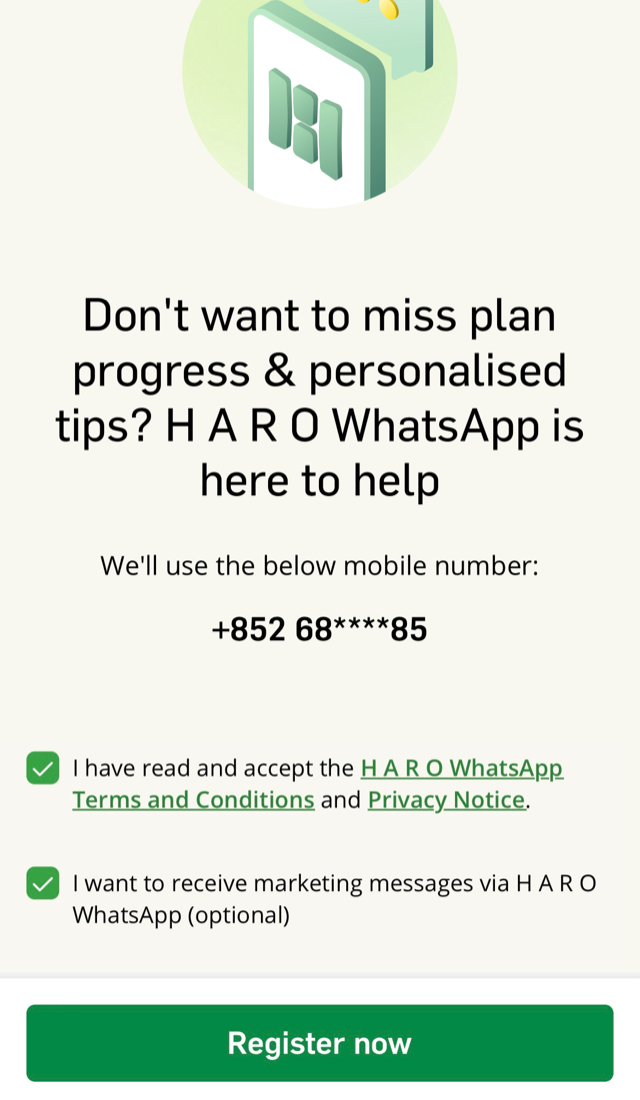

Money Master achieves goals together with you! After you've set up a savings plan, Money Master will automatically track your expenses from your Hang Seng Hong Kong Dollar accounts and credit cards, and reflect remaining spending budget in real time. You can also register for H A R O WhatsApp to receive personalised tips and progress updates to help you achieve your goal based on your needs and abilities with ease.

Log on to Hang Seng Mobile App and plan your future with Money Master now!

Simply register for Virtual Assistant H A R O to receive progress updates and personalised savings tips on WhatsApp

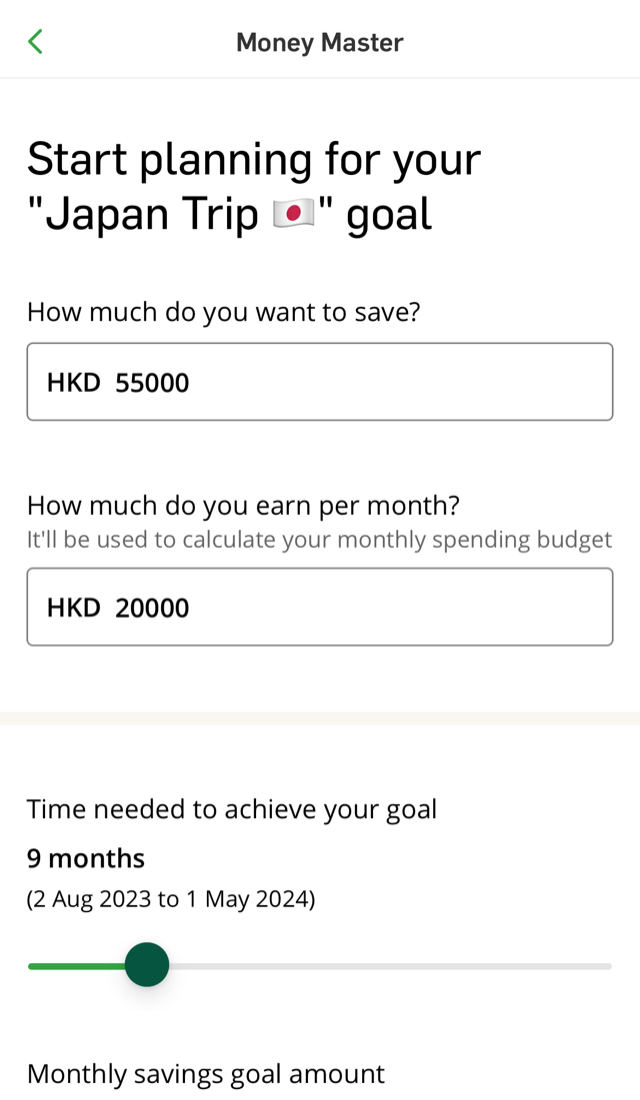

From 3 to 36 months, it's your call when to achieve your goal.

Save the hassle of manual entry – we'll track the expenses from your different accounts, so you can have a better understanding of your spending pattern.

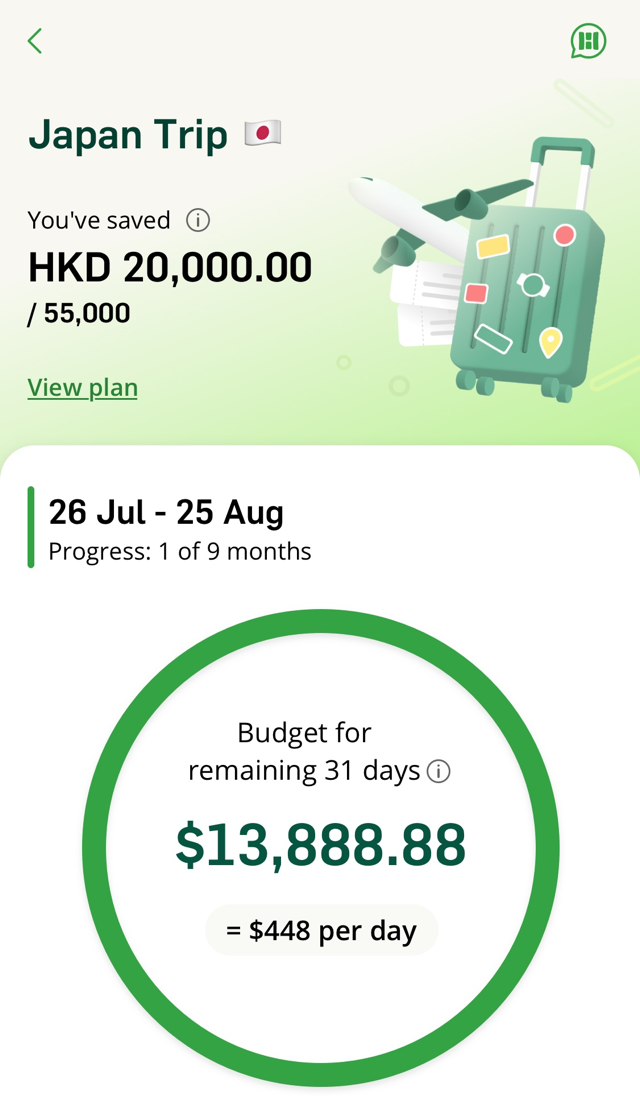

Simply set up your savings goal, monthly income and time needed to achieve your goal, Money Master will instantly calculate monthly and daily spending budget, saved amount and balance, making it easier for you to achieve your goal according to the progress.

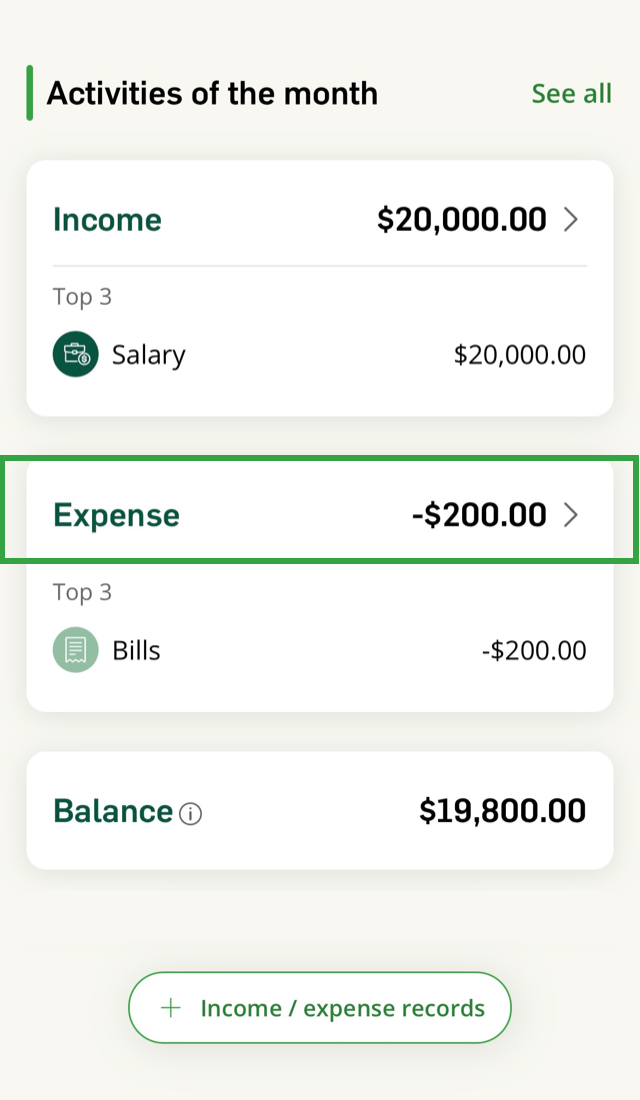

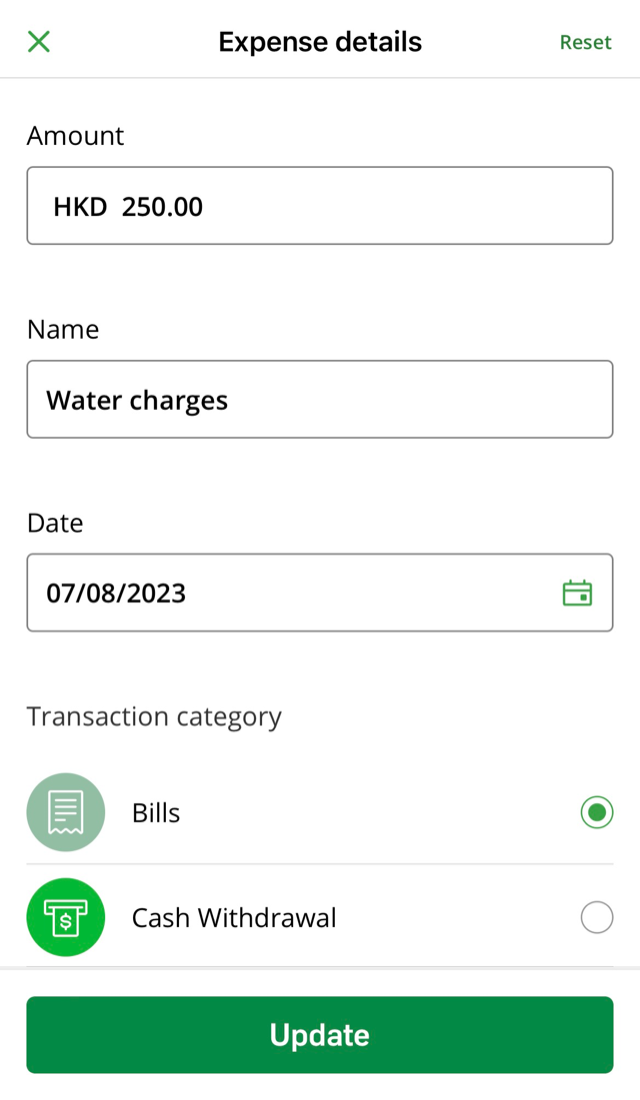

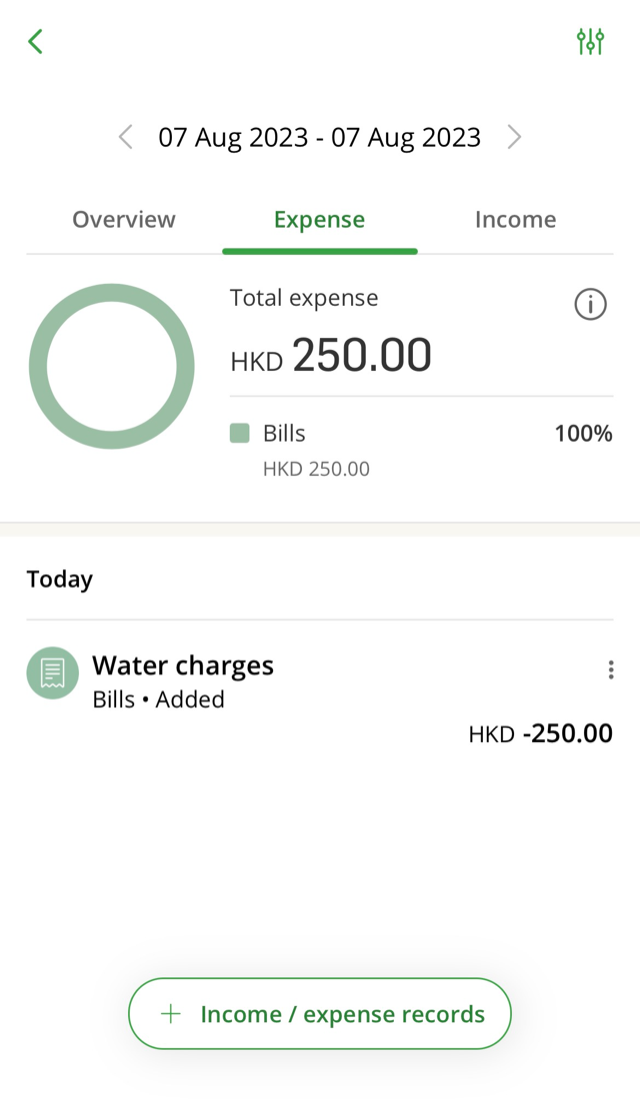

You can edit, add or exclude income / expense records anytime to reflect your financial condition more accurately.

Read the latest Terms and Conditions of Money Master[1].

Money Master will automatically track your expenses from your Hang Seng Hong Kong Dollar accounts and credit cards, while reflect remaining spending budget in real time. You can also register for H A R O WhatsApp to receive personalised tips and progress updates to help you achieve your goal based on your needs and abilities with ease.

Money Master is a free expense tracking function available to Personal e-Banking customers.

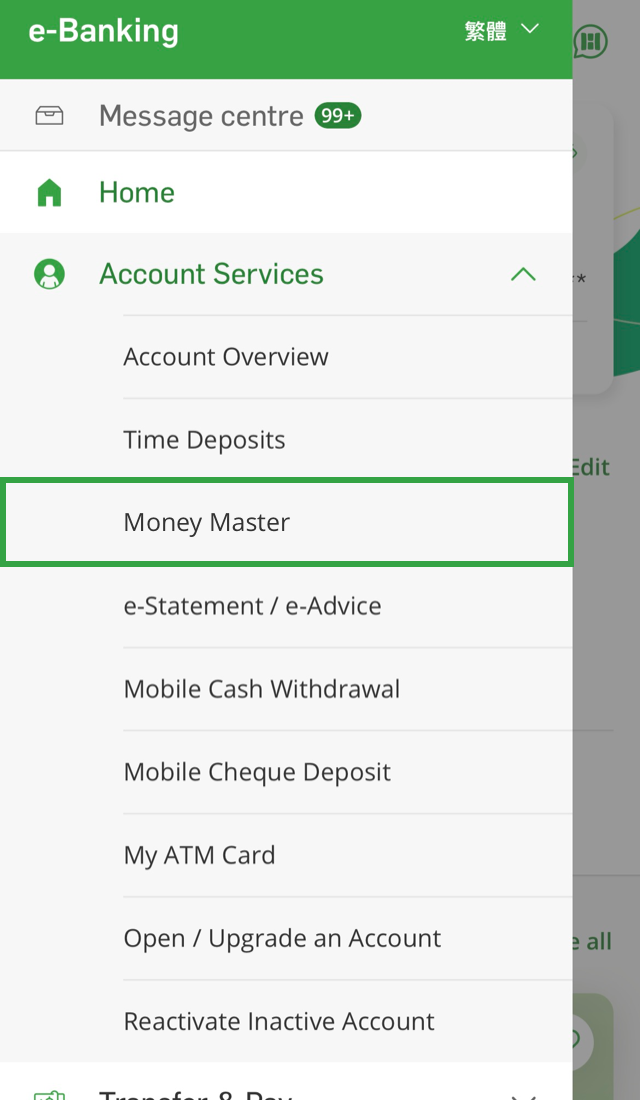

Simply log on to Hang Seng Mobile App and tap "Account Services" > "Money Master" from the main menu to start using the service.

You can currently set a savings plan to achieve your goal with Money Master. If you think the existing plan no longer suits you, you can end the plan on "Your plan" page first before setting up a new one.

All information will be removed after ending the plan manually.

Money Master will track expenses from the following Hang Seng Hong Kong Dollar accounts:

Money Master can automatically track all the new eligible accounts for your plan.

Money Master can only track the activities of Hang Seng Hong Kong Dollar accounts and credit cards in real time for now. You can add other income / expense records as you like.

You can add other records by tapping "+ Income / expense records" on the Money Master homepage and entering relevant details.

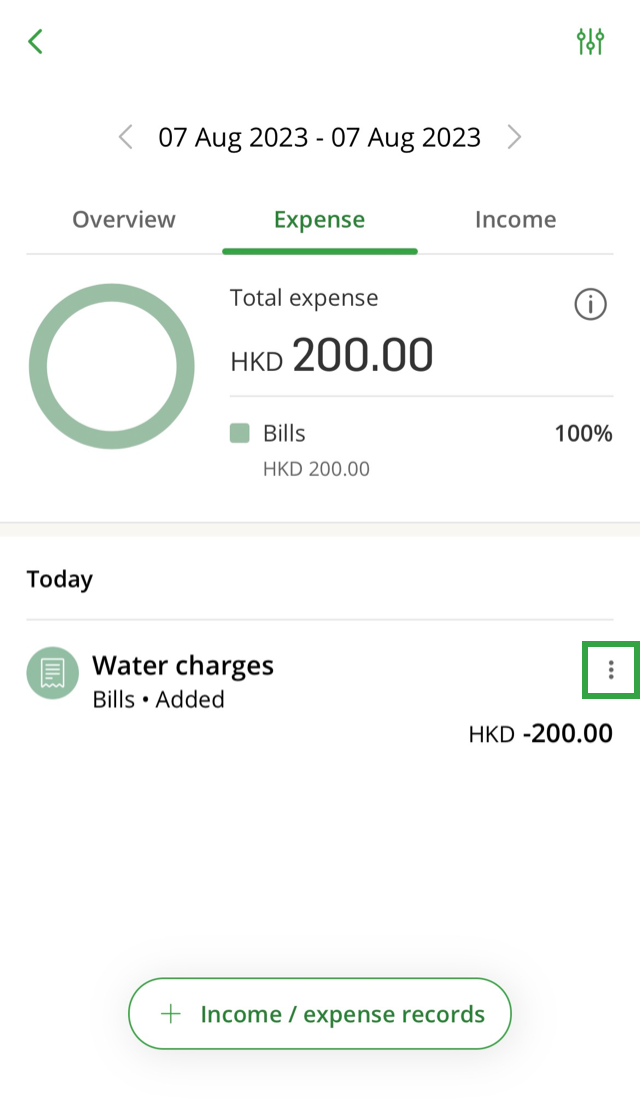

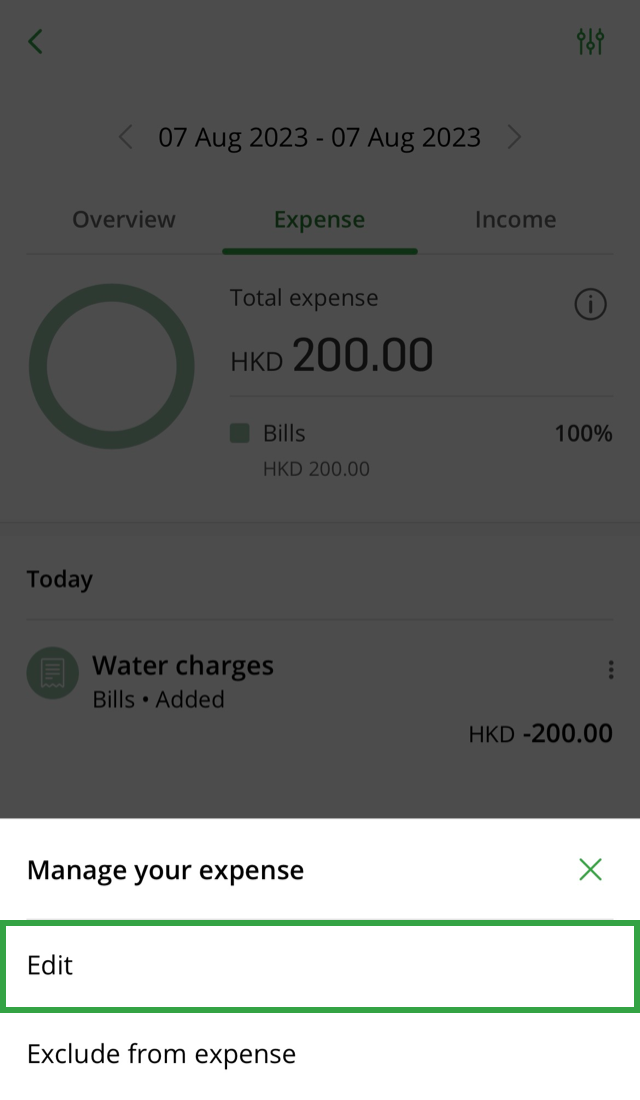

If you want Money Master to reflect your actual spending more accurately, you can edit or exclude particular expense in "Activities of the month".

If you want to revert an excluded expense, you can tap click the icon to the right of relevant record to add back to expense.

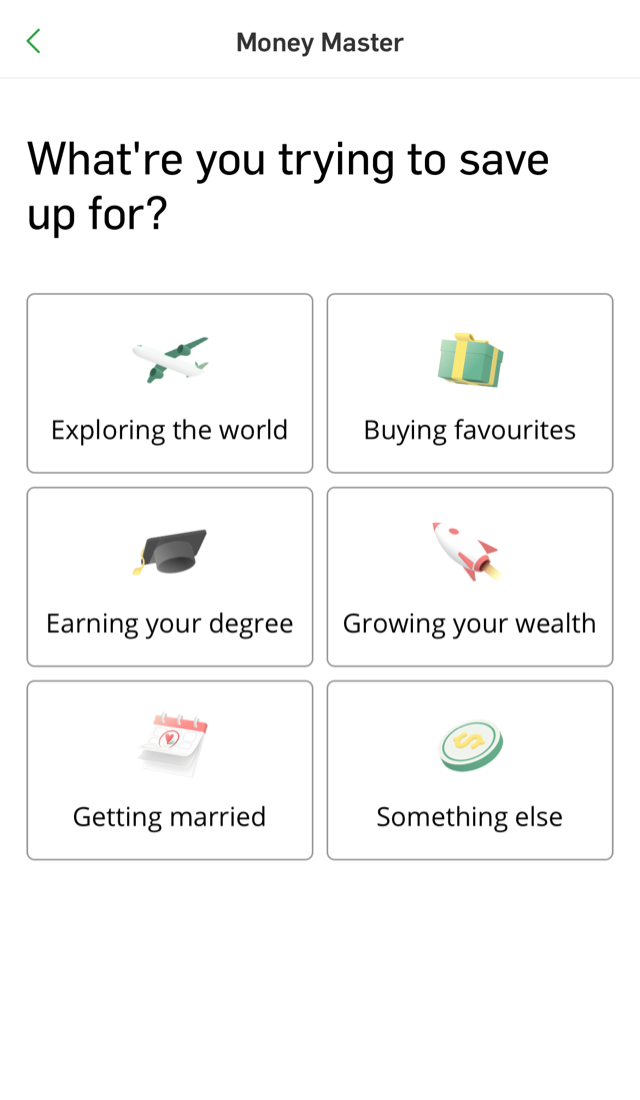

You can name your goal when setting up the savings plan.

If you want to rename your goal, simply tap "Edit" in "Your plan" page.

When setting up a savings plan, you can register for H A R O WhatsApp to receive monthly progress summary, personalised tips and off budget reminders to help you achieve your goal faster.

You can deregister all H A R O WhatsApp services anytime by entering "Manage preference" in H A R O WhatsApp.

Money Master only sends notifications via Hang Seng Mobile App and H A R O WhatsApp at the moment.

"Remaining budget" is the amount you can use after deducting monthly expense from monthly spending budget. Spending budget varies on the first day of each month of the plan because it will be adjusted according to your actual spending and progress in the previous month.

Money Master will update information such as your progress and spending budget in real time based on expenses from your Hang Seng Hong Kong Dollar accounts and credit cards accounts, as well as other income / expense records added by you.

Money Master will adjust your monthly savings goal according to your actual spending and overall progress. If you're close to overspending or already overspending, Money Master will adjust the plan to your situation so that you can still make it.

After the plan ends, Money Master will prepare a summary for you, letting you know whether you've achieved your goal and have a better understanding on your spending habits and patterns during the period.