We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Faster Payment System (FPS)[1] is a real-time online transfer and payment service platform. Register FPS now to make transfers between local banks, top up stored-value facilities (e.g. e-Wallets), pay bills and receive money from third parties, providing a round-the-clock fund transfer experience for you.

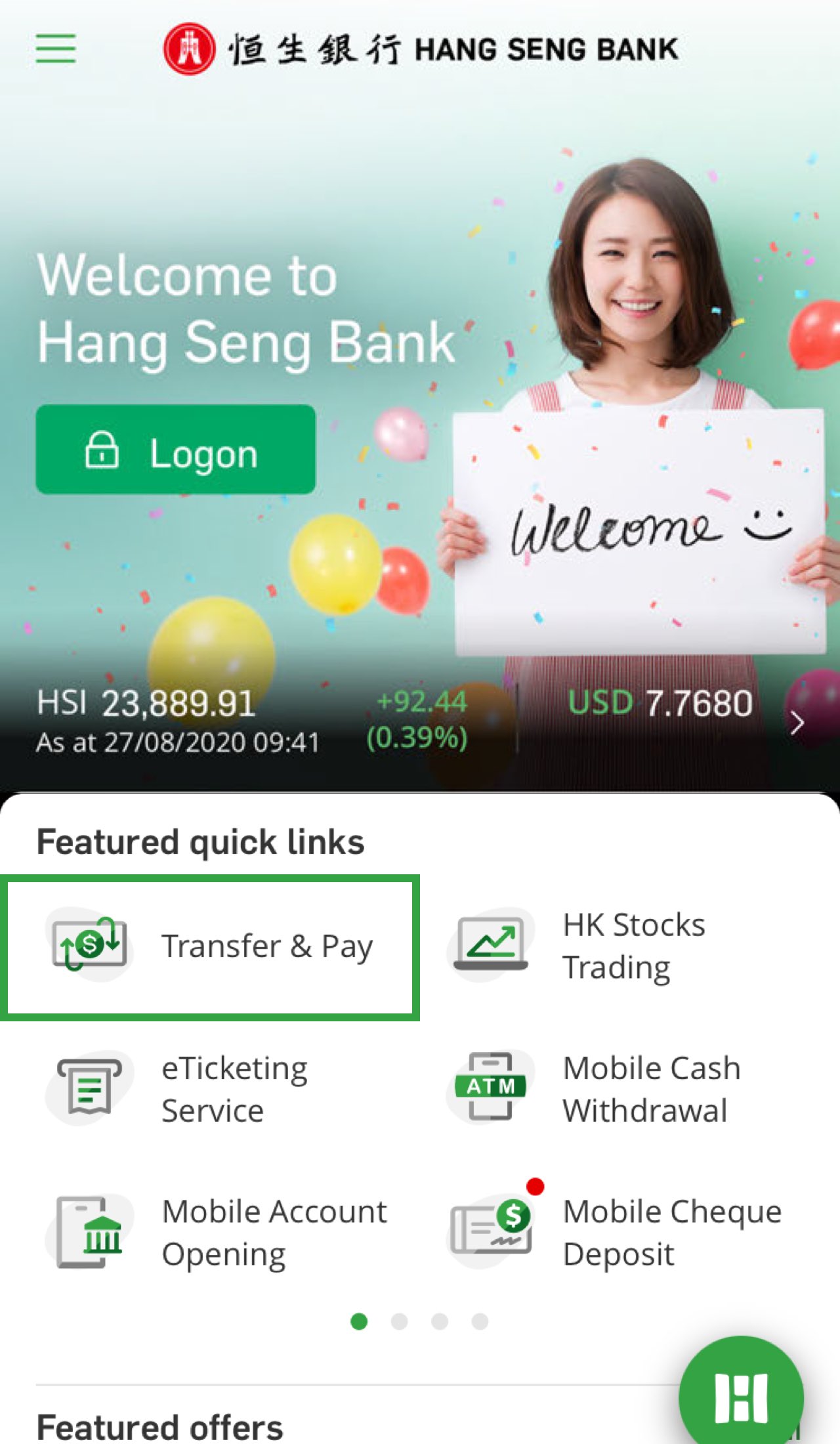

Choose multiple online transfer channels through FPS for instant[2] cross-bank transfer at no cost to match with your diverse needs. Three types of fund transfer are available to you through our e-Banking services:

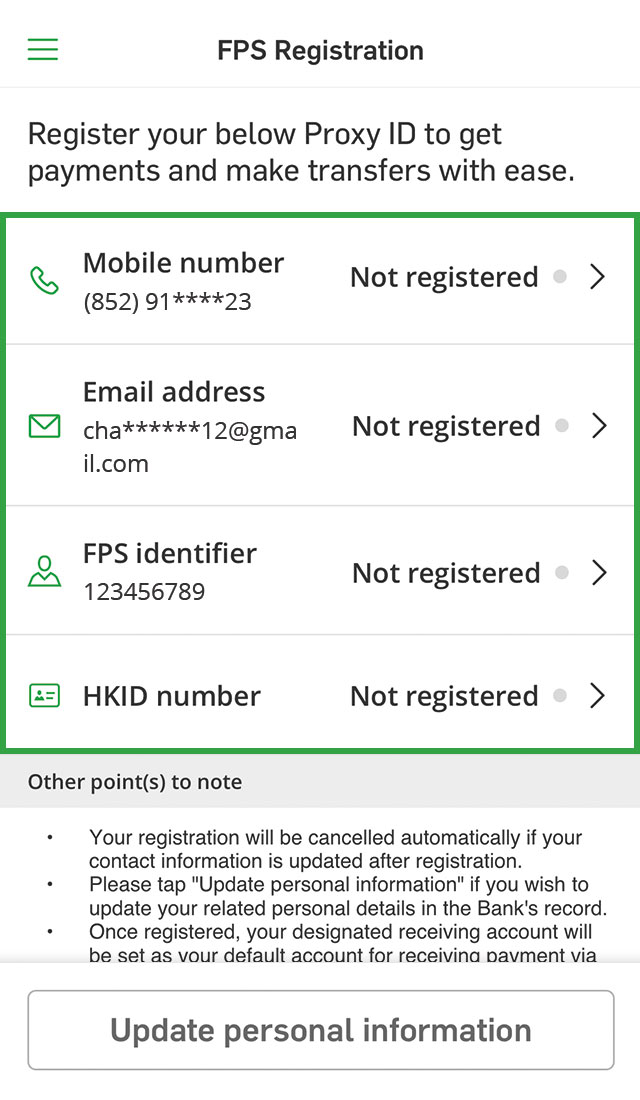

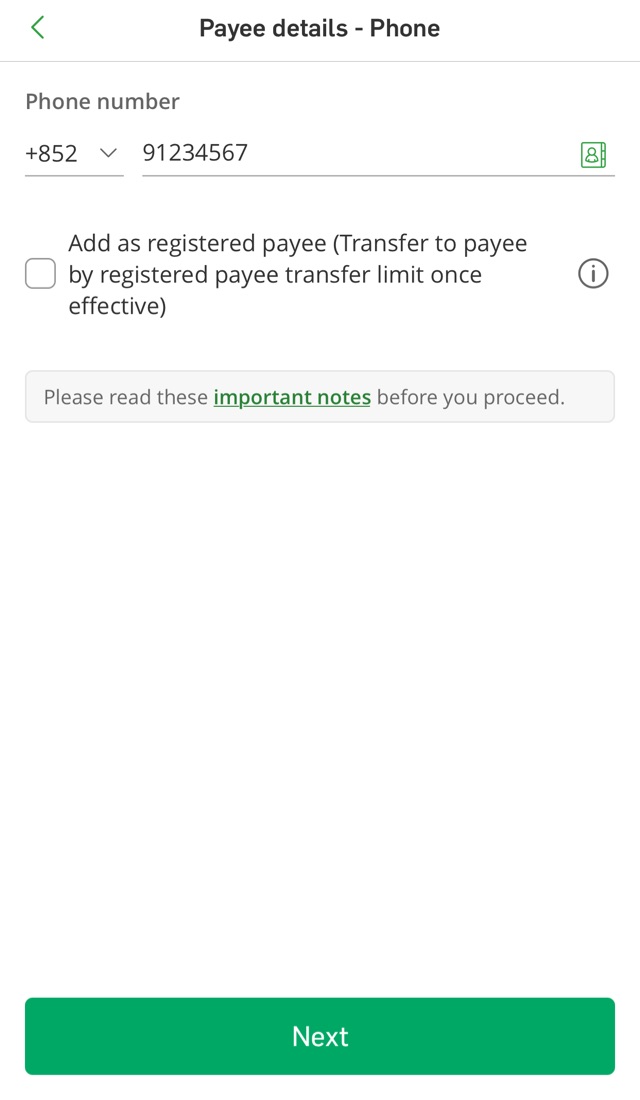

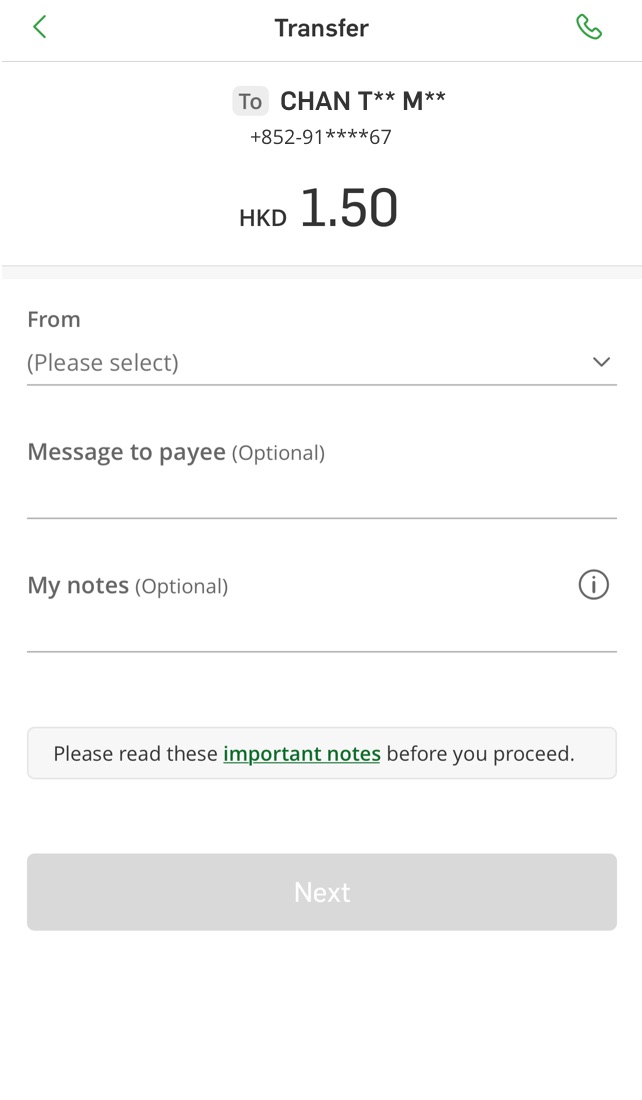

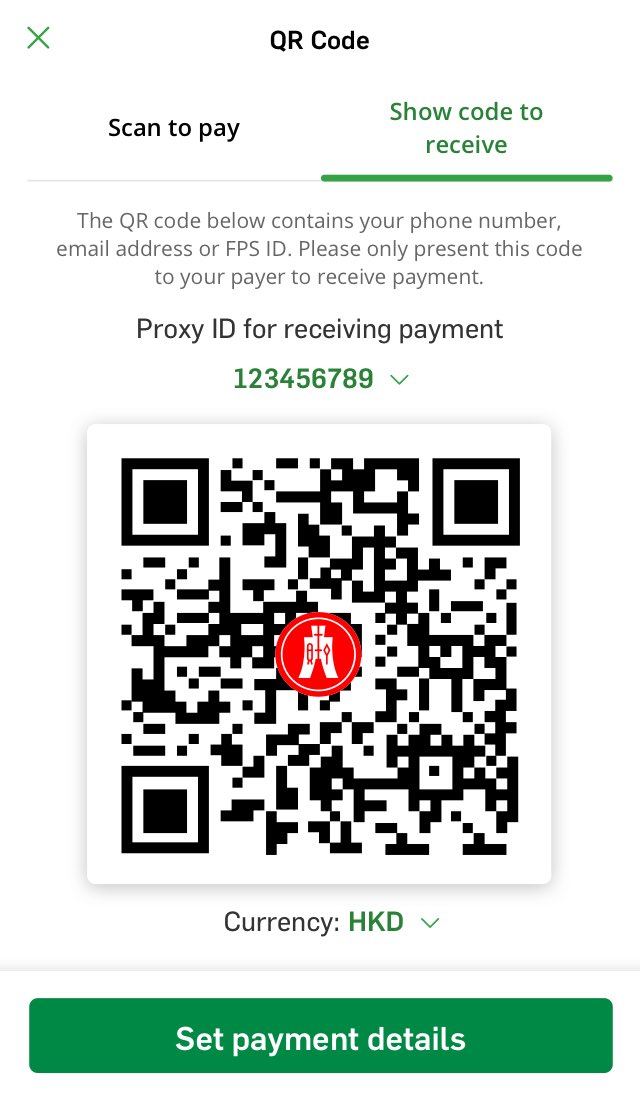

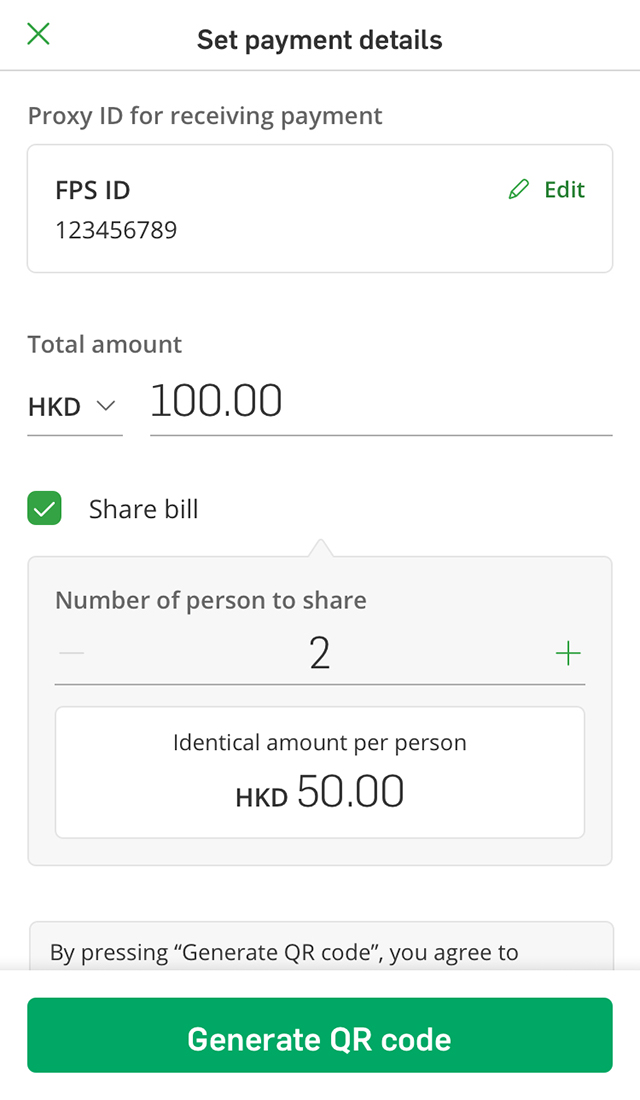

Send and receive money (in HKD and CNY) with just a phone number, email address or FPS identifier upon successful FPS registration without the need to disclose your account details to a third party.

Registering your HKID number as Proxy ID will facilitate you to receive payment and transfer from institutions, corporates and the HKSAR government.

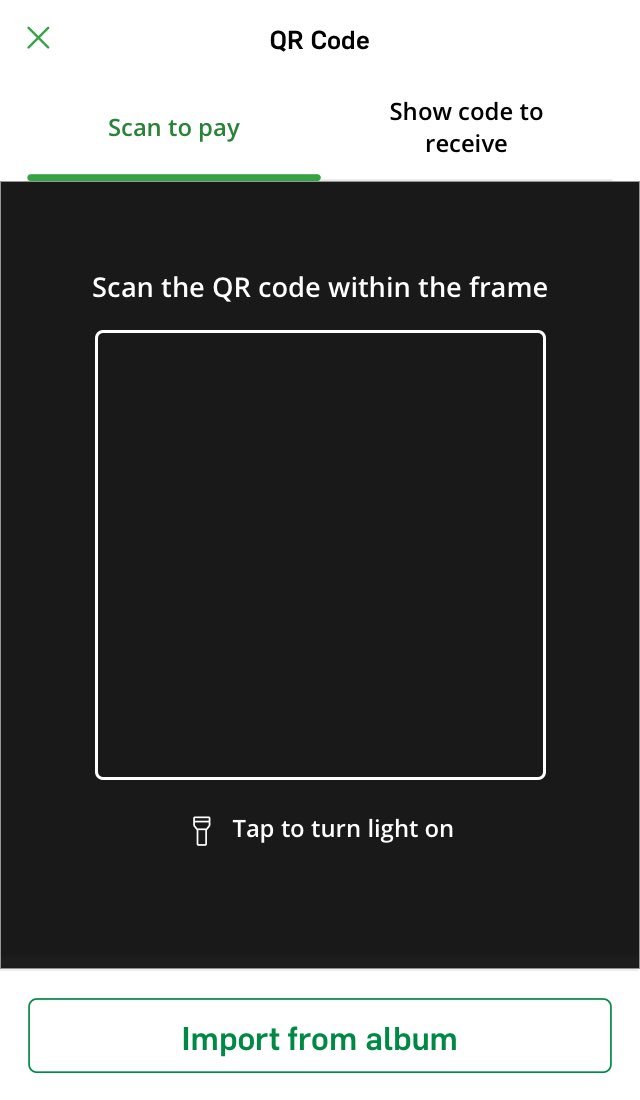

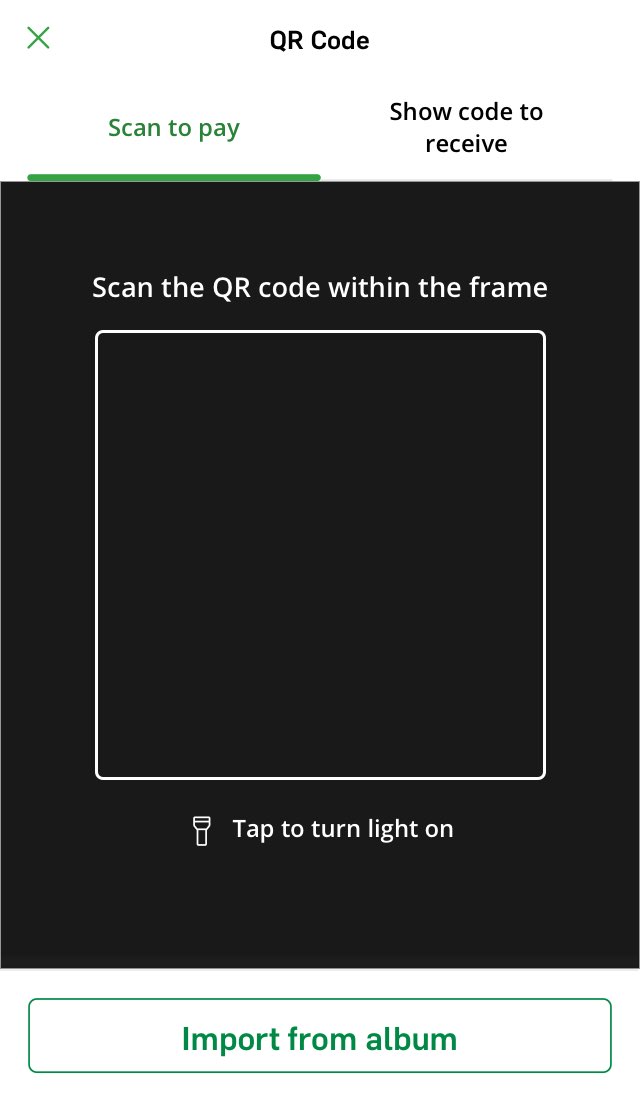

Pay bill with ease by scanning QR code without the need to select merchant and input bill reference number[3]

Make online merchant payments in a seamless journey[4]

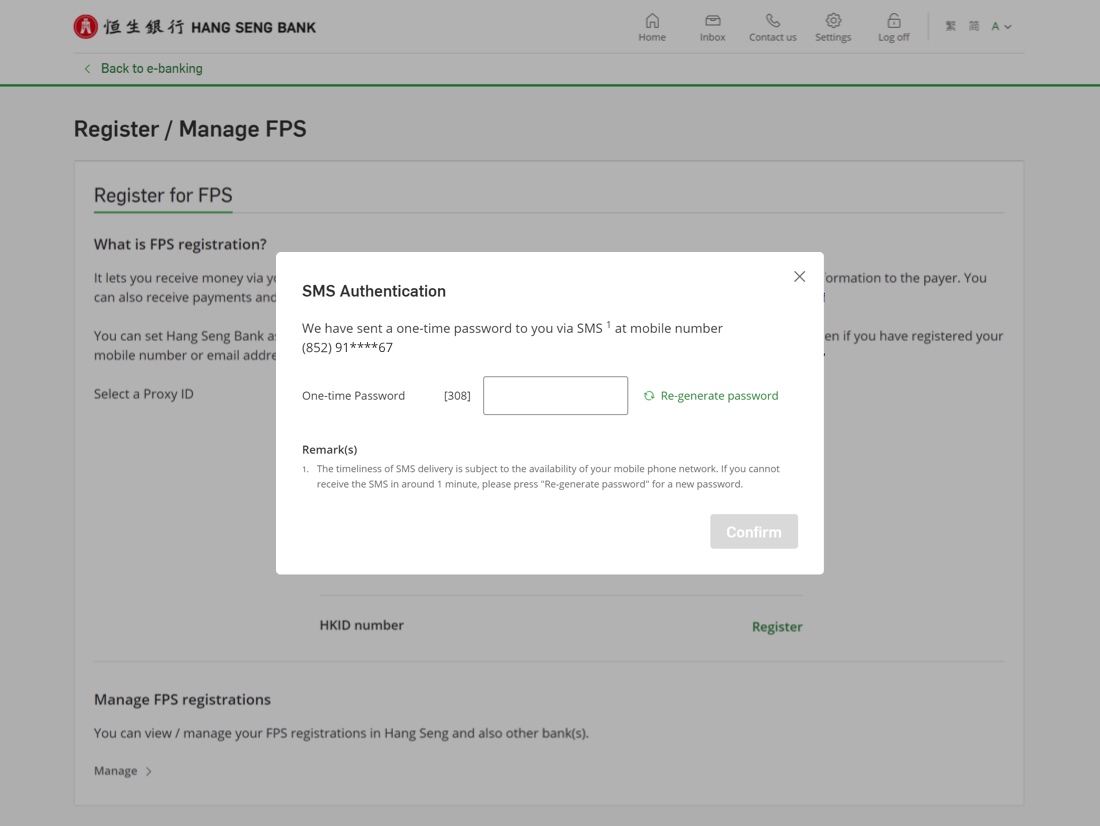

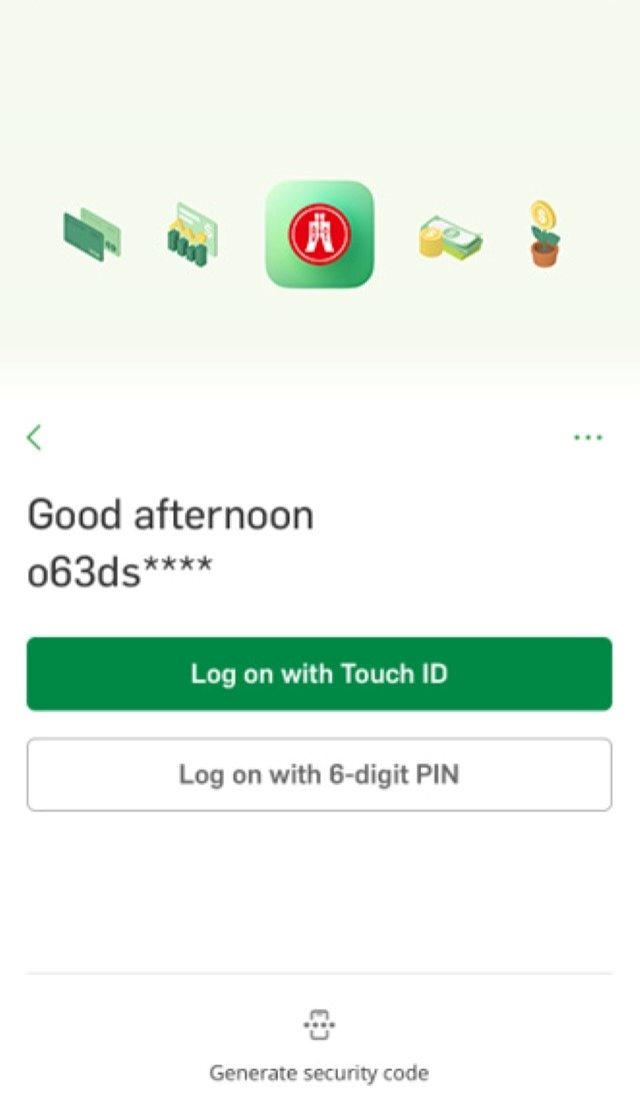

e-Banking login as first level of protection

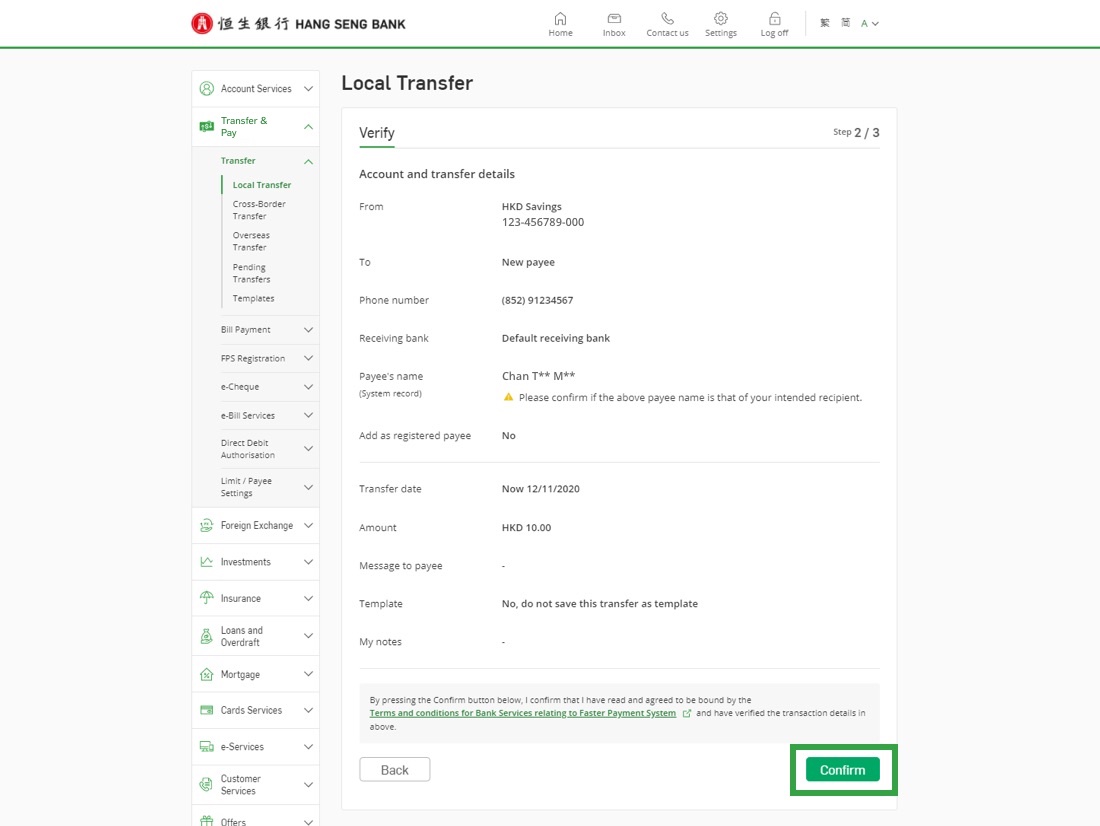

Before making any FPS transfers, customers have to log on to Personal e-Banking or Hang Seng Personal Banking mobile app ("Hang Seng Mobile App") with username and password or security code generated by Mobile Security Key / Security Device.

Two-factor authentication (2FA) for making payments to new payee

When making any FPS transfer to new payee, security device / mobile security key is needed as 2-factor authentication

Transfer amount is bound by the daily transfer limit set by the customer

Real-time email notification, push notification and/or SMS will be sent to the customers after the following FPS transactions are made:

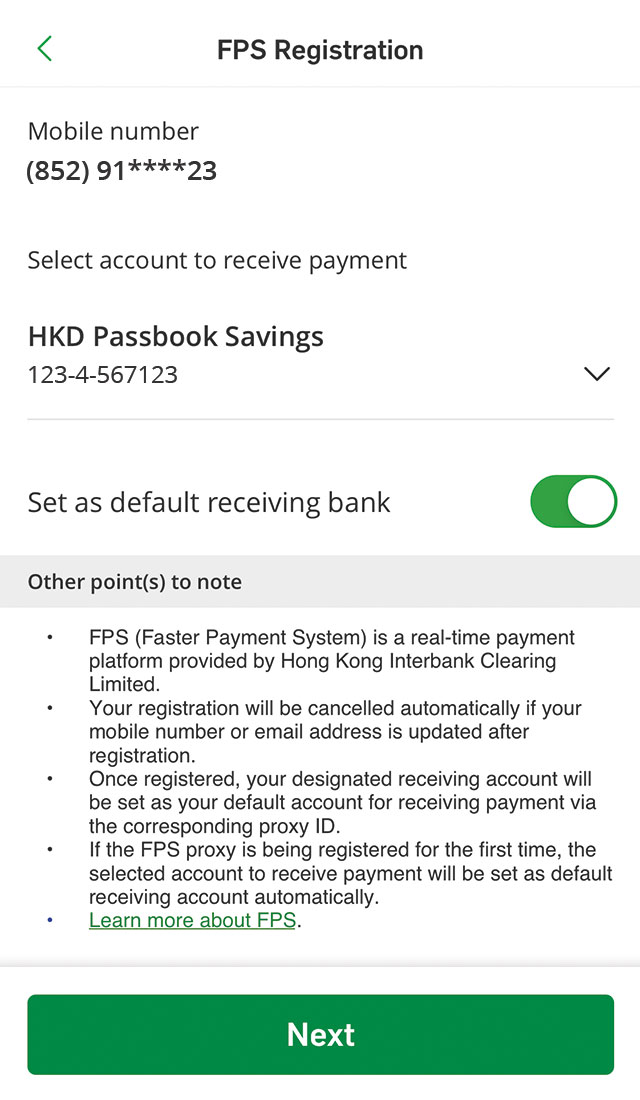

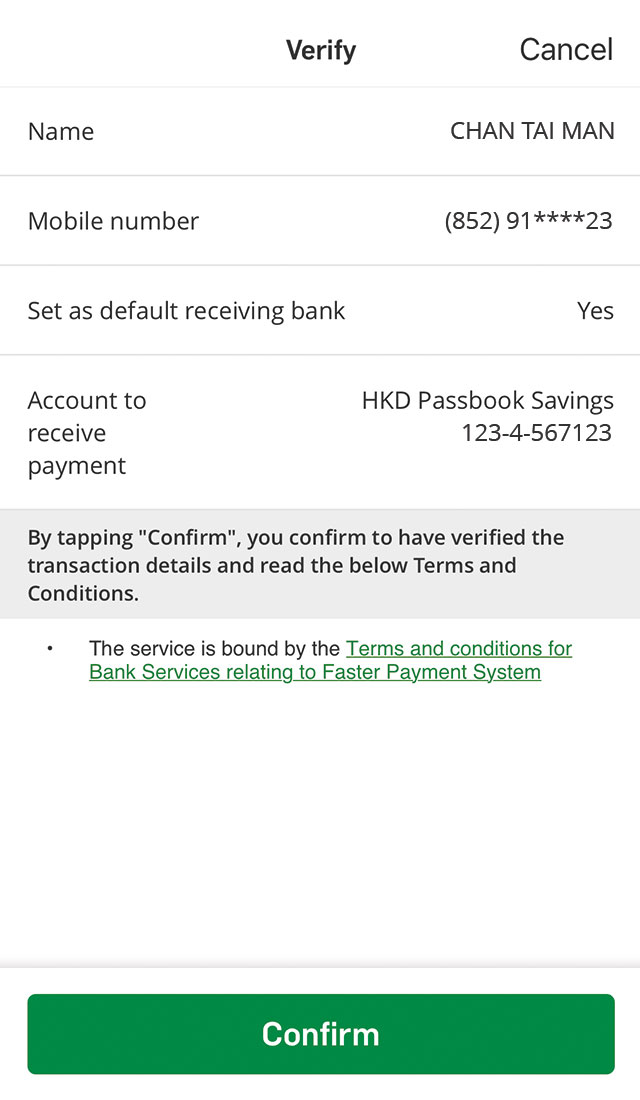

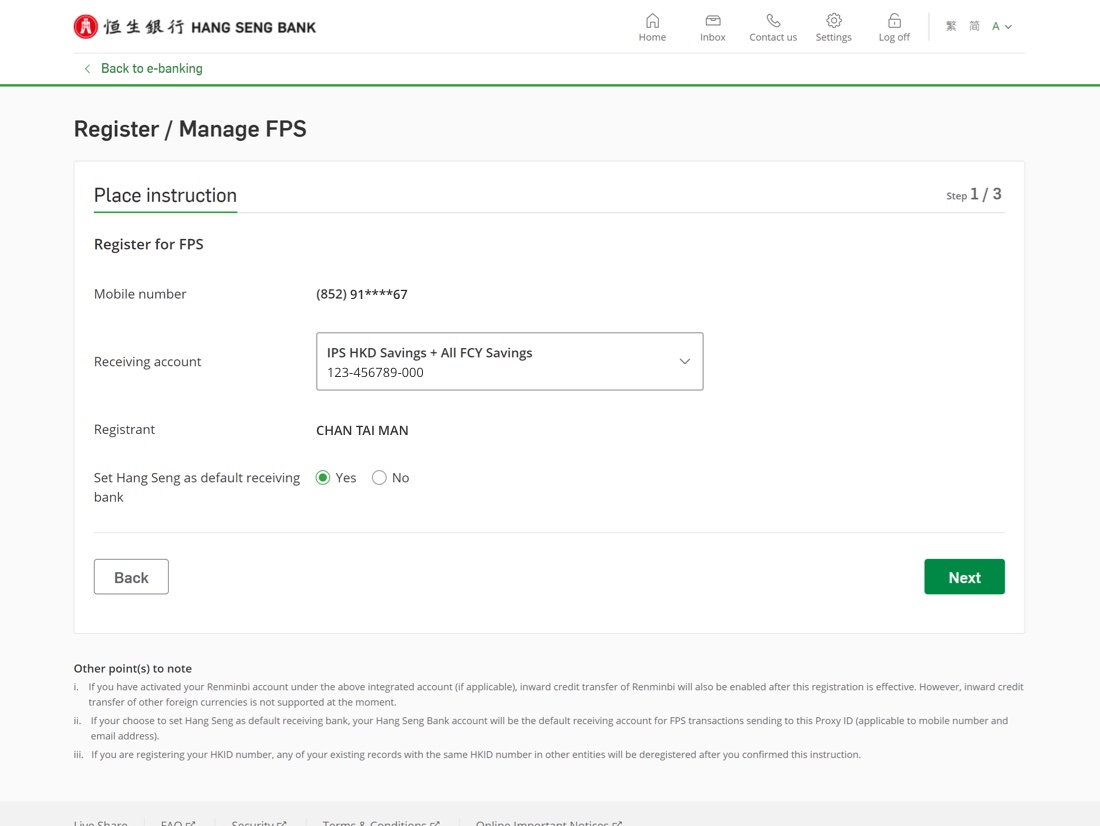

The account selected as a receiving account (can be set as default receiving account) when registering for FPS will be used to receive money via FPS.

An FPS-linked receiving account (can be set as default receiving account) can accept only a savings or current account of HKD / CNY. Please note that your HKID number cannot be linked to a joint account.

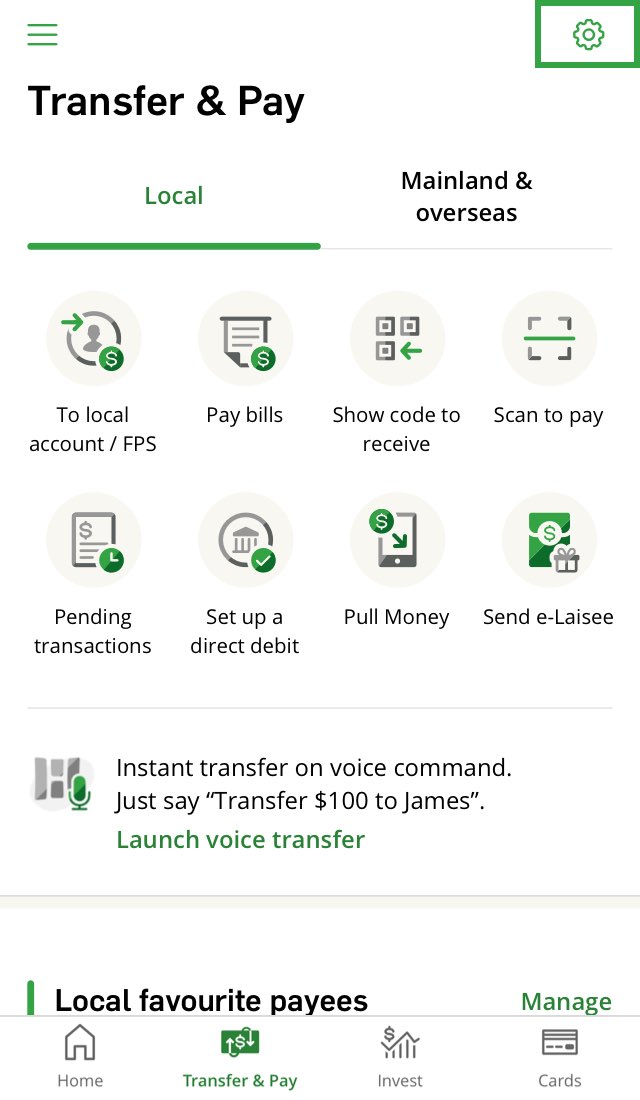

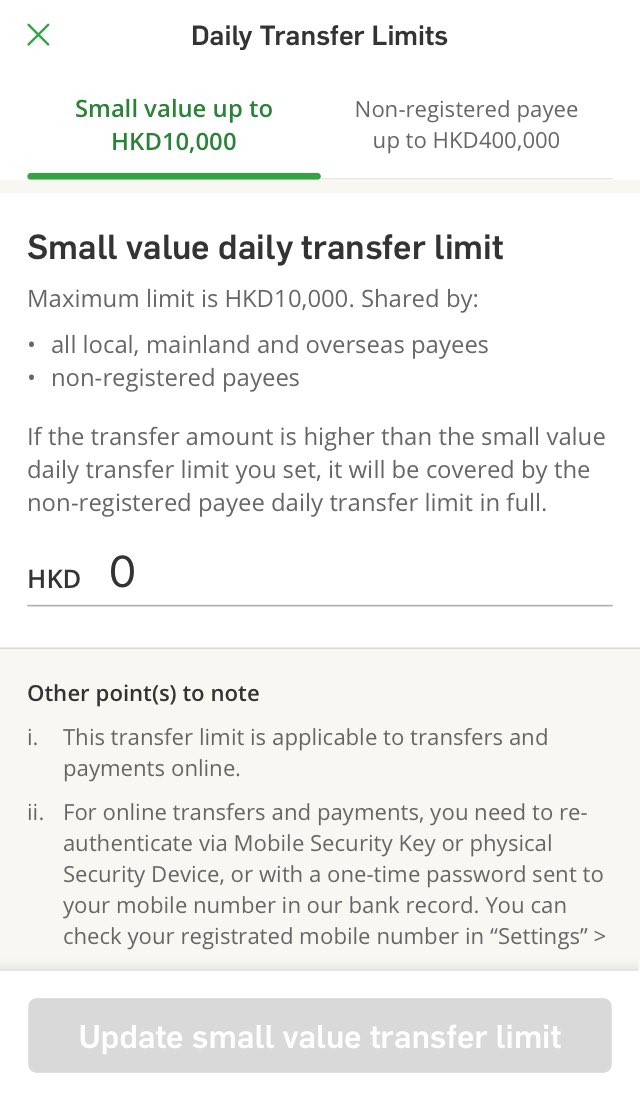

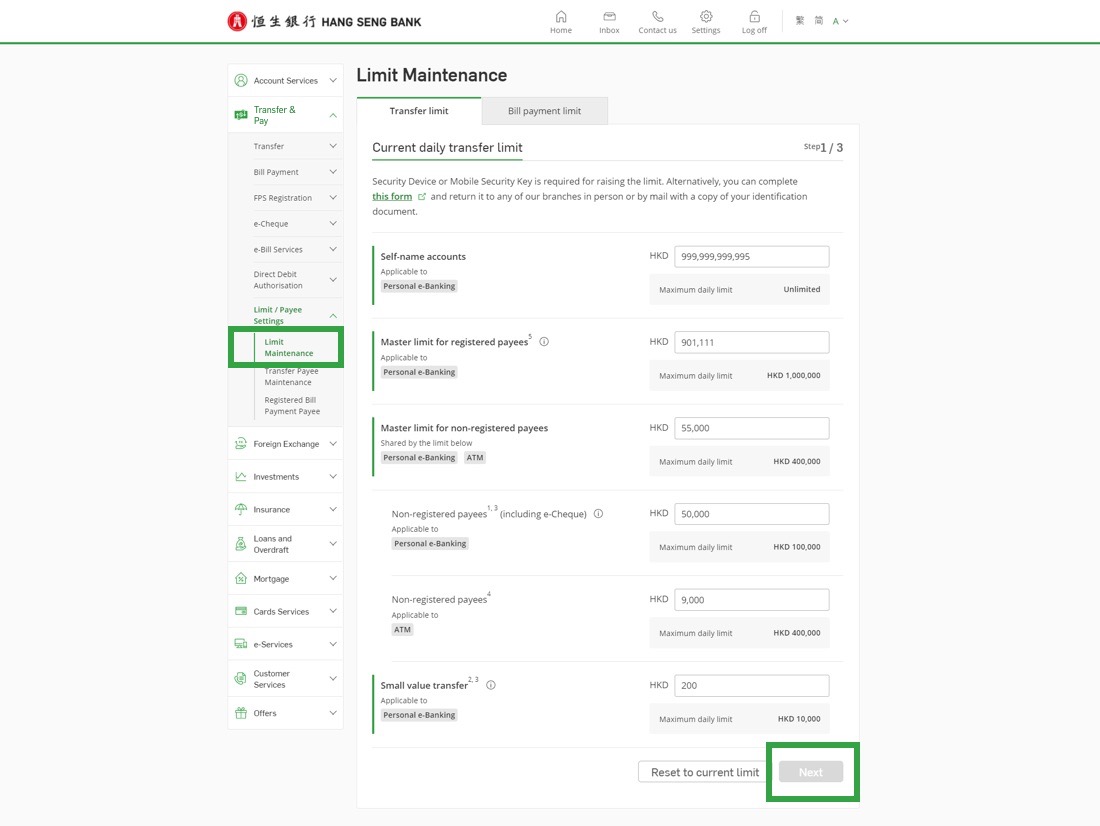

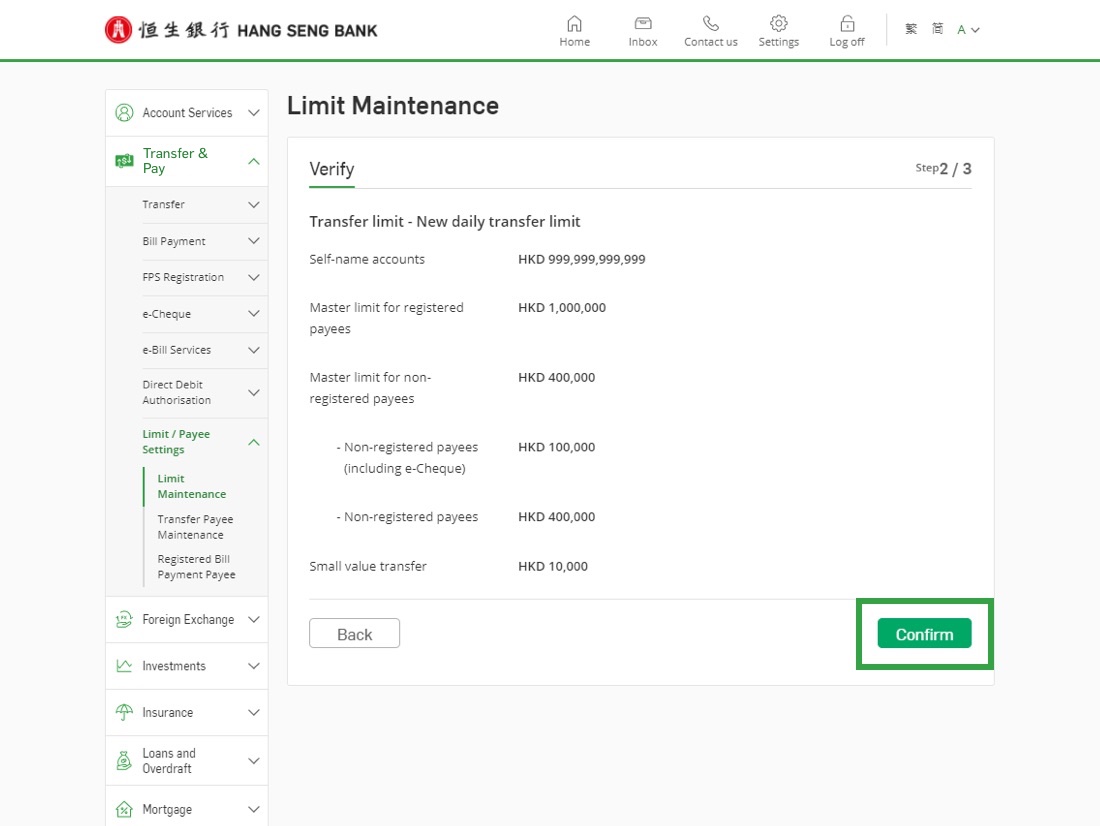

You can log on to Personal e-Banking via our website > "Settings" > "Limit Maintenance" under "Transfer and payment". Alternatively, you can log on to Hang Seng Mobile App, tap the gear icon at the top right corner of Transfer & Pay page, go to settings and choose "Set transfer & payment limits".

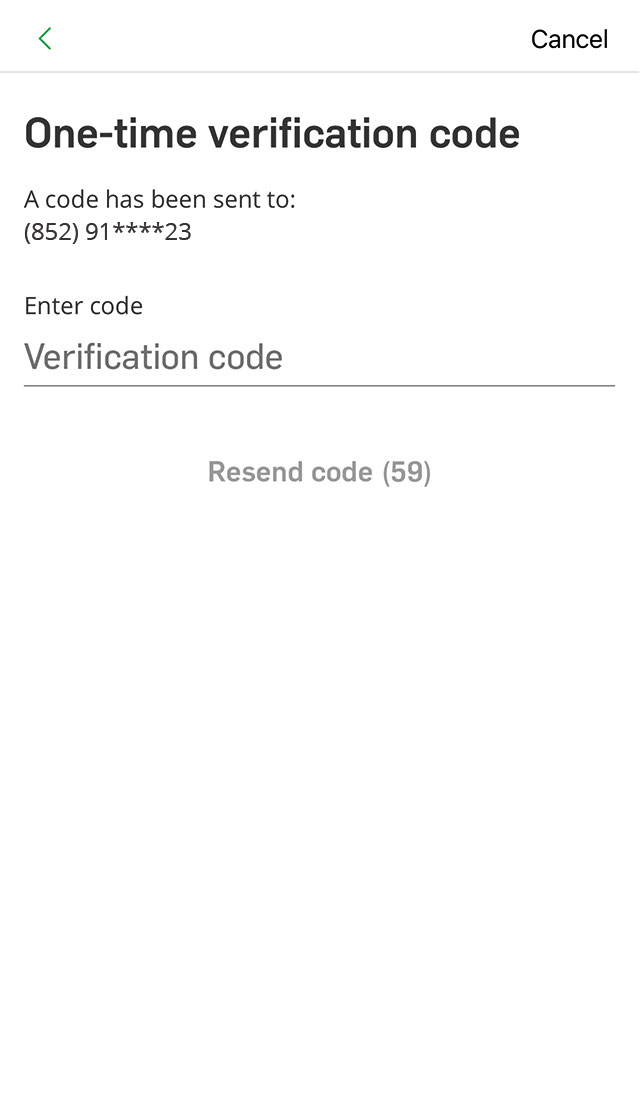

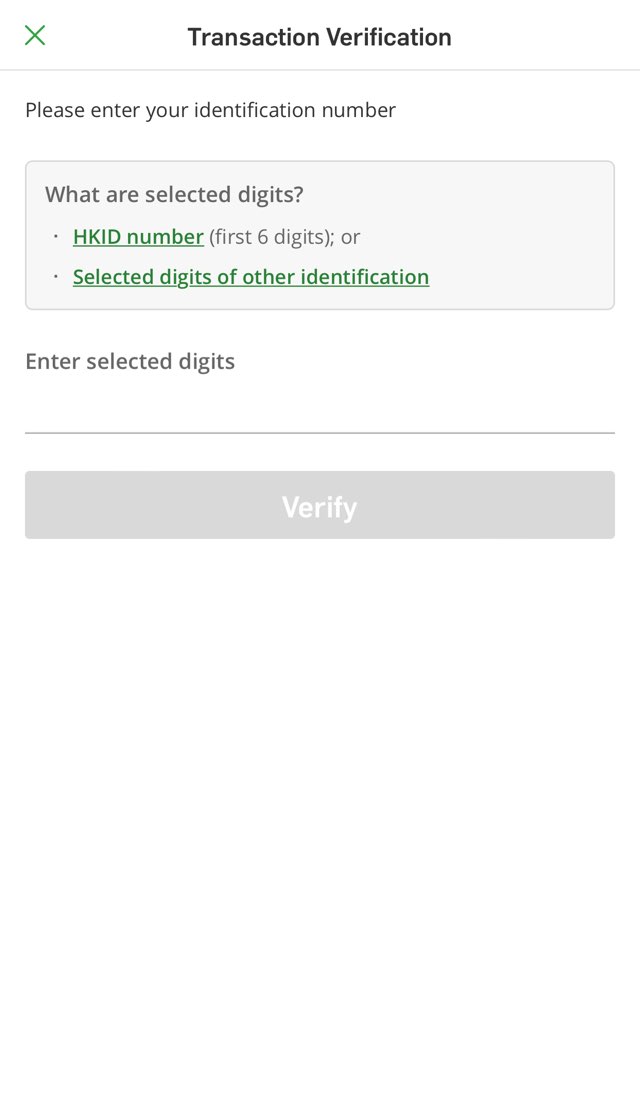

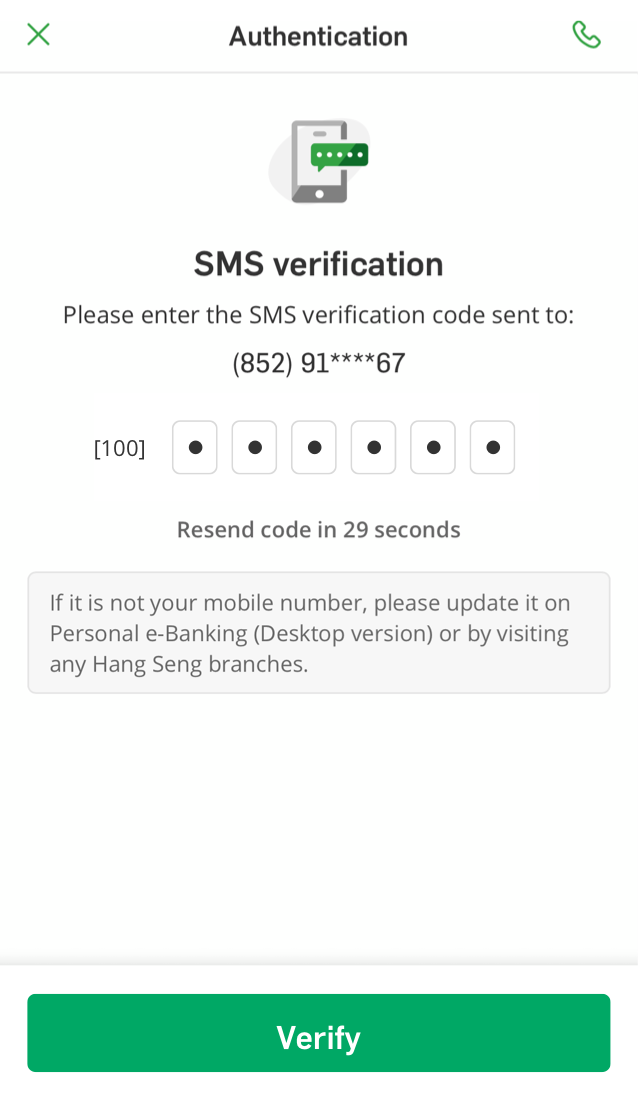

Please note, one-time security code, "6-digit PIN" or biometric authentication will be used for verifying your identity. You also need to maintain a valid mobile number in our record for raising the transfer limit. After successful authentication, the instruction will take effect immediately.

Yes, you can transfer to a Credit Card Account in other local banks using the transfer service under Transfer & Pay.

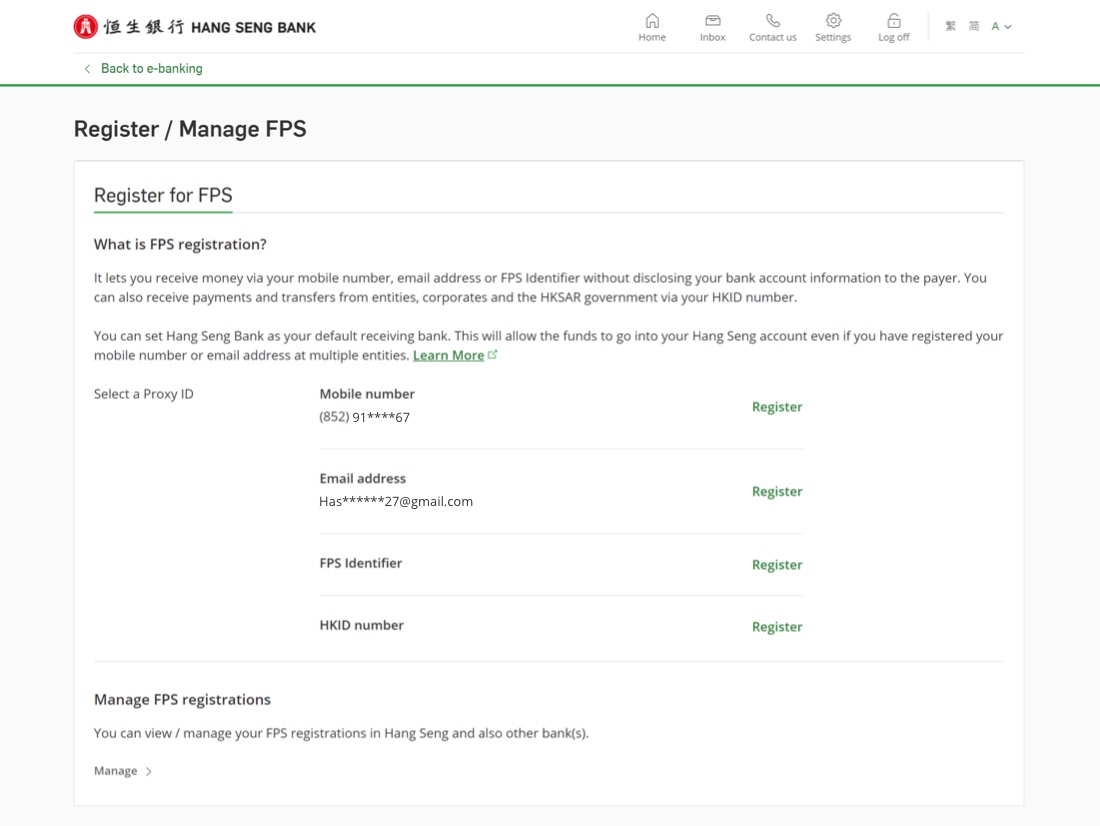

Any Personal e-Banking customer with a HKD / RMB deposit account is eligible for FPS registration. A valid phone number or email address in our bank record is also required if you register for receiving money with phone number and email address.

The account selected as a receiving account (can be set as default receiving account) when registering for FPS will be used to receive money via FPS.

As long as the CNY savings sub-account of your linked receiving account (can be set as default receiving account) is activated, the proxy ID linked to your receiving account can receive both HKD and CNY FPS payments.

An FPS-linked receiving account (can be set as default receiving account) can accept only a savings or current account of HKD / CNY. Please note that your HKID number cannot be linked to a joint account.

It is currently free of charge for FPS registration and inward / outward payment transaction.

Yes, but if the same phone number or email address is registered at multiple banks or stored-value facility (SVF) operators, you must designate one of the banks or SVF operators as your default receiving bank.

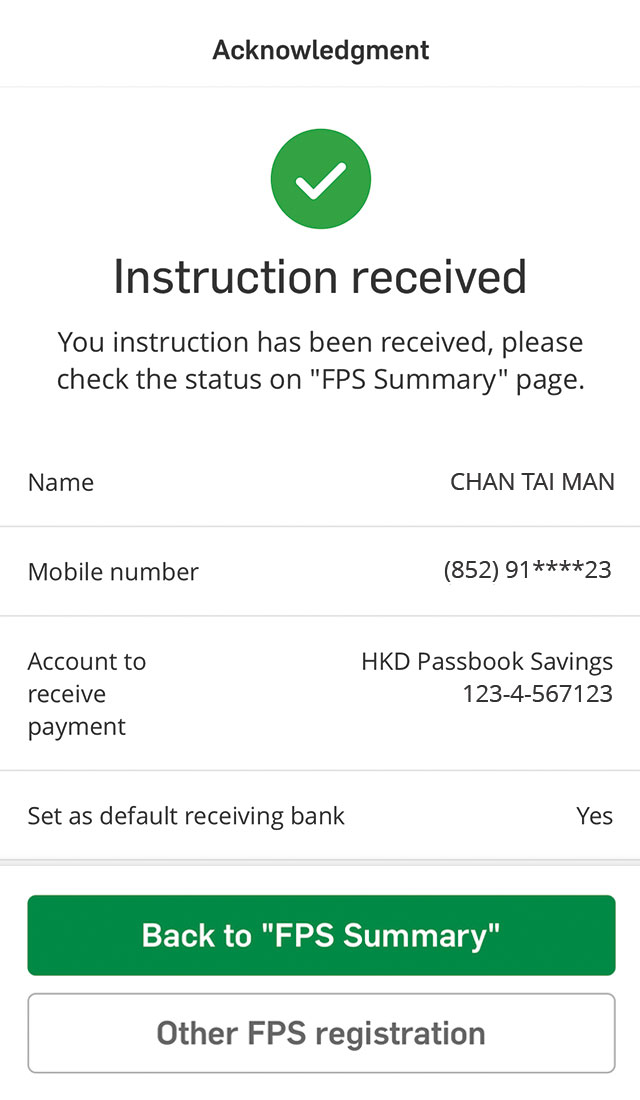

In general, FPS will be effective in a few seconds after registration, you can access “FPS Registration” in Personal e-Banking to check the registration status.

Each customer can register up to 4 proxy IDs, including a phone number, email address, FPS identifier and HKID number. Each proxy ID can be linked to just one FPS receiving account number.

You may use both Hong Kong and overseas phone numbers for FPS registration.

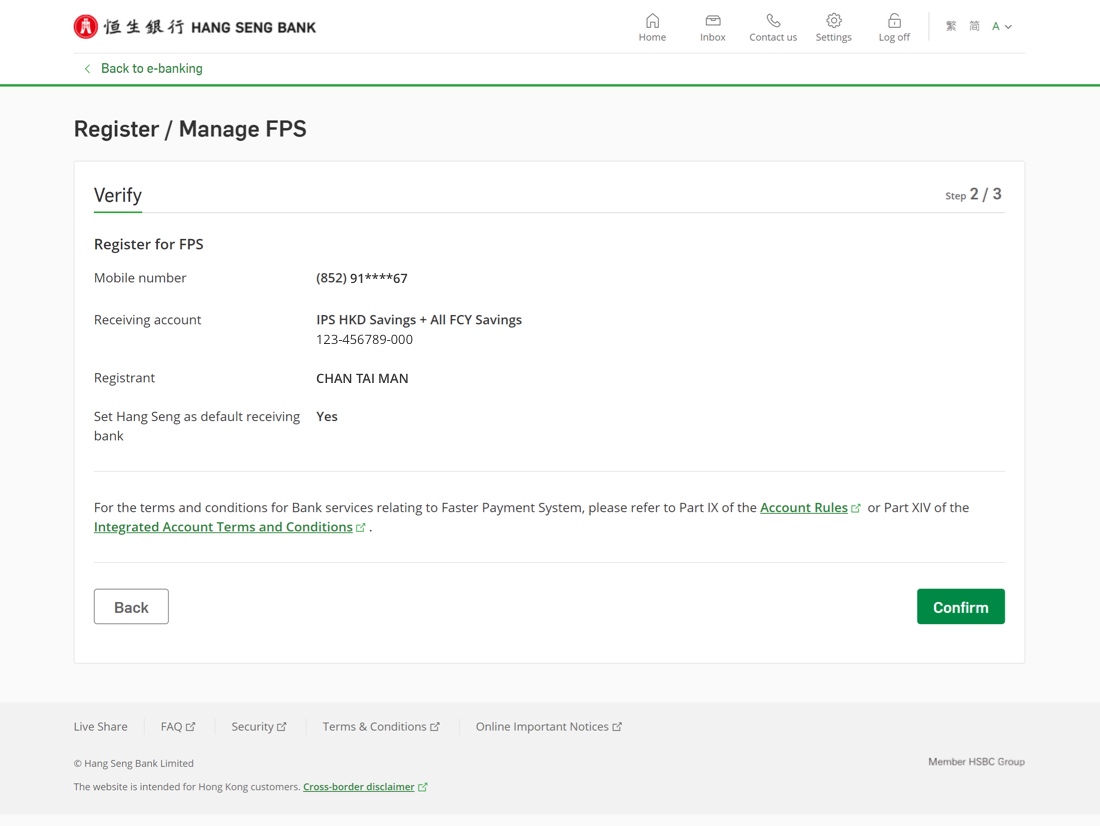

You can log on to Personal e-Banking via our website > "Settings" > "Register / Manage FPS" under "Transfer and payment". Alternatively, you can log on to Hang Seng Mobile App and tap "Settings & Security" in left menu > "Transfer & Pay" > "Register / manage FPS" under "Others" to deregister.

If you've set Hang Seng Bank as your default receiving bank, after the deregistration, the most recent bank registered with the same proxy ID will replace it as the default receiving bank.

If you have an activated physical Security Device or Mobile Security Key, you may update your phone number or email address via the following 2 methods, information will be updated instantly:

Once you have updated your phone number or email address in our bank record, the registration of old phone number or email address will be automatically cancelled by system in the next working day and you need to register for FPS with the new phone number or email address again.

Before making any transfers to registered / new payee(s) via FPS, you will need to set up relevant FPS transfer limit(s).

To set the limit, you may access via Hang Seng Personal e-Banking (Desktop version) or Personal Banking mobile app. For details, please refer to a step-by step guide in the "Transfer limit and send money" section.

The maximum daily transfer limits are as follows:

| Transaction Type | Channel | Maximum Daily Limit (HKD) |

|---|---|---|

| Self-name accounts | Personal e-Banking | Unlimited |

| Master limit for registered payees | Personal e-Banking | 1,500,000 |

| Master limit for non-registered payees | Personal e-Banking and ATM | 400,000 |

| Non-registered payees (including e-Cheque) | Personal e-Banking | 400,000 |

| Non-registered payees | ATM | 400,000 |

| Small value transfer | Personal e-Banking | 10,000 |

You can log on to Personal e-Banking via our website > "Settings" > "Limit Maintenance" under "Transfer and payment". Alternatively, you can log on to Hang Seng Mobile App, tap the gear icon at the top right corner of Transfer & Pay page, go to settings and choose "Set transfer & payment limits".

Please note, one-time security code, "6-digit PIN" or biometric authentication will be used for verifying your identity. You also need to maintain a valid mobile number in our record for raising the transfer limit. After successful authentication, the instruction will take effect immediately.

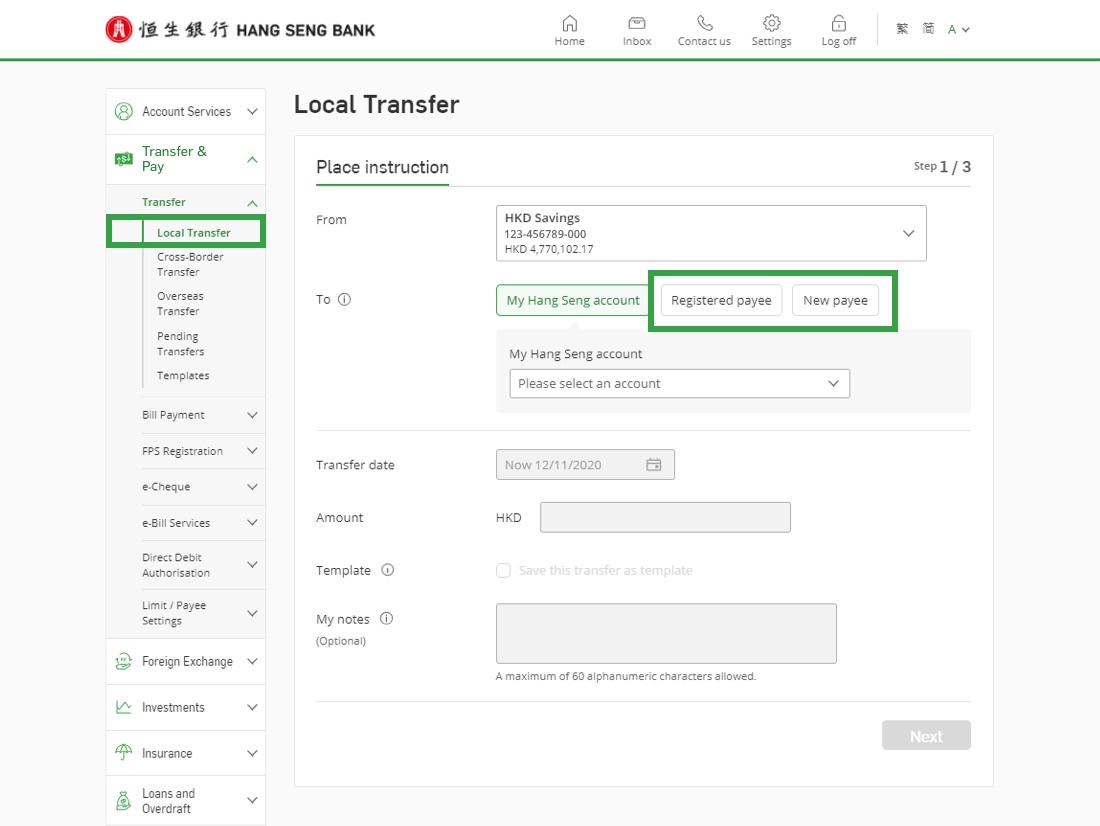

Yes, you can log on to Personal e-Banking via our website > "Transfer & Pay" > "Transfer" > "Local transfer". Alternatively, you can log on to Hang Seng Mobile App, tap "Transfer & Pay" > "To local account / FPS" under "Local" tab to transfer to a credit card account in other local banks.

Provided the receiving bank is a participant of FPS, payments are usually available almost instantly. But it is also subject to the running mode of receiving Bank.

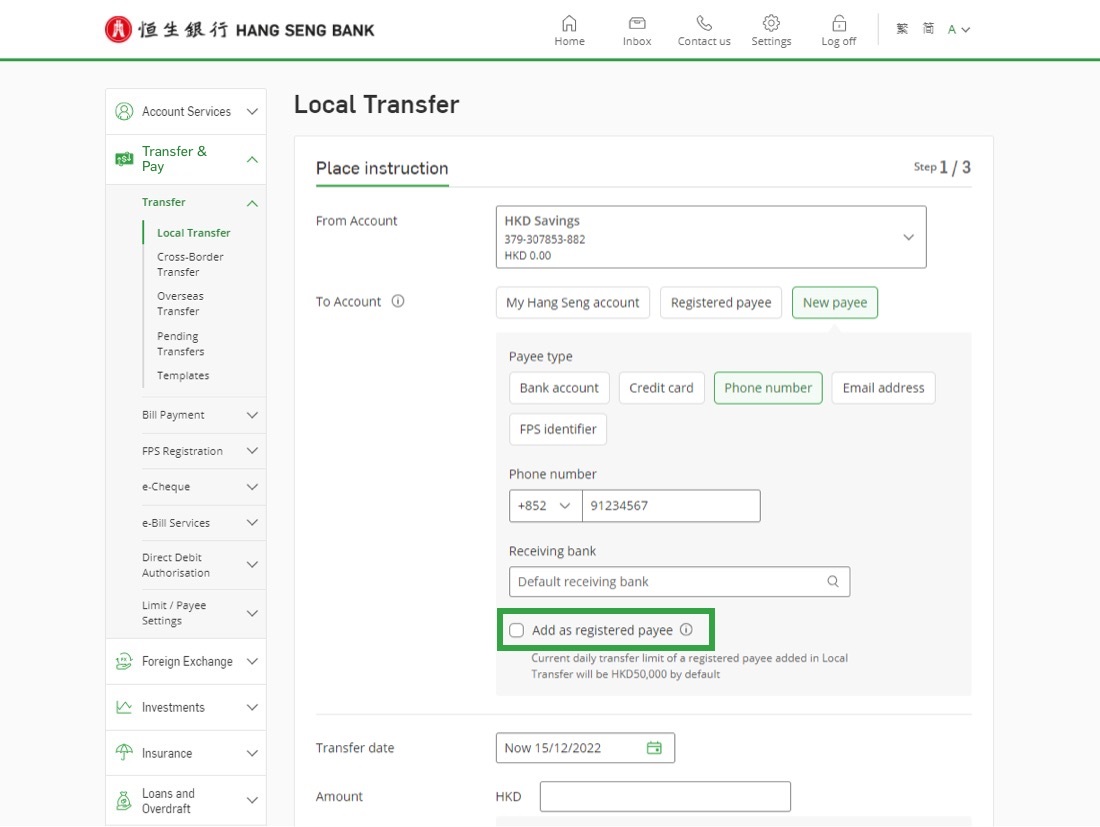

To transfer to a new payee, you need to maintain a valid phone number in our bank record, and activated non-registered payees transfer or small value transfer daily limit. If you wish to transfer by using non-registered payees transfer daily limit, you need to activate your Security Device / Mobile Security Key in order to complete the transaction verification. In general, if the receiving bank is a participant of FPS, the transfer can be instantly settled. However, it still depends on the specific settlement time of different receiving bank.

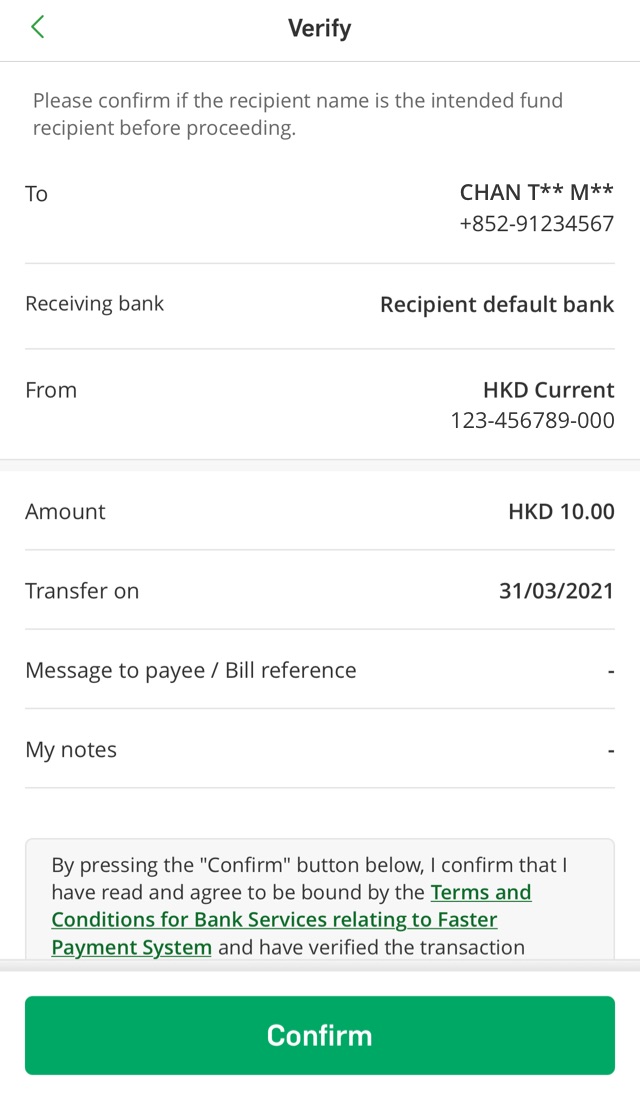

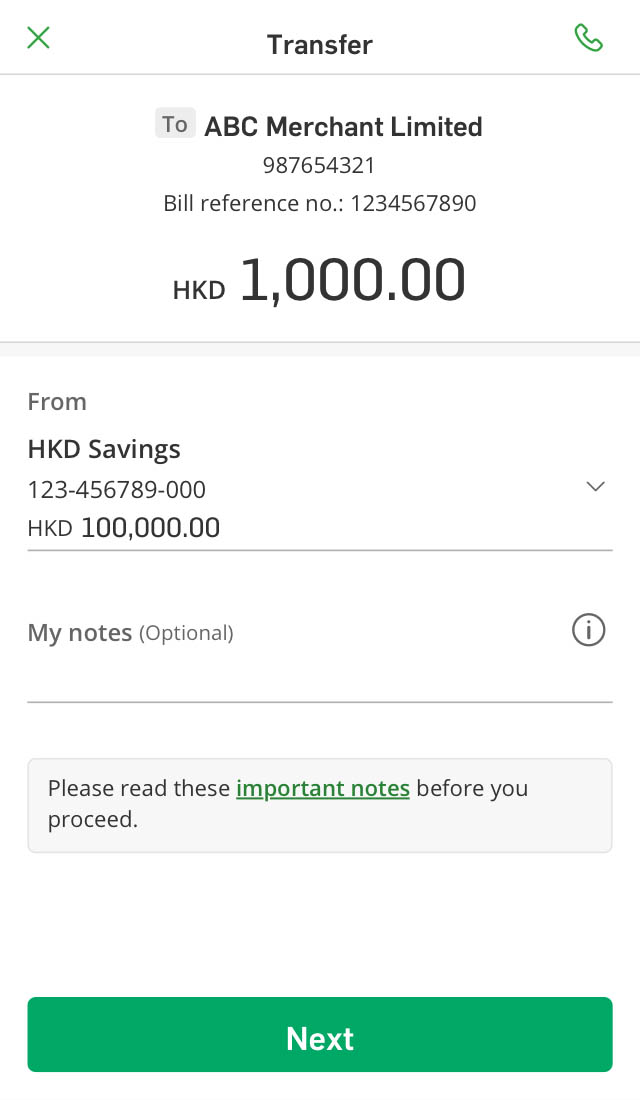

You are not able to stop the instruction once the FPS transfer has come into effect. So when making a real-time fund transfer through FPS, you should carefully verify the payment details, including the payee’s name and account number.

If it is an instant FPS transfer, once the instruction is placed and processed, you are not able to reverse or cancel the instruction.

Before confirming a transfer or deposit of funds to a third party in Hong Kong, you are advised to verify the account number / phone number / email address / FPS identifier and partially-masked name (if available) of the payee carefully to avoid mis-transfer of fund. After giving the instruction, you are advised to check with the payee to confirm the receipt of fund. If you find the fund was mis-transferred to a third-party account, please report to our bank at the earliest convenience. We will assist you to contact the payee to return the funds on condition that all required information is received by us.

If you have received funds which a transferer sent by mistake, you should contact us to arrange the return of fund to the transferer at the earliest convenience. The fund will be returned via our bank. Customers could be criminally liable if they refuse to return the fund to the transferer.

For any enquiries, please contact the Hang Seng Bank’s Customer Service Hotline at (852) 2822 0228.

You can also transfer to other bank credit cards without registration required.

In general, if the payer's bank is a participant of FPS, the transfer can be instantly settled. However, it still depends on the specific settlement time of different payer bank. Please contact the payer to confirm correct transaction details is being sent, or contact our Customer Services Hotline at (852) 2822 0228 for enquiry.

When you make a real-time transfer over HKD1,000 via FPS, the beneficiary bank may perform checks on the payee name. If the payee name and account number don't match the beneficiary's bank records, the payment will be rejected. For other not real-time transfer below HK$1,000, beneficiary bank may not conduct name matching on the payee name. Please verify the payee's name and other payment details carefully to ensure the transfer is for the intended payee. Once the payment is completed, you may not be able to cancel the transaction.

It is because the FPS Proxy ID (phone number / email address / FPS ID) / bank account number / SVF account number is identified as being related to scam report and listed as "High Risk" by the Hong Kong Police Force.

You can still continue with the transfer, but it's necessary to verify the payment details and make sure the payee is trustworthy before each transfer.

If you believe the alert is not correct, please contact Hong Kong Police Force by sending an email to enquiry@cyberdefender.hk.

You will only see the alert when the FPS Proxy ID (phone number / email address / FPS ID) / bank account number / SVF account number is identified as being related to scam report and listed as "High Risk" by the Hong Kong Police Force.

However, it does not guarantee the transfer is completely safe even without the alert. That's why it's necessary for you to verify the payment details and make sure the payee is trustworthy before each transfer.

Currently, FPS supports transfers in HKD and CNY only. Local foreign currency transfer via Hang Seng Mobile App supports transfers of 12 foreign currencies to other local banks , including AUD, CAD, CHF, CNY, EUR, GBP, JPY, NZD, SGD, THB, USD and ZAR. Please log on Hang Seng Mobile App and go to "Transfer & Pay" > "Local" > "To local account / FPS".

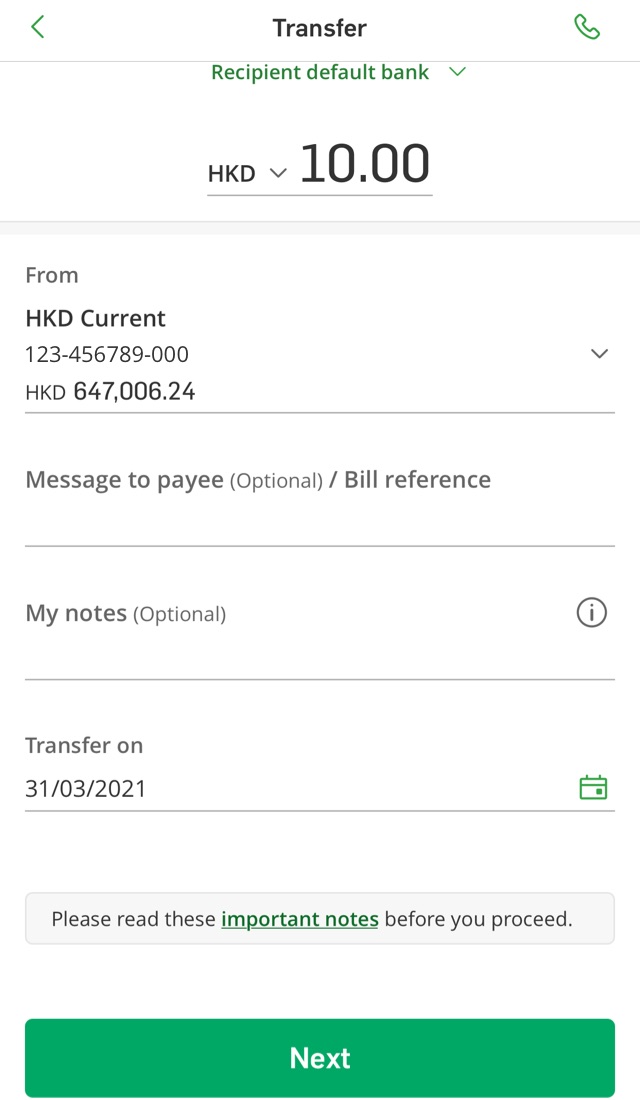

You may make your pending instructions 45 calendar days ahead for transfers to other bank accounts in Hong Kong. Please note that Sundays and public holidays will be unavailable for pending instructions to Hang Seng Accounts.

Yes, you may make amendments to all your pending transfers online anytime before the effective date of the transfers using Hang Seng Mobile App.

If you are using Personal e-Banking (Desktop version), you can delete the existing instruction and create a new one.

It is not necessary to have sufficient fund in your account when you make a pending transfer. However, your instruction will be rejected if there is insufficient fund in your account on the effective date of the transfer.

You can send e-Laisee to your friends and relatives with phone number, email or FPS ID registered for FPS.

No. Send e-Laisee service only supports personal FPS proxy.

Send e-Laisee service only supports instant transfer, and allows you to select festive theme and customise greetings. After successful transfer, you can also share the festive image to your friends and relatives via social medias, and send the same e-Laisee to others.

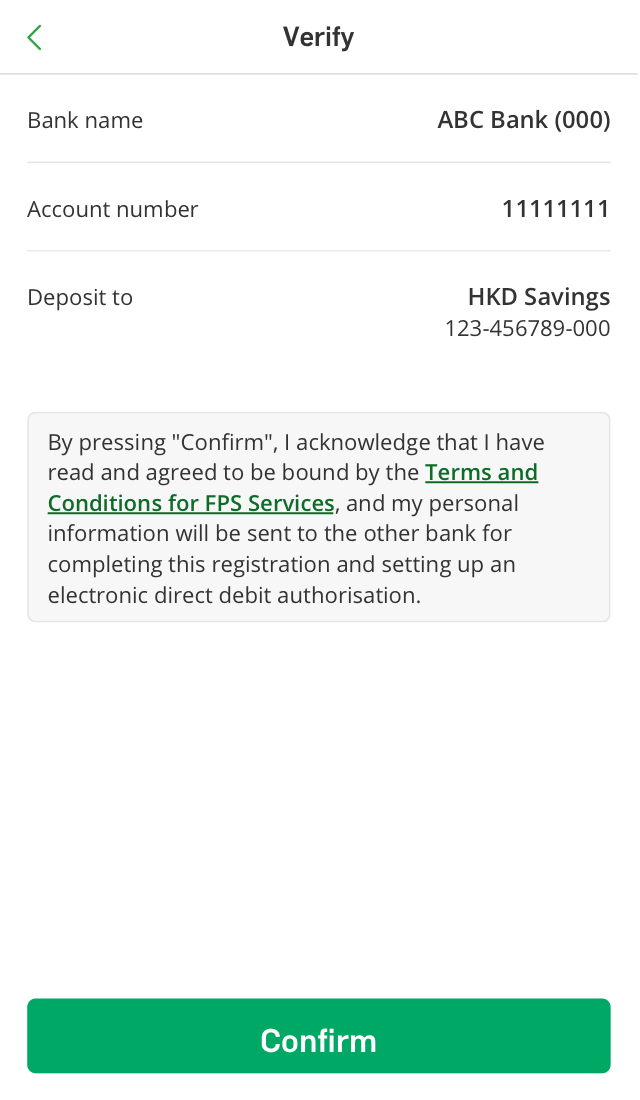

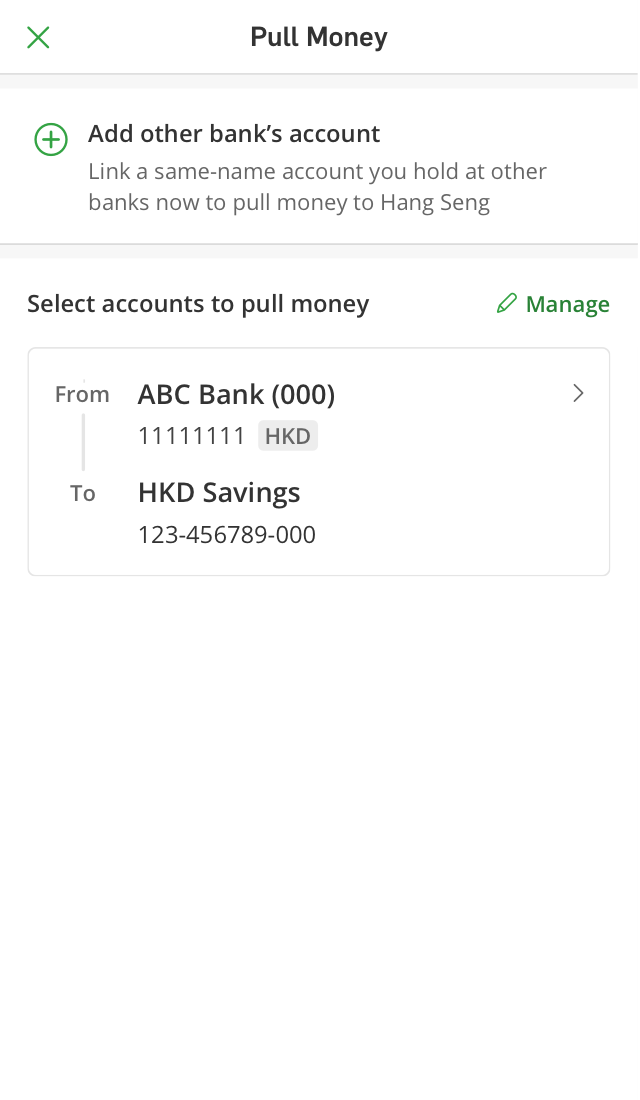

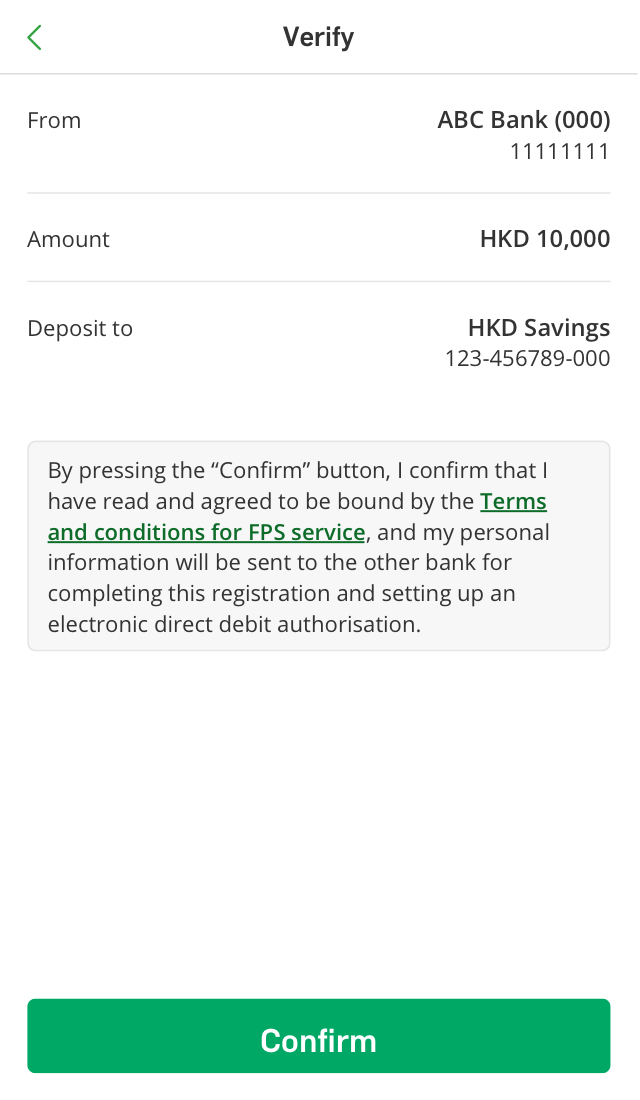

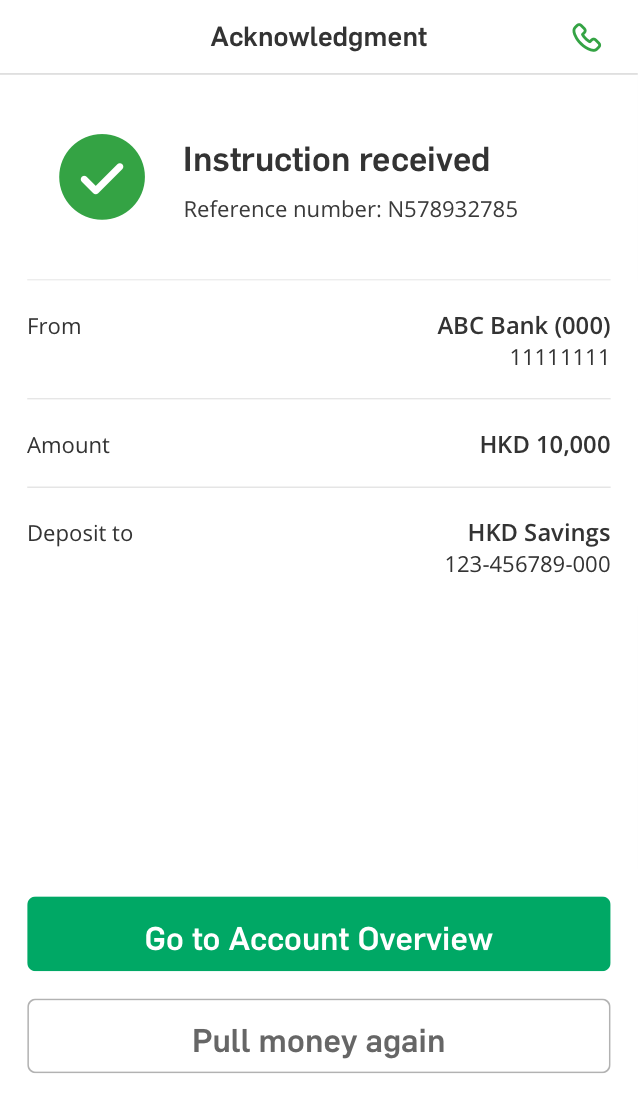

A seamless digital experience using Hang Seng Mobile App to link your other bank's accounts with us and then pull money instantly without logging out.

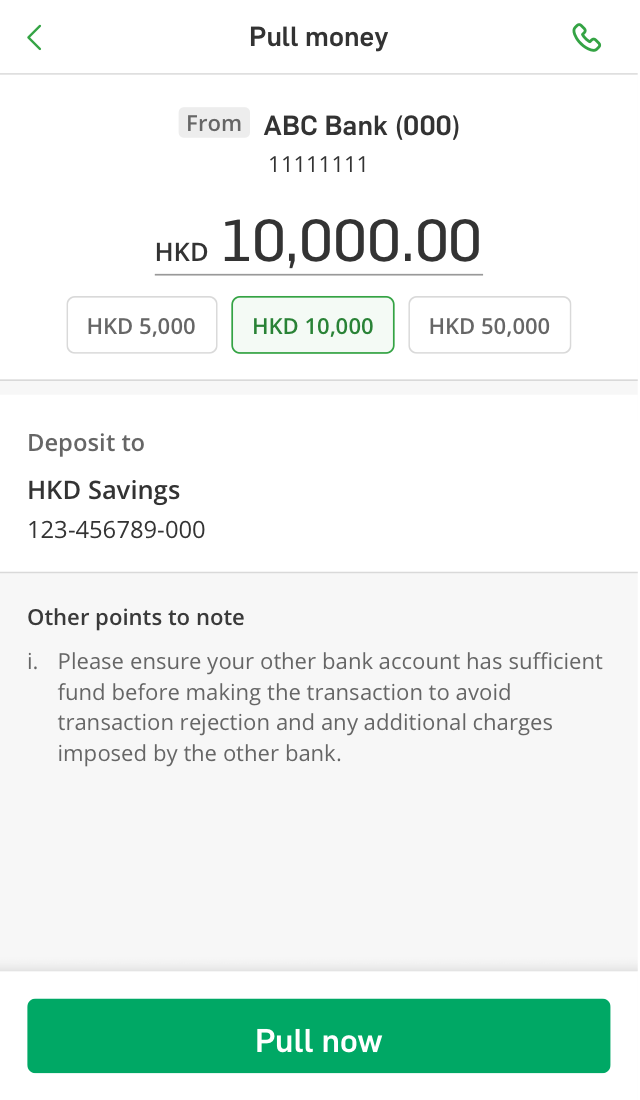

Pull Money service is free of charge at Hang Seng. However, some banks may have different charging policies and please contact your payer bank regarding their charges.

You might be charged by the payer bank, please contact your payer bank regarding their charges. As such, please ensure that you have sufficient funds in your payer bank account before pulling money.

Pull Money supports HKD and CNY transfers but no currency exchange involved.

Please confirm with your payer bank if there are different account numbers for your HKD and CNY accounts. If so, you will need to link them in separate registrations. Remember to provide corresponding account number and currency in the registration flow.

Another quick way to receive money from this bank is to register your FPS proxy ID (i.e. Mobile number / email address / FPS ID) with Hang Seng Bank and use it when you make transfer with this bank's online banking platform. You can also input your Hang Seng account number and select “024 Hang Seng Bank Limited” from the bank list.

A notification will be sent to you upon a successful transaction. You can also check the record in your transaction history.

There is no cut-off time. Instruction is handled in real-time, anytime.

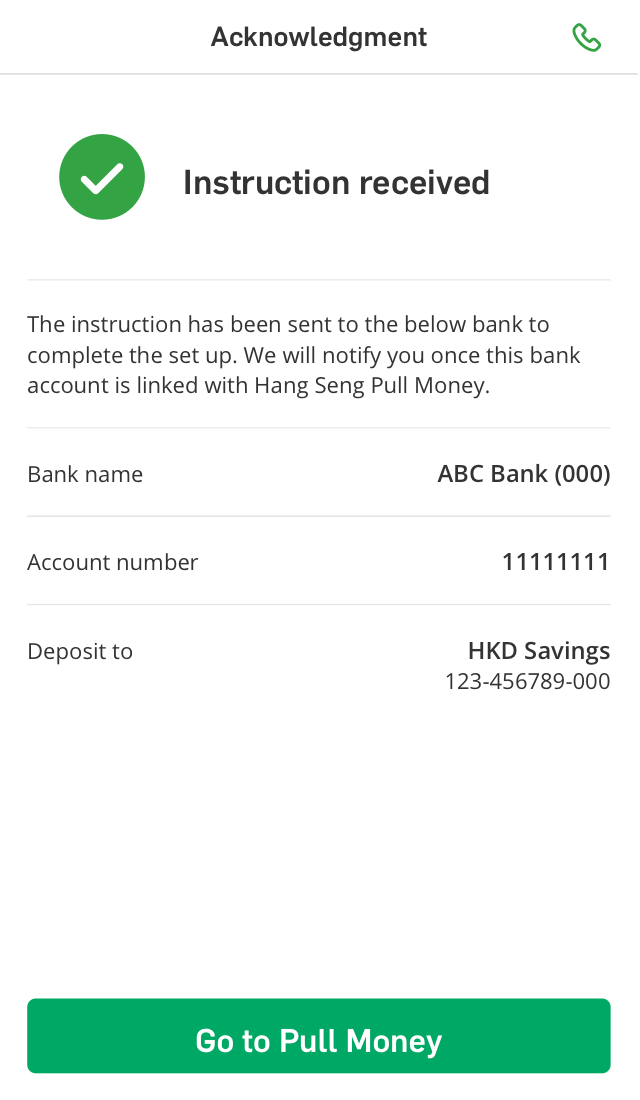

It means the payer bank has not yet completed the verification process. We will notify you via SMS and email notification once the verification is completed.

Yes, you can cancel the registered record via Hang Seng Mobile App.

To protect our customers, we have set the prevailing daily transfer limit of Pull Money to HKD1,500,000.

You can view the payer bank's limit for a single transaction when you select it from the payer bank list during your Pull Money registration. You can also see it before inputting the transfer amount when you pull money.

The bank code of Hang Seng Bank is 024.

To locate the latest list of supporting banks, please click here.

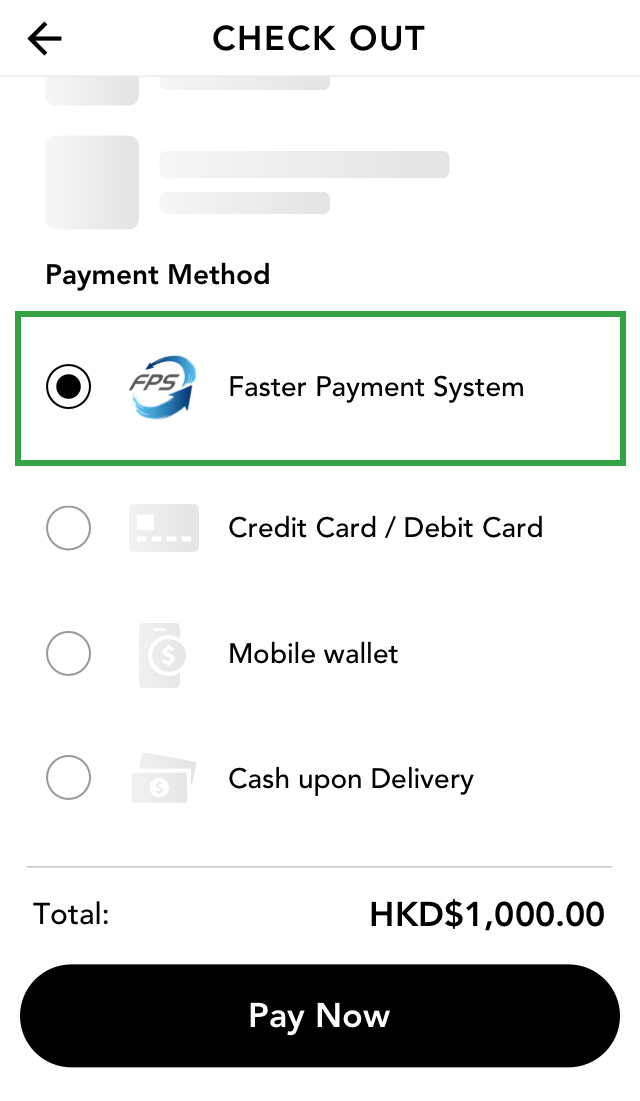

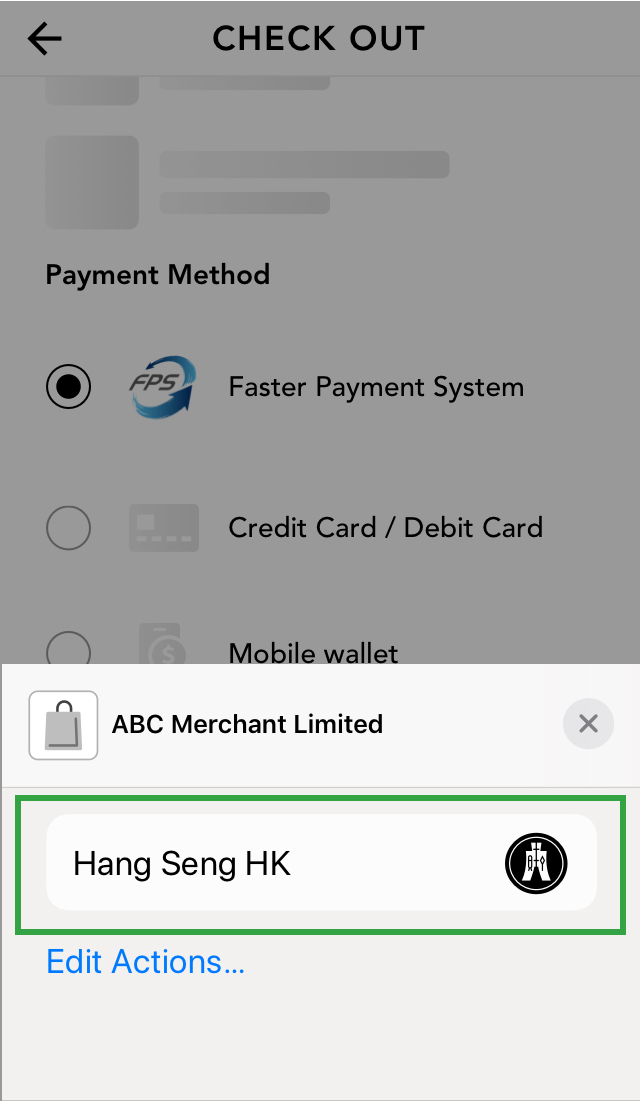

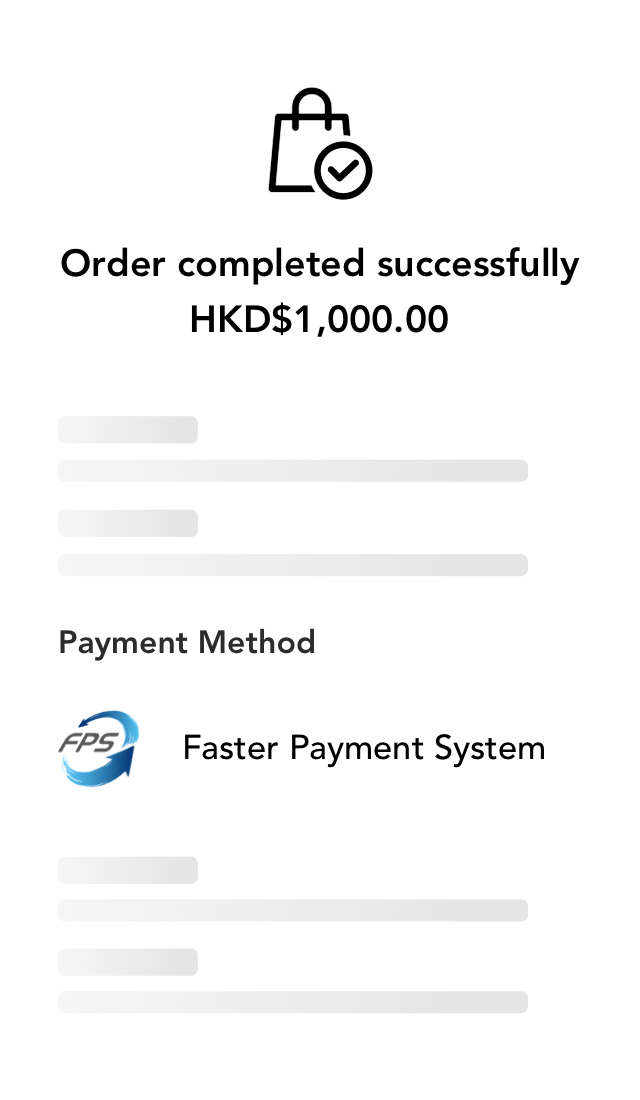

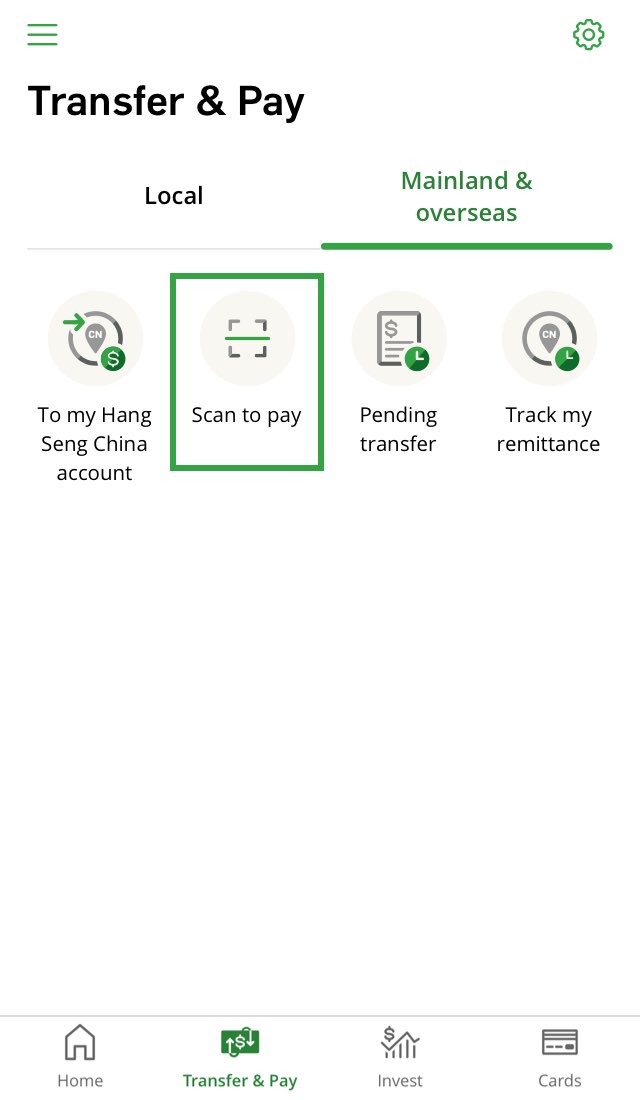

There will be a “Pay by FPS” payment option in the checkout page if the merchant app or website supports the FPS online merchant payments.

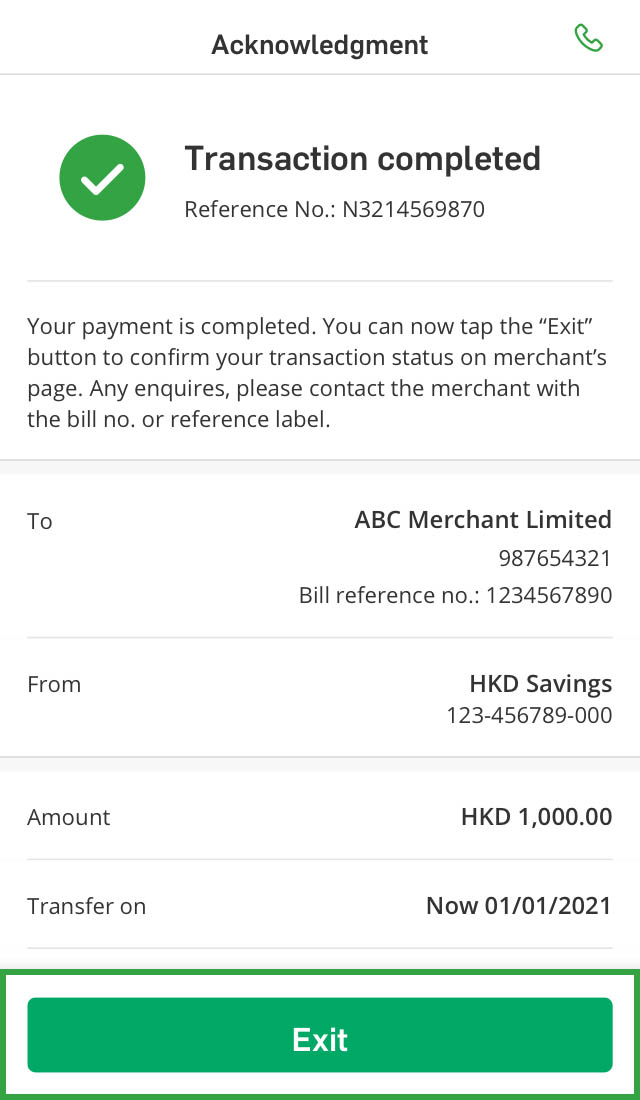

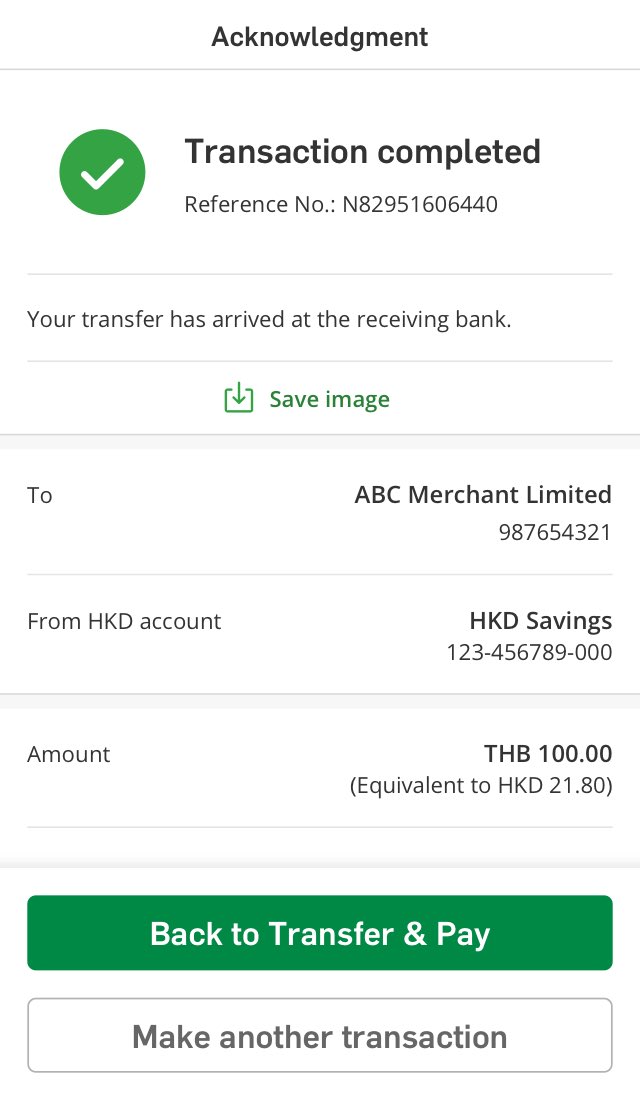

Once you have returned to the merchant app or website, you should see a payment confirmation.

You may state the transaction reference number or reference label to the merchant in case of any issues.

Please contact the merchant directly about any issues with your order / top-up instruction.

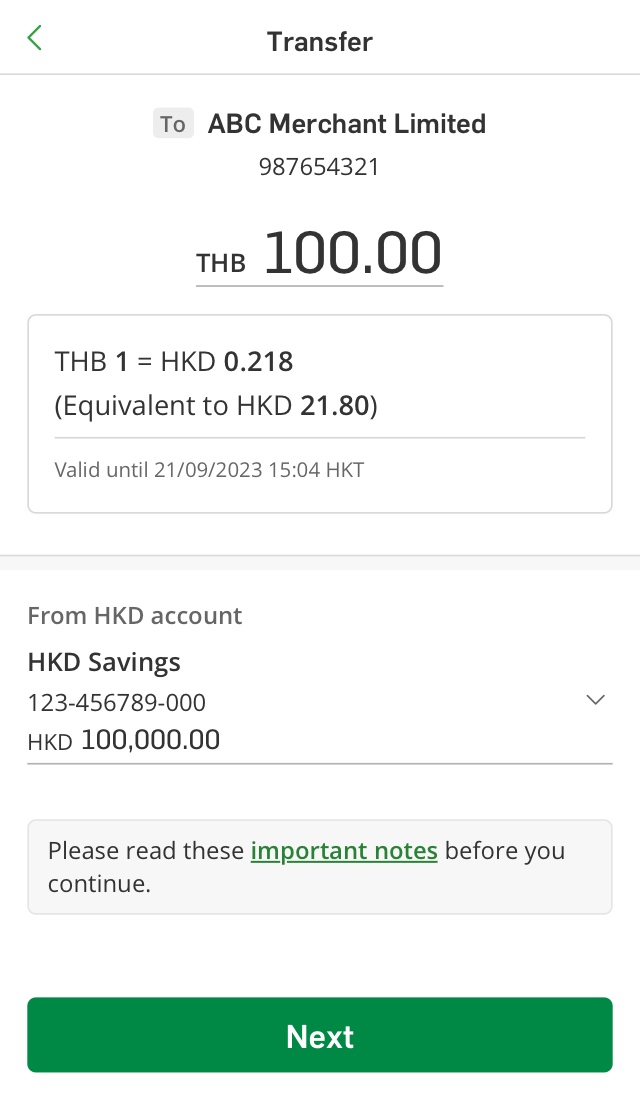

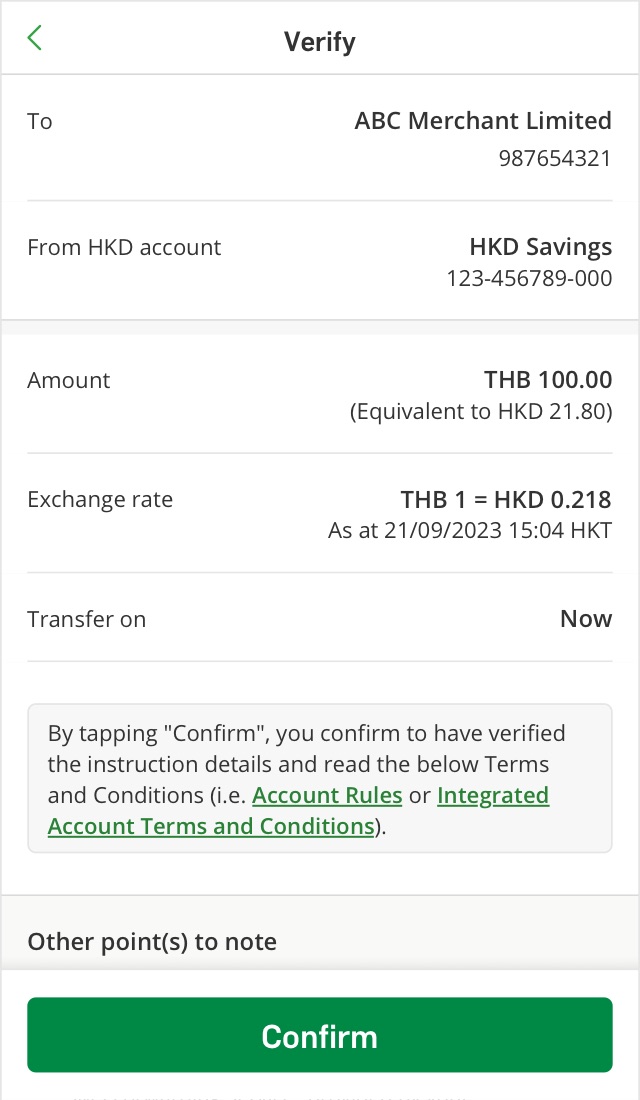

Payment via the FPS x PromptPay QR payment service is subject to your daily small value transfer limit, which is up to HKD10,000. Besides, as the payee is outside Hong Kong, this service is also subject to your mainland & overseas daily transfer limit.

To update the limit, you can log on to Personal e-Banking via our website > "Settings" > "Limit Maintenance" under "Transfer and payment". Alternatively, you can log on to Hang Seng Mobile App, tap the gear icon at the top right corner of Transfer & Pay page, go to settings and choose "Set transfer & payment limits".

No. Only Hong Kong Dollar account can be used for FPS x PromptPay QR payment. The payment amount will be based on prevailing exchange rate.

No. You can enjoy the service as long as you've registered for Personal e-Banking and hold a valid Hong Kong Dollar account.

No. As long as your accumulated payment amount on that day does not exceed the small vale transfer limit of HKD10,000, you can continue to use the FPS x PromptPay until the limit is used up.

Yes. Both payment amount of FPS x PromptPay QR Code and other local transfer will be calculated within the same small value transfer limit.

Thai merchants whose QR code displays the icons of the following 5 participating banks accept FPS x PromptPay QR payment:

e-CNY is a digital form of legal tender issued by the People's Bank of China. It can be stored in officially issued e-wallets and used as an electronic payment tool.

Please refer to this step-by-step demo.

Currently there is no handling fee for topping up e-CNY wallets via FPS.

Before using FPS top-up service for e-CNY wallet, you need to set up small value transfer limit (daily maximum limit HKD10,000) and daily mainland and overseas transfer limit (daily maximum limit HKD1,500,000).

The maximum balance of e-CNY wallet is CNY10,000. The maximum top-up amount is subject to your daily small value transfer limit (HKD 10,000), daily mainland and overseas transfer limit and the limit of individual e-CNY wallets. For details, please refer to the e-CNY wallet operating banks' websites.

Currently, e-CNY wallet can be topped-up with Hong Kong dollars and renminbi. You can either deduct funds from your CNY savings accounts or instantly exchange Hong Kong dollars to renminbi to top up your wallet. Please note that the minimum exchange amount is HKD30.

Yes. The funds will be automatically refunded to the e-CNY wallet used for payment.

You can log on to Hang Seng Mobile App and go to "Transfer & Pay" > "Local" tab > "To local account / FPS". For transferring to registered payee, please choose the payee from the list. For non-registered payee, you need to enter the new payee details, such as name, receiving bank and account number. Then, fill in the transfer amount, currency and message to payee (optional) to continue with the transfer.

The foreign currencies you can transfer with local foreign currency transfer service via Hang Seng Mobile App include AUD, CAD, CHF, CNY, EUR, GBP, JPY, NZD, SGD, THB, USD and ZAR.

Transfer can usually be transferred within 1-4 working days. It may vary depending on the processing time of the intermediary bank(s), payee's bank or its branches. We'll update you on the latest status via email, push notification (if enabled) and/or SMS.

Cut-off time for transfer to other local banks via CHATS or SWIFT:

| Currency Code | Cut-off time (Mon to Fri) |

|---|---|

USD, CAD, EUR, GBP, CHF |

6:00 p.m. |

JPY, THB |

11:00 a.m. |

NZD |

11:45 a.m. |

AUD |

12:00 noon |

ZAR |

3:00 p.m. |

SGD |

3:25 p.m. |

Please note:

Yes, for transfers via CHATS / SWIFT, you can arrange the transfer to a designated local bank account up to 45 days in advance.

If you make an instant transfer, you can't change or delete the instruction once it has been processed. If you make a scheduled transfer, you can delete this transaction by going to "Transfer & Pay" > "Local" tab > "Pending transactions".

No, you can't exchange foreign currency when making a local foreign currency transfer. Please log on to Hang Seng Mobile App, then choose "Foreign Exchange" > "Foreign Exchange Service" from left menu to exchange foreign currency in advance.

Hang Seng supports various types of same currency transfers. You can use the following services without any handling fees:

Please note that a service charge may be applied by the recipient bank for transferring funds to other local bank accounts. Personal e-Banking supports transfer to participants of Faster Payment System (FPS).

Fees and charges for transferring foreign currency to other local bank accounts via Hang Seng Mobile App:

Please note:

For local foreign currency transfer via Hang Seng Mobile App, if the beneficiary bank is a registered direct participant of local clearing in Hong Kong, we may choose to transfer by CHATS. Please note that the beneficiary bank may impose a service charge to the payee, and deduct additional fees from the transfer amount. For details, please check with the beneficiary banks.

For transfers via SWIFT though this transfer service, some beneficiary and/or correspondent banks may deduct additional fees from the transfer amount. For details, please check with the beneficiary and/or correspondent banks.

Through the local interbank transfer CHATS, you can make real-time payments and transfers in HKD / CNY / USD / EUR to other local bank accounts. Different remittance currencies are subject to different cut-off times. Generally, it will be sent on the same business day if it is submitted before the cut-off time. Otherwise, it will be sent the next business day. For details, please refer to Outward Remittance & CHATS Services Cut-off Timetable . For service charges, please refer to Bank Tariff Guide for Hang Seng Wealth and Personal Banking Customers.

The local transfer fee to other bank accounts in Hong Kong via Personal e-Banking and Hang Seng Mobile App will be waived.

The local transfer fee waiver will be automatically apply when transferring to other bank accounts in Hong Kong via Personal e-Banking and Hang Seng Mobile App.

The local transfer fee for transferring to other bank accounts in Hong Kong via Hang Seng Personal e-Banking and Hang Seng Mobile App is waived. The currencies include AUD, CAD, CHF, CNY, EUR, GBP, JPY, NZD, SGD, THB, USD and ZAR.

Only the local transfer fee for transferring to other bank accounts in Hong Kong via Personal e-Banking and Hang Seng Mobile App will be waived. The beneficiary and/or corresponding bank may still charge additional fees.

There is no minimum transfer amount for the local transfer fee waiver when transferring to other bank accounts in Hong Kong via Personal e-Banking and Hang Seng Mobile App.