We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Note(s): "Card" includes credit cards, spending cards and debit cards.

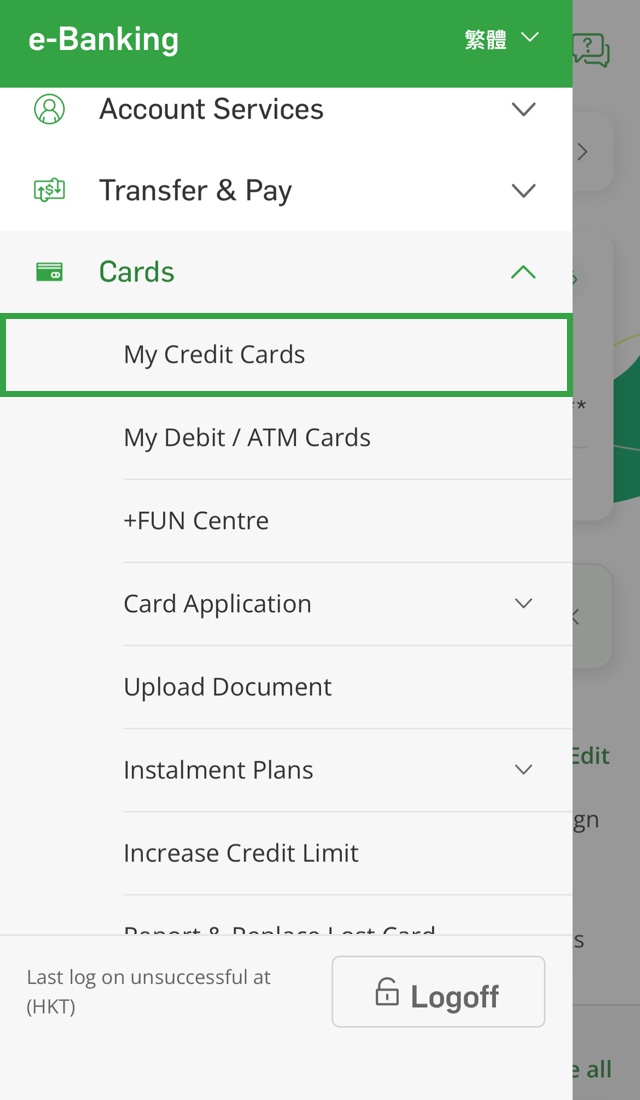

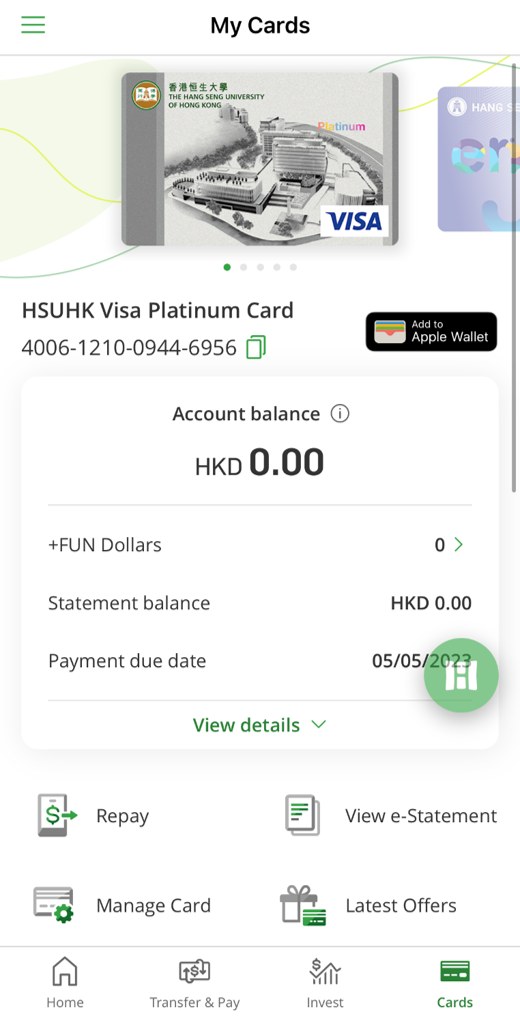

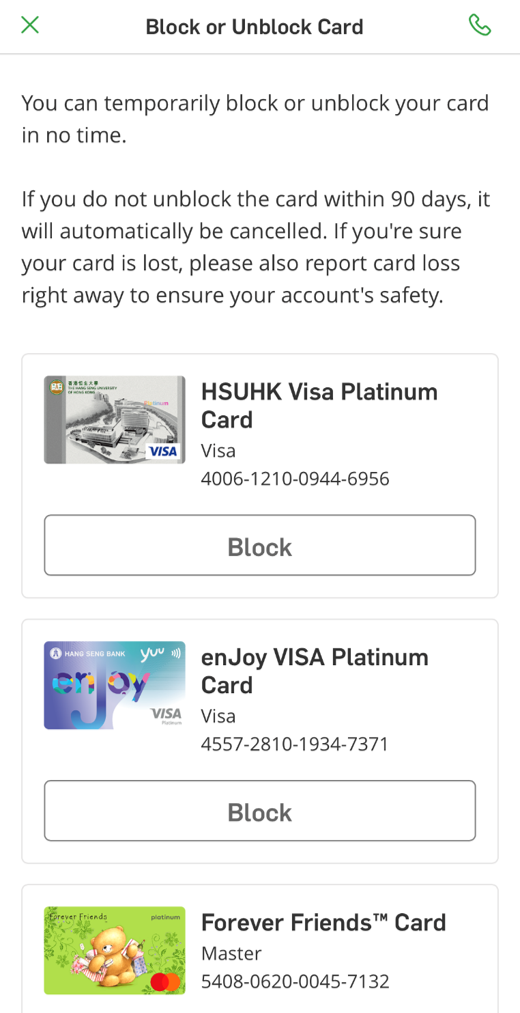

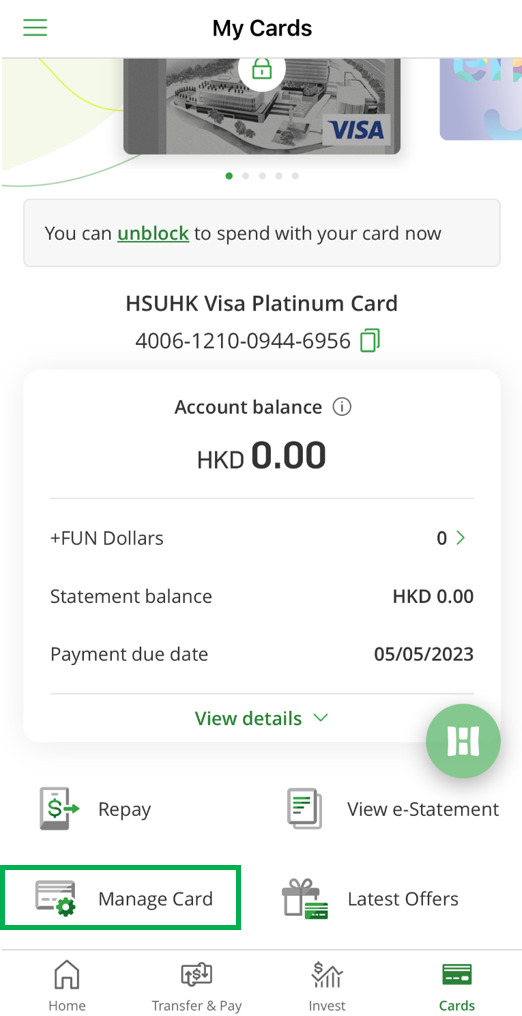

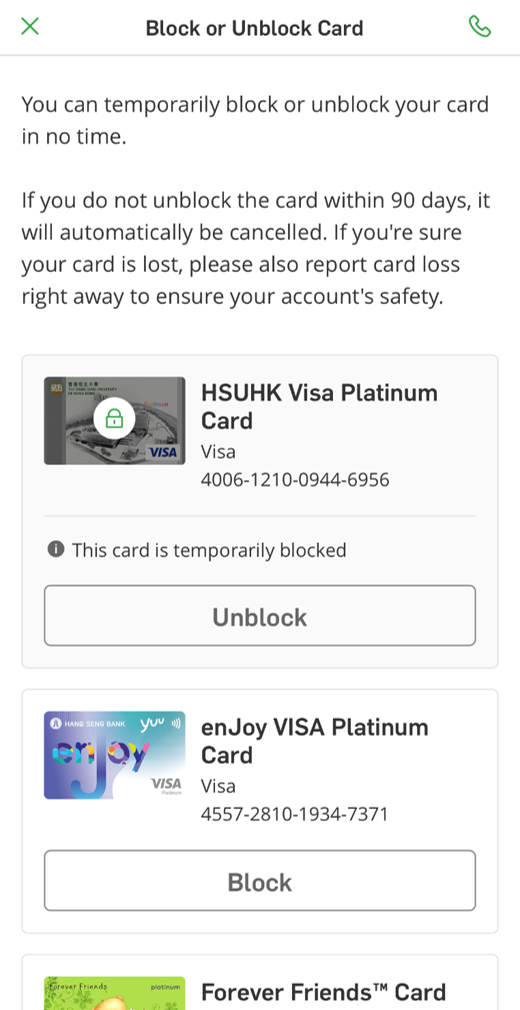

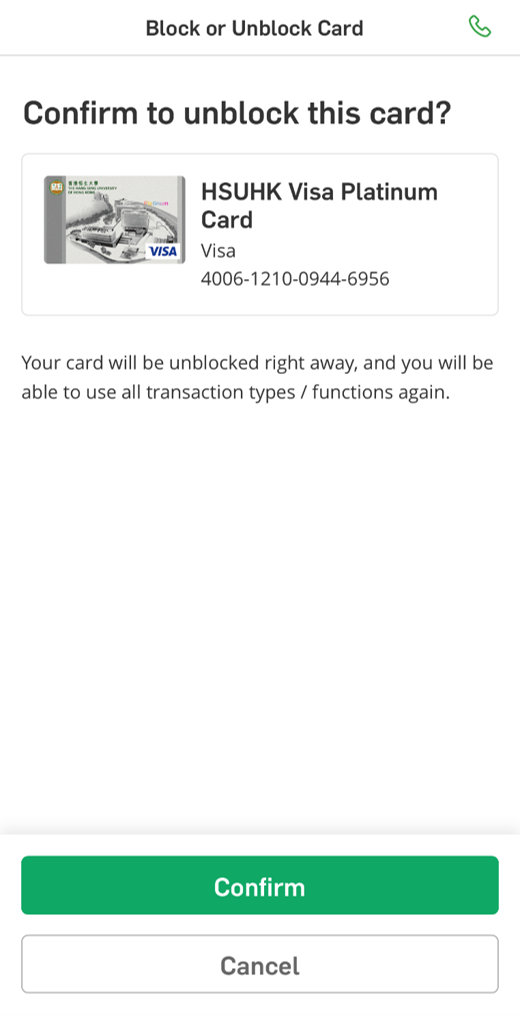

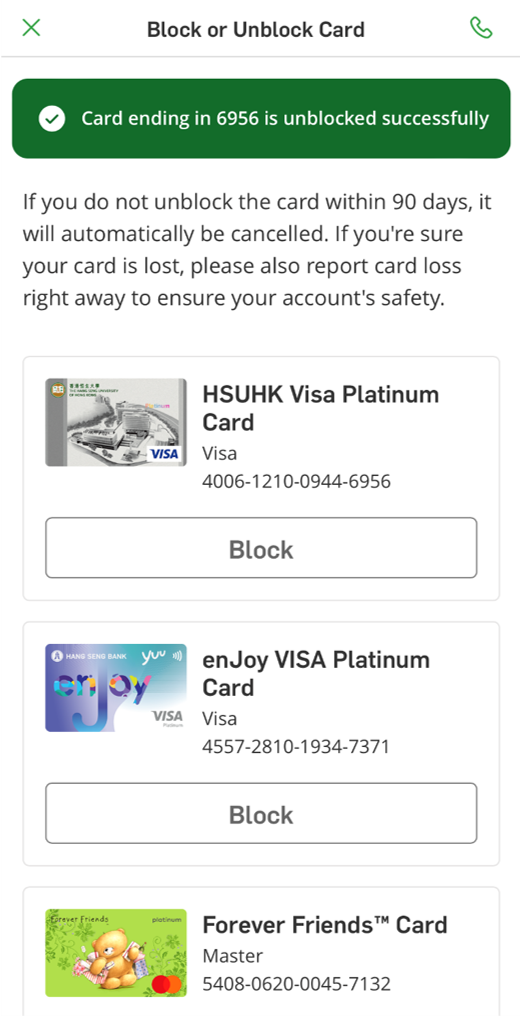

The block/unblock card service allows you to block or unblock your card with a few steps via Personal Mobile Banking.

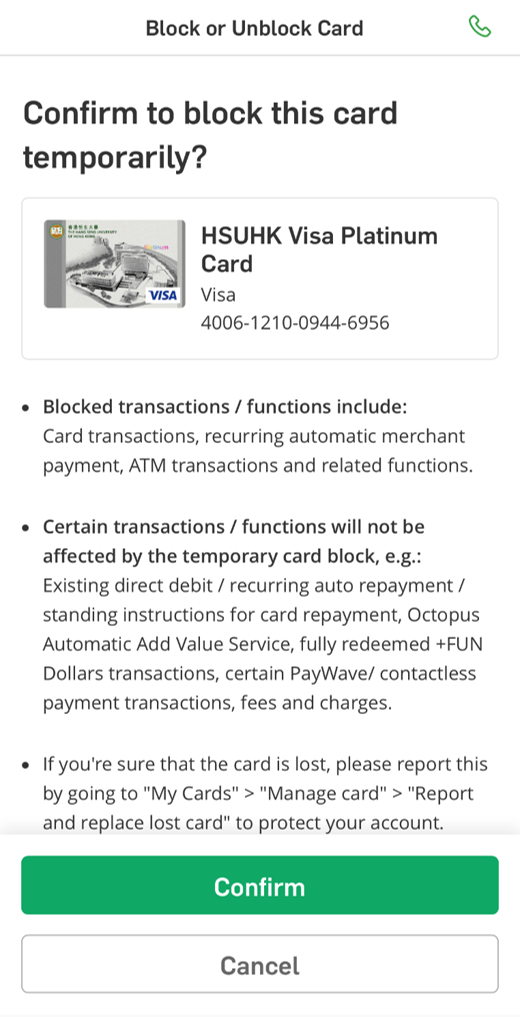

After blocking your card, most card transactions will immediately be blocked (except a few specified below). Similarly, once you unblock your card, the functionalities of your card will be immediately restored.

Yes. Every time you block or unblock a card, it will take effect immediately.

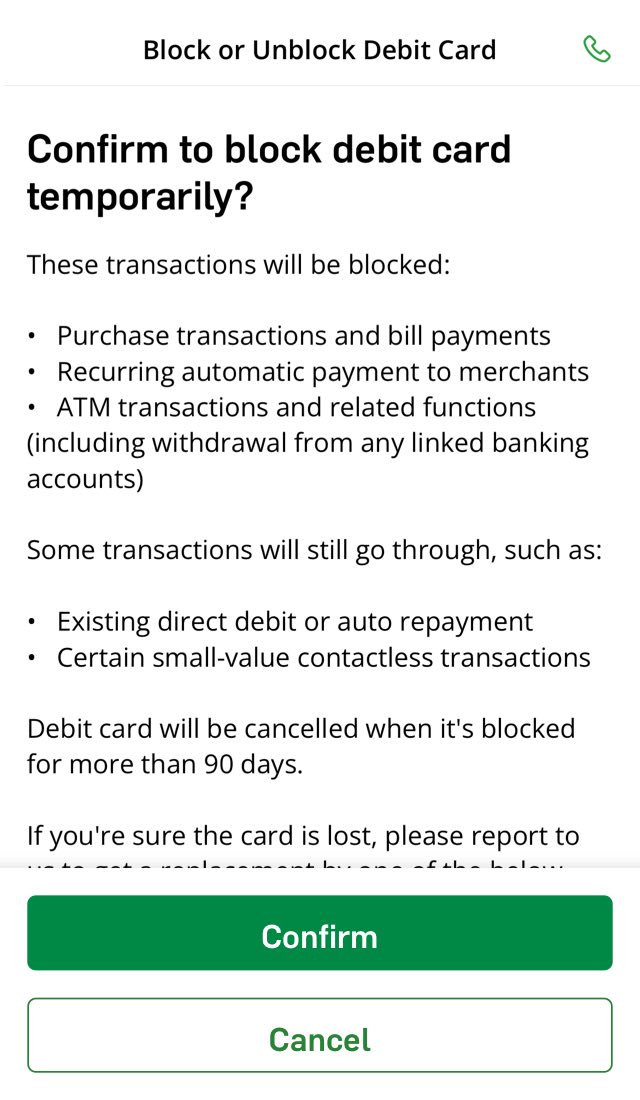

The following transactions / functions will be blocked:

Purchase transactions, bill payments, recurring automatic merchant payments (e.g. Telecom), ATM transactions and related functions (including withdrawal from any linked banking accounts) and enJoy card binding function via terminals at designated merchants / yuu Apps

The following transactions / functions will not be blocked:

Existing direct debit / recurring auto payment / standing instructions for card repayment, Octopus Automatic Add Value Service (including via e-wallet/other method to top up Smart Octopus), Fully redeemed +FUN Dollars transactions, Some Paywave/Contactless Payment transactions, Some spending at The Hong Kong Jockey Club (HKJC) using the HKJC Membership Card / The Racing Club Membership Card, Fees and charges.

Therefore when you card is blocked, you will still be responsible for these transactions.

As a principal card customer, you can block or unblock your principal cards as well as your combined limit supplementary card(s). But please note that blocking or unblocking your principal cards will not automatically block or unblock your combined limit supplementary card(s). You will need to do that separately.

Principal card customer will not be able to block or unblock your separate limit supplementary cards.

There is no limit to how many times you can block or unblock your card. You can do so whenever you need to.

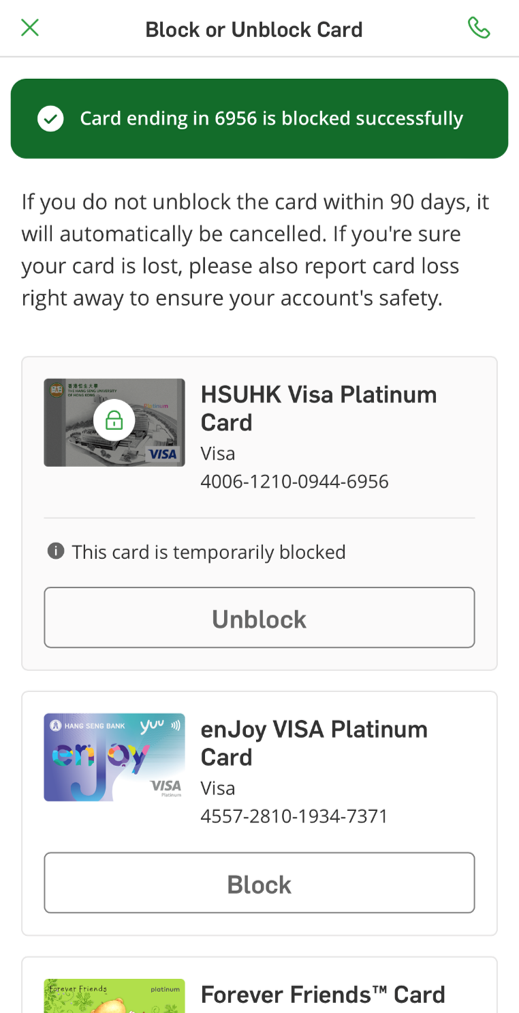

No, if you do not unblock the card within 90 days, it will automatically be cancelled.

No, you can only block or unblock your new card / renewal card that has already been activated.

The block/unblock function is not available to private label card.

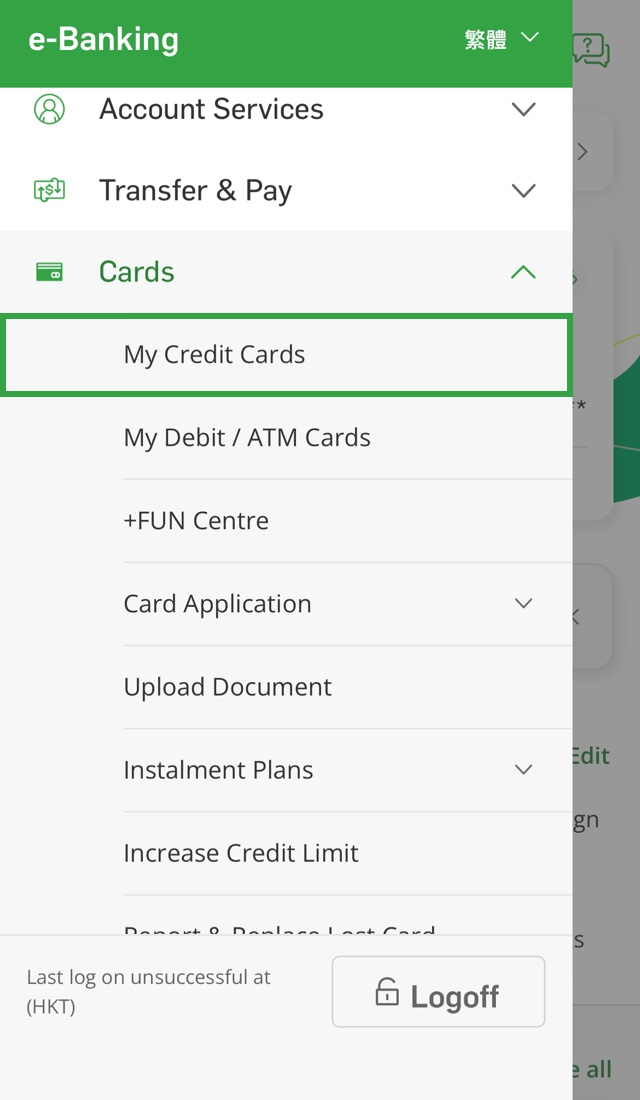

No. You should immediately report card lost if you confirmed losing access to your card. Please log on to Hang Seng Personal e-Banking or Hang Seng Mobile App, select "Cards" > "Manage Card" > "Report and replace lost card", or call our 24-hour Report Lost Card Hotline at (852) 2836 0838 to report card lost as soon as possible.

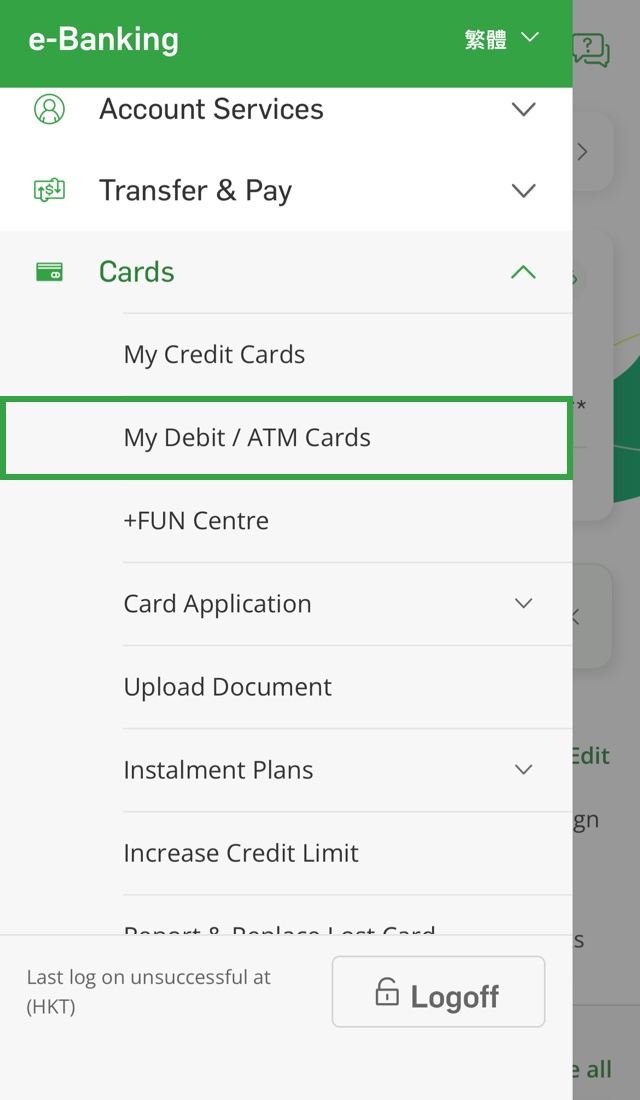

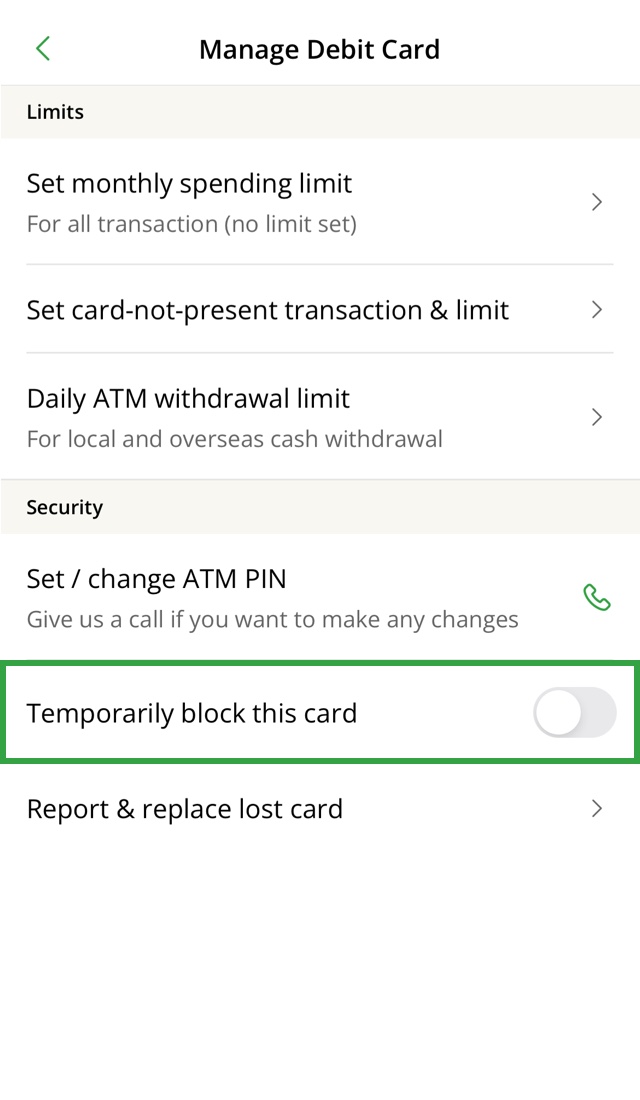

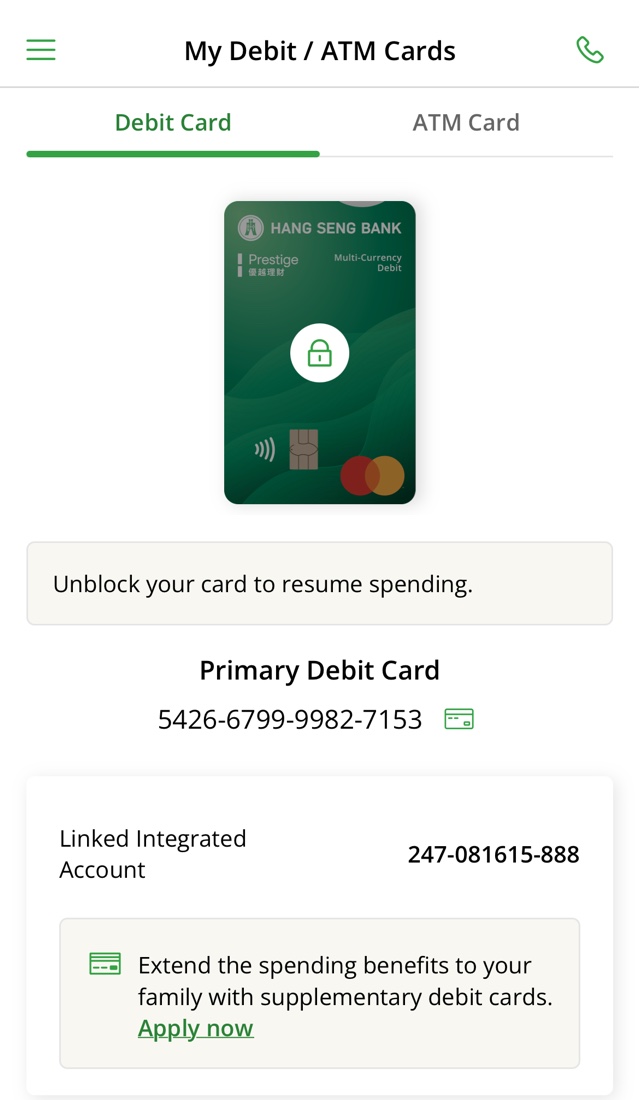

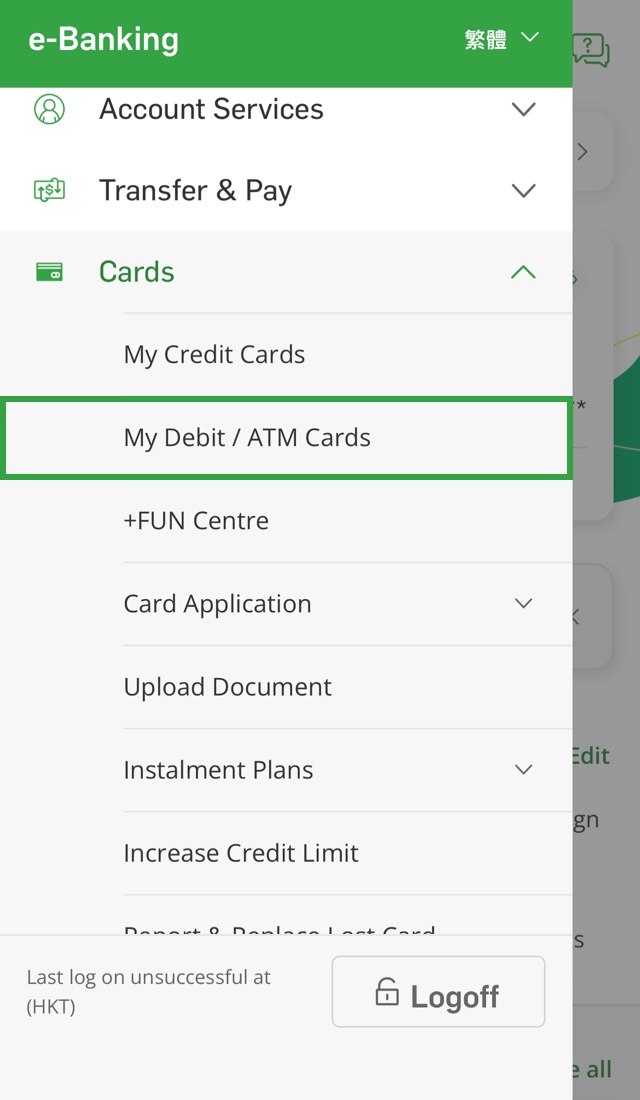

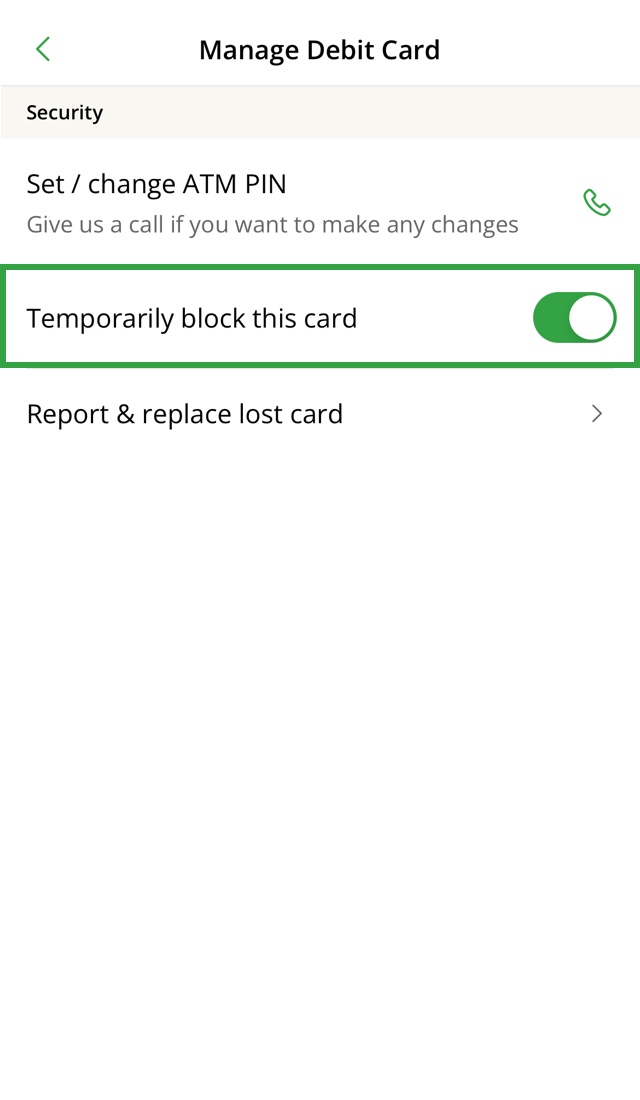

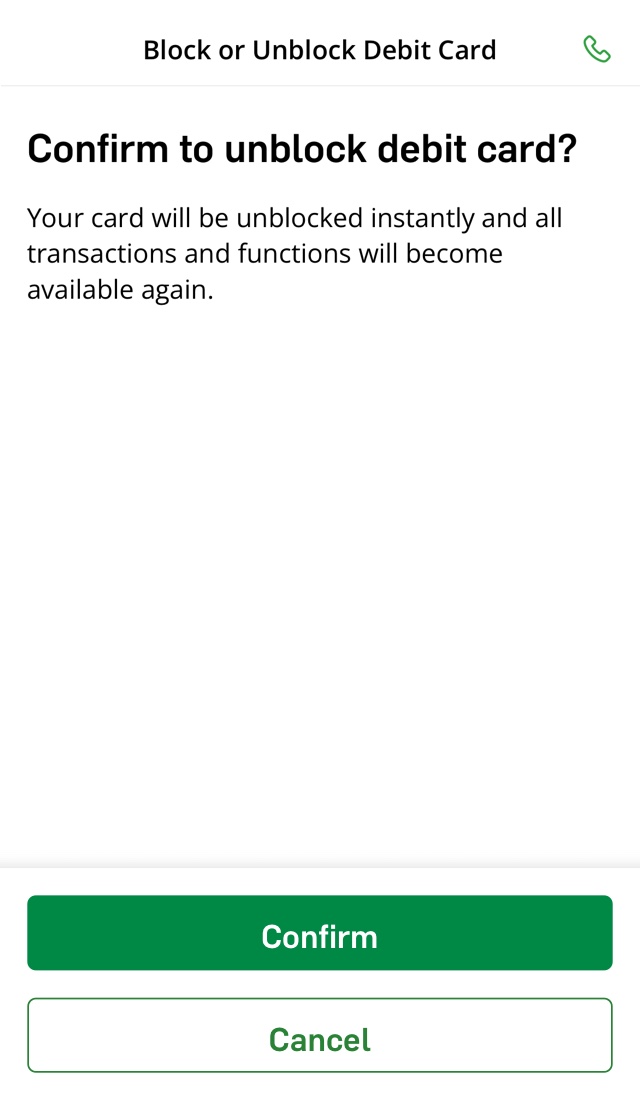

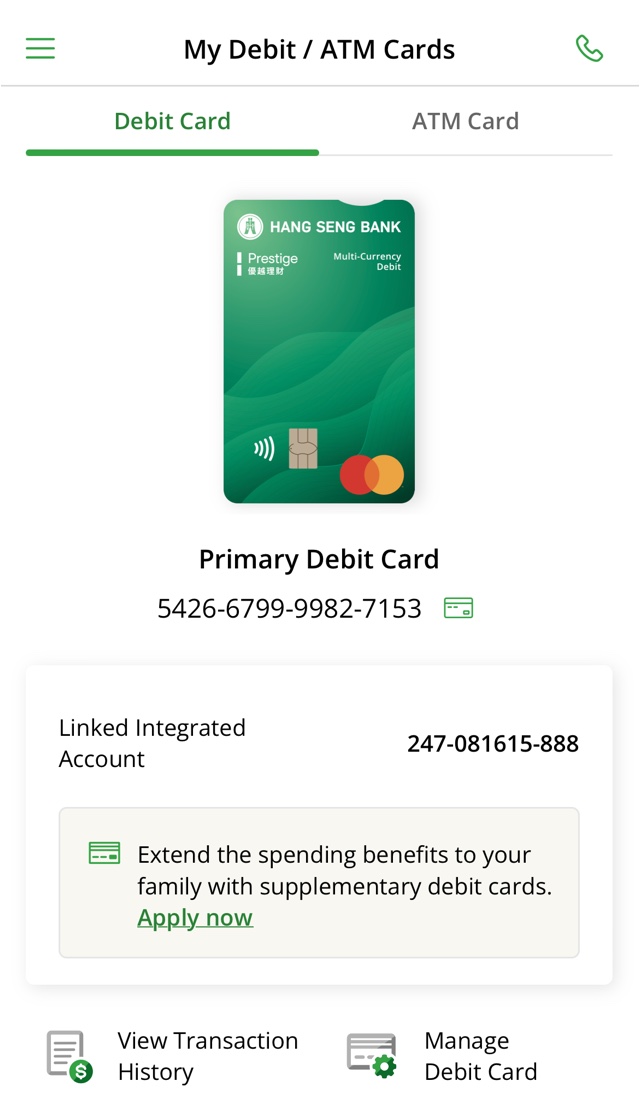

You may logon to your mobile app (“Cards” > “My Debit / ATM Card” > “Manage Debit Card”) then select “Temporarily block / unblock this card”) to block or unblock your debit card.

If you need to cancel or block your supplementary card, you may logon to your mobile app (“Cards” > “My Debit / ATM Card” > “Manage Debit Card”) then select “Temporarily block / unblock this card”) to block or unblock your supplementary debit card, or you may contact our customer service representative at the 24-hour Hang Seng Multi-Currency Debit Mastercard Customer Service Hotline:

Yes. Every time you block or unblock a card, it will take effect immediately.

You will not be able to perform transactions when you block your debit card.

To borrow or not to borrow? Borrow only if you can repay!