We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

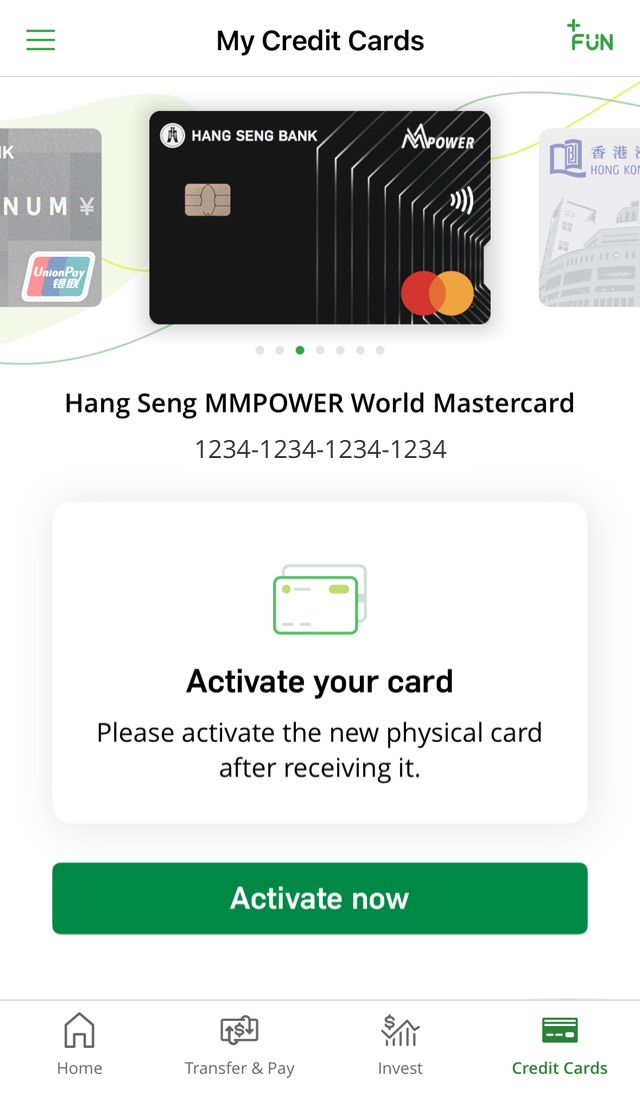

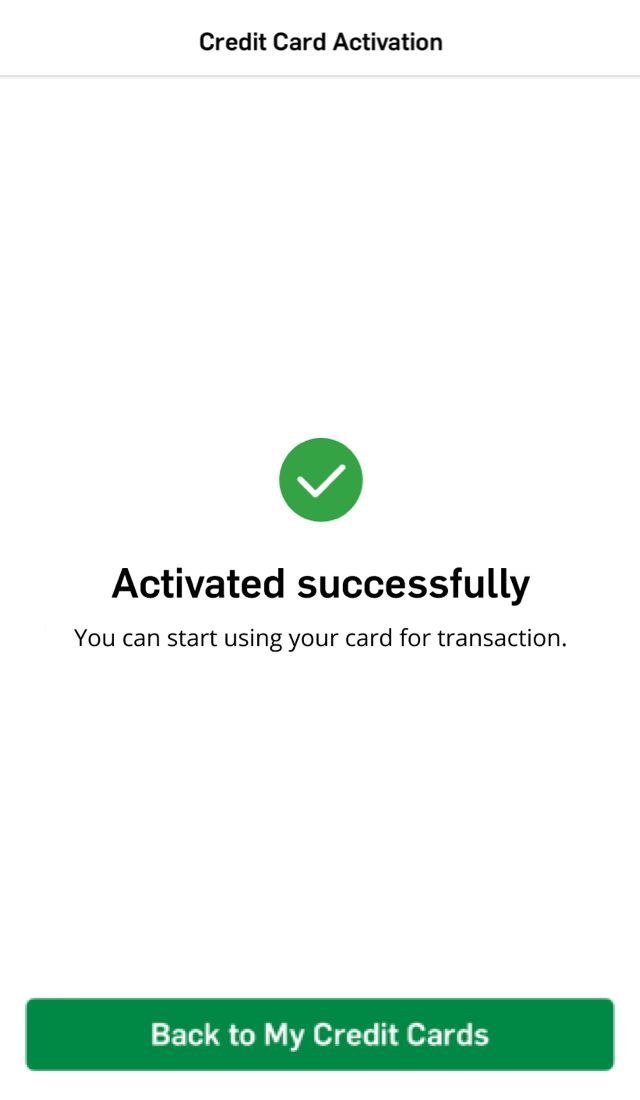

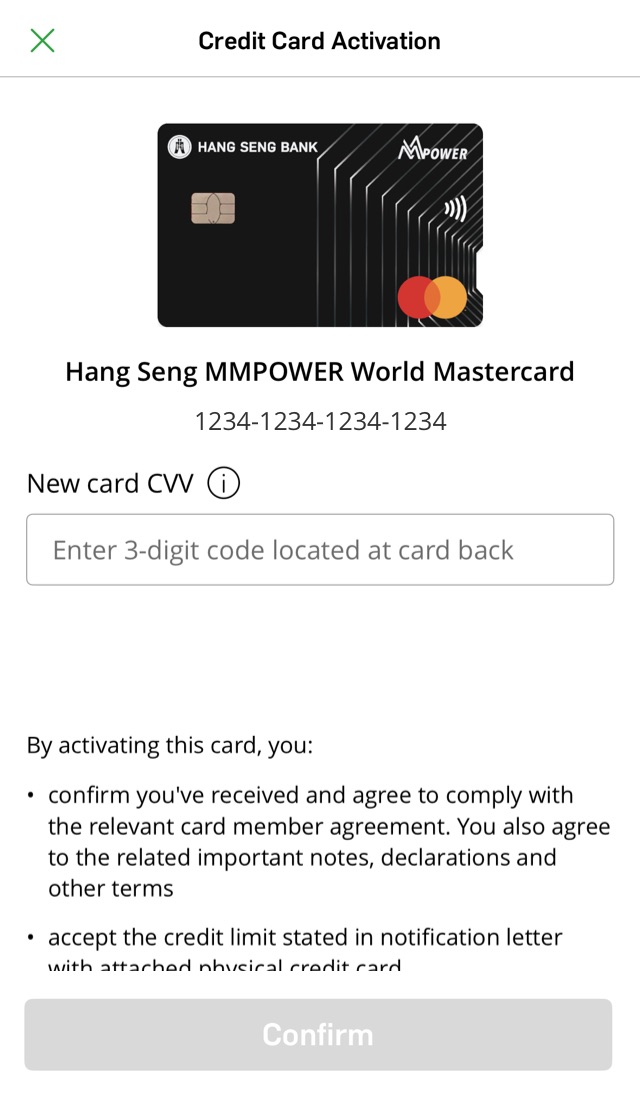

Simply activate your physical credit card via Hang Seng Mobile App or our 24-hour Card Activation Hotline to start using it for transaction after you've received it.

You can also manage your credit card anytime and enjoy more related functions with our app.

Scan the QR code to activate you card now

Just a few steps and you're all set to enjoy seamless transactions!

Call our 24-hour Card Activation Hotline at (852) 2997 3366 to activate your card.

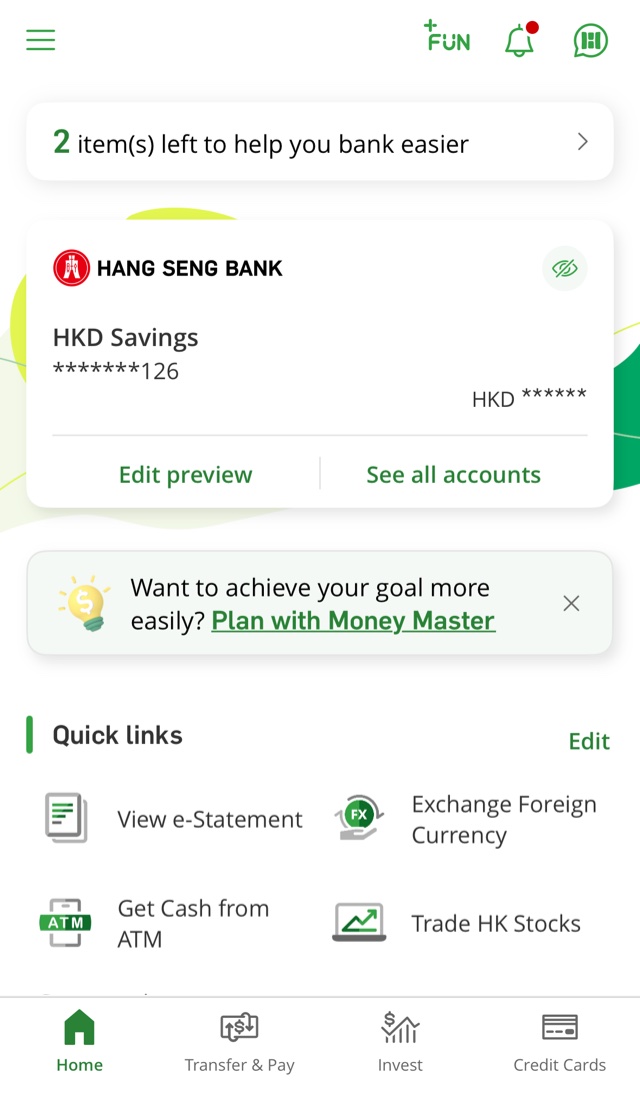

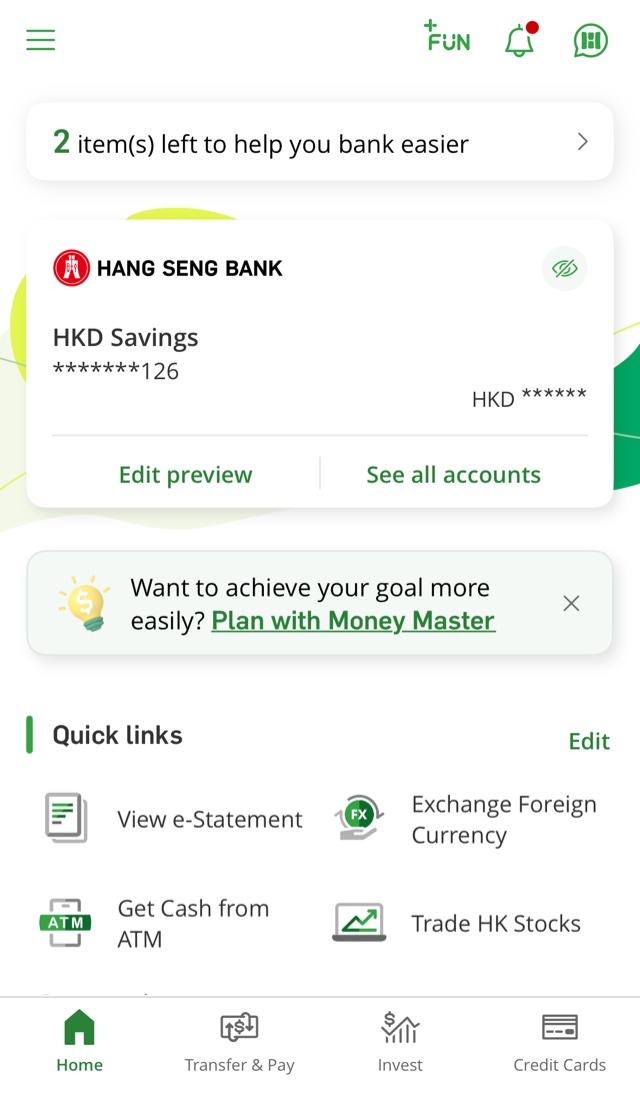

You can manage your cards and enjoy all-round services with Personal e-Banking account, including temporarily blocking and unblocking your card whenever you need to prevent unauthorised use.

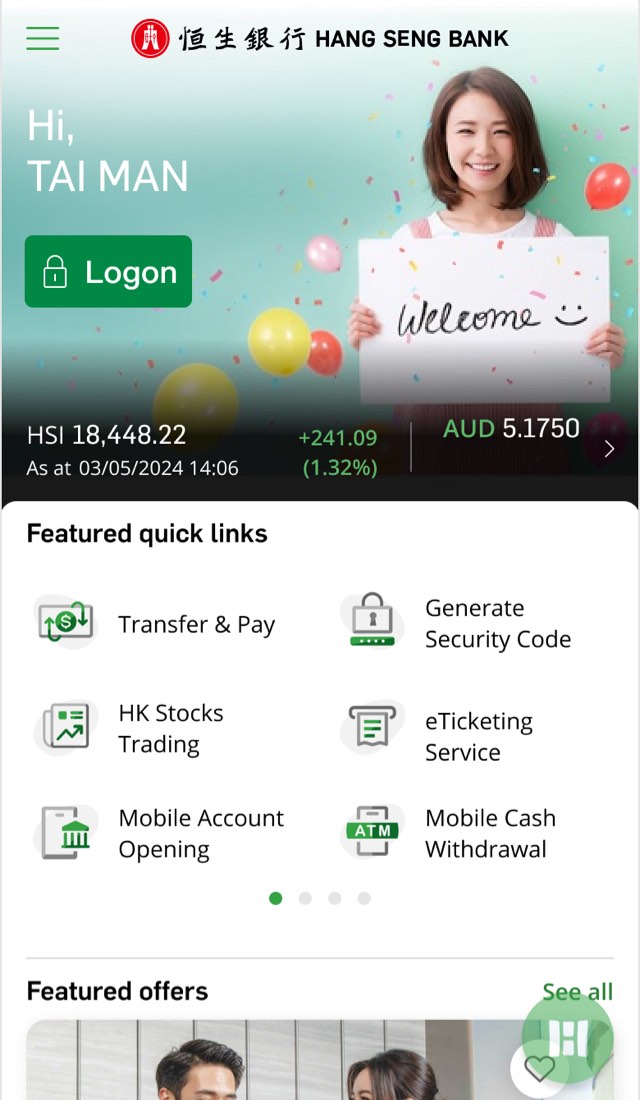

Scan the QR code to download the Hang Seng Mobile App

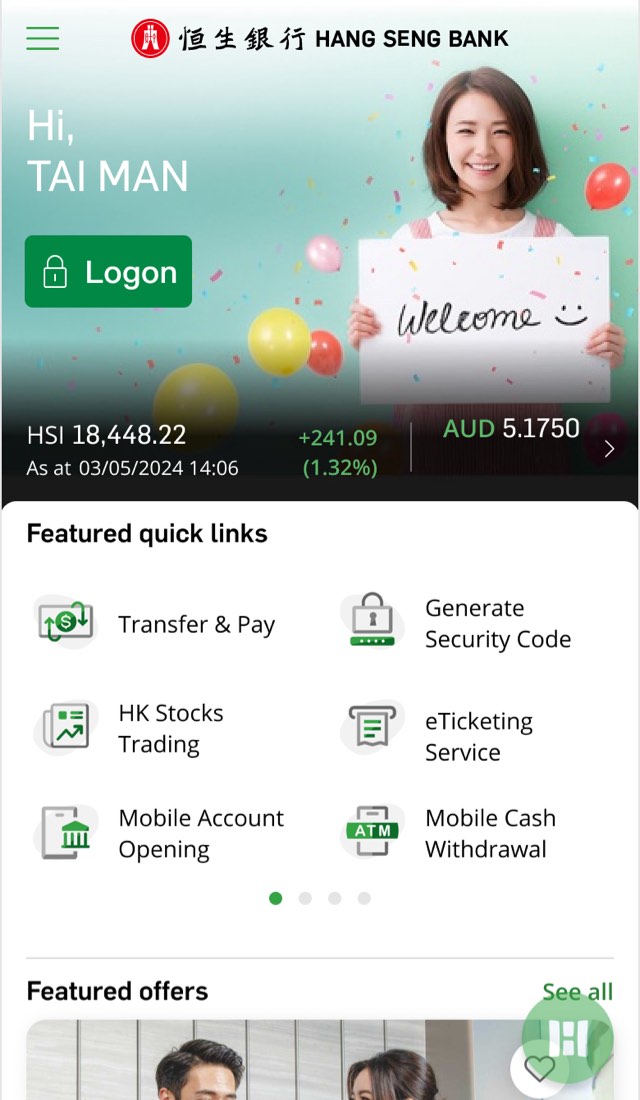

Tap "Register e-Banking" under "Featured quick links"

Set up your Personal e-Banking account by following the instructions

We'll mail your card to your correspondence address after 4 working days upon card issuance. If you still haven't received it, you can call our 24-hour customer service hotline for support.

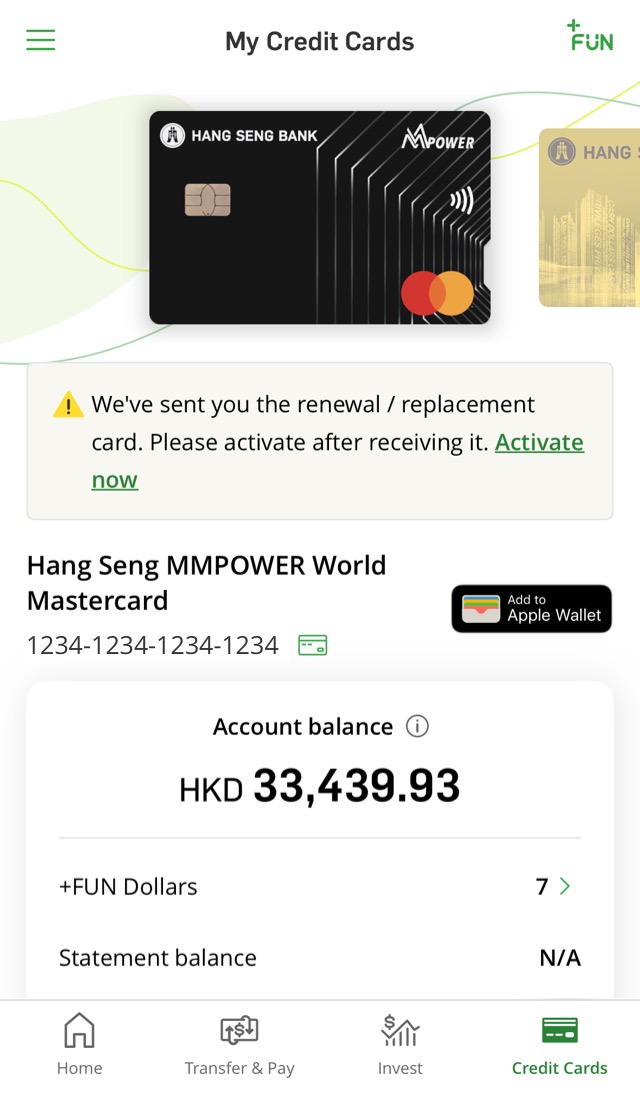

It may be because your credit card is not yet ready. You can also try updating your Hang Seng Mobile App to the latest version and then check the "My Credit Cards" page again.

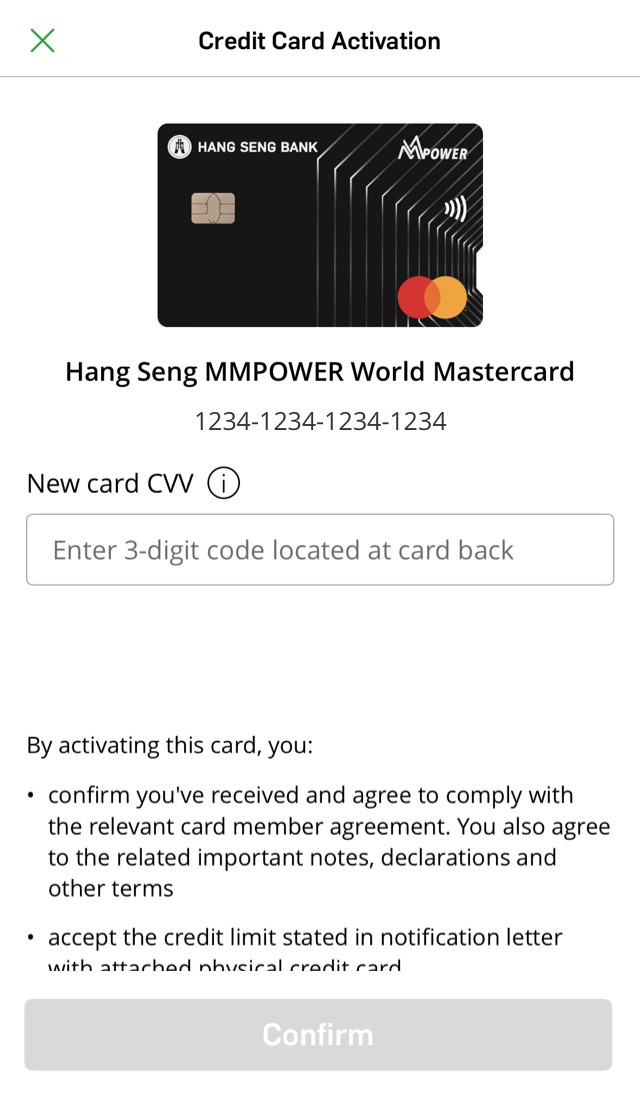

CVV is the Card Validation Code, which is the last 3-digit code located at the back of your card.

If you don't activate your new credit card, you won't be able to use your credit card for transactions. Activate it to start using your card.

If you've received a new renewal / replacement card, you should enter the CVV of the new card.

The process of activating supplementary card should be completed by the supplementary cardholder.

Both the primary and supplementary cardholder will receive a push notification, email, or SMS.

If you enter an invalid CVV multiple times in a row, we'll lock your credit card activation function to protect your account. You'll need to call our customer service hotline at the back of your credit card for activation.

You can call our 24-hour customer service hotline at back of your credit card for support.

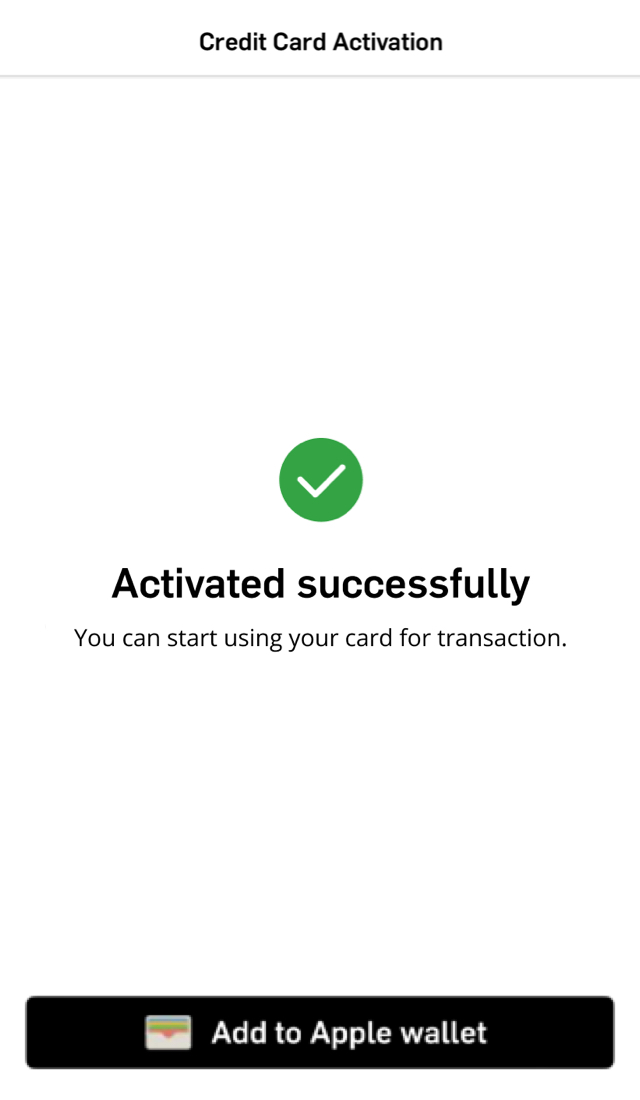

Once you've activated your credit card, you can start using it for transactions and add it to your mobile wallet (if any). However, some functions may take 1-3 working days to become available after activation.

Functions available immediately:

Functions available within 1-3 working days:

You can view and download up to past 7 years of statements anytime, anywhere while saving Paper Statement Service Annual Fee.

Want to pay effortlessly? Simply add your Hang Seng Credit Cards to Apple Wallet in your devices, and make contactless payments in shops or online.

To borrow or not to borrow? Borrow only if you can repay!