We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

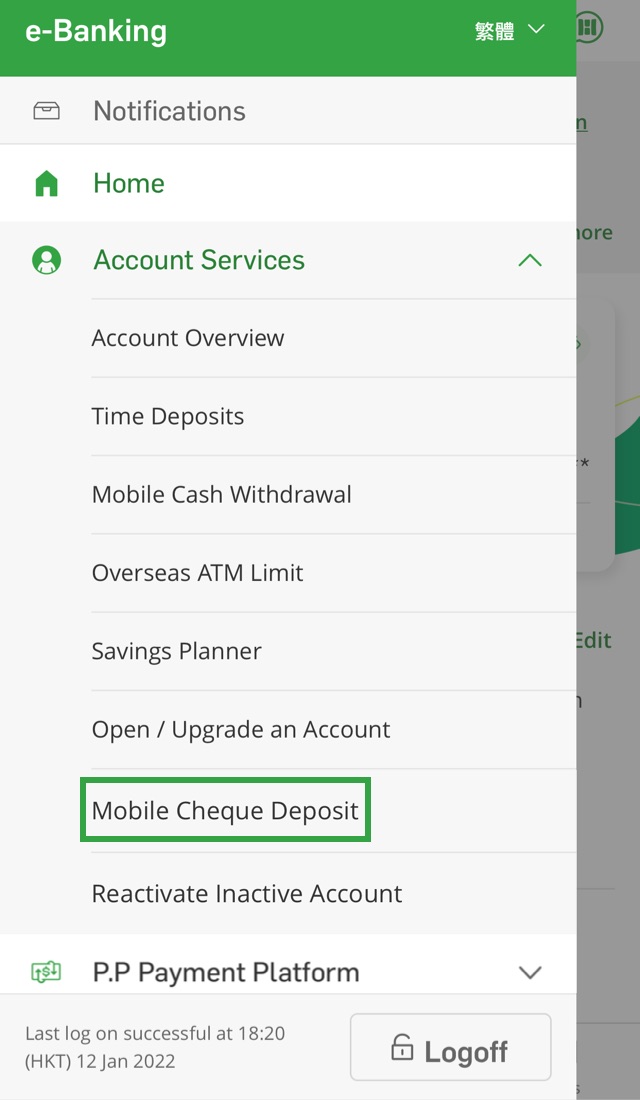

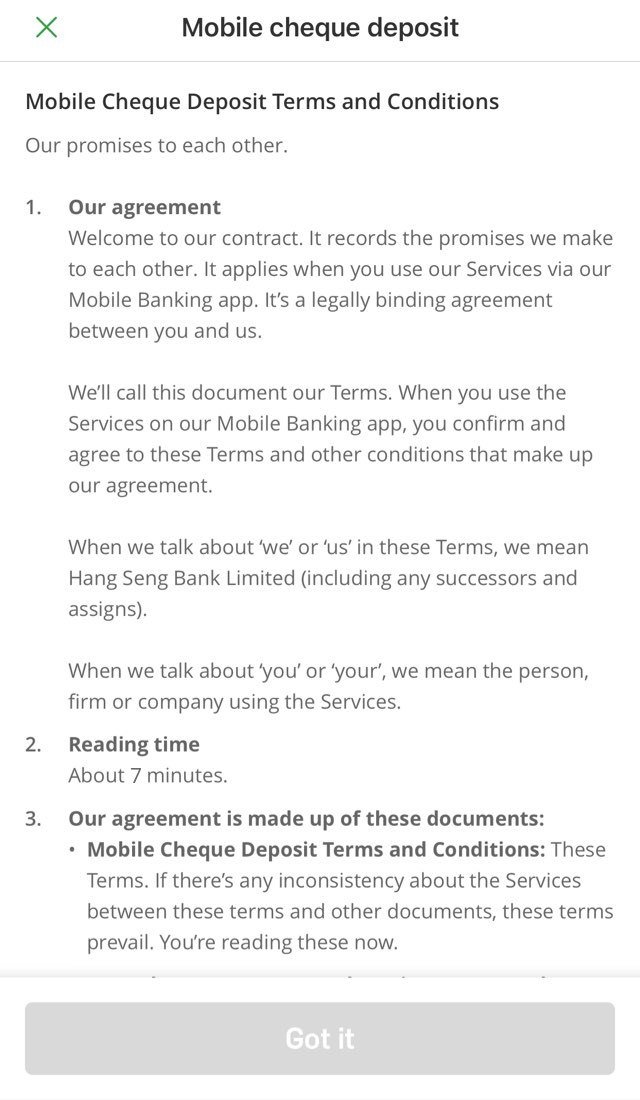

Hang Seng launches first-in-market Mobile Cheque Deposit (MCD) service. Simply use the Hang Seng Personal Banking mobile app ("Hang Seng Mobile App") to take a photo of the cheque with your mobile phone and deposit cheques online 24 hours a day. Deposit cheques before 5:30 p.m. on the settlement day, and the funds will be credited as soon as on the next settlement day.

From now on, you don't have to queue up at a branch anymore.

You can deposit your cheques via Mobile Cheque Deposit as long as they meet the following criteria:

• issued in Hong Kong Dollars;

• issued to you;

• issued from either Hang Seng or HSBC;

• don't exceed HKD100,000 in amount; and

• contain a cheque verification number, which is a unique identification number printed on the left of the cheque face

Please note that there are daily limits on the number of cheques and the total cheque amount you can deposit via Hang Seng Mobile App.

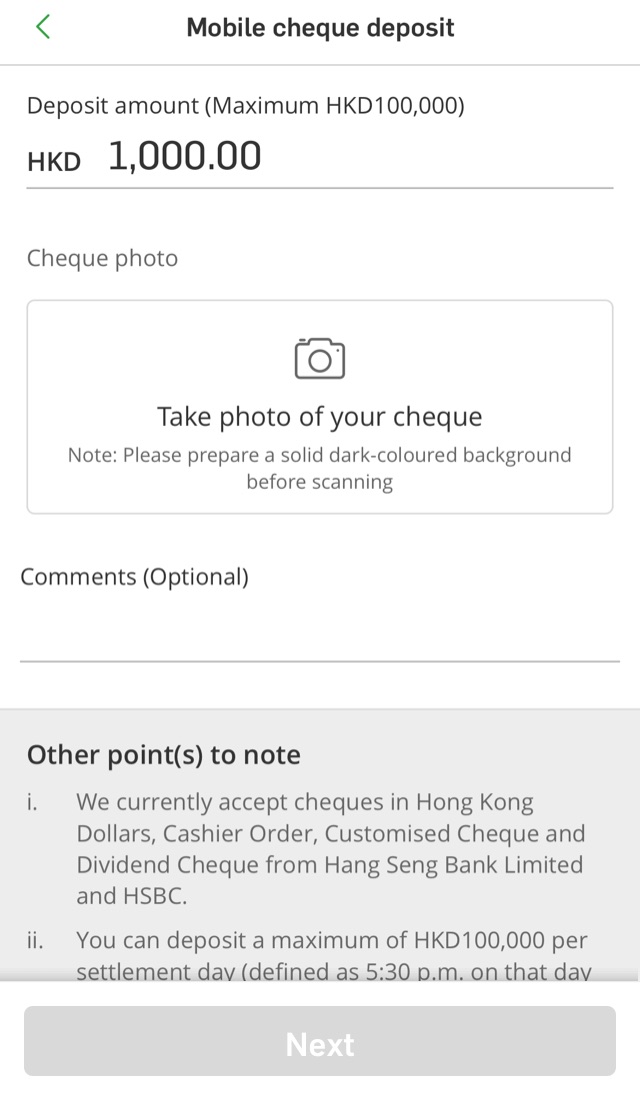

You can deposit a maximum of HKD100,000 per settlement day (defined as 5:30 p.m. on that day to 5:29 p.m. on the next settlement day). Each cheque should be HKD100,000 or less.

You can deposit a maximum of 20 cheques per settlement day (defined as 5:30 p.m. on that day to 5:29 p.m. on the next settlement day).

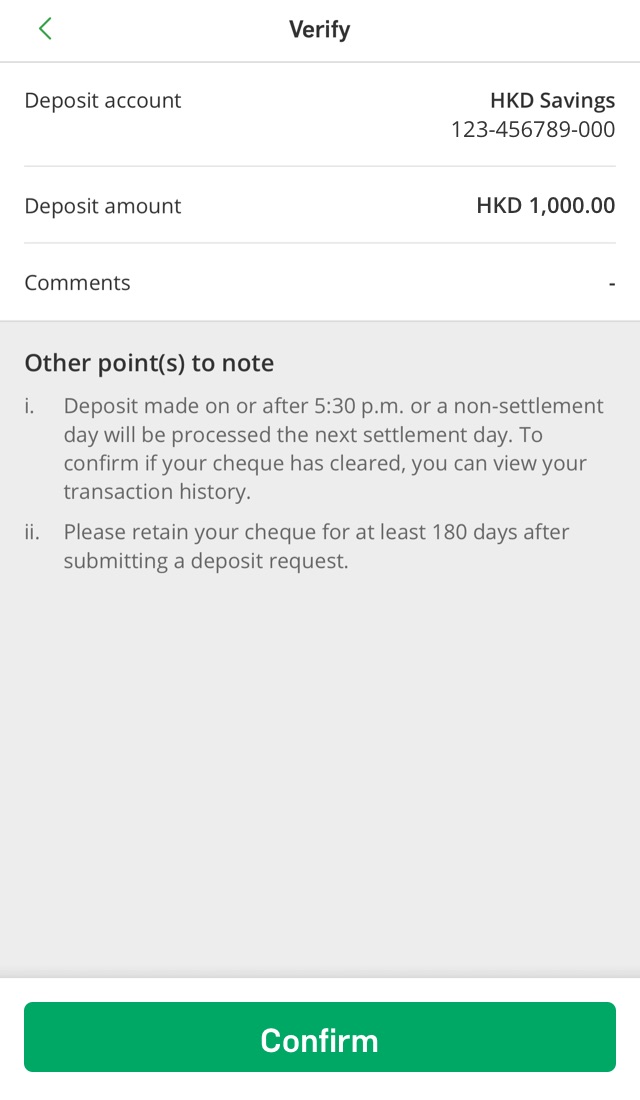

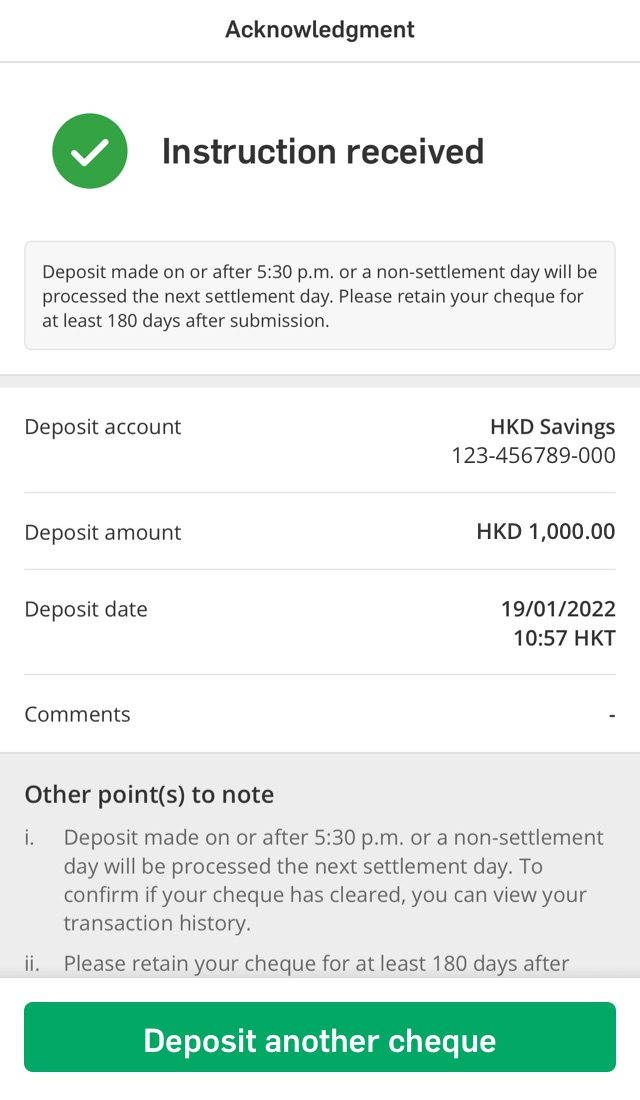

For mobile cheques deposited during a settlement day before 5:30 p.m., the instruction will be processed on the same day; for mobile cheques deposited on or after the cut-off time 5:30 p.m., or on a non-settlement day, the instruction will be processed on the next settlement day.

Please keep your physical cheques safe for at least 180 days after submitting a deposit instruction even the funds are deposited into your account. You can log on to Personal e-Banking and check your updated balance under Account Overview to confirm your cheque's status.

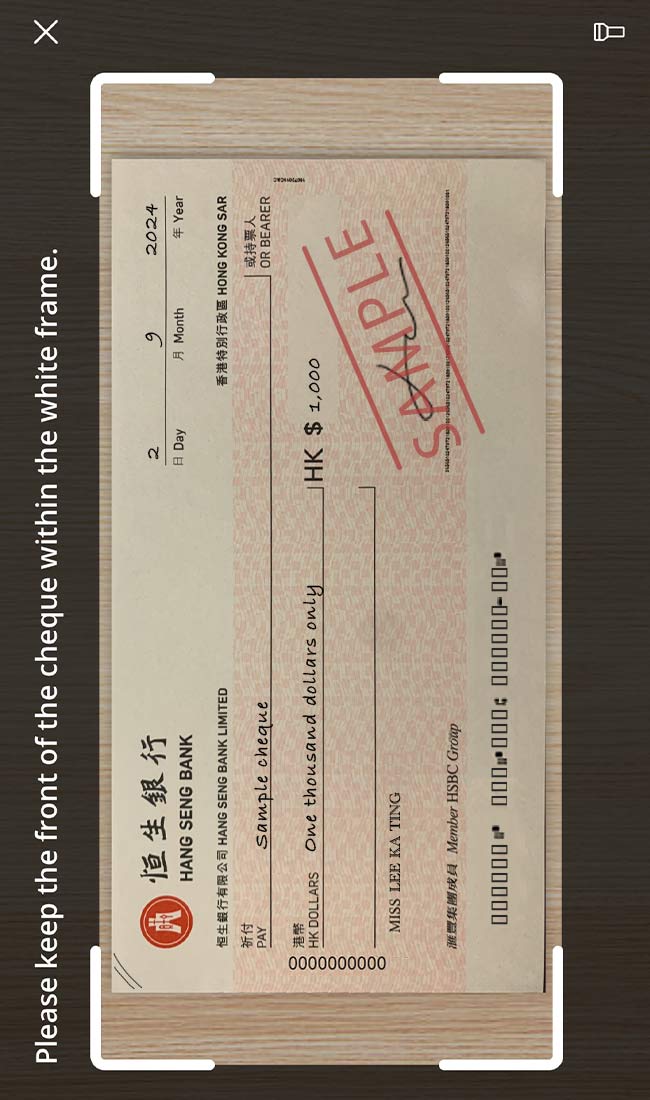

Please enable camera access from "Hang Seng HK" in your phone settings and retry.

When taking images of cheques, please note:

You cannot deposit the same cheque more than once. If you have successfully deposited the cheque via Mobile Cheque Deposit, you should not deposit this cheque through other channels or platforms. Likewise, if you have successfully deposited the cheque with us or at other institutions, you are unable to use Mobile Cheque Deposit. If any ineligible application is found, we reserve the right to revoke the deposit.

If you are a Hang Seng Bank cheque issuer, you may receive SMS and email on next day (including Saturday) after the cheque payee has deposited the cheque via mobile.

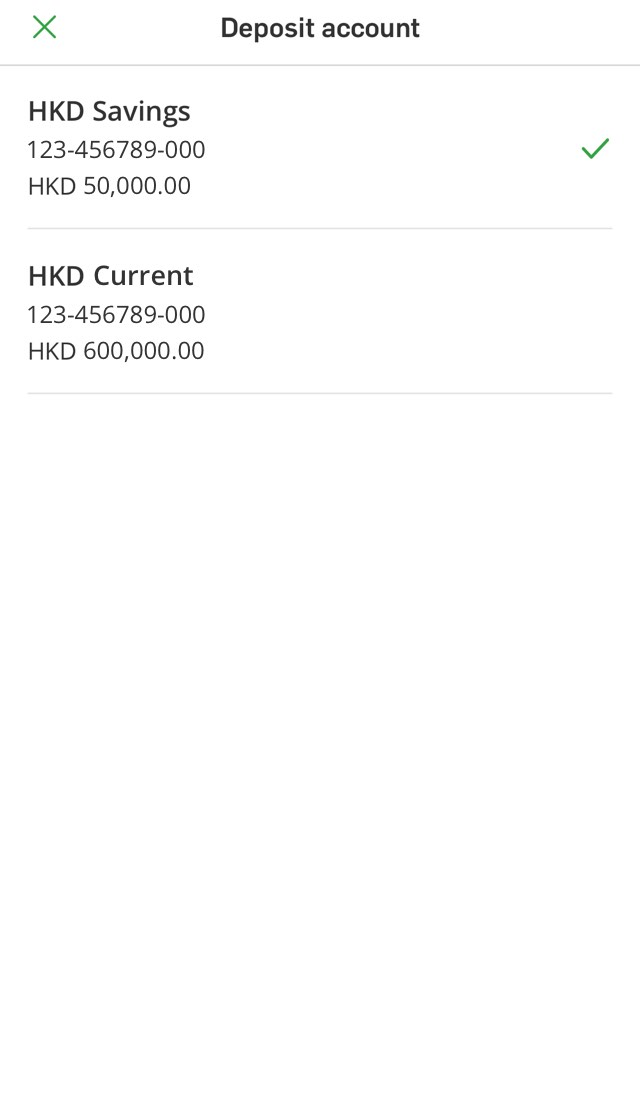

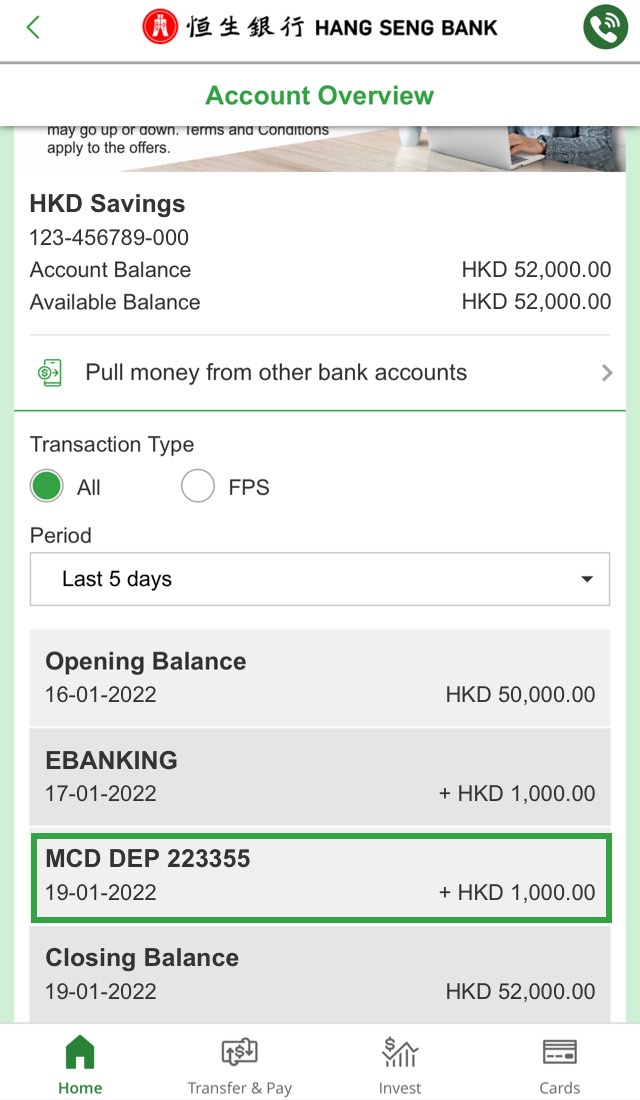

If you are the cheque receiver, you can log on to Personal e-Banking and check your account balance under Account Overview after you have deposited the cheque using the Mobile Cheque Deposit service[1].

In view of safeguarding the interests of both cheque issuer and receiver, the Bank reserves the right to revoke the deposit due to blurry cheque image.

Please ensure the image is complete and identifiable before submitting the deposit instruction.

No, Mobile Cheque Deposit is free of charge.

Cheque verification number is a unique identification number printed on the left of the cheque face. The following types of cheque may not have a cheque verification number:

For mobile cheques deposited on or after the cut-off time 5:30 p.m., or on a non-settlement day, cheque receiver can check balance update of their credit account in "Account Overview" on the next settlement day.

Want to know more about Banking Services?

Want to know more about Banking Services?

Chat with H A R O now