We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

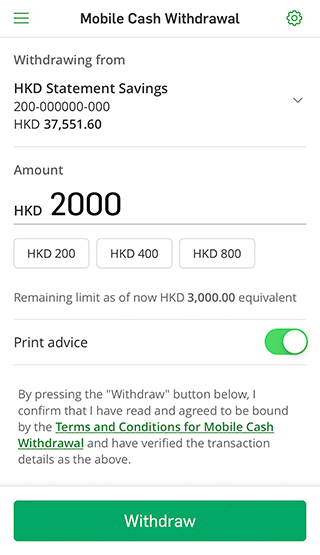

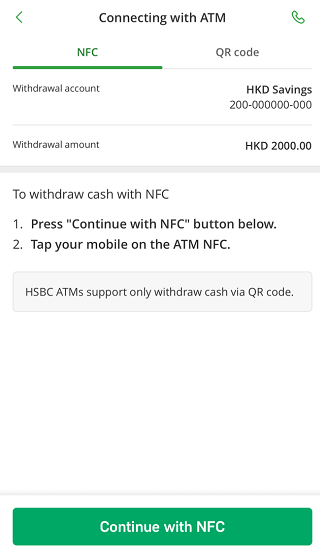

You can set a Mobile Cash Withdrawal instruction via Hang Seng Personal Banking mobile app, and get cash from Hang Seng or HSBC ATMs or Multi-function ATMs by tapping your mobile on the NFC device or scanning the QR code. The daily withdrawal limit is up to HKD10,000.

No need to bring your ATM card. Simply withdraw cash from your account using Hang Seng Personal Banking mobile app.

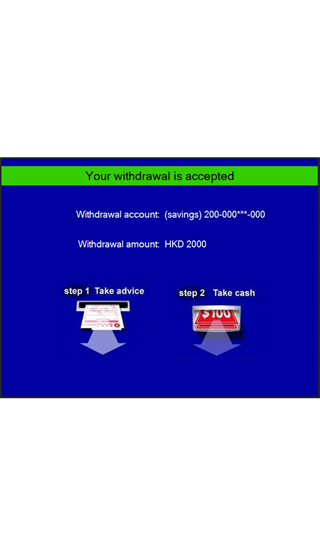

Initiate a mobile cash withdrawal instruction and get cash at the ATM / MFM with your mobile.

No more worry about ATM card skimming or expose your ATM card password to others.

Hang Seng Mobile Cash Withdrawal service via Hang Seng Personal Banking mobile app is provided to Hang Seng customers. Hang Seng customers place a mobile cash withdrawal instruction on Hang Seng Personal Banking mobile app and collect the cash from Hang Seng or HSBC Automated Teller Machines (ATM) or Multi-Function ATM (MFM) by tapping their mobile phone on the Near-Field Communication (NFC) device (applicable to Hang Seng ATM and MFM only) or scanning a QR code, instead of using ATM card.

You'll need to:

HKD Account; both solely or jointly owned by a customer.

All Hang Seng ATMs have both a NFC and a QR code to facilitate our Mobile Cash Withdrawal service while all HSBC ATMs have QR code to facilitate our Mobile Cash Withdrawal service.

No fee for this service.

You can call 24-hour enquiry hotline (852) 2997 2112 or (852) 2822 0228 for assistance.