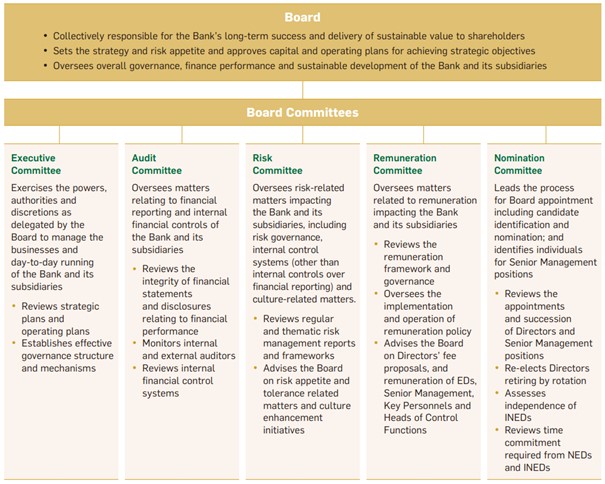

The Board has set up five Committees, namely, Executive Committee, Audit Committee, Risk Committee, Remuneration Committee and Nomination Committee, to assist it in carrying out its responsibilities.

Each of these Committees has specific written terms of reference, which set out in detail their respective authorities and responsibilities. Each Committee reviews its terms of reference and effectiveness annually. The terms of reference of all the Non-executive Board Committees are available on our website (https://www.hangseng.com/en-hk/about-us/corporate-governance/).

All Committees adopt the same governance processes as the Board as far as possible and report back to the Board on their decisions and recommendations on a regular basis.

The Company Secretary advises the Board on all corporate governance matters, maintains strong and consistent governance practices at Board level, facilitates induction and professional development of Directors, and ensures good information flows and communications within the Board and its committees and between the Bank’s Management and the Directors. During the year, the Company Secretary undertook no less than 15 hours of relevant professional training.

The Executive Committee meets approximately monthly and operates as a general management committee under the direct authority of the Board.

The Executive Committee exercises the powers, authorities and discretions as delegated by the Board in so far as they concern the management and day-to-day running of the Bank in accordance with its terms of reference and such other policies and directives as the Board may determine from time to time. The Executive Committee also sub-delegates credit, investment and capital expenditure authorities to its members and the Bank’s senior executives.

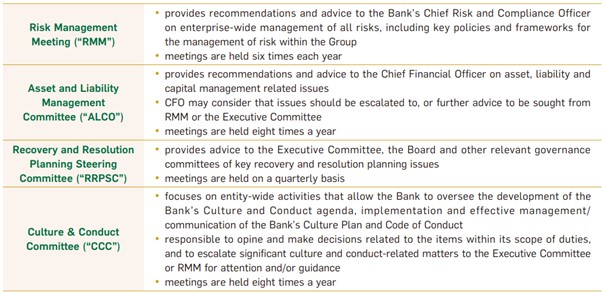

To support the Bank’s strong governance framework and its business and operational needs, the following four formal governance-related management level committees accountable to the Executive Committee have been established:

The Audit Committee meets at least four times a year. The Bank’s executives including the Chief Financial Officer, Chief Risk and Compliance Officer and Head of Audit are invited to present updates and/or answer relevant questions in order to facilitate the decision-making process. The Bank’s external auditor will also attend the Audit Committee meeting. The Audit Committee meets at least twice annually with the representatives of the Bank’s Head of Audit and external auditor without the presence of the Management in accordance with its terms of reference and Listing Rules.

Pre-meeting with the Audit Committee Chairman will be held before the regular meeting to allow the Audit Committee Chairman to make enquiries and ask for supplemental information. Audit Committee meetings usually take place a couple of days before Board meetings to allow the Audit Committee to report its findings and recommendations in a timely and orderly manner. The Audit Committee also reports to the Board following each Audit Committee meeting, drawing the Board’s attention to significant issues or matters of which the Board should be aware, identifying any matters in respect of which it considers that action or improvement is needed, and making relevant recommendations.

The Audit Committee Chairman also holds regular meetings with the Senior Management, and internal and external auditors to discuss specific issues as arisen during the year outside the formal meetings.

The Board has delegated to the Audit Committee the oversight of matters relating to financial reporting and internal financial controls, in particular, reviewing:

|

the integrity of the financial statements, formal announcements and disclosures relating to financial performance; |

|

the effectiveness of Internal Audit and the external audit process; and |

|

the effectiveness of internal financial control systems. |

The Audit Committee is also responsible for making recommendations to the Board on the appointment, re-appointment, removal and remuneration of the Bank’s external auditor. In addition, the Bank’s whistleblowing policy, which is aligned with the Group, whereby all staff members may report incidents of improprieties in confidence and anonymity so that the same can be timely and thoroughly investigated and appropriate actions can be taken promptly.

The responsibilities of the Audit Committee are set out in its terms of reference, which are available on our website (www.hangseng.com/en-hk/about-us/corporate-governance/) and on the website of HKEx (www.hkexnews.hk).

The Risk Committee meets at least four times a year. The Bank’s executives including the Chief Financial Officer, Chief Risk and Compliance Officer, Head of Audit and General Counsel are invited to present updates and/or answer relevant questions in order to facilitate the decision-making process. The Bank’s external auditor also joins the Risk Committee meeting. The Risk Committee also meets at least twice annually with the Bank’s Chief Risk and Compliance Officer, Head of Audit and external auditor separately without the presence of the Management in accordance with its terms of reference and Listing Rules.

Pre-meeting with the Risk Committee Chairman will be held before the regular meeting to allow the Risk Committee Chairman to make enquiries and ask for supplemental information. Risk Committee meetings usually take place a couple of days before Board meetings to allow the Committee to report its findings and recommendations in a timely and orderly manner. The Risk Committee also reports to the Board following each Risk Committee meeting, drawing the Board’s attention to significant issues or matters of which the Board should be aware, identifying any matters in respect of which it considers that action or improvement is needed, and making relevant recommendations.

The Risk Committee Chairman meets regularly with Chief Risk and Compliance Officer and the Senior Management to discuss specific risk matters that have arisen outside formal meetings.

The Board has delegated to the Risk Committee oversight of risk-related matters impacting the Bank and its subsidiaries, including risk governance, internal control systems (other than internal controls over financial reporting) and culture-related matters.

Pursuant to HKMA’s Circular on “Bank Culture Reform”, the Board has also delegated to the Risk Committee to encompass culture-related responsibilities. Such responsibilities include actions to approve, review and assess, at least annually, the adequacy of any relevant statement which sets out the Bank’s culture and behavioural standards.

The Risk Committee is responsible for, among other things, the Bank’s high level risk related matters, risk appetite and tolerance, risks associated with proposed strategic acquisitions or disposals, risk management reports from the Management, effectiveness of the risk management framework and systems of internal control and compliance (other than that regarding financial reporting), and appointment and removal of the Chief Risk and Compliance Officer.

The responsibilities of the Risk Committee are set out in its terms of reference, which are available on our website (www.hangseng.com/en-hk/about-us/corporate-governance/) and on the website of HKEx (www.hkexnews.hk).

The Remuneration Committee meets at least twice a year to consider and provide advice to the Board on the remuneration policy and structure in order to underpin the Bank’s people strategy.

In determining the bank-wide remuneration policy, the Remuneration Committee will take into account the Bank’s business objective, people strategy, short-term and long-term performance, business and economic conditions, market practices, conduct, compliance and risk control, in order to ensure that the remuneration aligns with business and individual performance, promotes effective risk management, facilitates retention of quality personnel and is competitive in the market. The Remuneration Committee may invite any Director, executive, consultant or other relevant party to provide advice in this respect, if necessary. In 2024, the Remuneration Committee engaged an external consultant to undertake an independent review of the Bank’s remuneration policy and its implementation for year 2024.

The Remuneration Committee reports to the Board following each Committee meeting, and draws to the Board’s attention any significant issues, identify any action or improvement required, and makes relevant recommendations.

The Remuneration Committee Chairman also meets regularly with Senior Management to discuss agenda planning.

The Board has delegated to the Remuneration Committee the oversight of matters related to remuneration impacting the Bank and its subsidiaries, in particular for:

|

satisfying itself that the remuneration framework is appropriate to attract, retain and motivate individuals of the quality required to support the success of the Bank |

|

overseeing the implementation and operation of the remuneration policy of the Bank, which is aligned with the Group’s remuneration framework |

|

satisfying itself that the remuneration framework complies with any relevant local law, rule or regulation |

|

satisfying itself that the remuneration framework is in line with the risk appetite, business strategy, culture and values, and long-term interests of the Bank |

The Remuneration Committee also considers and proposes for the Board’s approval the remuneration packages of all EDs, Senior Management, Key Personnels and Heads of Control Functions. In addition, it reviews at least annually and independently of the Management, the adequacy and effectiveness of the Bank’s remuneration policy and its implementation, to ensure that the Bank’s remuneration practices are consistent with relevant regulatory requirements and promotes effective risk management.

The responsibilities of the Remuneration Committee are set out in its terms of reference, which are available on our website (www.hangseng.com/en-hk/about-us/corporate-governance/) and on the website of HKEx (www.hkexnews.hk).

The Nomination Committee meets at least twice a year. It leads the process for Board appointments and identifies and nominates candidates for appointment to the Board, for the Board’s approval.

The Nomination Committee reports to the Board following each Committee meeting, drawing the Board’s attention to significant issues or matters of which the Board should be aware, identifying any matters in respect of which it considers that action or improvement is needed, and making relevant recommendations.

The Nomination Committee shall be responsible to the Board for leading the process for Board appointments by identifying and nominating suitable candidates for the approval by the Board to complement the Bank’s corporate strategy. The Nomination Committee shall also have responsibility for identifying individuals suitably qualified to become members of Senior Management and selecting, or making recommendations to the Board on the selection of, individuals nominated for Senior Management positions (based on the role and its responsibilities and the knowledge, experience and competence which the role requires).

The Nomination Committee also considers, among other things, the structure, size and composition of the Board and Non-executive Board Committees, independence of INEDs, re-election of Directors, succession planning of Directors, term of appointment of NEDs, time commitment required from NEDs and INEDs, appointment to Board Committees, and approves the appointment to the position of “manager” as defined under the Banking Ordinance.

The responsibilities of the Nomination Committee are set out in its terms of reference, which are available on our website (www.hangseng.com/en-hk/about-us/corporate-governance/) and on the website of HKEx (www.hkexnews.hk).

The Bank has adopted its Nomination Policy to ensure that proper selection and nomination processes are in place for Board appointments. The Nomination Committee shall consider the candidates based on merit having regard to the balance of skills, knowledge and experience on the Board as well as the overall Board diversity and shall undertake adequate due diligence in respect of the proposed candidates and make recommendations based on the selection criteria and such other factors that it considers appropriate for the Board’s consideration and, if thought fit, approval. If necessary, the Bank may also engage external search firm to assist in the sourcing and identification of appropriate candidates for Board appointments. The Nomination Policy is also available on our website (www.hangseng.com/en-hk/about-us/corporate-governance/). The Bank will from time to time review the Nomination Policy and monitor its implementation to ensure its compliance with regulatory requirements and good corporate governance practices.