We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Personal Instalment Loan APR as low as 1.88%

Up to HKD18,800 cash rebate

View the relevant Key Facts Statement.

Whenever you need cash in your different life moments, we are always here with you.

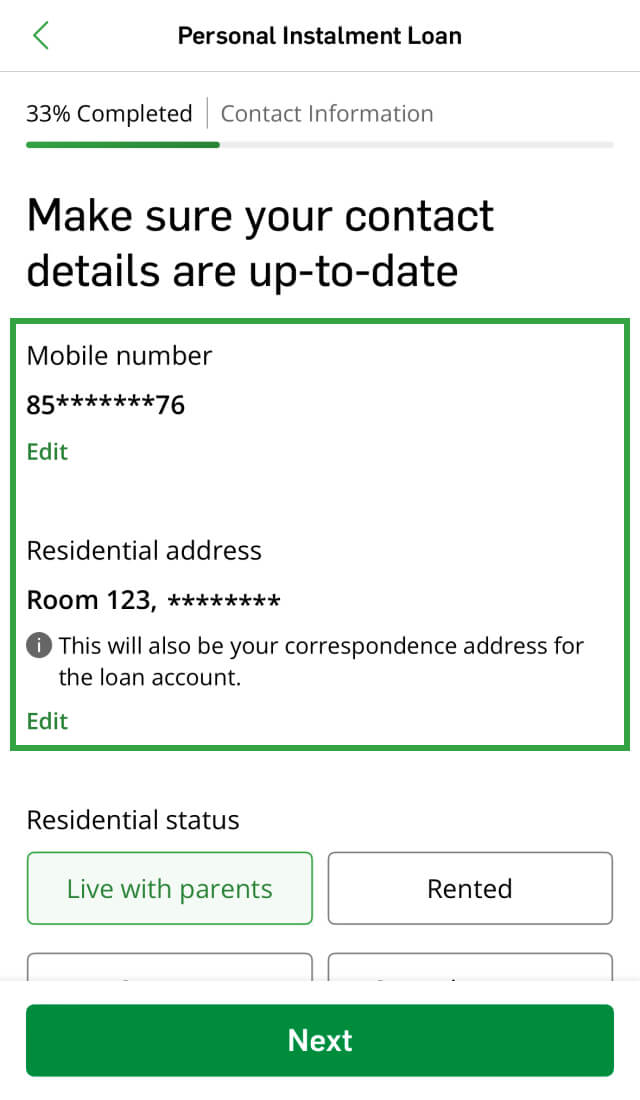

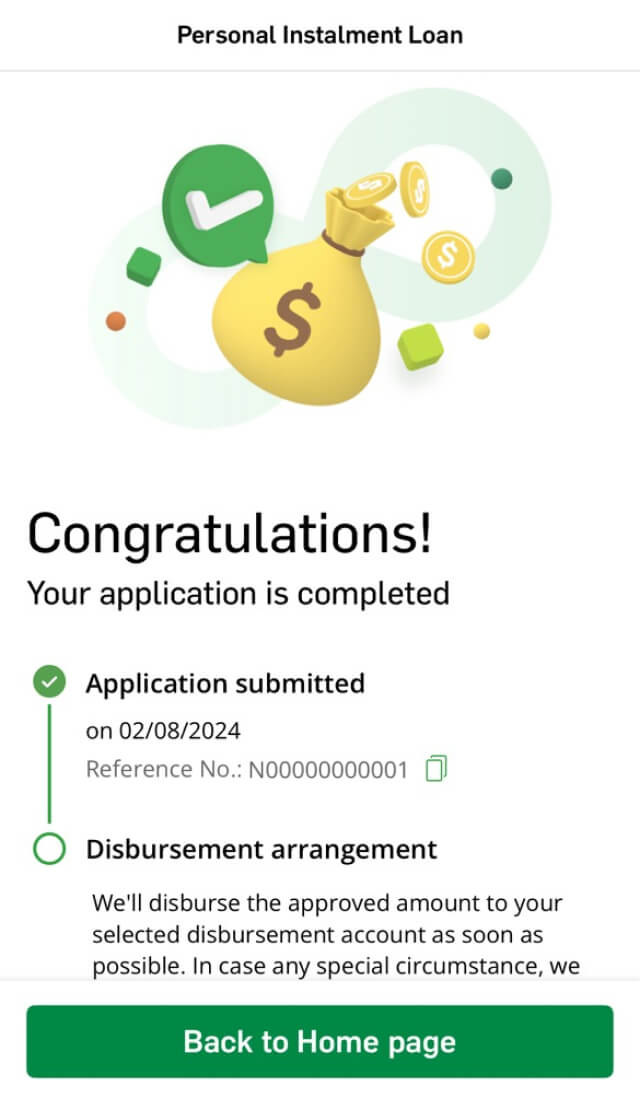

Simply apply online and enjoy instant approval in as fast as 1 minute [1] to get cash with ease!

Apply now to enjoy up to HKD18,800 cash rebate!

Please read the Privacy Notice, Terms and Conditions for Hang Seng Personal Instalment Loan and Hang Seng Personal Revolving Loan and the Declaration.

If you understand and agree to be bound by them, please call (852) 3146 9987.

Please read the Privacy Notice, Terms and Conditions for Hang Seng Personal Instalment Loan and Hang Seng Personal Revolving Loan and the Declaration.

If you understand and agree to be bound by them, please call (852) 3146 9987.

Personal loan Annualised Percentage Rate as low as 1.88%[2] and 0% handling fee

Up to HKD18,800 cash rebate:

- Up to HKD10,000 cash rebate for online application [3]

- Payroll customers or Eligible Payroll Customers of PayDay+ can further enjoy up to HKD8,800 cash rebate [3]

Loan amount up to HKD3,000,000 or 24 times of your monthly salary (whichever is lower)[4], and up to 60 months of repayment period[5]

Further apply for a top-up on your repaid amount[6] with no documents required[7]

Enjoy 7-day cooling off period. Interest-free and no handling fee[8]

Answer simple questions below and get your loan plan

| Debt Consolidation Instalment Loan | Credit Card Minimum Payment |

|---|

| Debt Consolidation Instalment Loan | Credit Card Minimum Payment | |

|---|---|---|

| Monthly repayment amount | HKD - | Minimum Payment |

| Total interest amount | HKD - (Save HKD -) |

HKD - |

| Repayment period | 72 month(s) (Shortened by - month(s)) |

- month(s) |

| Each month you pay (HKD) | Repayment period | Estimated total payment amount (HKD) |

|---|

| Each month you pay (HKD) | Repayment period | Estimated total payment amount (HKD) |

|---|---|---|

| Only the minimum repayment | - month(s) | - |

| - | 36 month(s) | - |

| Loan amount (HKD) | Maximum cash rebate for online application (HKD) [3] | Maximum cash rebate for payroll customers (HKD) [3] | Monthly flat rate | Monthly repayment amount (HKD) - Based on every HKD10,000 loan amount (APR) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 12 months | 18-24 months | 36 months or above | 12 months | 18 months | 24 months | 36 months | 48 months | 60 months | |||

| $5,000 - $49,999 | - | - | 0.44% | 0.44% | 0.42% | $877.40 | $599.60 | $460.70 | $319.80 | $250.40 | $208.70 |

| 10.04% | 10.23% | 10.29% | 9.80% | 9.72% | 9.62% | ||||||

| $50,000 - $99,999 |

$500 | $500 | 0.39% | 0.39% | 0.37% | $872.40 | $594.60 | $455.70 | $314.80 | $245.40 | $203.70 |

| 8.87% | 9.04% | 9.10% | 8.63% | 8.58% | 8.50% | ||||||

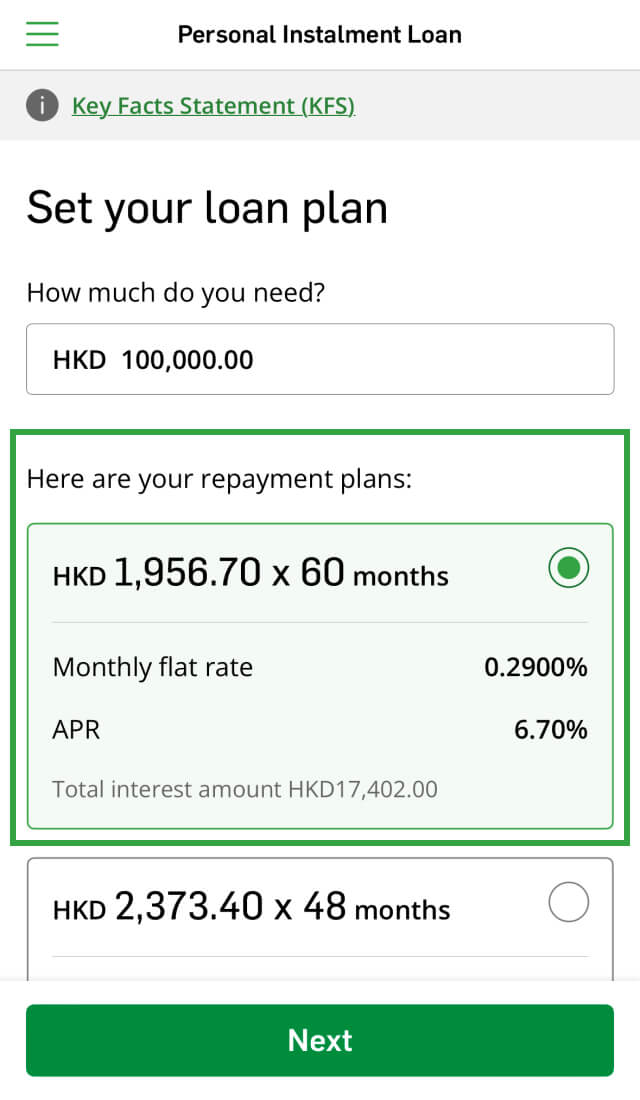

| $100,000 - $199,999 |

$1,000 | $1,000 | 0.29% | 0.29% | 0.27% | $862.40 | $584.60 | $445.70 | $304.80 | $235.40 | $193.70 |

| 6.55% | 6.69% | 6.75% | 6.30% | 6.28% | 6.24% | ||||||

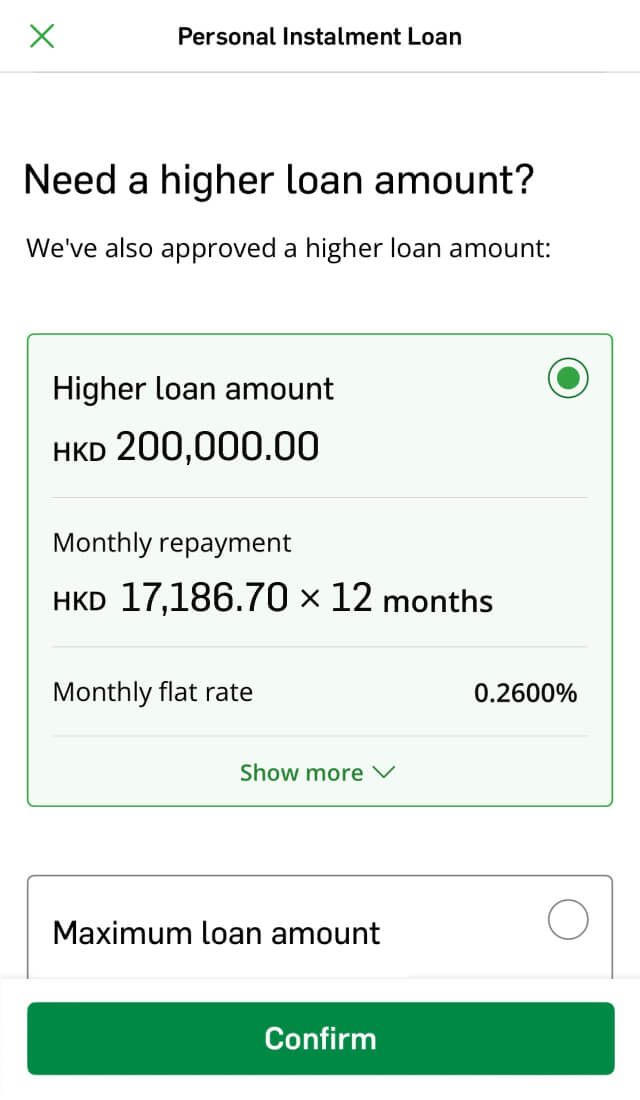

| $200,000 - $299,999 |

$2,000 | $1,000 | 0.28% | 0.28% | 0.25% | $861.40 | $583.60 | $444.70 | $302.80 | $233.40 | $191.70 |

| 6.32% | 6.46% | 6.51% | 5.83% | 5.82% | 5.79% | ||||||

| $300,000 - $499,999 |

$2,000 | $1,000 | 0.26% | 0.26% | 0.23% | $859.40 | $581.60 | $442.70 | $300.80 | $231.40 | $189.70 |

| 5.86% | 5.99% | 6.04% | 5.37% | 5.36% | 5.33% | ||||||

| $500,000 - $999,999 |

$3,000 | $2,000 | 0.24% | 0.24% | 0.21% | $857.40 | $579.60 | $440.70 | $298.80 | $229.40 | $187.70 |

| 5.40% | 5.52% | 5.57% | 4.90% | 4.89% | 4.88% | ||||||

| $1,000,000 - $1,499,999 |

$5,000 | $3,000 | 0.22% | 0.22% | 0.19% | $855.40 | $577.60 | $438.70 | $296.80 | $227.40 | $185.70 |

| 4.95% | 5.06% | 5.11% | 4.43% | 4.43% | 4.42% | ||||||

| $1,500,000 or above |

$10,000 | $8,800 | 0.0845% | 0.19% | 0.18% | $841.80 | $574.60 | $435.70 | $295.80 | $226.40 | $184.70 |

| 1.88% | 4.36% | 4.40% | 4.20% | 4.20% | 4.19% | ||||||

All Annualised Percentage Rates are calculated using the Net Present Value Method in accordance with the Code of Banking Practice. The Annualised Percentage Rates are reference rate which include the basic interest rate and other fees and charges of a product expressed as an annualised rate (if applicable).

The calculation of the monthly repayment amount and the annualised percentage rate has taken the 0% handling fee into account and does not include cash rebate. The monthly repayment amount is rounded up to 1 decimal point. The proportion of loan principal to interest in each monthly instalment amount is calculated according to the Rule of 78.

The rates for individual customer may vary. Please log on to Personal e-Banking or Hang Seng Mobile app, or call our Hotline for enquiry on your personalised offer.

The actual interest rate may be adjusted upon approval on a case-by-case basis, and the repayment liability depends on actual terms.

Terms and Conditions apply to the offers and services.

To borrow or not to borrow? Borrow only if you can repay!