We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

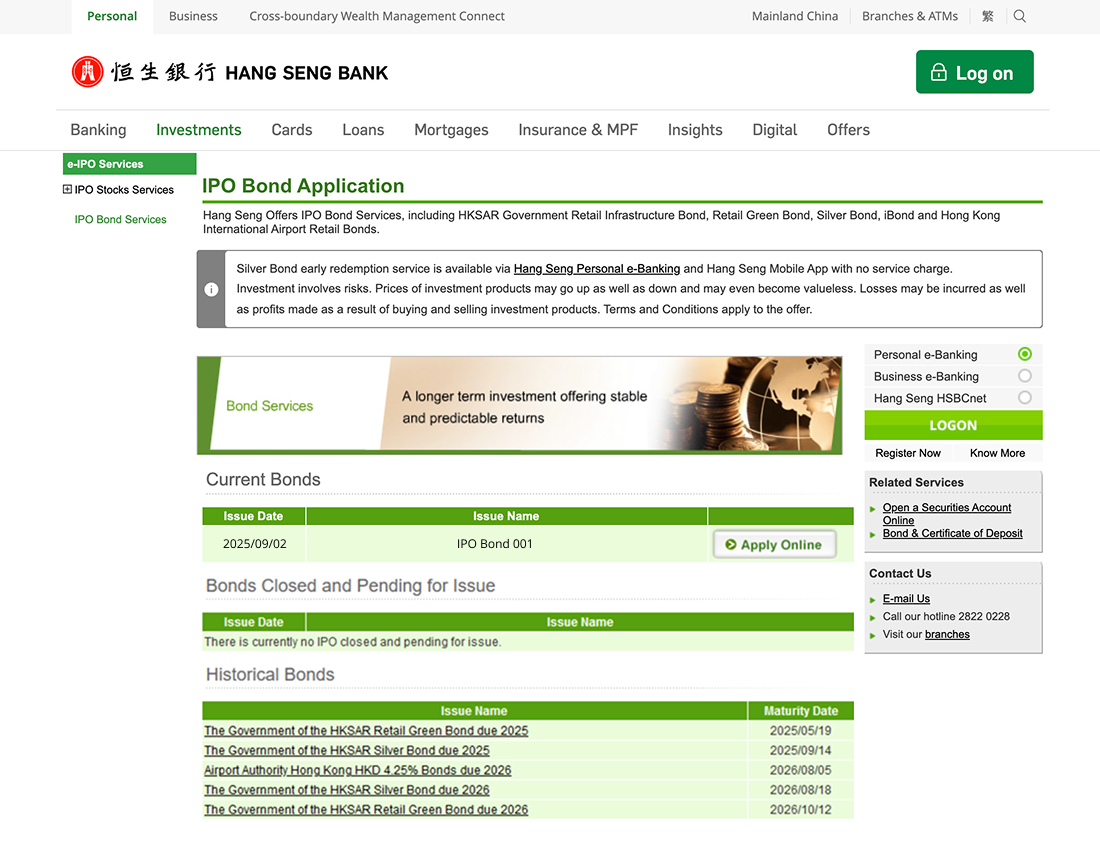

Our Initial Public Offering (IPO) subscription service allows you to seize opportunity to subscribe for the latest bonds in the market. You can easily subscribe via Hang Seng Mobile App, Personal e-Banking, Phone Banking or at our designated branches.

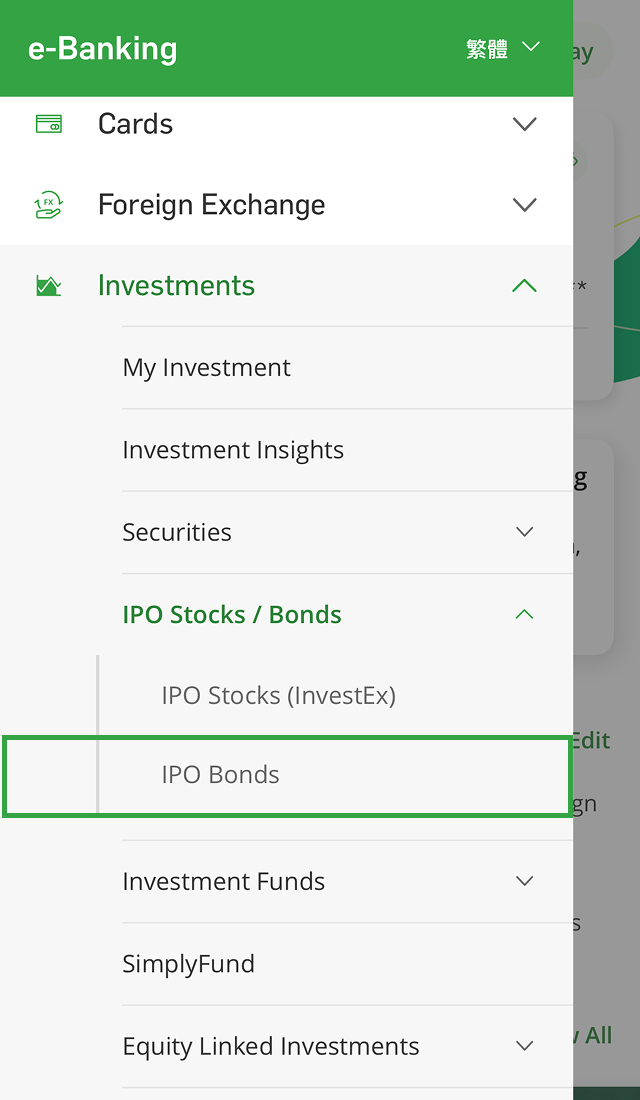

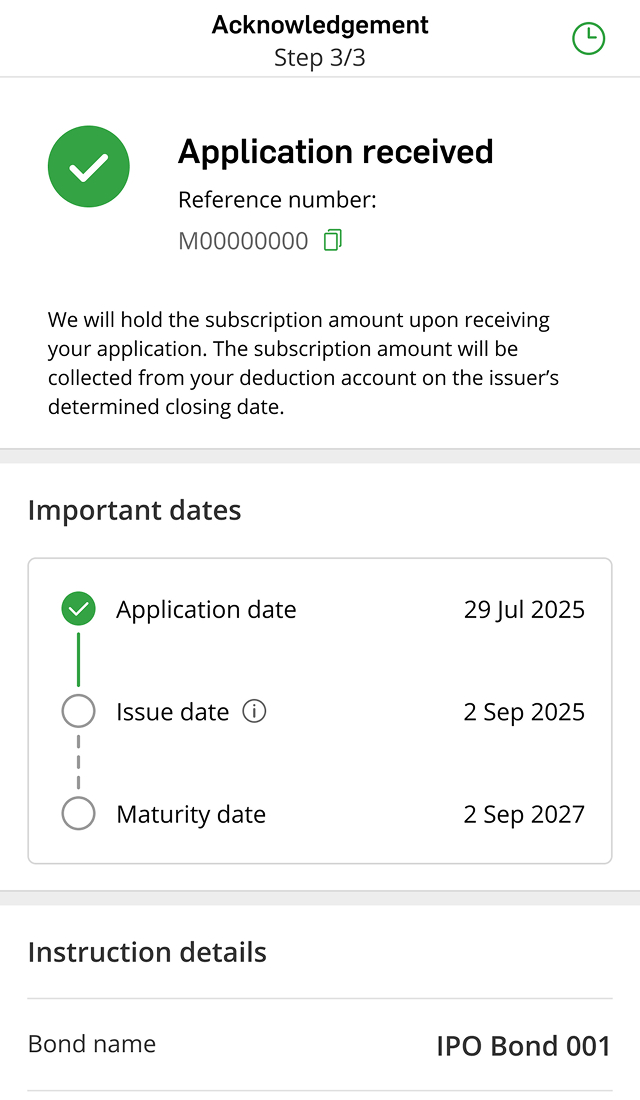

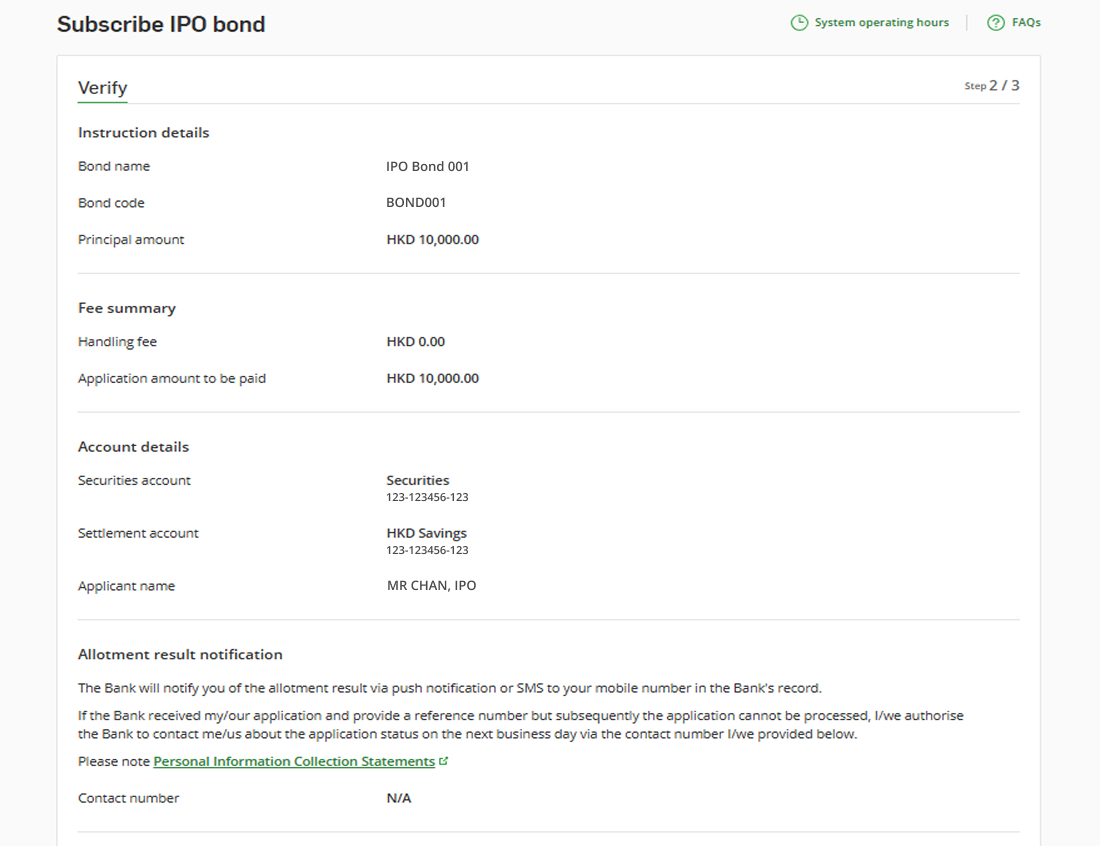

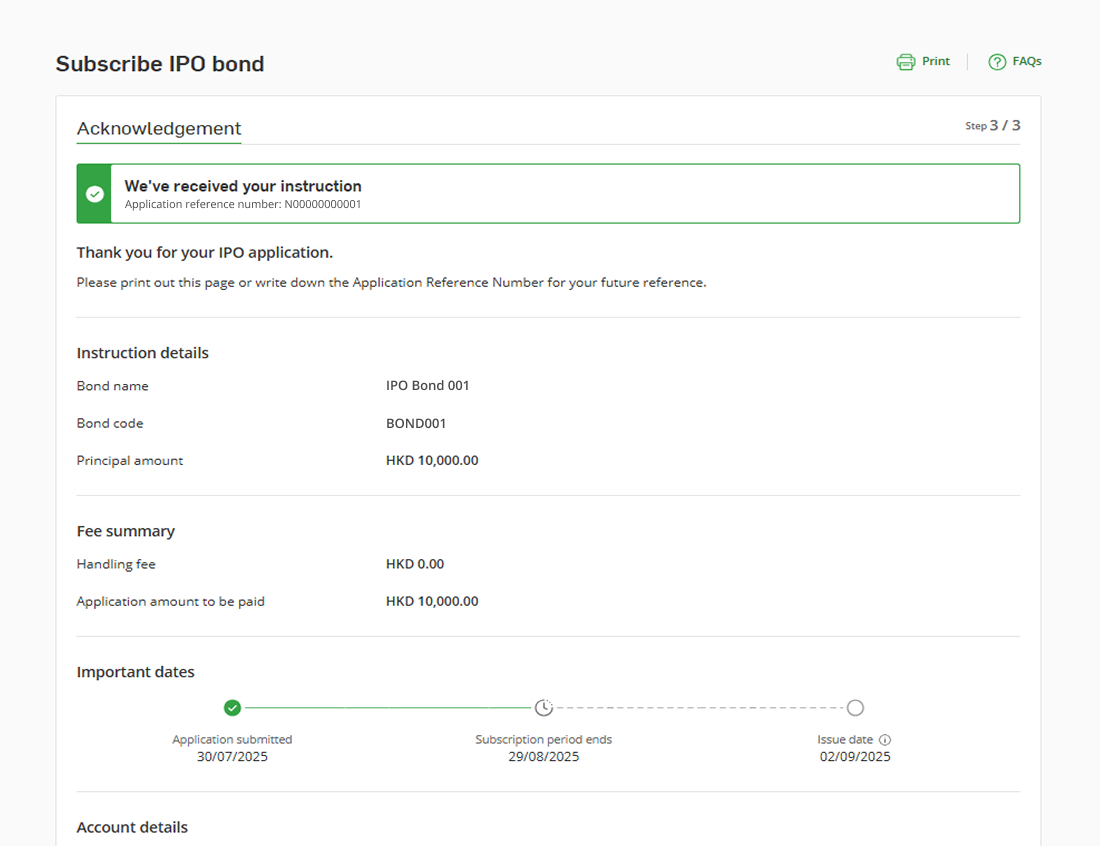

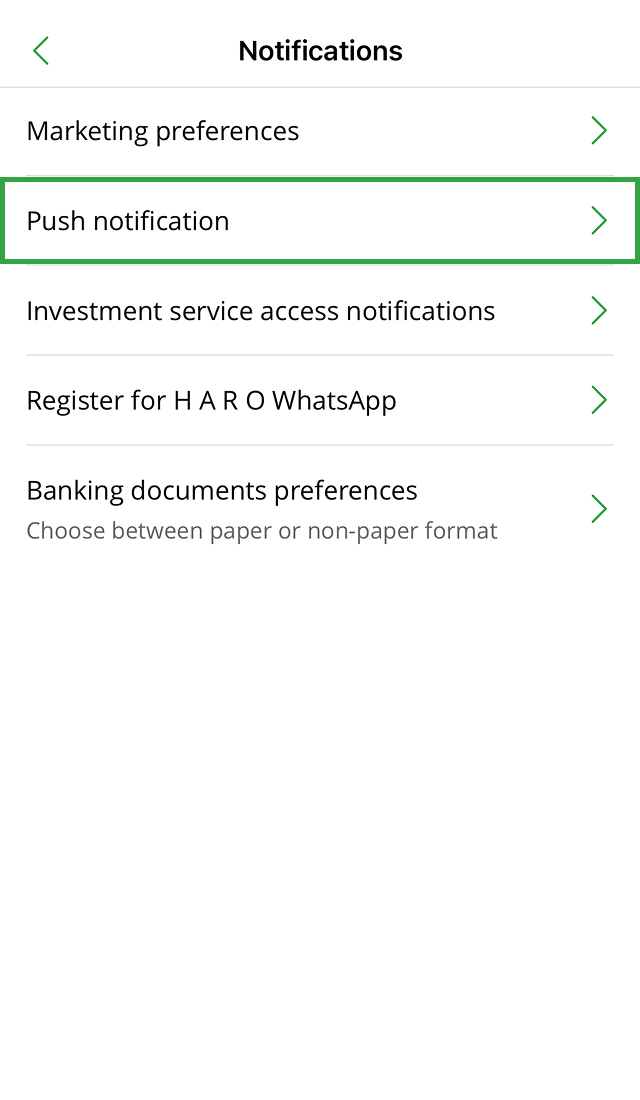

Subscribe in just 3 quick steps

![]()

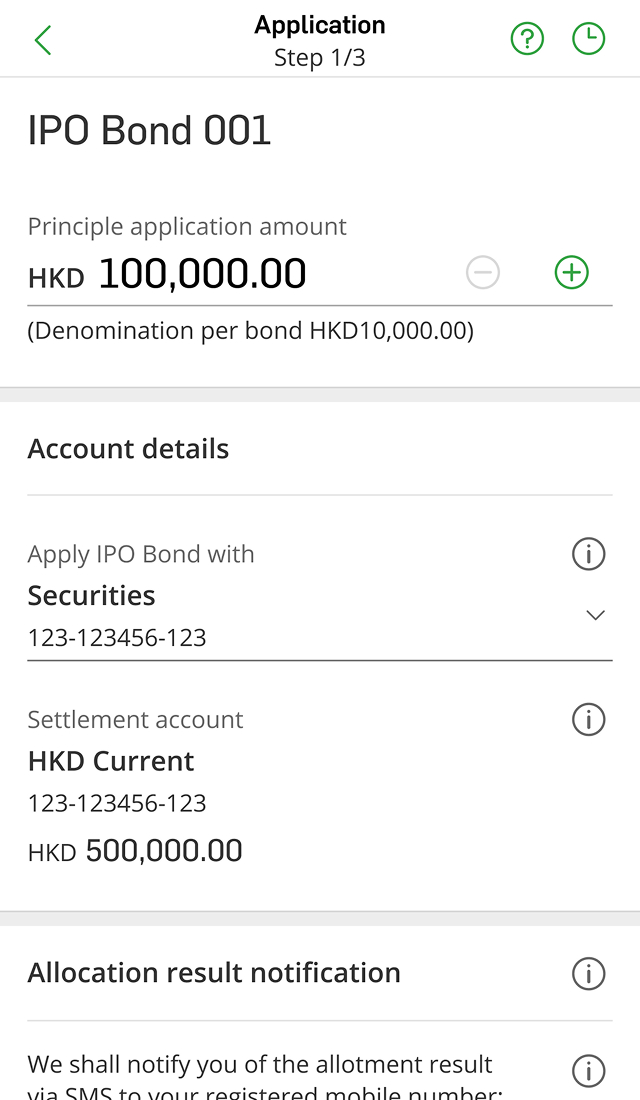

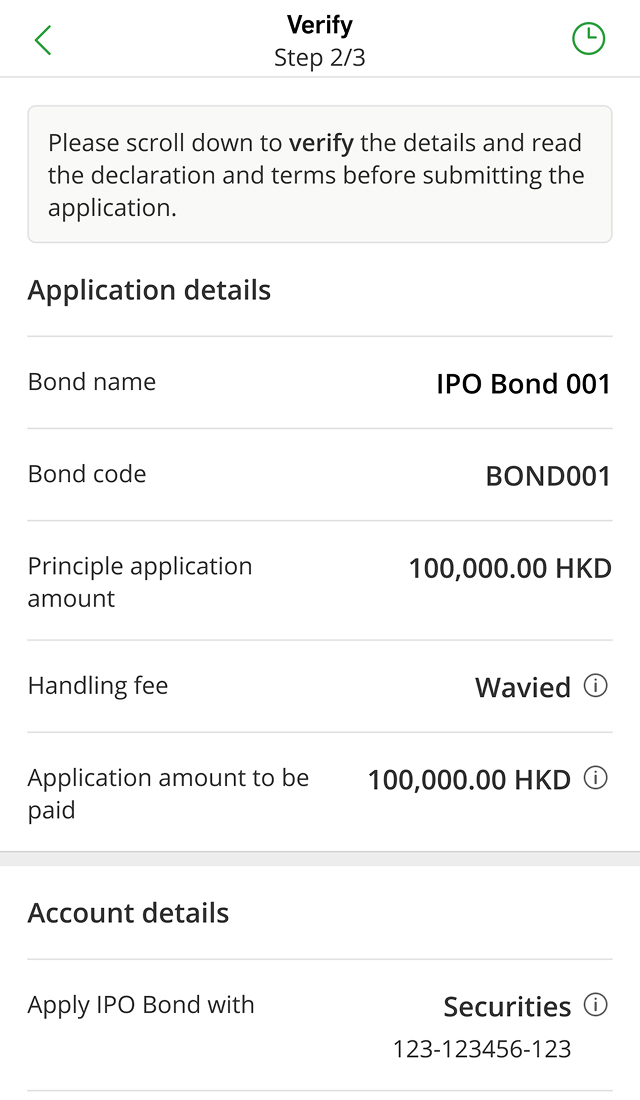

Subscribe for corporate or local government IPO bonds via Hang Seng Mobile App or Personal e-Banking in a few easy steps, without visiting a branch.

![]()

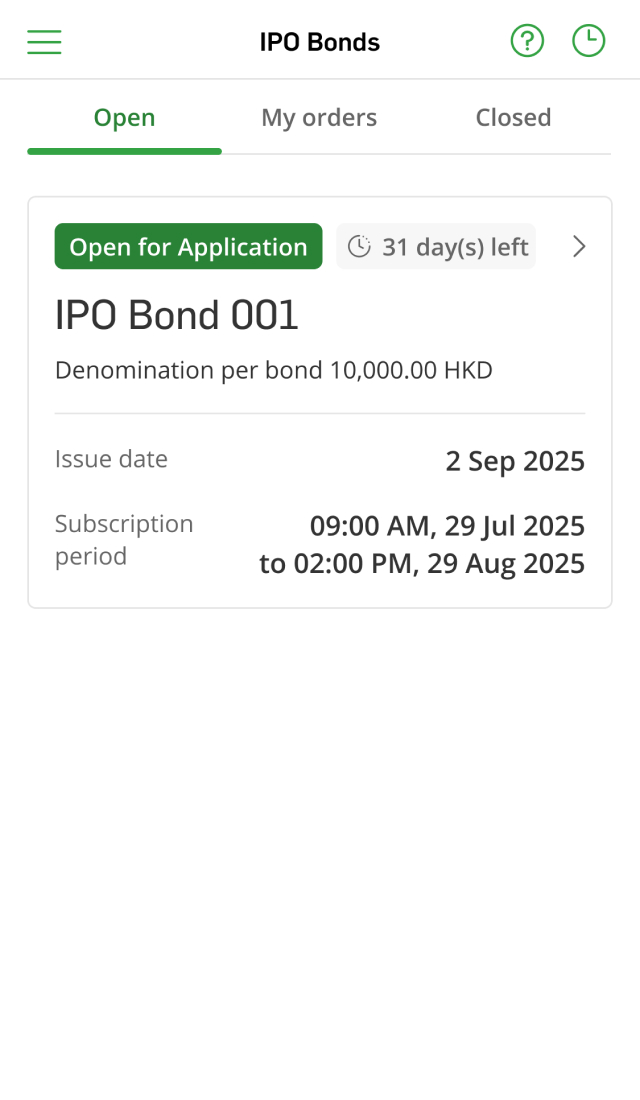

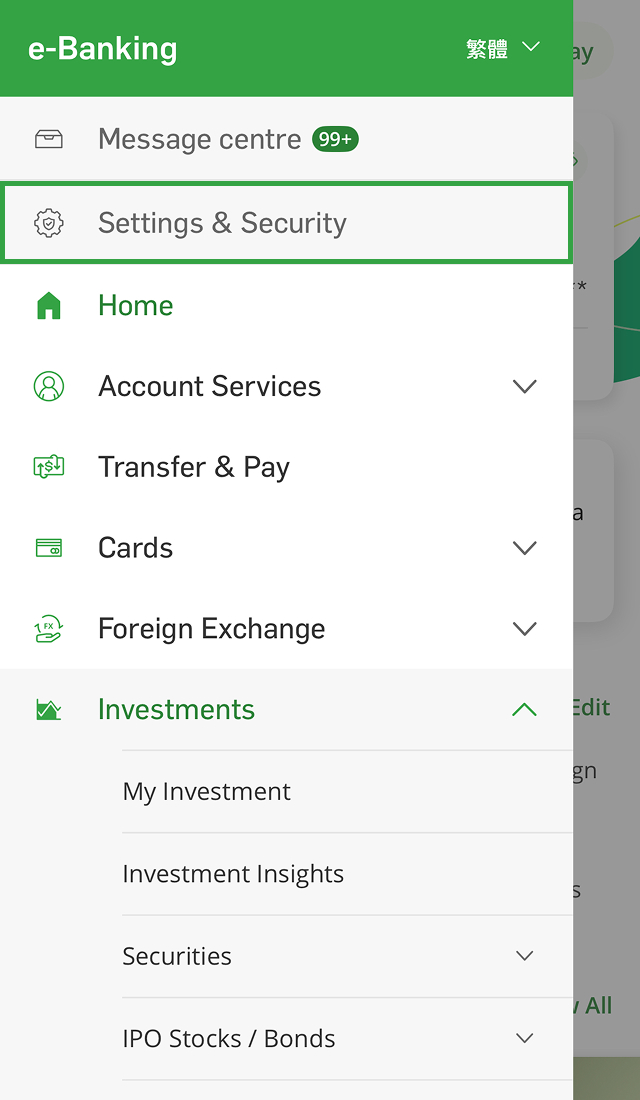

You can check your subscription status by logging on to Hang Seng Mobile App and tap "Investments" > "IPO Stocks / Bonds" > "IPO Bonds" > "My orders" from the left menu.

![]()

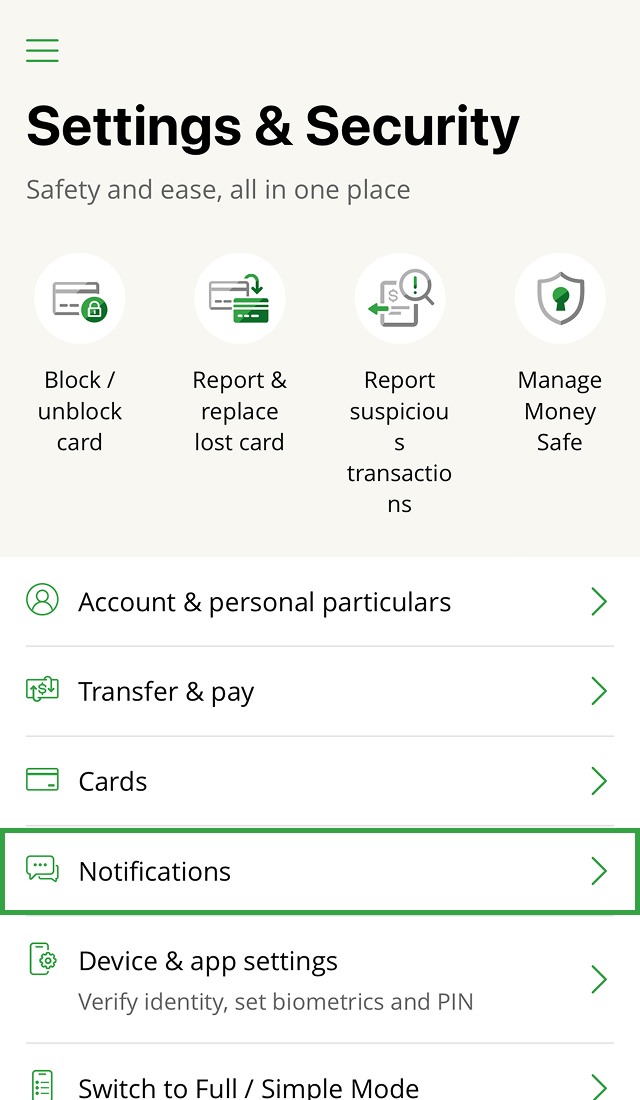

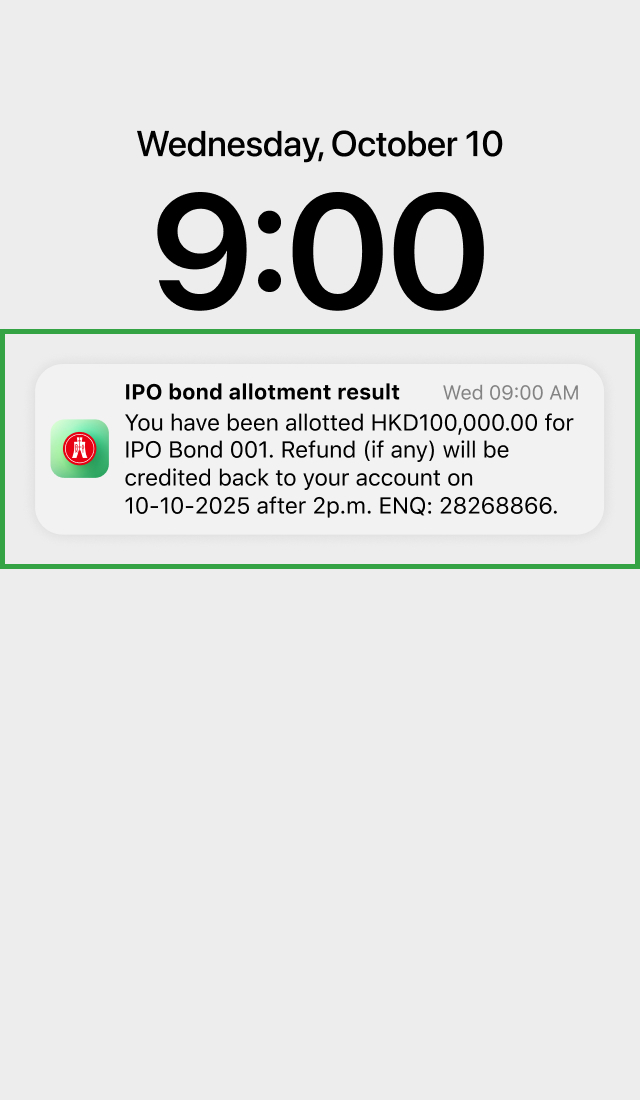

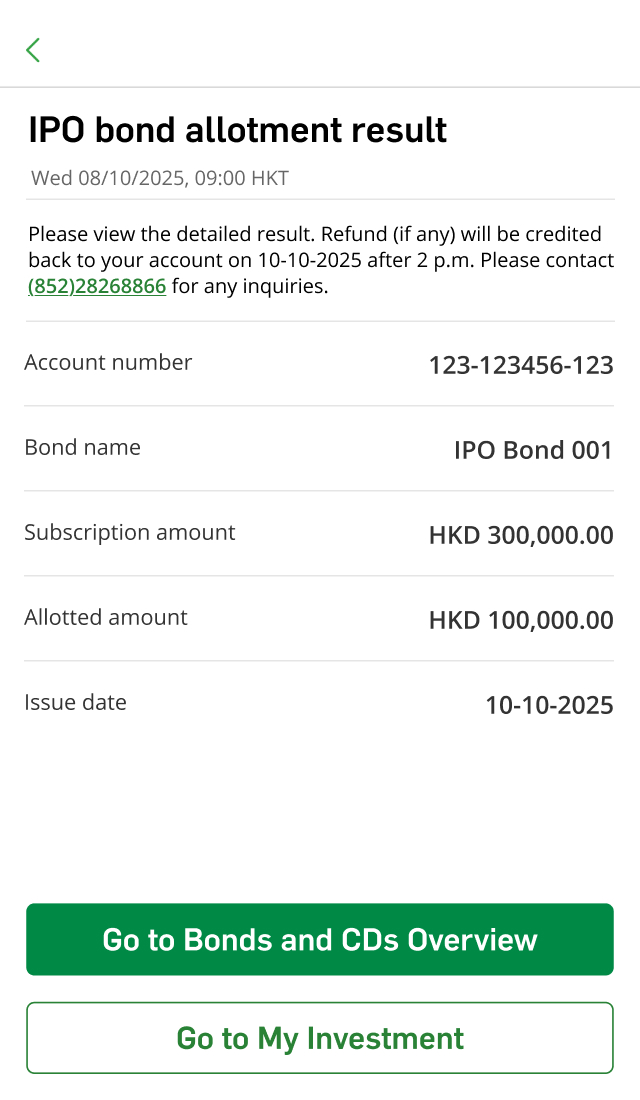

You'll receive your allotment result via push notification (if enabled) or SMS before IPO bond is listed.

A credit rating is an assessment of the creditworthiness of an individual, corporation or government. It essentially indicates the likelihood that an issuer will default on their debt obligation. Credit ratings generally are issued to companies and governments by several companies including S&P Global, Moody's and Fitch Ratings. Credit ratings are typically letter grades ranging from the highest AAA to C or D at the bottom, with higher ratings indicating lower risk.

Credit rating may change from time to time. You should refer to the latest credit rating information provided by bond issuer.

"Investment grade" is generally used to describe issuers and issues with relatively high levels of creditworthiness and credit quality. In S&P Global Ratings, issuers that receive a rating of "BBB-" or above are generally considered to be "investment grade".

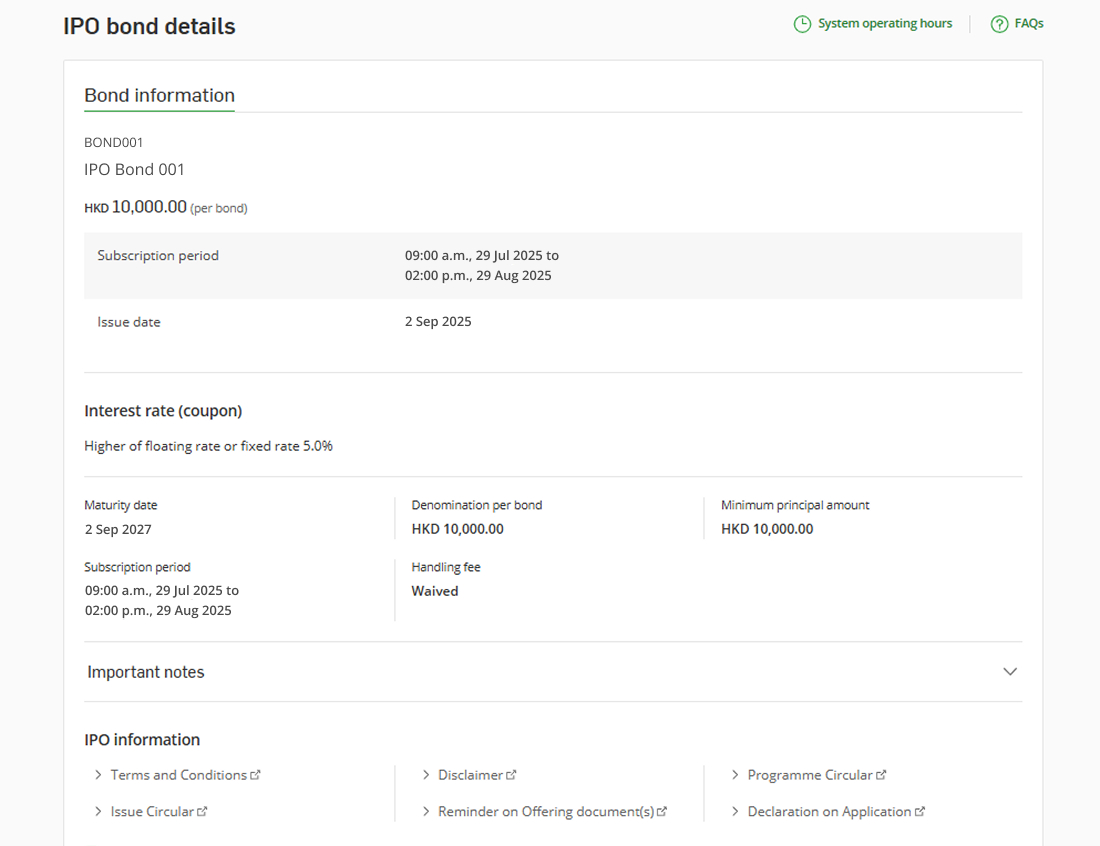

The bonds will be issued on the issue date. If the issue date ceases to be a business day in Hong Kong (e.g. if there's a "black" rainstorm warning or a tropical cyclone warning signal number 8 or above or an "extreme conditions" announcement in force in Hong Kong), then the relevant issue date will be the next following day which is a business day in Hong Kong.

Bondholders will receive principal amount of their bonds in full on the maturity date specified in the offering documents of the bond.

The interest on each IPO bond is payable in arrears on the interest payment dates specified in the bond offering documents (including on the retail bond's maturity date).

If the interest payment date isn't a business day, the relevant interest payment date will be postponed to the next business day unless that day fall into the next calendar month in which is a business day in Hong Kong. If the due date for any such action ceases to be a business day in Hong Kong, e.g. if there is a “black” rainstorm warning in Hong Kong, then issuer may perform the action on the next day which is a business day in Hong Kong not affected by the cessation.

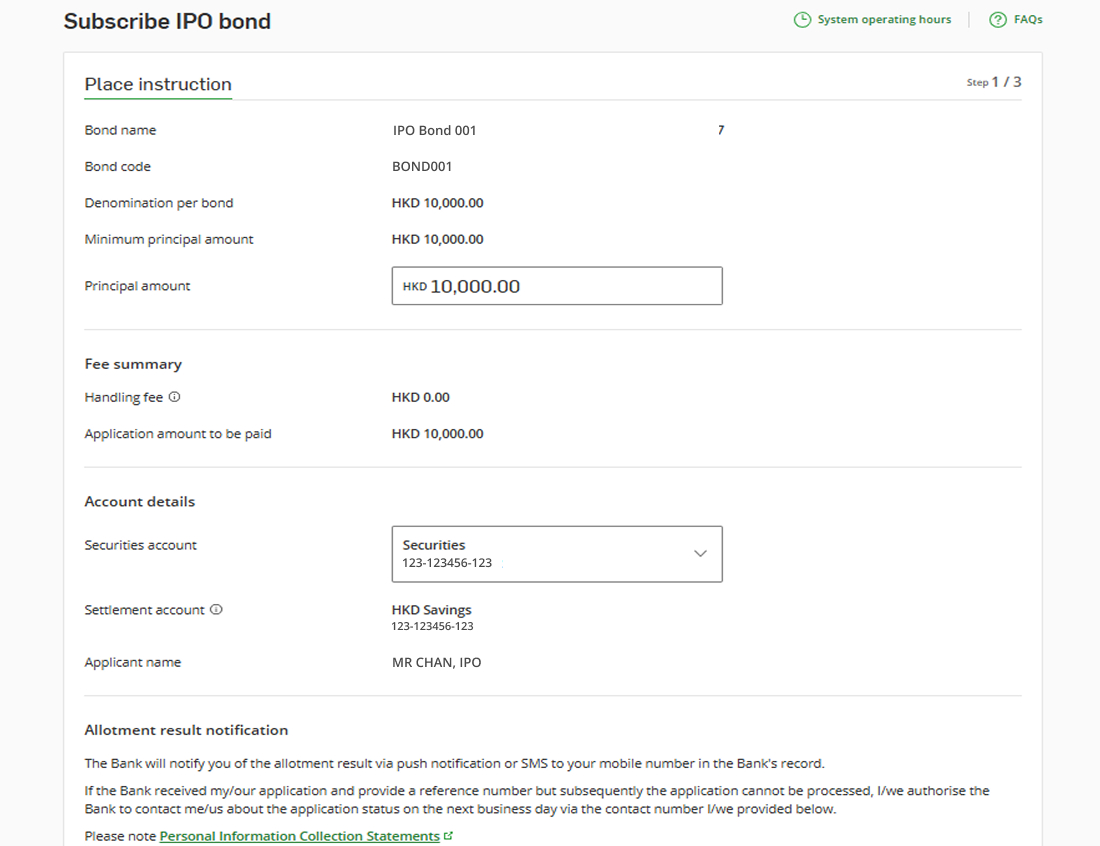

The application monies are the amount which you must pay for the principal amount of the bonds you're applying for at the time of your application. They're equal to the application price for the bonds multiplied by the principal application amount. The application monies will be held from the time you make your application pending release to the issuer of the subscription monies and/or payment of any refund.

Subscription monies are equal to the subscription price for the bonds actually allotted to you plus the handling fee.

The bond issuer may determine or adjust the total issue amount of the bond in light of market conditions or valid applications received subject to the maximum issue amount described in issue circular.

The regular intervals that interest payments are normally made, e.g. annually, semi-annually, quarterly.

Download Hang Seng Mobile App via APK file

To subscribe for IPO bonds, you need to activate securities account. Activate securities or other investment accounts with just few steps online.

Open or upgrade a bank account anytime, anywhere via Hang Seng Mobile App[1] and activate your investment account online with ease.

Terms and Conditions apply.

You must hold a securities account to apply for IPO bonds. For further details, you can call us at (852) 2822 0228 or visit any of our branches.

You must hold a valid HKID Card and be physically present in Hong Kong when applying for IPO bonds. For eligibility criteria, please refer to the offering document.

You can apply IPO Bonds via Hang Seng Mobile App, Personal e-Banking, at any of our designated branches or by calling us at (852) 2826 8866.

You can make ONE application only, if you've submitted multiple application to the bond issuer (e.g. HKSAR Government) through more than 1 placing banks or designed securities brokers, ALL your applications will be rejected.

Yes. An authorised person can visit any of our branches to apply for IPO bonds on behalf of the account holder, but the applicant name and HKID Card number of the relevant application will be submitted in accordance with that of the account holder's.

If an applicant makes an application under their joint-named account, we'll pass to the bond issuer the name and HKID Card number of the primary account holder of such joint-named account based on our bank record. The primary account holder of joint-named account is normally the first holder named in account. The secondary account holder of joint-named account is required to subscribe under their sole-named account. Please note that both primary and secondary account holders will be able to see the IPO bond subscription status of joint-named account’s application on Hang Seng Mobile App.

You can keep track of your application status from "My orders" tab in "IPO Bond" page via Hang Seng Mobile App. You'll see "Applied" when we've acknowledged and accepted your application. You can also check the messages to review the application status via "Inbox" from the top right corner after logging on to Personal e-Banking from the next trading day.

The meaning of your application status:

(1) Applied: We've received your application;

(2) Pending: We're processing your application. We shall have the discretion to reject or accept your application if you have insufficient fund in the settlement account. Please submit the IPO application again before the subscription end date;

(3) Allotted: You've been allotted the full amount of your applied IPO bonds;

(4) Partially allotted: You've been allotted partial amount of your applied IPO bonds. You'll receive refund of the excess subscription funds in your settlement account; and

(5) Unallotted: You aren't allotted any of your applied IPO bonds.

We'll generally process your application on the next business day. You'll see "Applied" once we've acknowledged and accepted your application. However, if the application isn't accepted due to the reasons such as insufficient funds or new account opened on the same day of application date, you'll no longer be able to see the application in Hang Seng Mobile App, please submit a new application again.

You can submit an application during the system's non-service hours (i.e. from 8:30 p.m. to 7:30 a.m. or public holidays). We may reject your application due to the reasons such as insufficient funds or new account opened on the same day of application date.

We'll waive service fees for subscription handling, custody3, interest collection, maturity redemption, sale through over-the-counter (OTC)4, transfer-in (not through the Central Clearing and Settlement System) and transfer-out (not through the Central Clearing and Settlement System relating to the IPO bonds. Deposit charge for purchase order of IPO bonds through the Hong Kong Stock Exchange (HKEX) will also be waived by us. We reserve the right to suspend, vary or discontinue the above offers at any time without prior notice. In case of disputes, our decision will be final.

You can keep track of your application result from "My orders" tab in "IPO Bond" page via Hang Seng Mobile App.

We'll also notify you the allotment result via Push Notification (if enabled) or SMS (if you've registered for Personal e-Banking and maintained a valid mobile number in our bank record). Allotment advice will be sent to you via e-Advice or mail to you as soon as practicable. The IPO bonds successfully allotted to you (if any) will be credited to your Hang Seng securities account on the issue date.

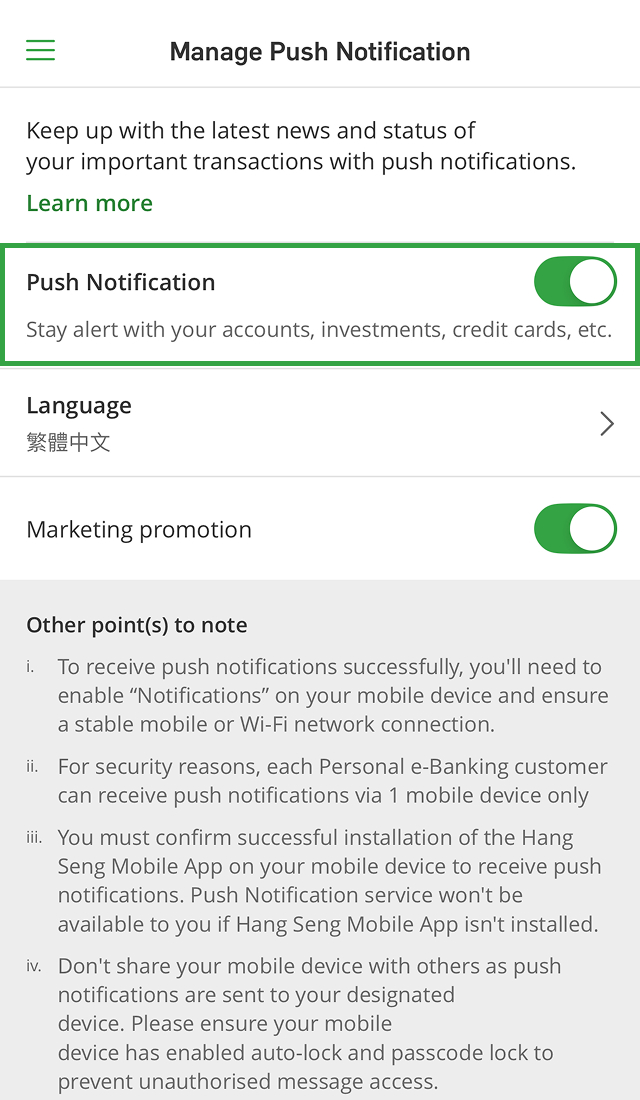

Yes. You can receive IPO bonds allotment result via Push Notification. To learn how to enable, please refer to "Receive IPO bonds allotment result push notification" demo under " Subscription guide and information" section on this page.

The refund of your application monies (if any) will be credited within the same allocation day at or before the evening to your HKD settlement account with Hang Seng.

You can sell the allotted IPO bonds OTC to us or HKEX (if applicable)5. However, this doesn't guarantee an active secondary trading market for IPO bonds, the ready availability of pricing information in relation to your IPO bonds, or that you'll have access to a firm bid or offer price for your IPO bonds. Please note that the prices may be volatile and are subject to changes from time to time due to market conditions.

Yes, you can sell your allotted IPO bonds OTC via Hang Seng Mobile App or Personal e-Banking from 10:30 a.m. to 4:30 p.m. on the bond issue date and from 9:30 a.m. to 4:30 p.m. Mon to Fri from the next business day onwards.

You can sell the allotted IPO bonds OTC via our other available channels during the following periods on IPO bond issue date:

You may also activate your securities account and other investment accounts via Hang Seng Mobile App (not available to customers who only hold joint-named Integrated Account(s)).