- (1) Customers can enjoy the monthly fee waive offer if a designated HKD savings account, a sub-account under the integrated account, is used as the mortgage repayment account under the “HKD Mortgage-Link Loan Scheme” or the “RMB/HKD Mortgage-Link Loan Scheme” to which the preferential interest shall accrue and with the Total Relationship Balance (“TRB”) not less than the designated amount. Hang Seng Bank Limited (“Hang Seng”) reserves the right to vary the above offers at any time without prior notice. In case of any dispute, the decision of Hang Seng shall be final.

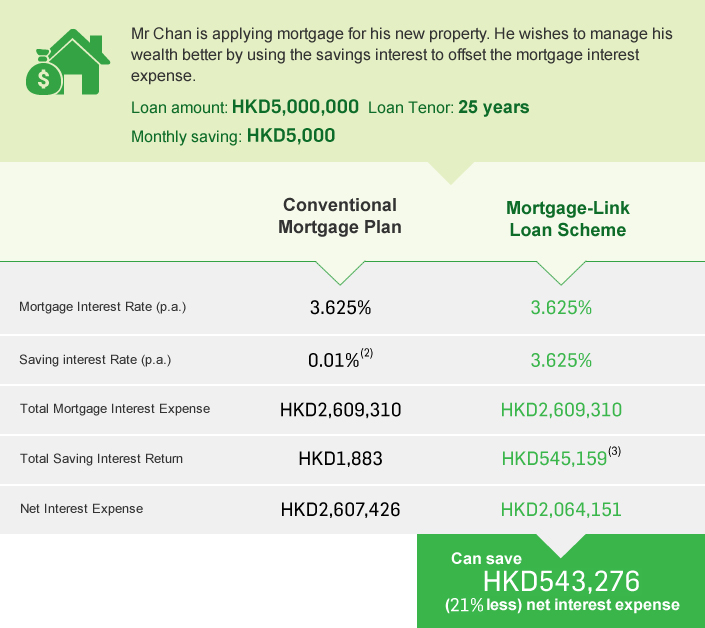

- (2) The preferential interest rate is not applicable to general mortgage plan, the interest rate under general mortgage plan will be set according to the daily balance of the savings account, please contact Hang Seng’s staff for details.

- (3) Credit balance in the designated savings account for enjoying preferential interest rate (“Preferential Savings Limit”) under the “Mortgage-Link loan scheme” is up to 50% of the daily outstanding principal of the mortgage loan. Credit balance of savings account exceeding the Preferential Savings Limit will be given interest at the rate based on the tiered interest rate of the HKD Savings Accounts quoted by Hang Sang from time to time.

- (4) The example is calculated based on the assumptions below,

- HK$5,000 will be deposited monthly, no withdrawal of deposits will be made until full repayment of the entire

loan; and

- Interest rate of the mortgage loan, loan tenor and interest rate of savings account have remained unchanged;

and

- No default payment is recorded throughout the entire mortgage period; and

- Interest is calculated on a day-to-day basis and assumes repayment starts from January 1st.

For details on offers and Terms and Conditions, please contact Hang Seng’s staff.

RMB Currency Risk

Renminbi (“RMB”) is subject to exchange rate risk. Fluctuation in the exchange rate of RMB may result in losses in the event that the customer subsequently converts RMB into another currency (including Hong Kong Dollars). Exchange controls imposed by the relevant authorities may also adversely affect the applicable exchange rate. RMB is currently not freely convertible and conversion of RMB may be subject to certain policy, regulatory requirements and/or restrictions (which are subject to changes from time to time without notice). The actual conversion arrangement will depend on the policy, regulatory requirements and/or restrictions prevailing at the relevant time.