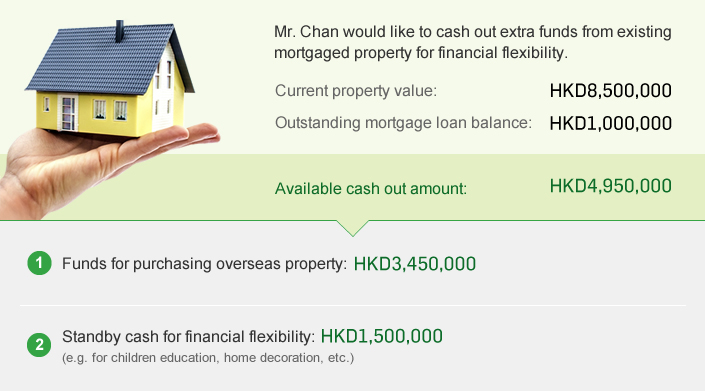

You can obtain more liquidity and financial flexibility from property refinancing in Hang Seng that allowing you to grasp market opportunities and meet your different financial needs (such as Children’s study abroad funds, Debt settlement… etc) whether your property is mortgaged or not.

Other than the monthly fixed instalment repayment option, you can also choose other repayment plans which suit your financial needs.