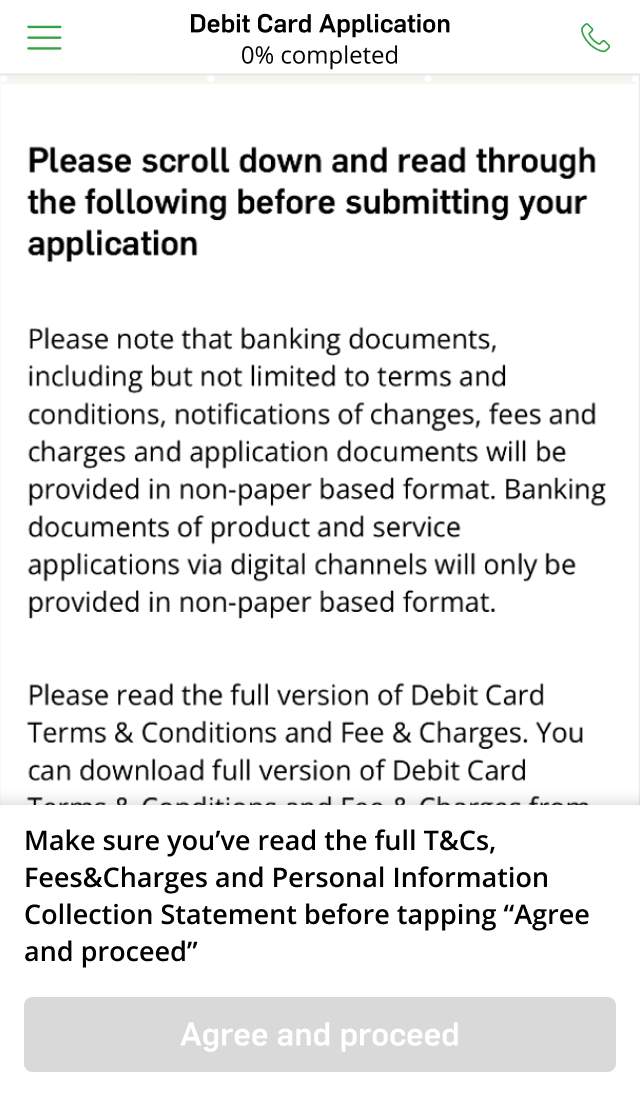

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

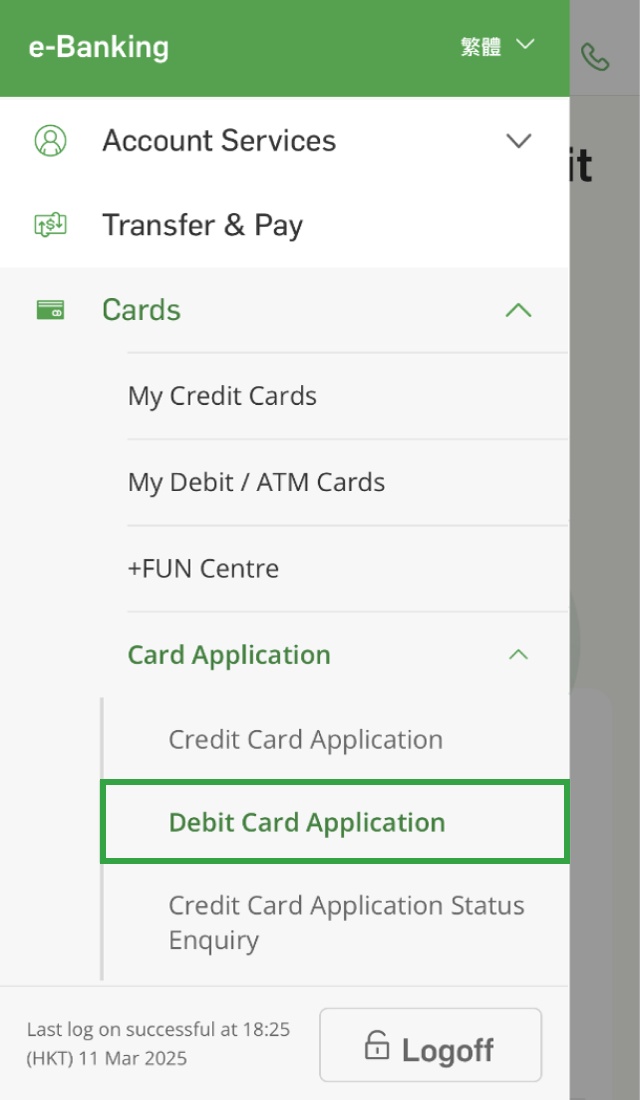

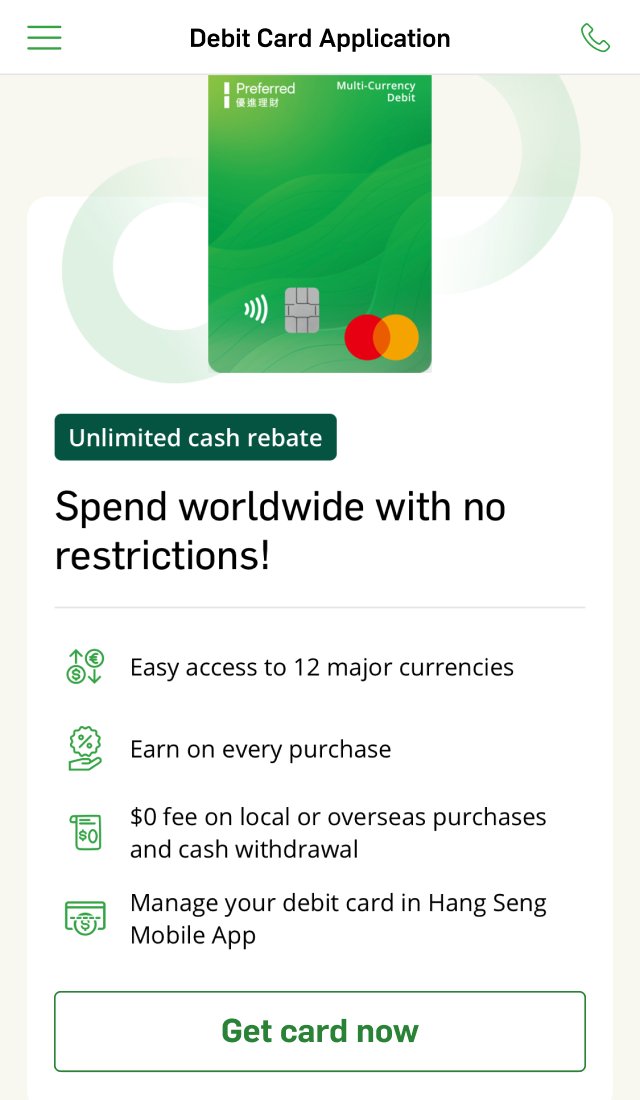

Get your debit card now and enjoy unlimited rebates on every purchase!

Scheduled system upgrade on 8 Mar 2026

Due to system upgrade, spending and cash withdrawal transactions in non-HKD using multi-currency debit card will be temporarily unavailable from 12:30 a.m. to 3:30 a.m. on 8 Mar 2026. Please make arrangements in advance to avoid any inconveniences.

Terms and conditions apply.

From 1 Jan till 31 Mar 2026, enjoy 15% cash rebate when settling eligible transactions at below designated overseas merchants. Eligible spending must be in single transaction during the Promotion. Each customer can earn an accumulated cash rebate up to an equivalent of HKD4,400 in foreign currency (determined by the record of the foreign currency when the transaction is made). Each customer can enjoy the cash rebate from each of the Designated Merchants once. No need to register.

| Country | Designated Merchants |

|---|---|

| Japan | Matsumoto Kiyoshi, Don Quijote, Hankyu Department Store and Hanshin Department Store, Daimaru Matsuzakaya Department Stores, Lotte Duty Free Tokyo Ginza, Isetan Mitsukoshi, Mitsui Outlet Park Jazz Dream Nagashima and Mitsui Outlet Park Kisarazu# |

| United Kingdom | Harrods |

| Canada | Lululemon# |

| Australia | Cole# and Woolworths# |

| Thailand | Emporium Bangkok and Paragon Department Stores |

#Newly added merchants

Terms and conditions apply, please refer to Useful Information below.

From 1 Jan till 31 Mar 2026, enjoy a 20% cash rebate when you pay for eligible transactions at the designated overseas public transportation merchants below. Each customer can earn accumulated cash rebates of up to HKD120. No registration is required.

| Country | Designated Local Merchants |

|---|---|

| Australia | • Transport for NSW TrainLink • Translink |

| Canada | • Go Transit# |

| China | • 12306 China Railway • Beijing Subway • GoByBus • Shanghai Metro# • Shanghai Maglev# • Trans-Island Chinalink |

| Japan | • Japan Railway |

| Thailand | • Mass Rapid Transit Authority of Thailand |

| United Kingdom | • Lothian Buses • Transport for Greater Manchester • Transport for London |

#Newly added merchants

Terms and conditions apply, please refer to Useful Information below.

From 1 Jan till 31 Mar 2026, enjoy 20% cash rebate when settling eligible transactions at below designated local merchants. Each customer can earn an accumulated cash rebate up to HKD120. No need to register.

POP MART, Don Quijote, Matsumotokiyoshi, MCL Cinema, Broadway Cinema and Emperor Cinema

Terms and conditions apply, please refer to Useful Information below.

Only applicable to customers who hold a sole-named Preferred Banking, Prestige Banking or Prestige Private Banking account (including the respective sole-named Family+ account).

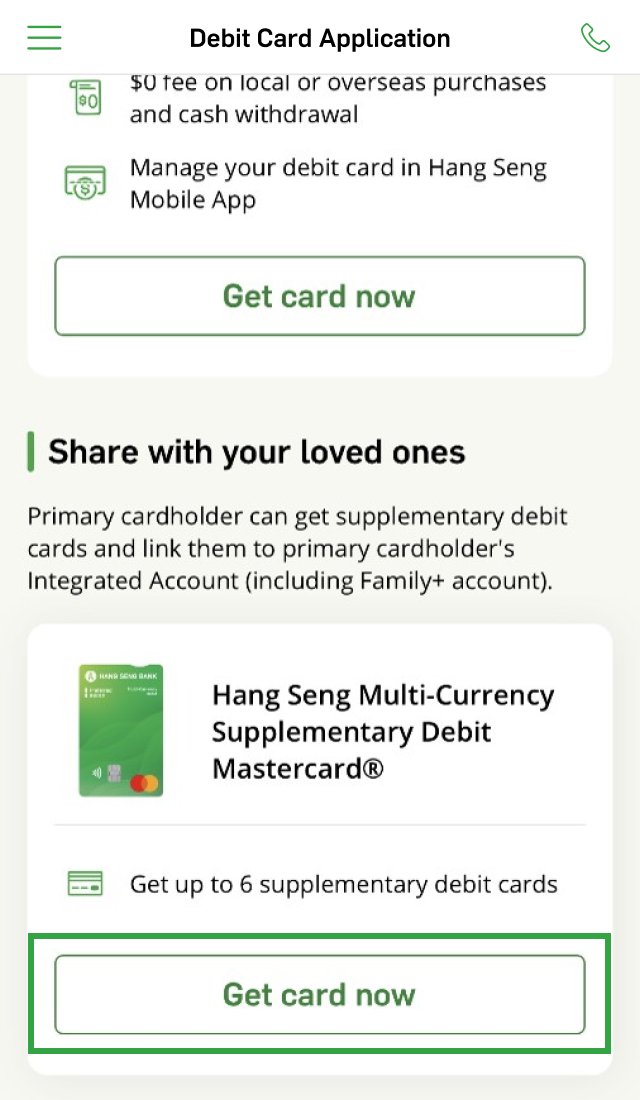

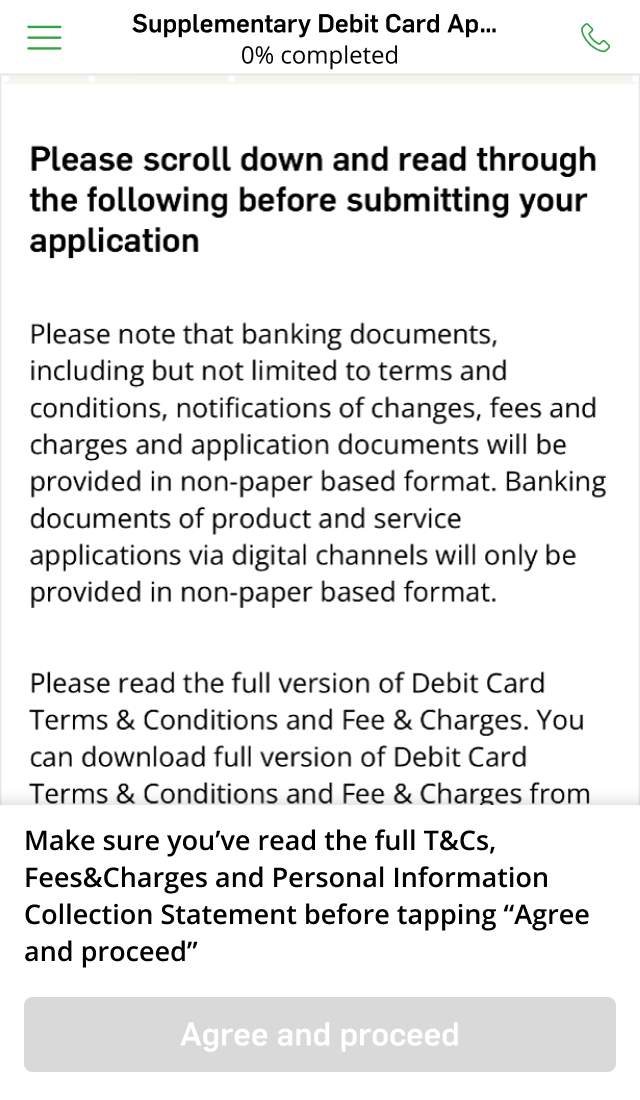

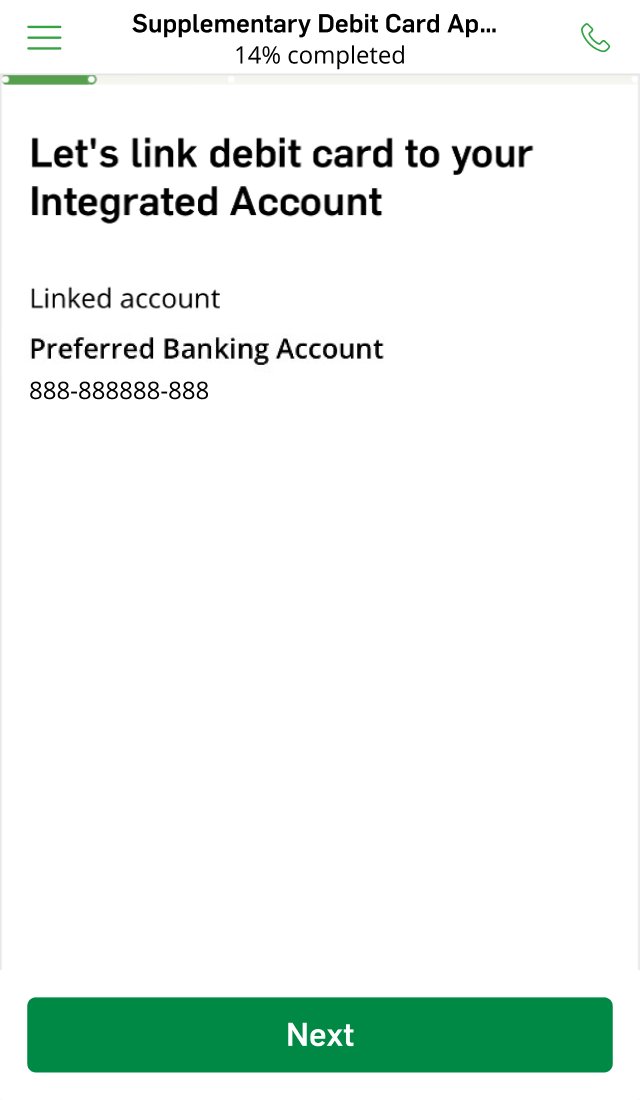

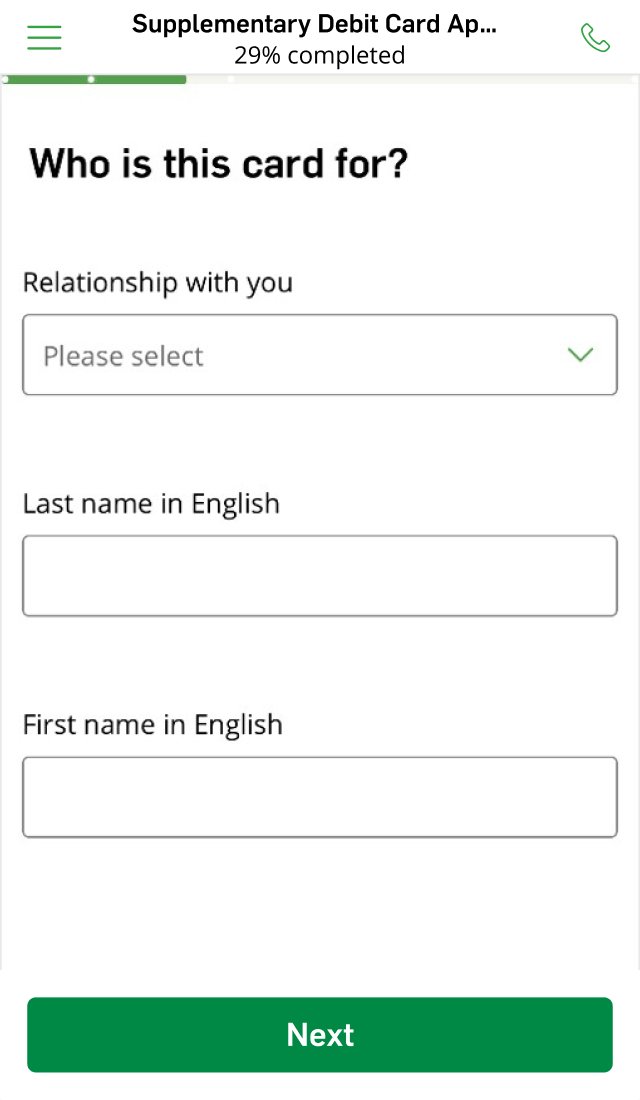

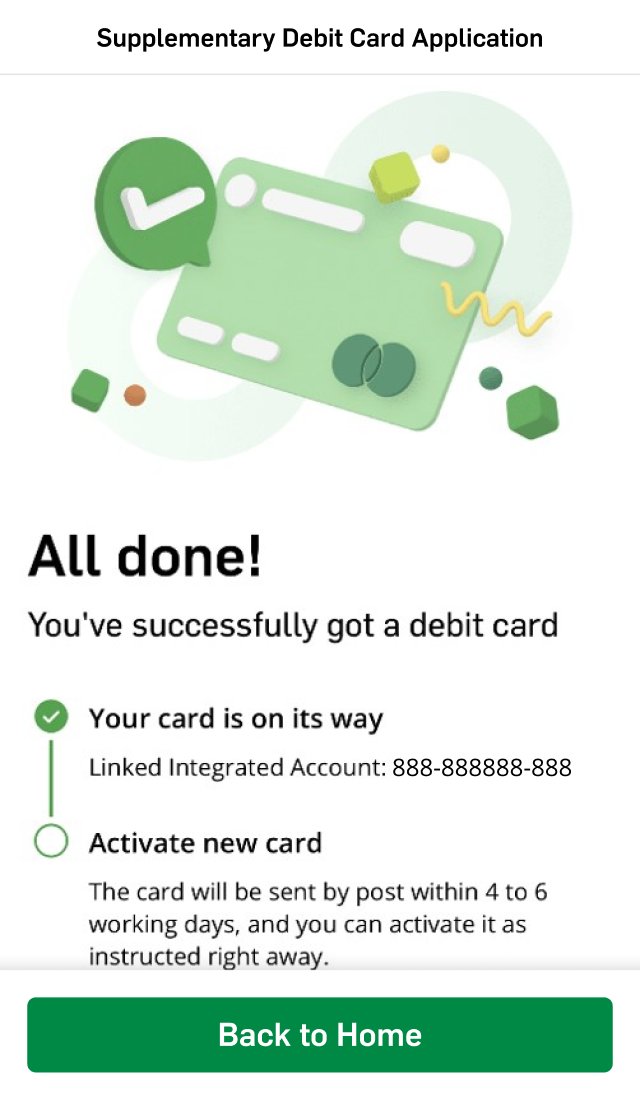

If you are aged 12 or above and have a HKID or passport, you can get a supplementary debit card even if you don't have a Hang Seng account. The primary cardholder needs to submit the request for family or friends via Hang Seng Mobile App.

Download Hang Seng Mobile App via APK file

Get 24/7 support from our Virtual Assistant.

Preferred 24-hour Banking Manned Hotline: (852) 2822 8228

Prestige 24-hour Manned Hotline: (852) 2998 9188

Prestige Private 24-hour Manned Hotline: (852) 2998 8022

24-hour Report Lost Card Hotline: (852) 2836 0838

Currency conversion risk: foreign exchange involves exchange rate risk. The value of your foreign currencies and RMB deposits are subject to exchange rate risk and may result in gains or losses when the exchange rate fluctuates at the time when the transaction amount is debited from your foreign currency or RMB account. It may also result in losses when your foreign currency or RMB account balance is insufficient to pay the transaction amount and need to convert HKD to foreign currency or RMB.

Want to know more about debit card?

Want to know more about debit card?

Chat with H A R O now

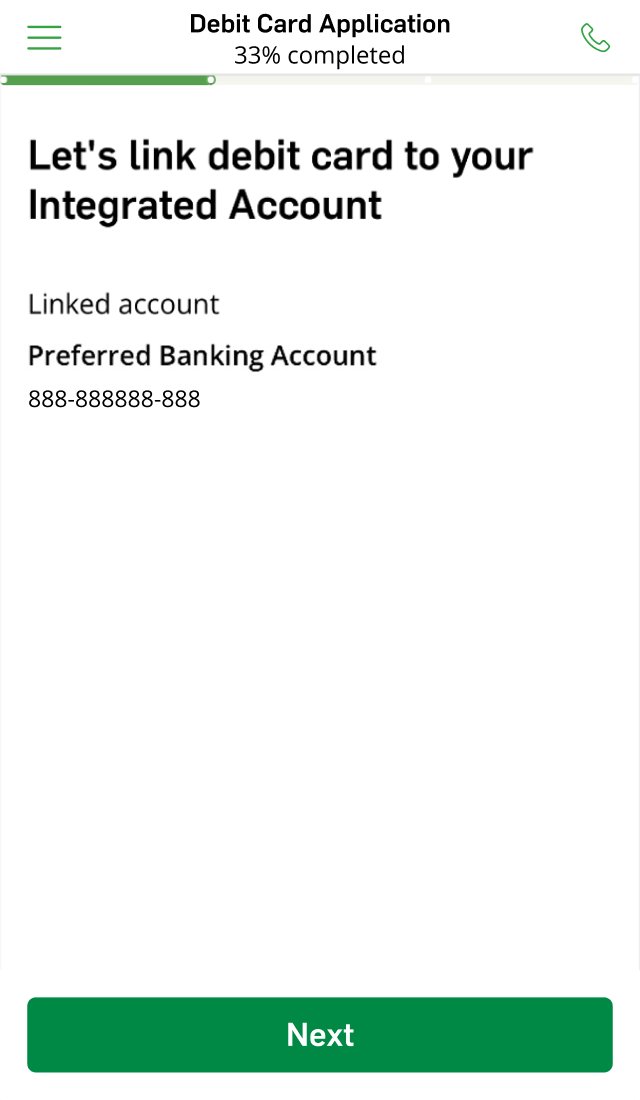

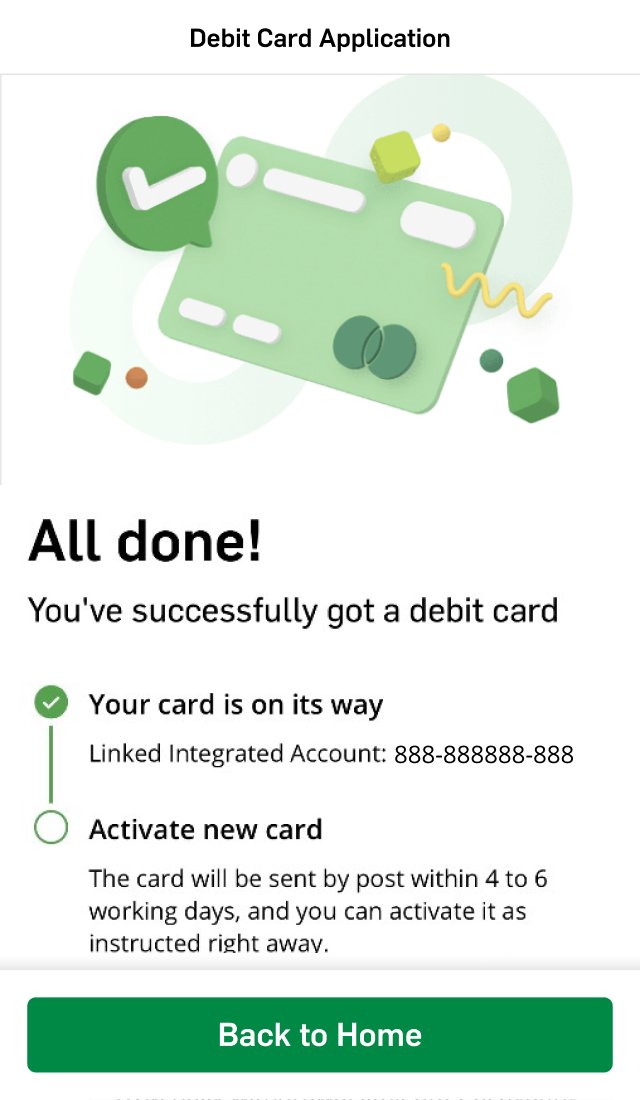

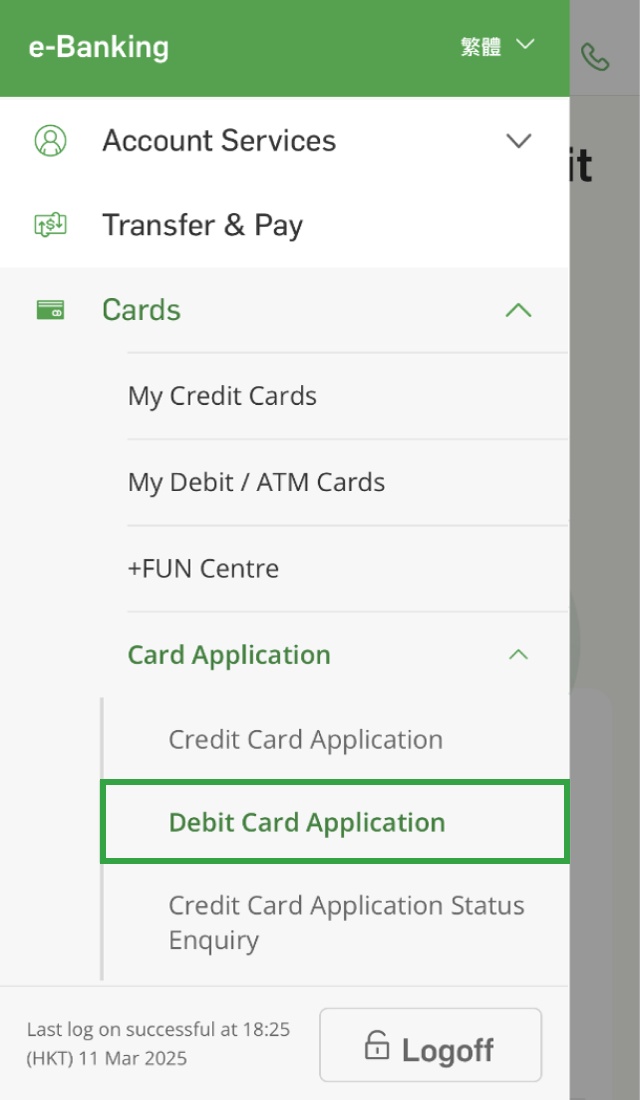

Scan the QR code to open Hang Seng Mobile App, and get yours in less than a minute!

Download Hang Seng Mobile App via APK file