We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Please read important notes.

Founded in 1933, Hang Seng Bank is one of Hong Kong’s largest listed companies. We are committed to establishing solid financial standing and providing you with quality services. We are your strong companion for MPF, together with your MPF investment needs.

Our MPF is operated by sponsor, trustee and custodian, administrator and investment managers. Each party is financially sound and has the experience and expertise to handle your money.

| Sponsor |

Hang Seng Bank Limited |

|

Administrator |

The Hongkong and Shanghai Banking Corporation Limited |

|

Trustee and Custodian |

HSBC Provident Fund Trustee (Hong Kong) Limited |

|

| Investment Managers | HSBC Global Asset Management (Hong Kong) Limited / |

|

Hang Seng Investment Management Limited |

|

Hang Seng MPF provides simple and fast contribution methods and various voluntary contribution arrangements for employers. MPF members can also prepare for their future retirement life accordingly with our flexible arrangement tool - Hang Seng MPF Flexi-Contributions.

| Employer | Member |

|---|---|

Simple and fast contribution methods

|

Hang Seng MPF Flexi-Contributions

|

Various voluntary contribution arrangements for employers

|

Withdrawal of Flexi-Contributions when in need

|

Hang Seng MPF Tax Deductible Voluntary Contributions

|

Hang Seng MPF provides comprehensive services for employers and members including:

Employer

Member

At Hang Seng, to provide people with various retirement needs, we provide a range of diversified constituent funds. Members can choose from a list of constituent funds available under the MPF scheme. Learn more

Enjoy additional benefits from Hang Seng's financial services:

Yes

(Consolidate MPF personal accounts only)

Yes

Yes

Yes

Yes

Yes

(Check account balance only)

Yes

Yes

Yes

Yes

Yes

Yes

(For the latest 24 months only)

Yes

(For the latest 12 months only)

Yes

(For the latest contribution only)

Yes

(For the latest contribution only)

Yes

Yes

(For the latest 24 months only)

Yes

(For the latest 12 months only)

Yes

Yes

(For Portfolio Rebalance, Asset Switch, Contribution Redirection and switch into Default Investment Strategy ('DIS') only)

Yes

(For Portfolio Rebalance, Asset Switch, Contribution Redirection and switch into Default Investment Strategy ('DIS') only)

Yes

(For Portfolio Rebalance and

Contribution Redirection only)

Yes

Yes

Yes

Yes

(For the latest unit prices only)

Yes

Yes

Yes

Yes

Yes

Yes

(Change contact details and e-Banking password only)

Yes

(Change contact details only)

Yes

(Change MPF phone PIN only)

Yes

To suit various investment needs, Hang Seng MPF provides a range of investment options. You can choose from a list of Constituent Funds available under the MPF scheme.

Hang Seng Mandatory Provident Fund – SuperTrust Plus comprises a total of 20 Constituent Funds including actively managed, passively managed and index-tracking Constituent Funds. They will suit your different needs in retirement.

For the investment objective of each Constituent Fund and other particulars, please refer to section 3.4 "Statement of investment policies of each Constituent Fund and other particulars" of the MPF Scheme Brochure.

To suit various investment needs, Hang Seng MPF provides a range of investment options. You can choose from a list of Constituent Funds available under the MPF scheme.

Hang Seng Mandatory Provident Fund – SuperTrust Plus comprises a total of 20 Constituent Funds including actively managed, passively managed and index-tracking Constituent Funds. They will suit your different needs in retirement.

For the investment objective of each Constituent Fund and other particulars, please refer to section 3.4 "Statement of investment policies of each Constituent Fund and other particulars" of the MPF Scheme Brochure.

To suit various investment needs, Hang Seng MPF provides a range of investment options. You can choose from a list of Constituent Funds available under the MPF scheme.

Hang Seng Mandatory Provident Fund – SuperTrust Plus comprises a total of 20 Constituent Funds including actively managed, passively managed and index-tracking Constituent Funds. They will suit your different needs in retirement.

For the investment objective of each Constituent Fund and other particulars, please refer to section 3.4 "Statement of investment policies of each Constituent Fund and other particulars" of the MPF Scheme Brochure.

The management fees (as a percentage of the net asset value (‘NAV’) per annum) and fund expenses ratio of the Constituent Funds under Hang Seng Mandatory Provident Fund ― SuperTrust Plus are briefly summarised as below for reference only. Please refer to the MPF Scheme Brochure for more details of the management fees and other applicable fees, charges and expenses[5] of the Constituent Funds.

| Name of Constituent Fund |

Management fees[6][7](As a percentage of NAV per annum) |

Fund Expense Ratio[13] |

|---|---|---|

| MPF Conservative Fund [8] | 0.75% | 0.77059% |

| Global Bond Fund | 0.79% | 0.82723% |

| Guaranteed Fund[9][10][11][12] | 1.275% | 2.05658% |

| Age 65 Plus Fund | 0.75% | 0.77844% |

| Core Accumulation Fund | 0.75% | 0.77643% |

| Stable Fund | 1.25% | 1.32713% |

| Balanced Fund | 1.35% | 1.42722% |

| Growth Fund | 1.45% | 1.52584% |

| Global Equity Fund | 0.79% | 0.81984% |

| North American Equity Fund | 1.30% | 1.32250% |

| European Equity Fund | 1.30% | 1.34422% |

| Asia Pacific Equity Fund | 1.45% | 1.50289% |

| Hong Kong and Chinese Equity Fund | 1.45% | 1.49059% |

| Chinese Equity Fund | 1.45% | 1.49495% |

| ValueChoice Balanced Fund | 0.79% | 0.92876% |

| ValueChoice North America Equity Tracker Fund | 0.79% | 0.82426% |

| ValueChoice Europe Equity Tracker Fund | 0.79% | 0.88059% |

| ValueChoice Asia Pacific Equity Tracker Fund | 0.79% | 0.87896% |

| Hang Seng China Enterprises Index Tracking Fund | Up to 0.79% | 0.88854% |

| Hang Seng Index Tracking Fund | Up to 0.73% | 0.78561% |

The Default Investment Strategy (DIS) is a standardised and fee-controlled MPF investment strategy that was applied since from 1 April 2017 as the "default" investment strategy in all MPF schemes in Hong Kong. It replaced the different default investment strategies employed by different MPF schemes prior to 1 April 2017. From now on, MPF members joining an MPF scheme without providing a valid investment choice will have their monies invested in accordance with the DIS.

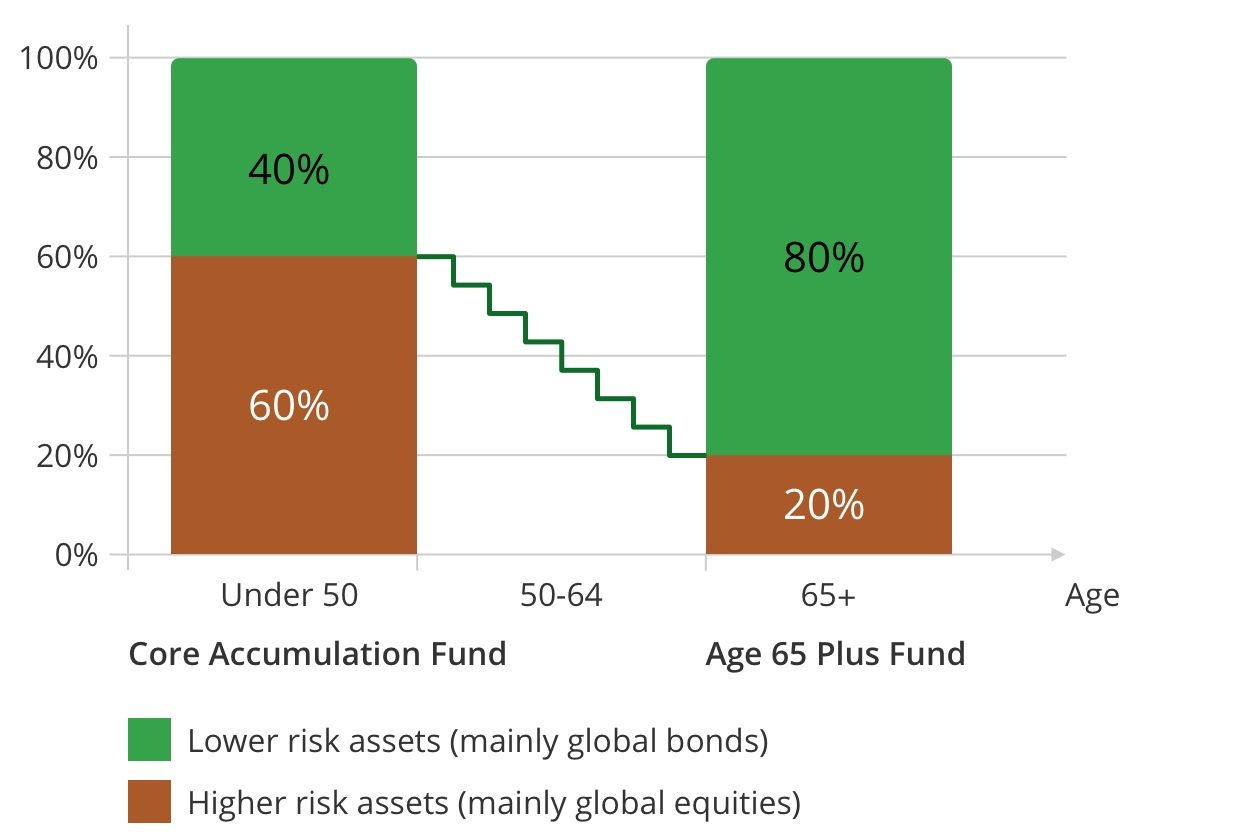

The DIS consists of 2 Constituent Funds, the Core Accumulation Fund (CAF) and the Age 65 Plus Fund (A65F). Both funds adopt a globally diversified investment approach, with the CAF investing 60% of its assets in higher risk assets such as equities and 40% in lower risk assets such as global bonds and money market instruments. The A65F has 20% of its assets invested in higher risk assets, and 80% in lower risks assets.

DIS contains an automatic de-risking feature, under which, members who are below age 50 investing in DIS will have their new contributions and accrued benefits 100% invested in CAF. In general, when a member turns 50, their accrued benefits and new contributions will automatically be partially allocated to the A65F annually on their birthdays until they reach 64, when the entire accrued benefits will be invested in the A65F. This is illustrated by the diagram and the DIS de-risking table.

Another key feature of the DIS is that both the CAF and A65F are subject to a management fee cap of 0.75% of the net asset value of the fund each year (measured on a daily basis). Furthermore, there is an additional cap of 0.2% of net asset value on the recurrent out-of-pocket expenses in operating the funds.

While the DIS has been intended for members who have not made any investment choices before, it may also be an appropriate investment option for you if the features of it fits your circumstances. The DIS is available as a standalone investment option that you may choose explicitly, or you may also choose to invest in the CAF and A65F separately.

| Age |

Core Accumulation Fund ("CAF") |

Age 65 Plus Fund ("A65F") |

|---|---|---|

Below 50 |

100.0% |

0.0% |

50 |

93.3% |

6.7% |

51 |

86.7% |

13.3% |

52 |

80.0% |

20.0% |

53 |

73.3% |

26.7% |

54 |

66.7% |

33.3% |

55 |

60.0% |

40.0% |

56 |

53.3% |

46.7% |

57 |

46.7% |

53.3% |

58 |

40.0% |

60.0% |

59 |

33.3% |

66.7% |

60 |

26.7% |

73.3% |

61 |

20.0% |

80.0% |

62 |

13.3% |

86.7% |

63 |

6.7% |

93.3% |

64 and above |

0.0% |

100.0% |

Members / Self-employed person:

(852) 2213 2213

HKSARG Employees:

(852) 2269 2269

(852) 2288 6822

(852) 2997 2838