We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

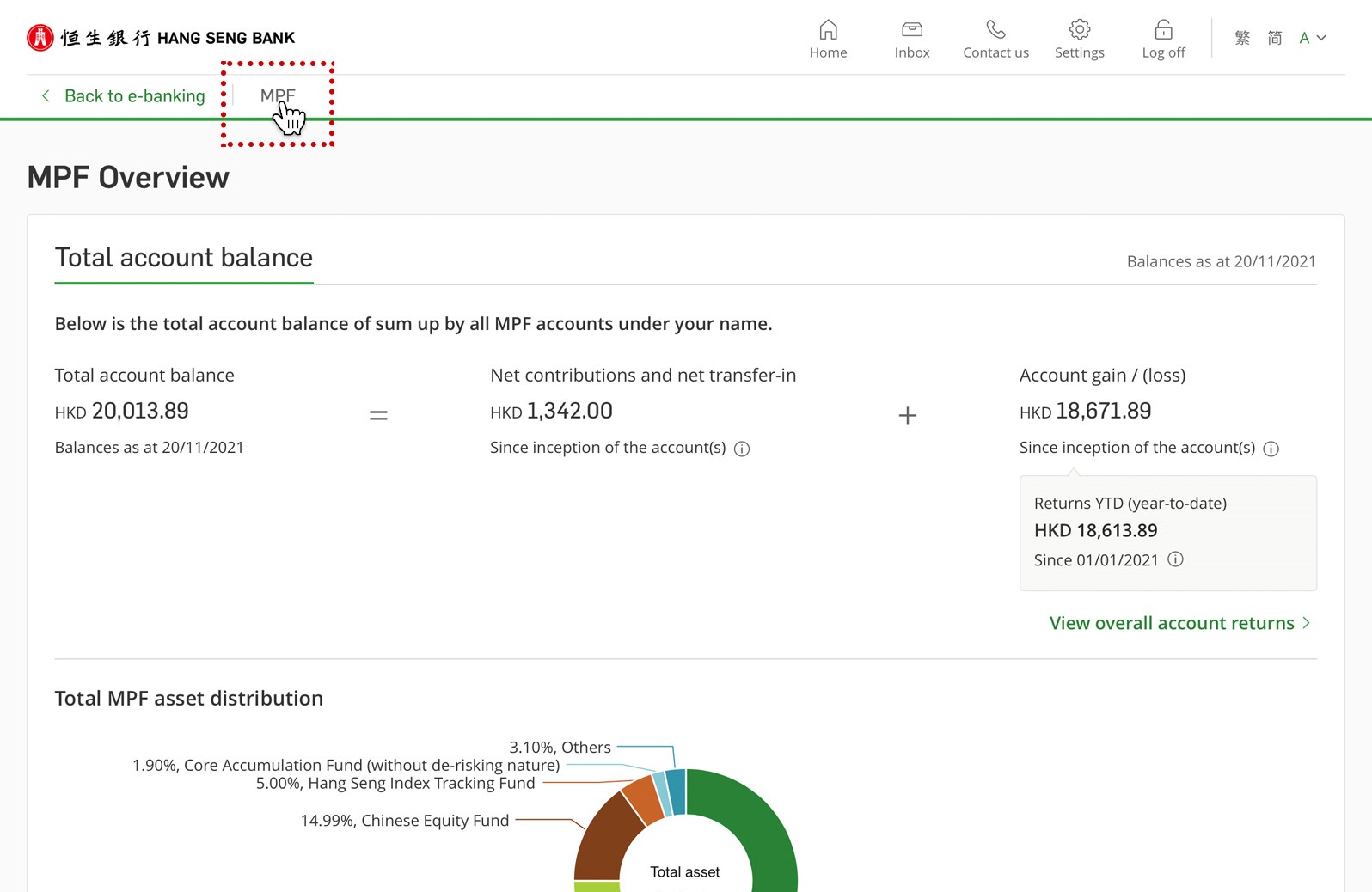

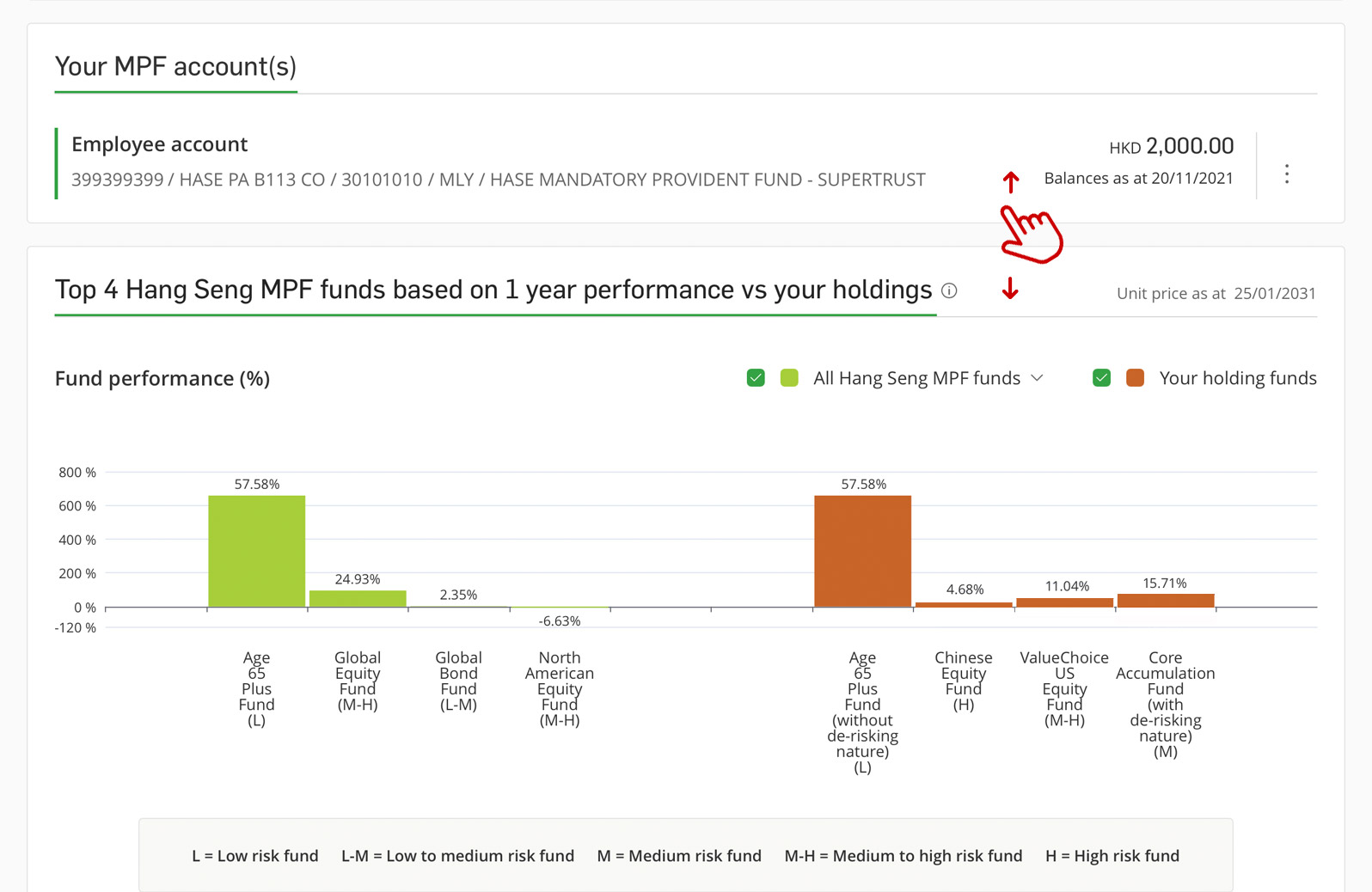

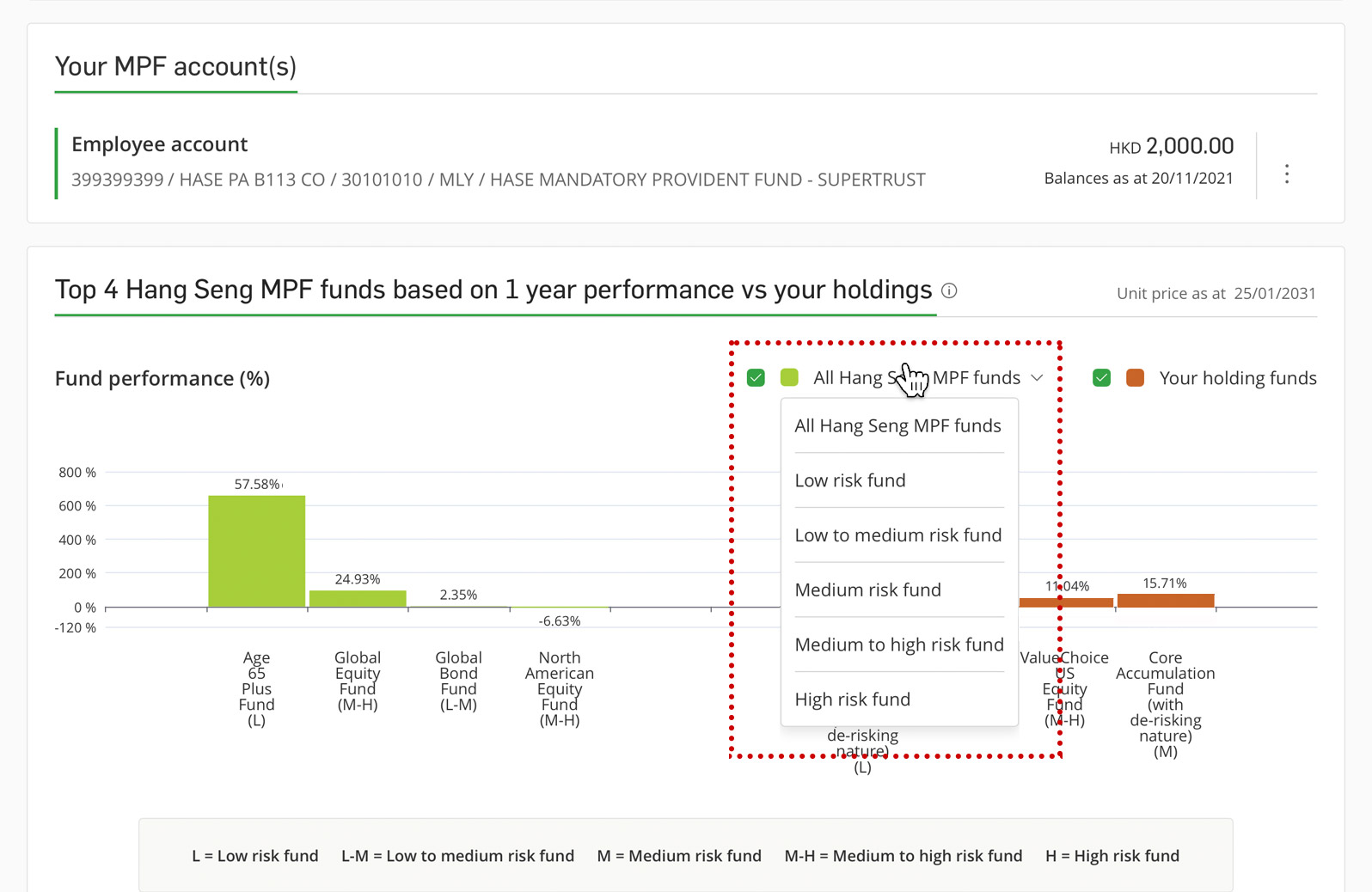

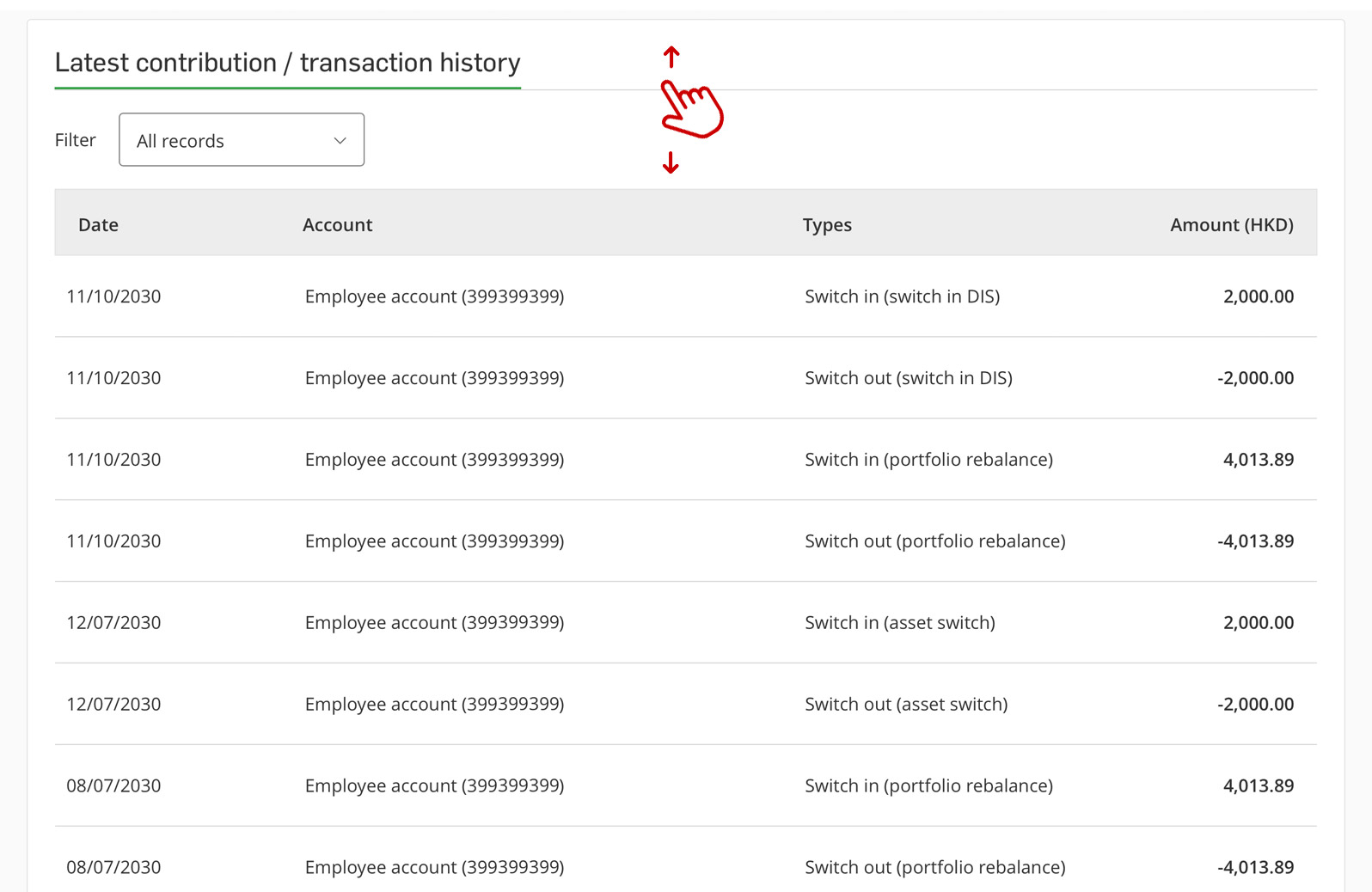

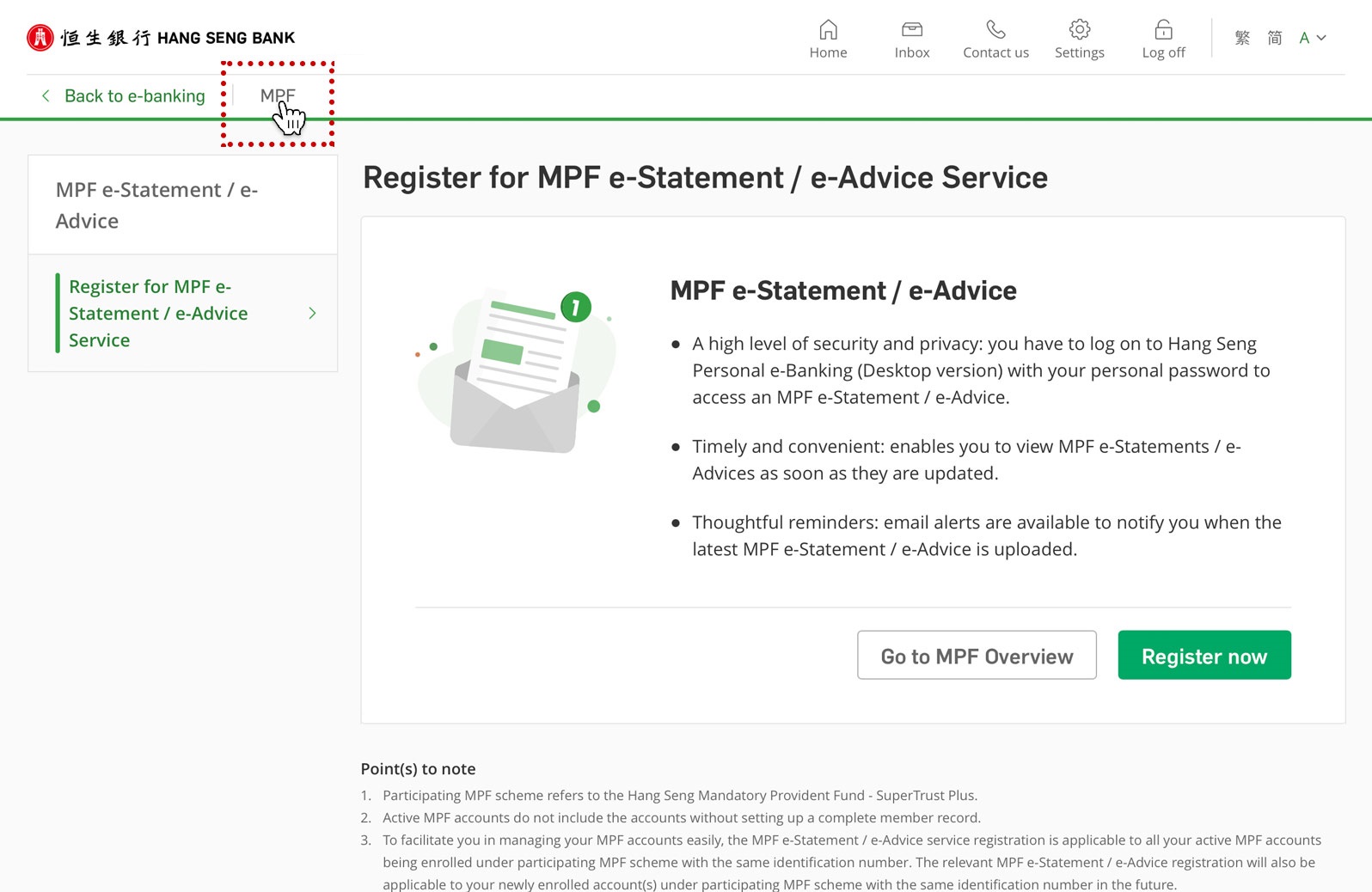

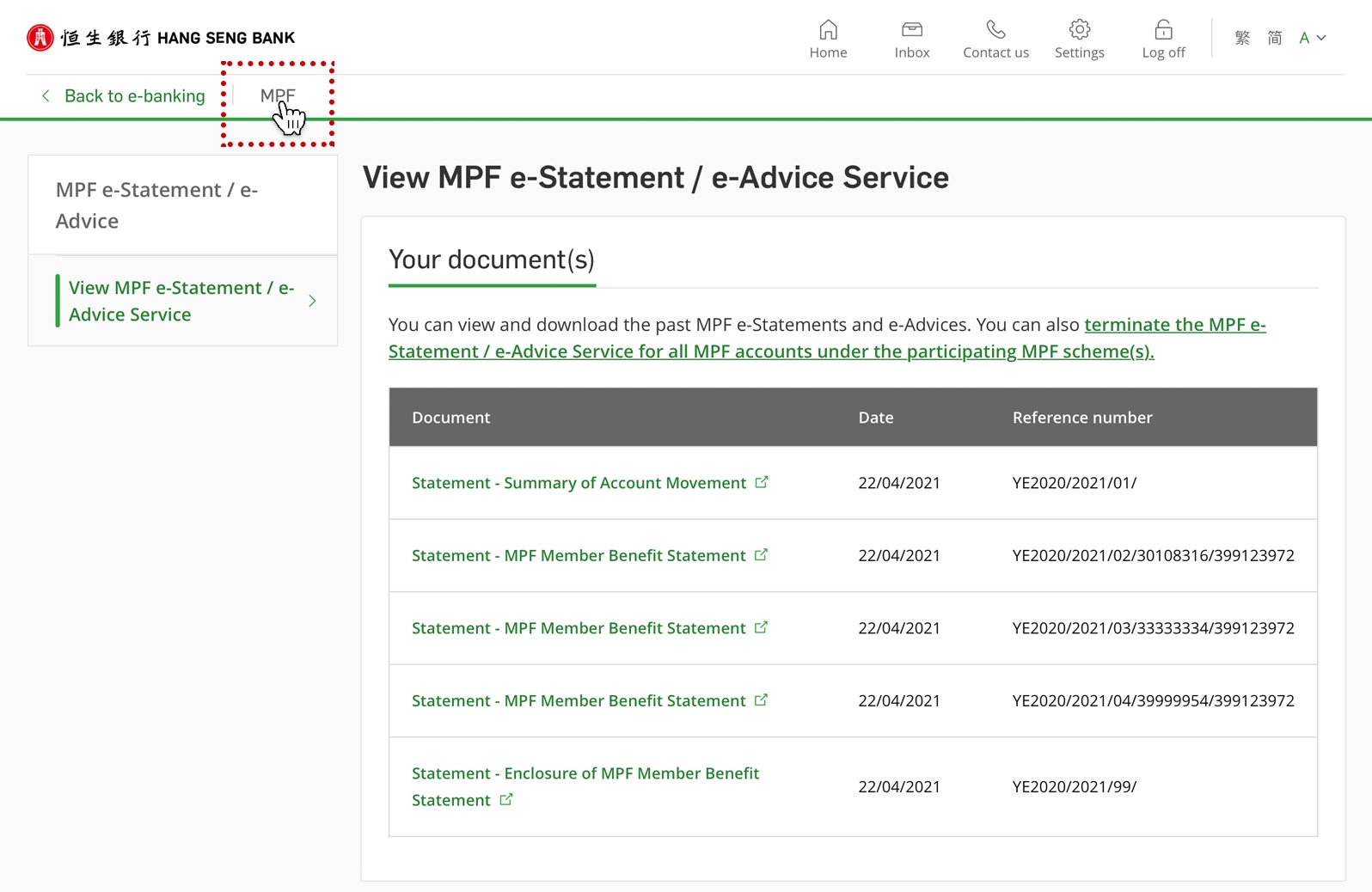

With our comprehensive Hang Seng All-in-1 MPF online dashboard, you can manage your MPF accounts closely by keeping track of how your MPF funds are performing and reviewing your MPF accounts balance, returns, contribution / transaction history and e-Statement / e-Advice anytime. All your MPF assets can be managed and reallocated at will. Log on to explore our MPF services for an ideal retirement life.

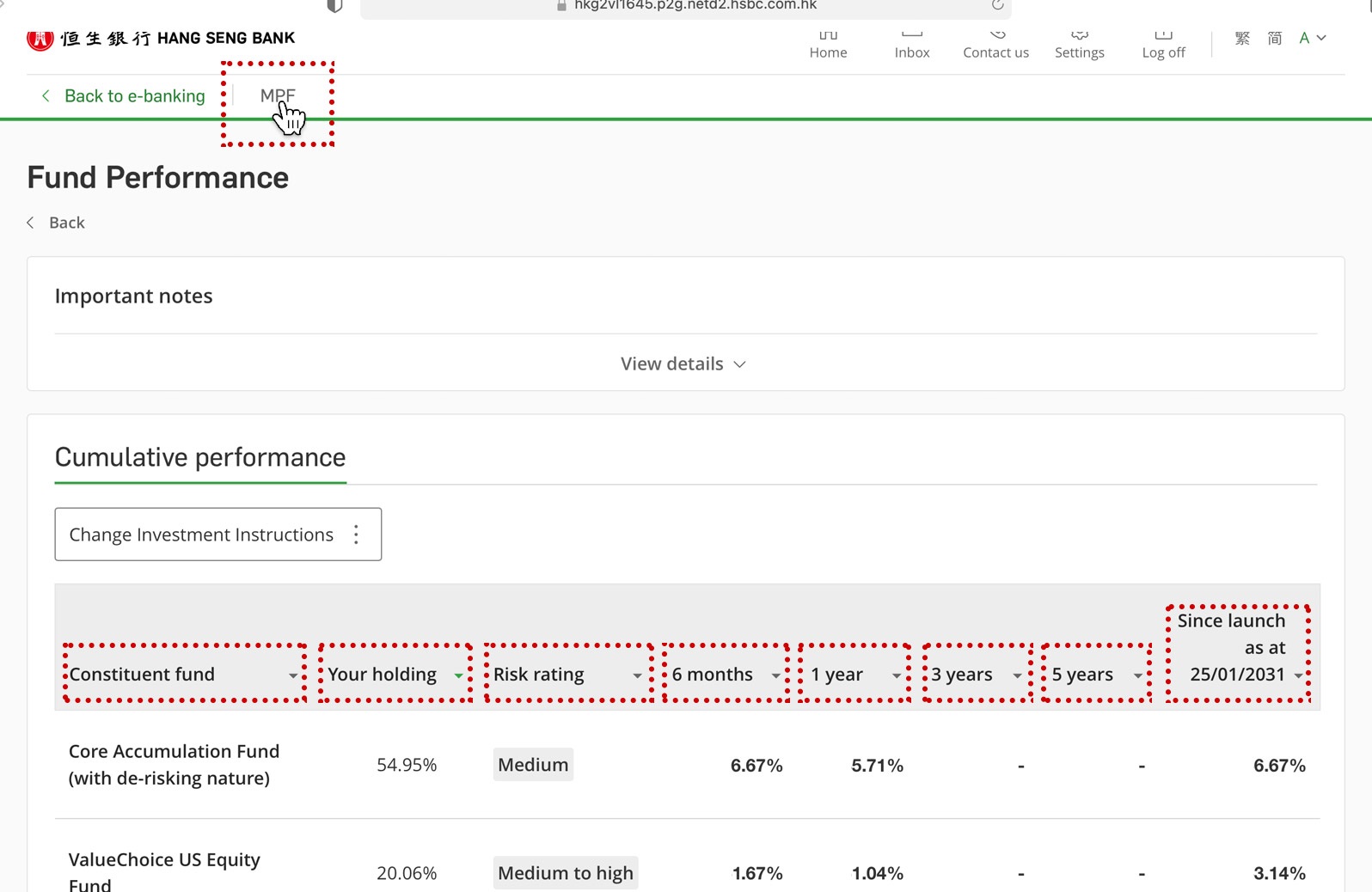

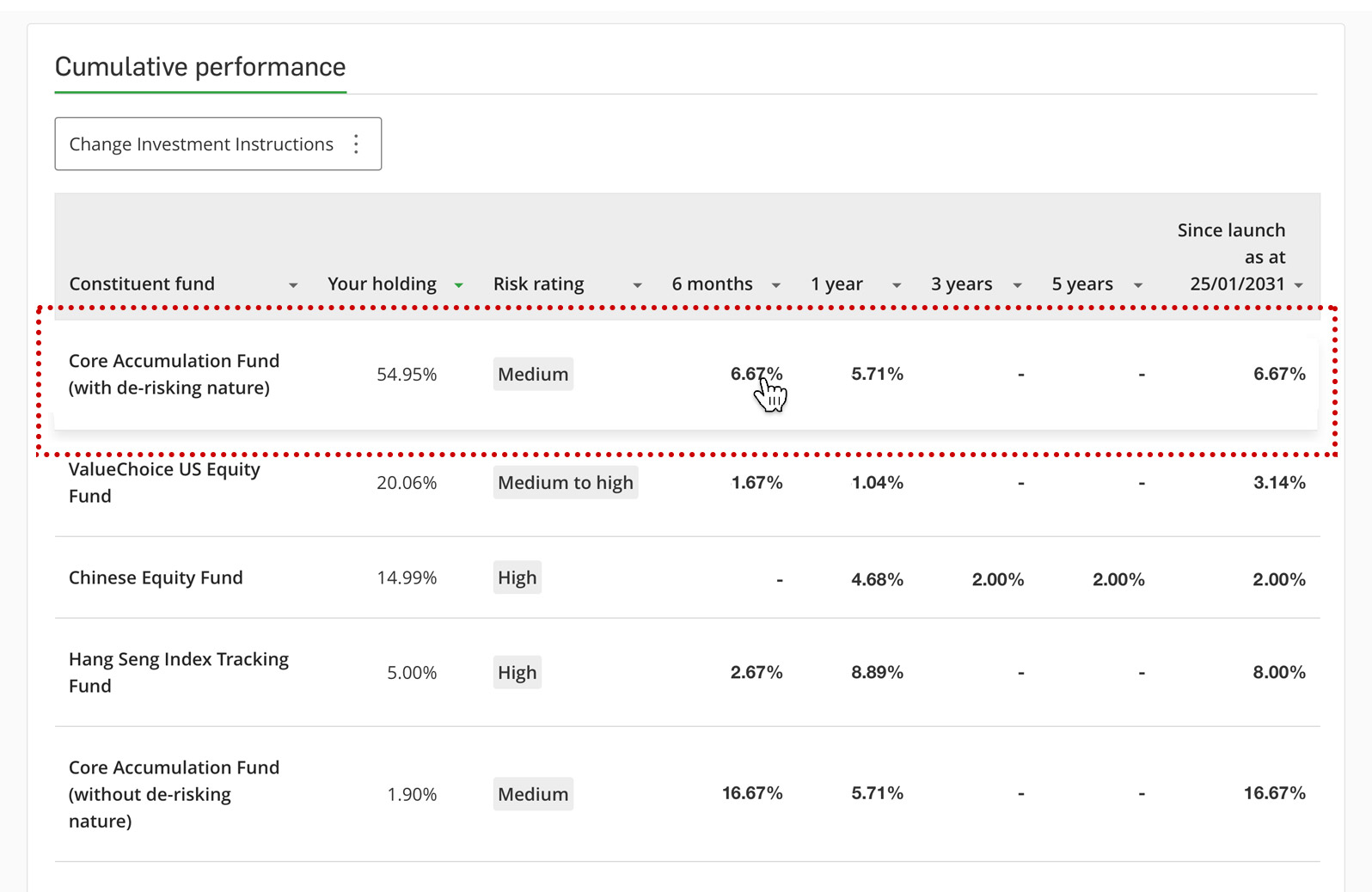

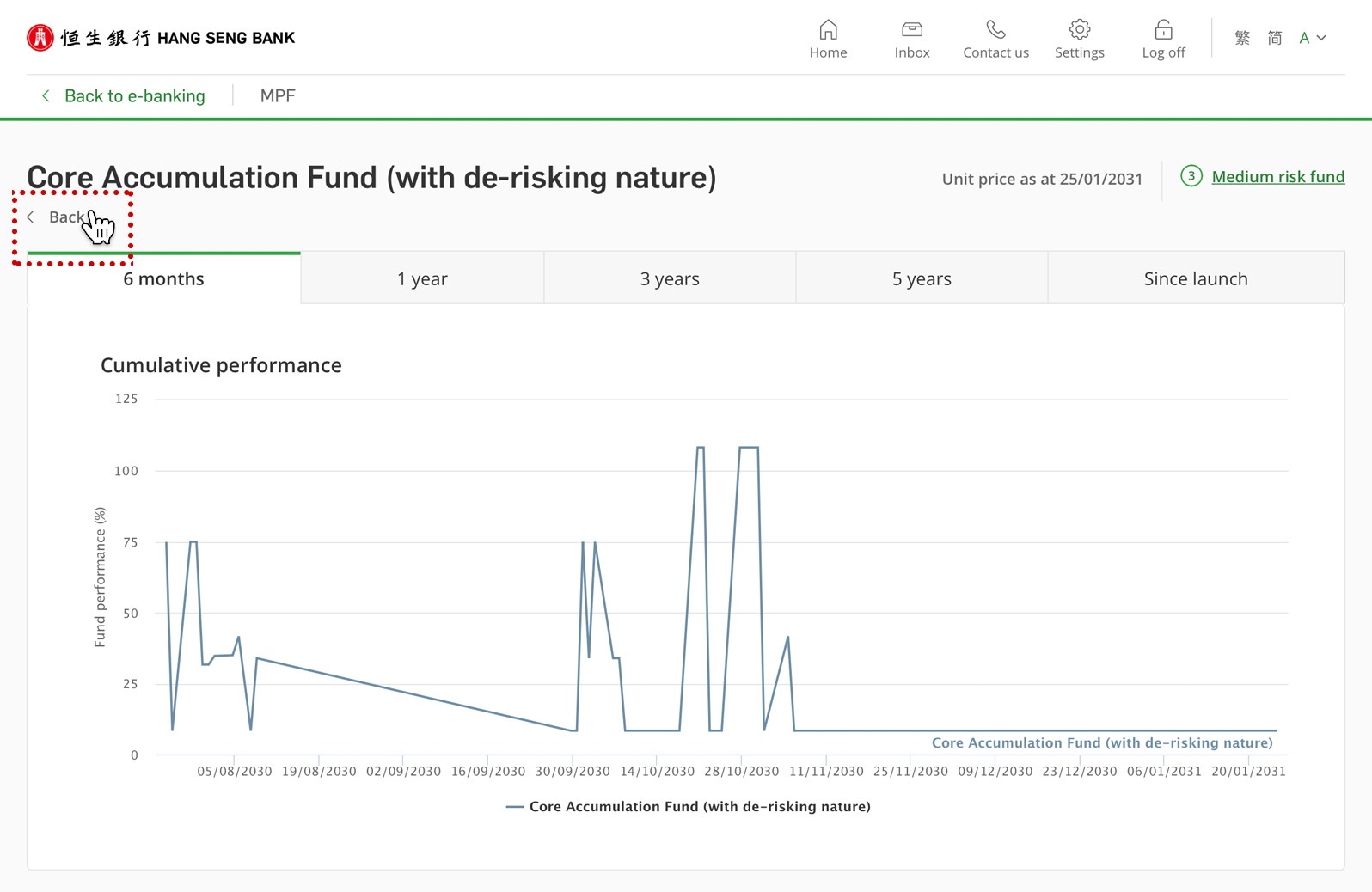

Keep track on your MPF performance by updated price information

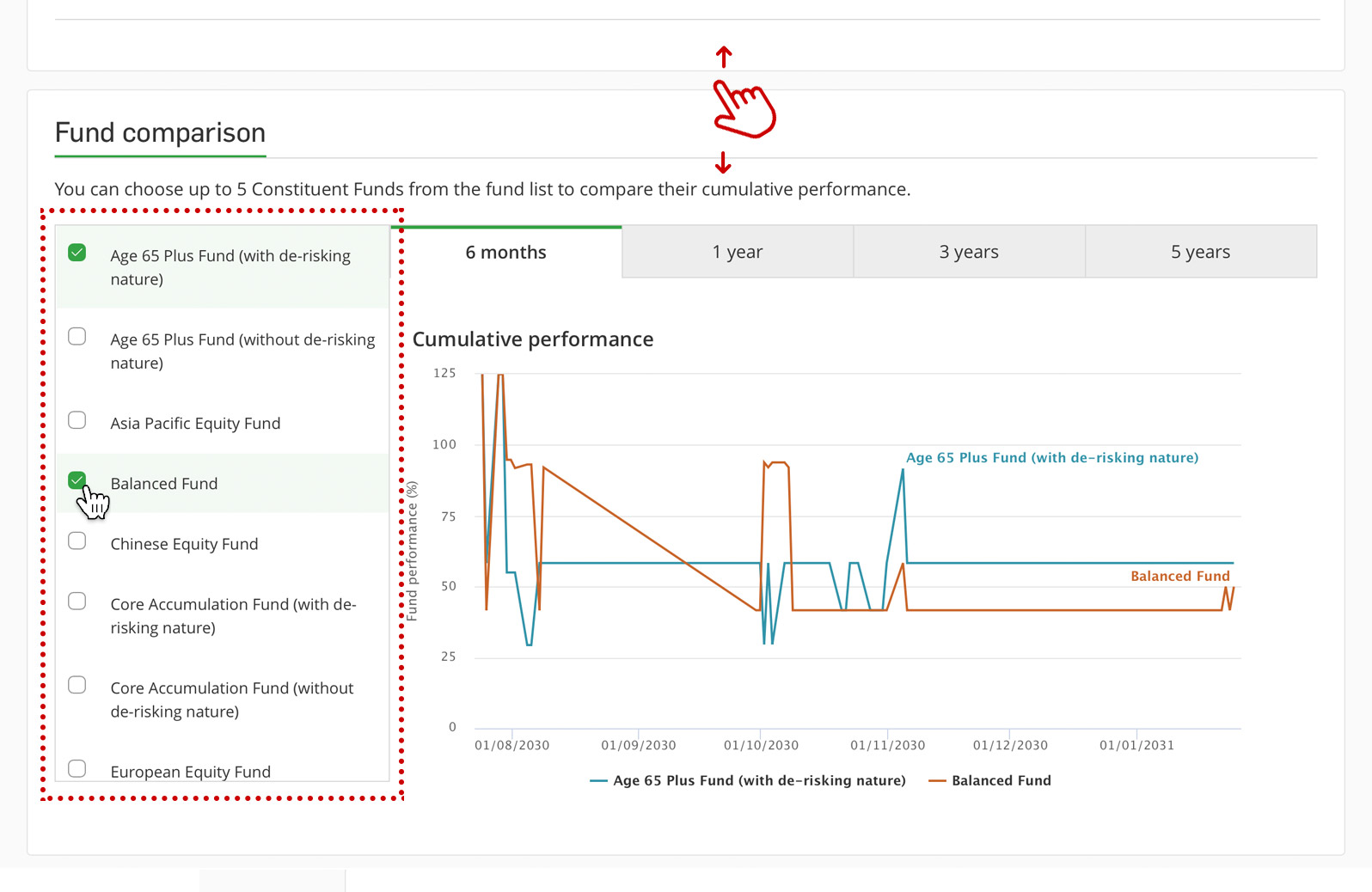

Compare performance of your MPF accounts

Latest unit price for your ease

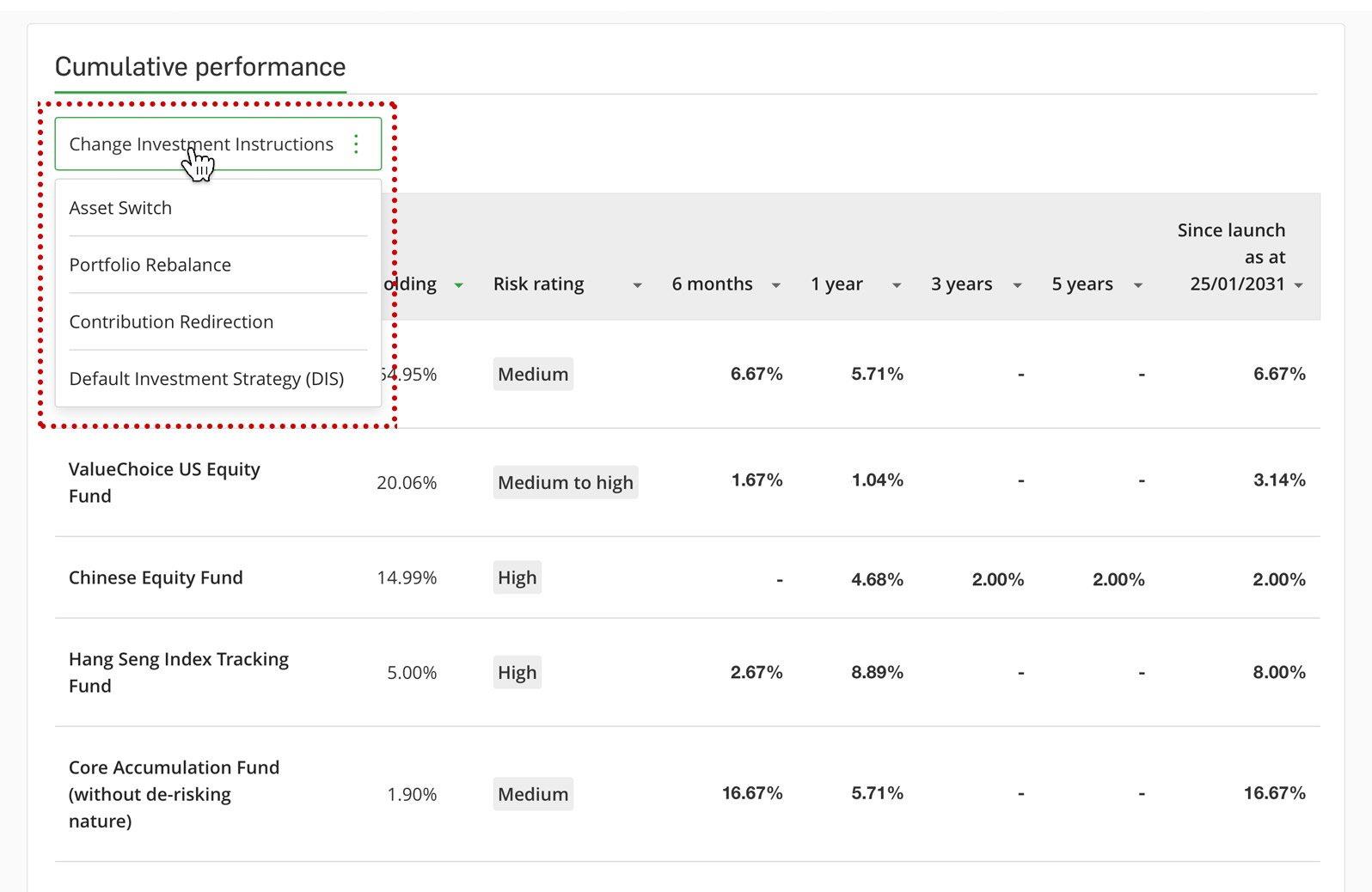

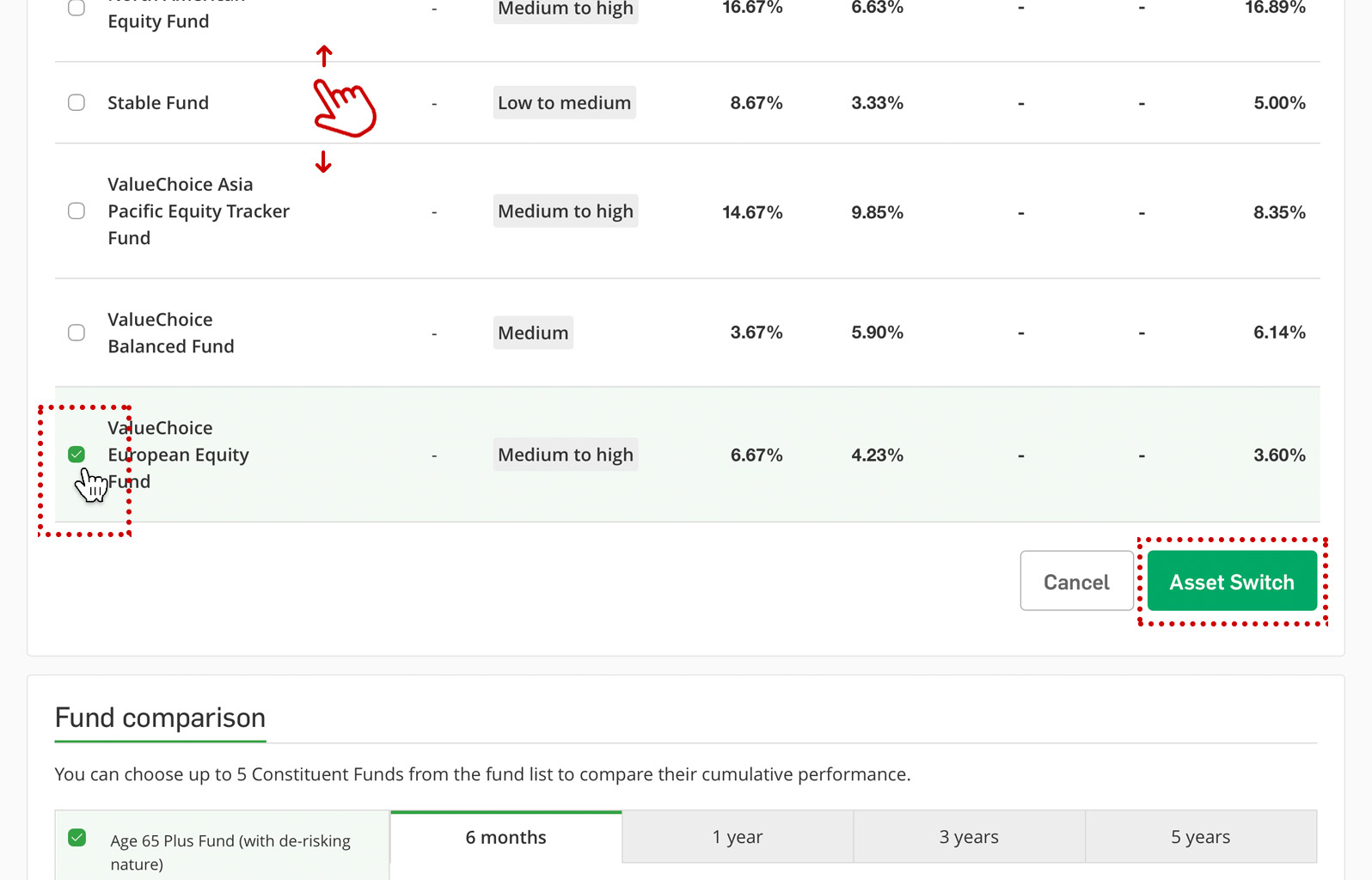

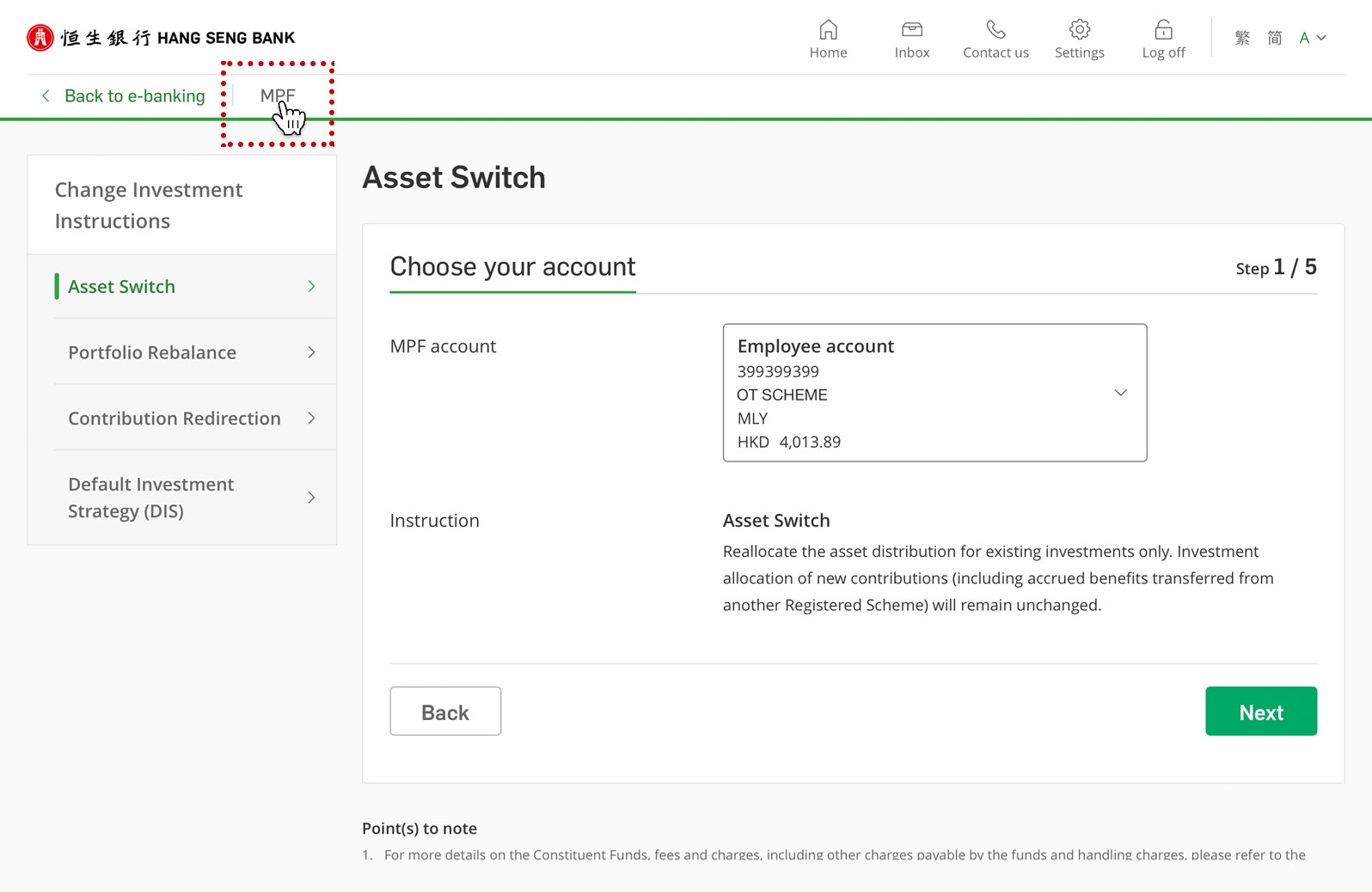

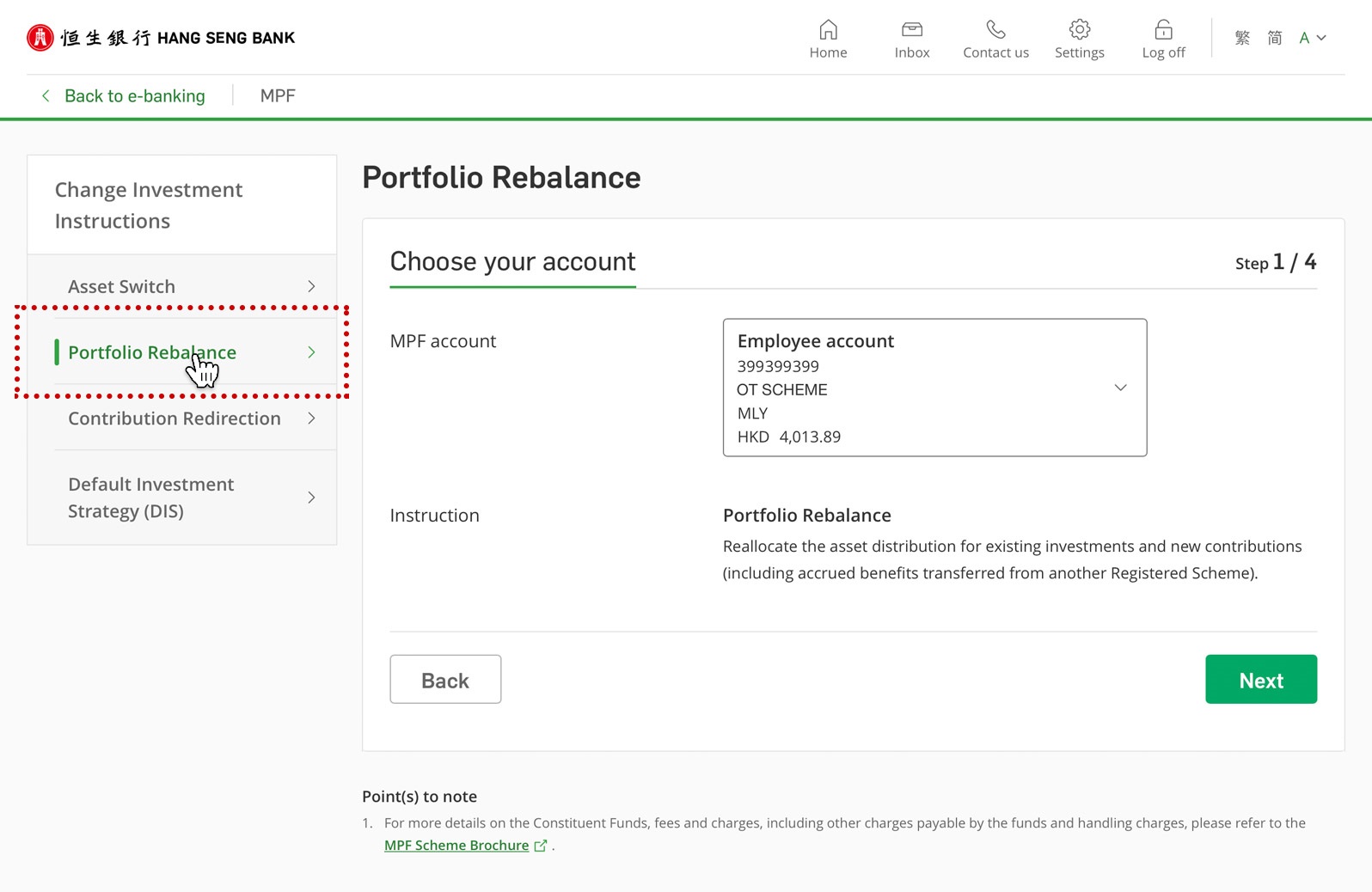

Switch between different instructions with ease

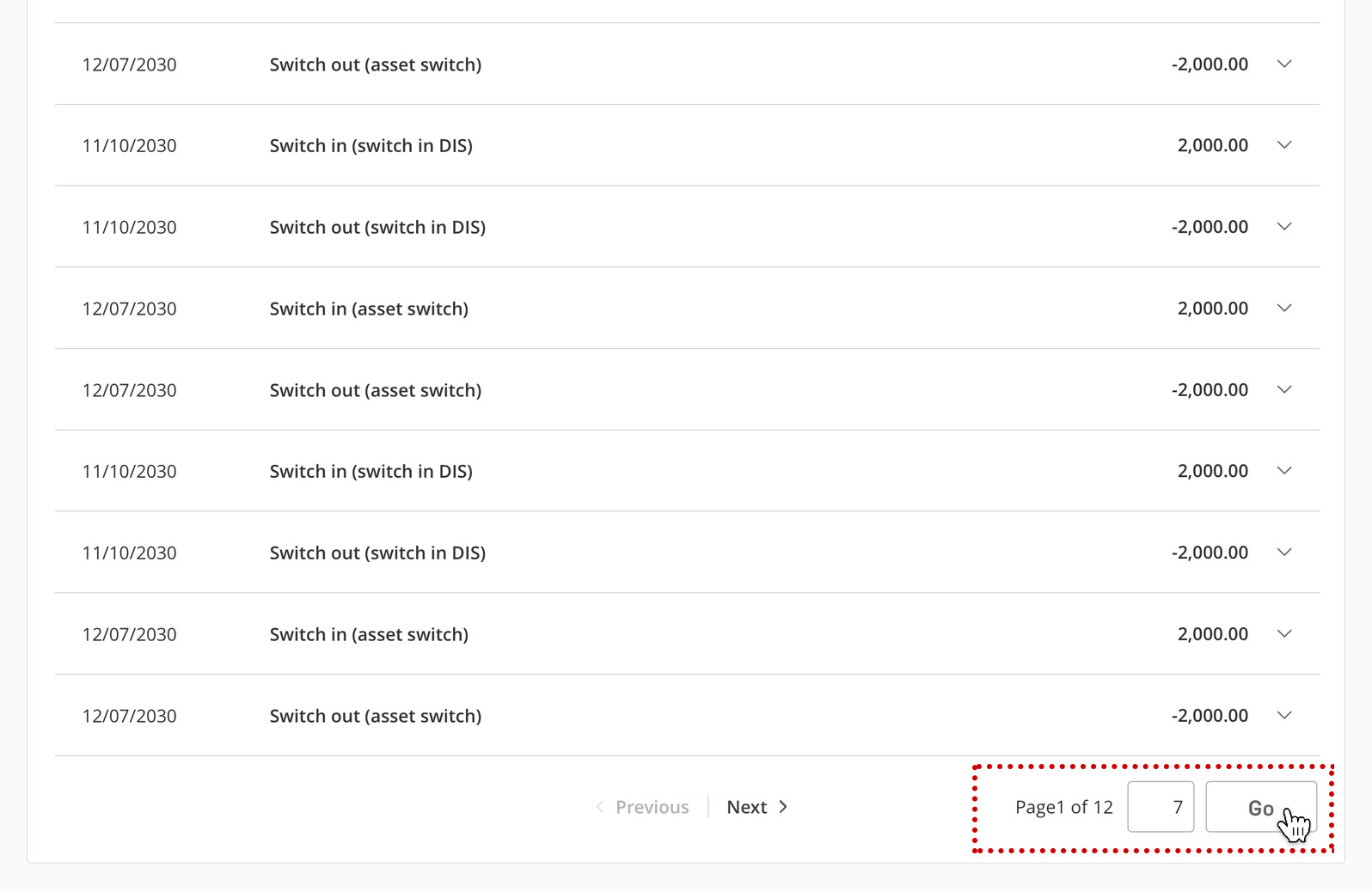

View latest 24 months of records

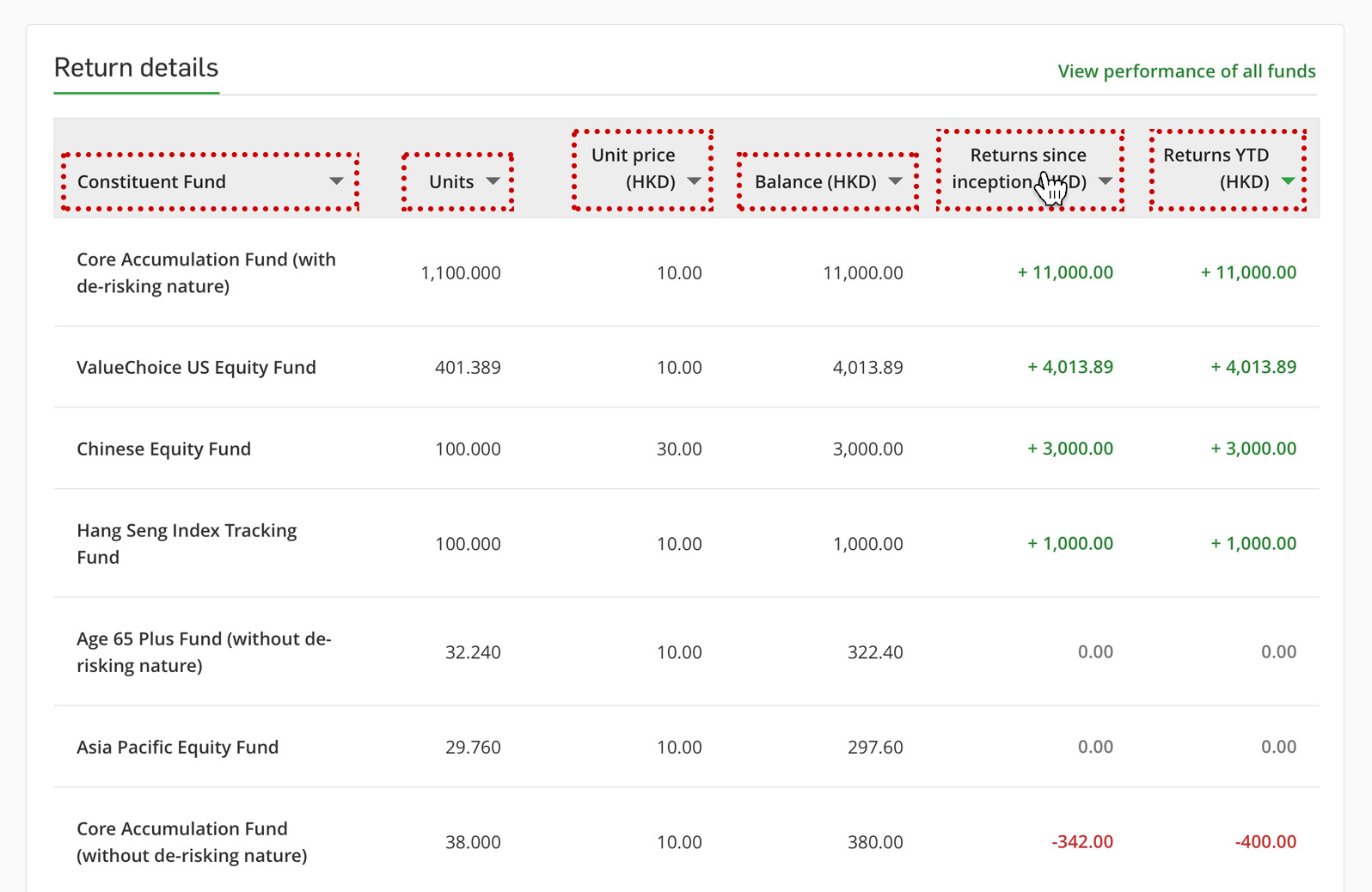

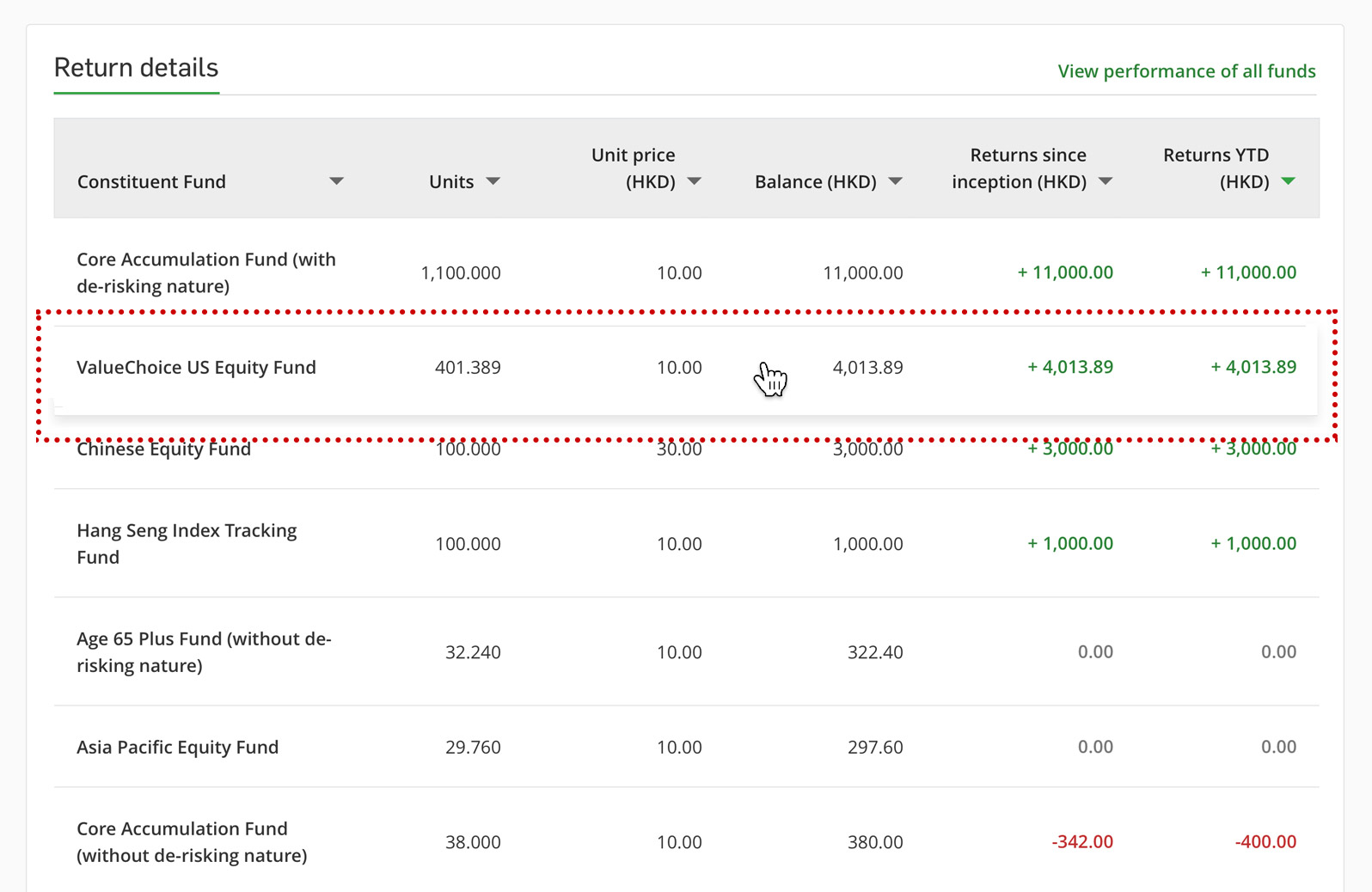

Clear returns of funds in your MPF accounts

Get timely notifications of the latest uploads

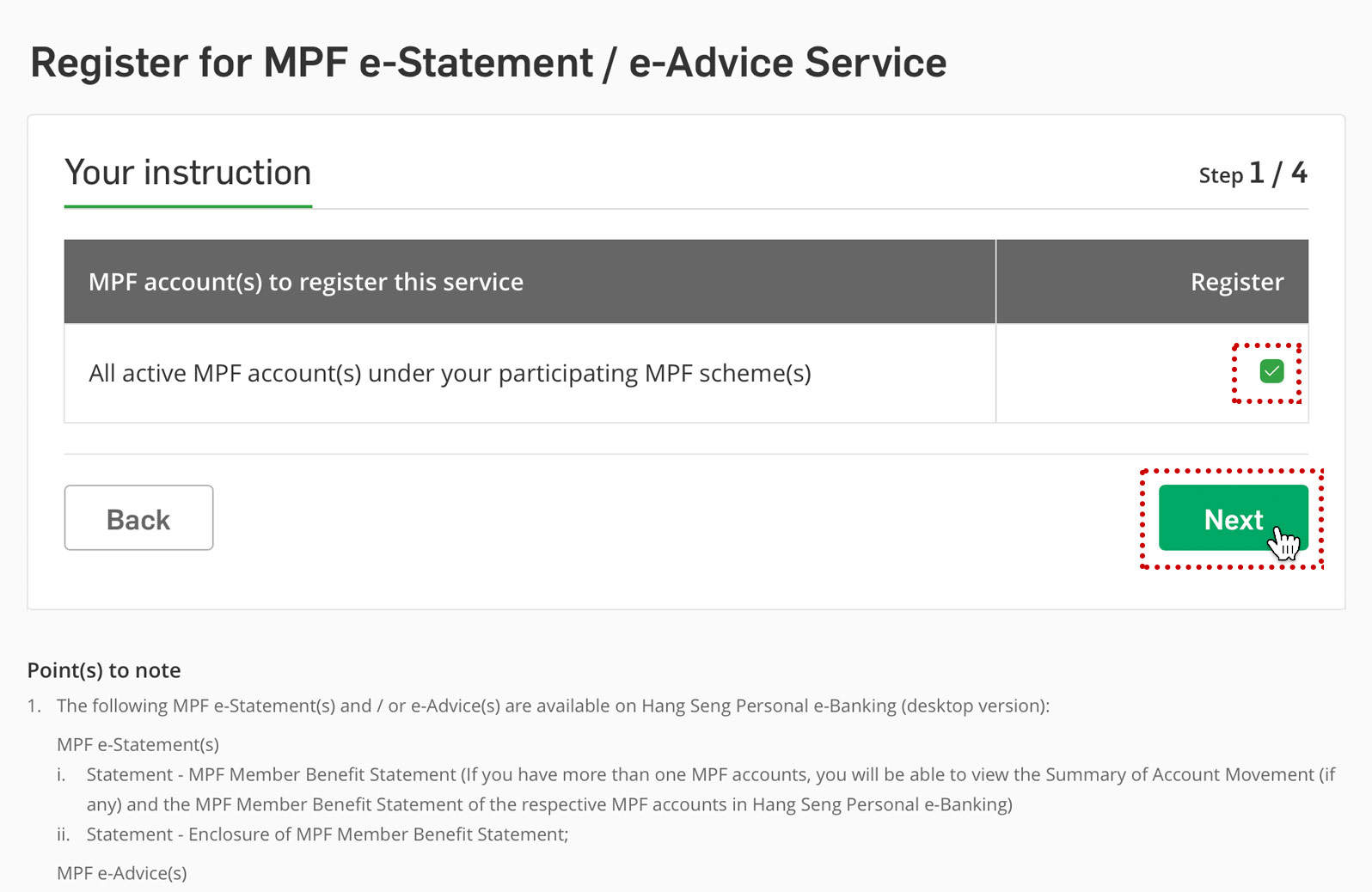

| Hang Seng Personal e-Banking (Desktop version) | Hang Seng Personal Banking mobile app |

|

|---|---|---|

| Total account balance and asset distribution |

✓yes |

✓yes |

| Latest fund performance and unit price |

✓yes |

✓yes |

| Change investment instructions |

✓yes |

✓yes |

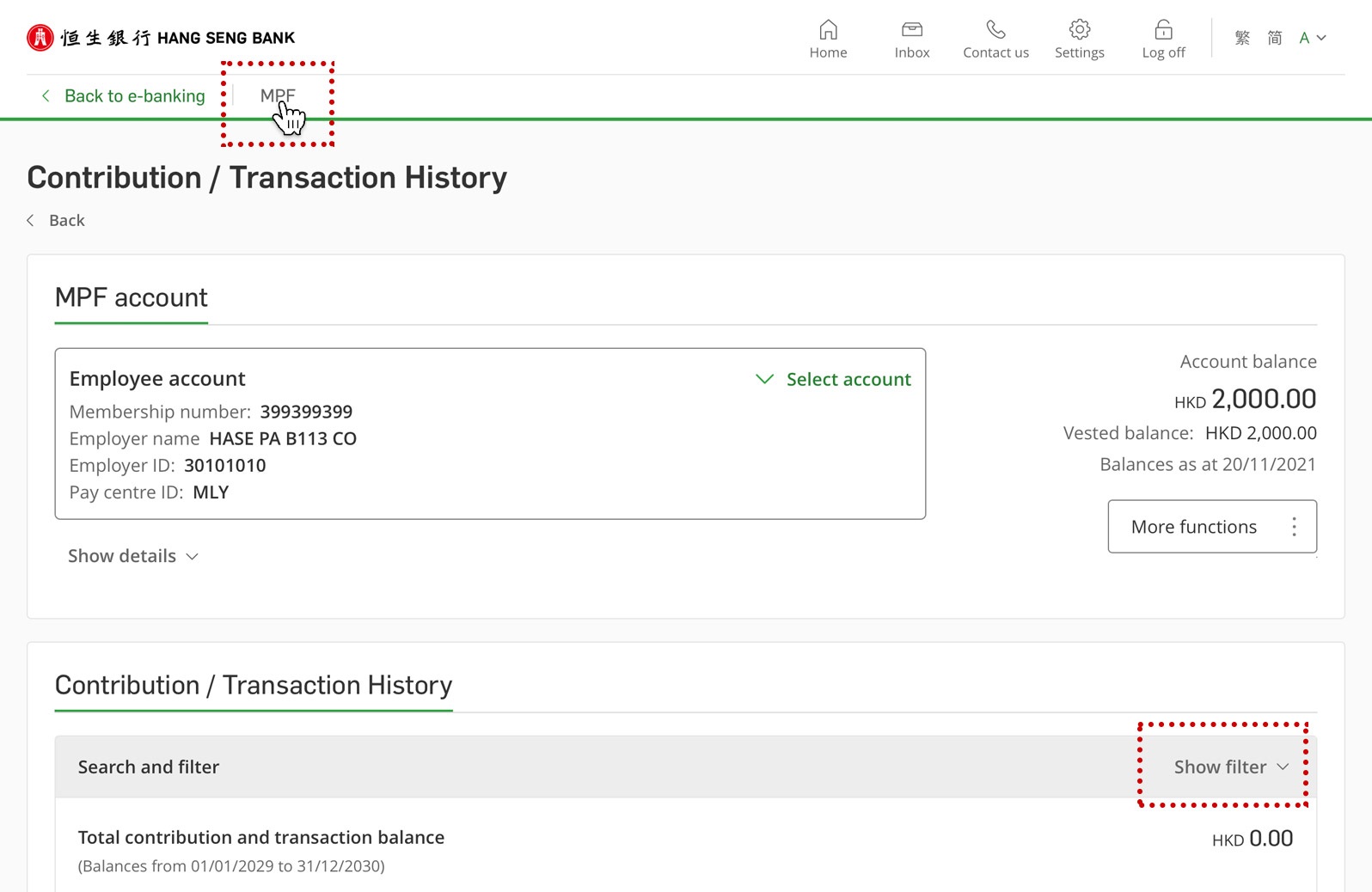

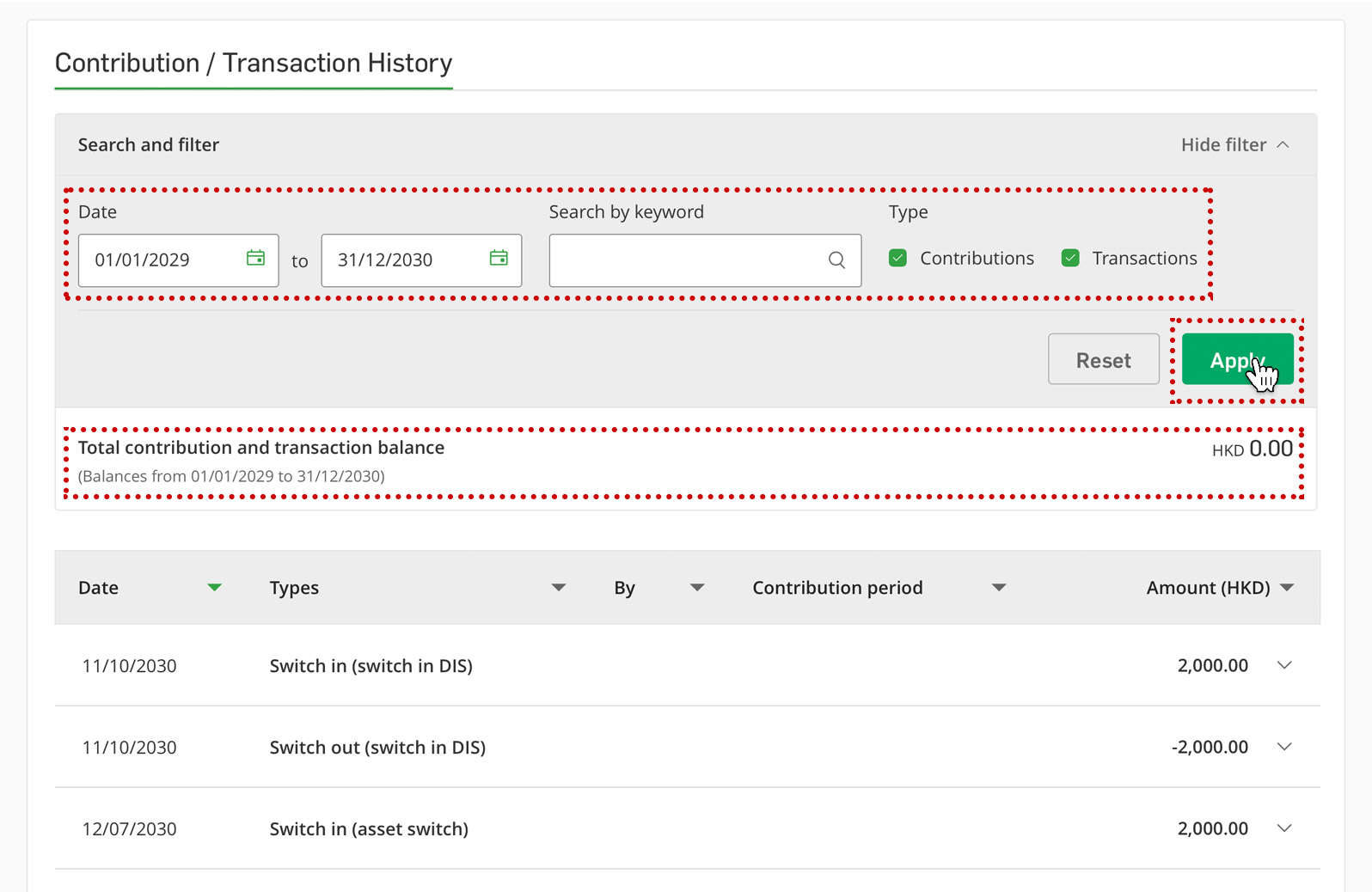

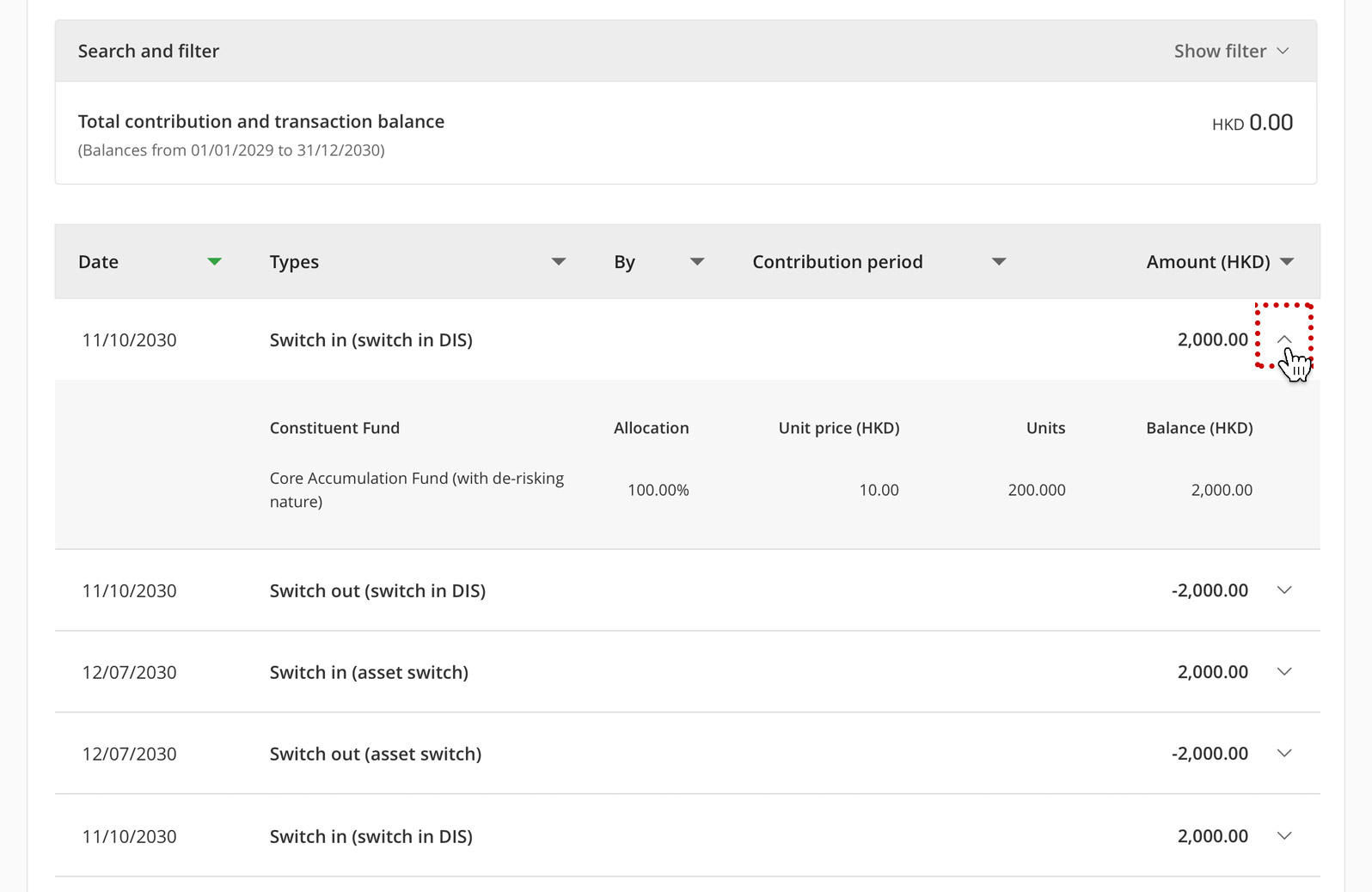

| Contribution and transaction history |

✓yes |

✓yes |

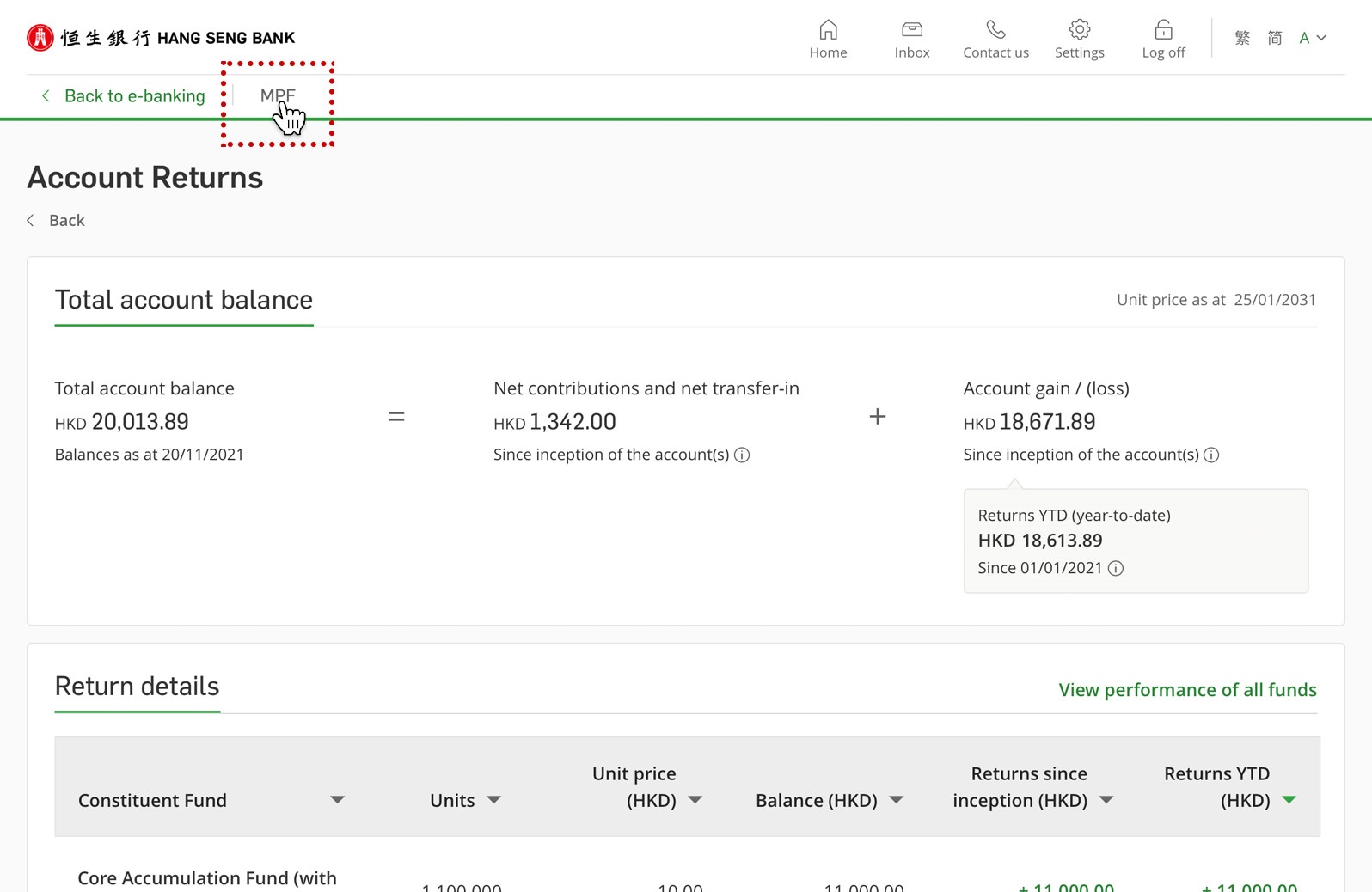

| Account returns |

✓yes |

✓yes |

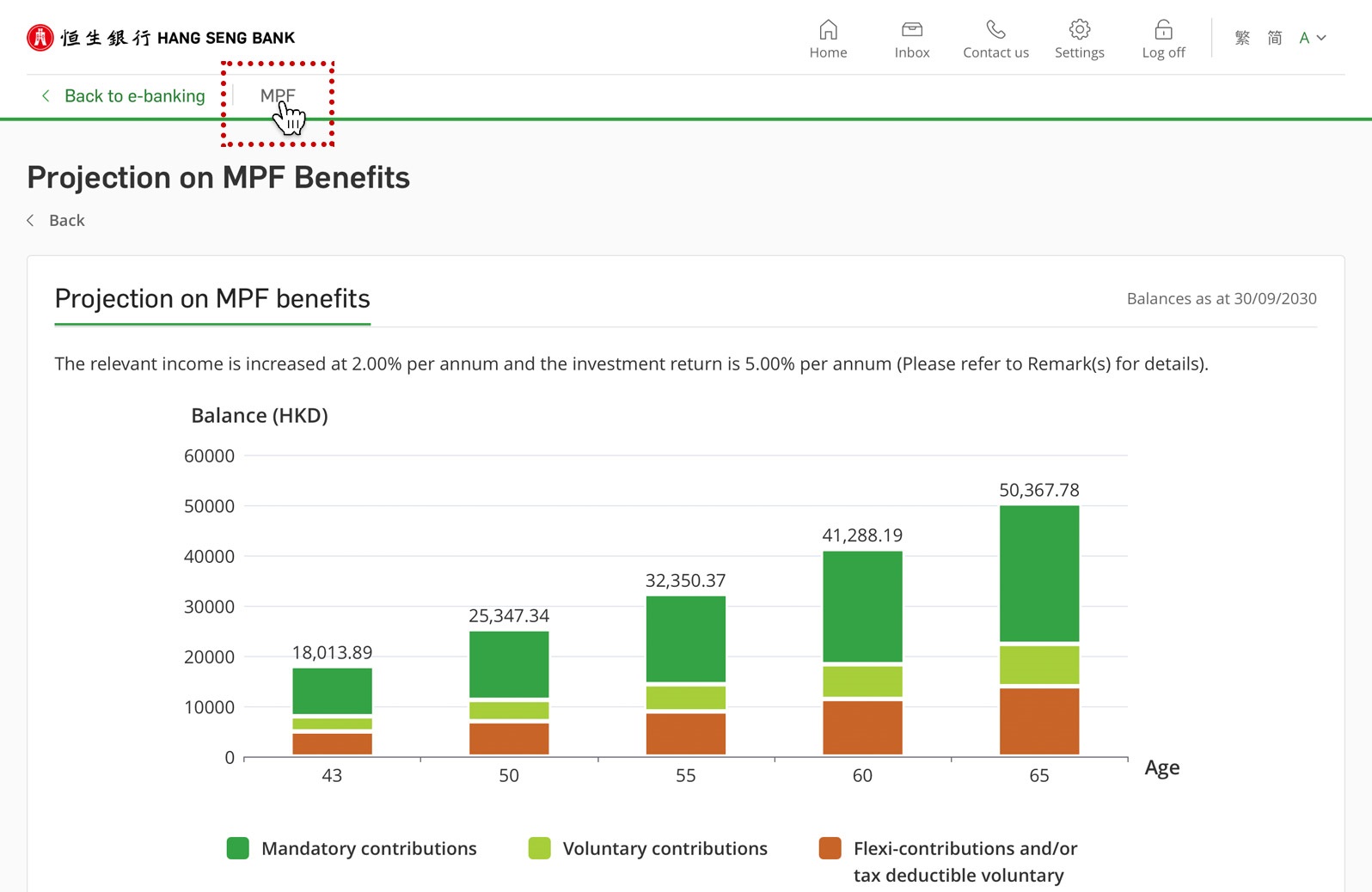

| Projection on total assets |

✓yes |

XNo |

| MPF e-Statement/ e-Advice |

✓yes |

XNo |

| Change contact information |

✓yes |

✓yes |

| Change Personal e-Banking password | ✓yes |

XNo |

| Download forms and documents | ✓yes |

XNo |

Members / Self-employed person:

(852) 2213 2213

HKSARG Employees:

(852) 2269 2269

Enquires / Apply for MPF:

(852) 2997 2838

The Hang Seng Mandatory Provident Fund – SuperTrust Plus is a mandatory provident fund scheme.

You should consider your own risk tolerance level and financial circumstances before making any investment choices or investing in the MPF Default Investment Strategy (the ‘DIS’). You should note that the DIS Constituent Funds, namely, the Core Accumulation Fund and the Age 65 Plus Fund, the DIS or a certain Constituent Fund may not be suitable for you. There may be a risk mismatch between the DIS Constituent Funds or a certain Constituent Fund and your risk profile (the resulting portfolio risk may be greater than your risk preference). When you are in doubt as to whether the DIS or a certain Constituent Fund is suitable for you (including whether it is consistent with your investment objectives), you should seek financial and/or professional advice. You should make the investment decision most suitable for you taking into account your circumstances.

You should note that the implementation of the DIS may have an impact on your MPF investments and accrued benefits. We recommend that you consult with the Trustee if you have doubts on how you are being affected.

The Guaranteed Fund invests solely in an approved pooled investment fund (‘APIF’) in the form of an insurance policy provided by HSBC Life (International) Limited. The guarantee is also given by HSBC Life (International) Limited. Your investments in the Guaranteed Fund, if any, are therefore subject to the credit risks of HSBC Life (International) Limited. Please refer to section 4 ‘Risks’ of the MPF Scheme Brochure for details of the credit risk.

The guarantee in the Guaranteed Fund only applies under certain conditions. Please refer to subsection 3.4.3(f) ‘Guarantee features’ of the MPF Scheme Brochure for details of the guarantee features (including in the context of payment of accrued benefits in instalments) and the ‘Guarantee Conditions’.

MPF Benefits, AVC Benefits and TVC Benefits are payable on a Member’s 65th birthday or on early retirement on or after reaching age 60. The accrued benefits can be paid in one lump sum or in instalments, at the Member’s election. The accrued benefits can be paid in such form and on such terms and conditions as the Trustee may, to the extent not prohibited by the MPF Ordinance or General Regulation, prescribe. Please refer to subsection 6.7(c) ‘Payment of MPF Benefits, AVC Benefits and TVC Benefits’ of the MPF Scheme Brochure for details.

You should not invest based on the information shown on this page alone and should read the MPF Scheme Brochure.

Investment involves risks. Past performance is not indicative of future performance. The value of financial instruments, in particular stocks and shares, and any income from such financial instruments, may go down as well as up. For further details including the product features and risks involved, please refer to the MPF Scheme Brochure.

Important - if you are in doubt about the meaning or effect of the contents of the MPF Scheme Brochure, you should seek independent professional advice.