We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Please read the important risk warnings for ELIs before making investment decisions.

Experience ELI subscription service and grasp HK and US stock markets news in one platform. Explore offers

Equity Linked Investments (ELIs) are structured investment products in which the investment returns are linked to the performance of the linked stock. ELIs provide linked stocks across HK stock market and US stock that are listed on NYSE and NASDAQ markets.

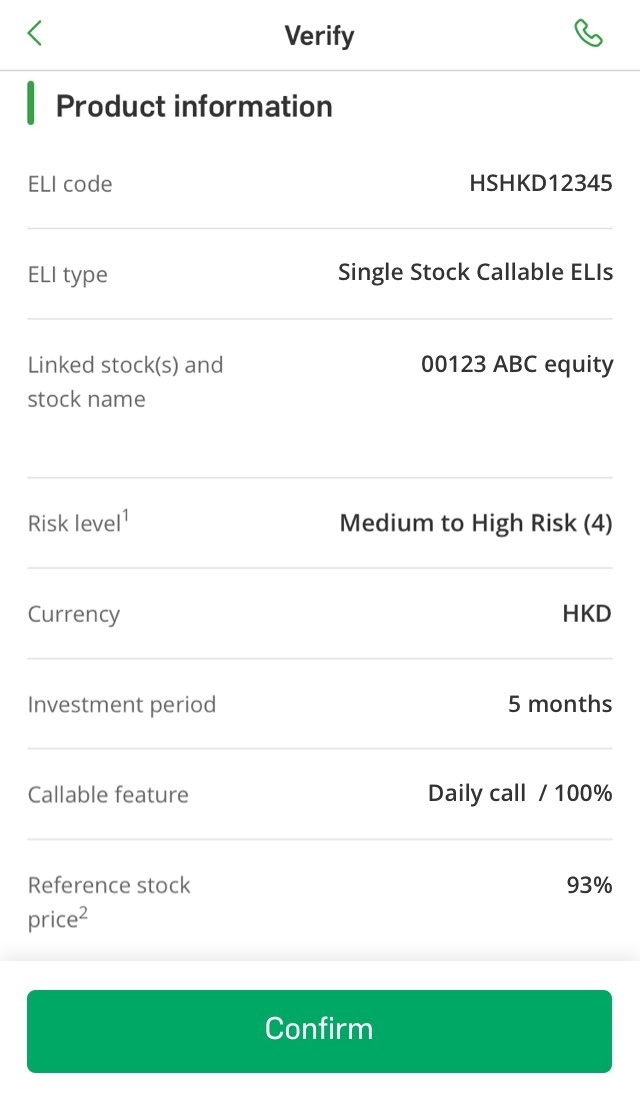

With a flexibility to select different tenors and product features such as callable feature, potential upside feature and airbag feature, ELI linked with HK stocks and ELI linked with US stocks can be tailored to meet your investment needs.

You can also click "Top 10 ELIs" to explore the top 10 equity-linked investments offered by our bank.

Subscribe in just 3 quick steps

What is Risk Tolerance Level?

Complete the form on Invest Express Mobile App for applicable ELIs subscription

ELIs can be linked to certain stocks or exchange-traded funds (ETFs) that are listed on stock exchanges. They can also be linked to a single stock or a basket of stocks.

ELI-linked stocks included HK stocks, and US stocks that are listed on NYSE and NASDAQ, covering diversified sectors such as technology, finance, telecommunications, consumption and health care.

Some ELIs include a partial capital protection feature at maturity, subject to a base redemption level.

The base redemption level, usually specified as a percentage, range from 70% to 99.9% of the invested amount.

In certain circumstances, you may earn higher potential returns than with conventional time deposits, depending on changes in the values of the underlying assets.

ELIs flexible tenors range from 2 months to 3 years.

ELIs with callable feature allows investors to receive the potential return and their invested amount before the maturity date.

Some ELI products include an airbag feature, in which case the settlement at maturity will depend on whether an airbag lapse event has occurred.

The airbag level is usually expressed as a percentage of the linked stock’s initial spot price, and is usually set lower than its strike price.

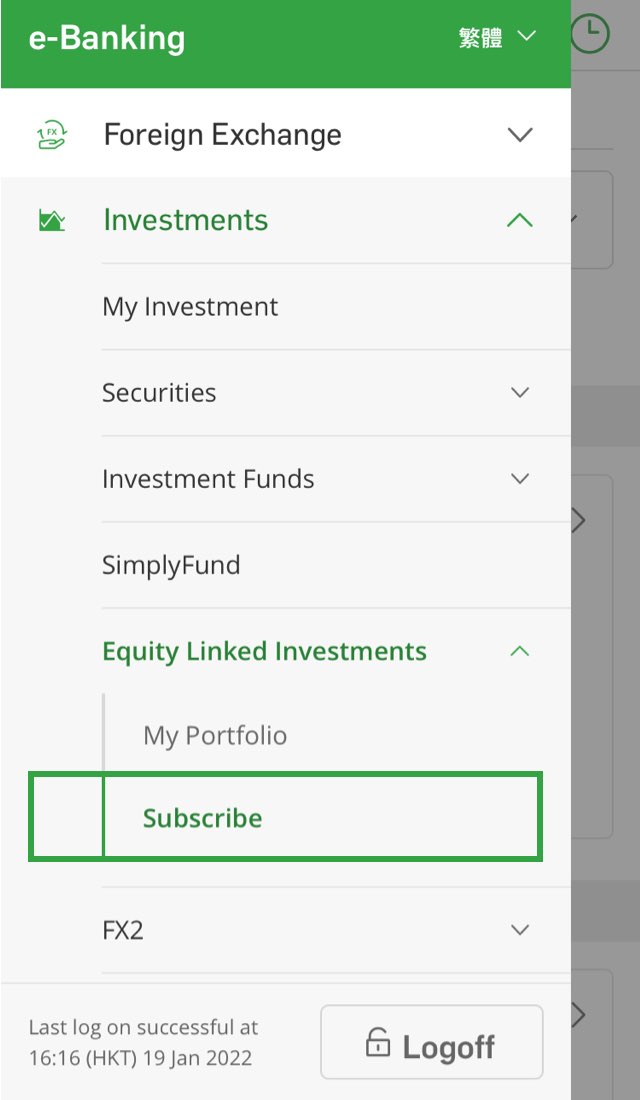

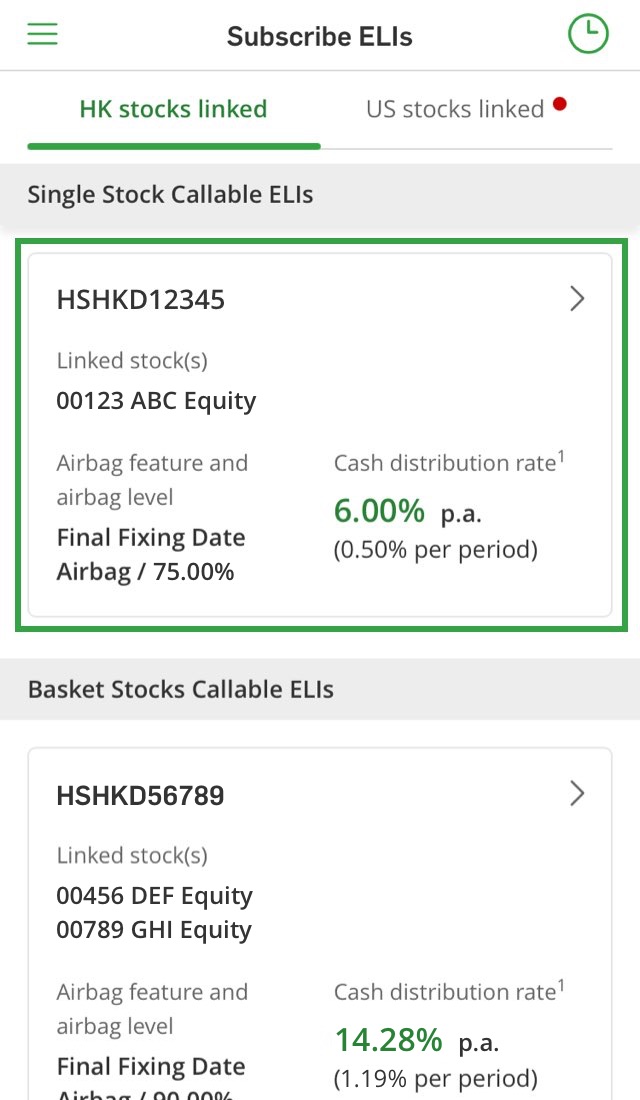

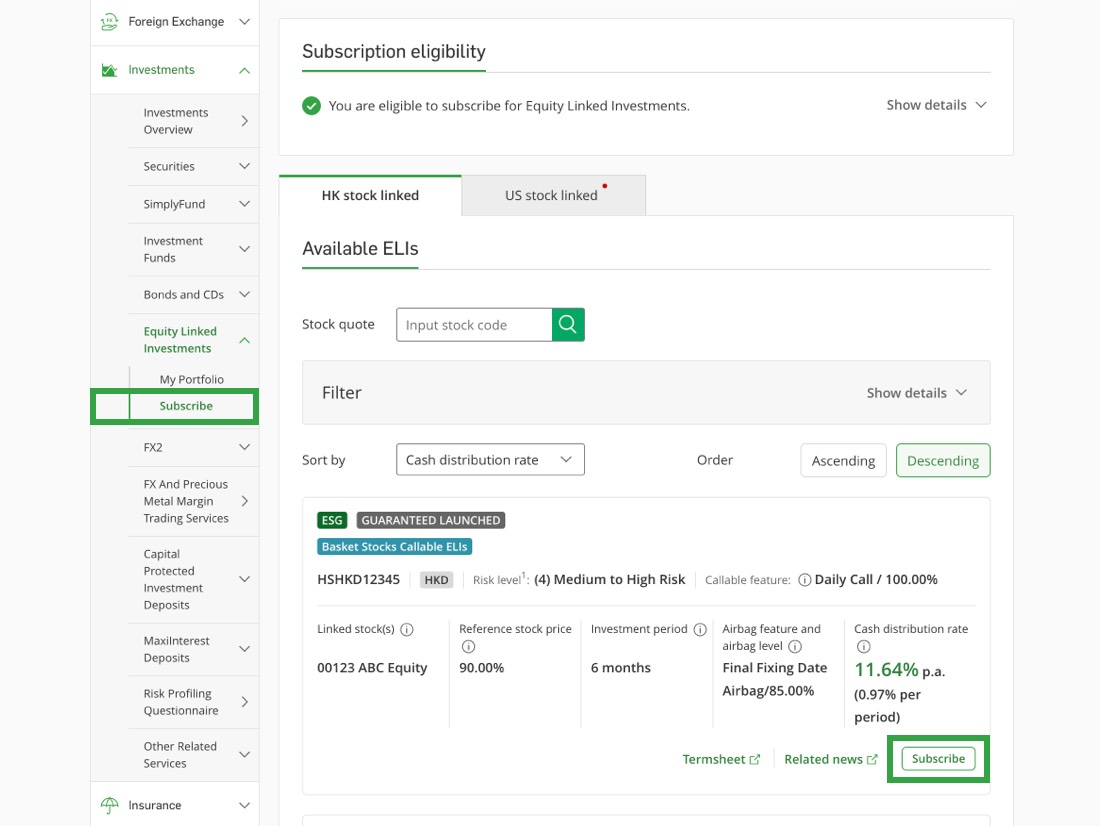

You may subscribe for ELIs linked to HK stocks and US stocks via Hang Seng Personal Banking mobile app, Personal e-Banking (Desktop version) or any of our branches.

Nowadays, market news is ever-changing and opportunities are everywhere. Besides the subscription service, you can also access news of related markets and linked stocks via Hang Seng Personal Banking mobile app and Personal e-Banking (Desktop version), based on different categories, stock codes, etc. We also provide Chinese translations for news related to certain US stock markets[2] for your reference.

Want to keep abreast of market news for your favourite stocks in ELI and stock watch list? "News Express" got you covered. You can browse in one click, and find out more about ELI subscription service. Grasp investment opportunities with us.

IIllustrative example[2]

Some ELIs allow partial capital protection at maturity. Let’s begin the illustration.

Assume you will invest in a 3-month ELI with partial capital protection at maturity, and linked to a stock. Here are 4 scenarios showing how the final stock price will affect your total returns.

The increase in final stock price is higher than coupon rate

The final stock price goes all the way up to HKD 120, an increases of 20% at final fixing date. This increase in stock price is higher than the coupon rate of 10%. Thus, the coupon rate at maturity rises to 20%.

First month when you subscribe

You invest HKD 80,000

At maturity date on the third month

Total final amount (including principal and coupon) HKD 96,000

Your returns at maturity

HKD 80,000 x 20% (coupon rate at maturity) = HKD 16,000

The increase in final stock price is lower than coupon rate

The final stock price hits HKD 109, an increases of 9% at final fixing date. This increase in stock price is lower than the coupon rate of 10%. In this case, the coupon rate at maturity will be 10%.

First month when you subscribe

You invest HKD 80,000

At maturity date on the third month

Total final amount (including principal and coupon) HKD 88,000

Your returns at maturity

HKD 80,000 x 10% (coupon rate at maturity) = HKD 8,000

The final stock price is lower than the strike price and initial stock price

The final stock price drops to HKD 90, a decrease of 10% at final fixing date. Since the final stock price is lower than the strike price and the initial stock price, you are not entitled to any coupon amount and will receive only 90% of your initial investment amount.

First month when you subscribe

You invest HKD 80,000

At maturity date on the third month

Total final amount HKD 72,000

Your loss at maturity

HKD 80,000 x 10% (decrease %) = HKD 8,000

The final stock price is lower than the base redemption level

The final stock price decreases by 30%, to HKD 70 at final fixing date. Since the final stock price is lower than the strike price and base redemption level, you are not entitled to any coupon amount, and will receive only 80% (base redemption level) of your initial investment amount.

First month when you subscribe

You invest HKD 80,000

At maturity date on the third month

Total final amount HKD 64,000

Your loss at maturity

HKD 80,000 x 20% = HKD 16,000

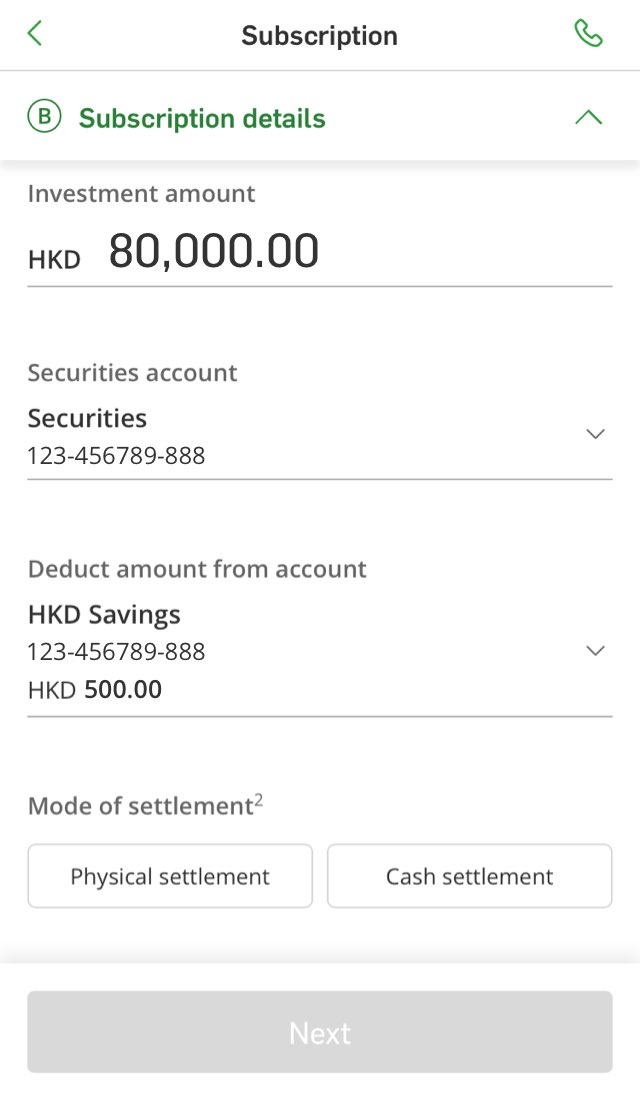

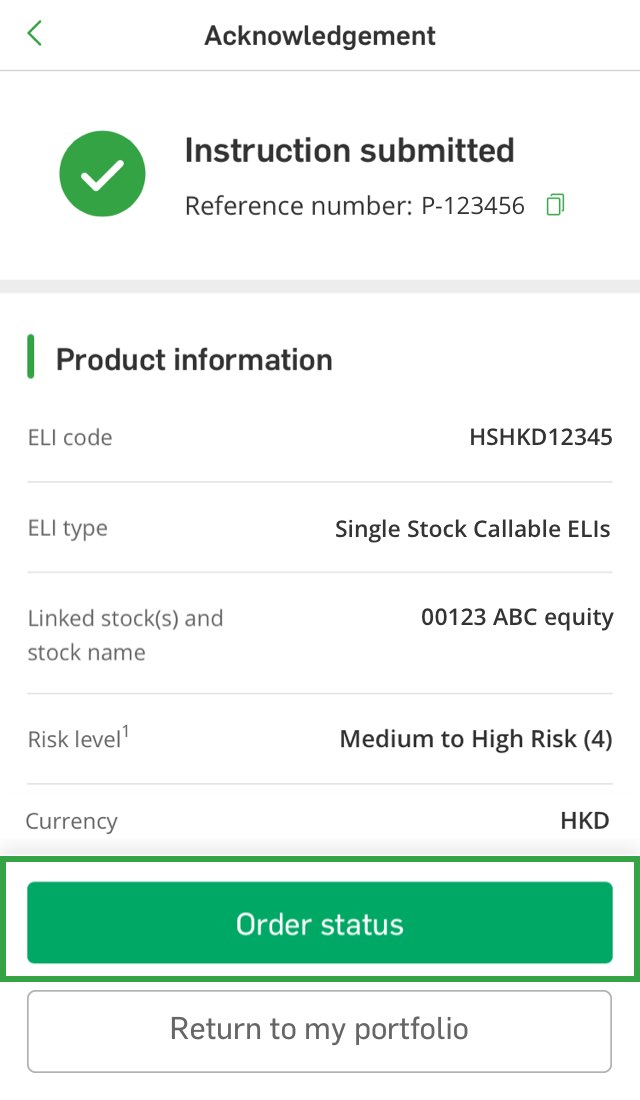

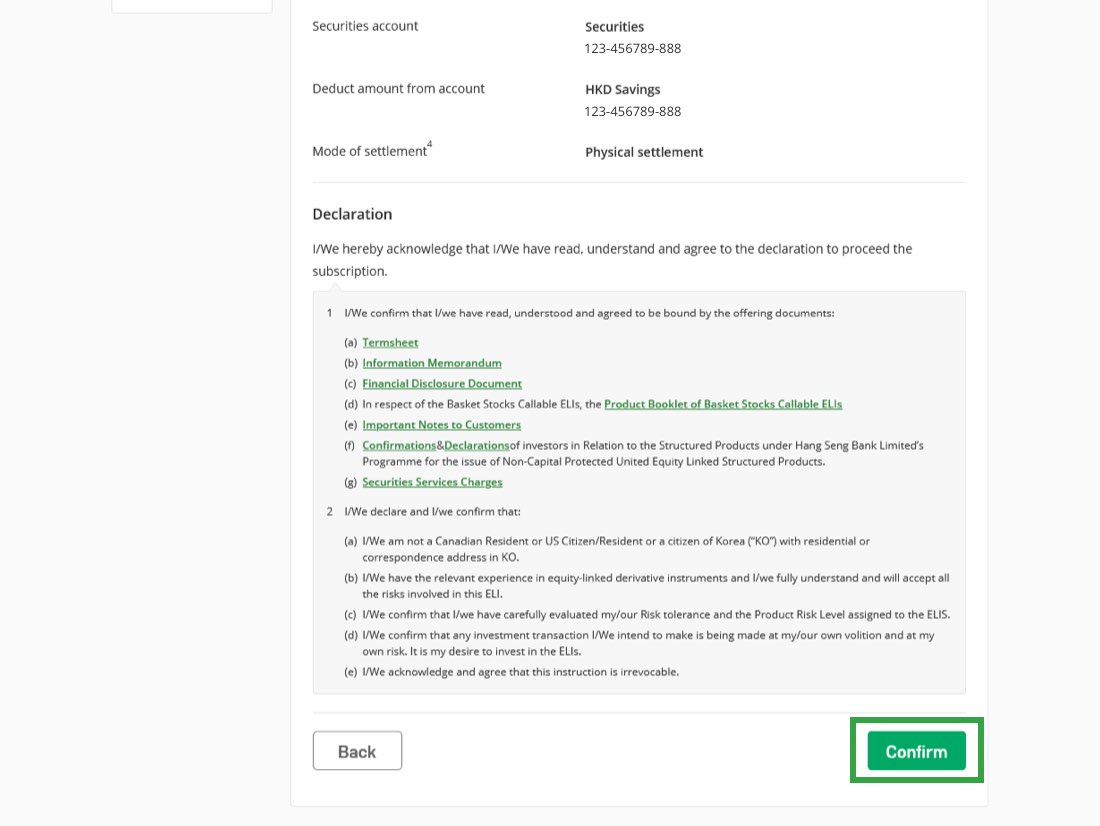

Via mobile app

Via website

Offering documents

Programme for the Issue of Unlisted Equity Linked Structured Products offered by Hang Seng Bank Limited:

ELI linked with HK stocks

ELIs linked with HK stocks provide various types of products for selection such as Callable Equity Linked, Bull ELI with potential upside cash distribution, and Bull ELI with potential upside cash distribution and partial capital protection at maturity.

ELIs can be linked to certain HK stocks or exchange-traded funds (ETFs) that are listed on stock exchanges. They can also be linked to a single stock or a basket of stocks, covering diversified sectors such as technology, finance, telecommunications, consumption and health care.

ELI linked with US stocks

Callable Equity Linked Investments can be linked with certain US stocks that are listed on NYSE and NASDAQ. They can also be linked to a single stock or a basket of stocks, covering diversified sectors such as technology, finance, telecommunications, consumption and health care.

Popular questions

Equity Linked Investments (ELI) are structured investment products where investment returns are linked to the performance of the linked stock. Diversified ELI products may have features such as Airbag, Callable and / or Daily accrual.

You can learn more about ELIs through “How does it work” section in this webpage. Please also refer to the terms and conditions as set out in the relevant offering documents for the ELIs.

Our equity linked investment services include both Hong Kong and US securities as the underlying choices. The ELI's market coverage includes Hong Kong Stock Exchange, New York Stock Exchange (NYSE) and NASDAQ Global Select Market. You can also access news related to HK and US stock markets.

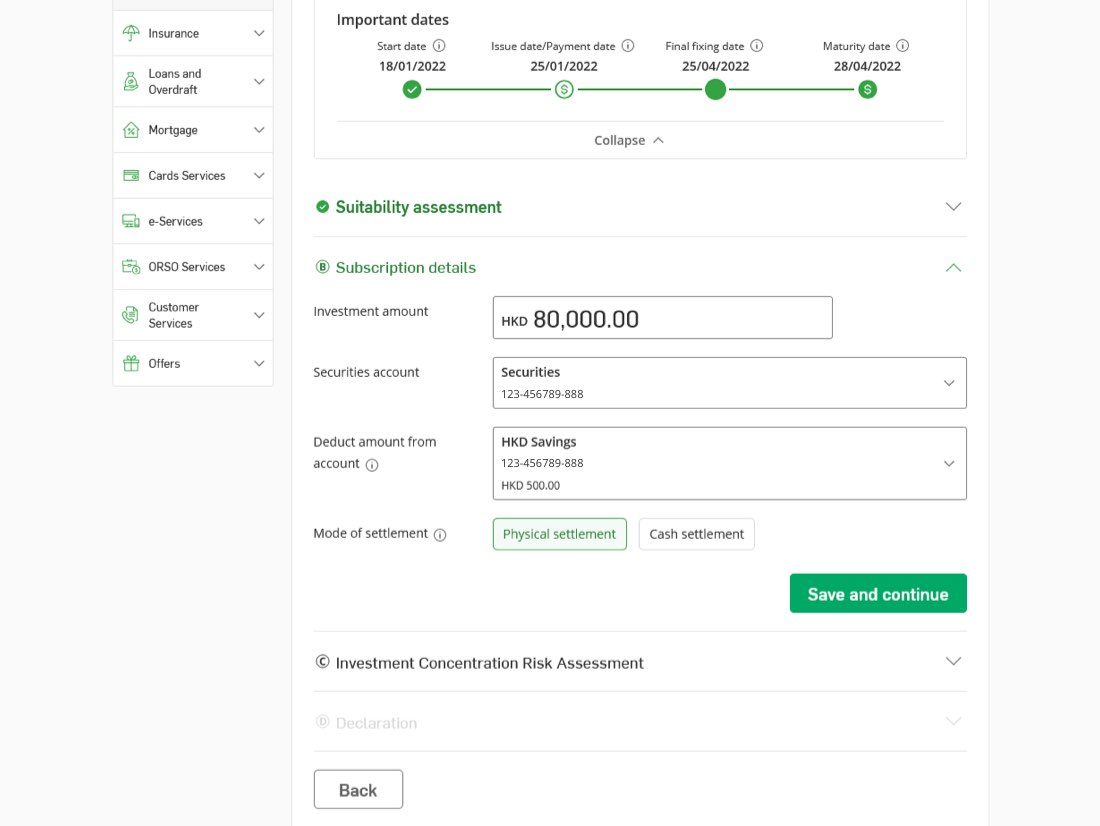

The typical minimum investment amount for ELIs linked with HK Stock(s) is approximately HKD80,000 or its equivalent in other currencies. While for ELIs linked with US Stock(s) may be around HKD100,000 or its equivalent in other currencies. The amount will be reviewed periodically and specified in the term sheet for the relevant series of ELIs.

You will need a Securities Account to subscribe to ELIs and for their stock delivery (if any). If you are an Integrated Account holder, you may open or reactivate the Securities Account via Personal e-Banking services or by visiting any of our branches. Please note that you need to go through suitability assessment before subscribing for ELIs.

Trading service

The ELIs online trading platform processes ELIs linked to HK Stock(s) orders from 9:00 am to 3:30 pm on trading days from Monday through Friday (Hong Kong Time) (“HKT”) (excluding Hong Kong public holidays, half-day trading, or market disruption days). While for ELIs linked with US Stock(s), the ELIs online trading platform processes ELIs orders from 9:00 am to 5:00 pm (HKT) on trading day from Monday to Friday (except for Hong Kong and United States public holidays, half-day trading, or market disruption day).

You can convert the currency via your Personal e-Banking account or instruct the Bank to convert it in your account prior to placing your ELIs order. Please note the potential currency conversion costs and you may be exposed to risk of fluctuation in the exchange rate against your home currency. Please note that the ELI order will be rejected if the funds in your account are insufficient in the relevant currency.

If there are any corporate actions relating to your ELIs holding, we will provide you with a written notification based on your contact information you registered with the Bank.

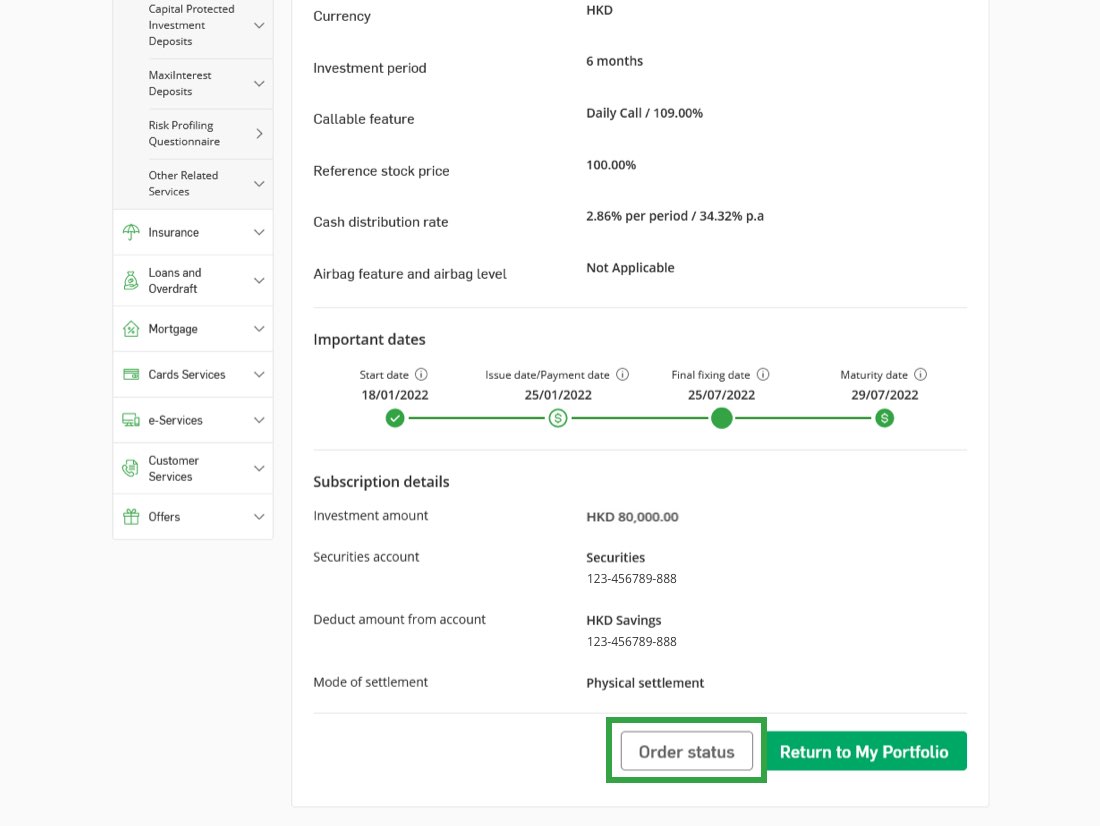

Yes. Simply log on to Hang Seng Personal e-Banking and click "Order status" section under “My Portfolio” tab. You can also view your holding details in the "My Portfolio" section under the "ELIs".

ELIs linked to US stock(s) subscription service is available at Hang Seng Bank’s branches, Personal e-Banking and mobile app from 9:00 am to 5:00 pm on trading day from Monday to Friday (HKT) (except for Hong Kong and United States public holidays, half day trading, or market disruption day).

Besides the subscription service, you can also access news of related markets and linked stocks via Hang Seng Personal Banking mobile app and Personal e-Banking (Desktop version). We also provide Chinese translations for news related to certain US stock markets[2] for your reference. You can also access Invest Express to keep track of different stock’s information, such as performance, stock quote and news or by visiting any of Hang Seng Bank branches.

Yes. You are required to hold a valid W-8BEN Form record before subscribing for ELIs linked to US stock(s). You may submit a Substitute Form W-8BEN through Invest Express if needed. Apart from that, you will have to conduct a suitability assessment with reference to your personal circumstances during the subscription process.

You can now subscribe ELIs linked to US stock(s) at Hang Seng Bank’s branches, Personal e-Banking and mobile app.

Feature & risk

The investment periods for ELIs usually range from 2 months to 3 years.

ELIs may be issued in any non-restricted and freely convertible currencies, such as AUD, CNY, EUR, GBP, HKD, JPY, NZD or USD. This will be specified in the term sheet for the relevant series of ELIs.

The settlement currency for any cash payment under an ELI will usually be the same as the currency used when you purchased the ELI.

Some of the ELIs are not capital-protected, while others are partially capital-protected at maturity, subject to a base redemption level specified in the relevant term sheet.

Please note that the full amount of your investment is at risk in either case and be prepared to bear full financial responsibility.

Please refer to risk factors listed in the relevant offering documents for the ELIs.

Once you have placed an ELI order, you have committed to purchase the ELIs unless:

You should note that the total cash amount returned to you when you unwind your order may be substantially less than your initial investment.

A product's risk rating is based on the Bank's proprietary risk rating methodology, which considers a variety of qualitative and quantitative factors.

All investment products are assigned a risk level from 1 to 5, with 1 as the lowest and 5 as the highest. A product risk rating is neither a statement of fact nor a recommendation to buy or sell the product.

Click to learn more about how we assign risk ratings for ELIs.

If you have any queries on product risk ratings, please contact your Relationship Manager. Independent financial and legal advice should be sought if necessary.

Fees and charges

Please refer to the offering documents for the ELIs you are considering.

Open an integrated account and activate your investment account via Hang Seng Mobile App with ease[3]

Comprehensive Equity Linked Investments experience is just a few steps away[4]

Get 24/7 support from our Virtual Assistant.

Personal customers:

(852) 2822 0228

Commercial customers:

(852) 2198 8000

The translated content is provided by 3rd party information provider with translation software used. The Bank makes no warranty as to the accuracy, reliability or correctness of any translations and accepts no liability in relation thereto.

Investors should not only base on this material alone to make investment decisions, but should read the relevant offering documents of the investment products (including the full text of the risk factors stated therein) and risk disclosure statements of the relevant investment products in details before making any investment decision.

You should obtain independent professional advice if you have concerns about your investment.

Want to know more about

Equity Linked Investments?

Want to know more about

Equity Linked Investments?

Chat with H A R O now