We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Paper Gold trading via Hang Seng Mobile App and Personal e-Banking

This page aims to provide key information about the Hang Seng Statement Gold Scheme (the “Scheme”). Please read the Important Risk Warnings for the Scheme.

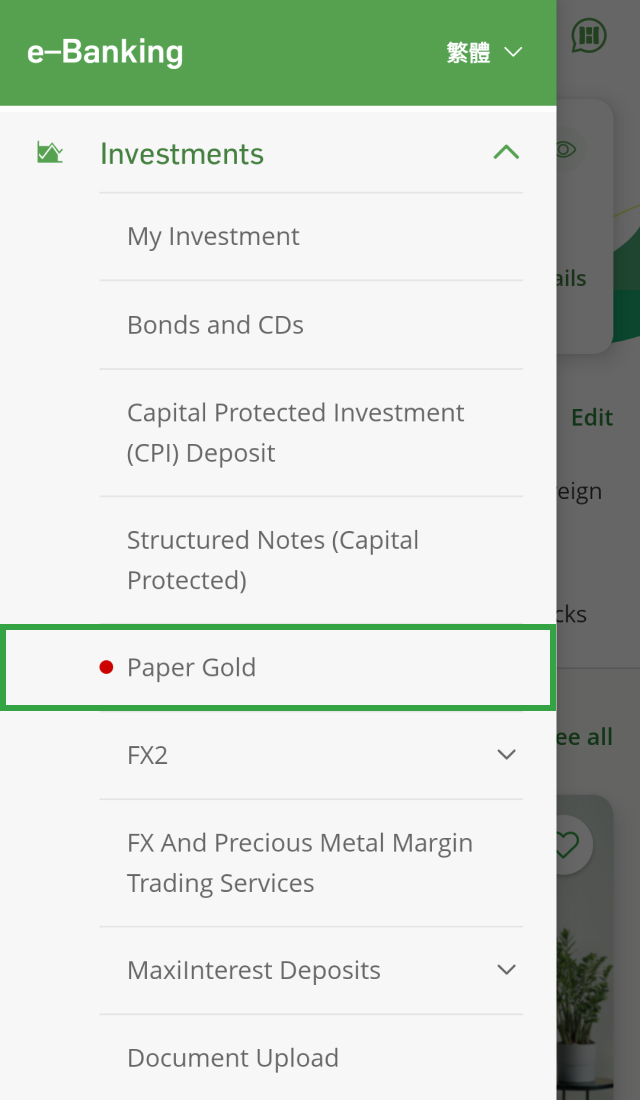

Our paper gold trading service is now available on Hang Seng Mobile App! Simply go to the left menu via the app > "Investments" > "Paper Gold" and trade paper gold with real-time prices. There is no separate handling charge.

The Hang Seng Statement Gold Scheme (the “Scheme") is an investment instrument for investors who are interested to buy and sell paper gold without requiring any physical delivery of gold.

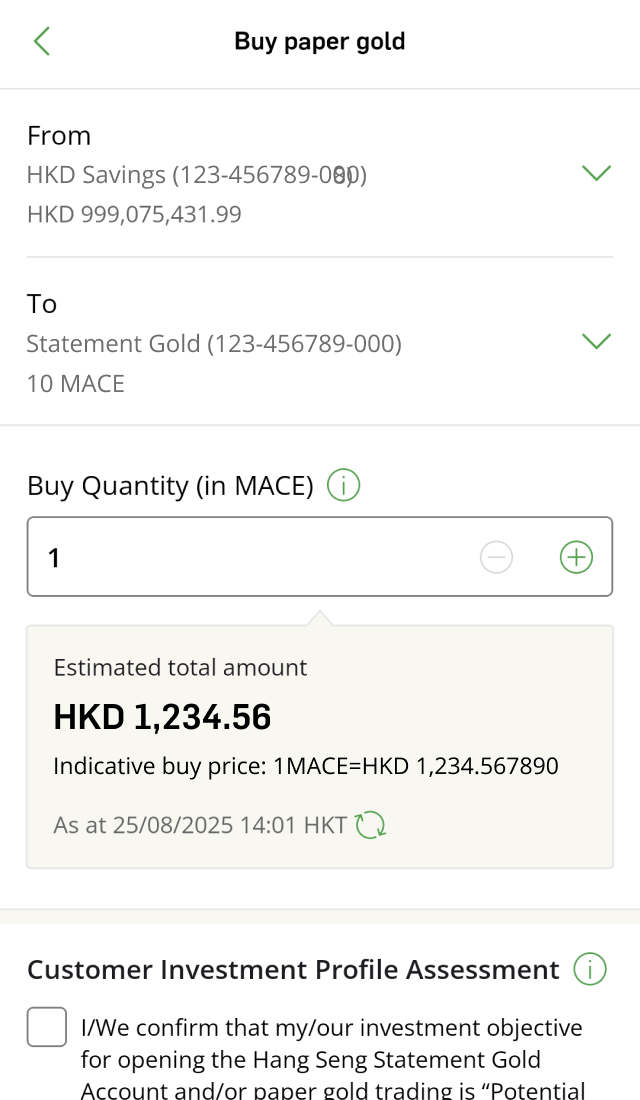

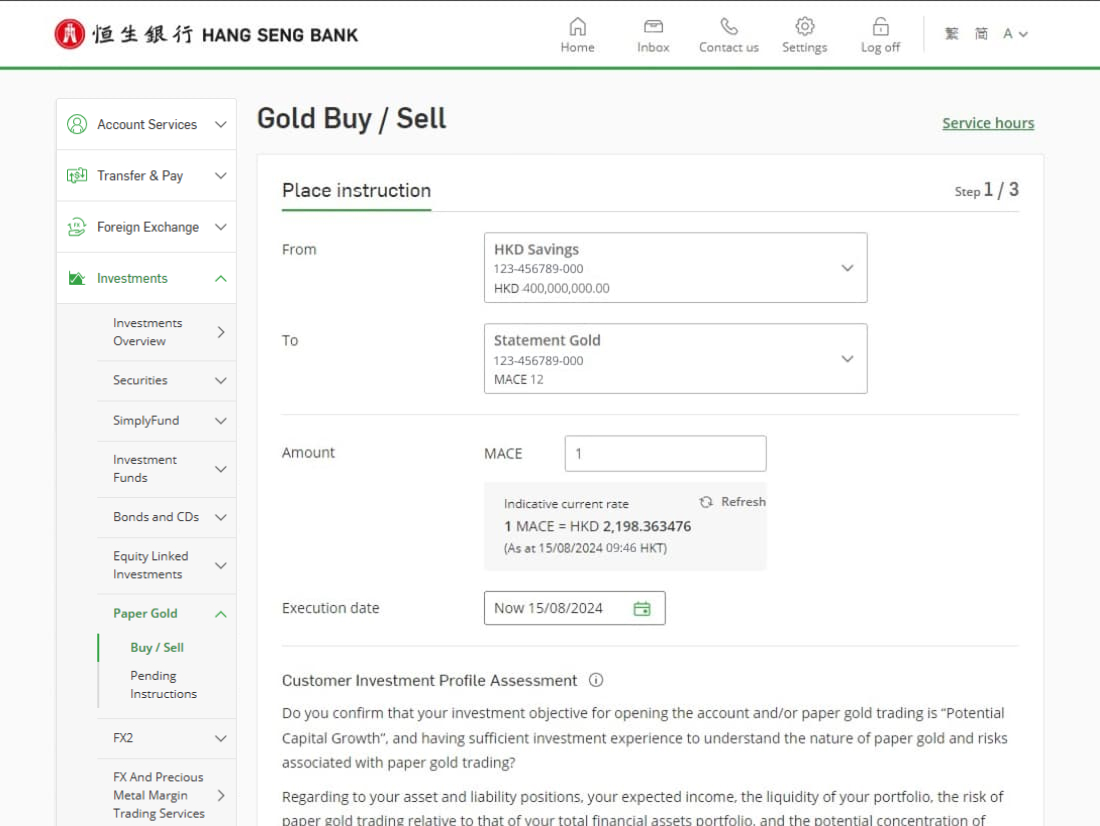

The Scheme is a paper gold scheme and the reference asset of the Scheme is gold bullion of 99% fineness. Investment in the Scheme will be conducted through the Hang Seng Statement Gold Account (which is a non-interest bearing account) and the minimum transaction amount is 1 unit of the Scheme (i.e. 1 MACE, which represents 1 mace troy of the reference asset).

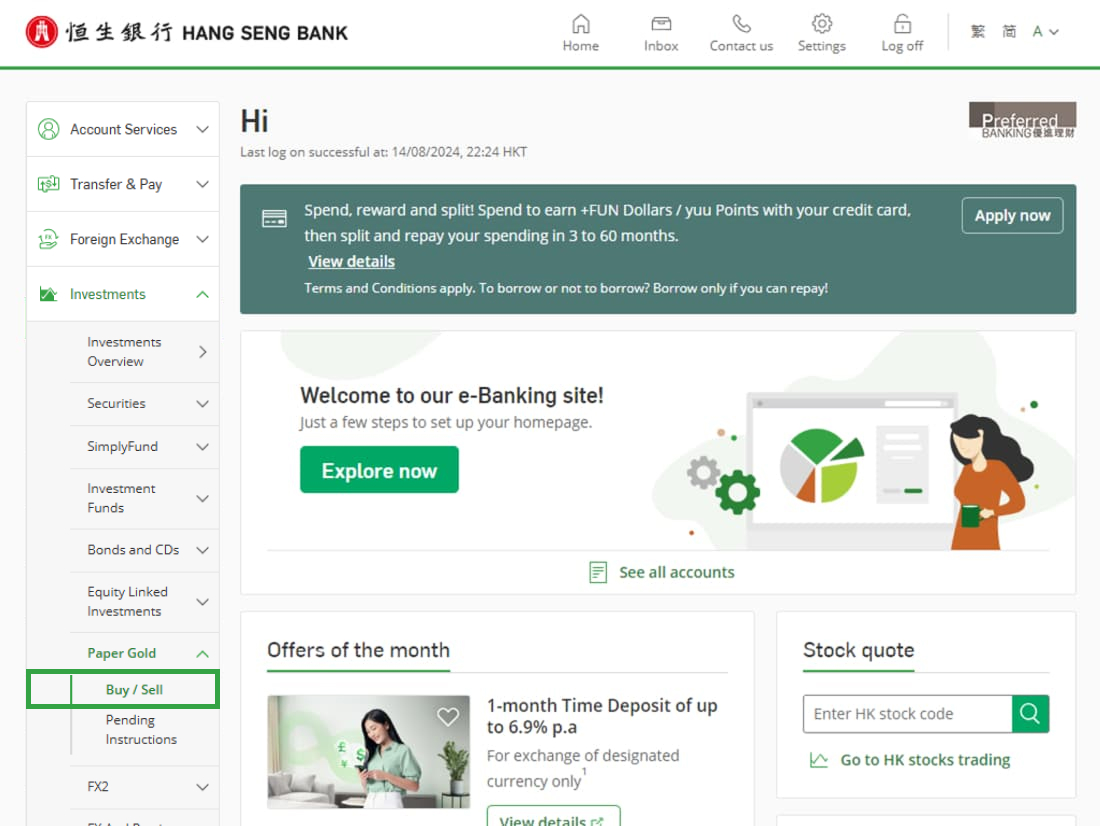

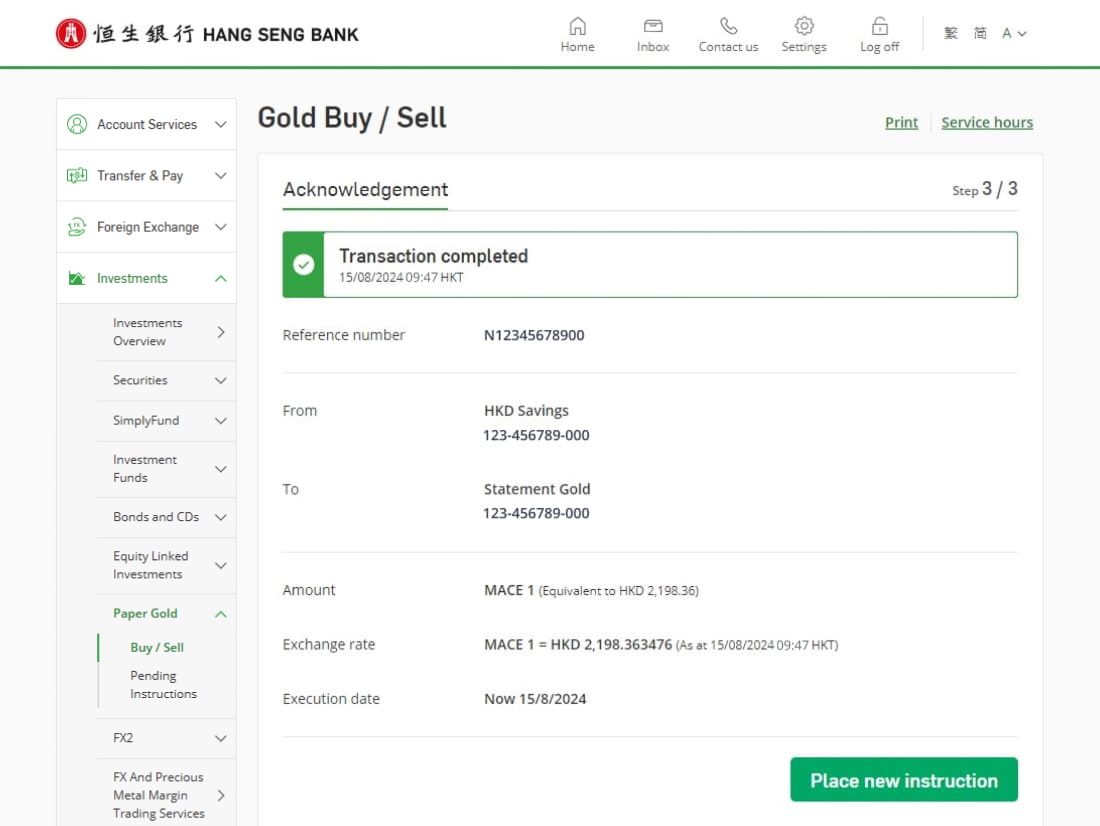

Apart from Phone Banking and our branches, you can also trade Unit of the Scheme via Hang Seng Mobile App and Personal e-Banking.

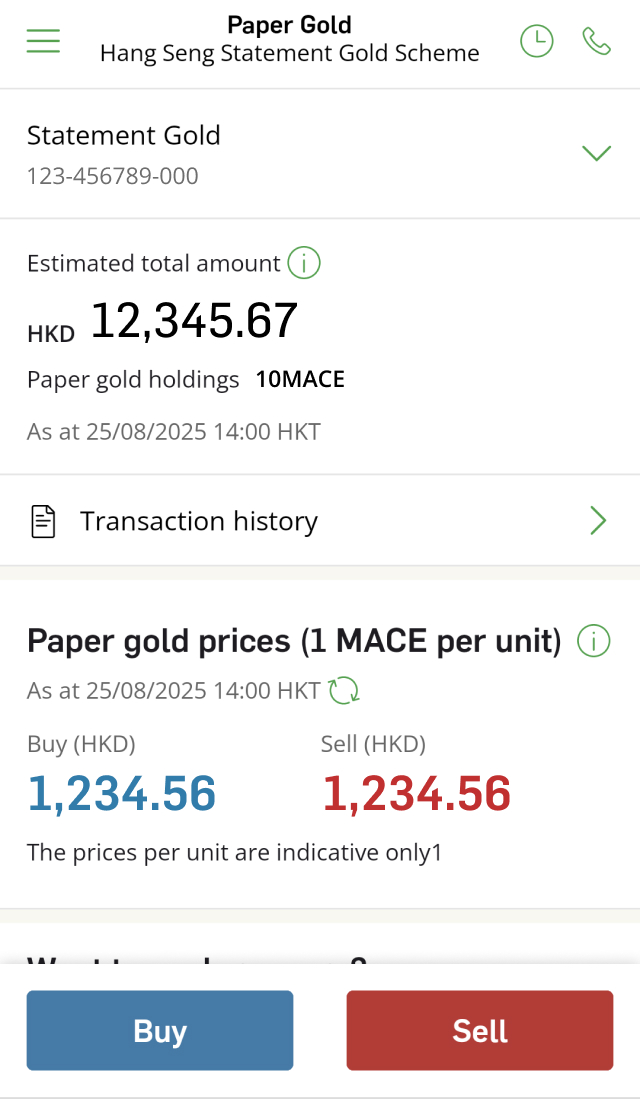

Get the latest real-time gold prices

The quotation unit of the Scheme is “MACE”, and denominated in HKD. 1 unit of the Scheme is reflected as 1 MACE in the Hang Seng Statement Gold Account. The price of 1 MACE quoted in HKD takes into account the price of 1 ounce troy of Loco London Gold in USD.

1 MACE of the Scheme is equal to 1 mace troy of the Reference Asset. 1 mace troy is equivalent to below unit:

| Unit | Conversion |

|---|---|

| Tael Troy | 0.1 |

| Ounce Troy | 0.120337 |

![]()

The trading will be done via the Hang Seng Statement Gold Account, without delivery of physical gold.

![]()

Trade in 1 unit (i.e. 1 MACE) or its multiples, and the price per unit is quoted by us as selling and buying price.

![]()

Trade directly with real-time unit prices without separate handling fees or charge.

![]()

Trading is available via Hang Seng Mobile App, Personal e-Banking, Phone Banking and at our branches in Hong Kong.

You can buy / sell paper gold during the below service hours:

| Trading Hour | No service in the following time slots | |

|---|---|---|

| Branch | Mon - Fri: 9:00 a.m. to 5:00 p.m. Sat: 9:00 a.m. to 1:00 p.m. |

|

| Phone Banking | Mon – Fri: 8:00 a.m. to 7:00 p.m. Sat: 8:00 a.m. to 1:00 p.m. |

|

| Hang Seng Mobile App, Personal e-Banking, and Business e-Banking | Mon 6:00 a.m. to Sat 3:29 a.m. Sat: 8:00 a.m. to 12:54 p.m. |

|

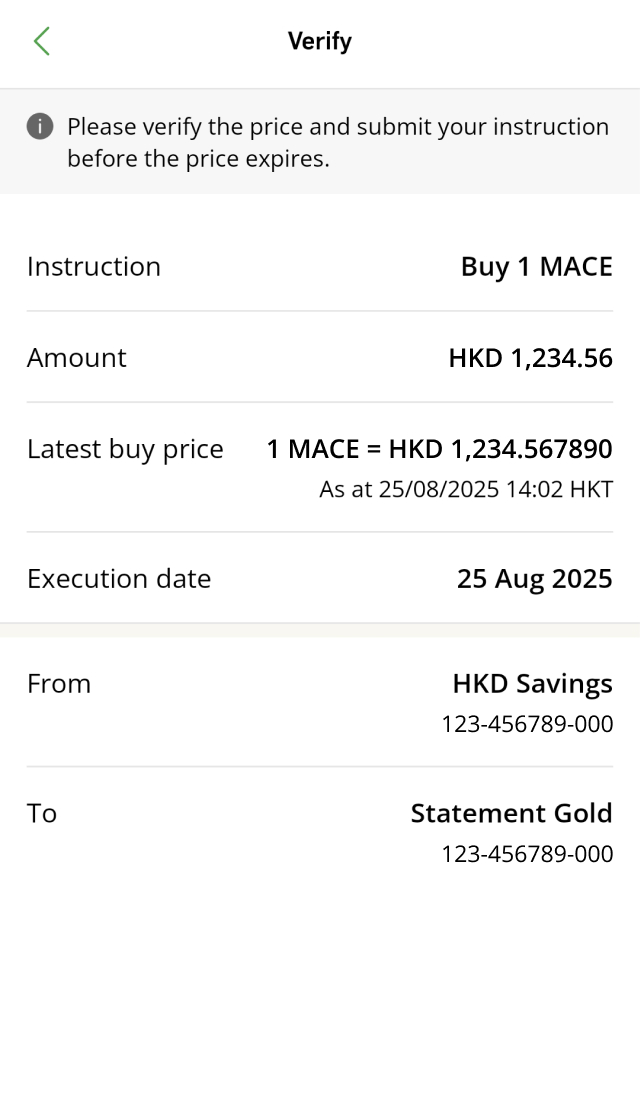

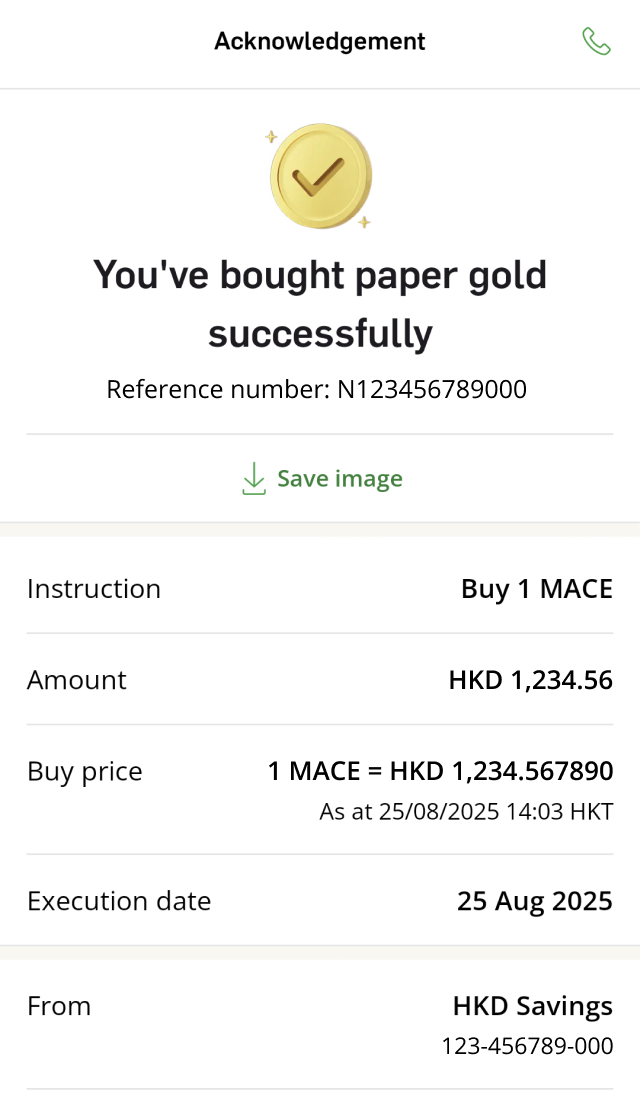

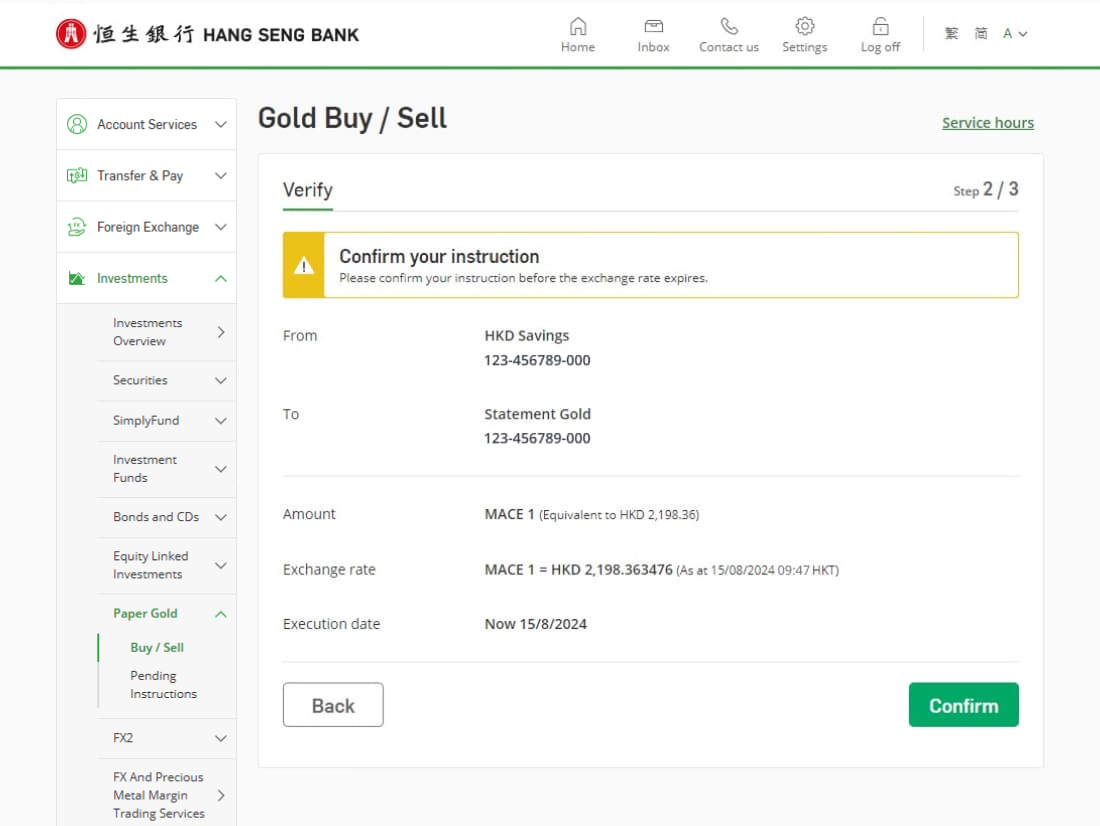

The buy / sell prices per unit displayed on this page are for reference only. If you're trading via Hang Seng Mobile App or Personal e-Banking, you can check the latest prices on the verify page before confirming the transaction. If you're trading via Phone Banking or branches, please contact our staff for the latest prices. Please note that the prices for trades conducted via digital channels may be higher or lower (depending on various factors including market conditions at the relevant time) than those conducted via non-digital channels.

The maximum transaction amount for the Scheme is HKD10,000,000 (or such amount as may be reasonably prescribed by us from time to time), calculated based on unit mid-price which we determine by taking the average of the Buying and Selling Prices per unit of the Scheme at the relevant time.

The minimum transaction amount is 1 unit of the Scheme (i.e. 1 MACE).

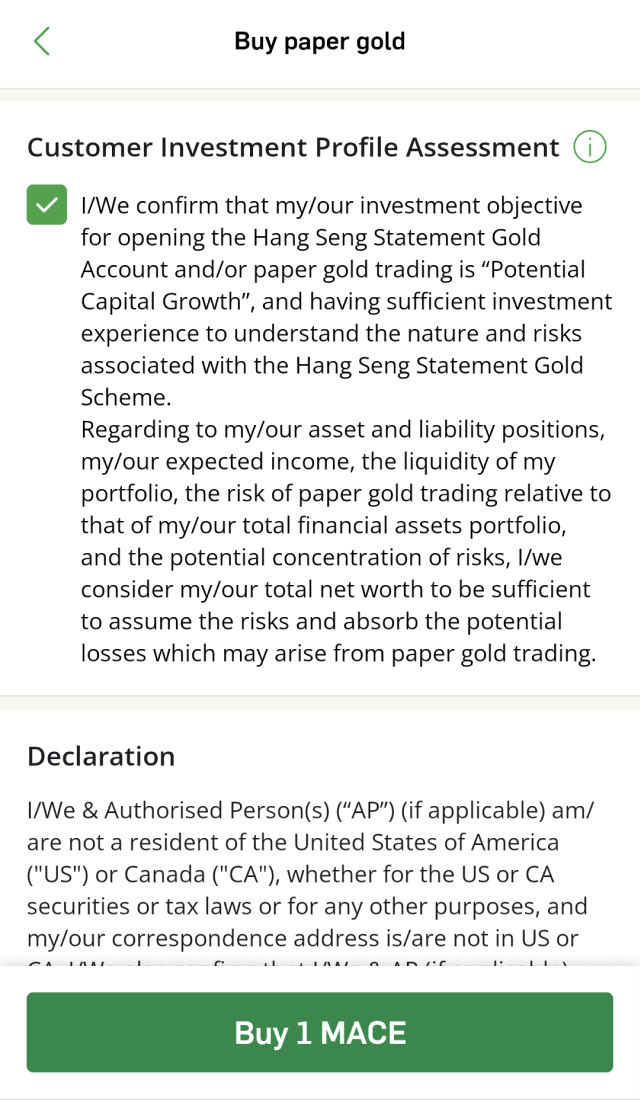

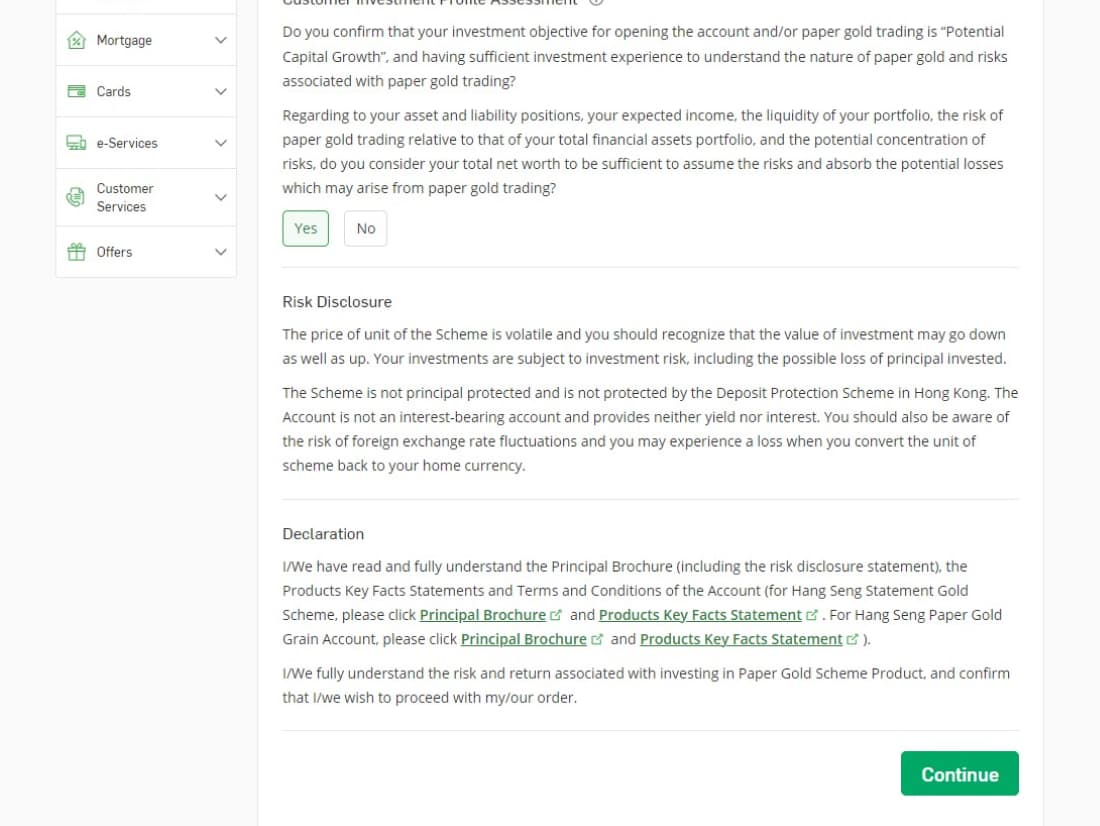

Investment involves risks. You should recognize that the unit prices of the Scheme are volatile and may go up and down, past performance information presented is not indicative of future performance. You will bear the potential losses due to the price fluctuation.

Your investments in the Scheme are not principal protected and are not protected by the Deposit Protection Scheme in Hong Kong. In the worst case scenario, you may lose your entire investment amount. The account through which you can buy or sell units of the Scheme is not an interest-bearing account and provides neither yield nor interest.

The reference asset of the Scheme is gold bullion of 99% fineness (“Gold”). The Scheme does not involve physical delivery of Gold and investment in the Scheme is not the same as investing in Gold. Price changes in Gold might not reflect in price changes of the Scheme.

You should also be aware of the risk of foreign exchange rate fluctuations and you may experience a loss when you convert the unit of the Scheme back to your home currency.

You should read carefully and understand the offering documents of the Scheme (including the Scheme details and the full text of the risk factors stated therein) before making any investment decision.

No. Investors in the Scheme won't have any rights, ownership or possession of any physical gold.

Get 24/7 support from our Virtual Assistant.

The information provided on this page is not, and should not be regarded as investment advice, an offer, a solicitation or recommendation to enter into any transactions in the Scheme or otherwise as any assurance of returns on the Scheme. Investors should read carefully and understand the offering documents of the Scheme (including the Scheme details and the full text of the risk factors stated therein) before making any investment decision.

This page is not intended to provide or be regarded as legal or taxation advice. Investors should obtain independent professional advice if investors have concerns about their investment. Investors should consult their own tax advisers on relevant tax arrangements.

The Hang Seng Statement Gold Scheme (the “Scheme”) is a paper gold scheme issued by Hang Seng Bank Limited. The Scheme and its offering documents have been authorized by the Securities and Futures Commission in Hong Kong (“SFC”). The SFC’s authorization is not an endorsement or recommendation of the Scheme nor does it guarantee the commercial merits of the Scheme or its performance. It does not mean the Scheme is suitable for all investors nor it is an endorsement of its suitability for any particular investor or class of investors.

Want to know more about Paper Gold?

Want to know more about Paper Gold?

Chat with H A R O now

Investment involves risks. The below risk disclosure provides the key risks, but cannot disclose all the risks involved or all product information. Before making any investment decision, please read in detail and understand the Principal Brochure and Product Key Facts Statement of the Hang Seng Statement Gold Scheme (the “Scheme”).

Investment involves risks. The below risk disclosure provides the key risks, but cannot disclose all the risks involved or all product information. Before making any investment decision, please read in detail and understand the Principal Brochure and Product Key Facts Statement of the Hang Seng Statement Gold Scheme (the “Scheme”).