We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Please read the important risk warnings for securities investment before making investment decisions.

Supplemental Personal Information Collection (Local Securities) (For Individual)

The Securities and Futures Commission (SFC) has introduced an investor identification regime (HKIDR) at trading level for the securities market in Hong Kong and an over-the-counter securities transaction reporting regime (OTCR) for shares listed on The Stock Exchange of Hong Kong (SEHK). HKIDR has been launched on 20 March 2023, and OTCR will be launched on 25 September 2023.

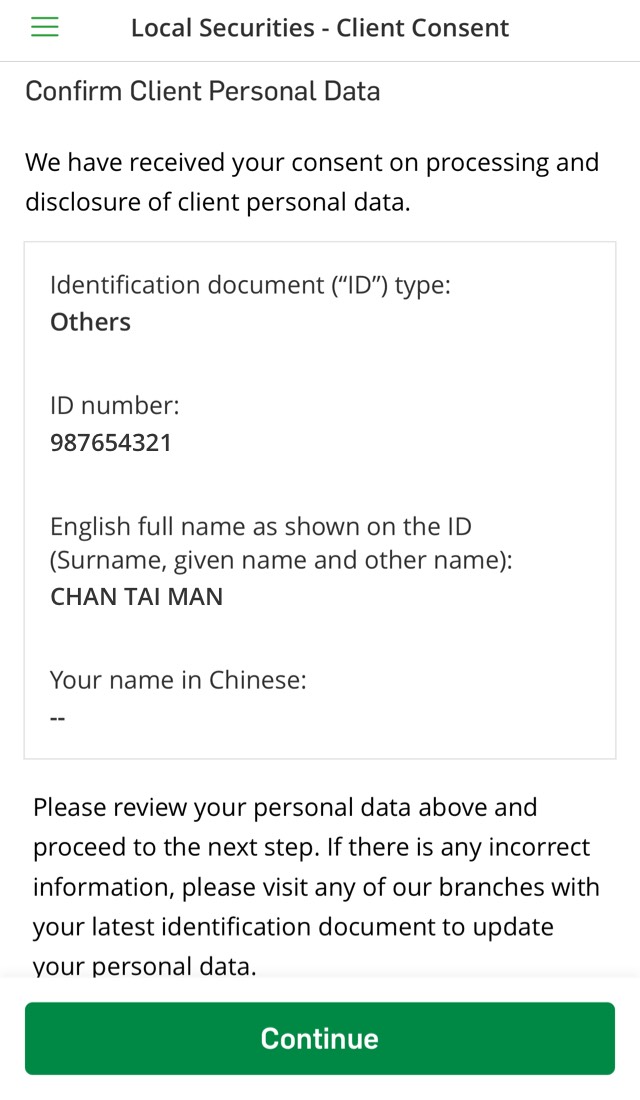

Under HKIDR, we will have to assign a Broker-Client Assigned Number (BCAN) to each of our securities customer/ joint account (as the case may be) and tag the BCAN to our clients’ securities orders. We will also have to submit to SEHK’s data repository the client identification data (CID) (i.e., names and identity document information) of clients placing securities orders on SEHK or who conduct off-exchange trades reportable to SEHK. This will allow relevant regulators to quickly obtain information about investors who place orders and enhance relevant regulators’ market surveillance function.

Separately, information about OTC securities transactions in ordinary shares and real estate investment trusts listed on SEHK as well as deposits and withdrawals of physical share certificates will be reported to SFC under OTCR.

For more details, please click “Learn more”.

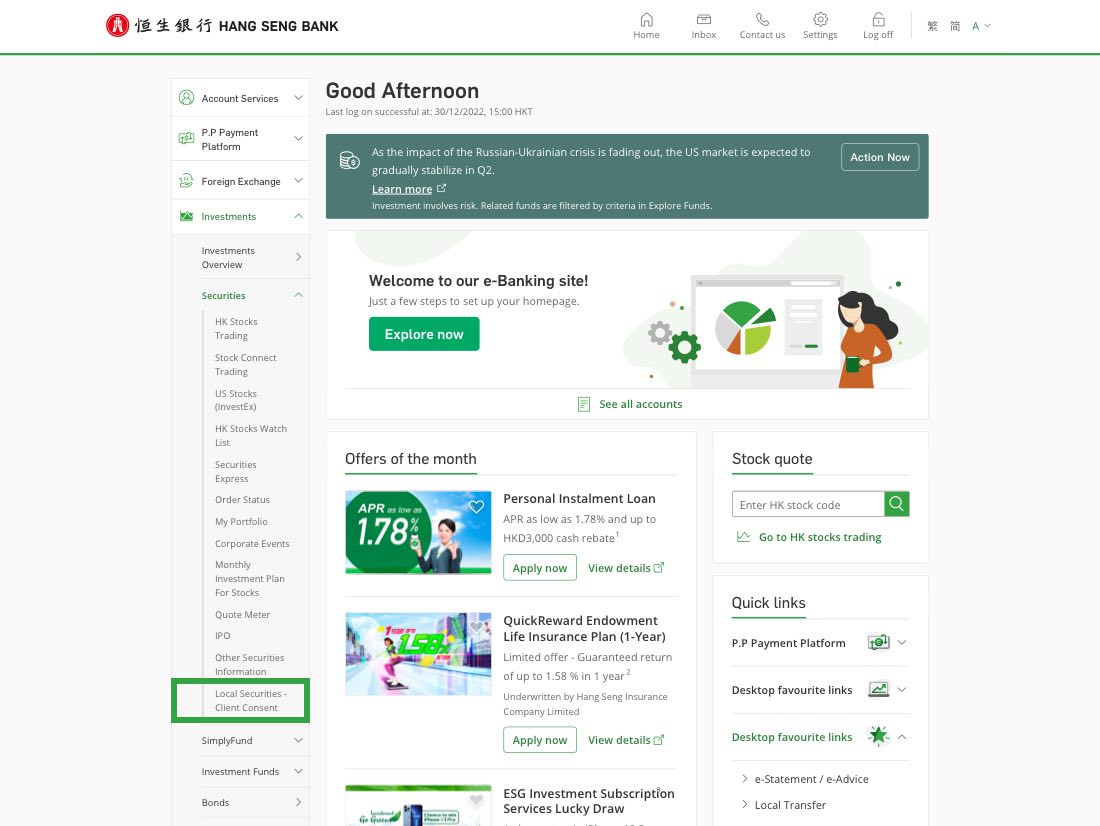

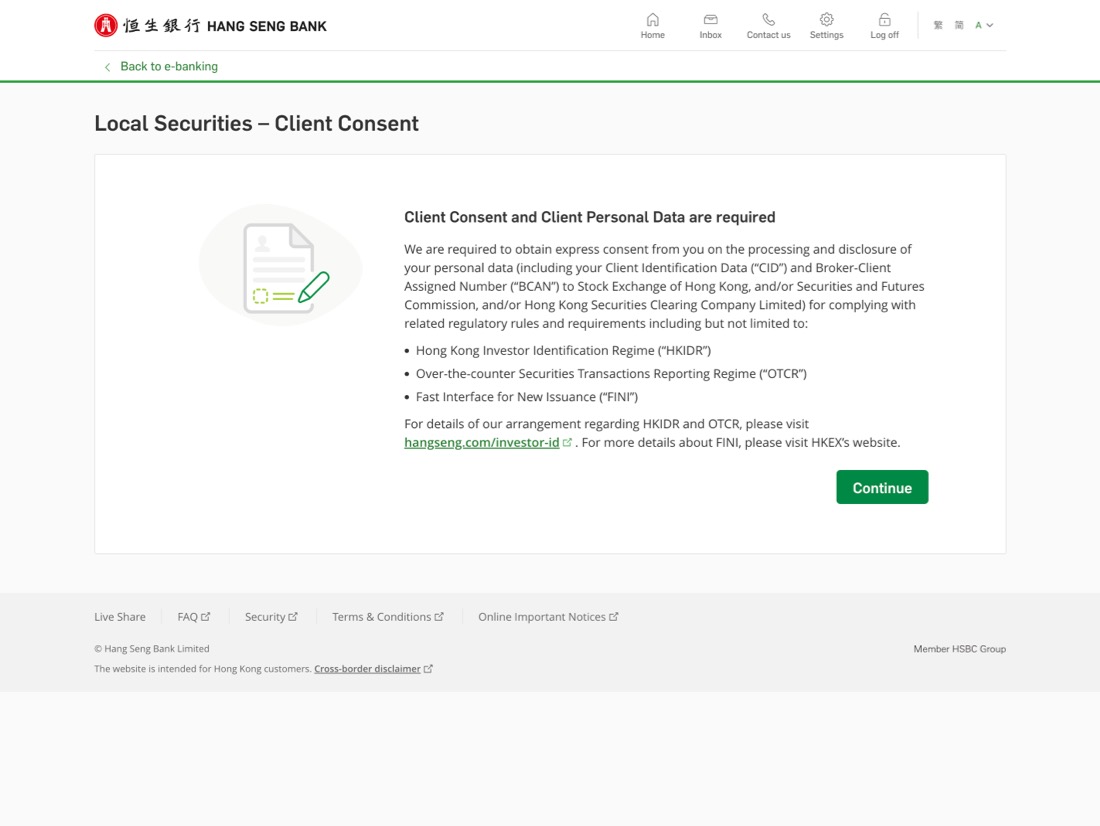

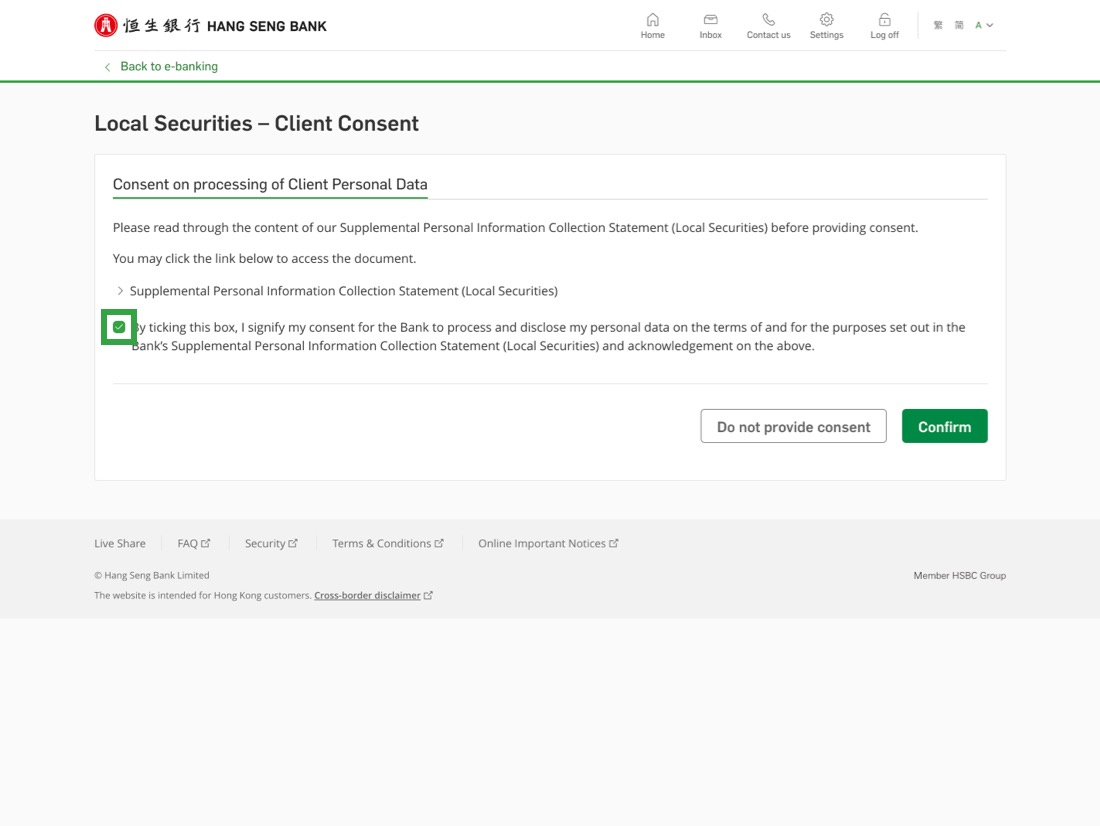

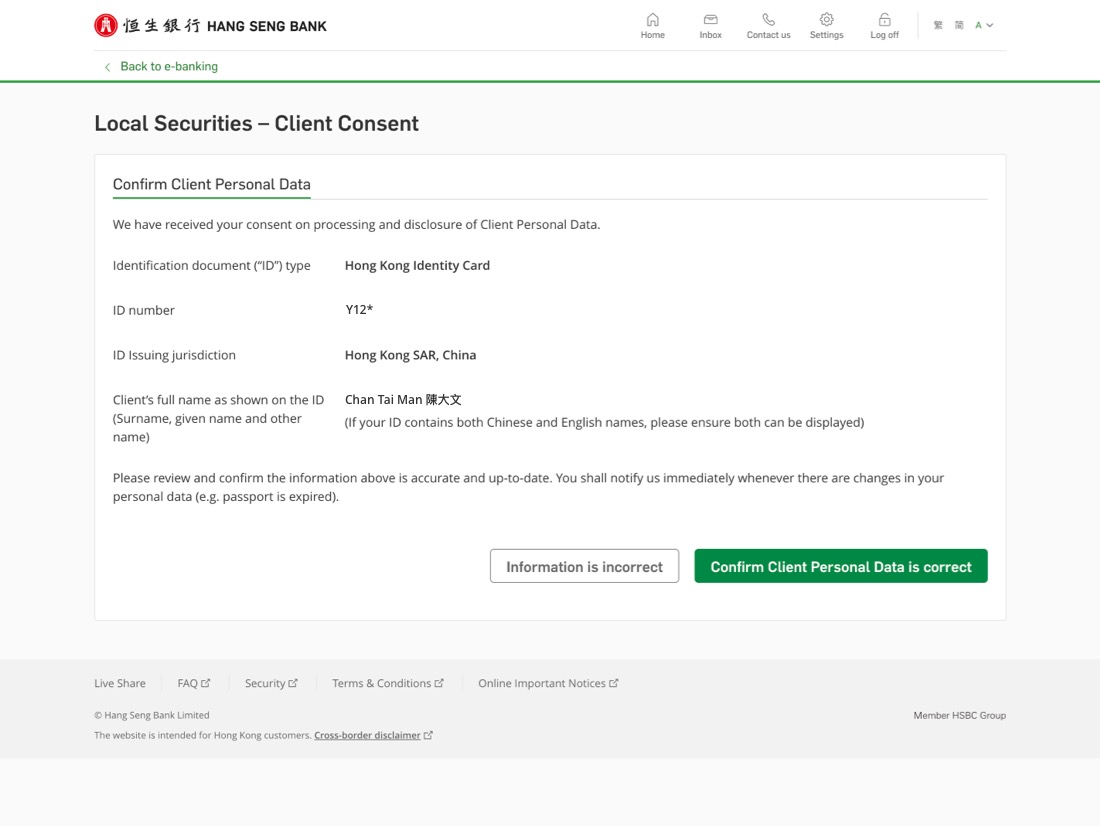

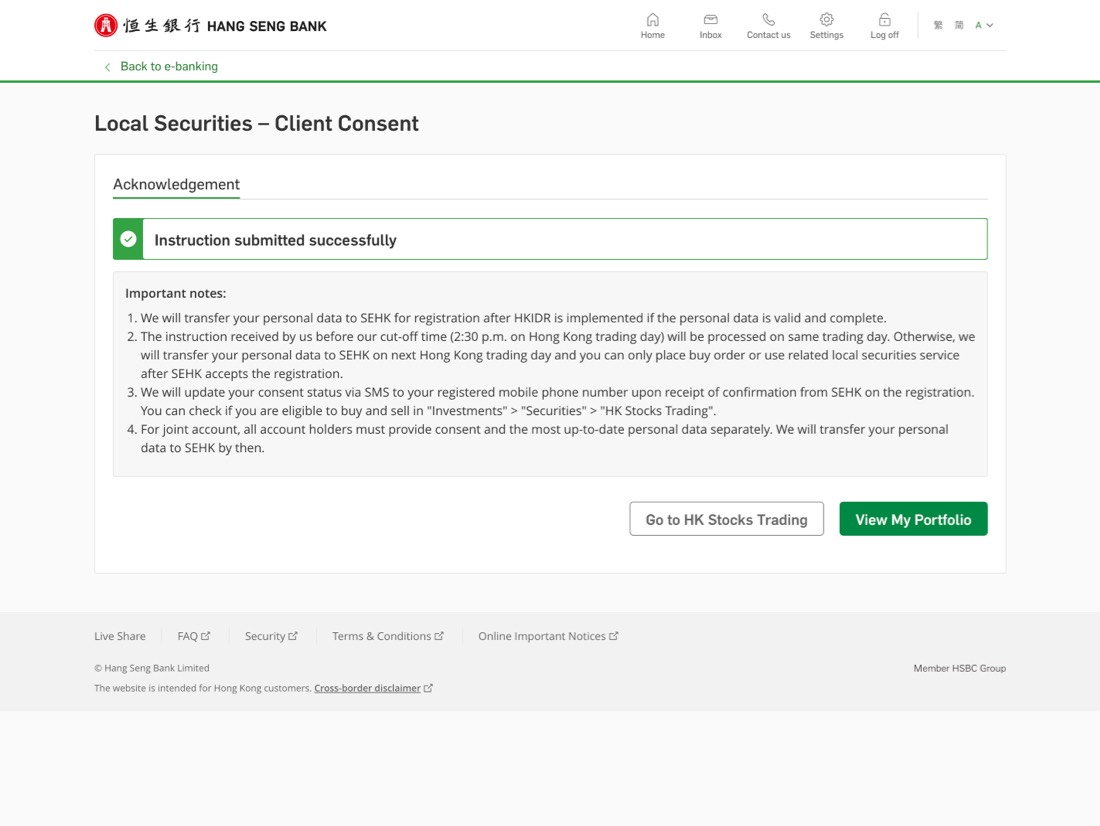

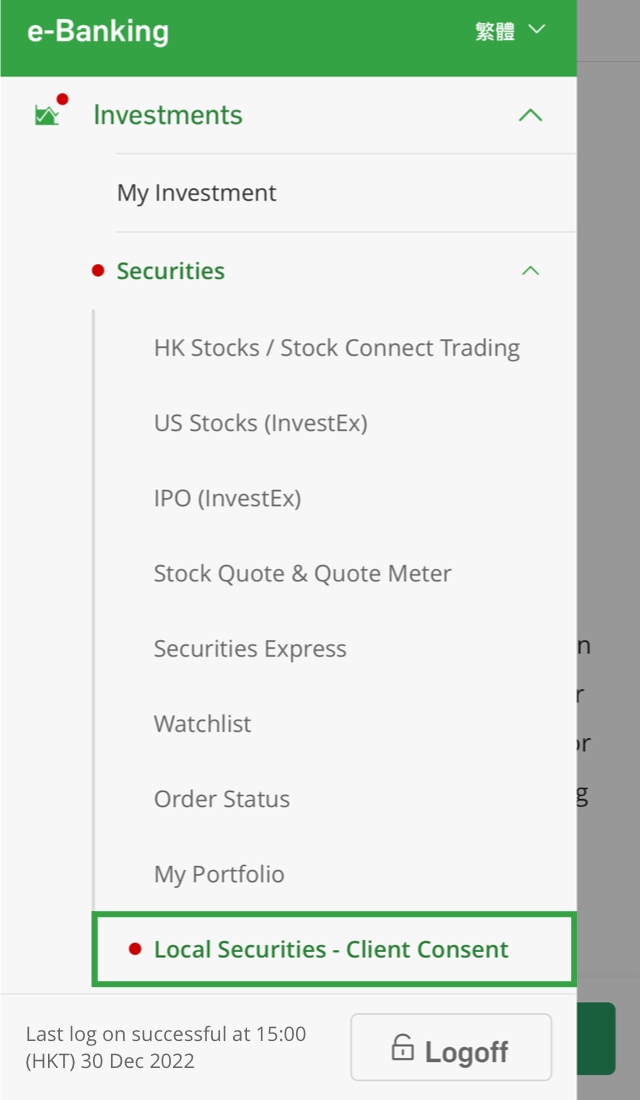

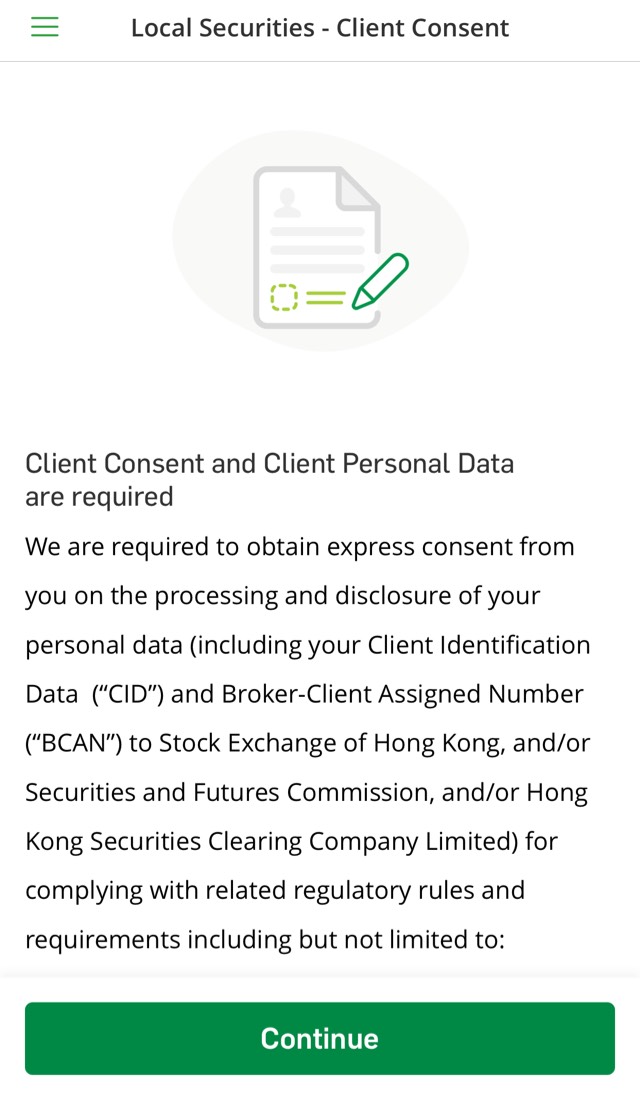

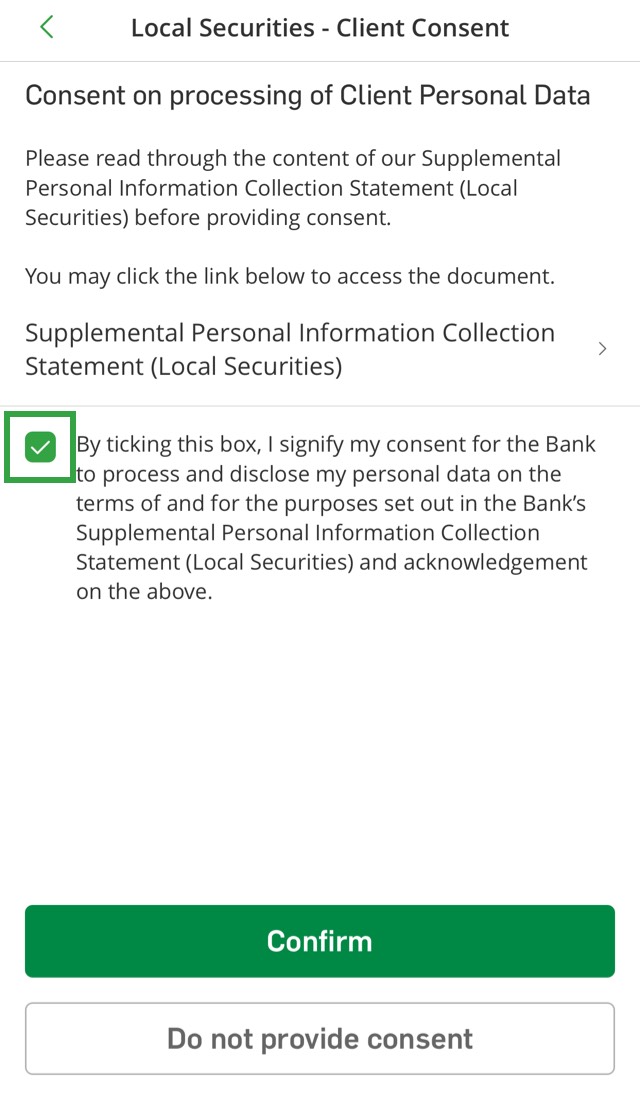

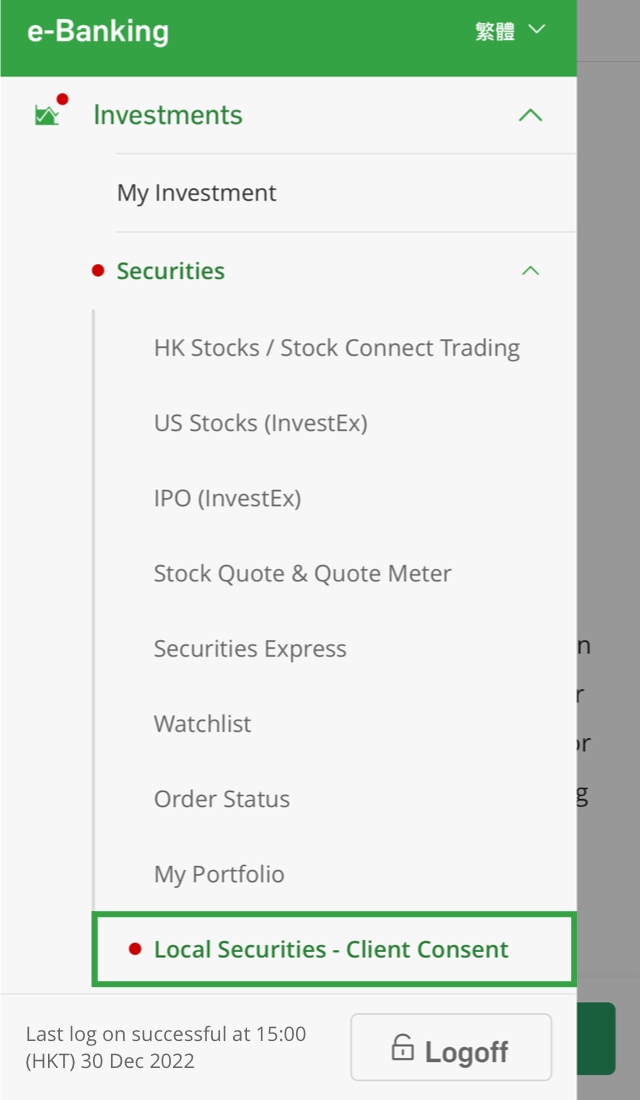

Provide consent in 5 simple steps

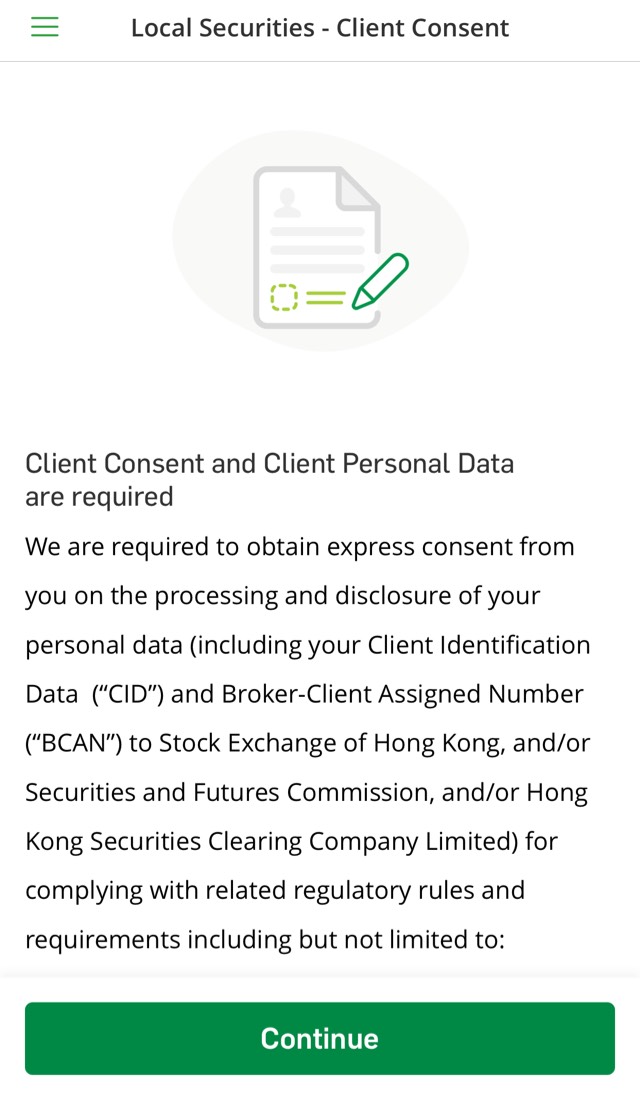

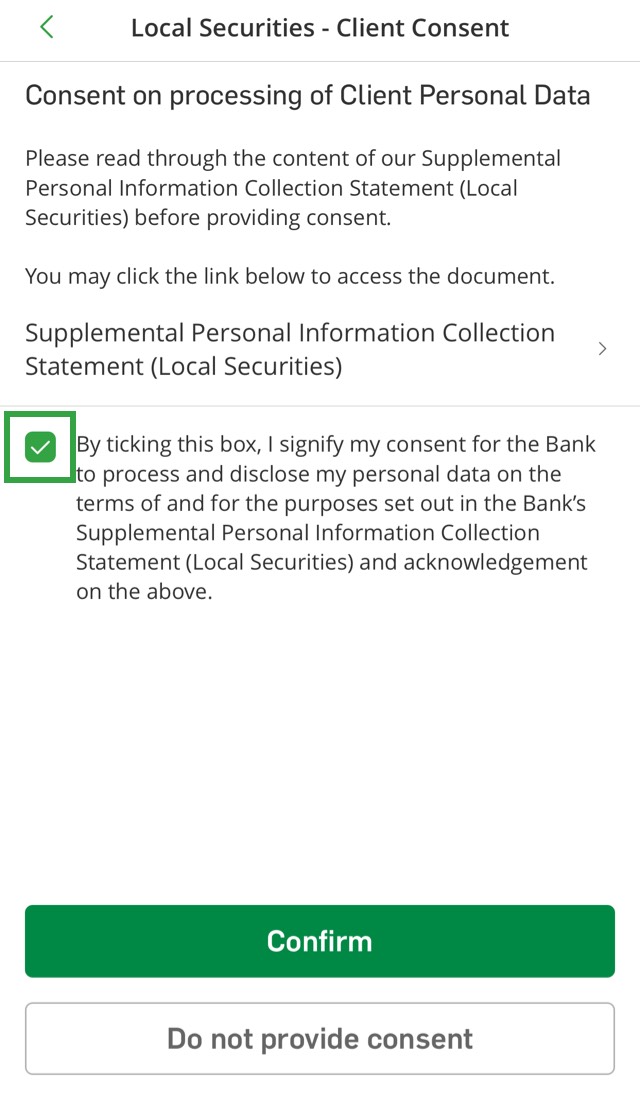

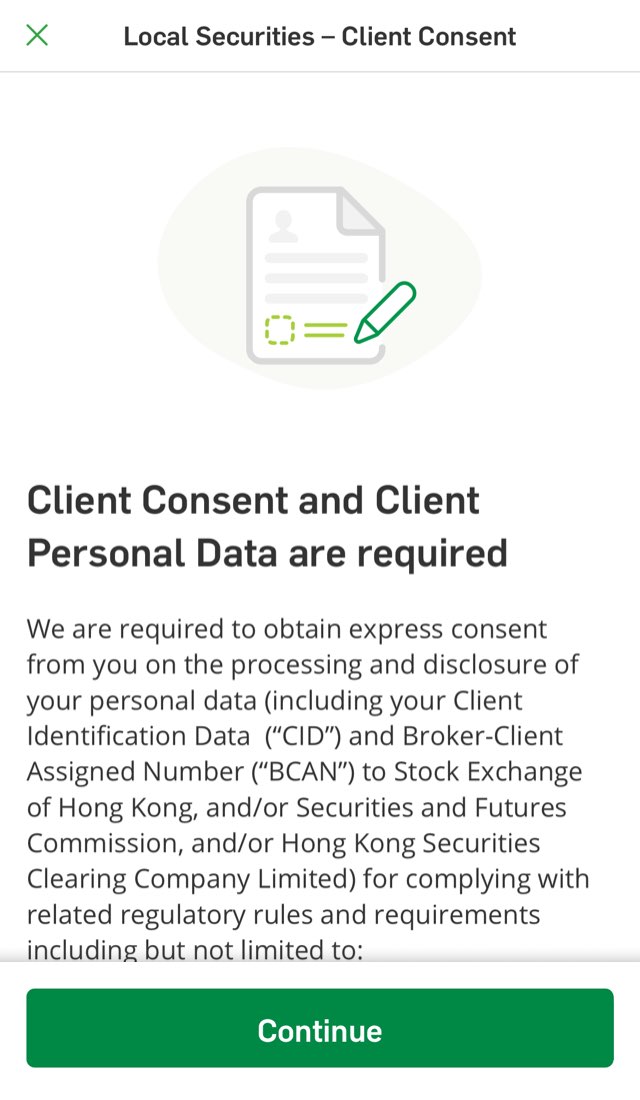

For complying with the rules and requirements of SEHK and SFC and Personal Data (Privacy) Ordinance in effect from time to time, we are required to obtain express consent from you on the collection, storage, processing, use, disclosure and transfer of your personal data (including disclosing and transferring your CID and BCAN, which are identifiers under respective regimes, namely HKIDR and OTCR, to SEHK and/or SFC). Otherwise, we will not be able to carry out your trading instructions or provide services to you in relation to securities listed or traded on SEHK (e.g. If the client consent cannot be obtained from you, under HKIDR, we should not submit any buy orders or trades to SEHK for you. Similarly, under OTCR, if the client consent cannot be obtained from you, we should not effect transfers of shares or deposits of physical share certificates into your account).

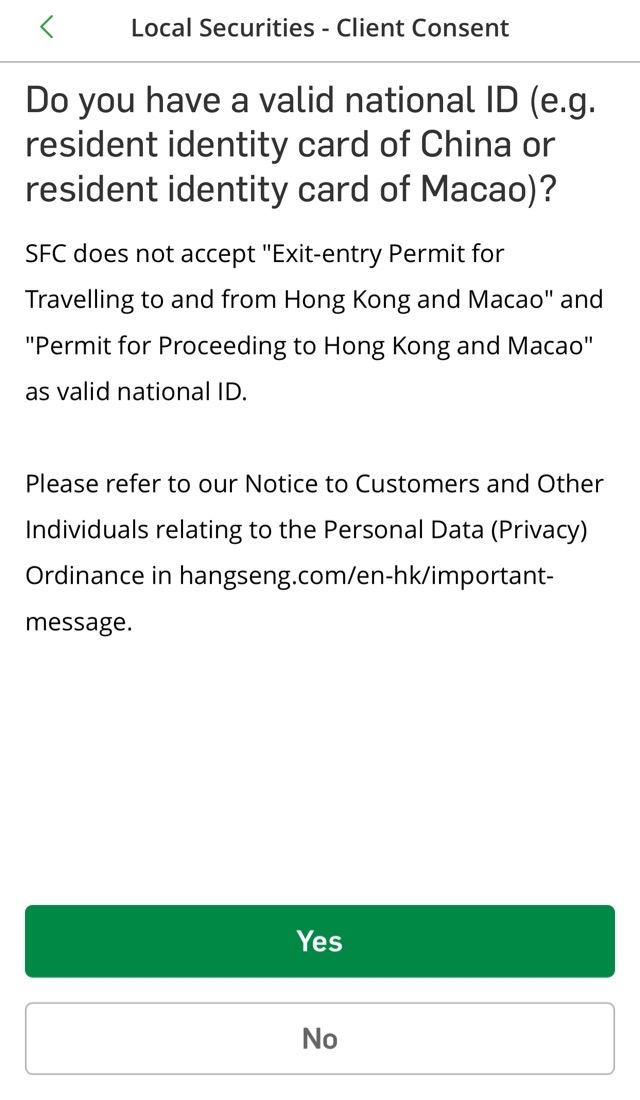

To fulfill SFC’s requirement, you need to:

1. Hong Kong Identity Card

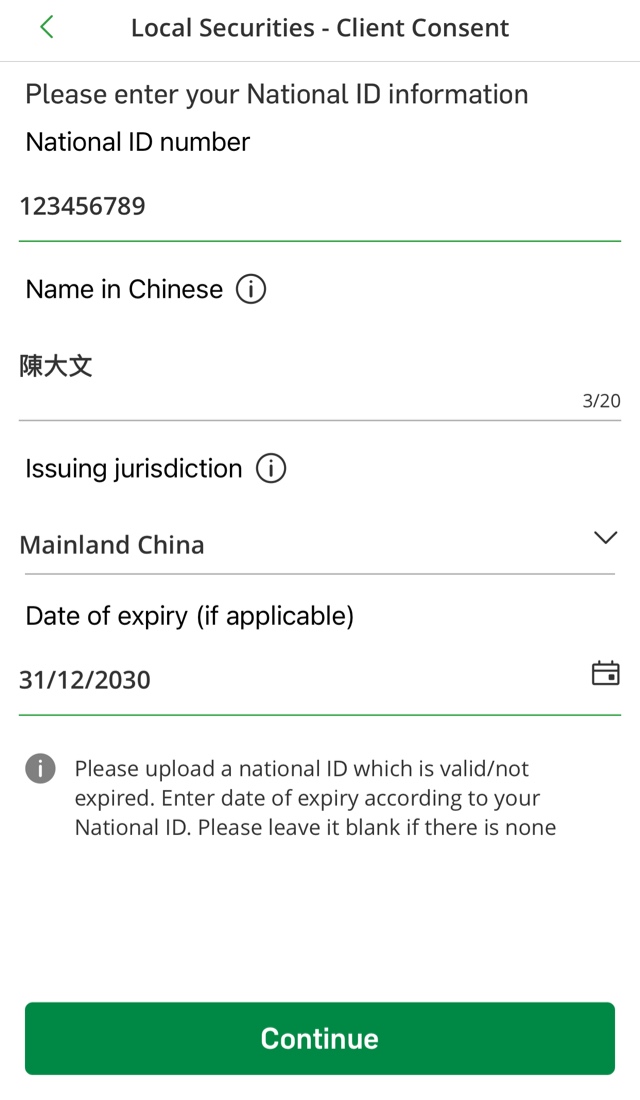

2. National identification document

3. Passport

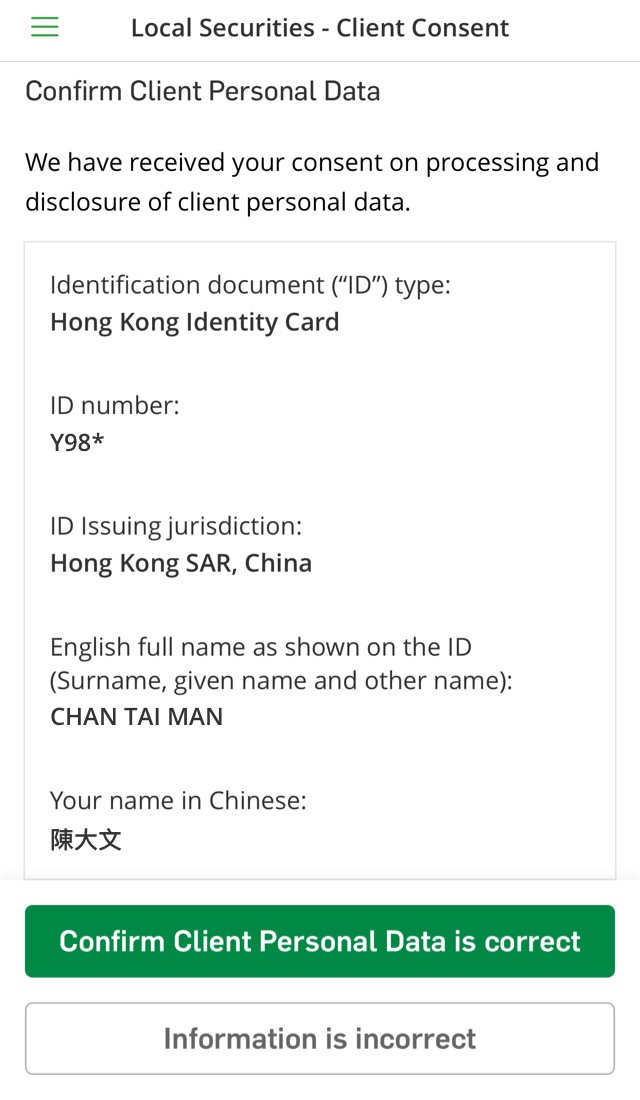

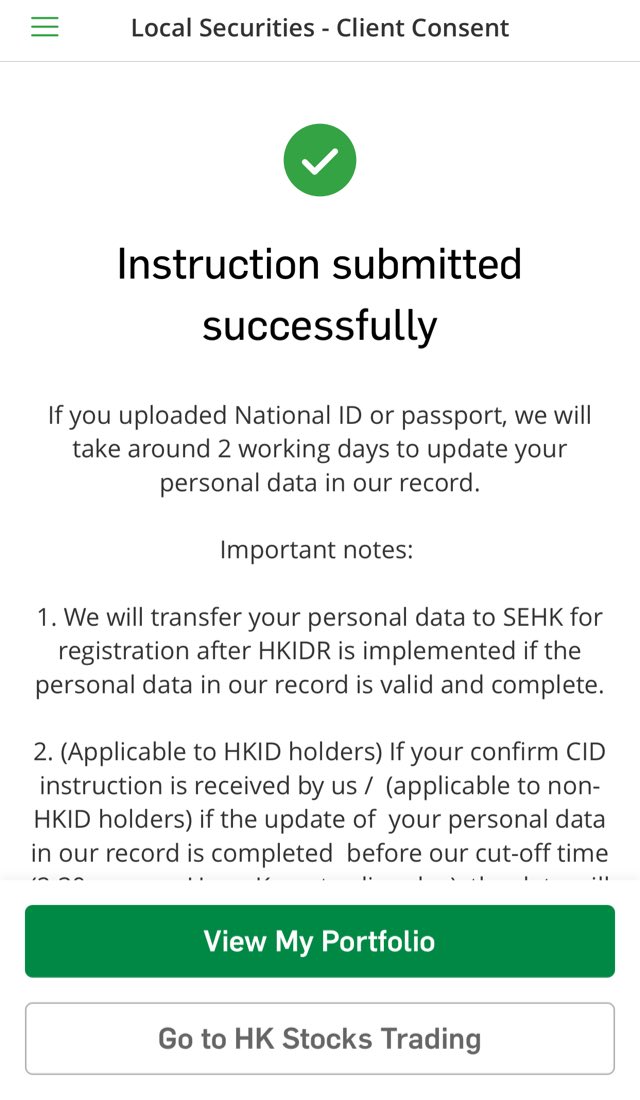

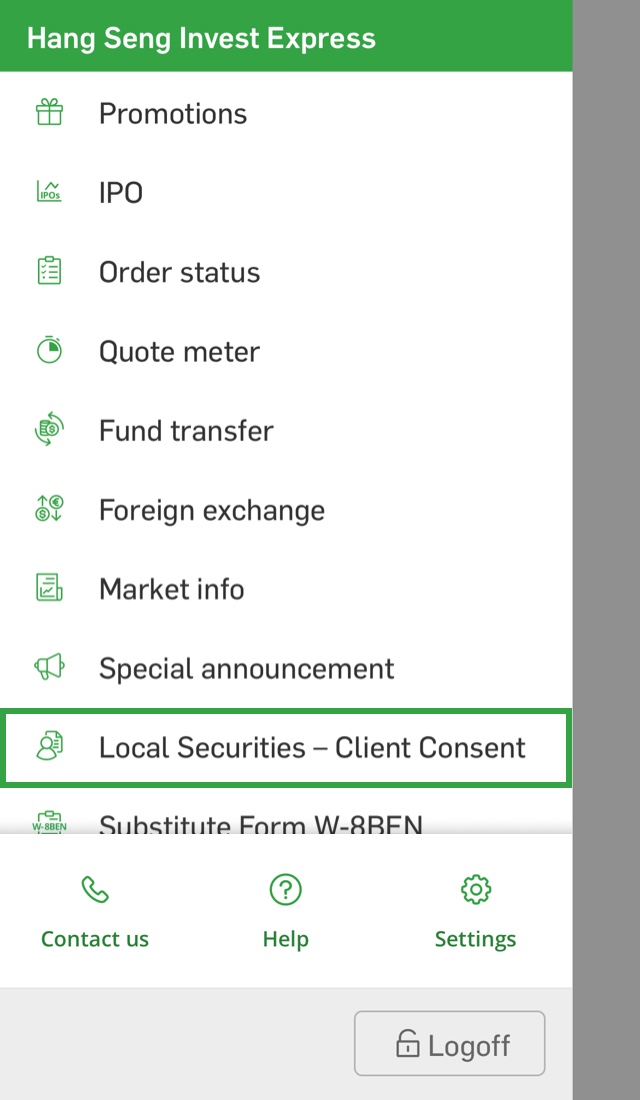

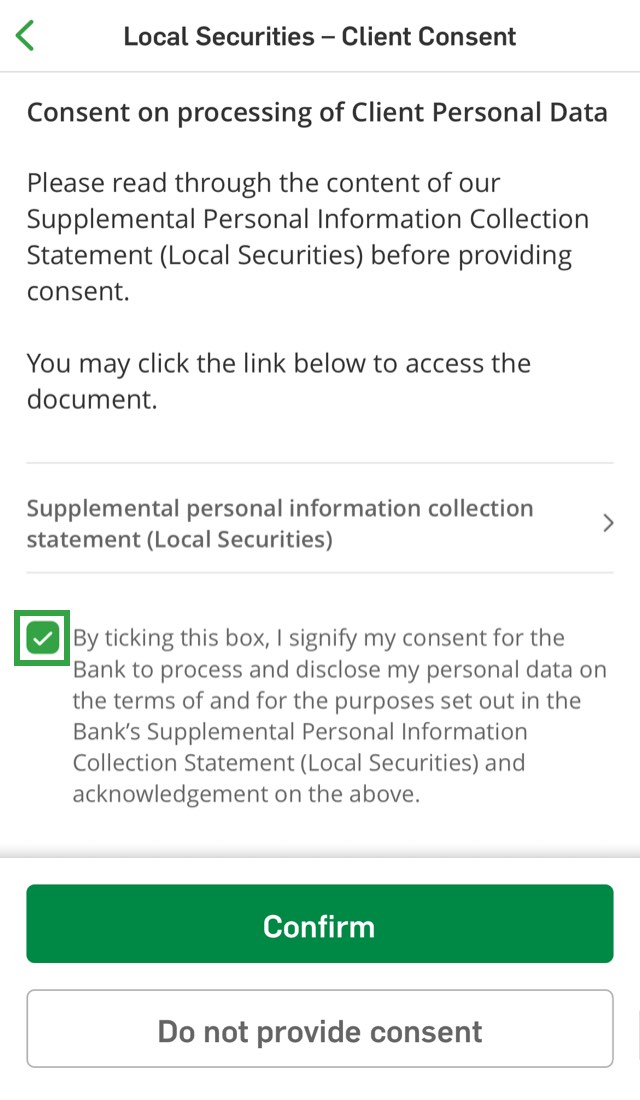

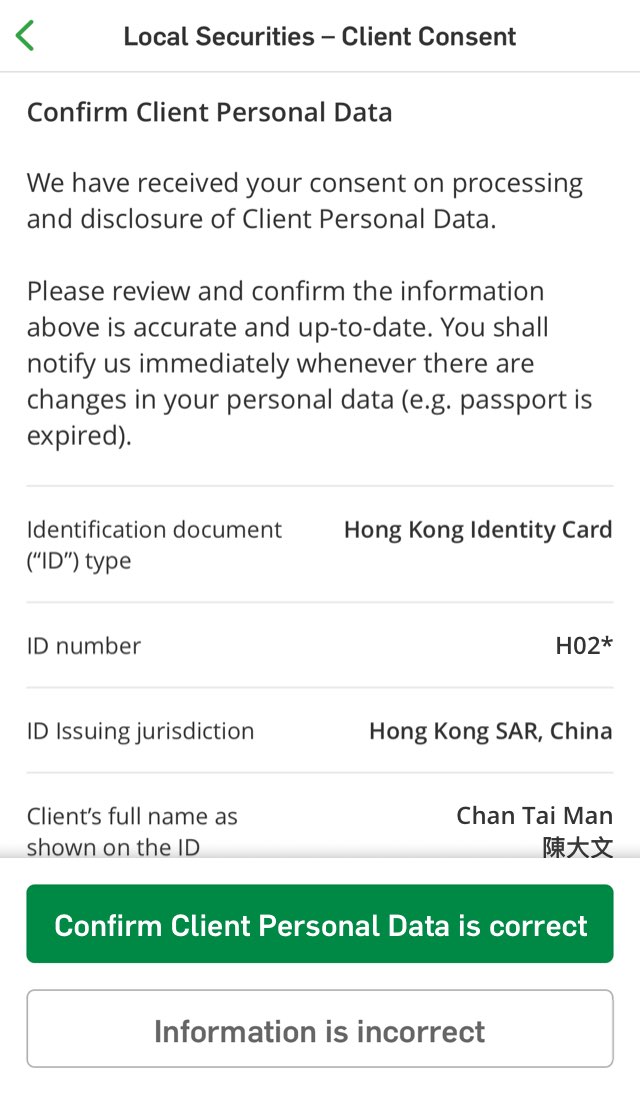

If you are holding a HKID Card, you can provide consent via Hang Seng Personal e-Banking, Hang Seng Mobile App, Hang Seng Invest Express mobile app following these steps or by going to our branches.

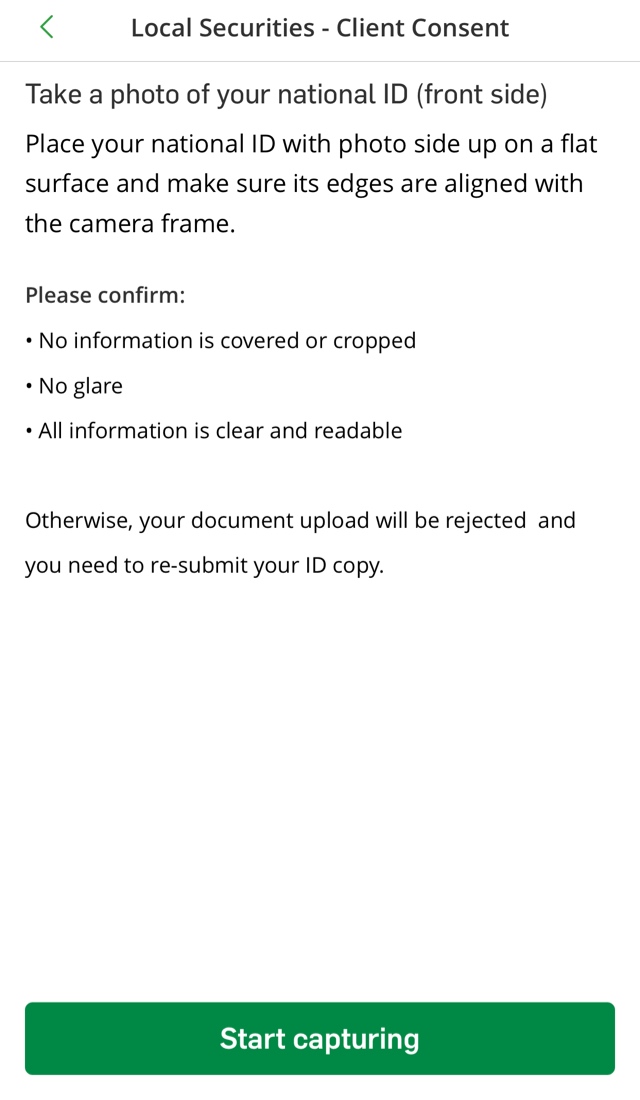

If you do not hold a HKID Card, you need to provide your consent and other identification documents to us according to SFC's requirement. Please do so via Hang Seng Mobile App following these steps or by visiting our branches.

To find out more details about HKIDR and OTCR, please visit the SFC or HKEX websites.

If we do not receive consents from all account holders of the same account and the most up-to-date personal data in the priority for CID specified by SFC, we will not be able to carry out your trading instructions or provide services to you in relation to securities listed or traded on SEHK (e.g. If the client consent cannot be obtained from you, under the HKIDR, we should not submit any buy orders or trades to SEHK for you. Similarly, under OTCR, if the client consent cannot be obtained from you, we should not effect transfers of shares or deposits of physical share certificates into your account)

If you hold a HKID Card, you can provide consent via any of the below channels.

If you do not hold a HKID Card, among the channels listed here, you can only provide consent and upload your identification document via Hang Seng Mobile App.

Yes, all account holders need to provide consent and the most up-to-date personal data following the order of priority for identity document type as specified by the SFC respectively. Otherwise, we will not be able to carry out your trading instructions or provide services to you in relation to securities listed or traded on SEHK (e.g. If the client consent cannot be obtained from you, under the HKIDR, we should not submit any buy orders or trades to SEHK for you. Similarly, under OTCR, if the client consent cannot be obtained from you, we should not effect transfers of shares or deposits of physical share certificates into your account).

No, each customer needs to provide consent to us once only.

Yes, you need to provide consent to Hang Seng.

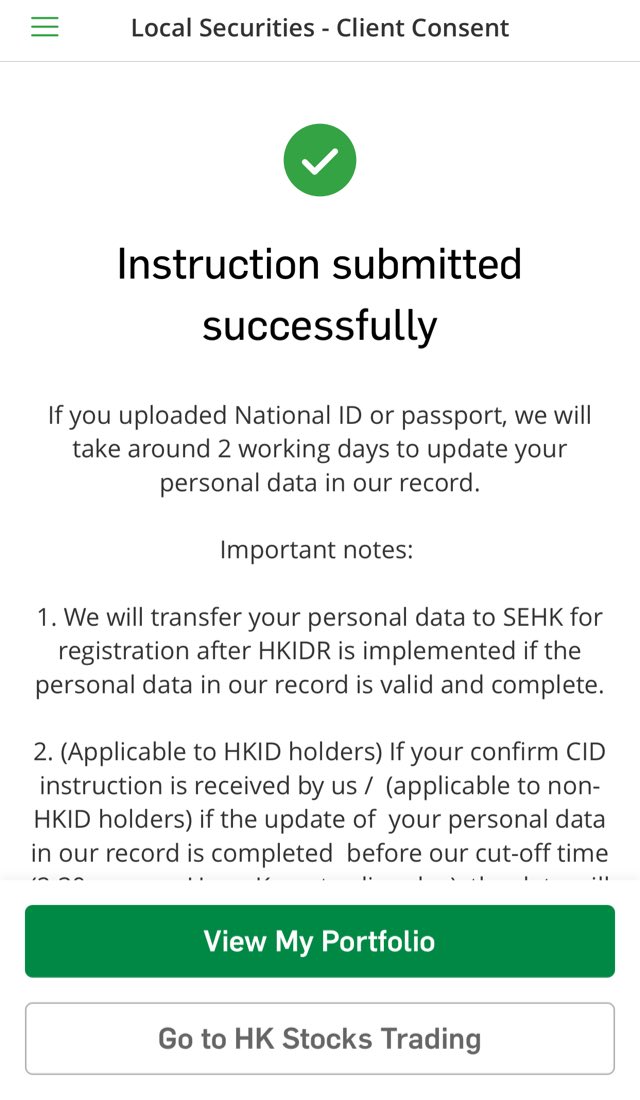

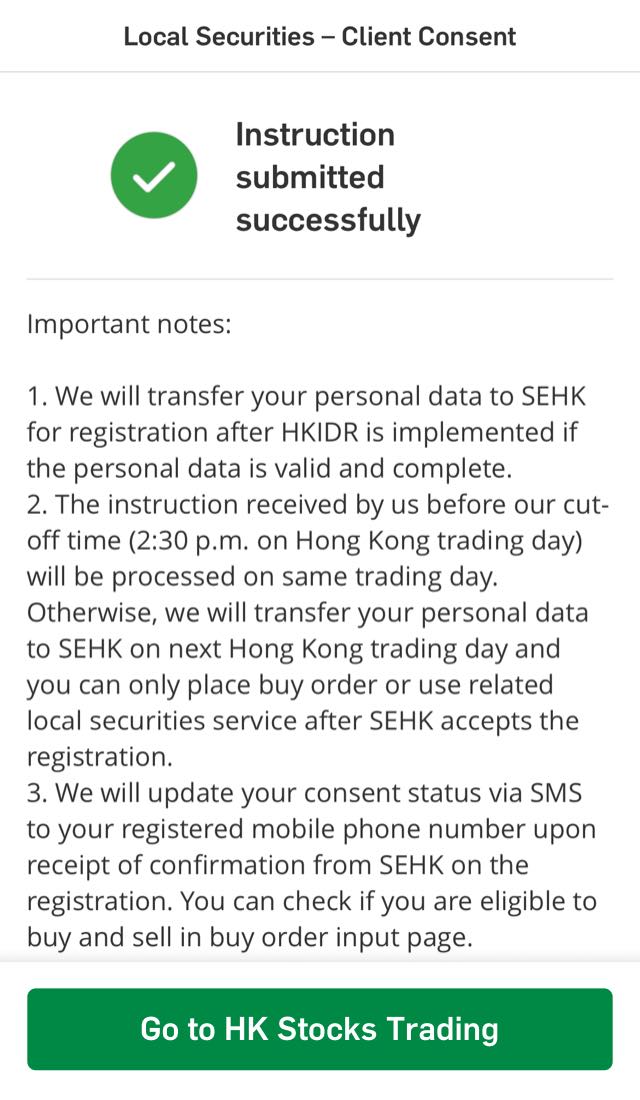

After HKIDR is implemented, we will assign Broker-Client Assigned Number and submit to SEHK’s data repository the client identification data (CID) (i.e. names and identity document information) when all account holders have provided consent and the most up-to-date personal data following the order of priority for identity document type as specified by the SFC. Upon receipt of confirmation from SEHK on your CID registration, the Bank will notify you the status via SMS (only for personal account customers).

Yes, you can withdraw your consent after it is provided. You can also provide your consent again after it is withdrawn, but you will have to provide the most up-to-date personal data following the order of priority for identity document type as specified by the SFC again.