We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

If you're a non-US individual, to proceed for the purchase of US credit, please complete and sign a Form W-8BEN issued by the US IRS and return it to any of our branches, or you can submit Substitute Form W-8BEN via "Hang Seng Invest Express" mobile app.

Please read relevant important risk warnings.

Earn potential interest with idle funds? Invest bond and CD with HKD10,000 up! Subscribe online for extra 2%p.a. interest and automatically participate a Lucky Draw. View offers

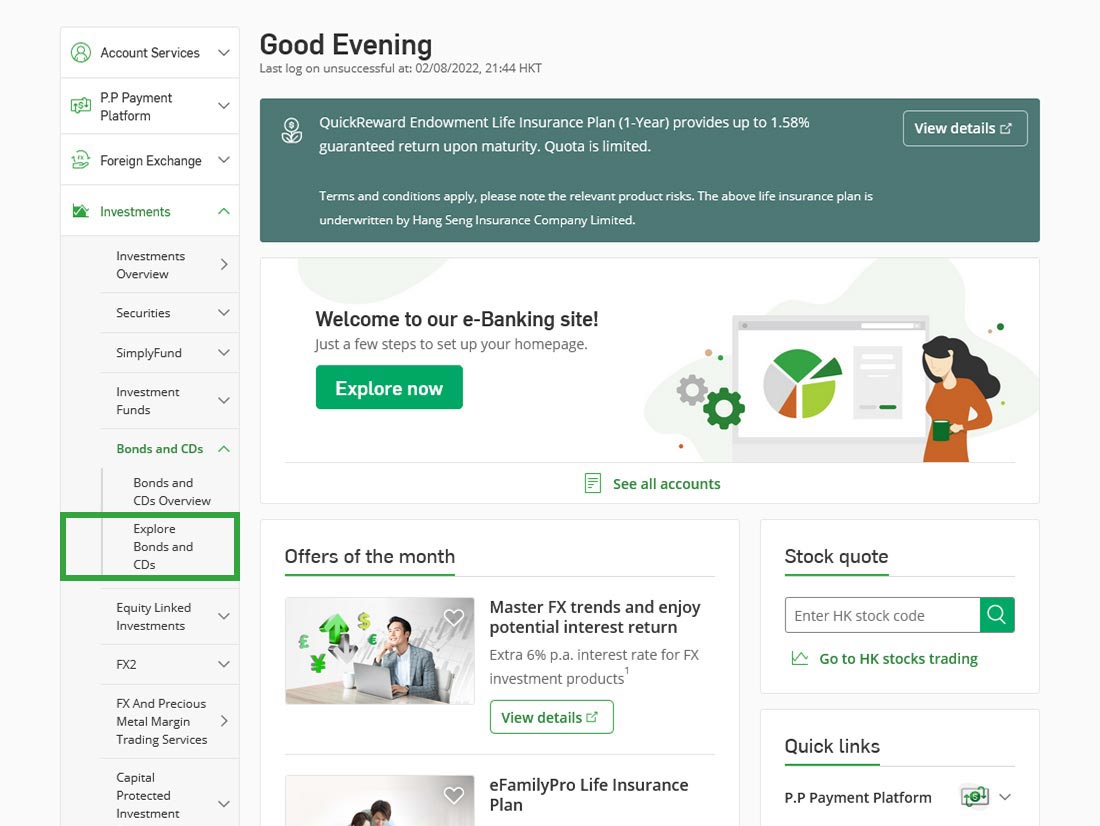

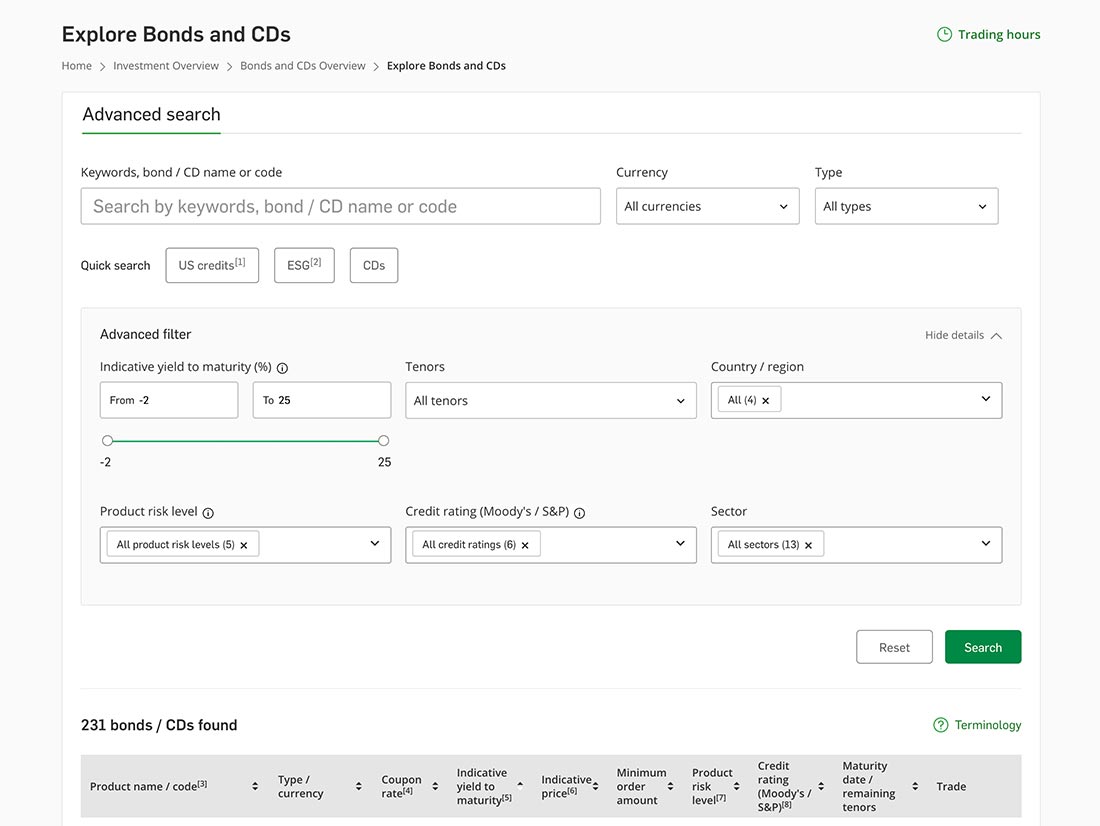

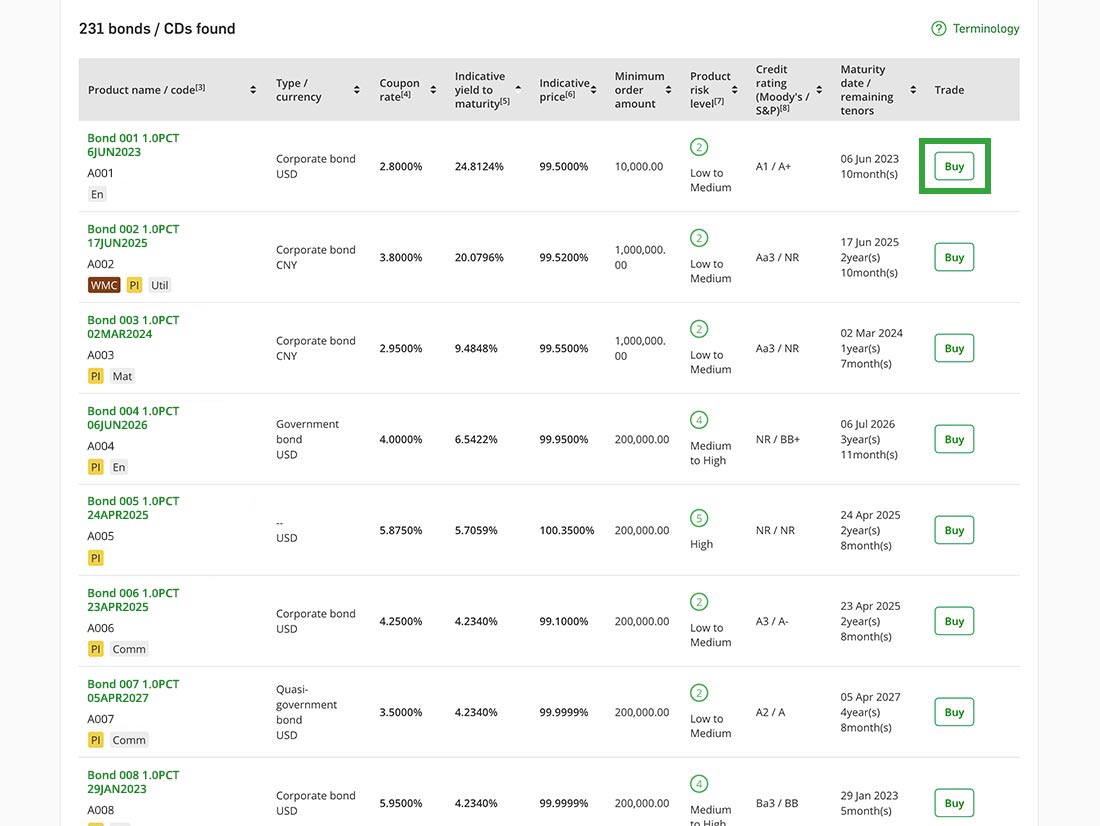

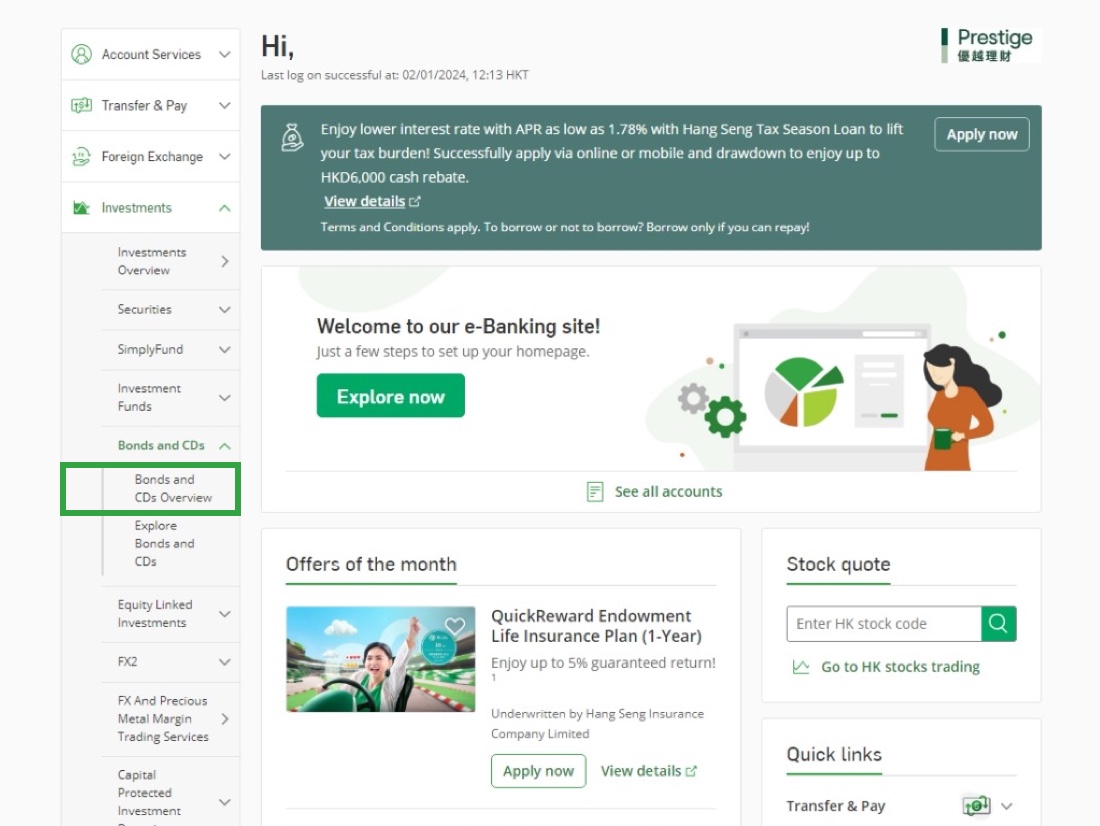

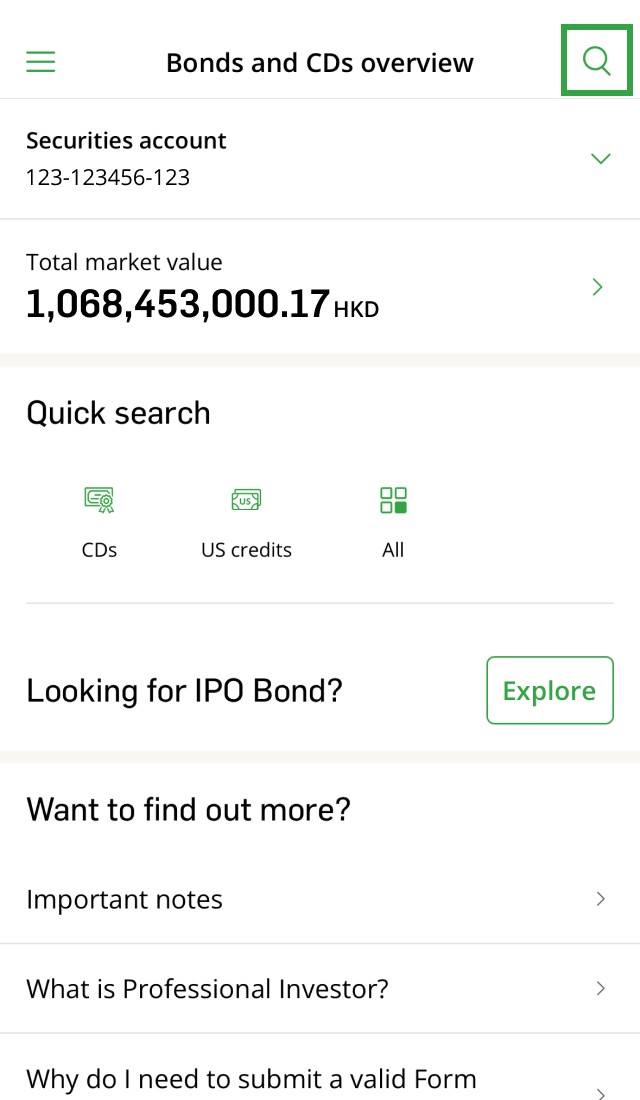

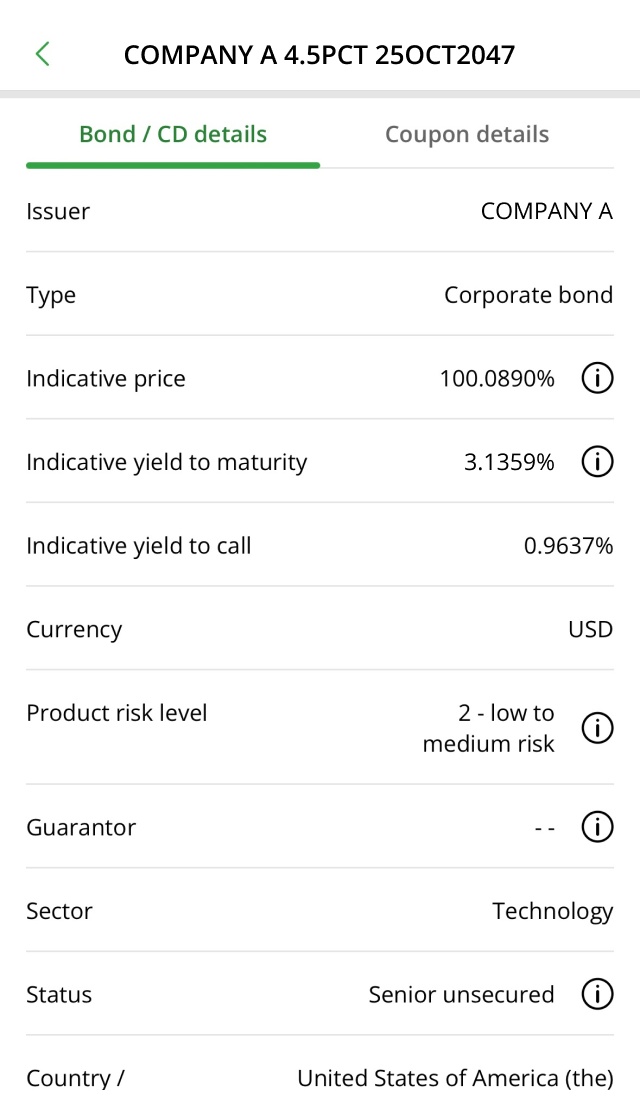

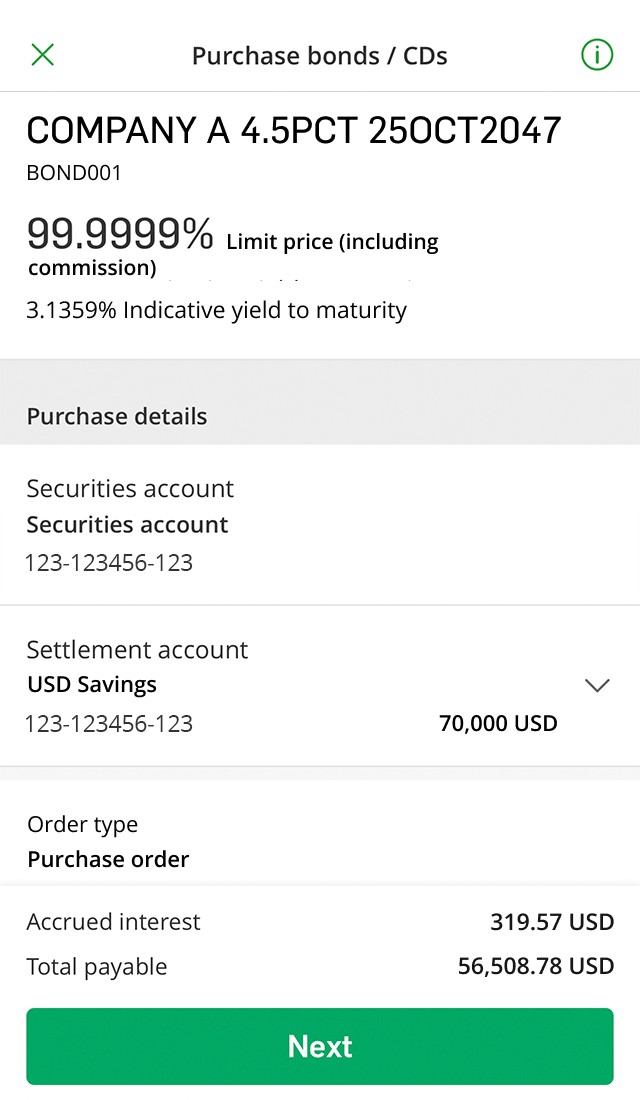

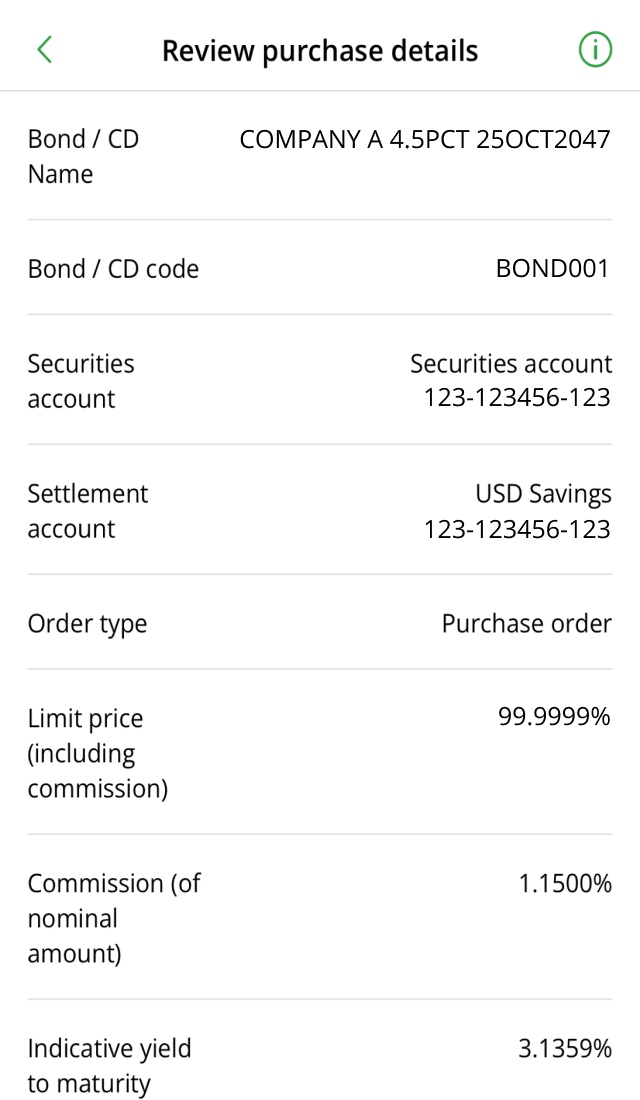

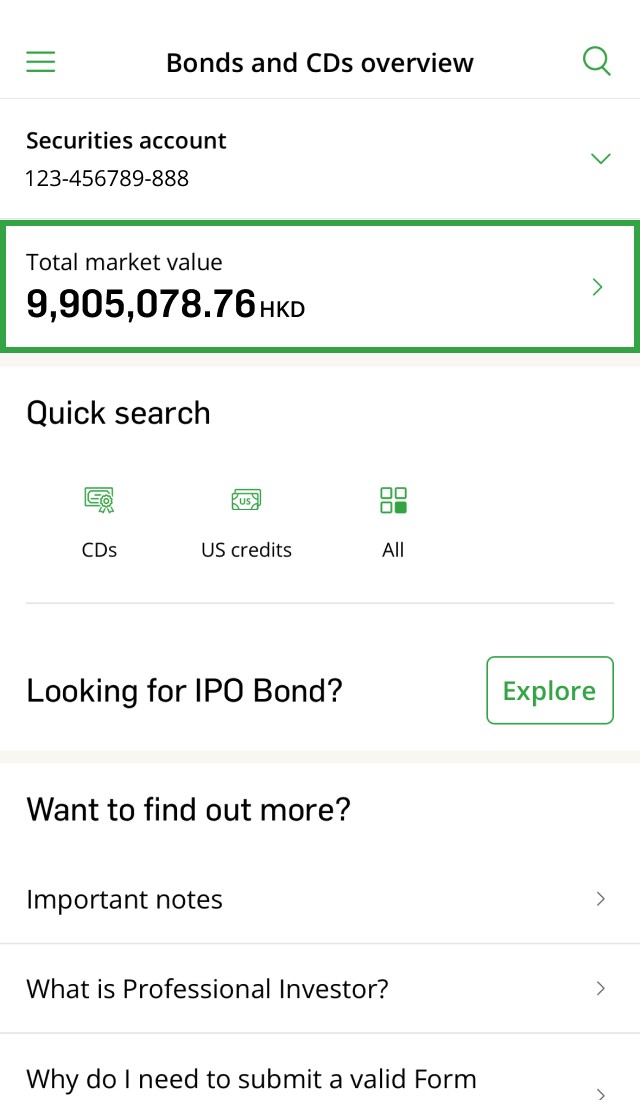

A wide variety of bonds and certificates of deposit are available for selection. Types of bonds for investment include government bonds, local quasi-government bonds, supranational bonds and corporate bonds. Certificates of Deposit (CDs) are issued by financial institutions such as banks. Bonds and CDs are available in major currencies including Renminbi. Tenors ranging from 1 to 10 years for bond investment and from 3 months to 3 years for CD investment are available.

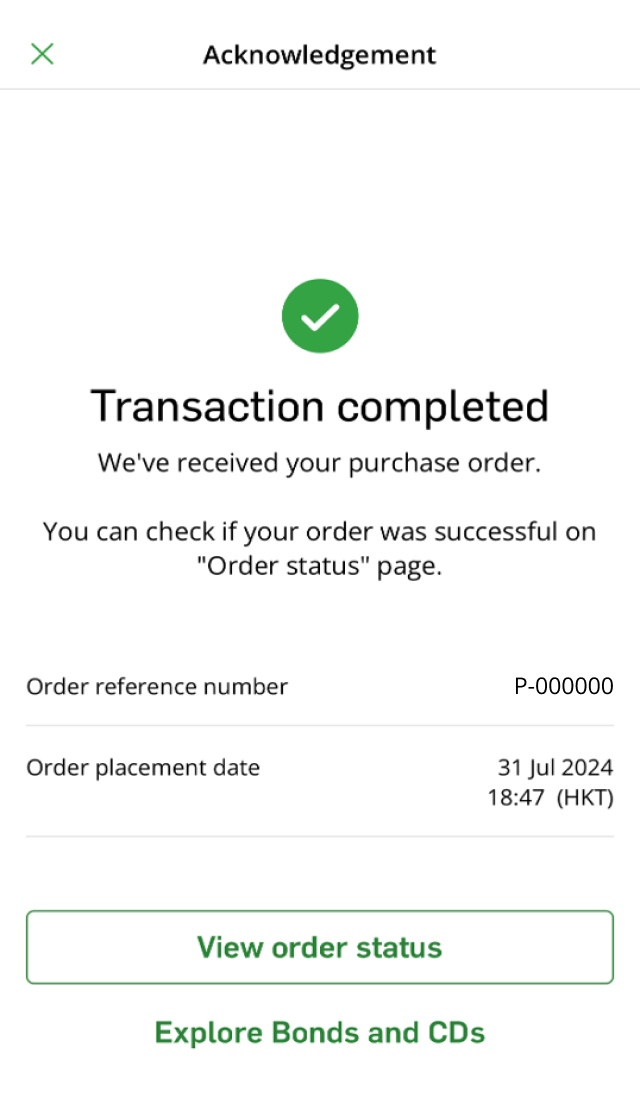

Purchase in just 3 quick steps

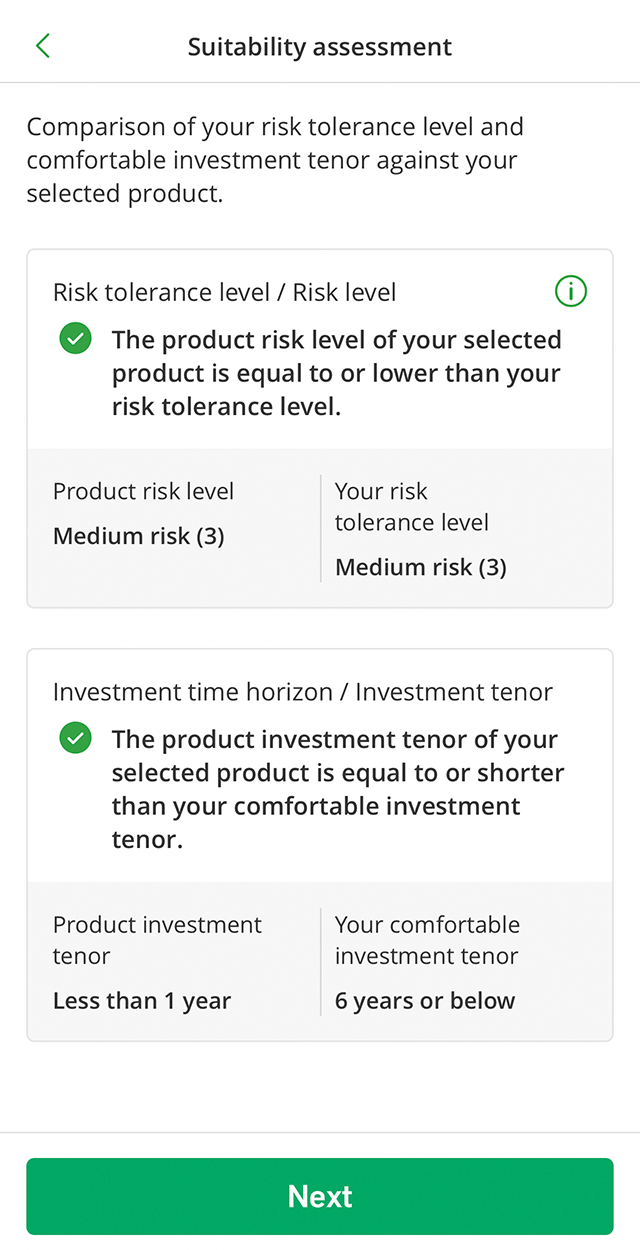

What is Risk Tolerance Level?

Complete the form on Invest Express Mobile App for eligible bonds issued by US corporations.

A wide variety of bonds and

CDs[2]are available for selection.

We are unable to retrieve bonds / CDs information temporarily. Please try again later.

About bond's credit rating

A bond’s credit rating indicates its credit quality and the issuer’s financial ability to repay the bond’s interest payments and/or principal at maturity.

Credit rating agencies (e.g. Moody’s and Standard & Poor’s) may assign credit ratings to the bonds themselves or to the issuer. Investors should be aware that credit ratings are only the opinion of a particular credit agency and may change from time to time.

Credit rating for Investment Grade:

| Moody's | Standard & Poor's | What do the Ratings mean? |

|---|---|---|

| Aaa | AAA | Highest quality |

| Aa1, Aa2, Aa3 | AA+, AA, AA- | High quality |

| A1, A2, A3 | A+, A, A- | Upper-medium quality |

| Baa1, Baa2, Baa3 | BBB+, BBB, BBB- | Medium quality |

Credit rating for non-Investment Grade:

| Moody's | Standard & Poor's | What do the Ratings mean? |

|---|---|---|

| Ba |

BB |

Speculative |

| B, Caa |

B, CCC, CC |

Highly speculative |

| Ca, C | D | Default |

Moody's applies a numerical indicator 1,2 and 3 in each generic rating. For examples, A1 is better than A2. Standard & Poor's use a plus or minus indicator. For example, A+ is better than A, and A is better than A-.

Ratings affect a bond's yield. The lower the rating, the higher will be the yields as investors will need extra incentive to compensate for taking on higher risk.

Investment grade bonds are of relatively high quality with a minimum S&P rating of BBB- or a minimum Moody's rating of Baa3.

Non-investment grade bonds, on the other hand, are of lower quality, and carry a higher risk of default. S&P rates these BB+ and below, while Moody's rates them Ba1 and below.

Things to note for credit ratings opinions

Credit ratings are primarily intended to provide investors and market participants with information about the relative credit risk of the bonds and its issuers. Investors should consult their intermediary to obtain the latest credit rating of a particular bond.

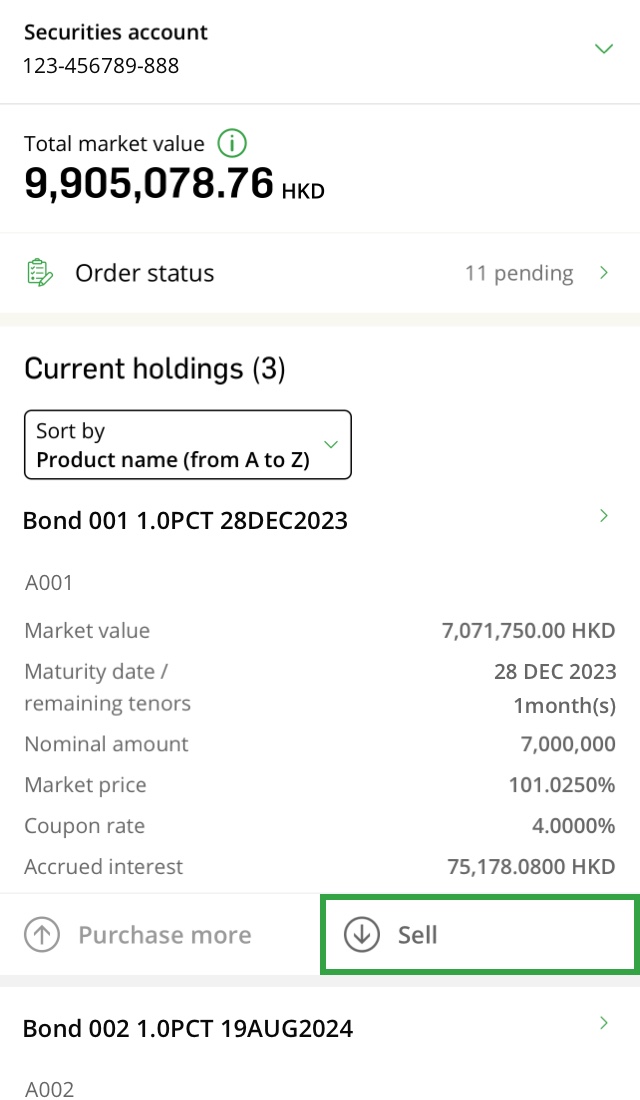

Bonds are debt instruments issued by governments, corporations or other issuers to bondholders. There are various types of bonds on the market including fixed rate bonds, floating rate bonds, zero coupon bonds and convertible bonds. Bondholders are effectively lending money to the bond issuer in return for the bond issuer’s promise to pay interest regularly over the life of the bond and repayment of principal at maturity.

Hang Seng Bank currently offers bonds denominated in the major currencies issued by governments (including the PRC government, the HKSAR government), local quasi-government bodies, supranational organisations and corporations. A wide selection of bonds with different investment tenors, ranging from 1 to 10 years with various benchmark yields is also available to suit different investors’ needs.

CD is a type of debt instrument similar to bond. CDs are issued by financial institutions such as banks. CD holders are effectively lending money to the CD issuers in return for the CD issuer’s promise to repay the principal with interest at maturity.

Hang Seng Bank offers investors with different types of CDs with various tenors and currency denominations to suit different investment objectives.

The trading price of a bond may fluctuate based on the prevailing market conditions (such as prevailing market rates, any change in the credit rating of the bond and the supply and demand of similar bonds in the market), and may not be in line with the expectations of bondholders.

Suppose you are subscribing an Bond with following terms:

Terms

Units

Invested Amount

USD98,000.00

Fixed Rate

98%

Coupon Rate

3% p.a.

Face value

USD 100,000.00

Maturity Date

December 15, 2018

Interest payment of 3% every year

Miss. Chin will receive an interest payment of USD3,000 (USD100,000 x 3%) every year before the maturity. On December 15, 2018, Miss. Chin will receive the final coupon payment of USD3,000 plus USD100,000 principal amount.

2013

US$3,000 (US$100,000x3%)

2014

US$3,000 (US$100,000x3%)

2015

US$3,000 (US$100,000x3%)

2016

US$3,000 (US$100,000x3%)

2017

US$3,000 (US$100,000x3%)

2018

US$3,000 (US$100,000x3%)

Sells the bond with market price

If Miss. Chin sells the bond in June 2013 and the market price of the bond at that time is 102%, Miss. Chin will receive an accrued coupon payment of USD1,500 plus USD102,000 (102/100 x USD100,000) for the sale of the bond.

2012

Invest USD98,000

2013

Receive USD103,500 after redemption

May not receive the face value of the bond at maturity

If the issuer becomes insolvent and defaults on its obligations under the bond on or before 15 December 2015, Miss. Chin will not receive any interest amount since last coupon payment date and in the worst case, Miss. Chin may not receive the face value of the bond at maturity.

2012

Invest USD98,000

2013

US$3,000 (US$100,000x3%)

2014

US$3,000 (US$100,000x3%)

2015

Issuer defaults

Bonds and Certificates of Deposit related documents

Issuer

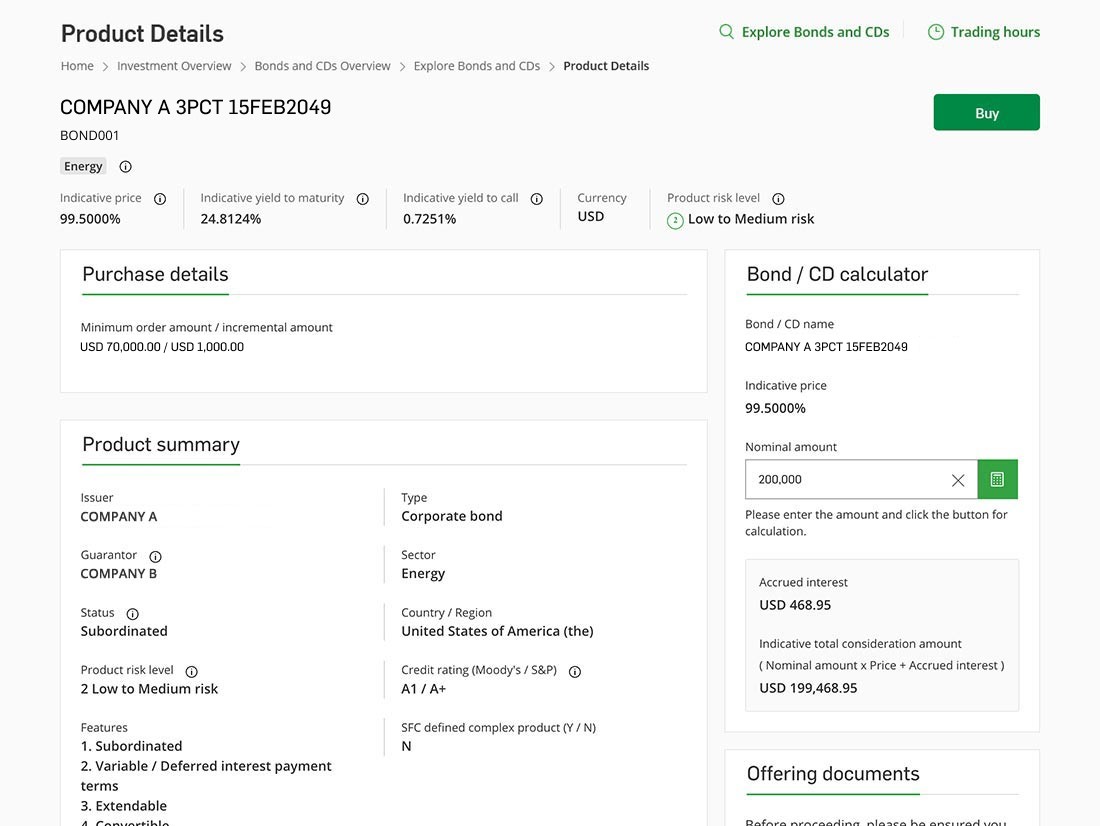

This is the party that borrows the money. Bonds are commonly classified by the nature of their issuer, for example, corporate bonds (issued by companies or their subsidiaries), government bonds (such as Exchange Fund Notes issued by the Hong Kong Monetary Authority), and bonds issued by supranational organisations (like the World Bank).

Principal

This is also called the par value or face value. It is the amount repaid to the bondholder when the bond matures.

Coupon rate

This is the rate at which the issuer pays interest on the principal to the bondholder each year. Interest payments are normally made at regular intervals, e.g. annually, semi-annually, quarterly. For Certificate of Deposit, the interest payment is usually paid at maturity. The coupon rate can be fixed, where it does not change over the term of the bond. It can be floating, where it is reset periodically according to a predetermined benchmark, such as HIBOR plus a spread. The coupon rate can even be zero. A zero-coupon bond is usually sold at a price below its principal. The bondholder's return is then the difference between the purchase price and the principal repaid on maturity.

Coupon Frequency

The regular intervals that interest payments are normally made, e.g. annually, semi-annually, quarterly.

Term

This is the life of the bond, i.e. the period (usually a number of years) over which the issuer has promised to meet its obligations under the bond. Some bonds can be "perpetual" in the sense that they do not have a fixed maturity date.

Guarantor

Some bonds are guaranteed by a third party called a guarantor. If the issuer defaults, the guarantor agrees to repay the principal and/or interest to the bondholder.

Maturity date

Bondholder will receive the principal and accrued interest on this date.

Bond yields

Bond yield is the amount of return an investor realises on a bond. There are several types of bond yield measures. Actual yield of bonds will depend on the subscription or purchase price and may be higher or lower than the specified coupon rate. Current yield, yield to maturity (YTM), and yield to call (YTC) are the three commonly used bond yield measures.

Current yield

The annualised rate of return calculated by simply dividing the current annual coupon of a bond by its price.

Yield to maturity

The rate of return anticipated on a bond if it is held until maturity. YTM is usually expressed as an annual rate of return.

Yield to call

The rate of return of a callable bond which is held until the call date. The yield will only become valid if the bond is called before maturity.

To learn more about Bonds, please visit "The Chin Family" website

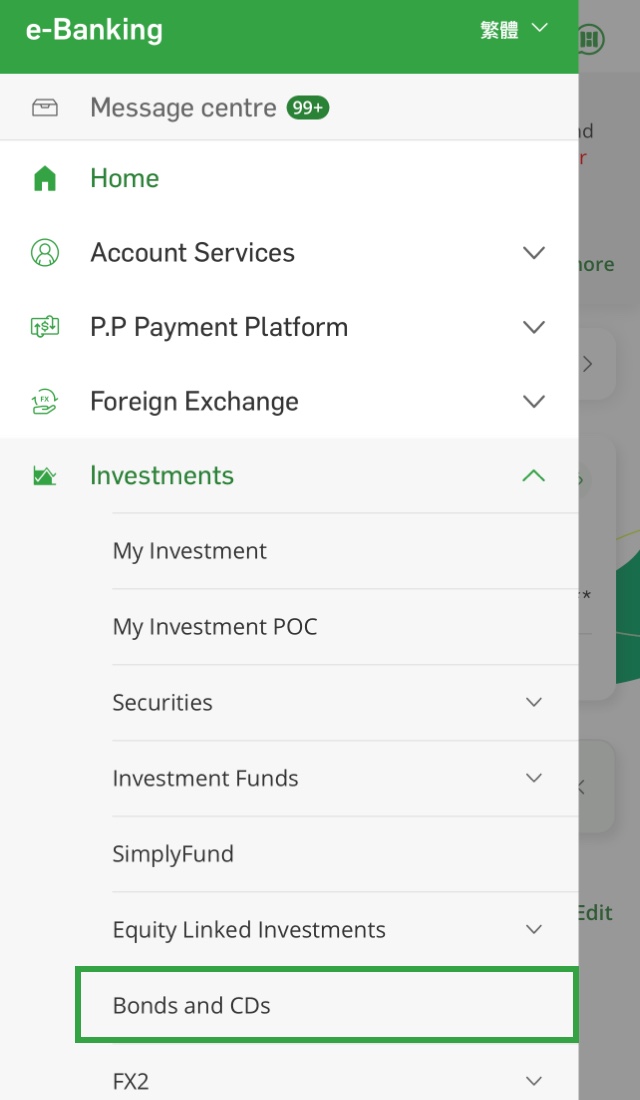

Open an integrated account and activate your investment account via Hang Seng Mobile App with ease[5]

Comprehensive Bonds/CDs Investments

experience is just a few steps away[6]

General hotline

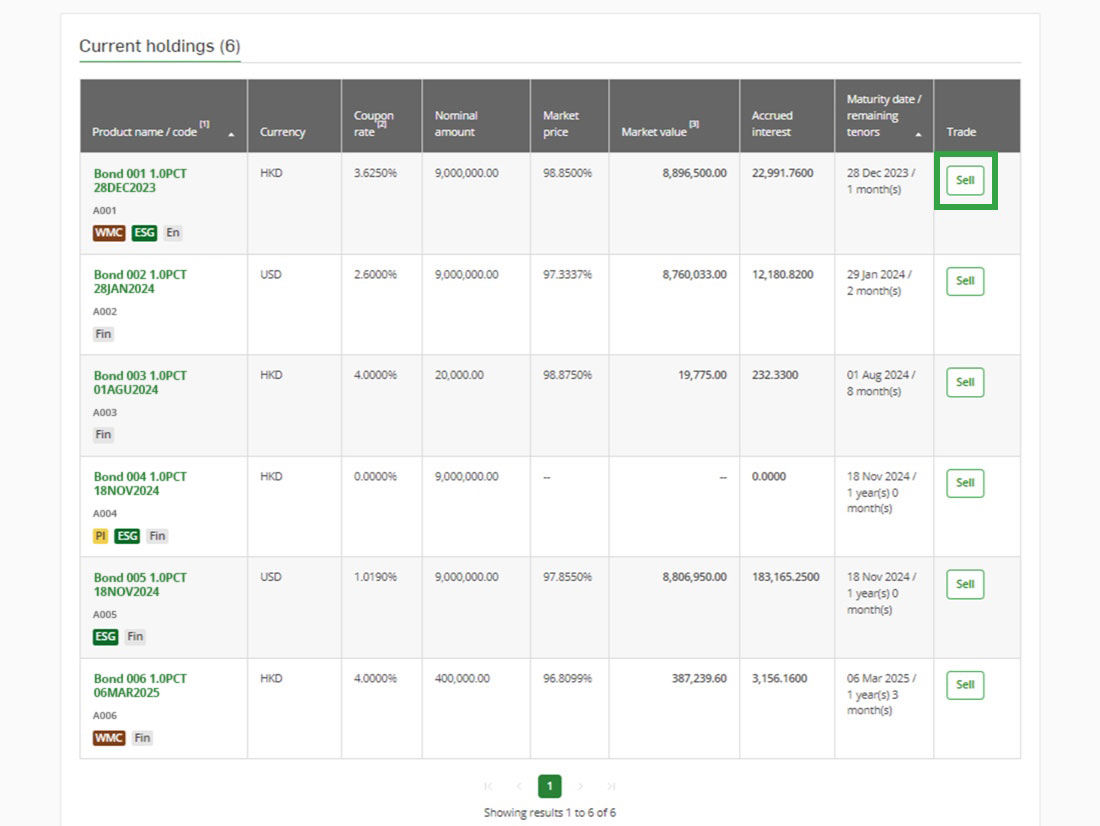

PI - Professional Investors

WMC - Cross-boundary Wealth Management Connect[4]

Comm - Communication Services

Condis - Consumer Discretionary

Constp - Consumer Staples

Div - Diversified

En - Energy

Fin - Financials

Go - Government

Health - Health care

Ind - Industrials

Mat - Materials

RE - Real Estate

Tech - Technology

Util - Utilities

For details, please view our [eligible retail bond list] for Southbound Service or call our Cross-boundary WMC hotlines at (852) 2912 3456 (Hong Kong) or (86) 4001 20 3456 (Mainland).

Hotlines details:

Applicable to Hong Kong and Mainland:

Office hour of Cross-boundary WMC Hotline is Monday to Friday, 9 a.m. to 6 p.m., except weekend and Hong Kong Public Holiday.

Applicable to Mainland:

The toll-free enquiry hotline allows you to contact us for free even while staying on the Mainland. The toll-free hotline can be accessed from mobile lines, fixed telephone lines, payphones and call cards and is free of IDD charges.

Please contact the relevant service supplier for details. Customer agrees to be bound by the terms and conditions for the service provided by service providers, which may be amended from time to time. For any claims, disputes and complaints regarding such service and information, customer should refer directly to service providers. Hang Seng Bank Limited (Hang Seng Hong Kong) assumes no responsibilities for such service.

The list of bonds / CDs (including PI bonds) is shown upon your request. Please note that the bond / CD list is for public and general information, and is for reference only. It is not necessarily a complete list of bonds available at the Bank and some of them are exclusive to professional investors. It is not, and is not intended to be, a solicitation, recommendation, or advice on, or offer of, any investment services or products. Investors should note that all investments involve risks (including the possibility of loss of the capital invested). Prices or value of the bonds / CDs may go up as well as down and past performance is not indicative of future performance. Investors should not make any investment decisions based only on this material alone, but should read the relevant offering documents of the bonds / CDs (including the full text of the risk factors stated therein) and risk disclosure statements of the relevant bonds in details before making any investment decision. Investors should carefully consider whether an investment is suitable for them in view of their own investment objectives, investment experience, investment tenor, financial situation, risk tolerance abilities, tax implications and other needs, etc., and should understand the nature, terms and risks of the investment products. Investors should obtain independent professional advice if they have concerns about their investment.

Want to know more about Bond?

Want to know more about Bond?

Chat with H A R O now