We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

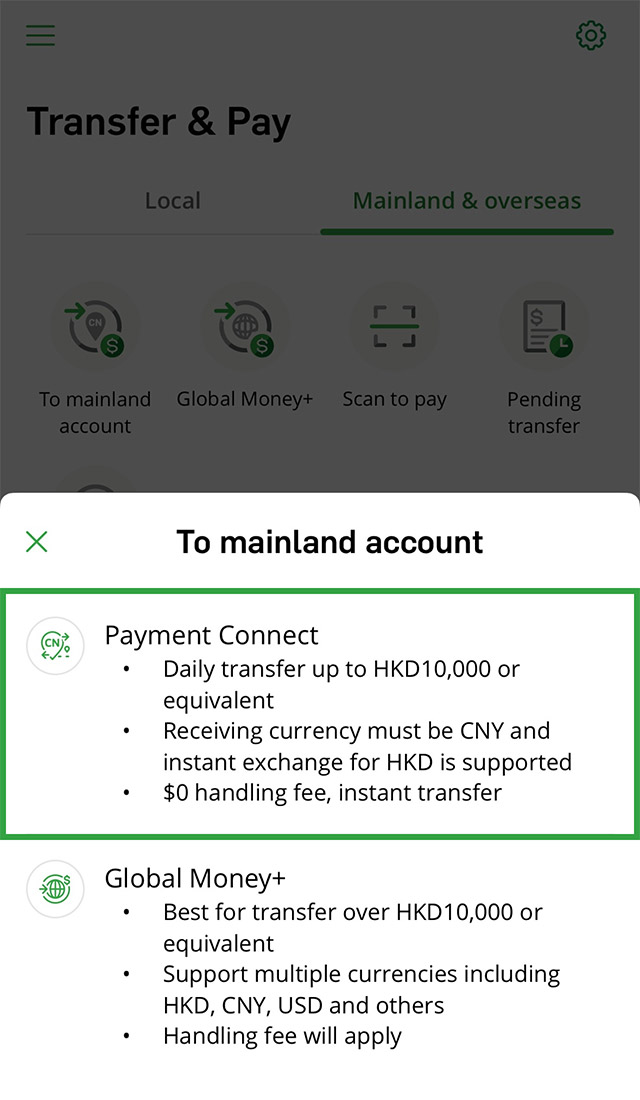

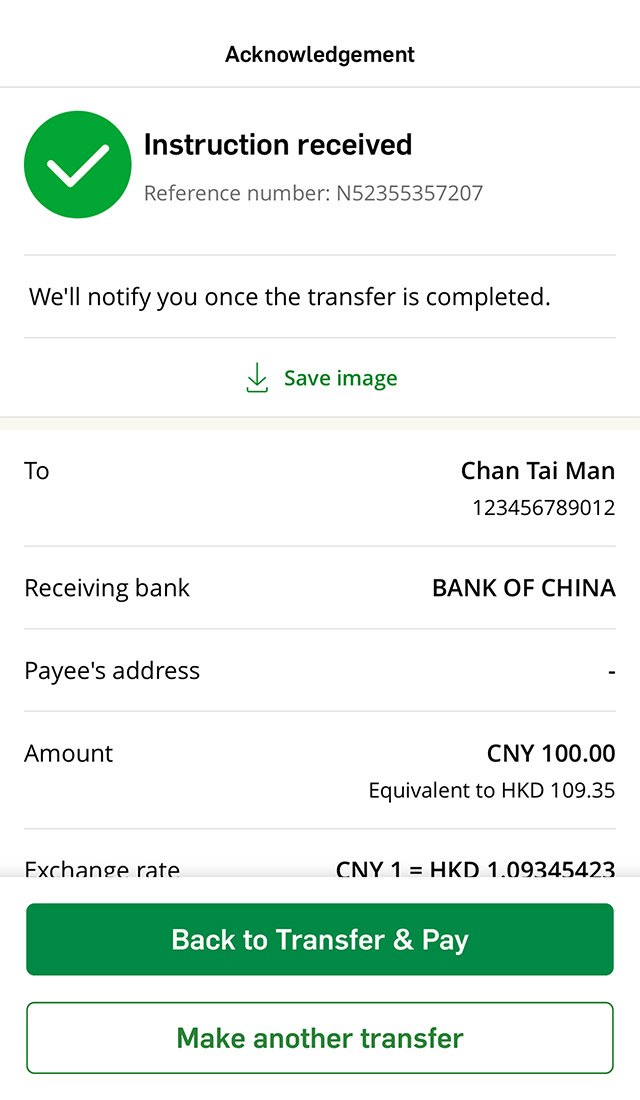

Payment Connect allows you to make instant small value transfers to mainland China. Whether it's tuition fees, utilities or medical expenses, use Hang Seng Mobile App to send CNY to designated mainland bank accounts with $0 handling fee effortlessly!

No more concern on the cut-off time! You can now make instant cross-border transfers any time almost instantly.

Transfer or receive fund seamlessly through Payment Connect without any fees.

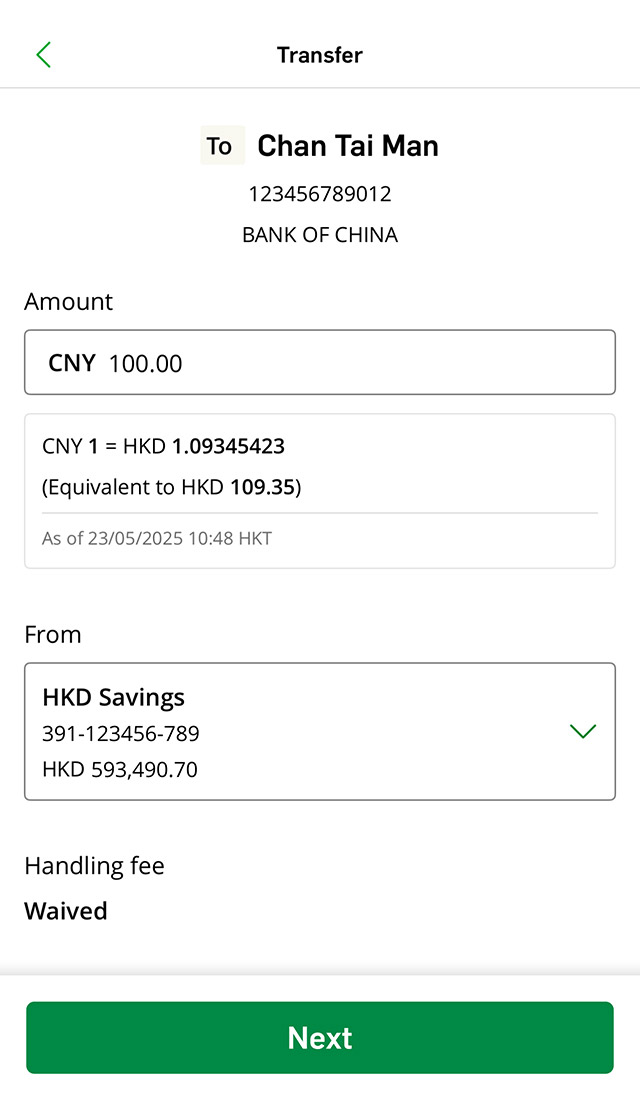

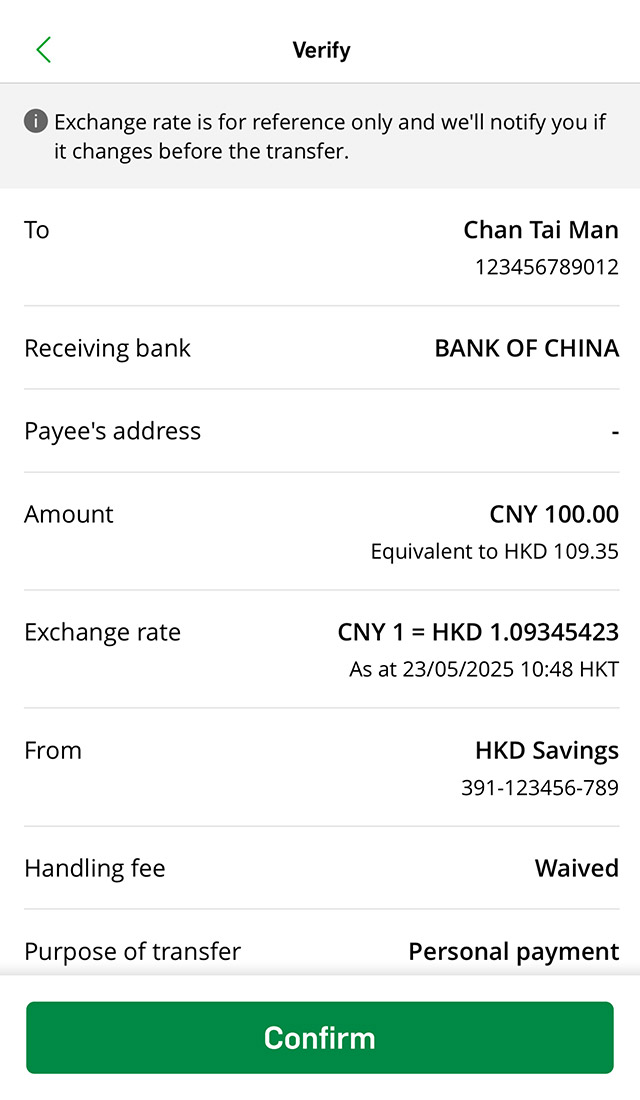

If you're sending money to mainland with Payment Connect, the handling fee will be fully waived. |

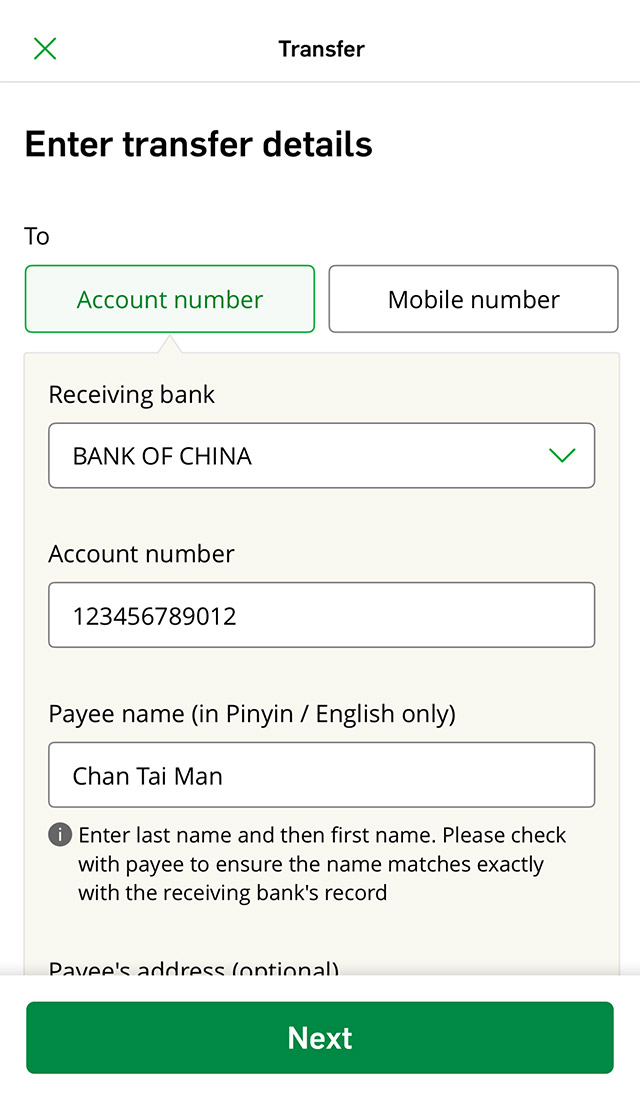

You can transfer / receive funds with designated mainland banks via Payment Connect, including Bank of China, Bank of Communications, China Construction Bank, China Merchants Bank, Industrial and Commercial Bank of China, etc. You can view the full list of designated mainland banks via Payment Connect on Hang Seng Mobile App.

Payments are usually almost instant, but it's also subject to the operating mode of receiving banks and clearing institutions.

Payment Connect currently only supports transfers in CNY to mainland accounts. However, we provide instant foreign currency exchange, allowing you to choose between debiting from HKD or CNY account.

For transferring other currencies to mainland accounts, you can use Global Money+. Please note remittance charge may apply and the arrival time may be longer.

If you hold a Hang Seng China account, you can register for the Cross-Border View and Transfer service via Hang Seng Mobile App and transfer other currencies to yourself with $0 handling fee.

Payment Connect is subject to an annual limit of HKD200,000 or equivalent (applicable to HKID Card holders who select “Personal payment” as the purpose of transfer) and the "Small value daily transfer limit" of up to HKD10,000 or equivalent. Besides, as the payee is outside Hong Kong, this service is also subject to your "Mainland & overseas daily transfer limit".

You can update the limits by logging on to:

If you need to transfer more than HKD10,000, you can either leave a partial amount for transfer the next day or proceed with Global Money+. If you choose to transfer CNY with Global Money+, the recipient must be your self-named mainland account. Please be aware of the relevant handling fees and the processing time it takes for the funds to be credited.

No. You can't stop the instruction once the transfer has come into effect. So when making an instant transfer, please review the payment details such as payee's name and account number carefully.

You can use your bank account number or Proxy IDs (i.e. mobile phone number, email address or FPS identifier) to receive HKD or CNY payments via Payment Connect. If you use a Proxy ID to receive payments, you must first register for FPS on the Hang Seng Mobile App or Personal e-Banking. Tap to learn how to register for FPS

If you hold a Prestige Banking account, Preferred Banking account, Integrated Account, CNY standalone savings or current account, you can receive CNY payments.

Additionally, if remit personal payment from mainland China to Hong Kong via Payment Connect, the payer is subject to an annual personal limit of USD50,000 or equivalent and must hold a PRC ID Card. The remittance service hours are from 7 am to 11 pm everyday.

As the transfer services provided by different mainland China banks via Payment Connect may vary, the payer should consult the relevant mainland China bank before making a transfer.