We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

HK Investor ID Regime is now effective

Client consent for processing and disclosure of personal data is required. Otherwise, customers are not able to buy HK stock. Investment involves risks View details

New securities customers can enjoy 3-month unlimited $0 brokerage for both buy and sell trades of stocks.

Want to invest easily with low barriers?

SimplyStock is designed for investors aged 18 to 30. Simply trade securities with $0 brokerage fee online in 3 markets anytime, anywhere. With free articles from Securities 101 and personalised chart analysis from Hang Seng Invest Express, it helps you invest at a lower cost while understanding market trends. No hassles for registration!

Starting from October 2023, you can download "Hang Seng Invest Express" to experience SimplyStock. Grab the chance and invest wisely!

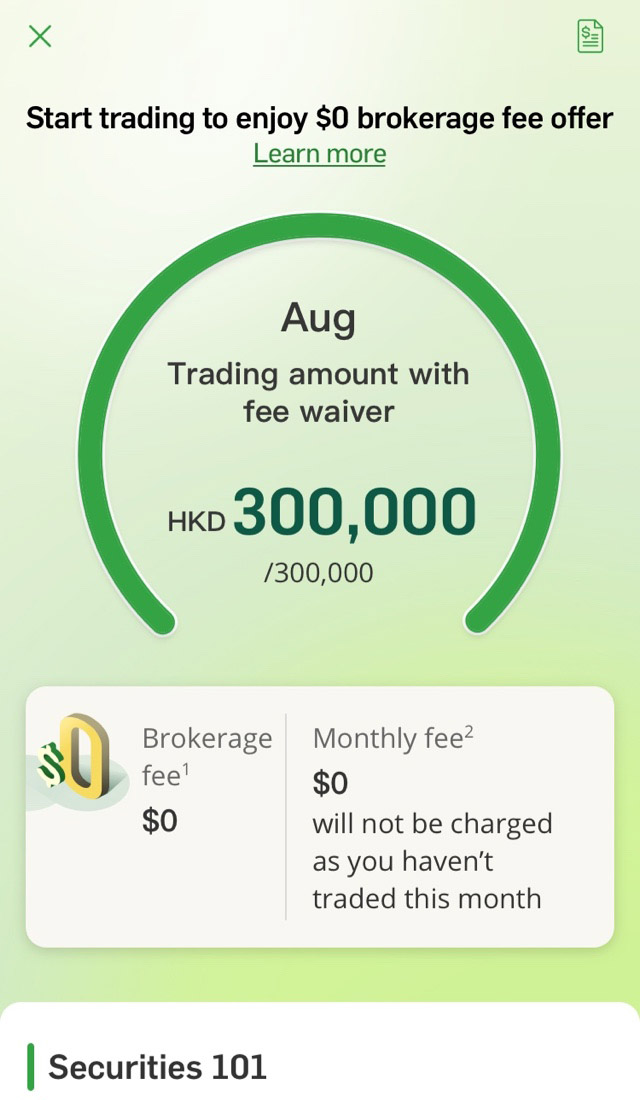

Simply invest with the price of a cup of coffee (HK$30 monthly fee with no hidden fee), and you can enjoy fee waiver for HK$300,000 trading amount for HK Stocks, Stock Connect Securities and US stocks.

No hidden fee is charged. If there is no securities transaction in the current month, no monthly fee will be charged for holdings.

Offering a series of free securities articles, even beginners can get started with ease.

(assume monthly trading amount is HKD300,000 or below)

| SimplyStock | Broker/Bank 1 | Broker/Bank 2 | |

|---|---|---|---|

| Eligibility | Customers aged 18-30 will enjoy offer automatically | Not applicable | Registered customers aged 18-25 |

| Brokerage fee: | |||

| HK Stocks |  |

$0 | $0 |

| A Shares |  |

Fee charged | $0 |

| US Stocks |  |

Fee charged | $0 |

| Custody fee |  |

$0 | Fee charged |

| Platform fee |  |

Fee charged | $0 |

| Third-party transaction charges (collected by HKSAR Government or regulatory authority), e.g. Transaction levy, stamp duty & trading fee | Fee charged | Fee charged | Fee charged |

| Monthly total trading amount | Monthly fee | HK Stocks brokerage fee | A shares brokerage fee | US Stocks brokerage fee |

|---|---|---|---|---|

| HKD0 |  |

|

|

|

| HKD300,000 or below | HKD30 |  |

|

|

| Exceeding HKD300,000 | HKD30 | 0.25% brokerage fee (At least HKD100) | 0.25% brokerage fee (At least RMB100) | USD0.015 per share (At least USD15) |

Please refer to Securities Services Charges for detailed fees and charges for SimplyStock.

If you’re aged between 18 and 30 (inclusive) and have a securities account (excluding Share Margin Account) under a sole name Integrated Account (eligible Securities Accounts), you’re qualified for SimplyStock.

How it works:

If you're 18-30 (inclusive) on any day of the calendar month, you can enjoy SimplyStock till the last trading day of that month.

Where a customer will turn 31 years old in that month as example:

You can enjoy SimplyStock when you trade Eligible Securities via an eligible Securities Account, you do not need to prepay the brokerage fee i.e. it is not in the form of a rebate.

Your monthly trading amount covers executed securities trading performed via eligible Securities Accounts through digital channels (including Hang Seng Personal e-Banking/Hang Seng Personal Banking mobile app/Hang Seng Invest Express mobile app): buy and sell transactions of Local Securities (including ETFs, warrants and CBBCs while IPO and MIPS are excluded), Stock Connect Northbound Securities, and US Securities (eligible securities).

You can enjoy $0 brokerage fee and $0 deposit charge for SimplyStock for Eligible Securities made via digital channels (including Hang Seng Invest Express mobile app, Hang Seng Personal e-Banking and Hang Seng Personal Mobile App). You will need to pay standard brokerage charges and deposit charges if you trade via non-digital channels (including branches, manned or automated securities trading hotlines).

To determine the total trading amount in a calendar month, all transaction amounts in RMB and USD will be converted to HK$ using the exchange rate as determined by Hang Seng on the day you trade.

The amount is calculated monthly and reset on the first day of each calendar month.

You still need to pay third-party transaction charges, e.g. transaction levy, stamp duty and trading fee, handling fee, securities management fee, transfer fee and capital gain tax, etc.

The Monthly Fee will be charged on the last business day (Mon to Sat excluding public holidays) of each month. You may check the record under ‘Custody or Monthly fee’ or ‘Bank Charge SEC’ in your account statement and your Securities account statement.

Monthly Fee will be deducted from the corresponding settlement account of the eligible Securities Account with the highest total trading amount.

If you didn't trade any securities via digital channel in that month, you don't need to pay the HK$30 Monthly Fee.

You can log on to Hang Seng Personal Banking mobile app, go to left menu and tap "Account Services" > "e-Statement / e-Advice", then choose a securities account to check the waived / paid brokerage fee.

Or, you can tap the record icon at the top right corner of SimplyStock homepage, and learn how to view your brokerage fee record of your transactions.