We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Please read the Important Risk Warnings for Capital Protected Investment Deposit.

Investors can choose Bearish CPI deposit if you anticipate the linked currency with bearish view will depreciate.

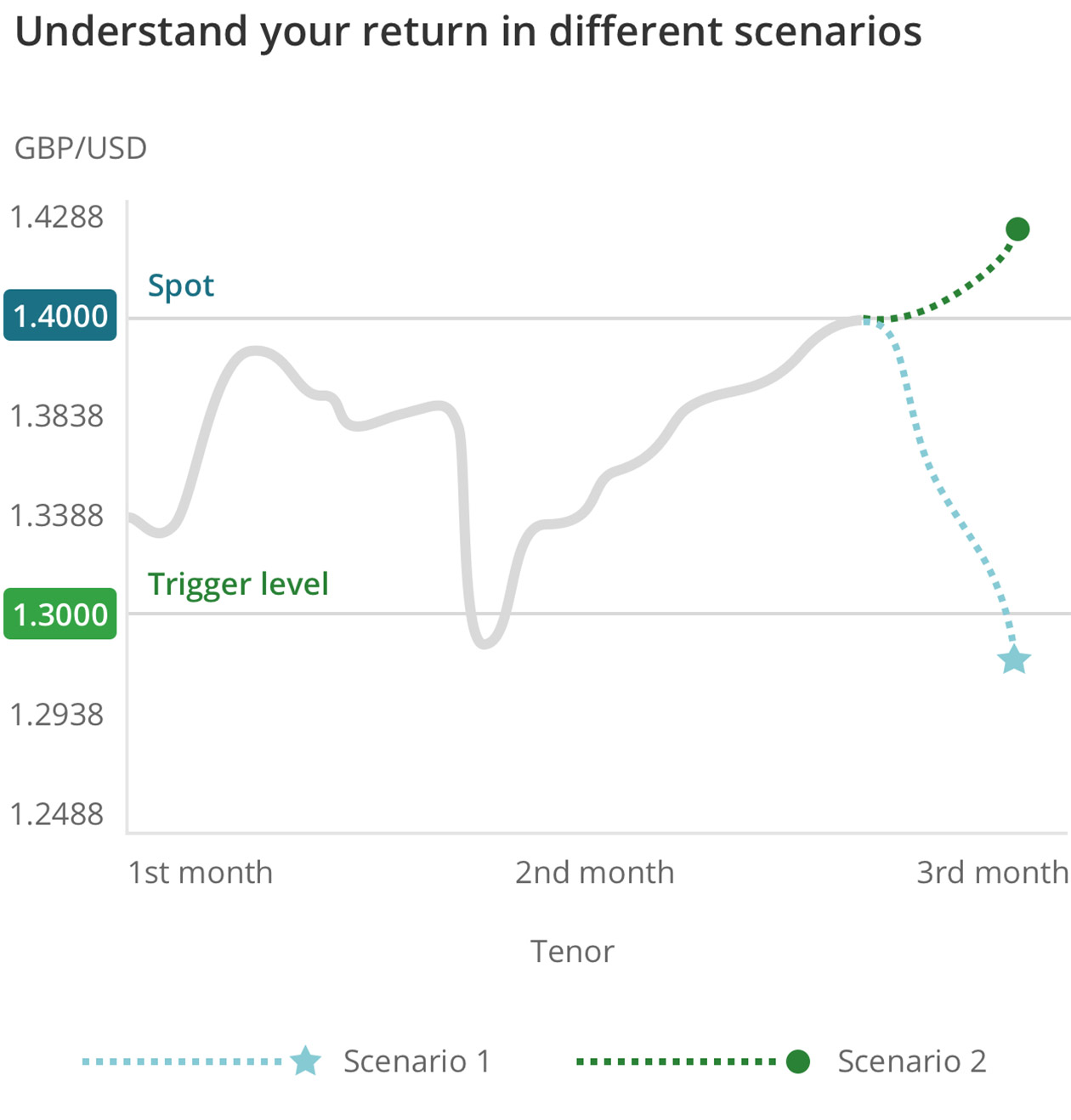

You may refer to the below illustrative examples to understand different investment types & return scenarios of bearish CPI deposit.

100% capital protected, subscribe currency pair in 5 steps

GBP / USD is equal to or below 1.3000 on Final Exchange Rate Determination Date

When you subscribe

You invest HKD 150,000

At maturity

Total final amount HKD 151,687.5 (100% Principal & Potential Return)

Your returns at maturity

HKD 150,000 x (1+4.5% x 3/12) = HKD 151,687.5

GBP / USD is above 1.3000 on Final Exchange Rate Determination Date

When you subscribe

You invest HKD 150,000

At maturity

Total final amount HKD 150,562.5 (100% Principal & Potential Return)

Your returns at maturity

HKD 150,000 x (1+ 1.5% x 3/12) = HKD 150,562.5

The bank becomes insolvent or defaults on its obligation

When you subscribe

You invest HKD 150,000

You lose your entire capital

Total final amount HKD 0

FX hotline:

(852) 2822 8233

Personal customer:

(852) 2822 0228

Commercial customer:

(852) 2198 8000