We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Please read the Important Risk Warnings for Capital Protected Investment Deposit.

Investors can choose Bullish CPI deposit if you anticipate the linked currency with bullish view will appreciate.

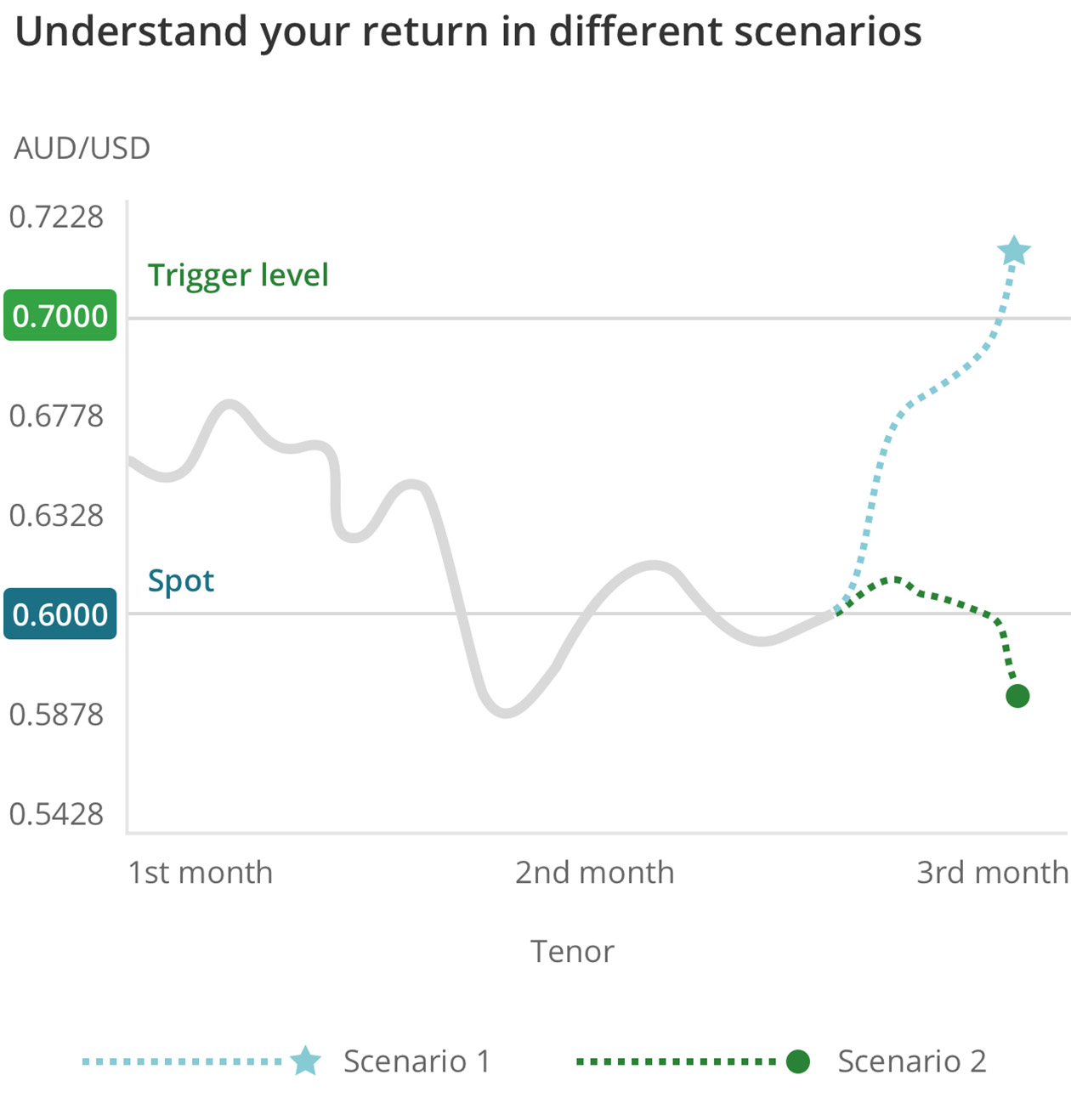

You may refer to the below illustrative examples to understand different investment types & return scenarios of bullish CPI deposit.

100% capital protected, subscribe currency pair in 5 steps

AUD / USD is equal to or above 0.7000 at any time during the observation period

When you subscribe

You invest HKD 100,000

At maturity

Total final amount HKD 101,000 (100% Principal & Potential Return)

Your returns at maturity

HKD 100,000 x (1+4% x 3/12) = HKD 101,000

AUD / USD is under 0.7000 during the whole observation period

When you subscribe

You invest HKD 100,000

At maturity

Total final amount HKD 100,125 (100% Principal & Potential Return)

Your returns at maturity

HKD 100,000 x (1+0.5% x 3/12) = HKD 100,125

The bank becomes insolvent or defaults on its obligation

When you subscribe

You invest HKD 100,000

You lose your entire capital

Total final amount HKD 0

FX hotline:

(852) 2822 8233

Personal customer:

(852) 2822 0228

Commercial customer:

(852) 2198 8000