We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Please read the Important Risk Warning for investment fund. Besides, Wealth Master is extended to Preferred Banking customers. Experience our portfolio analysis tool on Hang Seng Mobile App now to get insights into your investment portfolio.

Eligible customers who successfully open an Investment Fund Account, can enjoy a 0% fund subscription fee offer.

Investment funds are managed by dedicated fund managers. Based on their analysis and asset allocation strategy, investors can have the chance to seize investment opportunities in Hong Kong and across the world, even for those with less budget.

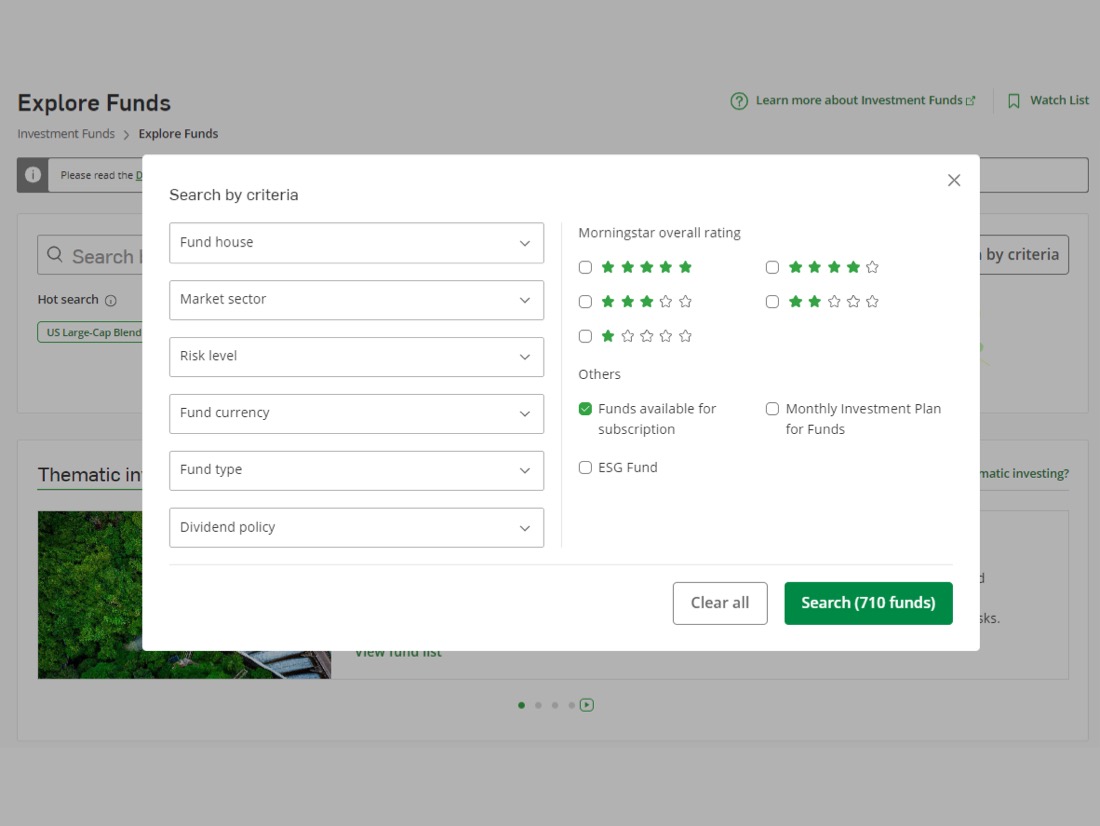

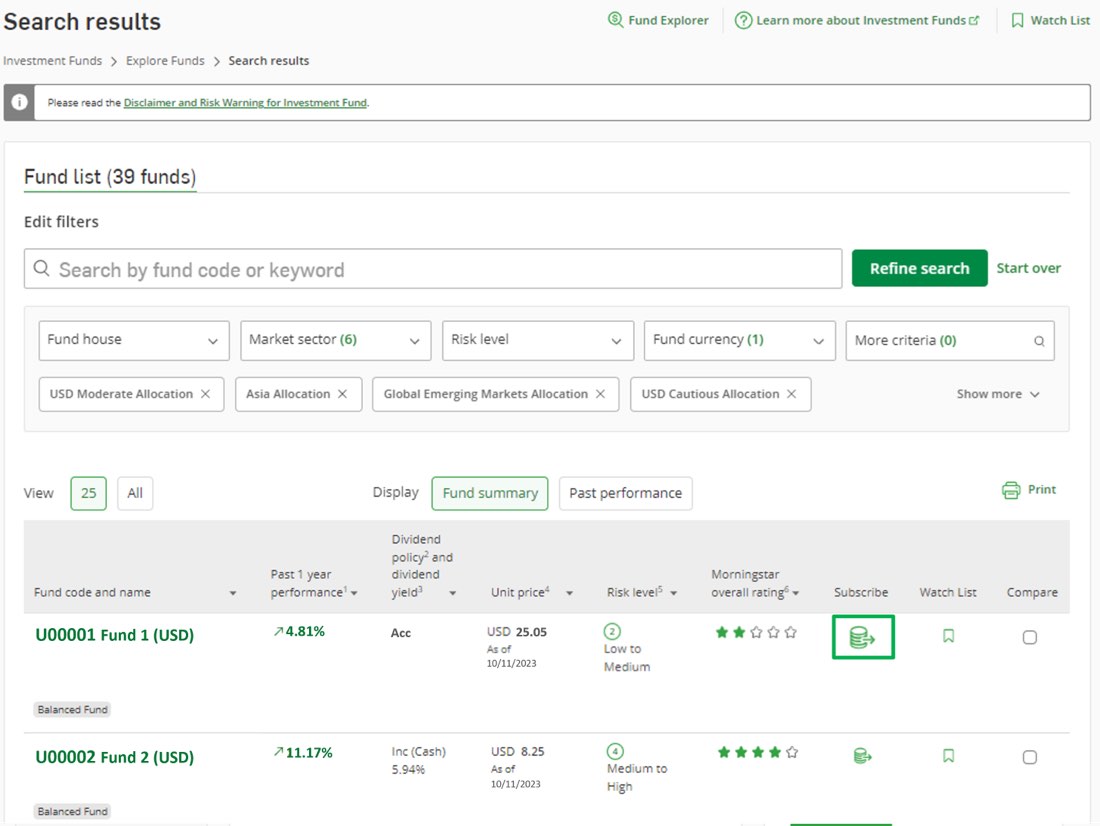

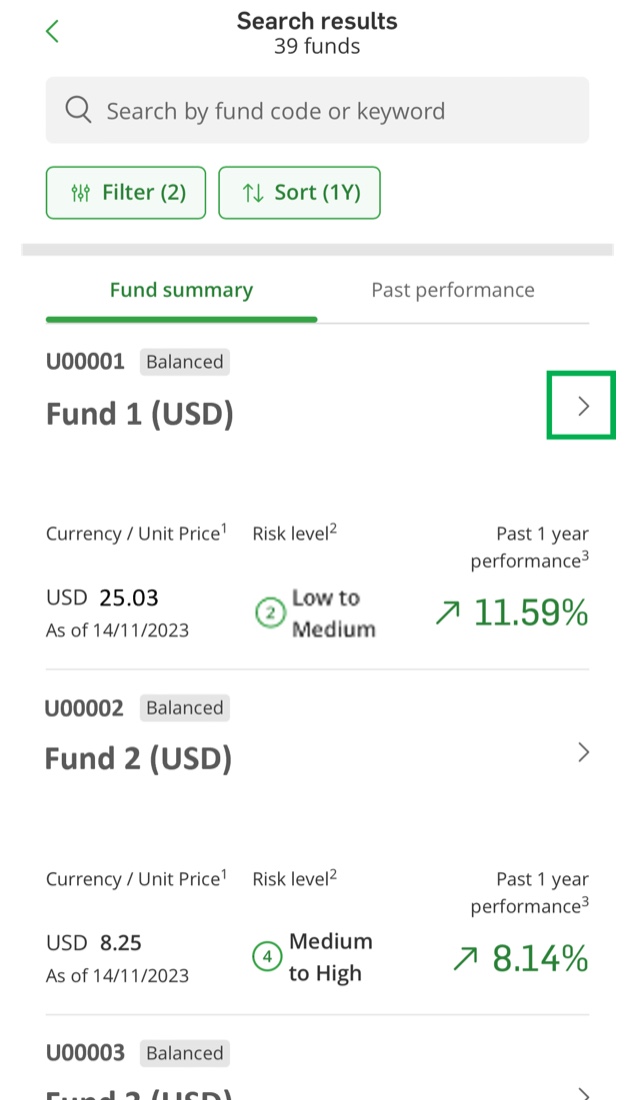

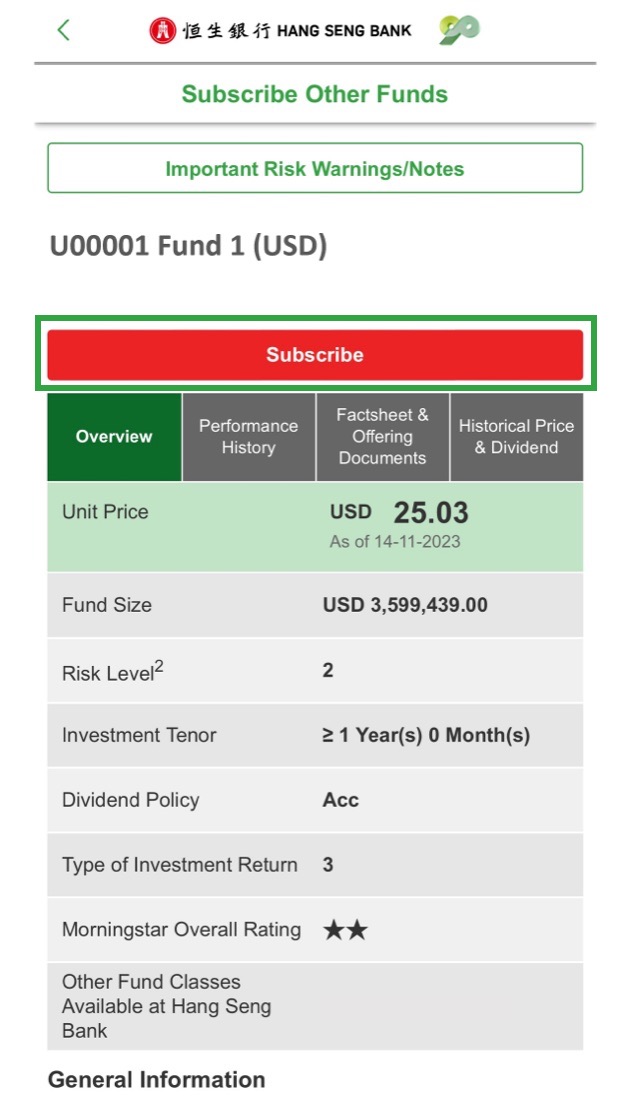

Meeting your various fund investment needs, our investment fund services offer a wide range of investment funds covering different types of funds, regions and asset classes, including equity funds, bond funds, multi-asset funds, thematic funds, income funds and index funds for your selection.

Each fund is managed by a dedicated fund manager. Based on different market conditions, a fund manager and his/her team will use professional analysis to select investments with higher potential, while aligning with the investment goals. They will also adjust the investment fund portfolio according to economic and market trends, in order to manage the risks and strive to generate returns.

Compared with direct subscription of assets like single equity and foreign currency, investment funds maybe better at risk diversification. For example, an equity fund can invest in a variety of stocks of different sectors and backgrounds at the same time. Even when one stock or stocks of a certain category are affected by different factors, the investment funds may still offset the losses with profits gained from other stocks.

It is comparatively difficult for general investors to invest directly in overseas assets, such as bonds issued by foreign governments, foreign stock markets, and commodities like oil and precious metals. By buying the types of funds that hold such assets, investors have the opportunity to engage in global investment.

Investors can buy or sell investment funds on any dealing days though different channels.

Answer a few simple questions to help you search for your preferred funds.[1]

Get insights on how to allocate your assets and diversify your investments

A simple comparison on 3 types of investment products: funds, stocks and ILAS

Comprehensive Investment Fund experience is just a few steps away

Open an integrated account and activate your investment account via Hang Seng Mobile App with ease[5]

You need to hold a Hang Seng Bank account and open a fund account for more services.

Hang Seng Bank offers diversified fund portfolios in Hong Kong, Mainland China and global markets, including equity funds, bond funds or balanced funds, which caters various investment needs.

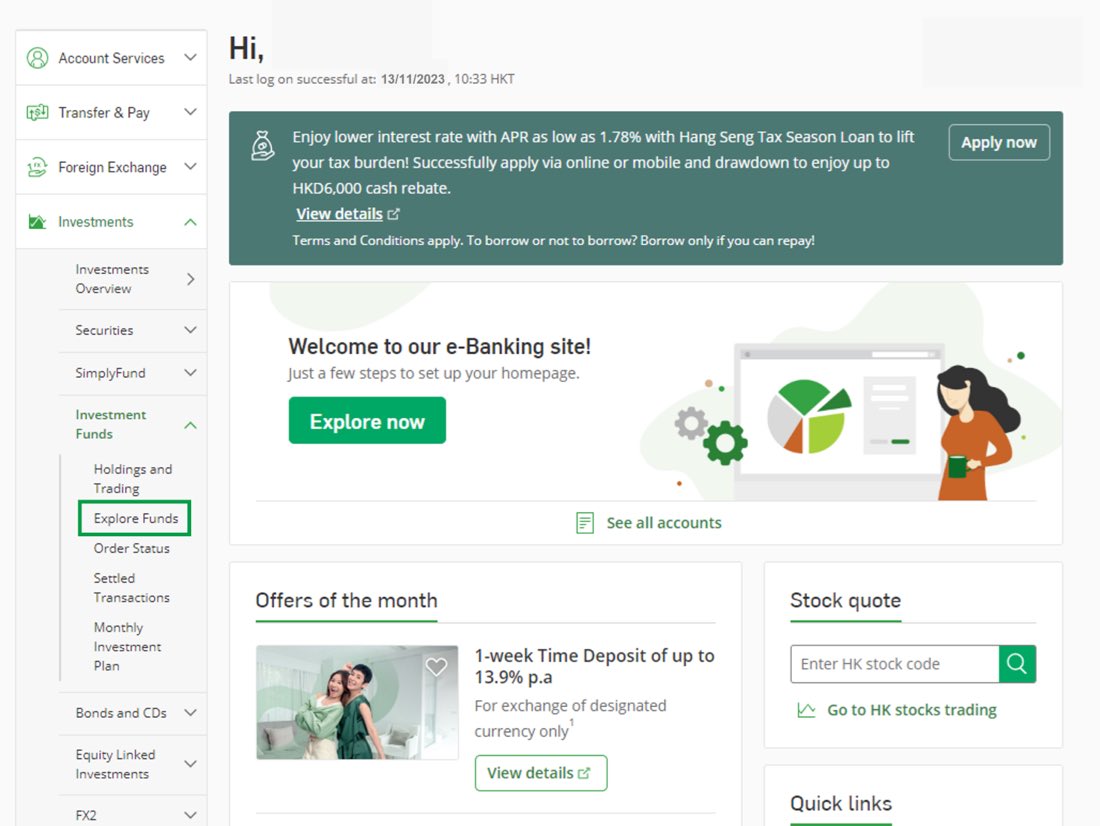

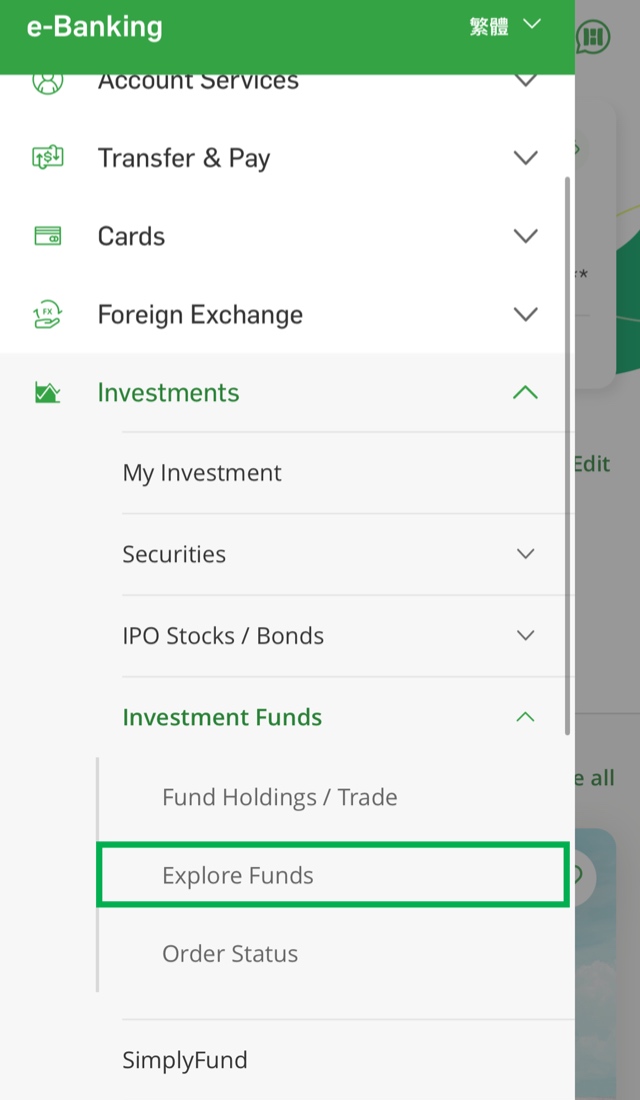

For more information, you can search for more funds in our Fund SuperMart or log on to the Hang Seng Personal e-Banking mobile app, and search for more fund options.

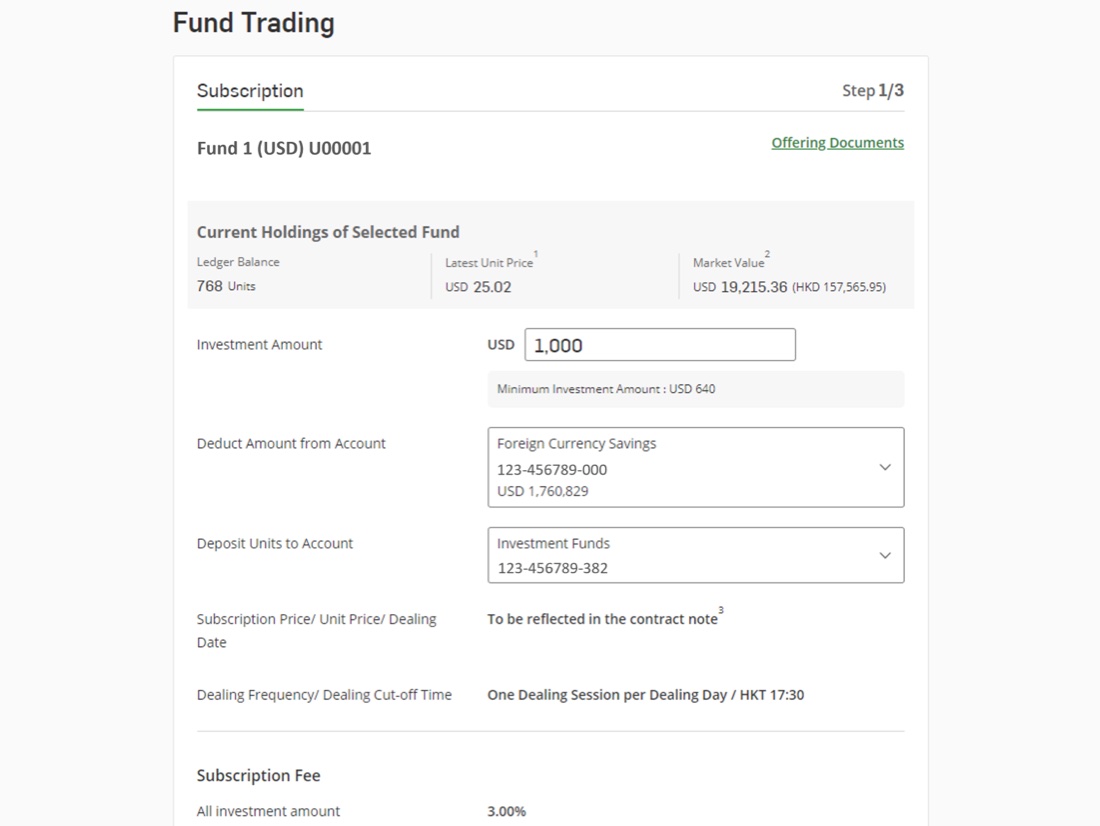

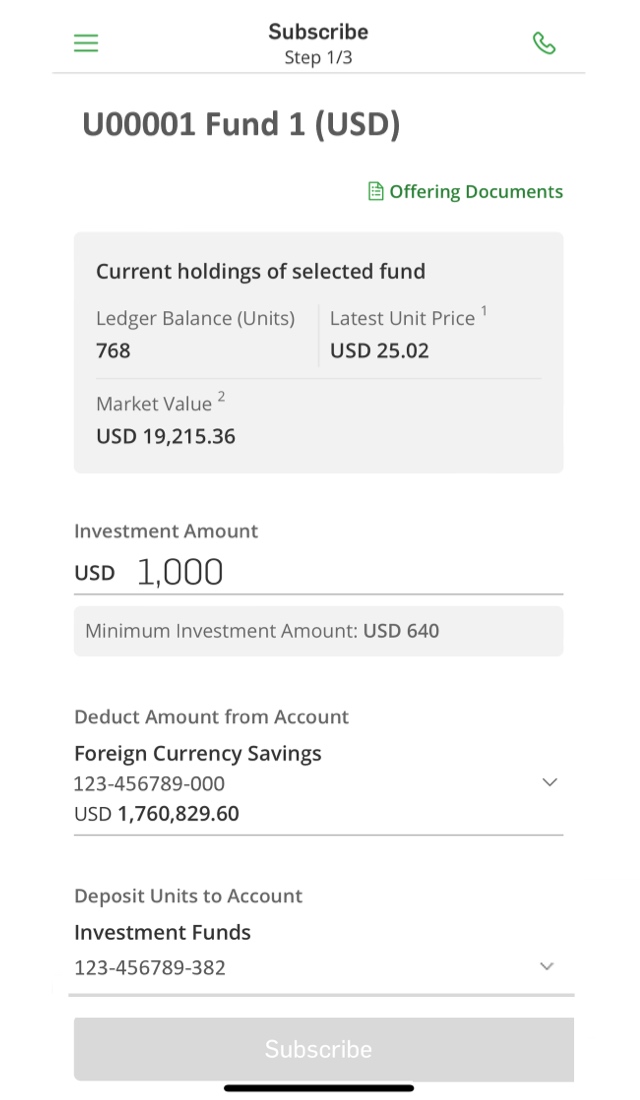

The minimum investment amount in branch is HKD20,000 or equivalent.

The minimum investment amount on Hang Seng Mobile App is HKD5,000 or equivalent.

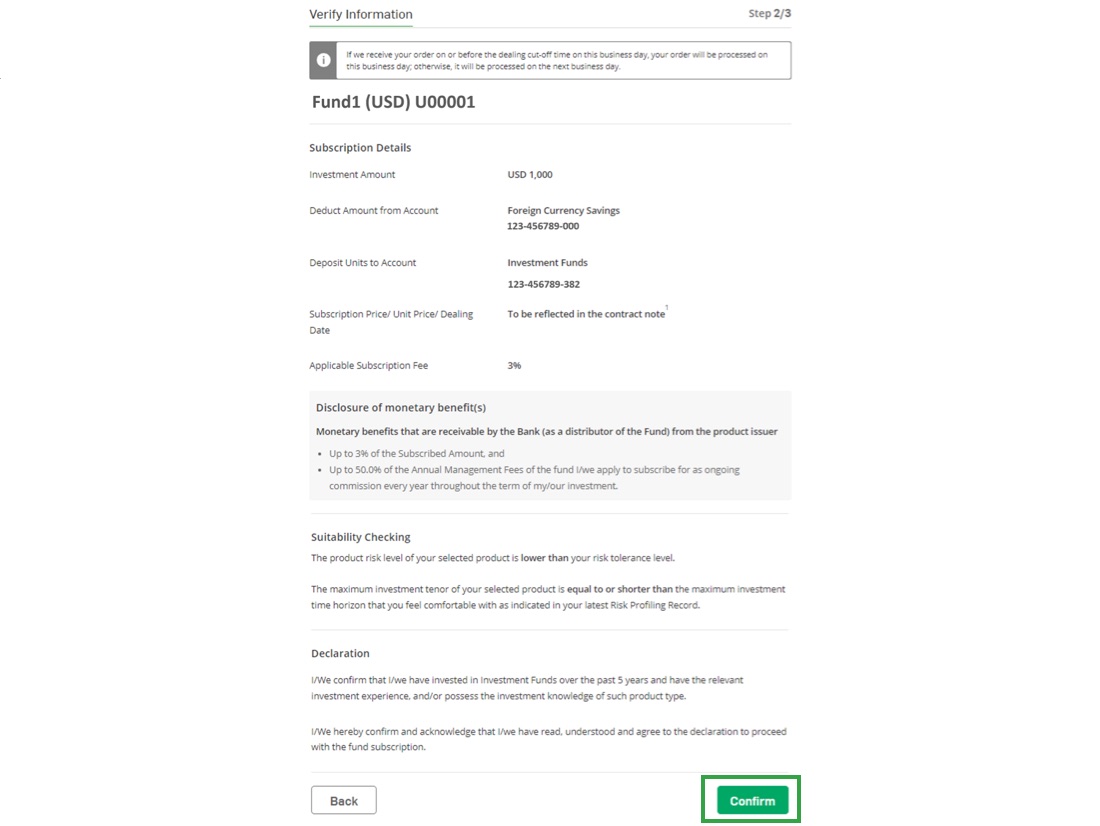

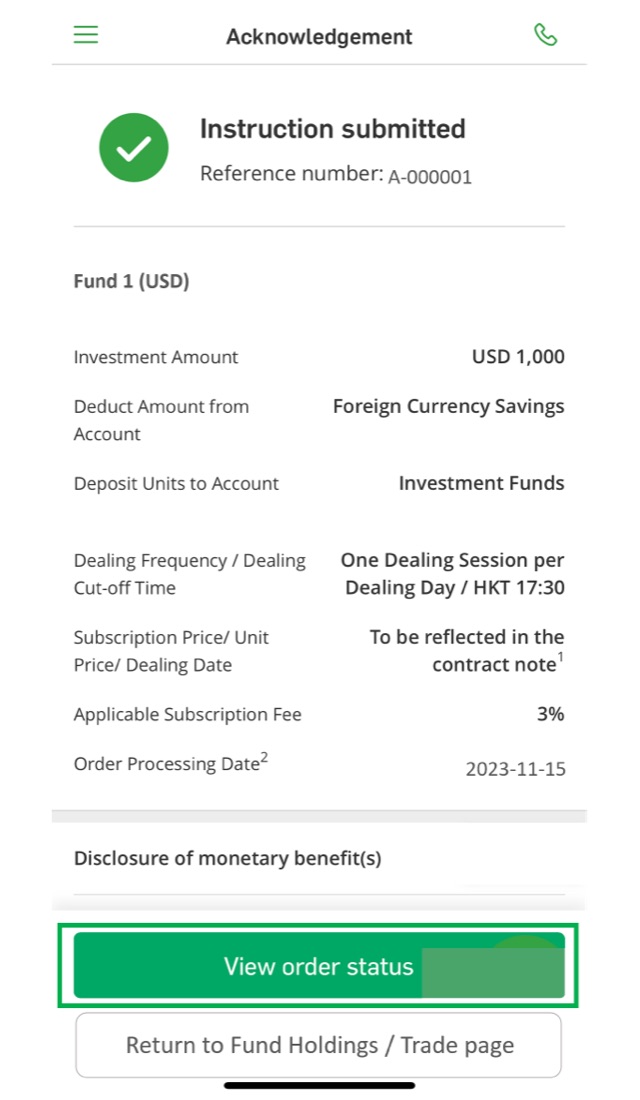

Normally, we deduct the investment amount from your selected account within the same business day when we process your instruction. Please ensure you have sufficient balance in your account.

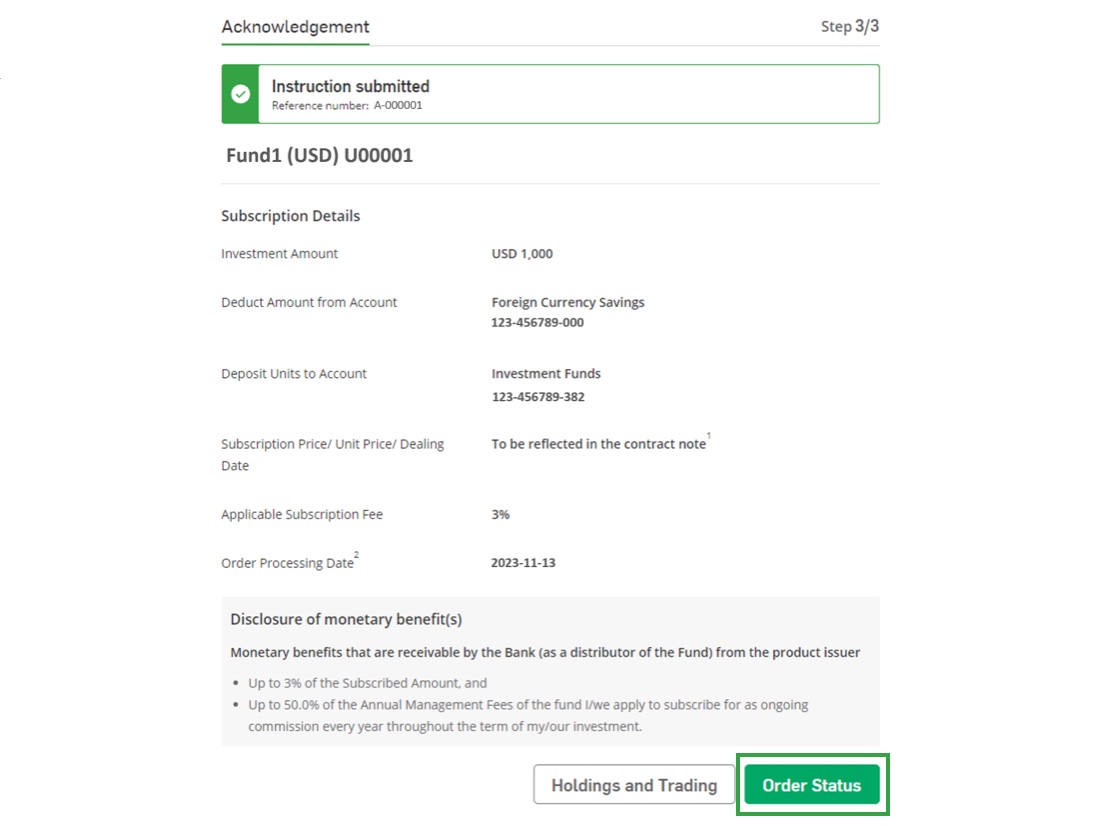

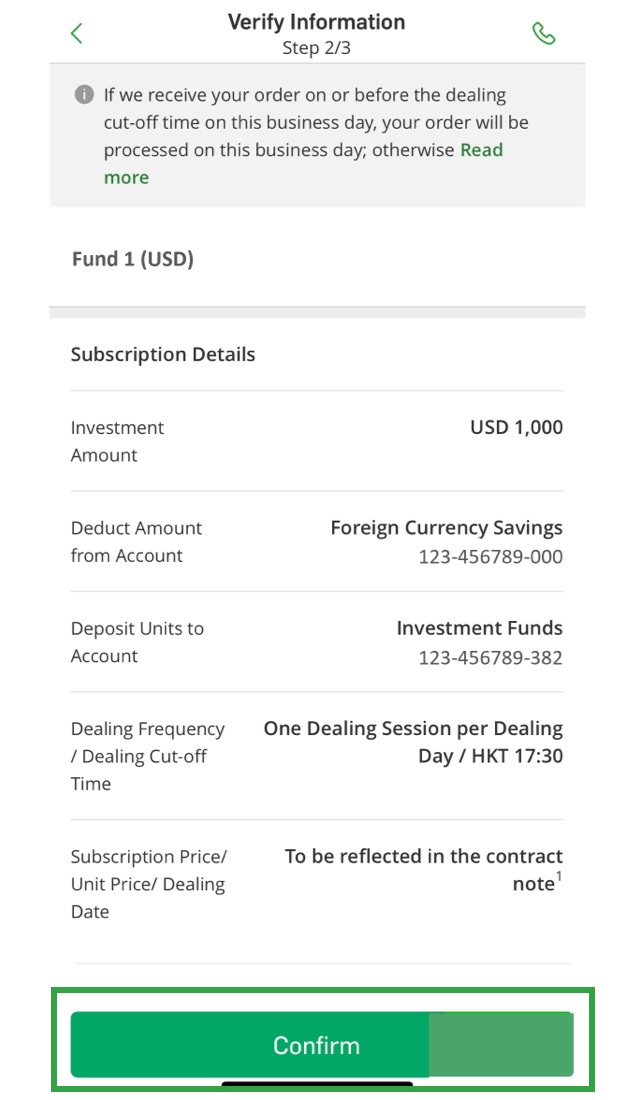

For orders received before the cut-off time of a fund, we will process them on the same day.

After the cut-off time, we will process it in the next dealing day.

Note that the order processing day may not be the fund dealing day, depending on the fund dealing frequency and whether it‘s a holiday in the relevant market.

Please also note that the cut-off time set by the bank may be earlier than that set by the fund manager of the relevant fund, and different cut-off time may be set in respect of applications through the bank and different dealing channels.

This service is solely for personal and non-commercial use and for general information and reference only. Re-distribution of any part in any means is strictly prohibited. Morningstar Asia Limited (the "Information Provider") and Hang Seng Bank Limited (the "Bank") endeavour to ensure the accuracy and reliability of the general financial and market information, news services, market analysis, product information and marketing materials prepared and/or issued by persons other than the Bank (including the Information Provider) (together, "Third Party Information") and the general financial and market information, news services and market analysis, prepared and/or issued by persons other than the Bank (including the Information Provider) and/or the Bank (together "Market Information"), but do not guarantee the accuracy or reliability of the Third Party Information and the Market Information and accept no liability (whether in tort or contract or otherwise) for any loss or damage arising from any inaccuracies or omission. Where the information related to investment funds is sourced externally (as disclosed), the Bank has reasonable belief that such information is accurate, complete and up-to-date.

For information which is "Powered By" the Information Provider and other fund houses, it is being re-transmitted by the Bank in the ordinary course of business to you for general information and reference purposes only. The Bank, its officers, employees, and agents did not devise, select, add to, modify or otherwise exercise control over its contents, do not take responsibility for it nor do they endorse the accuracy of such information.

The Bank also disclaims liability for any loss or damages resulting from the use of information contained herein, or the inability to use such information or in connection with any error, interruption, delay in operation or incomplete transmission, line or system failure.

This service should not be regarded as an offer, solicitation, or recommendation to buy or sell investment products in any jurisdiction to any person to whom it is unlawful to make such an invitation, offer, solicitation or recommendation in such jurisdictions.

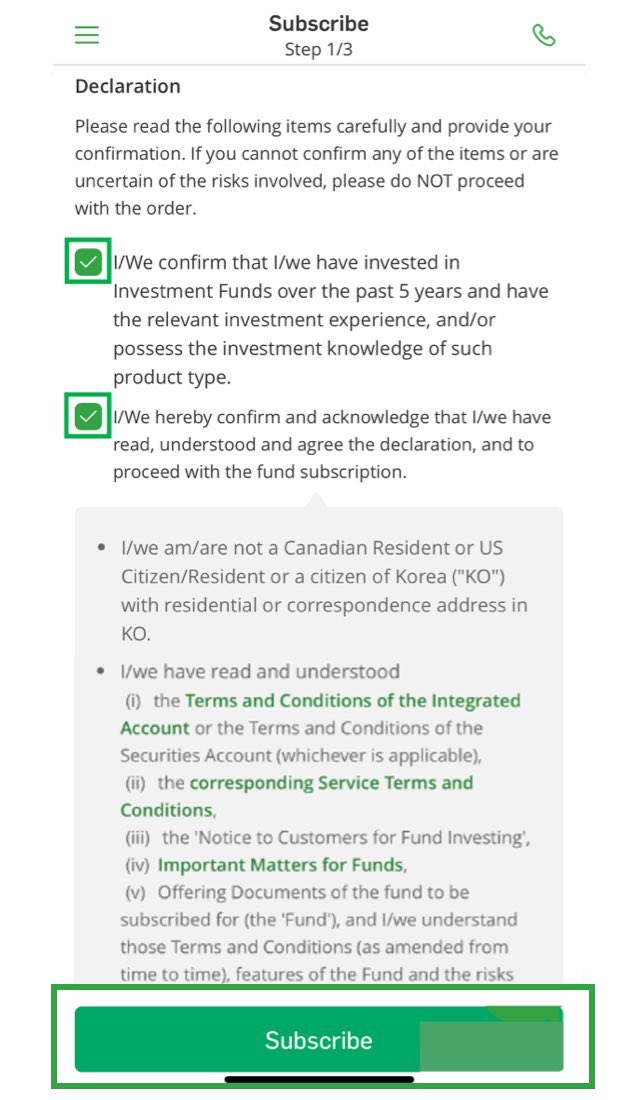

The relevant pages for investment funds have not been reviewed by the Securities and Futures Commission in Hong Kong ("SFC"). The information contained herein is for general information and reference purposes only and is not intended to provide professional investment or other advice. It is not intended to form the basis of any investment decision. Persons accessing this website should not make any investment decision based solely on the information and services provided herein. Before making any investment decision, persons accessing this website should take into account his/her own circumstances including but not limited to his/her financial situation, investment experience and investment objectives, and should understand the nature, terms and risks of the relevant investment funds. Persons accessing these pages should obtain appropriate professional advice where necessary.

Investors should note that all investments involve risks (including the possibility of loss of the capital invested), prices or value of investment fund units may go up as well as down and past performance information presented is not indicative of future performance.

In a worst case scenario, the value may be worth substantially less than the invested amount. Investment may involve substantial market, volatility, liquidity, regulatory and political risks. Funds invested in a limited number of markets, sectors or companies will be subject to higher risk and are more sensitive to price movements.

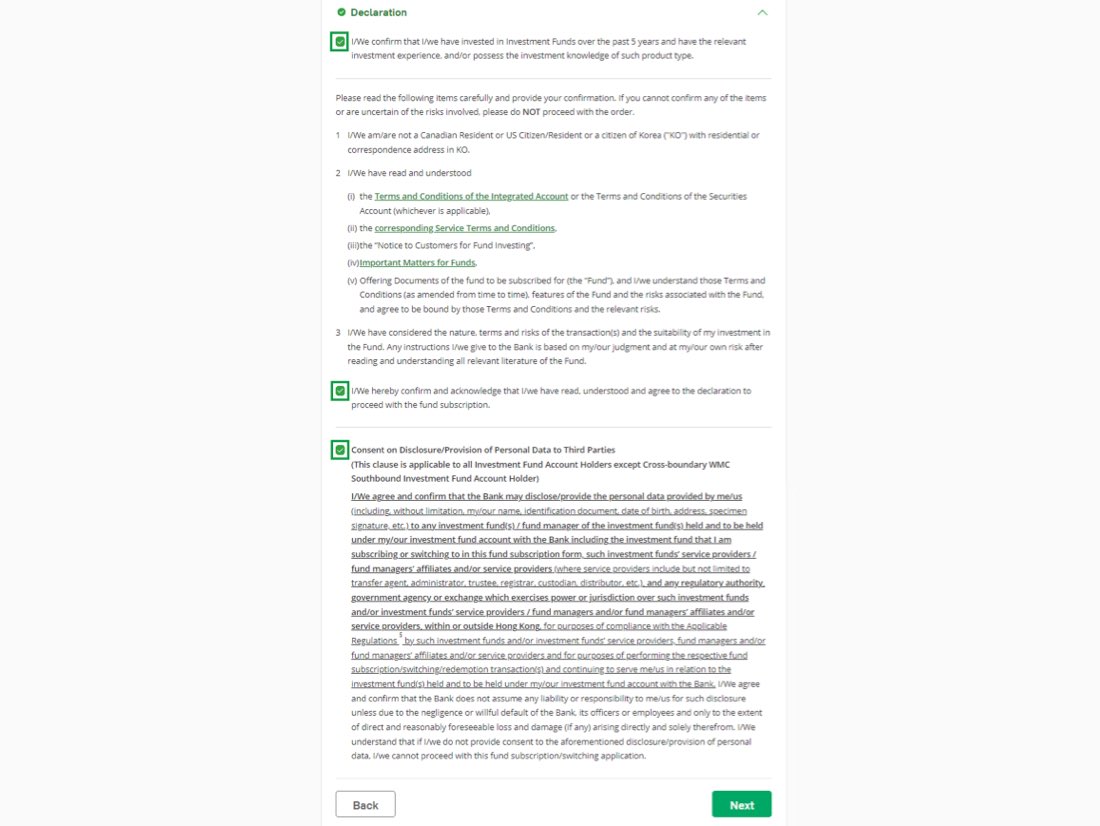

Investors should read carefully and understand the relevant offering documents of the investment funds (including the fund details and full text of the risk factors stated therein) and the Notice to Customers for Fund Investing before making any investment decision.

Chat with H A R O WhatsApp now