We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Please read the Important Risk Warning for Monthly Investment Plan For Funds.

Customers can exclusively enjoy a preferential fund subscription fee of as low as HKD8 for Monthly Investment for Funds service via e-Banking. New funds available now. View offer

Hang Seng Monthly Investment Plan is a regular subscription investment. Through this monthly fund investment plan, you can invest your contribution consistently to grow your wealth and capture returns, regardless of the market fluctuation.

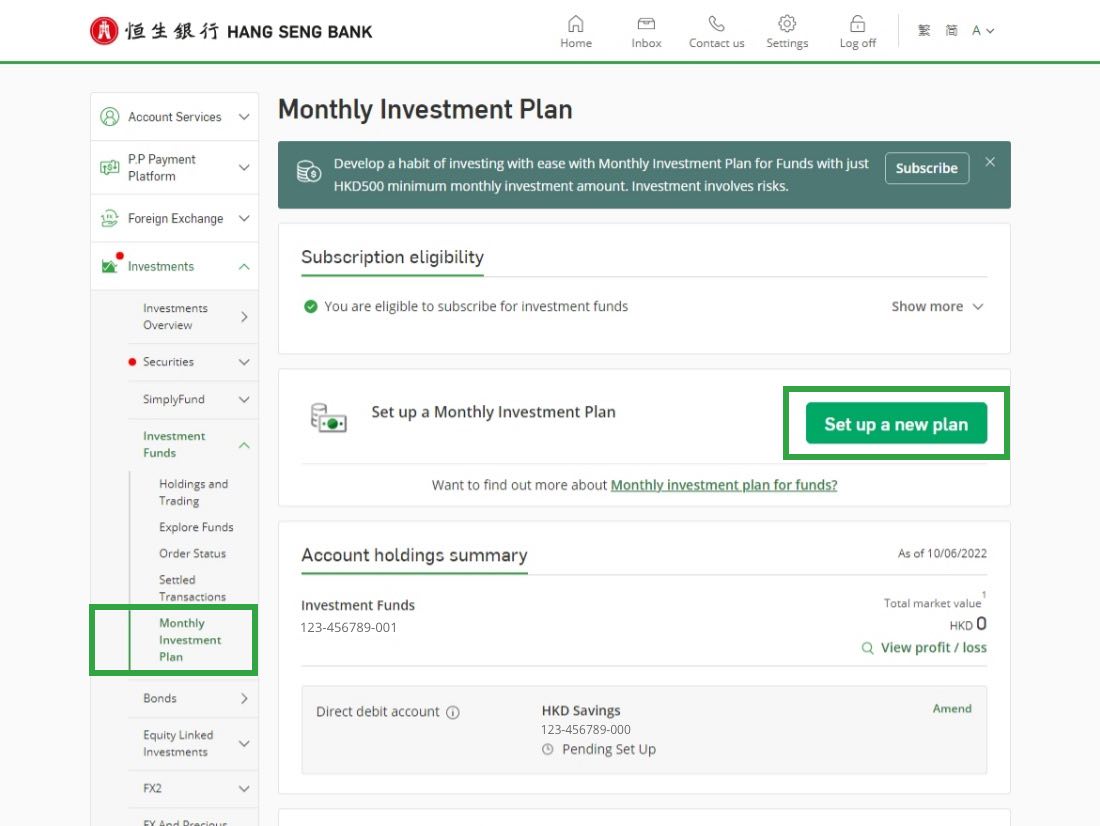

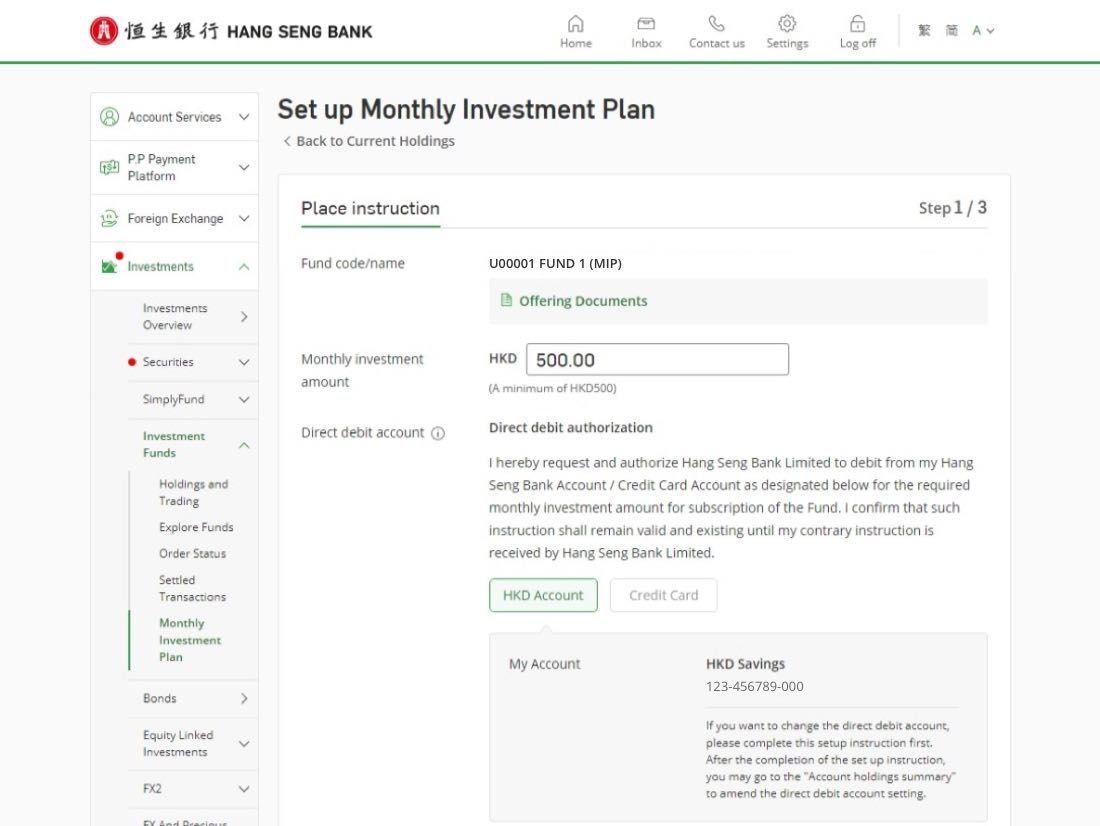

Subscribe in just 3 quick steps

Minimum monthly investment is as low as HKD500 to start your monthly fund investment journey.

No minimum investment holding periods and termination charges. You can update your investment instructions anytime.

Dollar Cost Averaging strategy helps reduce the impact of short- term price fluctuations.

Earn the rewards by making payment of monthly contribution with Hang Seng credit cards.[1]

"Buy low sell high" is always the investment golden rules, but sometimes you may take the wrong step to speculate the right market timing. Hang Seng Monthly Investment Plan for Fund operates based on Dollar Cost Averaging, help you to save time in capturing market opportunities, reduce risks and let you to start on a hassle-free investment journey in the long run.

When the unit price is high, the same amount buys fewer units.

| When the unit price is low, the same amount buys more units. |

After a period of time, the costs of fund units will be averaged out. In the long run, this helps to reduce the impact from short-term market fluctuations on investment.

Suppose in January, you buy a fund with HKD3000 in one go, the fund price would be rather high at HKD10 per units, so you can only buy 300 fund units.

After purchasing the funds systematically for 6 months, the average acquisition cost would be averaged out. In this particular example, the average fund price would work out to HKD5.76 per unit, and you would have 520 fund units.

Please visit Fund SuperMart and refer to the relevant fund's offering documents.

The applicable subscription fee may vary depending on the fund type, monthly investment amount and relevant offer Terms and Conditions.

| Fund Type | Regular Subscription Fee |

|---|---|

| Index Funds[6] | 2% |

| Bond Funds[7] | 2% |

| Other Fund Types | 3% |

1%

Nil

Nil

Nil

Popular questions

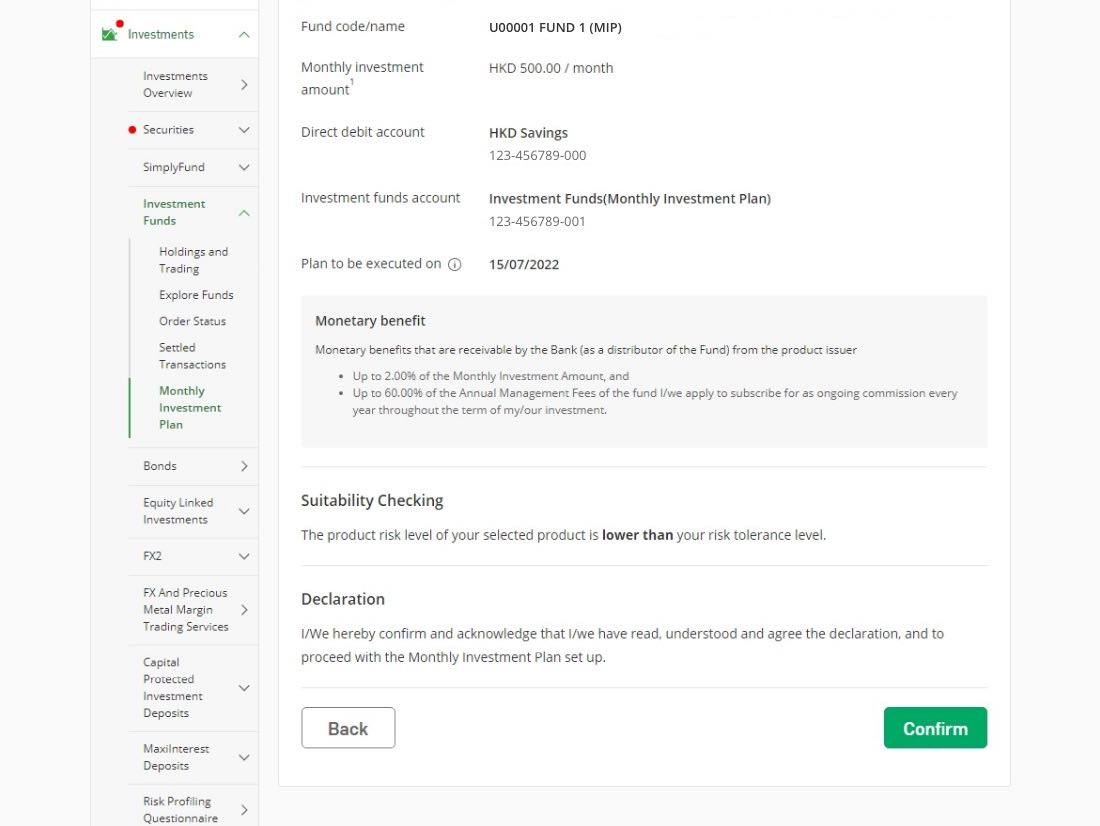

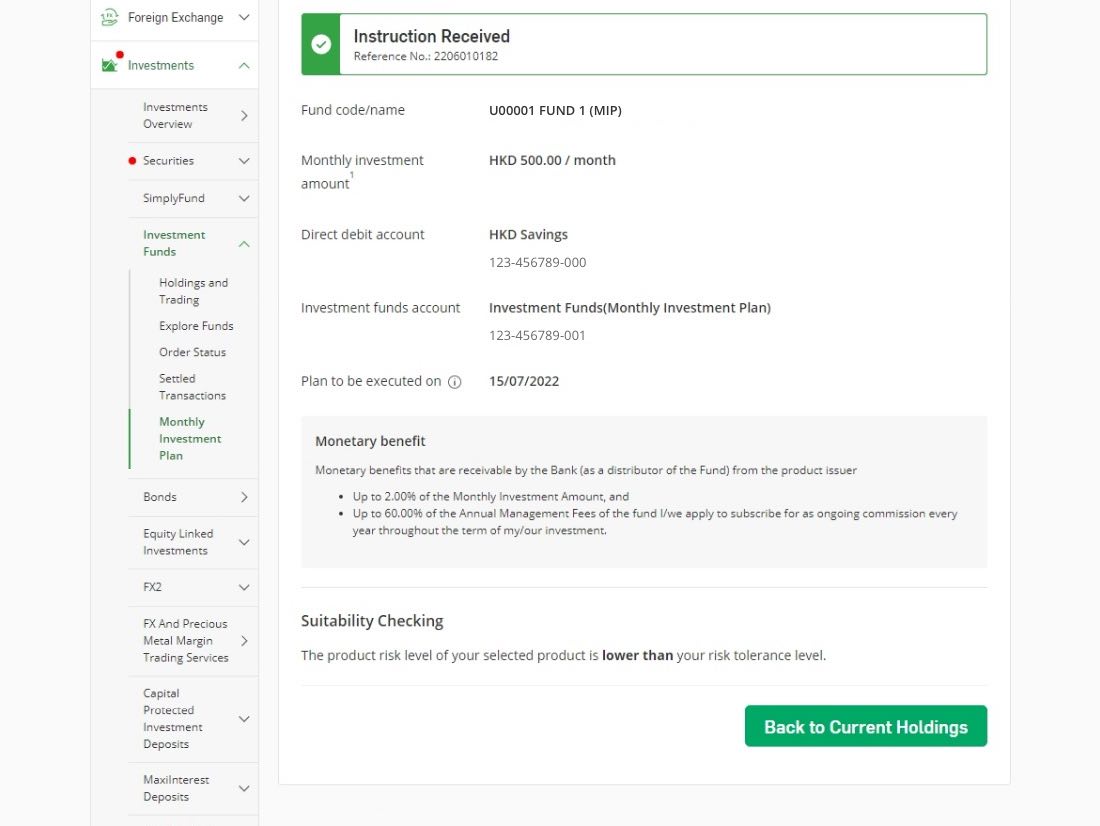

For sole name / joint names Integrated Account customers, you can open an Investment Fund account and apply to set up a Monthly Investment Plan for Funds through Hang Seng Personal e-Banking. The set-up instruction will be effective in the next calendar month and the first payment date will be the 15th calendar day of the following month (If there are no clearing services provided by Hang Seng Bank for the monthly contribution on such day, it will be the next day on which clearing service for such payment is available).

No. If you have already set up a monthly investment plan for funds, or have a set-up/amendment instruction pending for a fund, you cannot set up another plan for Funds the same fund under the same Investment Fund account.

The 3rd business day after the payment date.

Payment[11]

The 15th calendar day of each month

(If there are no clearing services provided by the Bank for the monthly contribution on such day, it will be the next day on which clearing service for such payment is available)

Subscription and Adjustment

Instruction received on or before the last business day of the relevant month will be effective on the payment date for the next month.

Redemption[13]

Redemption proceeds will be credited to customer's account within around 10 working days after the day units in the relevant fund are redeemed. The actual processing time will depend on individual fund's operation situation; generally it will not exceed one calendar month.

Termination

Instruction received on or before the last business day of the relevant month will be effective on the payment date for the next month.

To borrow or not to borrow? Borrow only if you can repay!

This service is solely for personal and non-commercial use and for general information and reference only. Re-distribution of any part in any means is strictly prohibited. Morningstar Asia Limited (the "Information Provider") and Hang Seng Bank Limited (the "Bank") endeavour to ensure the accuracy and reliability of the general financial and market information, news services, market analysis, product information and marketing materials prepared and/or issued by persons other than the Bank (including the Information Provider) (together, "Third Party Information") and the general financial and market information, news services and market analysis, prepared and/or issued by persons other than the Bank (including the Information Provider) and/or the Bank (together "Market Information"), but do not guarantee the accuracy or reliability of the Third Party Information and the Market Information and accept no liability (whether in tort or contract or otherwise) for any loss or damage arising from any inaccuracies or omission. Where the information related to investment funds is sourced externally (as disclosed), the Bank has reasonable belief that such information is accurate, complete and up-to-date.

For information which is "Powered By" the Information Provider and other fund houses, it is being re-transmitted by the Bank in the ordinary course of business to you for general information and reference purposes only. The Bank, its officers, employees, and agents did not devise, select, add to, modify or otherwise exercise control over its contents, do not take responsibility for it nor do they endorse the accuracy of such information.

The Bank also disclaims liability for any loss or damages resulting from the use of information contained herein, or the inability to use such information or in connection with any error, interruption, delay in operation or incomplete transmission, line or system failure.

This service should not be regarded as an offer, solicitation, or recommendation to buy or sell investment products in any jurisdiction to any person to whom it is unlawful to make such an invitation, offer, solicitation or recommendation in such jurisdictions.

The relevant pages for investment funds have not been reviewed by the Securities and Futures Commission in Hong Kong ("SFC"). The information contained herein is for general information and reference purposes only and is not intended to provide professional investment or other advice. It is not intended to form the basis of any investment decision. Persons accessing this website should not make any investment decision based solely on the information and services provided herein. Before making any investment decision, persons accessing this website should take into account his/her own circumstances including but not limited to his/her financial situation, investment experience and investment objectives, and should understand the nature, terms and risks of the relevant investment funds. Persons accessing these pages should obtain appropriate professional advice where necessary.

Investors should note that all investments involve risks (including the possibility of loss of the capital invested), prices or value of investment fund units may go up as well as down and past performance information presented is not indicative of future performance. The value of investments and the income (if any) from them can fluctuate and is not guaranteed. In a worst case scenario, the value may be worth substantially less than the invested amount. Investment may involve substantial market, volatility, liquidity, regulatory and political risks. Funds invested in a limited number of markets, sectors or companies will be subject to higher risk and are more sensitive to price movements.

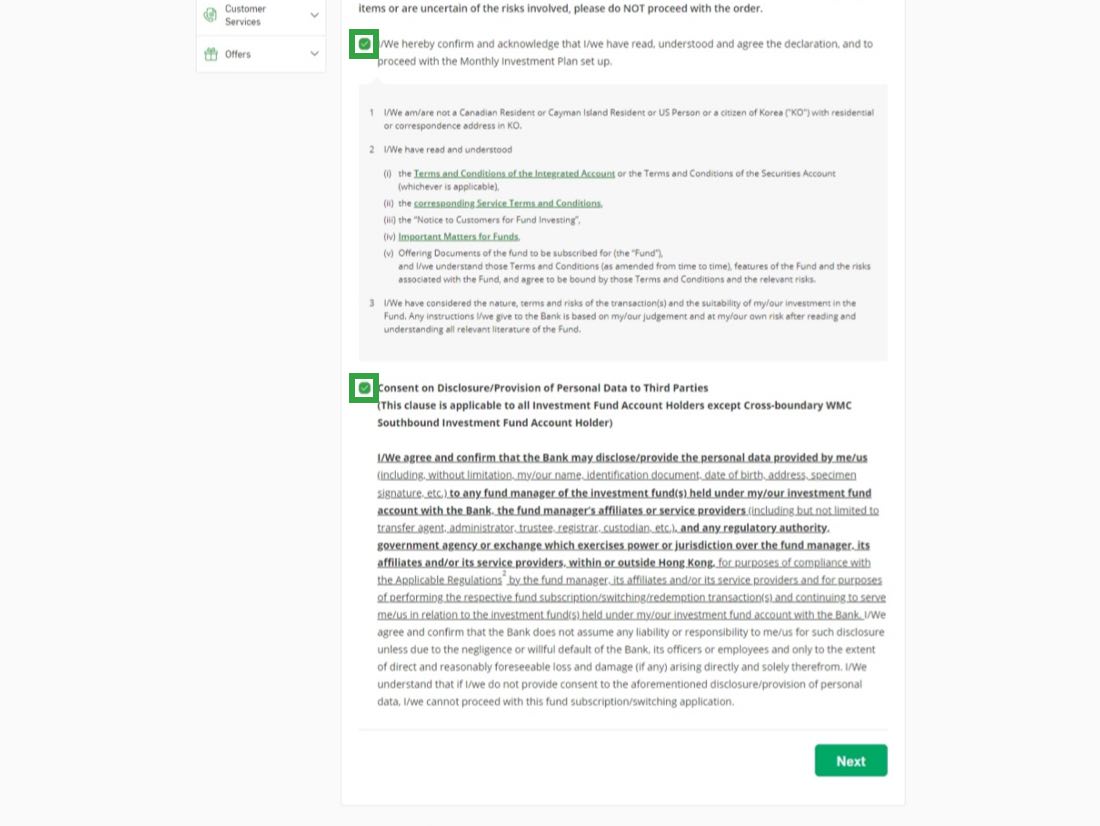

Investors should read carefully and understand the relevant fund's offering documents (including the fund details and full text of the risk factors stated therein and the Notice to Customers for Fund Investing before making any investment decision. Investment funds are investment products and some may involve derivatives. Investors should carefully consider their own circumstances whether an investment is suitable for them in view of their own investment objectives, investment experience, preferred investment tenor, financial situation, risk tolerance abilities, tax implications and other needs, etc., and should understand the nature, terms and risks of the investment products. Investors should obtain independent professional advice if they have concerns about their investment.

Want to know more about

Monthly Investment Plan for Funds?

Want to know more about

Monthly Investment Plan for Funds?

Chat with H A R O now