We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Important tips for transfer

For transfers to Morocco, you now need to provide the payee's 24-digit account number. Please confirm the account number with your payee, then choose "New Payee" to register the new number; for transfers to Bulgaria, we'll no longer support transfers in Bulgarian lev (BGN). Please choose euro (EUR) to complete the transfer.

Enjoy up to 17% p.a. 1-week time deposit rate for designated currencies exchange and earn stable interest return. View details

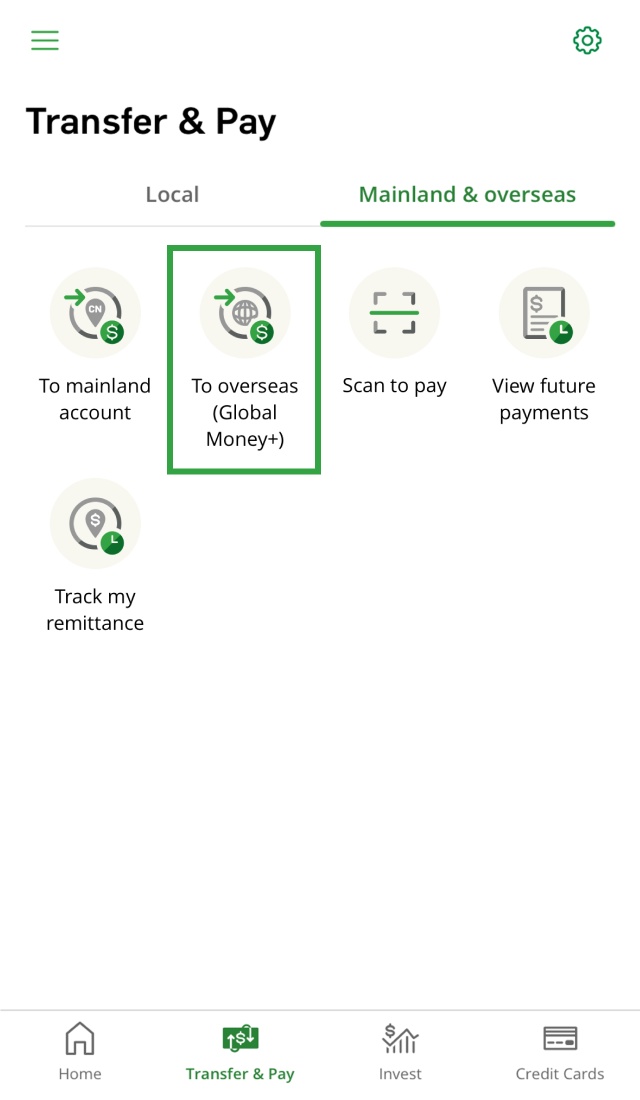

With Global Money+[1], you can send money overseas in just a few steps using Hang Seng Mobile App, even you're on the go! You can enjoy $0 handling fee for transfers to designated countries and regions, ensuring hassle-free and cost-effective transfers.

Transfer to CA, UK, US, AU, NZ and others at no cost

Hang Seng personal customers can transfer funds in local currency to over 50 designated countries or regions[2], such as Canada, the United Kingdom, the United States, Australia and New Zealand, without any handling fee.

If you need to transfer non-local currency (e.g. USD to UK) or to other non-designated countries or regions (e.g. Japan), it only costs HKD160 or equivalent regardless of the overseas banks fee[3].

Fastest same-day arrival

Transfer to applicable countries / regions and currencies will arrive within the same day at the earliest. Other transfers will generally arrive in 1 to 4 working days[4].

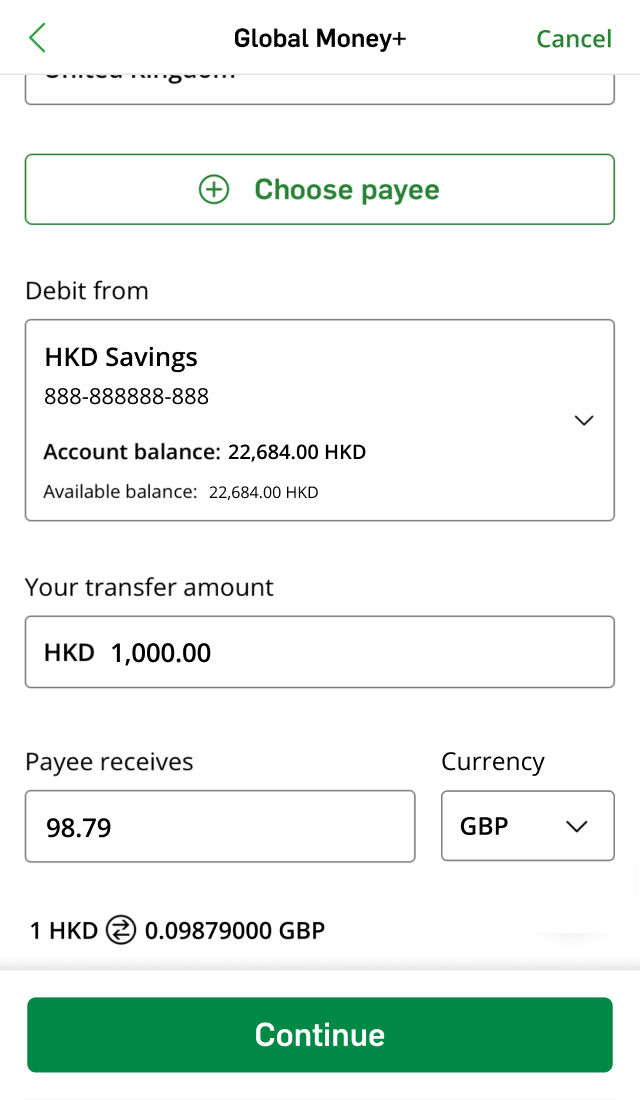

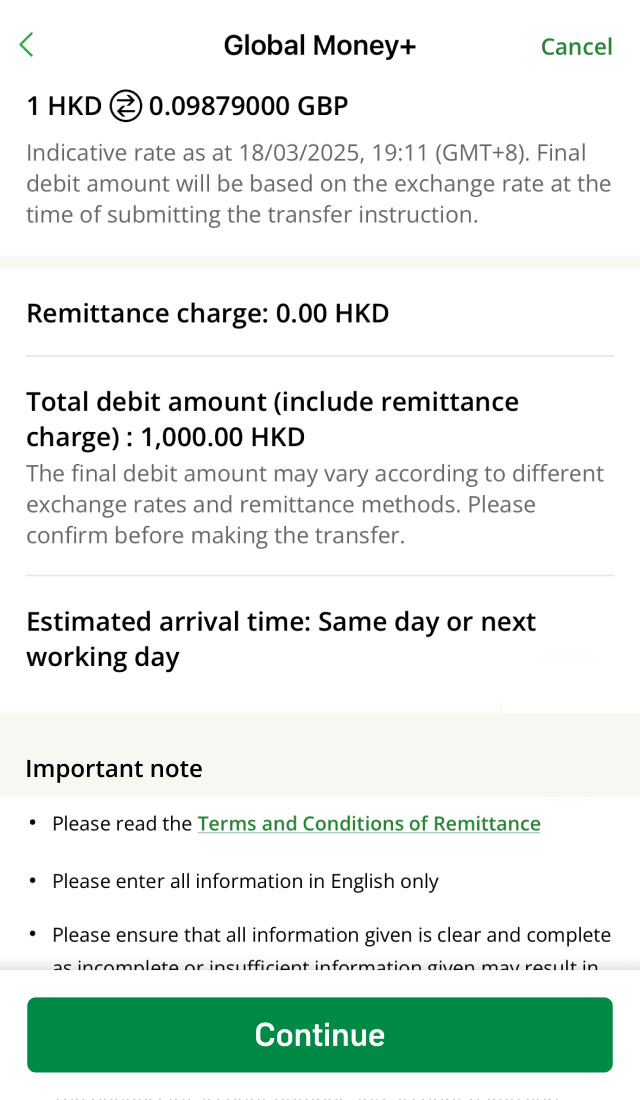

All transfer details are clear at a glance

Whether it's the exchange rate, handling fee and estimated arrival time, we'll list them clearly to make your transfer more transparent and help you budget more effectively!

Terms and conditions apply.

Fee waiver is applicable to overseas transfer in local currencies for certain designated country / region only. For overseas transfers, you'll need to provide basic payee information (e.g. payee name and address).

Make sure you provide the correct country / region bank code for successful transfers, which can be found on bank websites or bank statements. You can refer to the lists below for details:

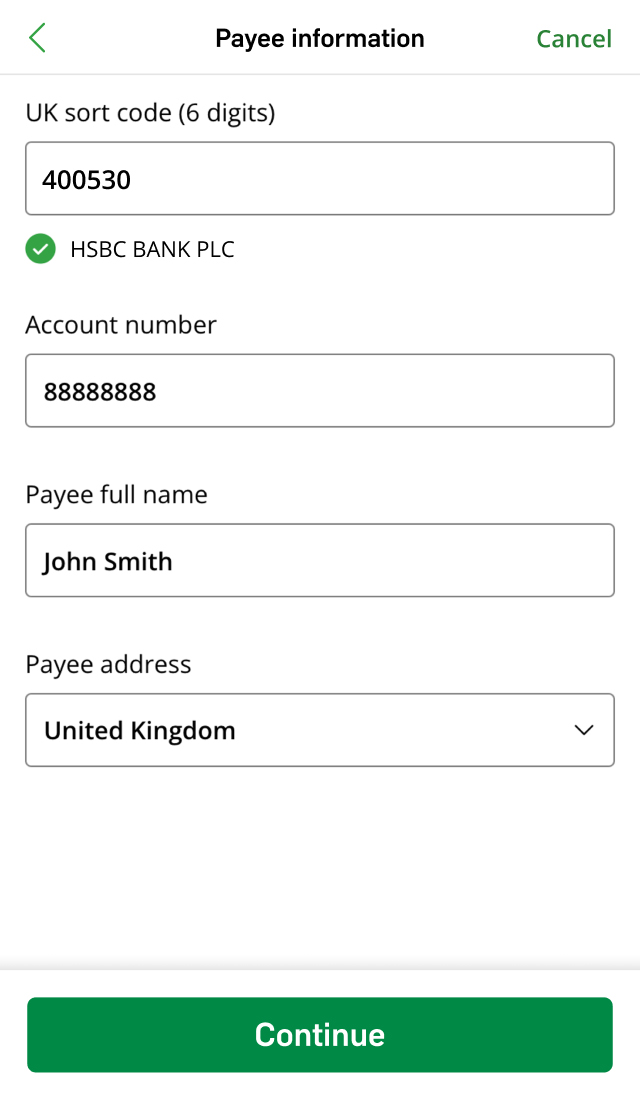

Each country has its own applicable bank code, common examples include: the United Kingdom (Sort Code), the United States (Routing Number), Canada (Institution Number and Transit Number), Australia (BSB number) and New Zealand (National Clearing Code). You can refer to the table in the above lists (scroll to bottom) for details.

The handling fee is subject to the transfer type:

Please note, some receiving and/or correspondent banks may still charge an additional fee to payee when they process the transaction. For example, the charges may vary for transfer to the US based on payee details, while for the below countries, it depends on the length of the payee's account number:

Specific requirements may apply to waive fees for certain designated country or region transfers.

When making a transfer, the fee details will be shown for your reference before you confirm the transfer. For details, please refer to Banking Services Fees and Charges.

The estimated time of arrival time depends on which country or region you're sending money to. It generally takes 1 business day to transfer local currencies to designated countries or regions, while other transfers may take 1 to 4 business days.

The estimated time of arrival of your transfer will be shown for your reference before you confirm and after you submit the instruction.

You can't amend or cancel a Global Money+ transfer that has already been made.

If you'd like to recall a submitted transfer instruction due to incorrect payee information, please call us at (852) 2822 0228 (press #-1-7-4 after choosing language) for assistance. Once we receive your request, we'll request the receiving bank to recall the transfer on your behalf. The result is subject to receiving bank's decision, and we can't guarantee you'll get the money back.

If the payee hasn't received your transfer within a reasonable time, it may be because the receiving bank's local clearing process takes time. You can call us at (852) 2822 0228 (press #-1-7-4 after choosing language) and provide the below information for us to follow up:

If receiving bank rejects your transfer, the amount will be credited back to your account. The refund time is subject to receiving bank's processing time and you'll be notified when the refund's made. Please note, some receiving and/or correspondent banks may charge additional fee when they process the transaction.

You can use Global Money+ as long as you hold an Integrated Account, current or savings account and have already registered for Hang Seng Mobile App.

Over 50 designated countries or regions don't require handling fee, you can refer to the full list under "List of free-of-charge country or region" section in this page.

Depending on the country or region you're transferring to, you need to provide the below information:

You can learn more under "List of free-of-charge country or region" section in this page.

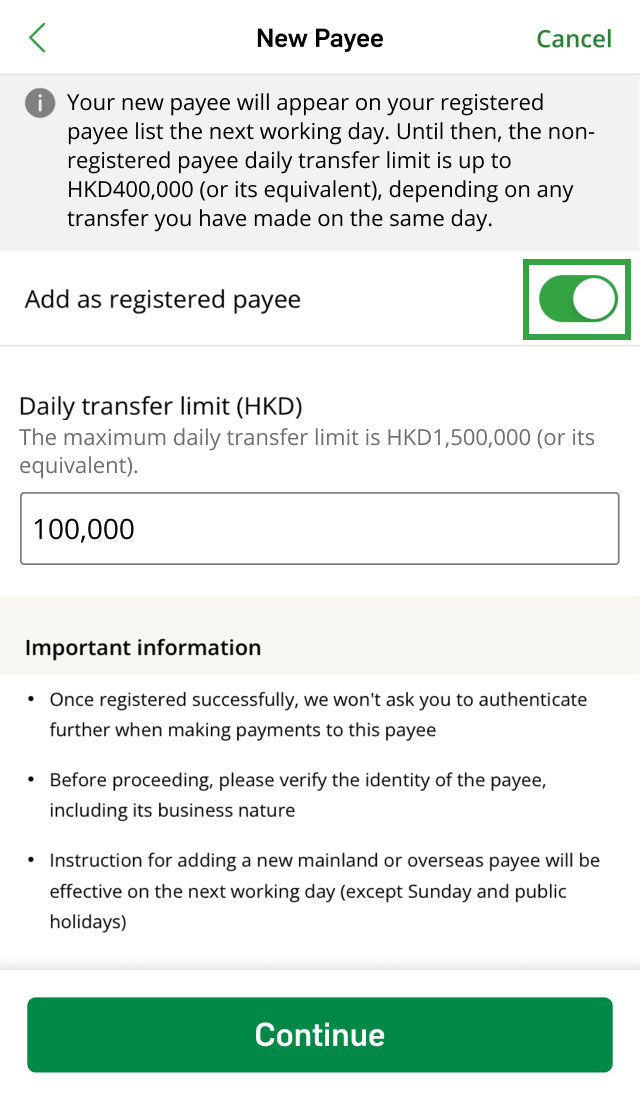

Yes. You can add a new payee during the Global Money+ transfer process. To learn how, please refer to the "Add payee for easier future transfers" tab under "How Global Money+ works" section in this page.

If the Global Money+ transfer involves foreign exchange, the page will display real-time exchange rates updated every 60 seconds (except for CNY). Before completing the transfer, we'll ask you to confirm the exchange rate and other payment details. You'll be notified if the exchange rate has been refreshed. Make sure you check the exchange rate again before confirming the transfer.

For transfers involving foreign exchange of CNY, the actual debit amount and exchange rate will be calculated based on the exchange rate on the execution time of your transfer.

We can't track the arrival time of the transfer, but you'll receive notification when the transfer amount is debited from your bank account.

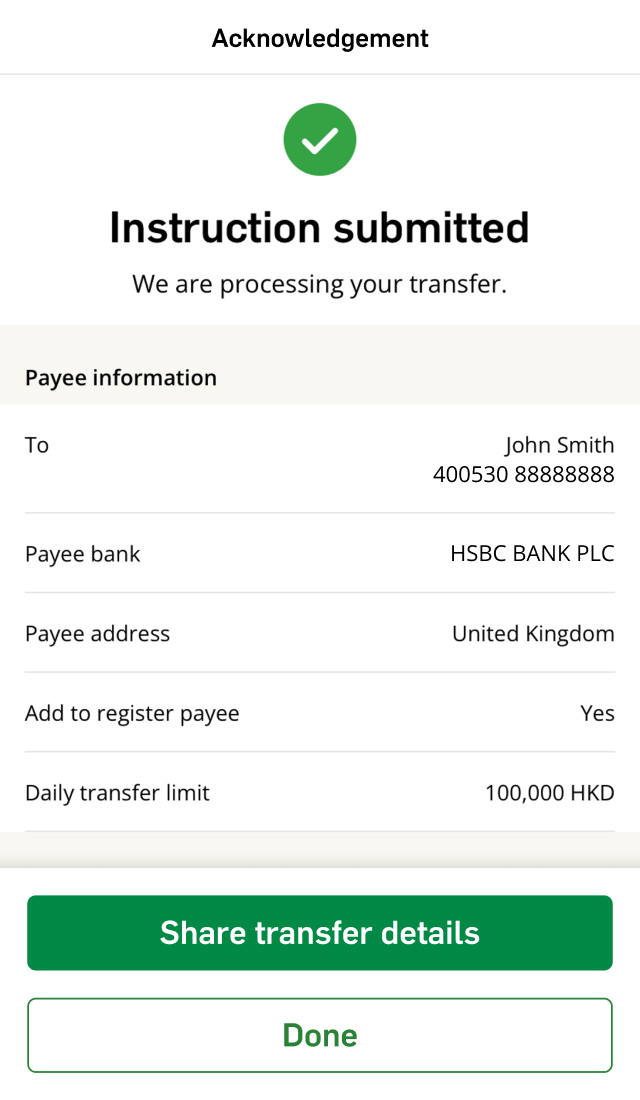

The non-registered payee daily transfer limit is up to HKD400,000, which is shared by (i) cross-border transfers, (ii) transfers to non-registered third-party Hang Seng accounts, (iii) remittances and (iv) fund transfers to non-registered payee's other Hong Kong bank accounts through FPS or CHATS.

The registered payee daily transfer limit is up to HKD1,500,000, which is shared by (i) cross-border transfers, (ii) fund transfers to registered third-party Hang Seng accounts, (iii) remittances and (iv) fund transfers to registered payee's other Hong Kong bank accounts through FPS or CHATS.

The maximum mainland & overseas daily transfer limit is HKD1,500,000, and only applies to the transfer to payee outside Hong Kong. The transfer amount may also subject to registered payee daily transfer limit, non-registered payee daily transfer limit or small value daily transfer limit, whichever is lower. Mainland & overseas daily transfer limit is applicable to mainland and overseas transfer, FPS × PromptPay QR Payment.

For transferring CNY to mainland China, please refer to the questions under the part of “Mainland China transfers” below. Please note, CNY transfers to self-named account in mainland China will be subject to a daily limit of CNY80,000 based on CNY transfer regulations. For details, please refer to FAQs of Cross-Border Transfer.

You'll be notified via SMS, email and/or push notification (if enabled) when we debit funds from your account.

We currently don't provide recurring and future dated payment services for Global Money+.

Yes. If you've registered an overseas payee in Personal e-Banking, you can use the record for Global Money+. However, depending on the receiving country or region, you'll need to supplement the corresponding bank code.

We've implemented multiple authentication to protect your account security:

You can also make an overseas transfer via methods below:

Yes, currently only personal customers with a Hang Seng personal CNY account (non-commercial customers) can transfer CNY to a self-named personal CNY account in mainland China. According to the current CNY transfer regulations, HKID Card holders must transfer to a self-named account, and the maximum daily CNY transfer limit per person is CNY80,000. Transfers used for the purchase or mortgage repayment of residential properties in the Greater Bay Area are not subject to this restriction.

Non-HKID Card holders must adhere to the local rules and requirements of mainland China or the relevant jurisdictions for transferring funds to mainland China or places outside Hong Kong. Please note that the overseas transfer may be rejected due to local regulatory requirements and rules and subject to charges applicable to returned transfers.

The purpose of payment is required for CNY remittance to mainland China. Please refer to Purpose of Payment Category for details.

The handling fee for transfers via different channels are:

The above handling fees don't include corresponding bank charges. To learn more about the privileges for Prestige Private or Prestige Banking customers, please refer to Banking Services Fees and Charges.

If Hong Kong and Macau residents purchase new and second-hand residential properties in 9 Greater Bay Area cities, namely Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen, and Zhaoqing, and/or pay for mortgage repayment or relevant property purchase price (e.g. deposit, security deposit, down payment, full payment, public maintenance fund, home purchase-related taxes and liquidated damages, etc.), such transfer isn't subject to the limit.

This transfer service is currently only available at our branches, but you don't need to make an appointment in advance.

You should provide your receiving account information, including the account number, the account and bank name, and the related bank's SWIFT code. For transfer made to Hang Seng Bank accounts, please provide our bank name "Hang Seng Bank Limited" and our SWIFT code "HASEHKHH".

For US transfers, you should also provide our CHIPS number "010522", in addition to the above information.

In general, money will be credited to your account on the same business day if we receive the transfer instruction from the transferring bank before the cut-off time (Mon to Fri: 5:30 p.m., Sat: 11:00 a.m.; excluding public holidays).

Money transferred directly from an overseas bank to us isn't subject to handling fees. Learn more via Banking Services Fees and Charges.

If you opt in paper advices, we'll mail the advice to you on the next working day after the money is credited.

If you have Personal e-Banking and opt for e-Advices, you'll receive the Inward Remittance e-Advice instantly on the day the money is credited. The advice will be saved for 30 days and automatically deleted afterwards.

Based on exchange regulations, HKID Card holders can receive CNY transfer if they've previously transferred money from their CNY account in Hong Kong to their self-named account in mainland China. In such cases, with prior approval from the relevant financial institutions in mainland China, the amount they can transfer back shouldn't exceed the original transfer amount. Transfers from mainland China or overseas for non-HKID Card holders are subject to the regulations of the respective regions.

You can learn more about the details via smart tips for inward payments.

Please ensure that the payment information you provide is complete and accurate to avoid delays or rejection of the transfer.

If the payer provides incorrect payment information (e.g. wrong account name or number), and we can identify you as the payee, we may ask you to inform the payer to update the information via the correspondent bank. You can call our Remittance Hotline at (852) 2123 1088 to check your transfer status.

Effortlessly send money overseas from the comfort of your home using your computer or tablet with just a few clicks. Enjoy peace of mind as you easily track your transfer progress and status.

Planning for your children's studies abroad requires thorough preparation. Studysure Protection Plan offers comprehensive protection for your children, providing 24/7 support in case of emergencies while they're overseas.

Manage your cross-border accounts easily and transfer up to 10 currencies between your self-named Hang Seng accounts in Hong Kong and mainland China anytime and anywhere.

Get 24/7 support from our Virtual Assistant.

You can find more details about applicable bank code under this list.

Country / region |

Currency |

Applicable bank code |

|---|---|---|

Canada |

CAD |

Canadian Institution Number / |

| United Kingdom | GBP / EUR | Sort Code / IBAN |

| United States | USD | Routing Number (or ABA Routing Number)

(When sending money to the US, the charges may vary based on payee details. The fee details will be shown for your reference before you confirm the transfer.) |

| Australia | AUD | Australian Bank State Branch (BSB) |

| New Zealand | NZD | National Clearing Code (NCC) |

| Singapore | SGD | SWIFT / BIC |

| Andorra | EUR | IBAN |

| Austria | EUR | IBAN |

| Belgium | EUR | IBAN |

| Bulgaria | EUR | IBAN |

| Croatia | EUR | IBAN |

| Cyprus | EUR | IBAN |

| Czech Republic | CZK/EUR | IBAN |

| Denmark | DKK/EUR | IBAN |

| Estonia | EUR | IBAN |

| Finland | EUR | IBAN |

| France | EUR | IBAN |

| French Guiana | EUR | IBAN |

| Germany | EUR | IBAN |

| Gibraltar | EUR | IBAN |

| Greece | EUR | IBAN |

| Guadeloupe | EUR | IBAN |

| Guam | USD | Routing Number (or ABA Routing Number)

(When sending money to the US, the charges may vary based on payee details. The fee details will be shown for your reference before you confirm the transfer.) |

| Guernsey | GBP/EUR | Sort Code / IBAN |

| Holy See (Vatican City State) | EUR | IBAN |

| Hungary | HUF/EUR | IBAN |

| Iceland | EUR | IBAN |

| India | INR | SWIFT / BIC |

| Ireland | EUR | IBAN |

| Isle of Man | GBP/EUR | Sort Code / IBAN |

| Italy | EUR | IBAN |

| Jersey | GBP/EUR | Sort Code / IBAN |

| Kenya | KES | IBAN |

| Latvia | EUR | IBAN |

| Liechtenstein | CHF/EUR | IBAN |

| Lithuania | EUR | IBAN |

| Luxembourg | EUR | IBAN |

| Malta | EUR | IBAN |

| Martinique | EUR | IBAN |

| Mayotte | EUR | IBAN |

| Monaco | EUR | IBAN |

| Netherlands | EUR | IBAN |

| Norway | NOK/EUR | IBAN |

| Poland | PLN/EUR | IBAN |

| Portugal | EUR | IBAN |

| Romania | RON/EUR | IBAN |

| Saint Pierre and Miquelon | EUR | IBAN |

| San Marino | EUR | IBAN |

| Saudi Arabia | SAR | IBAN |

| Slovakia | EUR | IBAN |

| Slovenia | EUR | IBAN |

| South Africa | ZAR | SWIFT / BIC |

| Spain | EUR | IBAN |

| Sweden | SEK/EUR | IBAN |

| Switzerland | CHF/EUR | IBAN |

Bank code details

Country / region |

Bank code |

Details |

|---|---|---|

Canada |

Canadian Institution Number |

A 3-digit number identifying a particular bank or financial institution in Canada. |

Canadian Transit Number |

A 5-digit number identifying a particular bank and branch in Canada. |

|

| United Kingdom | Sort Code | A 6-digit number identifying a particular bank and branch in the UK. |

| United States | Routing Number (or ABA Routing Number) | A 9-digit number used in the US to identify a particular bank for transactions. |

| Australia | Bank State Branch (BSB) code | A 6-digit number identifying a particular bank and branch in Australia. |

| New Zealand | National Clearing Code (NCC) | A 6-digit number identifying a particular bank and branch in New Zealand. |

| Others | The International Bank Account Number (IBAN) | A globally recognised code consisting of up to 34 letters and numbers. |

| SWIFT / BIC | A code with 8 to 11 characters that identifies your payee's country / region, city, bank, and branch. |

You can find more details about applicable bank code under this list.

Country / region |

Bank code |

|---|---|

| Albania | IBAN |

| Algeria | SWIFT / BIC |

| American Samoa | SWIFT / BIC |

| Anguilla | SWIFT / BIC |

| Antigua and Barbuda | SWIFT / BIC |

| Argentina | SWIFT / BIC |

| Armenia | SWIFT / BIC |

| Aruba | SWIFT / BIC |

| Azerbaijan | IBAN |

| Bahamas | SWIFT / BIC |

| Bahrain | IBAN |

| Bangladesh | SWIFT / BIC |

| Barbados | SWIFT / BIC |

| Belize | SWIFT / BIC |

| Benin | SWIFT / BIC |

| Bermuda | SWIFT / BIC |

| Bhutan | SWIFT / BIC |

| Bolivia, Plurinational State of | SWIFT / BIC |

| Bonaire, Sint Eustatius and Saba | SWIFT / BIC |

| Bosnia and Herzegovina | IBAN |

| Botswana | SWIFT / BIC |

| Brazil | SWIFT / BIC |

| Brunei Darussalam | SWIFT / BIC |

| Burkina Faso | SWIFT / BIC |

| Burundi | SWIFT / BIC |

| Cambodia | SWIFT / BIC |

| Cameroon | SWIFT / BIC |

| Cape Verde | SWIFT / BIC |

| Cayman Islands | SWIFT / BIC |

| Central African Republic | SWIFT / BIC |

| Chad | SWIFT / BIC |

| Chile | SWIFT / BIC |

| China | SWIFT / BIC |

| Colombia | SWIFT / BIC |

| Comoros | SWIFT / BIC |

| Congo | SWIFT / BIC |

| Congo, the Democratic Republic of the | SWIFT / BIC |

| Cook Islands | SWIFT / BIC |

| Costa Rica | IBAN |

| Côte D'Ivoire | SWIFT / BIC |

| Curacao | SWIFT / BIC |

| Djibouti | SWIFT / BIC |

| Dominica | SWIFT / BIC |

| Dominican Republic | IBAN |

| Ecuador | SWIFT / BIC |

| Egypt | IBAN |

| El Salvador | SWIFT / BIC |

| Equatorial Guinea | SWIFT / BIC |

| Eritrea | SWIFT / BIC |

| Eswatini (Swaziland) | SWIFT / BIC |

| Ethiopia | SWIFT / BIC |

| Falkland Islands (Malvinas) | SWIFT / BIC; or IBAN |

| Faroe Islands | IBAN |

| Fiji | SWIFT / BIC |

| French Polynesia | IBAN |

| Gabon | SWIFT / BIC |

| Gambia | SWIFT / BIC |

| Georgia | IBAN |

| Ghana | SWIFT / BIC |

| Greenland | IBAN |

| Grenada | SWIFT / BIC |

| Guatemala | SWIFT / BIC |

| Guinea | SWIFT / BIC |

| Guinea-Bissau | SWIFT / BIC |

| Guyana | SWIFT / BIC |

| Haiti | SWIFT / BIC |

| Honduras | SWIFT / BIC |

| Indonesia | SWIFT / BIC |

| Israel | IBAN |

| Jamaica | SWIFT / BIC |

| Japan | SWIFT / BIC |

| Jordan | SWIFT / BIC |

| Kazakhstan | IBAN |

| Kiribati | SWIFT / BIC |

| Korea, Republic of | SWIFT / BIC |

| Kuwait | IBAN |

| Kyrgyzstan | SWIFT / BIC |

| Lao People's Democratic Republic | SWIFT / BIC |

| Lebanon | IBAN |

| Lesotho | SWIFT / BIC |

| Liberia | SWIFT / BIC |

| Libya | SWIFT / BIC |

| Macao SAR | SWIFT / BIC |

| Madagascar | SWIFT / BIC |

| Malawi | SWIFT / BIC |

| Malaysia | SWIFT / BIC |

| Maldives | SWIFT / BIC |

| Mali | SWIFT / BIC |

| Marshall Islands | SWIFT / BIC |

| Mauritania | IBAN |

| Mauritius | IBAN |

| Mexico | SWIFT / BIC |

| Moldova, Republic of | IBAN |

| Mongolia | SWIFT / BIC |

| Montenegro | IBAN |

| Montserrat | SWIFT / BIC |

| Morocco | SWIFT / BIC |

| Mozambique | SWIFT / BIC |

| Myanmar | SWIFT / BIC |

| Namibia | SWIFT / BIC |

| Nepal | SWIFT / BIC |

| New Caledonia | IBAN |

| Nicaragua | SWIFT/BIC |

| Niger | SWIFT/BIC |

| Nigeria | SWIFT/BIC |

| Norfolk Island | SWIFT/BIC |

| North Macedonia | IBAN |

| Oman | IBAN |

| Pakistan | SWIFT / BIC |

| Palestine, State of | IBAN |

| Panama | SWIFT / BIC |

| Papua New Guinea | SWIFT / BIC |

| Paraguay | SWIFT / BIC |

| Peru | SWIFT / BIC |

| Philippines | SWIFT / BIC |

| Puerto Rico | SWIFT / BIC |

| Qatar | IBAN |

| Réunion | IBAN |

| Rwanda | SWIFT / BIC |

| Saint Helena, Ascension and Tristan Da Cunha | SWIFT / BIC |

| Saint Kitts and Nevis | SWIFT / BIC |

| Saint Lucia | SWIFT / BIC |

| Saint Vincent and the Grenadines | SWIFT / BIC |

| Samoa | SWIFT / BIC |

| Sao Tome and Principe | SWIFT / BIC |

| Senegal | SWIFT / BIC |

| Serbia | IBAN |

| Seychelles | IBAN |

| Sierra Leone | IBAN |

| Sint Maarten (Dutch part) | IBAN |

| Solomon Islands | SWIFT / BIC |

| Somalia | SWIFT / BIC |

| South Sudan | SWIFT / BIC |

| Sri Lanka | SWIFT / BIC |

| Suriname | SWIFT / BIC |

| Taiwan | SWIFT / BIC |

| Tajikistan | SWIFT / BIC |

| Tanzania, United Republic of | SWIFT / BIC |

| Thailand | SWIFT / BIC |

| Timor-Leste | SWIFT / BIC |

| Togo | SWIFT / BIC |

| Tonga | SWIFT / BIC |

| Trinidad and Tobago | SWIFT / BIC |

| Tunisia | IBAN |

| Turkey | IBAN |

| Turkmenistan | SWIFT / BIC |

| Turks and Caicos Islands | SWIFT / BIC |

| Tuvalu | SWIFT / BIC |

| Uganda | SWIFT / BIC |

| Ukraine | IBAN |

| United Arab Emirates | IBAN |

| Uruguay | SWIFT / BIC |

| Uzbekistan | SWIFT / BIC |

| Vanuatu | SWIFT / BIC |

| Venezuela (Bolivarian Republic of) | SWIFT / BIC |

| Vietnam | SWIFT / BIC |

| Virgin Islands, British | SWIFT / BIC |

| Virgin Islands, U.S. | SWIFT / BIC |

| Wallis and Futuna | IBAN |

| Yemen | SWIFT / BIC |

| Zambia | SWIFT / BIC |

Bank code details

Country / region |

Bank code |

Details |

|---|---|---|

| Other countries / regions | IBAN | The International Bank Account Number (IBAN) is a globally recognised code consisting of up to 34 letters and numbers. |

| SWIFT / BIC | A code with 8 to 11 characters that identifies your payee's country / region, city, bank, and branch. |