We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

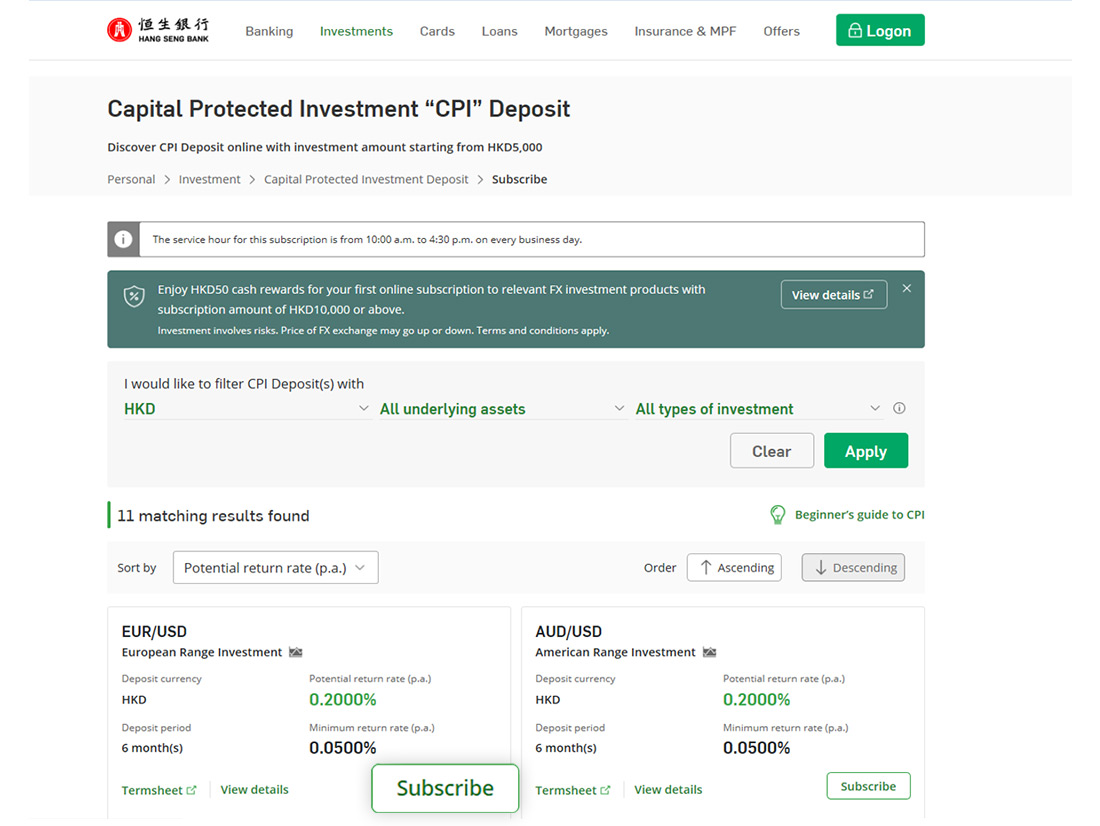

Please read the Important Risk Warnings for Capital Protected Investment Deposit (CPI). Please also note that the subscription hours of CPI have been extended. You can now apply for subscription online from Mon to Sun (including public holidays) 10:00 a.m. - 6:00 a.m. the next day.

Extended online subscription hours to 20 hours everyday. Eligible customers who successfully subscribe Capital Protected Investment (CPI) Deposit online can enjoy extra 2% p.a. interest rate for one month. Explore CPI

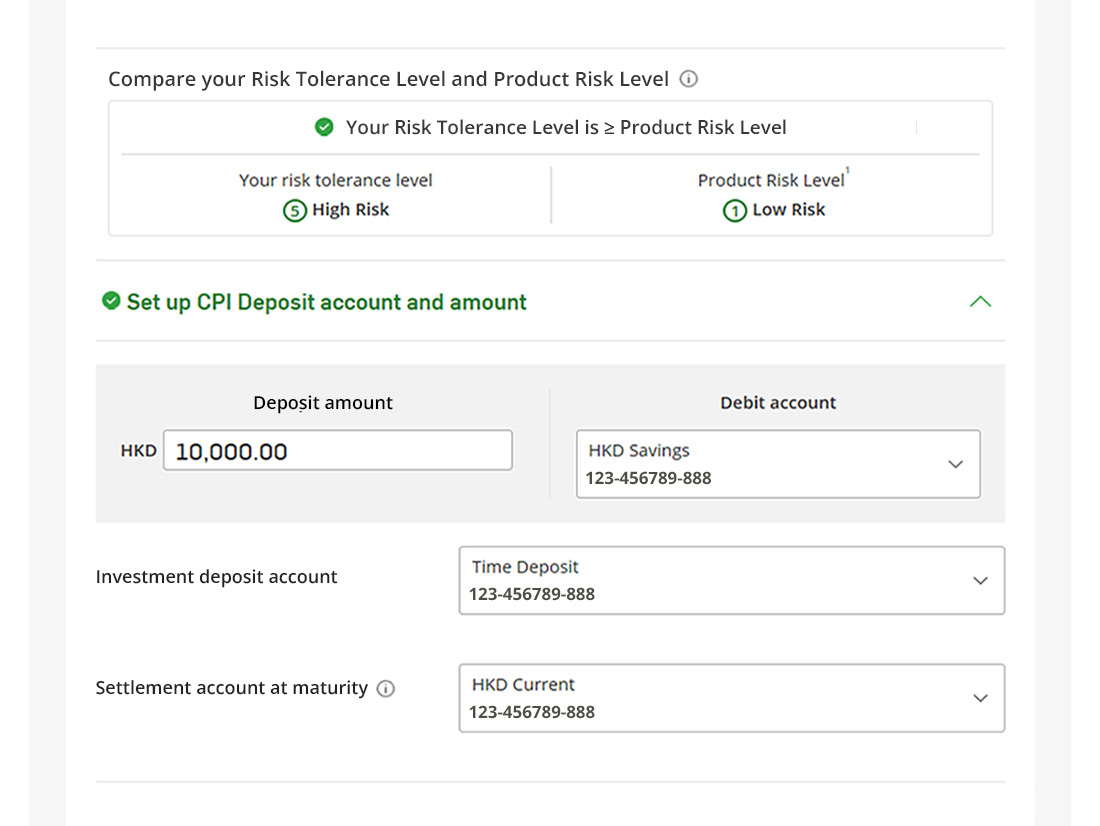

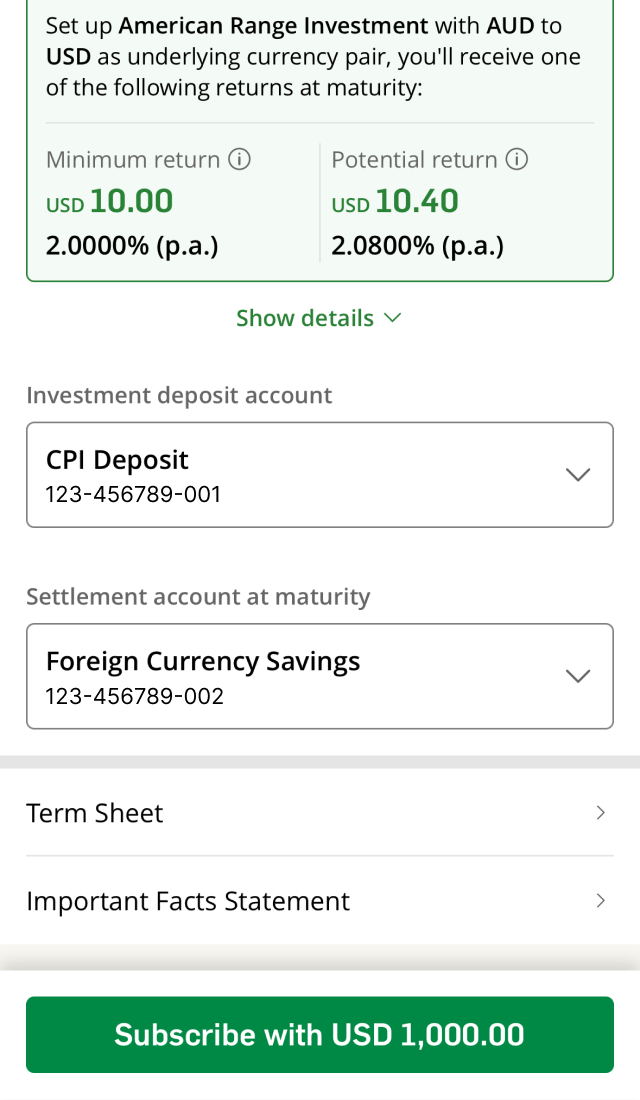

A Capital Protected Investment (CPI) Deposit[1] is a currency-linked structured product involving derivatives, with 100% capital protection at maturity and a chance to enjoy higher potential return. Minimum online investment amount of HKD5,000 only and you can start your forex investment journey with just a few clicks.

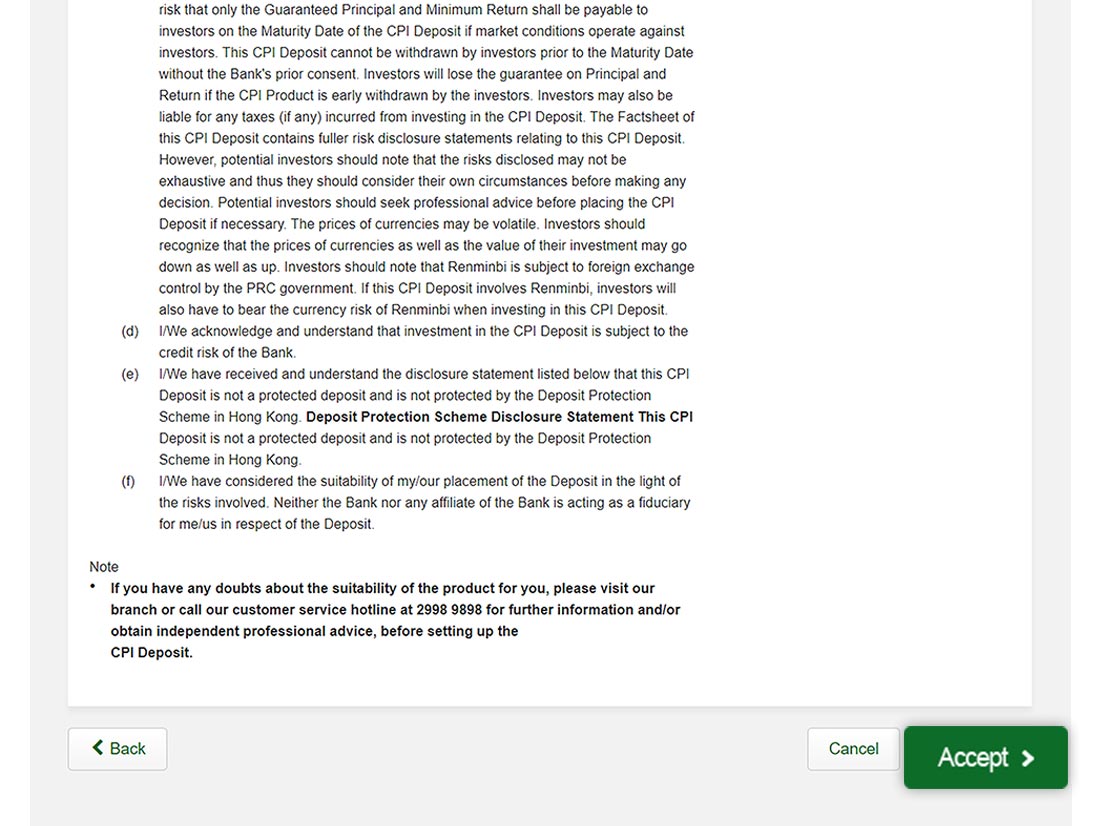

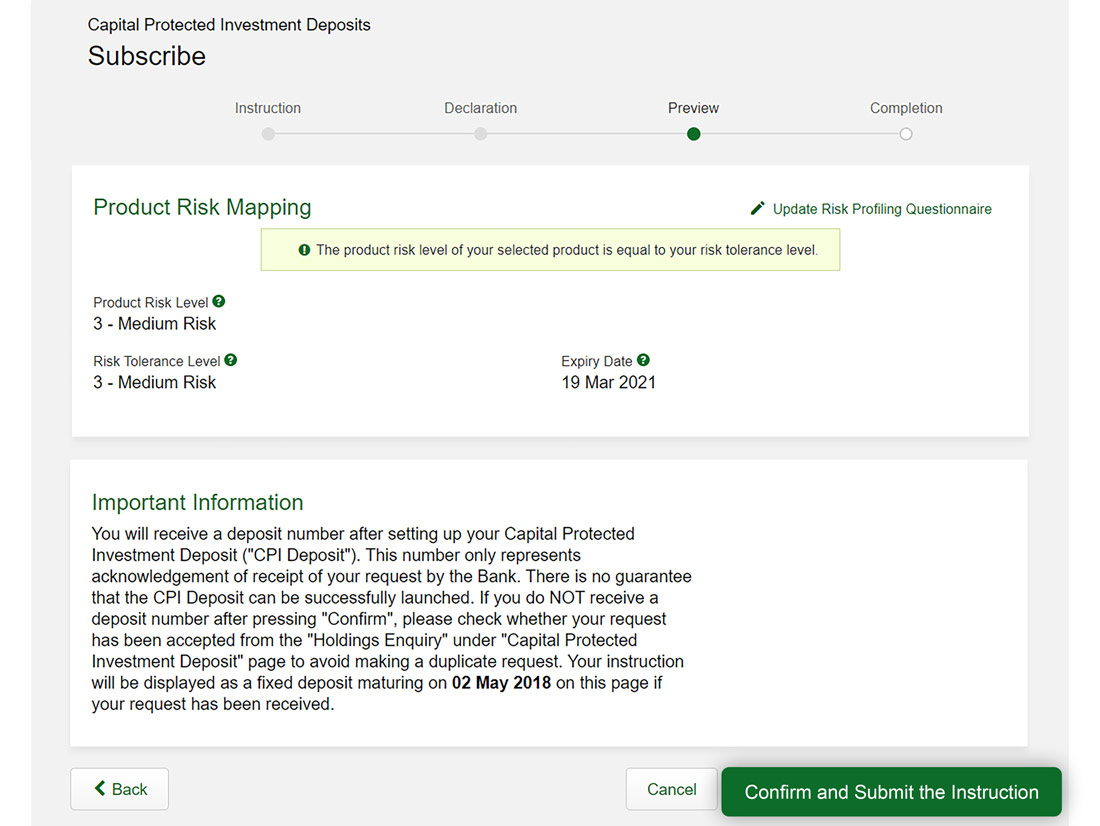

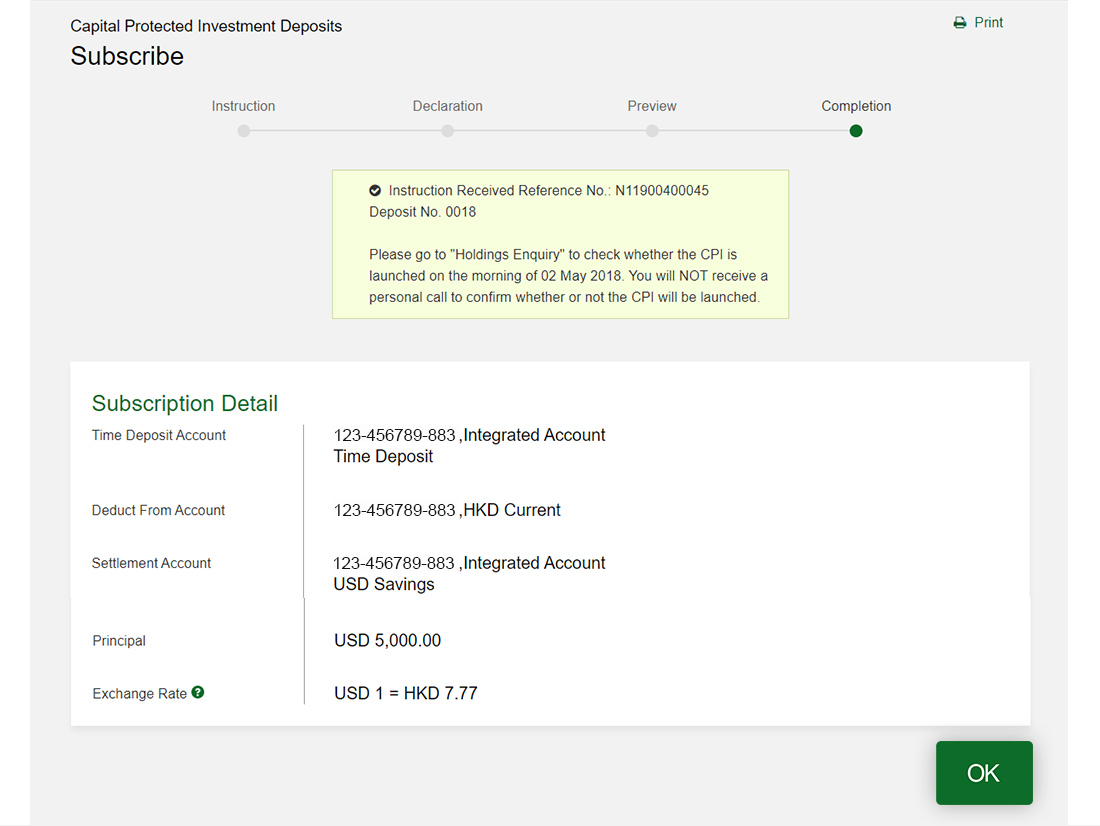

100% capital protected, subscribe currency pair in 5 steps

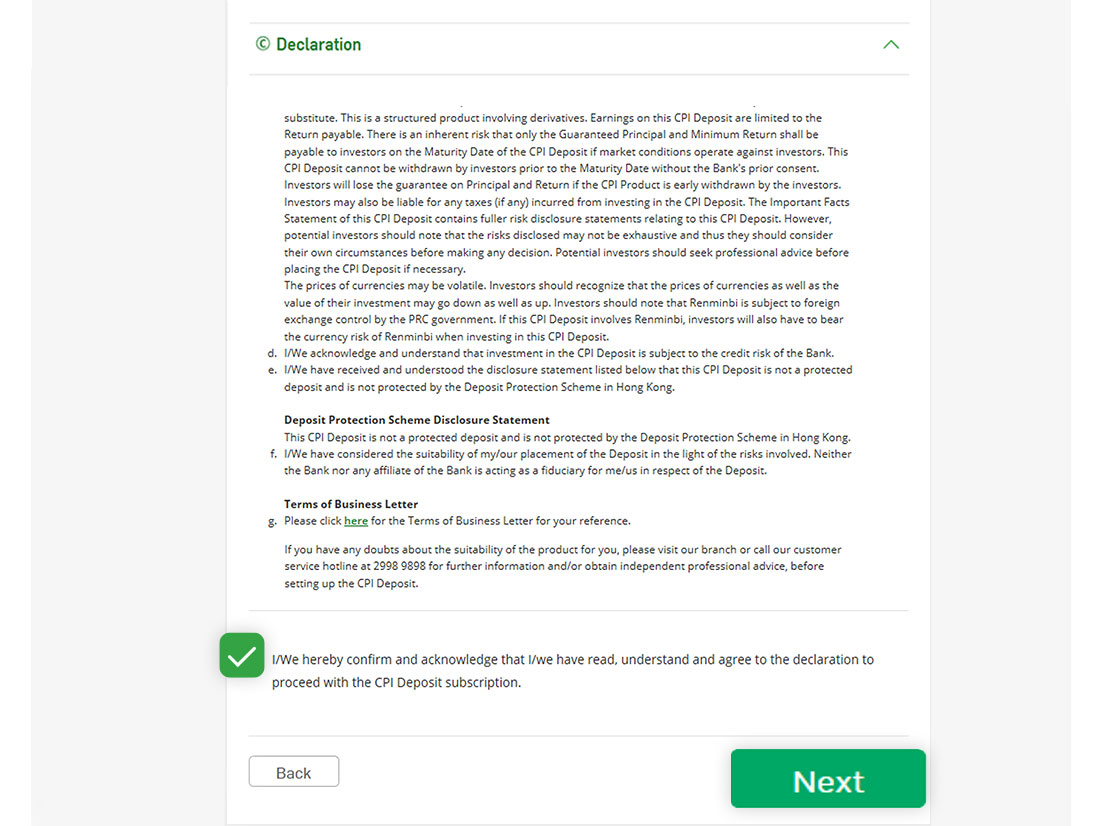

If you hold the CPI Deposit until maturity, you can get 100% capital protection. This low-risk investment product helps to reduce capital loss risk amid market fluctuations.

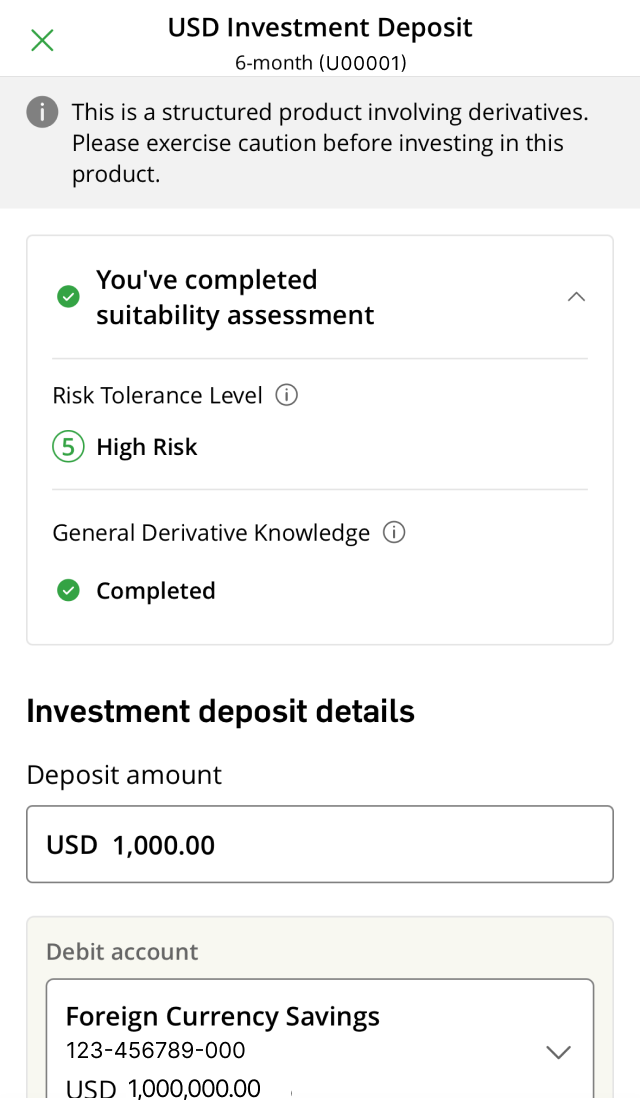

Whether you are an investment beginner or experienced investor, you can subscribe for a CPI Deposit online easily with an investment amount as low as HKD 5,000.

Your potential return / minimum return (if any) is based on the exchange rate movements of the underlying currency pair. Please refer to "How does it work" section for more details.[2]

Investment tenor can be as short as 1 month, providing greater flexibility to achieve your investment goal.

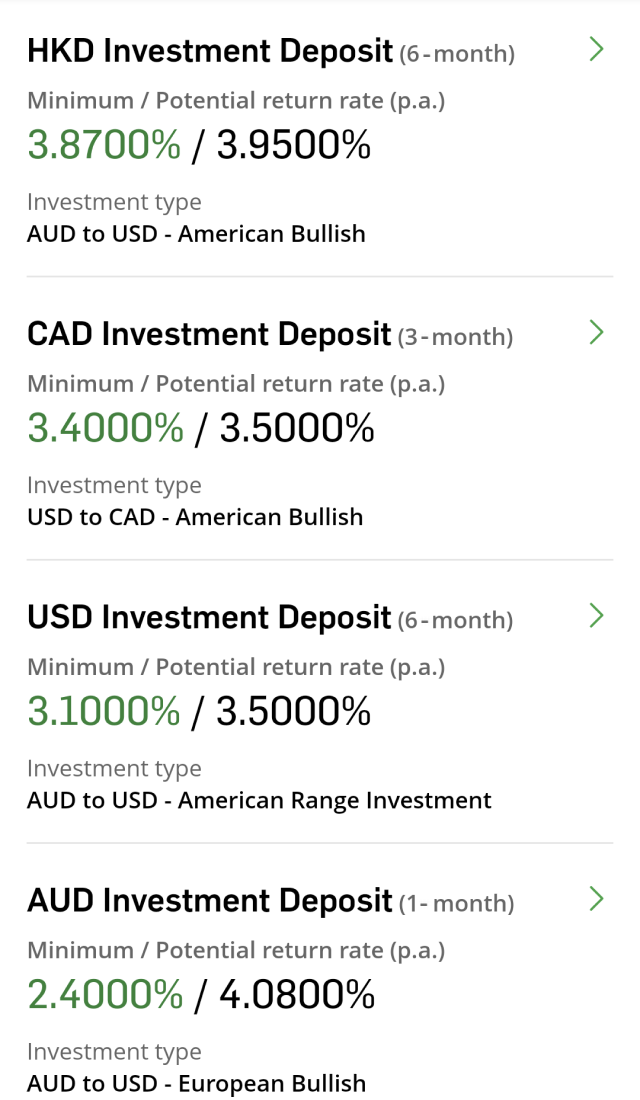

This currency-linked investment offers choices of underlying currency pairs, including AUD / USD, GBP / USD, EUR / USD, USD / JPY, USD / CAD, USD / CHF, NZD / USD and USD / CNH.[3]

There's no handling or management fee to help minimise your investment costs.

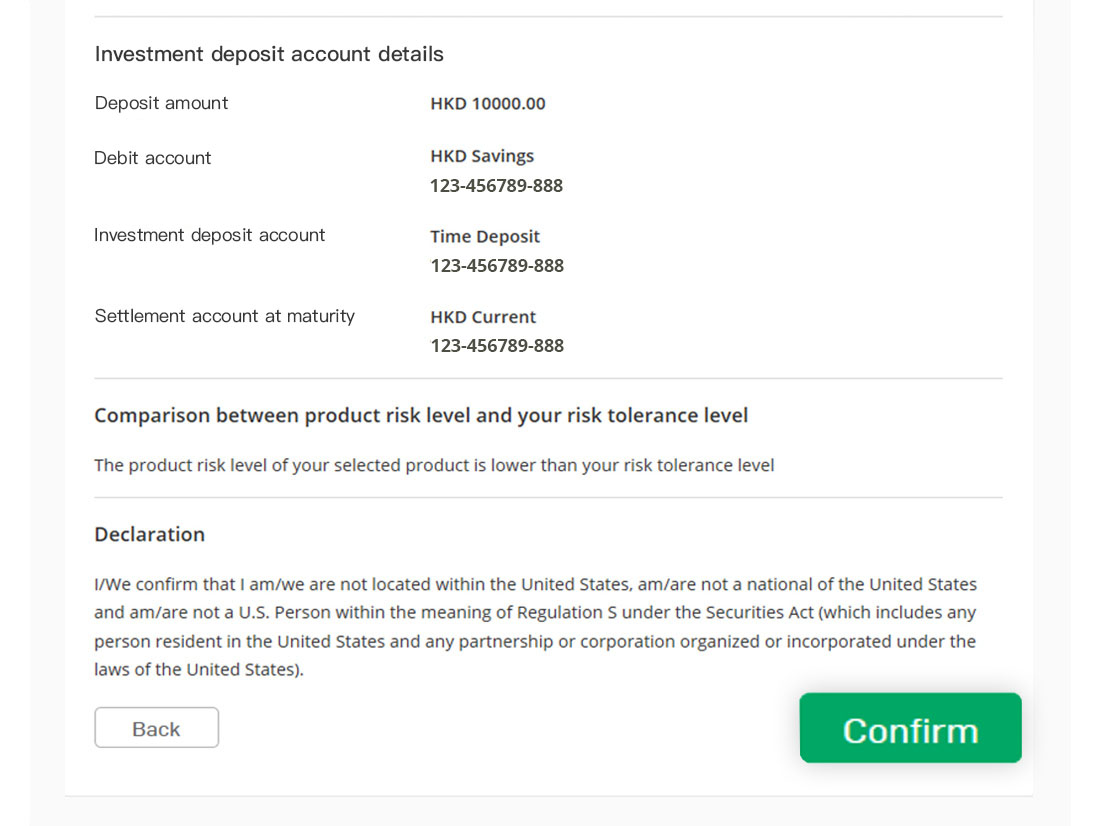

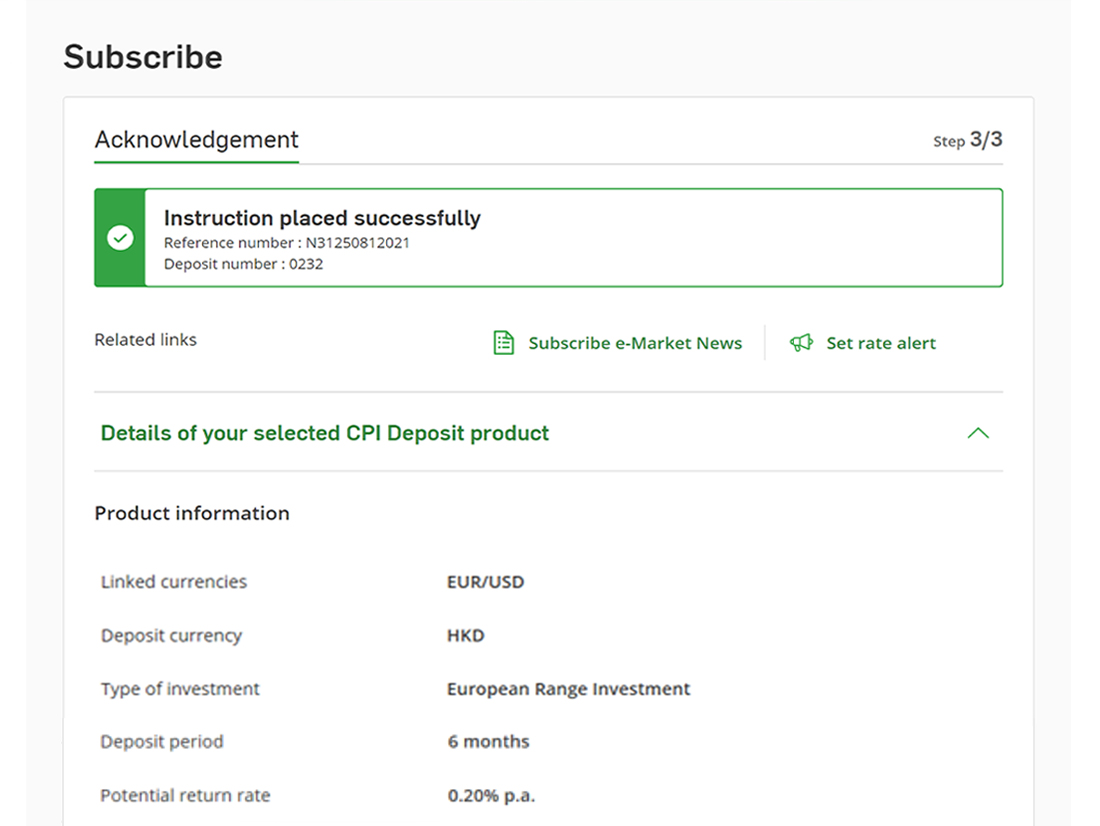

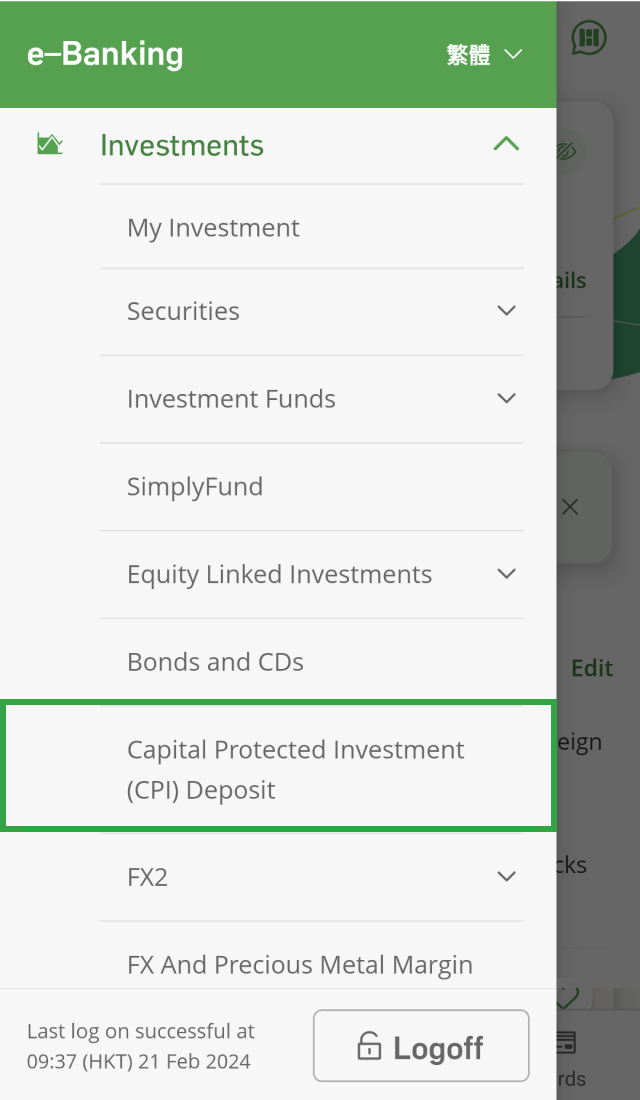

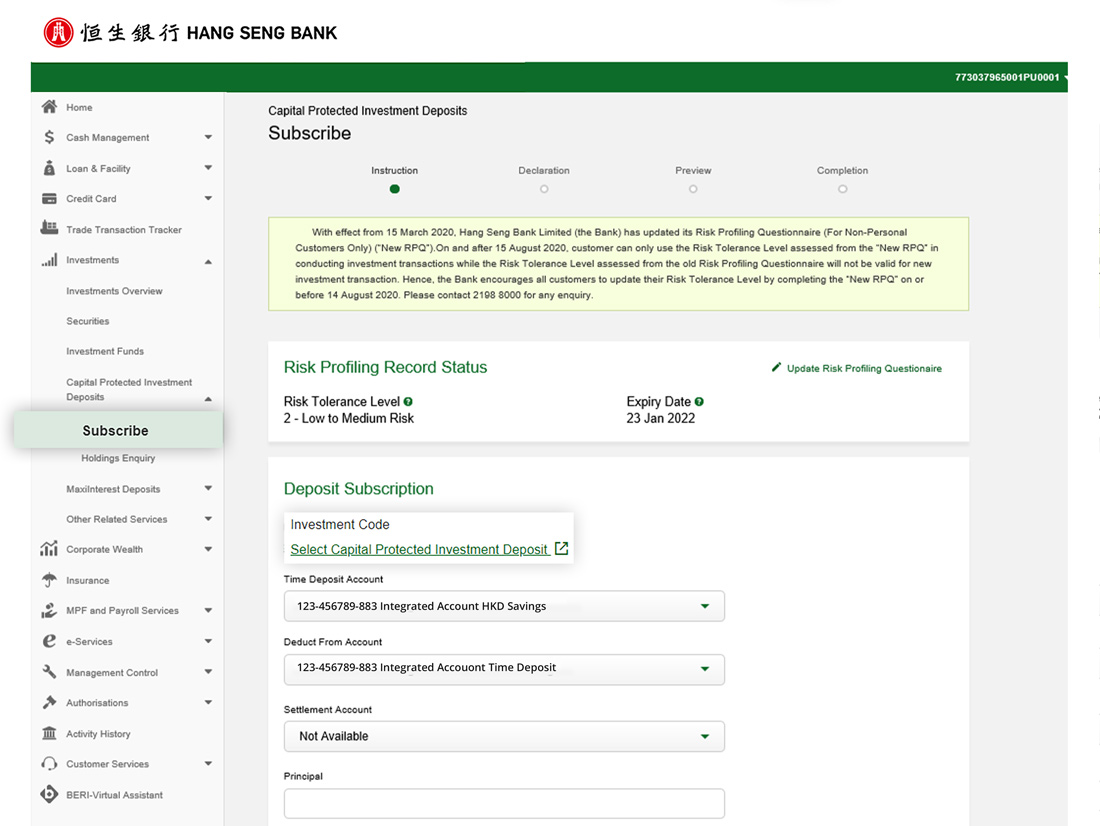

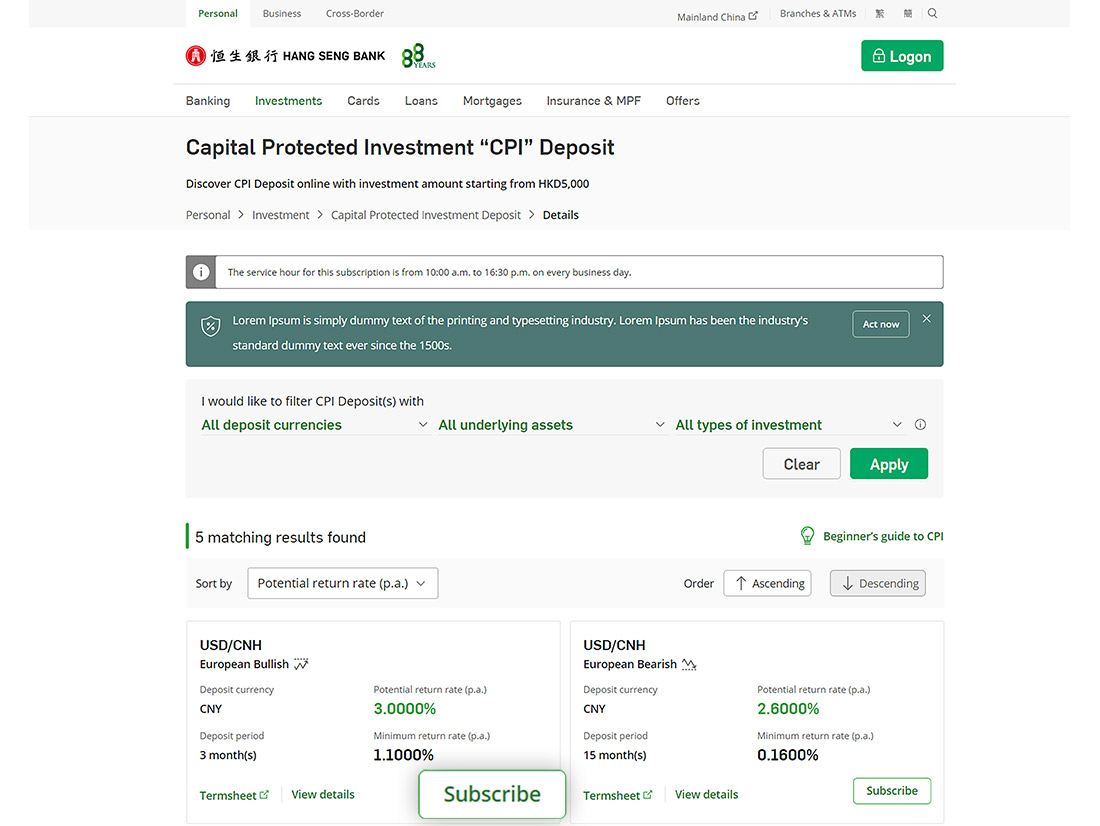

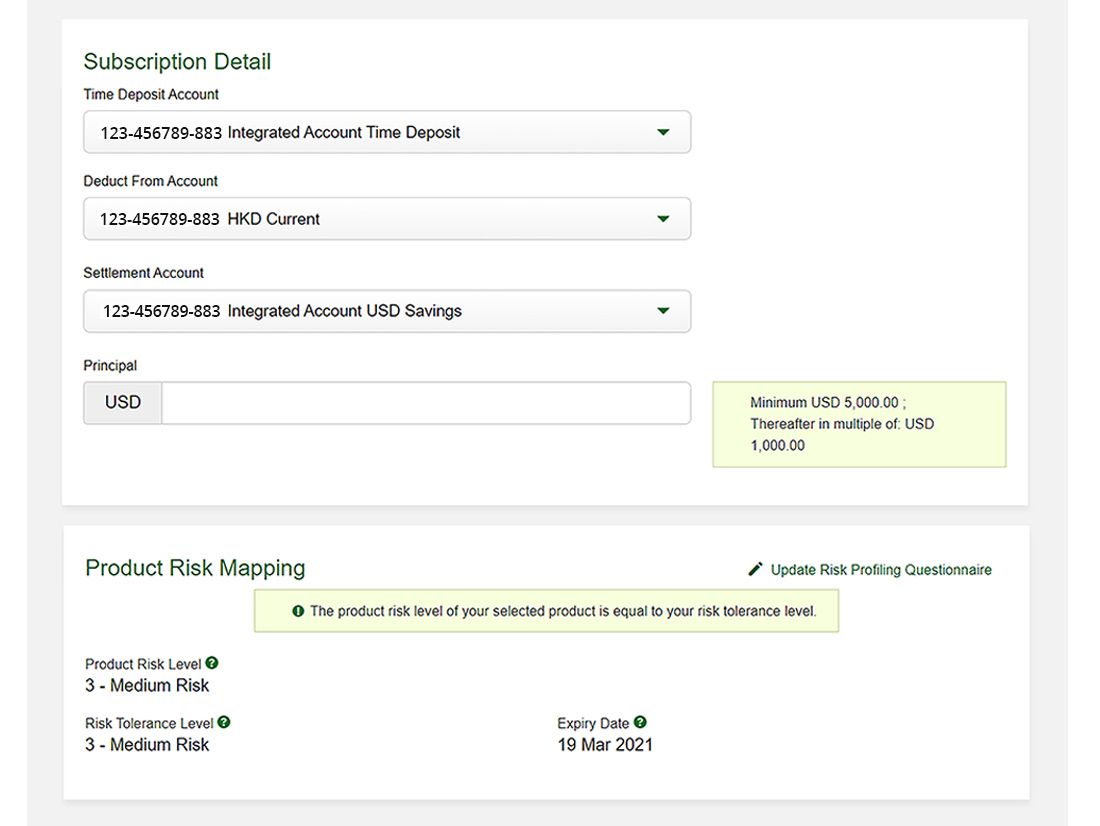

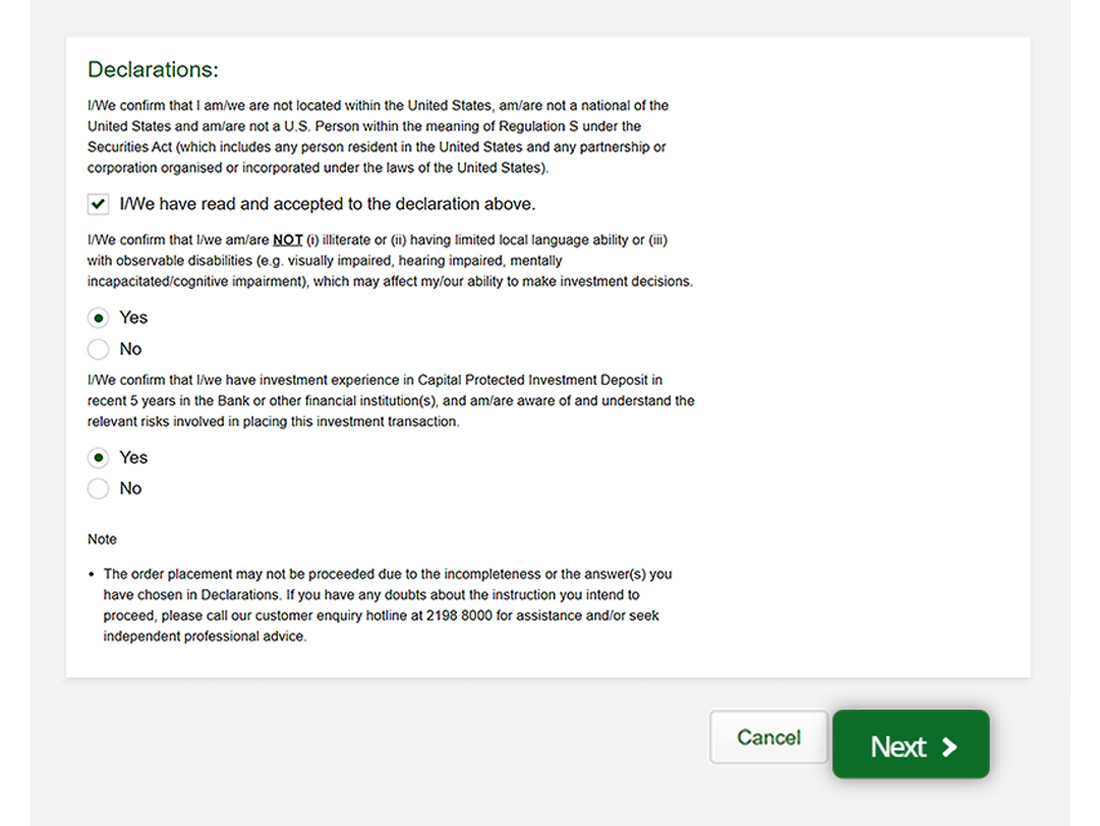

Learn how to subscribe CPI Deposit via Personal e-Banking:

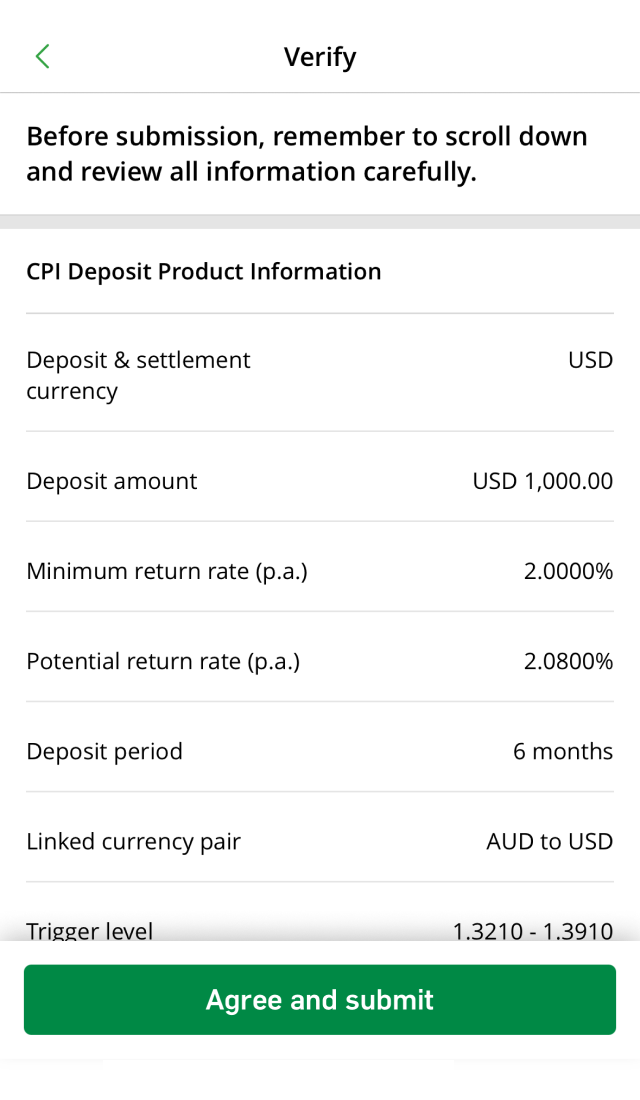

Investor can choose different types of investments according to his/her anticipated exchange rate of the underlying currency pair, namely, Bullish, Bearish or Range.

A CPI deposit can also be classified as American[4] or European[5] according to the basis for determining the type of returns to be received at maturity, which are either potential returns or minimum returns (if any).

At maturity, you can receive the principal and enjoy the following returns (if any) depending on the exchange rate movement of the Underlying Currency Pair :

| Scenario | Returns (if any) to be received at maturity |

|---|---|

| Exchange rate of the Underlying Currency Pair moves as you anticipate and meets the trigger event | Principal + Potential Return(s) |

| Exchange rate of the Underlying Currency Pair moves against your anticipation and doesn't meet the trigger event | Principal + Minimum Return(s) (if any) |

Please refer to the below examples for illustration.

Invest in Capital protected products and enjoy higher potential returns while managing risk

Explore our Top10 CPIs in term of transaction volume

Eligible customers who successfully subscribe MaxiInterest Investment Deposit online with as low as HKD5,000 can enjoy extra 2% p.a. interest rate for one month.

Investment involves risks. Prices of foreign exchange may go up or down. Terms and conditions apply to the offer.

You can convert the currency in your account prior to placing your CPI deposit order via Personal e-Banking, Hang Seng Mobile App, automated teller machine or visit our branches. Please note that the CPI deposit order will be rejected if the funds in your account are insufficient to convert to the relevant currency.

CPI Deposit is available for subscription from Mon to Sun 10:00 a.m. - 6:00 a.m. the next day (subject to our discretion, market disruption events, etc.)

General subscription session (for branch and online subscription) |

Mon to Fri: 10:00 a.m. - 5:00 p.m. (excluding Hong Kong public holiday) |

Extended-hours subscription session (online subscription only) |

Mon to Fri: 5:00 p.m. - 6:00 a.m. the next day Sat to Sun, Hong Kong public holiday: 10:00 a.m. - 6:00 a.m. the next day |

CPI Deposit subscription instructions made during extended-hours subscription session (including Saturdays, Sundays and Hong Kong public holidays are regarded as pending instructions and to be processed in the Offer Period stated in the relevant Term Sheets.

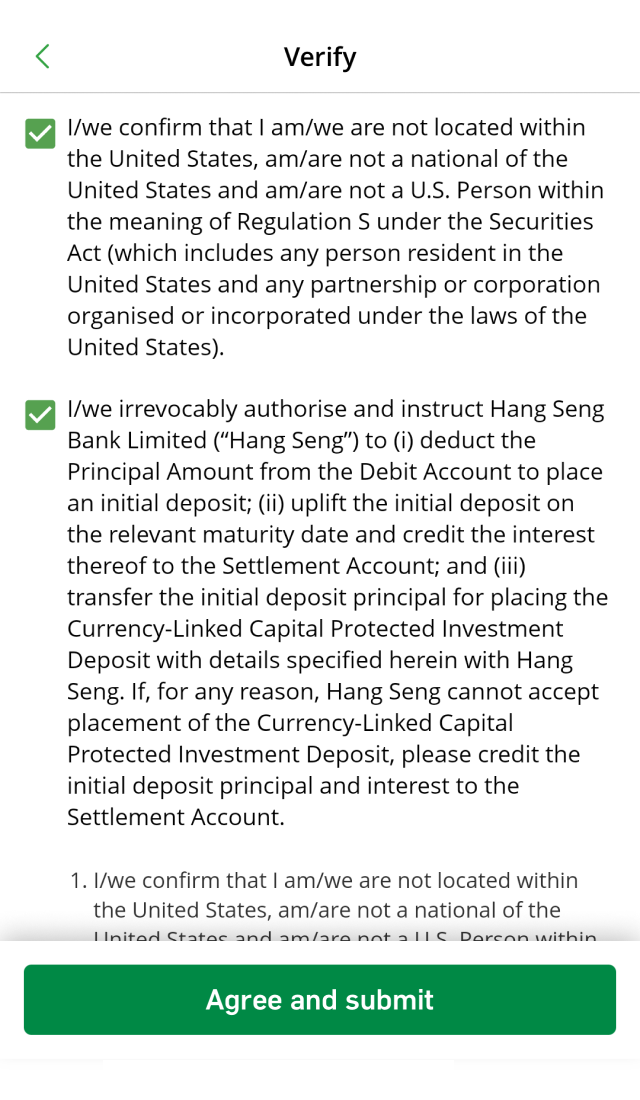

After setting up the CPI deposit, customer is not allowed to amend, cancel or terminate the CPI deposit before its maturity date.

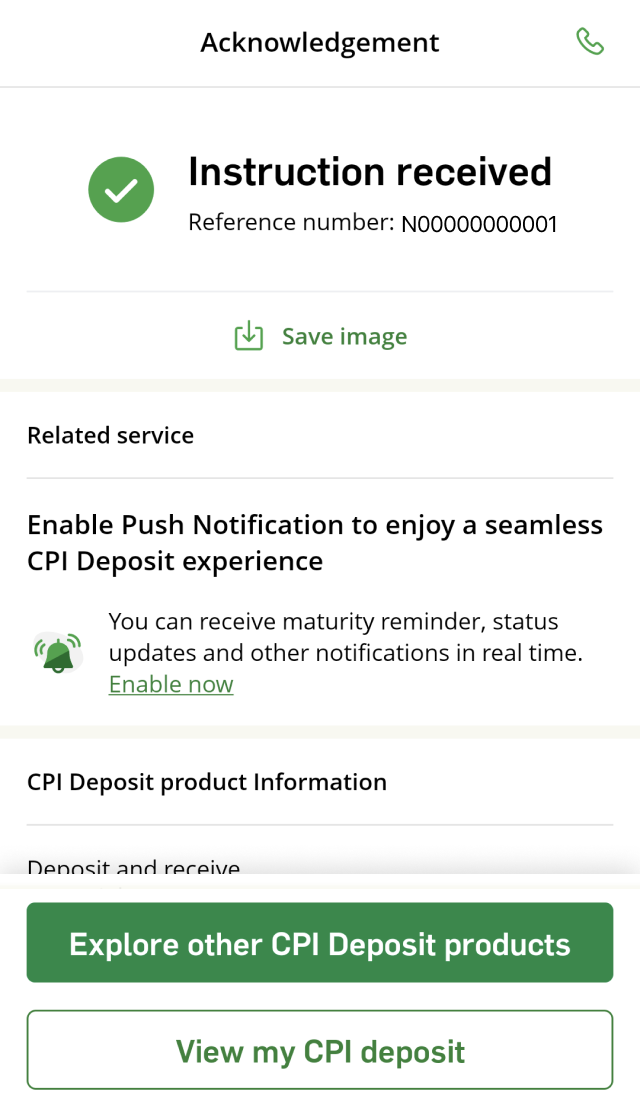

If you've registered e-Statement / e-Advice Service for your Integrated Account, you can view and download e-Advice via Personal e-Banking or Hang Seng Mobile App. Otherwise, you'll receive paper advices.

FX hotline:

(852) 2822 8233

Personal customer:

(852) 2822 0228

Commercial customer:

(852) 2198 8000