How to Start - US Securities Online Trading Service

Step 1: Open an Integrated Business Solutions Account at one of our designated business banking centres.

Step 2: Activate a Securities Account under your Integrated Business Solutions Account and activate the US Securities Service by completing and returning the Important Notes and Agreement for US Market Information Display Services and US Internal Revenue Service (“IRS”) W-Series Form to your relationship manager/ any of our business banking centres.

Remark:

- Click above links to learn more about the Important Notes and Agreement and submission of IRS W-Series Forms or contact your Relationship Manager or contact our 24-hour Business Partner Direct at (852) 2198 8000 for assistance.

- Please note that we cannot provide you with any legal and/or tax advice and this message is not intended to provide you with any legal and/or tax advice. If you are in any doubt as to your tax position or the completion of the aforesaid IRS W-Series Forms, please consult your professional advisors and refer to the IRS website.

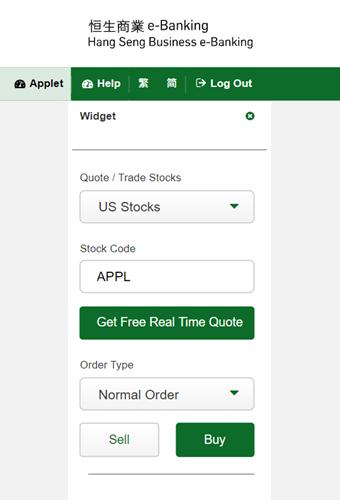

How to get US stock quote

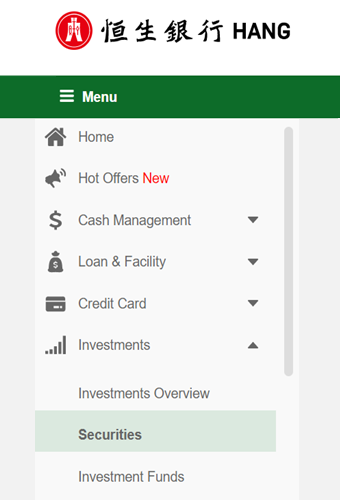

Step 1

Click "Investments" > "Securities" on the left-hand side menu.

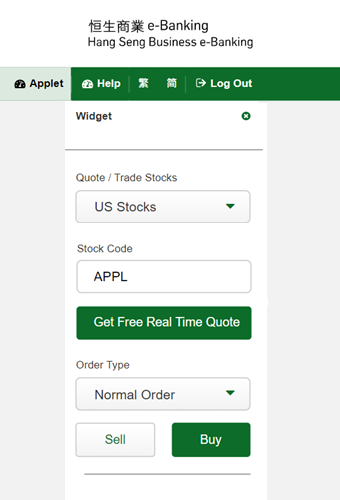

Step 2

Find out the stock(s) you are looking for with stock code on “Widget” and choose "Get Free Real Time Quote”.

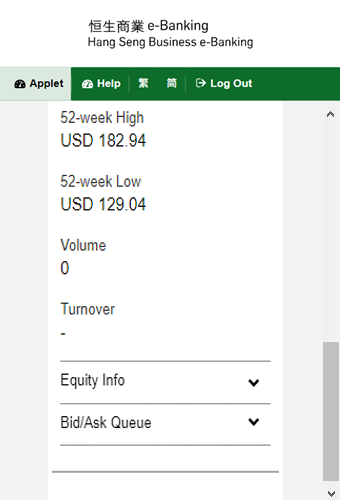

Step 3

View the stock Quote details.

How to trade US stocks

Step 1

Find out the stock(s) you are looking for with stock code on “Widget”.

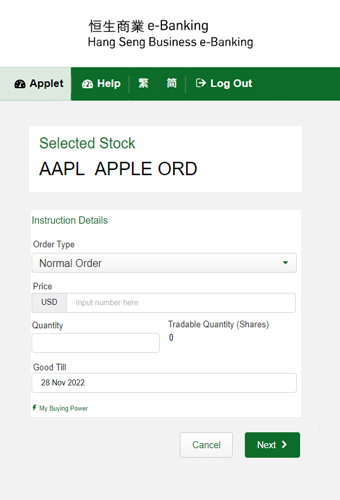

Step 2

Input your order details and specify an order expiry date under “Good Till” (if applicable).

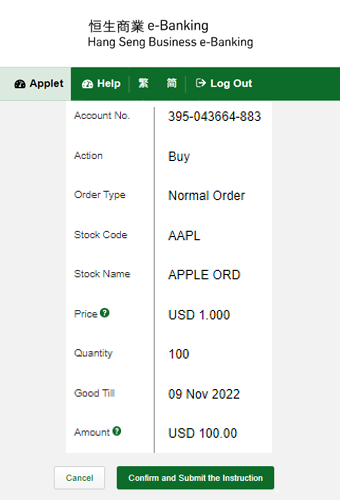

Step 3

Confirm and Submit your Instruction.

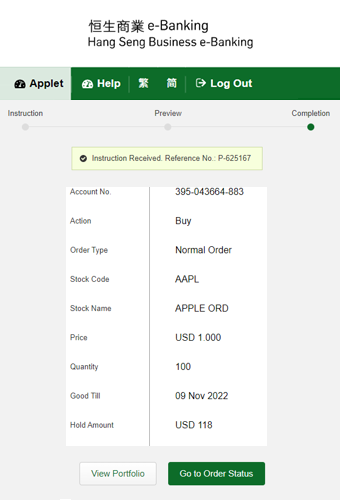

Step 4

Instruction received, with reference number provided.

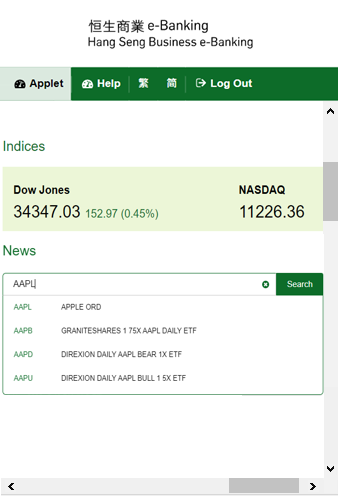

How to view US market news

Step 1

Select "US Market", the find out the stock(s) you are looking for with stock code or stock name.

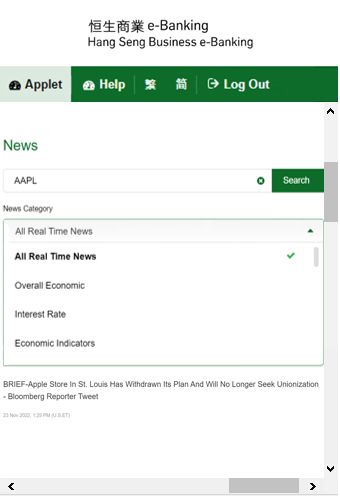

Step 2

Choose the News Category you are looking for.

Trading Services:

Market news:

Fee and charges:

Bank Account Opening

Bank Account Opening